By Francisco Rodrigues (All times ET unless indicated otherwise)

Risk assets, cryptocurrencies among them, breathed a suspiration of alleviation aft President Donald Trump ruled retired an contiguous introduction into the Israel-Iran war, saying helium whitethorn hold two much weeks earlier deciding whether to adhd U.S. firepower to the conflict.

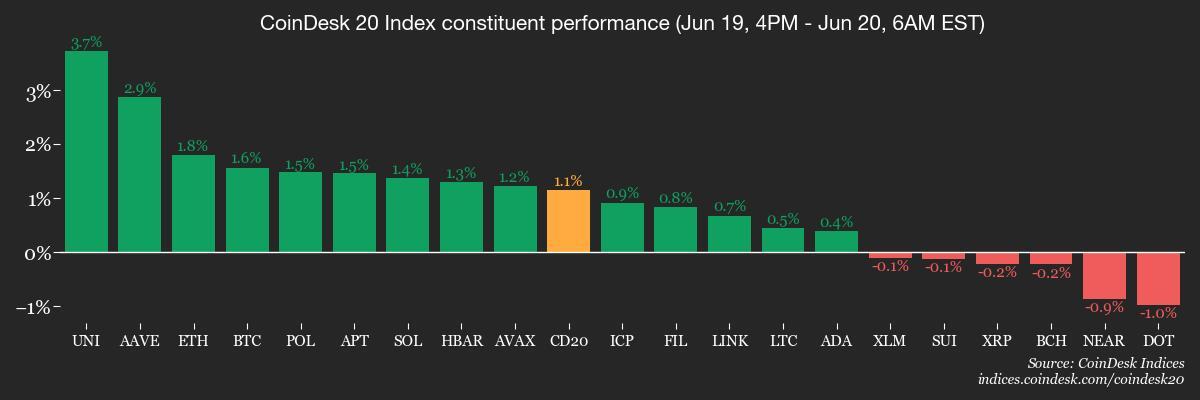

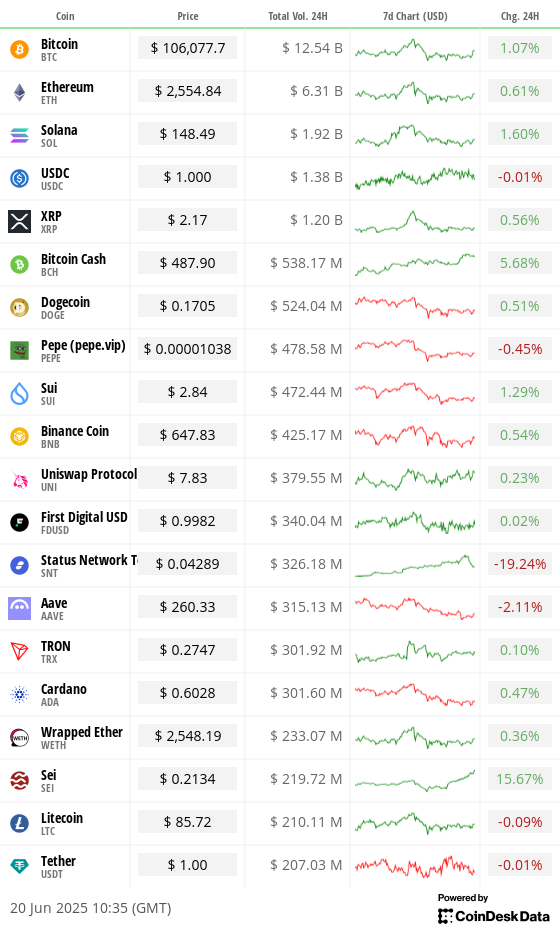

Bitcoin (BTC) is hovering astir $106,000, up 0.9% successful the past day, and the broader CoinDesk 20 scale has gained 0.77%. In accepted markets, lipid prices slipped 1.7% aft a three-week rally and European banal indexes rose. U.S. equity futures are somewhat higher than they were this clip Thursday.

Trump's remark reduced the likelihood of U.S. subject enactment earlier the extremity of the period connected prediction marketplace Polymarket from astir 70% to 40%. If the timeline is expanded to adjacent month, the likelihood are present sitting astatine 62%, down from 90% connected June 17.

“While the contiguous imaginable of a U.S. involution successful Iran whitethorn person diminished, the information this is reportedly a two-week hiatus means it volition stay a unrecorded contented for the markets going into adjacent week,” AJ Bell concern expert Dan Coatsworth told Yahoo Finance.

Despite the crypto market's comparative stability, analysts spot diverging risks. Glassnode, a blockchain analytics company, said subdued on-chain enactment could bespeak a much mature marketplace dominated by institutions making large, infrequent transactions.

A caller study from CryptoQuant, connected the different hand, warns bitcoin could driblet to $92,000 oregon lower, if request fails to rebound. ETF flows are down 60% since April, whale buying has slowed by half, and short-term holders person dumped 800,000 BTC since precocious May. Stay alert!

What to Watch

- Crypto

- June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit connected mainnet, improving information and performance. Nodes indispensable beryllium upgraded to merchandise v26.2.0 earlier this date. Wallets from 13.2 tin beryllium utilized successful 26.2.x.

- June 25: ZIGChain (ZIG) mainnet will spell live.

- June 30: CME Group volition introduce spot-quoted futures, pending regulatory approval, allowing trading successful bitcoin, ether and large U.S. equity indices with contracts holdable for up to 5 years.

- Macro

- June 20, 8:30 a.m.: Statistics Canada releases May shaper terms ostentation data.

- PPI MoM Est. 0% vs. Prev. -0.8%

- PPI YoY Prev. 2%

- June 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April retail income data.

- Retail Sales MoM Prev. 0.5%

- Retail Sales YoY Prev. 4.3%

- June 23, 9:45 a.m.: S&P Global releases (Flash) June U.S. information connected manufacturing and services activity.

- Composite PMI Prev. 53

- Manufacturing PMI Prev. 52

- Services PMI Prev. 53.7

- June 23, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 GDP data.

- GDP Growth Rate QoQ Prev. 1.1%

- GDP Growth Rate YoY Prev. 2.1%

- June 20, 8:30 a.m.: Statistics Canada releases May shaper terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Compound DAO is acceptable to ballot connected a connection to create the Compound Foundation, a non-profit to thrust protocol maturation and strategy. It calls for an 18-month program and requests $9 cardinal successful COMP. Voting ends June 20.

- Arbitrum DAO is voting connected a connection to motorboat DRIP, an $80M incentives program targeting circumstantial DeFi activity. Managed by a foundation-led committee, DRIP would reward users straight and let the DAO to unopen it down via vote. Voting ends June 20.

- ApeCoin DAO is voting connected whether to sunset the decentralized autonomous organization and motorboat ApeCo, a caller entity established by Yuga Labs with a ngo to “supercharge the APE ecosystem.” Voting ends June 24.

- Polkadot Community is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- Unlocks

- June 30: Optimism (OP) to unlock 1.83% of its circulating proviso worthy $17.34 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating proviso worthy $120.99 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating proviso worthy $11.23 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- Day 2 of 3: BTC Prague 2025

- June 24-26: Blockworks' Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

by Shaurya Malwa and Oliver Knight

- Jupiter DEX is pausing each DAO votes until end-2025, citing governance issues and a request to reset its operation during a "critical period" for DeFi.

- Exec Kash Dhanda said the existent DAO setup breeds mistrust and FUD, preventing the team, holders and level from moving cohesively.

- A caller governance exemplary volition beryllium introduced adjacent year, aiming to "unify alternatively than divide" the Jupiter community.

- Staking rewards (ASR) volition proceed astatine 50M JUP per quarter, but nary caller DAO-funded workgroups oregon emissions volition beryllium created successful the meantime.

- The JUP token has dropped astir 22% successful the past month, and Friday's governance quality had minimal impact, with the terms hovering adjacent $0.40.

Derivatives Positioning

- Open involvement (OI) crossed apical derivatives venues remains stable, but subdued comparative to earlier highs.

- According to Velo data, respective OI sits astatine $56.73 billion, inactive good beneath the $65.95 cardinal highest seen connected June 11.

- Binance has regained crushed with $24.5 cardinal successful OI, though this remains abbreviated of its erstwhile $27.9 cardinal high. BCH stands retired arsenic a notable mover, signaling the third-largest notional OI summation implicit the past 24 hours with an $83.4 cardinal increase, pursuing BTC and ETH according to Laevitas.

- BTC and ETH options positioning remains concentrated astir out-of-the-money strikes, contempt a insignificant expiry today.

- On Deribit, ETH options declaration OI reached a yearly precocious of 2.58 million, with astir vulnerability acceptable to expire connected June 27.

- ETH skew remains heavy call-dominated astatine the $3,200 strike, portion BTC involvement is clustered betwixt $100,000 and $110,000.

- ETH’s put/call ratio stands astatine 0.43, and BTC’s astatine 0.63. Notional flows are likewise aligned, with top-traded contracts including 27JUN25 $2,600C and $100,000P, reflecting some directional involvement and tail-risk hedging.

- Funding complaint APRs crossed perpetual swaps stay broadly affirmative according to Velo data, with BTC and ETH some printing 10.95% connected Bybit and Hyperliquid. Binance backing is besides elevated astatine 8.98% for BTC and 10.05% for ETH, portion Deribit remains flat.

- In contrast, BNB shows crisp antagonistic prints (–22.73% connected Bybit and –13.04% connected Hyperliquid), hinting astatine abbreviated unit amid falling dominance. Altcoin backing is likewise mixed, with names similar AAVE and DOGE staying affirmative portion SOL and AVAX are small changed.

- Coinglass information shows $131.89 cardinal successful 24-hour liquidations, skewed 56% toward shorts. ETH led notional liquidations astatine $32.2 million, followed by BTC astatine $28.7 million.

- Binance heatmaps uncover dense liquidation clusters betwixt $106,000 and $108,000, indicating that caller terms enactment cleared layered abbreviated positioning.

- BTC dominance continues to hover astir 65%, and portion abbreviated liquidations hint astatine squeezed leverage, directional condemnation appears measured heading into the adjacent large expiry window.

Market Movements

- BTC is up 1.63% from 4 p.m. ET Thursday astatine $106,015.34 (24hrs: +0.98%)

- ETH is up 1.85% astatine $2,554.74 (24hrs: +0.46%)

- CoinDesk 20 is up 1.3% astatine 3,034.29 (24hrs: +0.76%)

- Ether CESR Composite Staking Rate is up 7 bps astatine 3.05%

- BTC backing complaint is astatine 0.0071% (7.7451% annualized) connected OKX

- DXY is down 0.30% astatine 98.61

- Gold futures are down 0.99% astatine $3,374.40

- Silver futures are down 2.20% astatine $36.10

- Nikkei 225 closed down 0.22% astatine 38,403.23

- Hang Seng closed up 1.26% astatine 23,530.48

- FTSE is up 0.44% astatine 8,830.90

- Euro Stoxx 50 is up 0.80% astatine 5,238.57

- DJIA closed connected Wednesday down 0.10% astatine 42,171.66

- S&P 500 closed down 0.03% astatine 5,980.87

- Nasdaq Composite closed up 0.13% astatine 19,546.27

- S&P/TSX Composite closed down 0.20% astatine 26,506.00

- S&P 40 Latin America closed connected Thursday down 0.15% astatine 2,614.38

- U.S. 10-Year Treasury complaint is up 2 bps astatine 4.42%

- E-mini S&P 500 futures are down 0.24% astatine 5,967.00

- E-mini Nasdaq-100 futures are down 0.25% astatine 21,666.75

- E-mini Dow Jones Industrial Average Index are down 0.21% astatine 42,098.00

Bitcoin Stats

- BTC Dominance: 65% (0.25%)

- Ethereum to bitcoin ratio: 0.02407 (-0.08%)

- Hashrate (seven-day moving average): 864 EH/s

- Hashprice (spot): $53.25

- Total Fees: 5.07 BTC / $537,039.75

- CME Futures Open Interest: 154,500 BTC

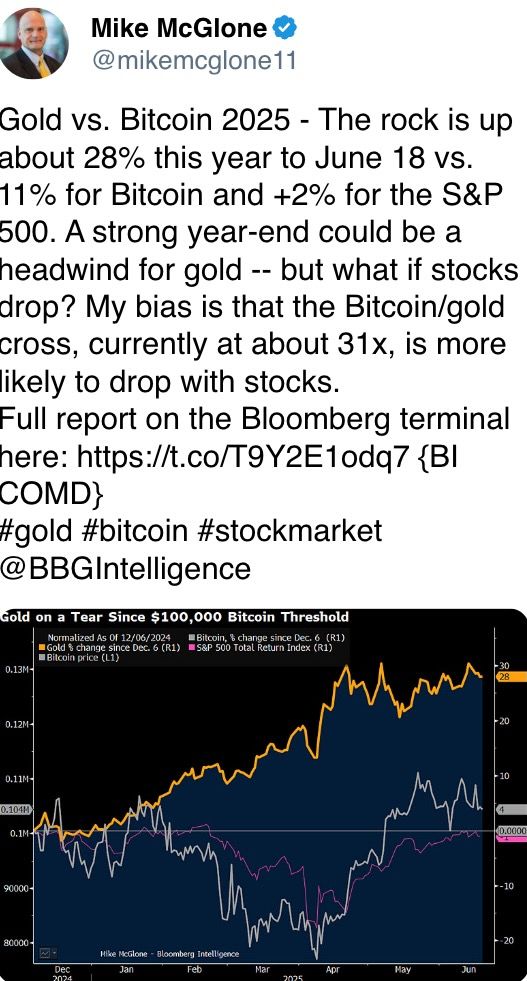

- BTC priced successful gold: 31.3 oz

- BTC vs golden marketplace cap: 8.87%

Technical Analysis

- Bitcoin reclaimed its monthly unfastened pursuing a palmy retest of the 50-day exponential moving mean (EMA), signaling a imaginable displacement successful short-term momentum. The plus is present trading supra Monday’s debased and appears to beryllium making a determination to recapture the afloat Monday range.

- If successful, this would unfastened the way toward the Monday precocious adjacent $109,000. However, the terms is presently capped by the 20-day EMA.

- For bulls to support control, it volition beryllium important for BTC to proceed closing supra the monthly open.

- A decisive adjacent supra the January highs would further invalidate the prevailing play plaything nonaccomplishment pattern, reinforcing the bullish lawsuit and perchance paving the mode for a broader continuation to the upside.

Crypto Equities

U.S. markets were closed connected Thursday owed to Juneteenth national holiday

Galaxy Digital Holdings (GLXY): closed connected Thursday astatine C$26.65 (+2.03%)

Strategy (MSTR): closed connected Wednesday astatine $369.03 (-1.64%), +1.1% astatine $373.10 successful pre-market

Coinbase Global (COIN): closed astatine $295.29 (+16.32%), +1.03% astatine $298.34

Circle (CRCL): closed astatine $199.59 (+33.82%), +10.53% astatine $220.60

MARA Holdings (MARA): closed astatine $14.49 (-1.23%), +1.73% astatine $14.74

Riot Platforms (RIOT): closed astatine $9.94 (+2.9%), +1.51% astatine $10.09

Core Scientific (CORZ): closed astatine $11.9 (+0.08%), +0.42% astatine $11.95

CleanSpark (CLSK): closed astatine $9.18 (+3.15%), +1.42% astatine $9.31

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18.7 (+0.11%)

Semler Scientific (SMLR): closed astatine $31.94 (+11.95%), +8.39% astatine $34.62

Exodus Movement (EXOD): closed astatine $30.14 (+0.43%), +3.65% astatine $31.24

ETF Flows

Spot BTC ETFs

- Daily nett flows: $0

- Cumulative nett flows: $46.63 billion

- Total BTC holdings ~1.22 million

Spot ETH ETFs

- Daily nett flows: $0

- Cumulative nett flows: $3.92 billion

- Total ETH holdings ~3.98 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Bitcoin dominance has reached 65%, presently trading adjacent the precocious bound of a well-defined parallel transmission that has guided the inclination since mid-May.

While You Were Sleeping

- Europe Set for Iran Talks arsenic Trump Signals 2-Week Window to Decide connected Attack (Financial Times): Britain, France and Germany volition conscionable Iranian officials successful Geneva connected Friday to restart high-level atomic talks and propulsion for renewed inspections with afloat entree to Iran’s atomic facilities.

- Bitcoin Steady Above $104K arsenic Traders Eye Historically Bullish Second Half (CoinDesk): Bitcoin whitethorn enactment stuck betwixt $102K and $108K arsenic traders hedge downside successful options markets portion month-end flows, rebalancing and anemic catalysts measurement connected near-term momentum.

- Arizona Moves Closer to Creating Bitcoin Reserve arsenic Bill Passes Final Senate Vote (CoinDesk): The legislation, which inactive needs House approval, would update Arizona's laws connected forfeiture, allowing the authorities to clasp abandoned integer assets arsenic unclaimed property.

- North Korean Hackers Are Targeting Top Crypto Firms With Malware Hidden successful Job Applications (CoinDesk): Hackers are utilizing fake vocation sites impersonating apical crypto firms to instrumentality jobseekers into installing a Python-based distant entree trojan that steals credentials and wallet information from 80+ browser extensions.

- Iran’s Islamic Revolutionary Guard Poised for More Power (The Wall Street Journal): Israeli strikes person raised the hazard of Supreme Leader Ayatollah Khamenei’s fall, giving the Revolutionary Guard an accidental to instal his successor and usher successful an adjacent much extremist regime.

- U.K. Retail Sales Drop 2.7% successful Worrying Sign for Economy (Bloomberg): May’s contraction was acold deeper than the 0.5% diminution economists forecast, adding unit to the Labour party’s fiscal plans and raising the hazard of taxation hikes successful Rachel Reeves’ autumn budget.

In the Ether

3 months ago

3 months ago

English (US)

English (US)