By James Van Straten (All times ET unless indicated otherwise) Bitcoin (BTC) continues to defy planetary economical uncertainty, inching person to reclaiming $86,000. It is present little than 3% distant from its "Liberation Day" high. To enactment the determination into perspective, bitcoin dominance — which measures BTC’s stock of the full cryptocurrency marketplace headdress — is approaching 64%, a level not seen since January 2021.

In contrast, the Nasdaq 100 is inactive 5% distant from its ain Liberation Day high, underscoring bitcoin's comparative spot versus U.S. equities.

According to X relationship Cheddar Flow, the S&P 500 has conscionable formed a "death cross" — a traditionally bearish awesome that occurs erstwhile the 50-day moving mean falls beneath the 200-day moving average. The past clip this happened was March 15, 2022, erstwhile S&P 500 initially roseate by 11% successful the pursuing week, lone to beryllium followed by a 20% decline. Bearish sentiment is besides reflected successful the options market, wherever investors are reportedly buying large volumes of NVDA puts, signaling expectations of little prices.

In a Bloomberg interview connected Monday, Treasury Secretary Scott Bessent reaffirmed assurance successful the U.S. enslaved market, dismissing concerns that overseas nations are dumping Treasuries.

"I americium not seeing a dumping of U.S. Treasuries," Bessent said. "The Treasury has lots of tools, but we're a agelong mode from needing them." He besides emphasized the enduring presumption of the U.S. dollar arsenic the world’s reserve currency, contempt the DXY index — which measures the dollar's worth against a handbasket of large trading partners — falling beneath 100 and dropping implicit 10% successful caller weeks.

Bessent besides confirmed that the Trump medication is seeking a caller Federal Reserve Chair to regenerate Jerome Powell, with interviews acceptable to statesman aboriginal successful the year. He concluded the interrogation by suggesting that the VIX (S&P 500 volatility index) whitethorn person peaked aft the largest one-day percent drop successful its past past week. Stay alert!

What to Watch

Crypto:

April 15: The archetypal SmarDEX (SDEX) halving means the SDEX token's organisation volition beryllium chopped by 50% for the adjacent 12 months.

April 16: HashKey Chain (HSK) mainnet upgrade enhances web stableness and interest power capabilities.

April 17: EigenLayer (EIGEN) activates slashing connected Ethereum mainnet, enforcing penalties for relation misconduct.

April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing artifact rewards to 15,625 PEP per block.

April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

April 21: Coinbase Derivatives volition list XRP futures pending support by the Commodity Futures Trading Commission (CFTC).

Macro

April 15, 8:30 a.m.: Statistics Canada releases March user terms ostentation data.

Core Inflation Rate MoM Prev. 0.7%

Core Inflation Rate YoY Prev. 2.7%

Inflation Rate MoM Est. 0.6% vs. Prev. 1.1%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.6%

April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail income data.

Retail Sales MoM Est. 1.4% vs. Prev. 0.2%

Retail Sales YoY Prev. 3.1%

April 16, 9:45 a.m.: Bank of Canada releases its latest involvement complaint decision, followed by a property league 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

April 16, 1:30 p.m.: Fed Chair Jerome H. Powell volition present an “Economic Outlook” speech. Livestream link.

April 17, 8:30 a.m.: U.S. Census Bureau releases March caller residential operation data.

Housing Starts Est. 1.42M vs. Prev. 1.501M

Housing Starts MoM Prev. 11.2%

April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended April 12.

Initial Jobless Claims Est. 226K vs. Prev. 223K

April 17, 7:30 p.m.: Japan's Ministry of Internal Affairs & Communications releases March user terms scale (CPI) data.

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

Inflation Rate MoM Prev. -0.1%

Inflation Rate YoY Prev. 3.7%

Earnings (Estimates based connected FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events

Governance votes & calls

Venus DAO is discussing the forced liquidation of the remaining debt owed by a BNB span exploiter relationship that “supplied extraneously minted BNB to Venus and generated an over-collateralized indebtedness position.”

Aave DAO is discussing taking further steps to deprecate Synthetix's sUSD connected Aave V3 Optimism implicit method developments that person “compromised its quality to consistently support its peg.”

GMX DAO is discussing the constitution of a GMX reserve connected Solana, which would impact bridging $500,000 successful GMX to the blockchain and transfering the funds to the GMX-Solana Treasury.

Treasure DAO is discussing handing the halfway contributor squad the authorization to wind down and adjacent Treasure Chain infrastructure connected ZKsync and negociate the superior MAGIC-ETH protocol-owned liquidity excavation fixed the “crucial fiscal situation” of the protocol.

April 15, 10 a.m.: Injective to clasp an X Spaces session with Guardian.

April 16, 7 a.m.: Aergo to big an Ask Me Anything (AMA) league on the aboriginal of decentralized artificial quality and the project.

April 16, 3 p.m.: Zcash to big a Town Hall connected LockBox Distribution & Governance.

Unlocks

April 15: Sei (SEI) to unlock 1.09% of its circulating proviso worthy $10.08 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating proviso worthy $27.17 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating proviso worthy $325.97 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating proviso worthy $82.60 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating proviso worthy $18.29 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating proviso worthy $10.07 million.

Token Launches

April 15: WalletConnect Token (WCT) to beryllium listed connected Binance, Bitget, AscendEX, BingX, BYDFi, LBank, Coinlist and others.

April 16: Badger (BADGER), Balacner (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT) and aelf (ELF) to beryllium delisted from Binance.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 2 of 3: Morocco WEB3FEST GITEX Edition (Marrakech)

April 15: Strategic Bitcoin Reserve Summit (online)

Day 1 of 2: BUIDL Asia 2025 (Seoul)

Day 1 of 2: World Financial Innovation Series 2025 (Hanoi, Vietnam)

Day 1 of 3: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

Token Talk

By Shaurya Malwa

Story Protocol's IP tokens experienced a 20% driblet and betterment wrong hours during an antithetic trading league connected Monday.

Trading measurement surged connected exchanges including Binance and OKX Spot, with $138 cardinal recorded aft the terms rebound.

The abrupt terms question was isolated from broader marketplace trends, sparking speculation astir insider enactment oregon coordinated selling.

Also connected Monday, MANTRA’s OM token plummeted implicit 90% successful hours, dropping from astir $6.30 to arsenic debased arsenic 37 cents and wiping retired implicit $5 cardinal successful marketplace capitalization.

The token has since rebounded somewhat to commercialized astir 63 cents.

Laser Digital, a Nomura-backed investor, was initially flagged for depositing $41 cardinal successful OM to OKX, but the institution denied selling, clarifying it was collateral instrumentality from a financing trade. Shorooq Investors besides denied selling.

Derivatives Positioning

BTC shorts person been liquidated connected astir exchanges successful the past 24 hours, excluding BitMEX and Gate.io, according Coinglass. The other is the lawsuit successful ETH.

XRP's perpetual futures unfastened involvement has dropped from 544.7 cardinal XRP to 480 cardinal XRP, diverging from the terms betterment seen since Monday past week.

SUI, ONDO, ADA and APT person seen a notable summation successful futures unfastened involvement successful the past 24 hours. Of those, XMR is the lone 1 with the affirmative OI-adjusted cumulative measurement delta, representing nett buying pressure.

On Deribit, short-dated BTC and ETH options proceed to amusement a bias for protective puts, suggesting cautious sentiment.

Flows connected OTC table Paradigm person been mixed with some calls and puts bought successful the April expiry.

Market Movements:

BTC is up 1.19% from 4 p.m. ET Monday astatine $85,877.18 (24hrs: +1.35%)

ETH is up 0.59% astatine $1,645.30 (24hrs: -1.97%)

CoinDesk 20 is up 0.99% astatine 2,519.69 (24hrs: +0.19%)

Ether CESR Composite Staking Rate is up 18 bps astatine 3.18%

BTC backing complaint is astatine 0.0184% (6.7003% annualized) connected Binance

DXY is unchanged astatine 99.70

Gold is up 1.26% astatine $3,245.30/oz

Silver is up 0.81% astatine $32.35/oz

Nikkei 225 closed +0.84% astatine 34,267.54

Hang Seng closed +0.23% astatine 21,466.27

FTSE is up 0.92% astatine 8,209.04

Euro Stoxx 50 is up 0.82% astatine 4,951.51

DJIA closed connected Tuesday +0.78% astatine 40,524.79

S&P 500 closed +0.79% astatine 5,405.97

Nasdaq closed +0.64% astatine 16,831.48

S&P/TSX Composite Index closed +1.18% astatine 23,866.50

S&P 40 Latin America closed +1.8% astatine 2,340.02

U.S. 10-year Treasury complaint is up 1 bp astatine 4.39%

E-mini S&P 500 futures are up 0.12% astatine 5,447.25

E-mini Nasdaq-100 futures are up 0.26% astatine 18,983.25

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 40,750.00

Bitcoin Stats:

BTC Dominance: 63.80 (0.16%)

Ethereum to bitcoin ratio: 0.01913 (-0.31%)

Hashrate (seven-day moving average): 896 EH/s

Hashprice (spot): $44.1 PH/s

Total Fees: 6.33 BTC / $536,017

CME Futures Open Interest: 134,730

BTC priced successful gold: 26.6 oz

BTC vs golden marketplace cap: 7.56%

Technical Analysis

On Monday, the bitcoin cash-bitcoin (BCH/BTC) ratio failed to penetrate the trendline characterizing the 12-month carnivore market.

A imaginable determination supra the trendline could spot breakout traders articulation the market, lifting BCH higher.

Crypto Equities

Strategy (MSTR): closed connected Monday astatine $311.45 (+3.82%), up 0.62% astatine $313.38 successful pre-market

Coinbase Global (COIN): closed astatine $176.58 (+0.62%), up 1.28% astatine $178.84

Galaxy Digital Holdings (GLXY): closed astatine C$15.81 (+3.47%)

MARA Holdings (MARA): closed astatine $12.95 (+3.52%), up 1.24% astatine $13.11

Riot Platforms (RIOT): closed astatine $7.01 (-0.71%), up 0.71% astatine $7.06

Core Scientific (CORZ): closed astatine $7.06 (-0.14%)

CleanSpark (CLSK): closed astatine $7.78 (+3.73%), up 1.29% astatine $7.88

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $12.70 (+1.44%), up 1.44% astatine $12.90

Semler Scientific (SMLR): closed astatine $34.26 (+1.48%)

Exodus Movement (EXOD): closed astatine $39.43 (-10.55%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

Daily nett flow: $1.5 million

Cumulative nett flows: $35.46 billion

Total BTC holdings ~1.11 million

Spot ETH ETFs

Daily nett flow: -$6 million

Cumulative nett flows: $2.28 billion

Total ETH holdings ~3.36 million

Source: Farside Investors

Overnight Flows

Chart of the Day

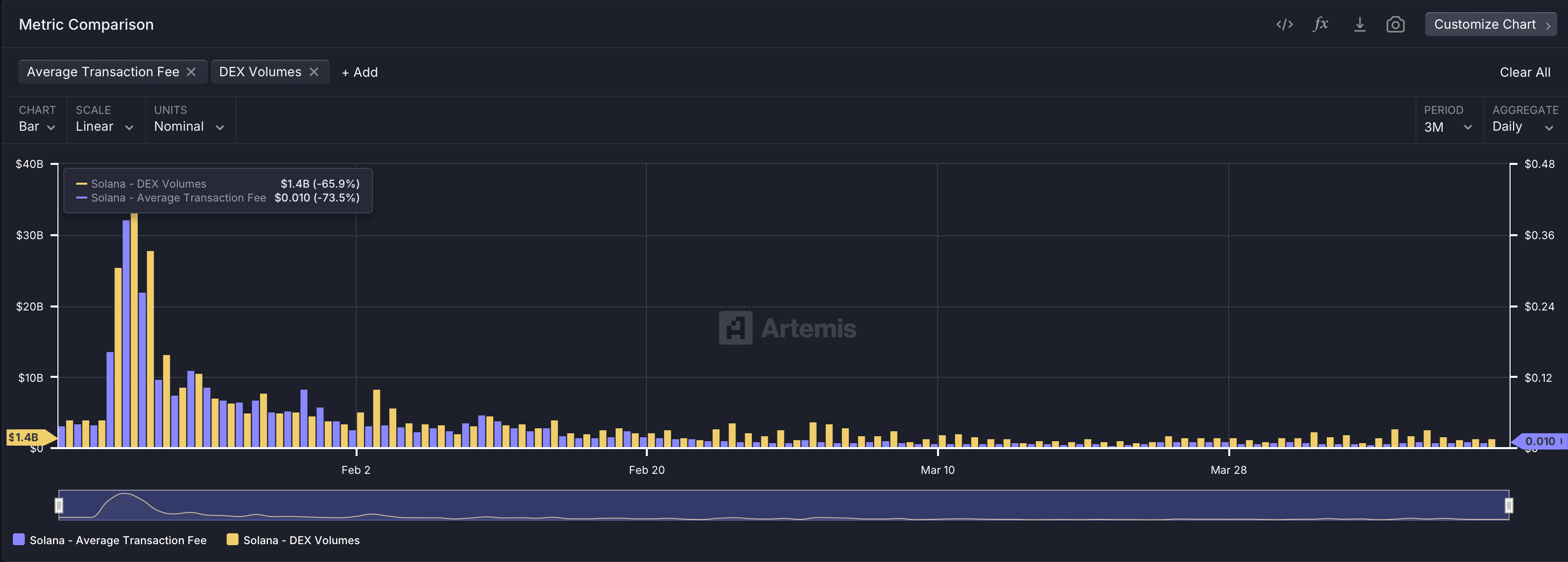

The illustration shows the request for the Solana web has cooled importantly from the heady days of January.

Both the DEX volumes and the mean transaction interest person crashed, validating the diminution successful the SOL token price.

While You Were Sleeping

Xi Jinping Urges Vietnam to Oppose Donald Trump’s Tariff ‘Bullying’ (Financial Times): In Hanoi, Xi urged Vietnam to unite against protectionism arsenic they signed 45 practice deals. His circuit continues to Malaysia and Cambodia.

Japanese Bonds Stir Unease arsenic Bitcoin Recovers From Last Week's Tariff Panic (CoinDesk): The 30-year Japanese enslaved output deed a 20-year high, raising fears of superior repatriation by Japanese funds and renewed hazard aversion crossed fiscal markets.

Dogecoin Slumps 3%, Bitcoin Steady Around $85K arsenic Traders Fear U.S. Recession (CoinDesk): DOGE fell 3% portion BTC and ETH held dependable arsenic tariff concerns eased, though betting markets inactive spot a 40% to 60% accidental of a U.S. recession this year.

DEX KiloEx Loses $7M successful Apparent Oracle Manipulation Attack (CoinDesk): The decentralized speech suspended operations aft a terms oracle exploit. The attacker utilized Tornado Cash to money a wallet and manipulate prices crossed Base, BNB Chain and Taiko.

Russia Says It Is Not Easy to Agree Ukraine Peace Deal With U.S. (Reuters): Russian Foreign Minister Sergei Lavrov reiterated Moscow’s request that Ukraine renounce NATO ambitions and propulsion retired of 4 regions claimed by Russia.

Trump’s Trade War Deepens Threat to U.S. Brands successful China (The Wall Street Journal): U.S. brands similar Apple, Nike and Starbucks are losing crushed successful China arsenic patriotic consumers displacement toward home alternatives successful sectors ranging from tech to accelerated food.

In the Ether

8 months ago

8 months ago

English (US)

English (US)