By Omkar Godbole (All times ET unless indicated otherwise)

The outlook for bitcoin (BTC) looks bullish adjacent aft the largest cryptocurrency pulled backmost to $95,000 from Friday's highs supra $98,000 and the full crypto marketplace capitalization dropped nether $3 trillion

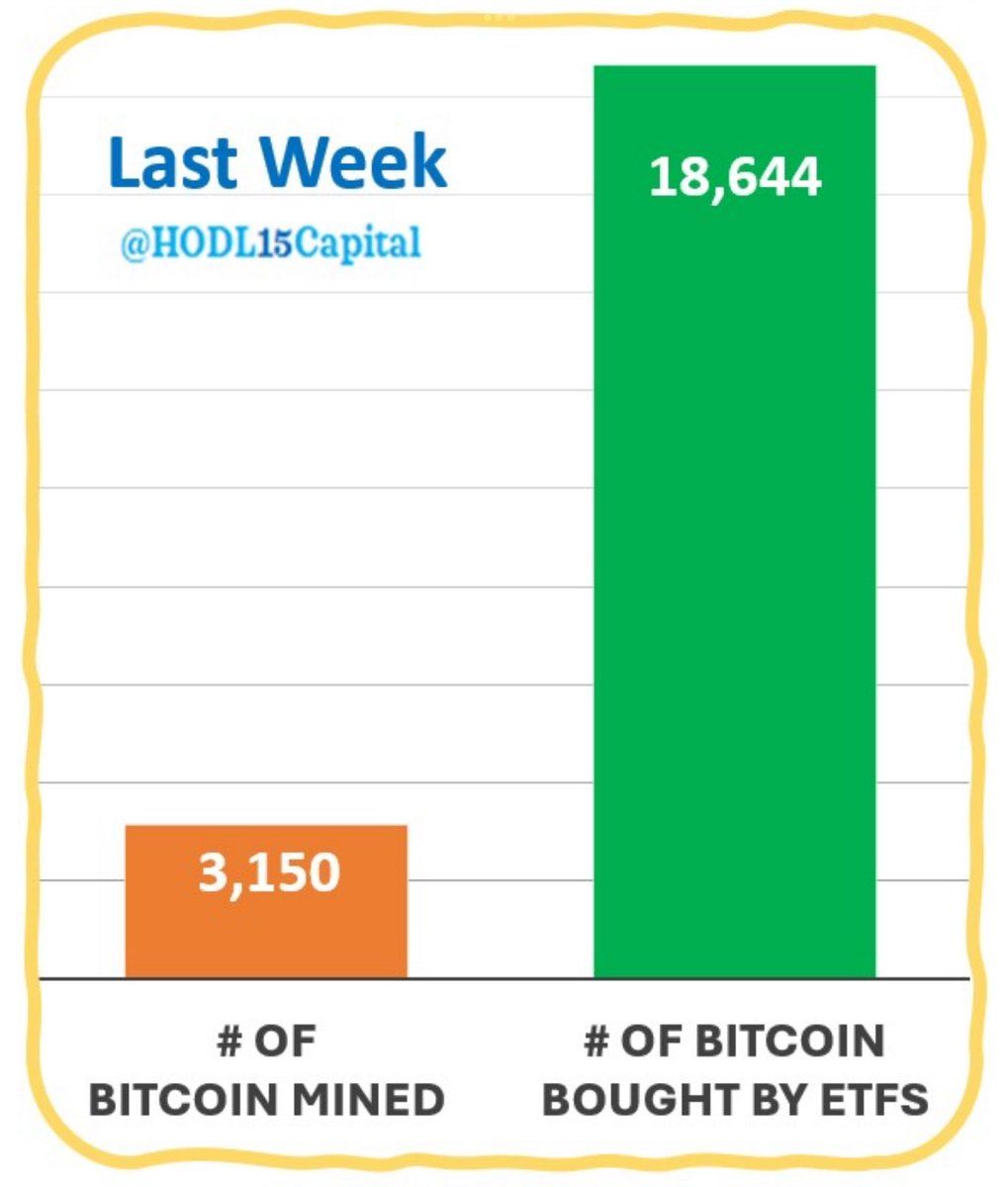

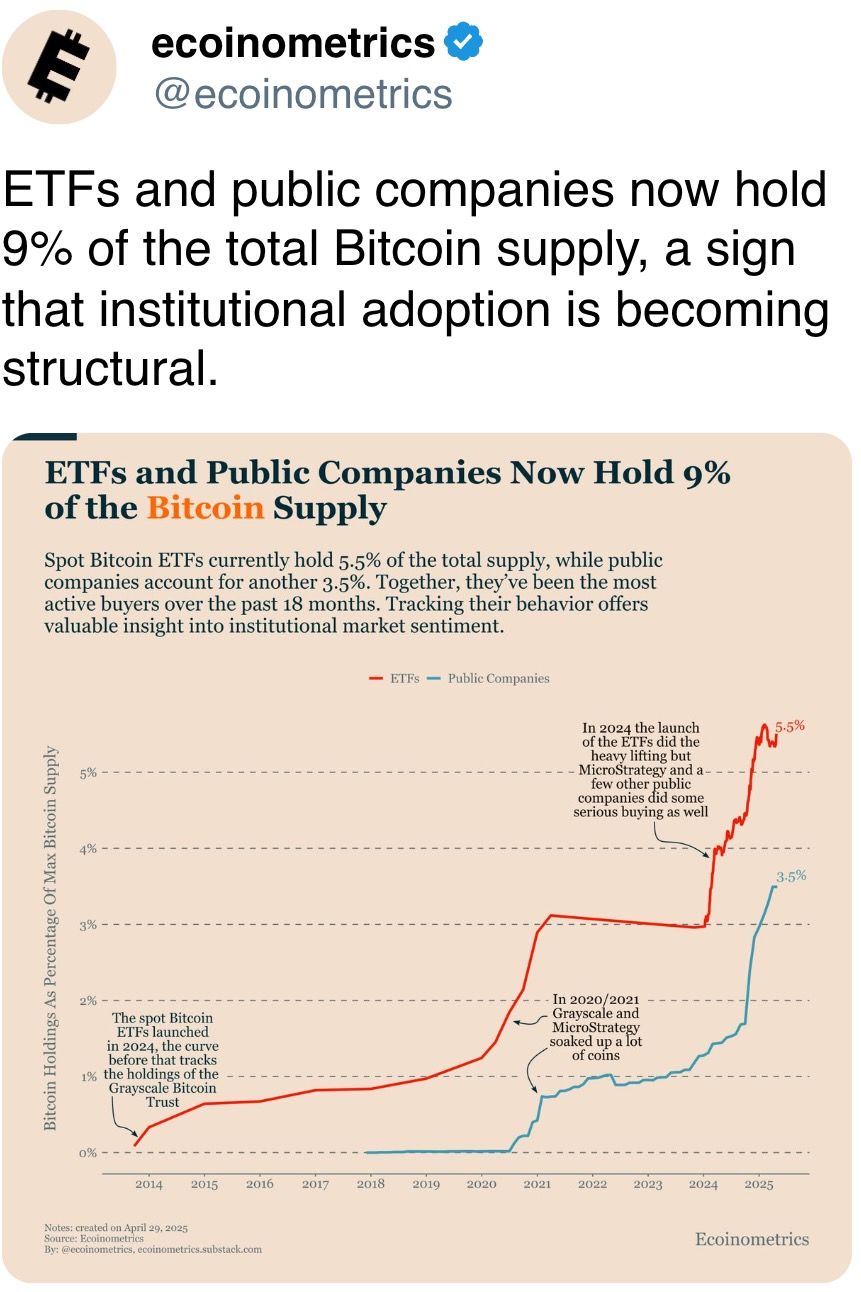

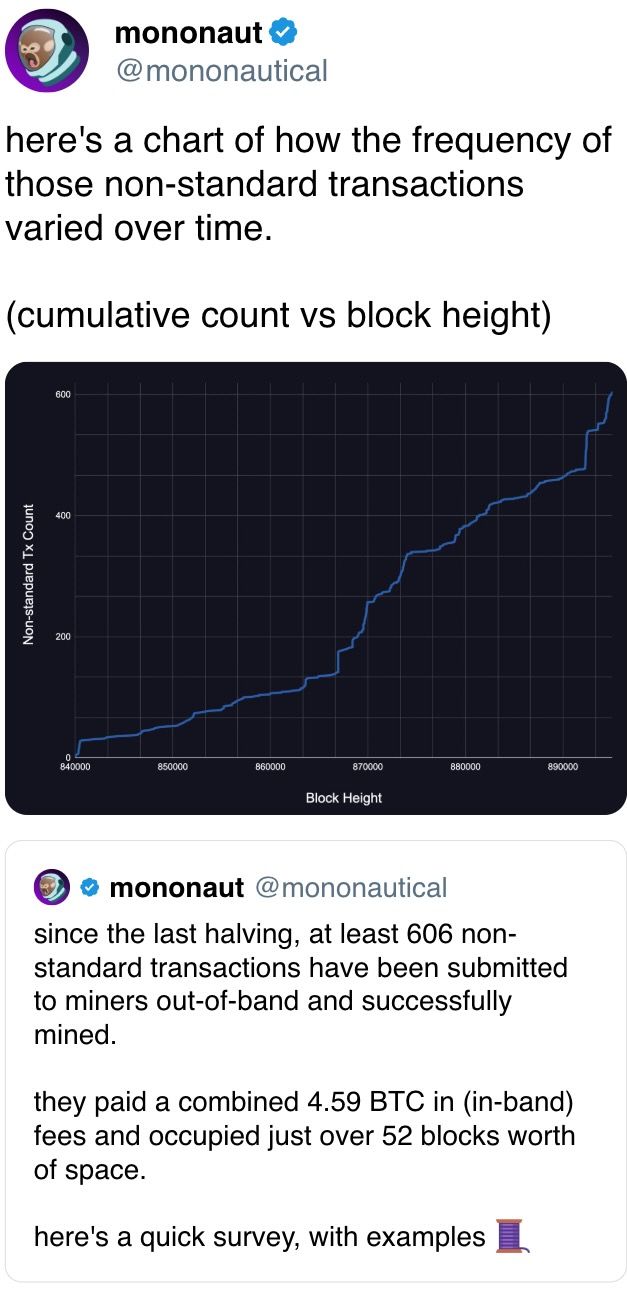

Among the signals, U.S.-listed spot bitcoin ETFs are rapidly absorbing supply. Last week, the 11 ETFs registered a cumulative nett inflow of $1.8 billion, equating to implicit 18,500 BTC, six times much than the 3,150 BTC mined, according to information sources Farside Investors and HODL15Capital. (See Chart of the Day)

On-chain enactment has besides picked up, suggesting a bullish outlook. According to information root IntoTheBlock, the fig of progressive BTC addresses topped 800,000 connected Sunday, "While it is inactive acold from its highs, the rebound signals a wide pickup successful on-chain engagement; often a motion of renewed marketplace demand," the steadfast said connected X.

As for DeFi, the fig of on-chain transactions involving wrapped bitcoin (WBTC) continues to rise, having doubled since January, indicating capitalist involvement successful bitcoin-backed decentralized finance.

Still, semipermanent holders may measurement up their selling arsenic the terms nears $100,000, perchance slowing complaint of increase, investigation from Glassnode shows.

In ether's (ETH) case, information from CryptoQuant amusement that the fig of ETH held by the alleged accumulation addresses increased by 22% to 19.04 cardinal ETH successful 2 months. Ethereum is acceptable to instrumentality the Pectra upgrade connected Wednesday to boost scalability, usability and validator efficiency, doubling the blob information capableness per artifact and lowering the costs for layer-2 protocols.

On the macro front, the Federal Reserve interest-rate determination is owed this Wednesday. According to ING, the near-term ostentation concerns, highlighted by survey data, bounds the Fed's quality to easiness and the cardinal slope is apt to propulsion backmost against the calls for complaint cuts. The bank, however, said that the caller softening of the GDP suggests scope for easing successful the 2nd half.

"Volatility is coming," PowerTrade said, pointing to the Fed decision, U.S. ISM services PMI and the Bank of England complaint determination arsenic catalysts this week. Stay alert!

What to Watch

- Crypto:

- May 5, 11 a.m.: The Crescendo web upgrade goes unrecorded connected the Kaspa (KAS) mainnet. This upgrade boosts the network’s show by expanding the artifact accumulation complaint to 10 blocks per 2nd from 1 artifact per second.

- May 6: Casper Network (CSPR) launches its 2.0 mainnet upgrade, introducing faster transactions, enhanced astute contracts and improved staking features to boost endeavor adoption.

- May 7, 6:05 a.m.: The Pectra hard fork web upgrade volition get activated connected the Ethereum (ETH) mainnet astatine epoch 364032. Pectra combines 2 large components: the Prague execution furniture hard fork and the Electra statement furniture upgrade.

- May 8: Judge John G. Koeltl volition condemnation Alex Mashinsky, the laminitis and erstwhile CEO of the now-defunct crypto lending steadfast Celsius Network, astatine the U.S. District Court for the Southern District of New York.

- Macro

- May 5, 9:45 a.m.: S&P Global releases (Final) U.S. April purchasing managers’ scale (PMI) data.

- Composite PMI Est. 51.2 vs. Prev. 53.5

- Services PMI Est. 51.4 vs. Prev. 54.4

- May 5, 10 a.m.: Institute for Supply Management (ISM) releases U.S. April economical enactment data.

- Services PMI Est. 50.6 vs. Prev. 50.8

- May 6, 9 a.m.: S&P Global releases Brazil April purchasing managers’ scale (PMI) data.

- Composite PMI Prev. 52.6

- Services PMI Prev. 52.5

- May 7, 7 p.m.: The Federal Reserve announces its involvement complaint decision. The FOMC property league is livestreamed 30 minutes later.

- Federal Funds Rate Target Range Est. 4.25%-4.5% vs. Prev. 4.25%-4.5%

- May 5, 9:45 a.m.: S&P Global releases (Final) U.S. April purchasing managers’ scale (PMI) data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Uniswap DAO is voting on whether to wage Forse, a data‑analytics level from StableLab, $60,000 successful UNI to physique an “analytics hub” that tracks however inducement programs are moving connected 4 much blockchains. Voting ends connected May 6.

- Arbitrum DAO is voting connected whether to enactment the last $10.7 million from its 35 million ARB diversification plan into 3 low‑risk, dollar‑based funds from WisdomTree, Spiko and Franklin Templeton. Voting ends connected May 8.

- May 5, 4 p.m.: Livepeer (LPT) to big a Treasury Talk session connected Discord.

- May 6, 1:30 p.m.: MetaMask and Aave to big an X Spaces league on USDC supplied to Aave being spendable connected the MetaMask card.

- May 7, 7:30 a.m.: PancakeSwap to big an X Spaces Ask Me Anything (AMA) league on the aboriginal of trading.

- May 7, 11 a.m.: Pendle to big a Pendle Yield Talk: Stablecoin Alpha X Spaces session.

- May 8, 10 a.m.: Balancer and Euler to big an Ask Me Anything (AMA) session.

- Unlocks

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating proviso worthy $13.59 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating proviso worthy $9.85 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating proviso worthy $88.46 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating proviso worthy $58.36 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating proviso worthy $1.13 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $17.02 million.

- Token Launches

- May 5: Sonic (S) to beryllium listed connected Kraken.

- May 7: Obol (OBOL) to beryllium listed connected Binance, Bitget, Bybit, Gate.io, MEXC, and others.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- May 6-7: Financial Times Digital Assets Summit (London)

- May 6-8: Stripe Sessions (San Francisco)

- May 7-9: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest successful DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- Memecoin markets are not attracting personage hype anymore.

- Prices of the GORK token, which references a parody AI chatbot that itself mimics XAI's Grok chatbot, failed to leap higher implicit the play adjacent arsenic technocrat Elon Musk wide referenced the Gork X account.

— gorklon rust (@elonmusk) May 3, 2025 - Musk adjacent changed his X representation to the 1 utilized by Gork. He aboriginal added pit viper sunglasses — a notation to Mog Coin — aft a MOG holder asked Musk to "put those" on.

- GORK, which was issued past week, zoomed to an $80 cardinal marketplace capitalization successful 4 days, but did not emergence aft Musk's references, a imaginable motion of fatigue among memecoin speculators. Such an endorsement past twelvemonth would astir apt person led to a monolithic spike successful prices.

- That muted absorption highlights a broader displacement successful memecoin dynamics: Celebrity engagement nary longer guarantees terms momentum. In 2023 and aboriginal 2024, adjacent a azygous tweet oregon similar from high-profile figures could trigger double- oregon triple-digit percent gains successful minutes.

- But the marketplace has since matured, or, arguably, burned out. Now, traders look much focused connected liquidity depth, tokenomics and communicative stickiness than quick-hit endorsements.

- GORK's stalled reaction, contempt Musk’s implicit nod, suggests that attraction unsocial isn’t capable — memecoins request sustained assemblage traction oregon inferior memes to thrust value.

- It besides hints that retail appetite whitethorn beryllium cooling, particularly arsenic memecoins go much saturated and short-term rotations turn much competitive.

Derivatives Positioning

- Monero's (XMR) perpetual futures marketplace looks overheated, with annualized backing rates nearing the 100% mark. Extreme bullish positioning often translates into abrupt terms propulsion backs.

- BCH and SUI markets look the other concern with bias for shorts driving backing rates to minus 20% oregon lower. This could perchance pb to a abbreviated compression and a large determination higher.

- BTC futures unfastened involvement connected the CME roseate to $14.01 cardinal connected Friday, the highest since Feb. 21. ETH unfastened involvement remains level adjacent caller lows nether $1.5 billion.

- On Deribit, BTC calls commercialized astatine a premium to puts crossed aggregate clip frames, hazard reversals show. In ETH's case, bullishness is seen lone aft the end-May expiry.

Market Movements

- BTC is down 1.27% from 4 p.m. ET Sunday astatine $94,447.49 (24hrs: -1.07%)

- ETH is down 0.77% astatine $1,819.25 (24hrs: -0.39%)

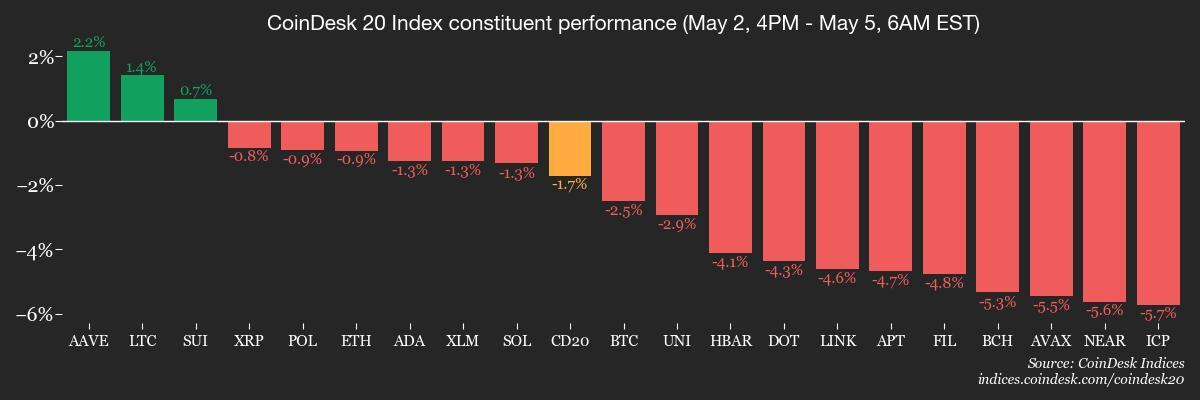

- CoinDesk 20 is down 0.70% astatine 2,721.32 (24hrs: unchanged)

- Ether CESR Composite Staking Rate is down 3 bps astatine 2.90%

- BTC backing complaint is astatine 0.0007% (0.7512% annualized) connected Binance

- DXY is down 0.34% astatine 99.69

- Gold is up 2.29% astatine $3,316.45/oz

- Silver is up 1.4% astatine $32.43/oz

- Nikkei 225 closed +1.04% astatine 36,830.69

- Hang Seng closed +1.74% astatine 22,504.68

- FTSE closed connected Friday +1.17% astatine 8,596.35

- Euro Stoxx 50 is down 0.35% astatine 5,266.20

- DJIA closed connected Friday +1.39% astatine 41,317.43

- S&P 500 closed +1.47% astatine 5,686.67

- Nasdaq closed +1.51% astatine 17,977.73

- S&P/TSX Composite Index closed +0.95% astatine 25,031.51

- S&P 40 Latin America closed -2.94% astatine 2,227.14

- U.S. 10-year Treasury complaint is up 8 bps astatine 4.32%

- E-mini S&P 500 futures are down 0.75% astatine 5,666.00

- E-mini Nasdaq-100 futures are up 0.90% astatine 20,013.75

- E-mini Dow Jones Industrial Average Index futures are down 0.61% astatine 41,174.00

Bitcoin Stats

- BTC Dominance: 64.65 (-0.21%)

- Ethereum to bitcoin ratio: 0.01928 (+0.52%)

- Hashrate (seven-day moving average): 886 EH/s

- Hashprice (spot): $50.30

- Total Fees: 3.40 BTC / $321,456

- CME Futures Open Interest: 145,920 BTC

- BTC priced successful gold: 28.9 oz

- BTC vs golden marketplace cap: 8.18%

Technical Analysis

- TON traded astatine the enactment level offered by the trendline connecting lows registered successful March and April.

- Potential usurpation of trendline would awesome an extremity of the corrective bounce from first-quarter lows, exposing the yearly debased of $2.43.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $394.37 (+3.35%), down 2.38% astatine $384.98 successful pre-market

- Coinbase Global (COIN): closed astatine $204.93 (+1.8%), down 1.81% astatine $201.22

- Galaxy Digital Holdings (GLXY): closed astatine $26.84 (+11.6%)

- MARA Holdings (MARA): closed astatine $14.48 (+3.06%), down 2.56% astatine $14.11

- Riot Platforms (RIOT): closed astatine $8.39 (+7.98%), down 2.15% astatine $8.21

- Core Scientific (CORZ): closed astatine $8.74 (+2.22%), down 1.49% astatine $8.61

- CleanSpark (CLSK): closed astatine $8.81 (+1.61%), down 2.50% astatine $8.59

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.97 (+2.6%)

- Semler Scientific (SMLR): closed astatine $36.16 (+8.49%)

- Exodus Movement (EXOD): closed astatine $44.79 (+10.92%), up 2.66% astatine $45.98

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $674.9 million

- Cumulative nett flows: $40.20 billion

- Total BTC holdings ~ 1.16 million

Spot ETH ETFs

- Daily nett flow: $20.1 million

- Cumulative nett flows: $2.52 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The illustration shows the U.S.-listed spot bitcoin ETFs snapped up implicit 18,000 BTC past week, importantly outpacing the caller proviso from miners.

While You Were Sleeping

- President Donald Trump Denies He's Profiting From TRUMP Token: (NBC): In an interrogation with "Meet the Press" moderator Kristen Welker, Trump said helium hasn’t checked his crypto token’s value.

- Maldives Could Soon Become a Crypto Hub Thanks to Dubai Family Office's $9B Commitment (CoinDesk): A Dubai-based household bureau tied to Qatari royal Sheikh Nayef plans to put up to $8.8 cardinal successful a Maldives fiscal hub implicit 5 years, with $4 cardinal already committed.

- Kyrgyzstan's Gold-Backed Dollar Pegged Stablecoin USDKG to Debut successful Q3 (CoinDesk): The stablecoin volition beryllium backed by $500 cardinal successful golden from the Kyrgyz Ministry of Finance, with plans to grow reserves to $2 billion.

- Why the U.S. Senate Crypto Bill Is successful Turmoil (Politico): Nine Democrat senators pulled enactment Saturday for a revised stablecoin bill, citing diluted anti-money laundering rules, systemic hazard concerns and Trump household ties to a $2 cardinal crypto deal.

- Chinese Exporters ‘Wash’ Products successful Third Countries to Avoid Donald Trump’s Tariffs (Financial Times): Authorities successful Asia are investigating intermediaries helping Chinese firms reroute goods done adjacent countries, wherever shipments are repackaged and relabeled to get caller root certificates.

- OPEC+ Supply Hike Forces Wall Street to Redo Sums, Yet Again (Bloomberg): Saudi Arabia appears consenting to judge weaker lipid prices to rein successful overproducing allies, undercut U.S. shale rivals and show practice with Washington amid planetary ostentation concerns.

In the Ether

5 months ago

5 months ago

English (US)

English (US)