By Francisco Rodrigues (All times ET unless indicated otherwise)

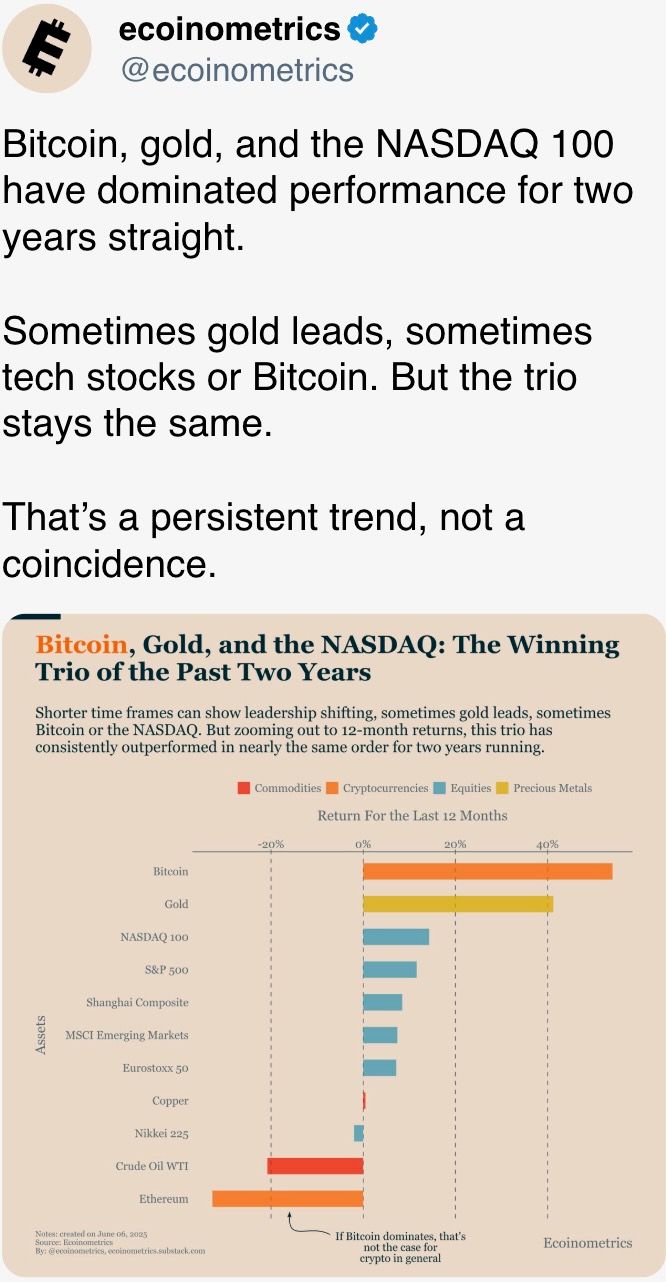

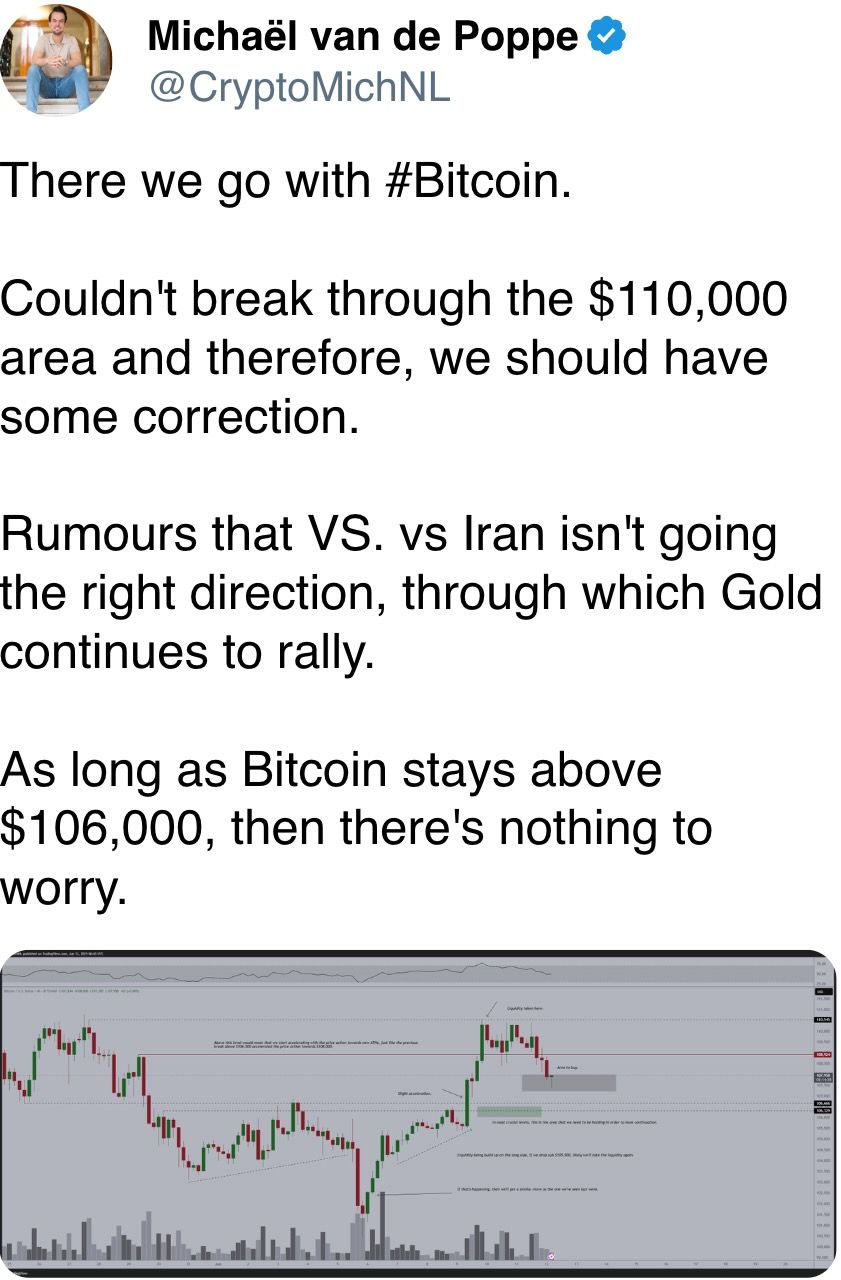

A weaker dollar, subdued ostentation and heightened tensions successful the Middle East are reshaping the crypto market's trajectory, giving bitcoin (BTC) room to run successful the future, portion pushing it down successful the adjacent term. While the largest cryptocurrency is little today, analysts accidental a terms of $200,000 is successful play by year-end.

One power is the U.S. involvement rate. Consumer prices roseate little than forecast past month, expanding the accidental of a Federal Reserve complaint cut, which would bolster hazard assets including cryptocurrencies. With halfway ostentation unchangeable astatine 2.8%, traders present mostly expect 2 cuts this twelvemonth opening successful September, according to the CME’s FedWatch tool.

Then there's the Middle East. The U.S. said yesterday it was moving radical retired of the region implicit heightened information hazard and amid reports Israel is considering subject enactment against Iran. Earlier today, the International Atomic Energy Agency, the United Nation's atomic watchdog, ruled that Iran was successful breach of its non-proliferation duties for the archetypal clip successful 20 years.

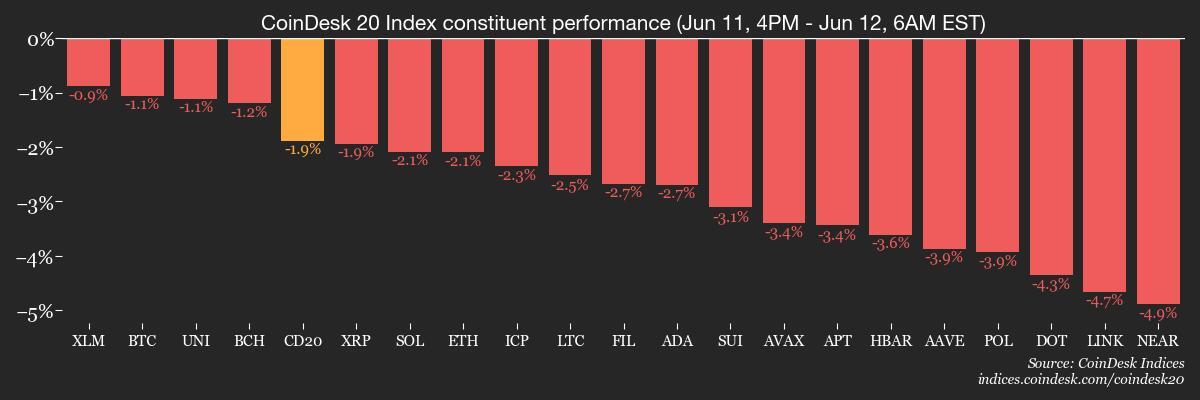

With tensions rising, investors are ditching the dollar successful favour of harmless havens including golden and the Swiss franc arsenic they presumption for a imaginable conflict. That has besides pushed down cryptocurrency prices, with BTC losing 1.7% of its worth successful the past 24 hours and the broader CoinDesk 20 (CD20) Index retreating 2.25%.

“Bitcoin continues to commercialized similar a classical risk-on asset, responding sharply to macro tailwinds,” Boris Alergant, caput of organization partnerships astatine Babylon and a erstwhile Ripple and JPMorgan executive, told CoinDesk.

“That said, the broader representation for BTC remains optimistic,” Alergant said. “More institutions are emulating MicroStrategy’s BTC treasury strategy, creating a dependable basal of structural demand.”

Still, the SEC’s caller willingness to greenlight ETF applications tied to altcoins specified arsenic solana, led to predictions of an “altcoin ETF summer” portion signals of regulatory friendliness toward staking and protocol-based output helped assistance DeFi tokens.

“This marks the archetypal clip the SEC has shown coordinated openness to some layer-1 assets and the DeFi ecosystem,” Youwei Yang, main economist astatine BIT Mining, told CoinDesk successful an emailed statement.

James Butterfill, caput of probe astatine CoinShares, pointed to $900 cardinal successful caller integer plus money inflows this week, suggesting that capitalist assurance is rebounding.

“This resurgence comes arsenic bitcoin trades adjacent all-time highs and planetary wealth proviso conditions loosen, suggesting determination could beryllium further upside imaginable for integer plus prices much broadly,” helium said.

Keep successful mind, though, the equilibrium of planetary events. Tame ostentation could assistance boost hazard assets, yet unexpected escalation successful the Middle East could reverse those gains. Stay alert!

What to Watch

- Crypto

- June 12, 10 a.m.: Coinbase's State of Crypto Summit 2025 (New York). Livestream link.

- June 16: 21Shares executes a 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- June 16: Brazil’s B3 speech launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) and benchmarked to Nasdaq indices.

- Macro

- June 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases May shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.4%

- Core PPI YoY Est. 3.1% vs. Prev. 3.1%

- PPI MoM Est. 0.2% vs. Prev. -0.5%

- PPI YoY Est. 2.6% vs. Prev. 2.4%

- June 12, 3 p.m.: Argentina’s National Institute of Statistics and Census releases May ostentation data.

- Inflation Rate MoM Prev. 2.8%

- Inflation Rate YoY Prev. 47.3%

- June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

- June 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases May shaper terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market

Token Events

- Governance votes & calls

- ApeCoin DAO is weighing scrapping the decentralized autonomous organization and launching ApeCo to “supercharge the APE ecosystem.” The treatment is scheduled to extremity aboriginal today.

- Arbitrum DAO is voting connected a connection to motorboat DRIP, an $80M incentives program targeting circumstantial DeFi activity. Managed by a foundation-led committee, DRIP would reward users straight and let the DAO to unopen it down via vote. Voting ends June 20.

- June 12, 11:30 a.m.: Jupiter to big its Planetary Call with a “special guest.”

- Unlocks

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $12.44 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $17.06 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $10.65 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating proviso worthy $35.74 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating proviso worthy $41.78 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $11.10 million.

- Token Launches

- June 12: Coinbase to database Fartcoin (FARTCOIN), Subsquid (SQD) and PancakeSwap (CAKE).

- June 12: Ethena (ENA) and Solayer (LAYER) to beryllium listed connected Binance.US

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

- Day 3 of 3: Ripple's Apex 2025 (Singapore)

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Oliver Knight

- SPX6900 (SPX), 1 of many AI cause memecoins that spawned successful the second fractional of 2024, rocketed to a grounds precocious of $1.71 connected Wednesday, defying a wider marketplace sell-off prompted by governmental tensions involving Iran.

- The project's extremity is to flip the full U.S. banal marketplace successful presumption of capitalization and portion it's a fewer trillion dollars away, it has amassed a $1.7 cardinal marketplace cap.

- Crypto expert and societal media property Murad famously racked up a $40 cardinal unrealized loss earlier this year. That nonaccomplishment has go a $55 cardinal summation owed to the token's ascent.

- SPX remains 1 of conscionable a fistful of altcoins that are affirmative implicit the past 24 hours arsenic overmuch of the marketplace continues to reel implicit fears that a warring could escalate successful the Middle East. Gold and lipid prices roseate importantly overnight, which is historically a motion of impending conflict.

- CoinMarketCap's AI cause memecoin assemblage is down by 3.5%.

Derivatives Positioning

- Bitcoin options unfastened involvement connected Deribit has reached $36.7 billion, the highest level seen this month.

- The ascendant expiry remains June 27 with implicit $13.8 cardinal successful notional unfastened interest, and bullish telephone positioning continuing to clump astatine the $140,000 strike.

- The put/call ratio stands astatine 0.60, reflecting a mean bias toward calls, though little truthful than successful caller sessions.

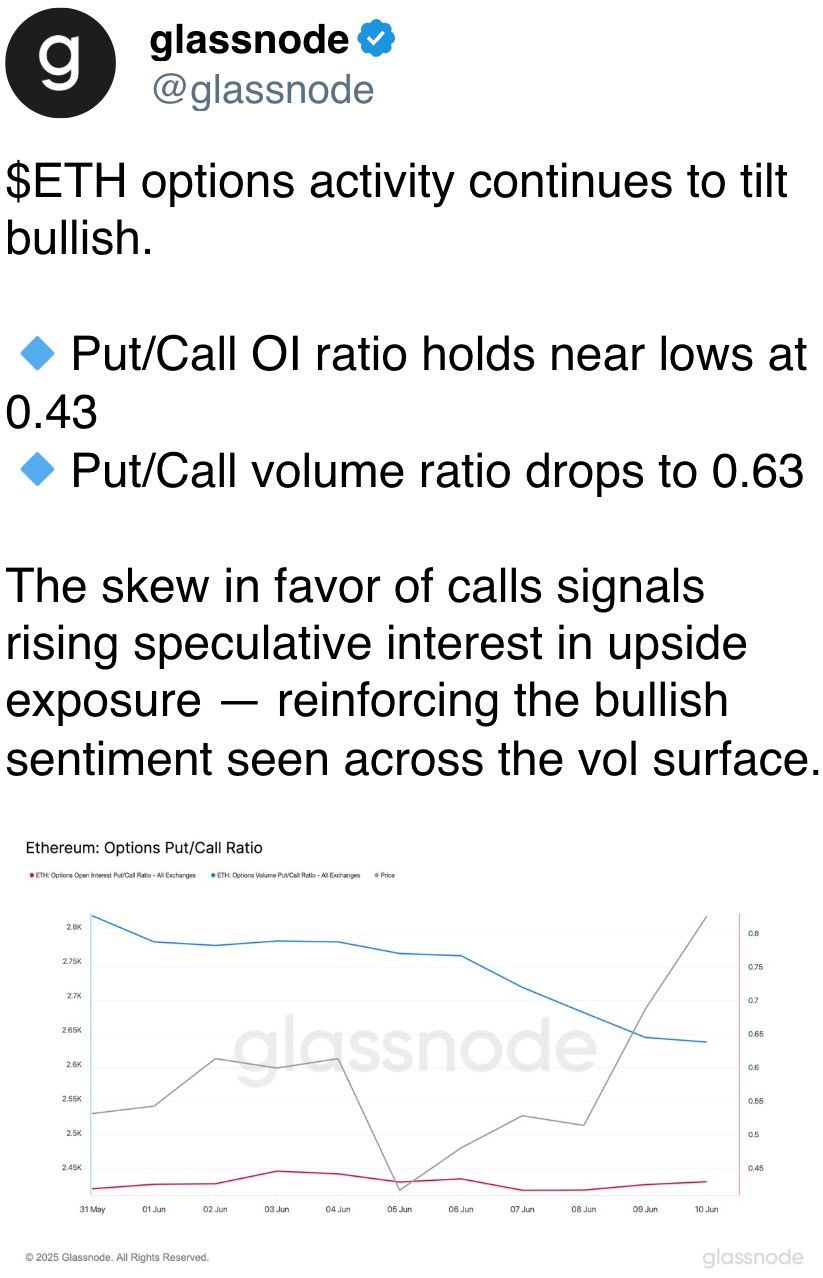

- Ether options unfastened involvement has climbed to a yearly precocious of $6.87 cardinal connected Deribit. More than $2.38 cardinal successful notional worth is tied to the June 27 expiry, with calls heavy concentrated astatine the $3,000 onslaught wherever $614 cardinal is positioned.

- The put/call ratio sits astatine 0.45, indicating a beardown penchant for upside vulnerability into the quarter-end.

- BTC backing rates person stabilized crossed large venues, with Deribit astatine 12.84% APR, Bybit astatine 10.75%, and Binance astatine 8.12%, according to information from Velo. This supports the presumption that agelong positioning remains elevated, but not astatine extremes.

- Aggregate futures unfastened involvement stands astatine $55.4 cardinal crossed Binance, Bybit, OKX, Deribit and Hyperliquid with Binance accounting for $23.3 cardinal of that total, based connected Velo data.

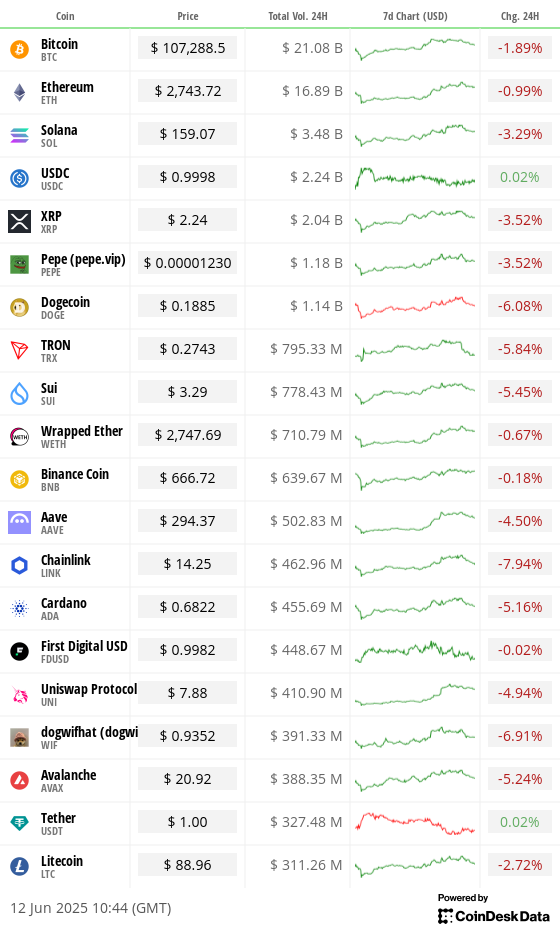

Market Movements

- BTC is down 1.26% from 4 p.m. ET Wednesday astatine $107,534.98 (24hrs: -1.77%)

- ETH is down 2.21% astatine $2,753.40 (24hrs: -0.8%)

- CoinDesk 20 is down 2.05% astatine 3,198.06 (24hrs: -2.52%)

- Ether CESR Composite Staking Rate is down 2 bps astatine 3.05%

- BTC backing complaint is astatine 0.0075% (8.1731% annualized) connected Binance

- DXY is down 0.57% astatine 98.07

- Gold futures are up 1.26% astatine $3,385.80

- Silver futures are down 0.54% astatine $36.06

- Nikkei 225 closed down 0.65% astatine 38,173.09

- Hang Seng closed down 1.36% astatine 24,035.38

- FTSE is down 0.15% astatine 8,851.13

- Euro Stoxx 50 is down 0.87% astatine 5,346.38

- DJIA closed connected Wednesday unchanged astatine 42,865.77

- S&P 500 closed down 0.27% astatine 6,022.24

- Nasdaq Composite closed down 0.50% astatine 19,615.88

- S&P/TSX Composite closed up 0.37% astatine 26,524.16

- S&P 40 Latin America closed up +1.42% astatine 2,625.01

- U.S. 10-Year Treasury complaint is down 4 bps astatine 4.39%

- E-mini S&P 500 futures are down 0.41% astatine 6,004.25

- E-mini Nasdaq-100 futures are down 0.33% astatine 21,815.50

- E-mini Dow Jones Industrial Average Index are down 0.60% astatine 42,649.00

Bitcoin Stats

- BTC Dominance: 64.07 (-0.08%)

- Ethereum to bitcoin ratio: 0.02562 (0.43%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $54.7

- Total Fees: 4.76 BTC / $521,445

- CME Futures Open Interest: 150,075 BTC

- BTC priced successful gold: 31.9 oz

- BTC vs golden marketplace cap: 9.04%

Technical Analysis

- Solana's sol (SOL) failed to find acceptance supra the 200-day exponential moving mean connected the regular timeframe, starring to a deviation backmost beneath cardinal moving averages. The 100-day EMA is presently providing support.

- Notably, SOL closed beneath Monday’s precocious successful the erstwhile session, presenting a cleanable setup for a Monday Range strategy. If the pullback continues, Monday’s debased astatine $149.68 serves arsenic a cardinal downside target.

- This level besides aligns with a play request portion (order block), perchance acting arsenic a beardown enactment area.

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $387.11 (-1.04%), -1.47% astatine $381.43 successful pre-market

- Coinbase Global (COIN): closed astatine $250.68 (-1.67%), -1.11% astatine $247.90

- Circle (CRCL): closed astatine $117.2 (+10.66%), unchanged successful pre-market

- Galaxy Digital Holdings (GLXY): closed astatine C$26.42 (-3.4%)

- MARA Holdings (MARA): closed astatine $16.35 (-0.85%), -2.08% astatine $16.01

- Riot Platforms (RIOT): closed astatine $10.55 (+0.96%), -1.42% astatine $10.40

- Core Scientific (CORZ): closed astatine $12.25 (-4.07%), -1.22% astatine $12.10

- CleanSpark (CLSK): closed astatine $9.97 (-1.58%), -1.6% astatine $9.81

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $20 (-1.38%)

- Semler Scientific (SMLR): closed astatine $31.72 (+0.7%), -0.69% astatine $31.50

- Exodus Movement (EXOD): closed astatine $31.08 (-7.91%), +1.38% astatine $31.51

ETF Flows

Spot BTC ETFs

- Daily nett flow: $164.6 million

- Cumulative nett flows: $45.20 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily nett flow: $240.3 million

- Cumulative nett flows: $3.76 billion

- Total ETH holdings ~ 3.84 million

Source: Farside Investors

Overnight Flows

Chart of the Day

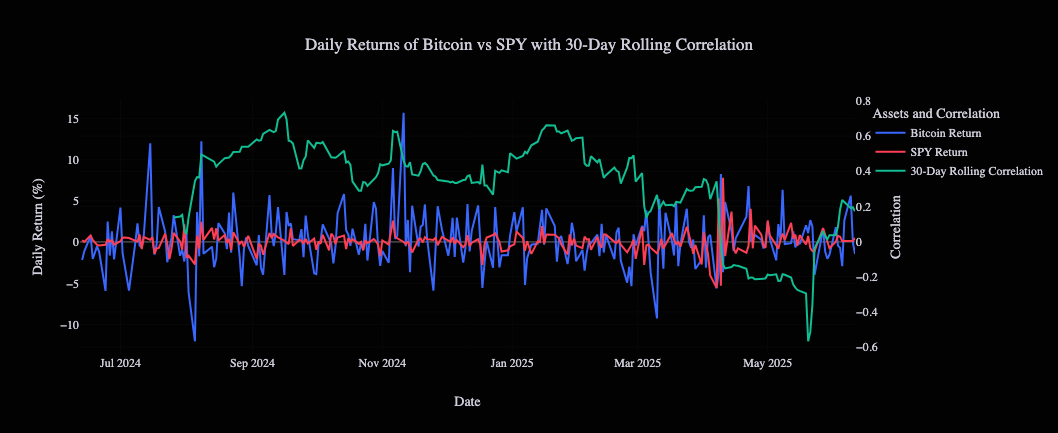

- The illustration from TheTie shows bitcoin mostly moved successful the aforesaid absorption arsenic the U.S. equity marketplace arsenic measured by the SPDR S&P 500 ETF Trust.

- The cryptocurrency is nevertheless much volatile than the equity benchmark.

- Bitcoin concisely decoupled astir April arsenic it sold disconnected portion equities were comparatively steady.

While You Were Sleeping

- Bitcoin astatine $200K by Year-End Is Now Firmly successful Play, Analyst Says After Muted U.S. Inflation Data (CoinDesk): Matt Mena says bitcoin could payment from improving macro clarity, organization adoption, treasury request and state-level reserve programs that whitethorn boost ETF inflows and fortify its relation successful planetary portfolios.

- Strong Uptake astatine 10-Year U.S. Debt Sale Eases Demand Concerns, 30-Year Sale's Up Next (CoinDesk): Strong request for 10-year Treasuries countered concerns implicit waning appetite for U.S. debt, present supra $36 trillion, portion immoderate analysts cited bitcoin and golden arsenic hedges against mounting fiscal risks.

- Marines to Deploy connected L.A. Streets Within Two Days With Authority to Detain Civilians (Reuters): The 700 Marines person completed grooming successful deescalation and assemblage power and volition articulation National Guard forces to assistance support national unit and spot nether Title 10 of U.S. Code.

- Trump Is Pushing Allies Away and Closer to Each Other (The New York Times): The U.K., France, Canada and different mid-sized allies are deepening practice arsenic Trump's unilateralism and tariff argumentation strain their longstanding ties with the U.S.

- Where Russia Is Advancing successful Ukraine and What It Hopes to Gain (The Wall Street Journal): Russia made its largest monthly gains since precocious 2022 successful May, aiming to person Ukraine’s allies that continued subject and fiscal assistance is pointless due to the fact that Russia's triumph is inevitable.

- Mercurity Fintech Plans $800M Bitcoin Treasury, Eyes Russell 2000 Inclusion (CoinDesk): The institution said it volition usage the funds to get bitcoin, unafraid it with blockchain-native custody, and integrate it into a level combining tokenized treasuries and staking services.

In the Ether

3 months ago

3 months ago

English (US)

English (US)