By James Van Straten (All times ET unless indicated otherwise)

After Wednesday’s unexpectedly high user terms inflation (CPI) figures, each eyes present crook to the nutrient terms study owed astatine 8:30 a.m.

Analysts expect year-over-year PPI to travel successful astatine 3.2%, beneath December’s 3.3%, with a month-on-month speechmaking of 0.3%, up from 0.2%. Core PPI, which strips retired volatile nutrient and vigor prices, is expected to amusement underlying inflationary pressure, accelerating to 0.3% from 0% successful December. From January past year, it's seen easing to 3.3%.

Hotter-than-expected information could awesome monetary argumentation remains excessively loose, perchance delaying oregon adjacent eliminating Fed complaint cuts this year, against President Trump's wishes. A much restrictive Fed is apt to beryllium bearish for hazard assets. On the different hand, softer ostentation information could weaken the dollar and little treasury yields portion helping boost risk-assets.

Following the CPI information markets were volatile.

Treasury yields surged to 4.6% earlier retreating slightly. The Dollar Index (DXY) mirrored this movement, spiking to 108.5 earlier pulling backmost beneath 108.

Despite the archetypal sell-off, large asset classes rebounded, with bitcoin (BTC), U.S. equities and golden finishing the league successful the green.

Also connected the agenda, Coinbase (COIN) reports fourth-quarter net aft the marketplace closes. Following Robinhood's beardown results, expectations are high, and a affirmative study could supply a boost to the cryptocurrency market. Stay Alert!

What to Watch

Crypto:

Feb. 13: Start of Kraken's gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 13: Story (IP) mainnet launch.

Feb. 14: Dynamic TAO (DTAO) web upgrade goes unrecorded connected the Bittensor (TAO) mainnet.

Feb. 14, 2:30 a.m.: Qtum (QTUM) hard fork web upgrade.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, starts reimbursing creditors.

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging level Telegram’s Mini App ecosystem.

Macro

Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Producer Price Index (PPI) report.

Core PPI MoM Est. 0.3% vs. Prev. 0%

Core PPI YoY Est. 3.3% vs. Prev. 3.5%

PPI MoM Est. 0.3% vs. Prev. 0.2%

PPI YoY Prev. 3.3%

Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims study for the week ended Feb. 8.

Initial Jobless Claims Est. 215K vs. Prev. 219K

Feb. 14, 8:30 a.m.: The U.S. Census Bureau releases January's Retail Sales data.

Retail Sales MoM Est. -0.1% vs. Prev. 0.4%

Retail Sales YoY Prev. 3.9%

Earnings

Feb. 13: Coinbase Global (COIN), post-market, $2.11

Feb. 14: Remixpoint (3825)

Feb. 18: CoinShares International (CS), pre-market

Feb. 18: Semler Scientific (SMLR), post-market

Feb. 20: Block (XYZ), post-market, $0.88

Token Events

Governance votes & calls

Curve DAO is voting connected increasing 3pool’s amplification coefficient to 8,000 implicit 30 days and rise admin fees to 100%. To optimize liquidity, arsenic portion of an experiment, 3pool volition person higher fees portion Strategic Reserves volition connection little fees.

Aave DAO is discussing utilizing GHO arsenic a state token crossed assorted networks. The model proposes utilizing the canonical web span to mint GHO straight arsenic a state token.

Unlocks

Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating proviso worthy $80.5 million.

Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating proviso worthy $45.1 million.

Feb. 16: Avalanche (AVAX) to unlock 0.4% of circulating proviso worthy $42.8 million.

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating proviso worthy $79 million.

Feb. 28: Optimism (OP) to unlock 2.32% of circulating proviso worthy $34.8 million.

Token Launches

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to nary longer beryllium supported astatine Deribit.

Feb. 13: Story (IP) to beryllium listed connected Bybit, Bitrue, Bitget, MEXC, KuCoin, and OKX, among others.

Feb. 14: Pudgy Penguins (PENGU) to beryllium listed connected Coinbase, according to a station shared by the Pudgy Penguins account.

Conferences:

CoinDesk's Consensus to instrumentality spot in Hong Kong connected Feb. 18-20 and in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 2 of 2: Frankfurt Digital Finance (FDF) 2025

Day 1 of 2: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

Derivatives Positioning

Funding rates successful perpetual futures tied to SOL, TRS, TRON and DOT stay negative, indicating a bias for shorts, information from Coinglass and Velo Data show.

Annualized backing rates successful BTC and ETH hover adjacent 5%.

Most large coins, excluding BNB, person seen antagonistic open-interest-adjusted cumulative measurement deltas, a motion of nett selling pressure, which raises a question people connected the sustainability of Wednesday's post-U.S. CPI recovery.

BTC and ETH options skews are affirmative crossed the board, reflecting a bull bias.

Flows, however, person been muted, with immoderate request for out-of-the-money higher onslaught ETH calls, according to information sources Deribit and Paradigm.

Market Movements:

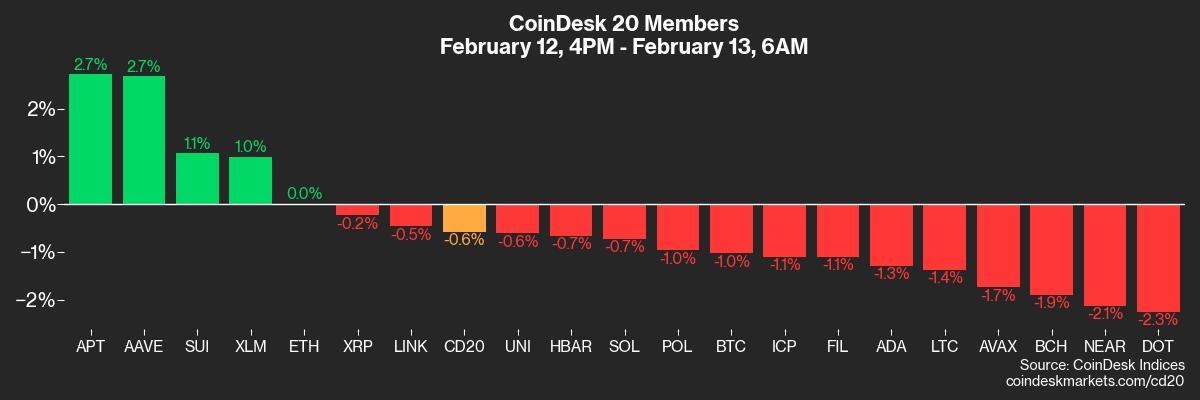

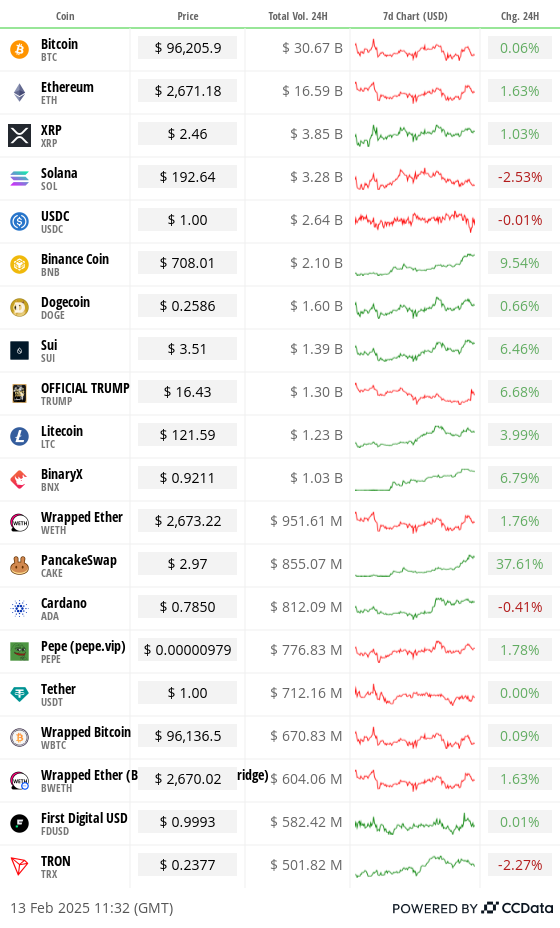

BTC is down 1.53% from 4 p.m. ET Wednesday to $96,206.67 (24hrs: -0.02%)

ETH is down 0.23% astatine $2,677.69 (24hrs: +1.79%)

CoinDesk 20 is down 0.71% to 3,201.06 (24hrs: +0.66%)

Ether CESR Composite Staking Rate is down 5 bps to 3.05%

BTC backing complaint is astatine 0.0005% (0.5606% annualized) connected Binance

DXY is down 0.34% astatine 107.58

Gold is up 1.26% astatine $2945.7/oz

Silver is up 0.49% to $32.85/oz

Nikkei 225 closed up 1.28% astatine 39,461.47

Hang Seng closed -0.20% astatine 21,814.37

FTSE is down 0.74% astatine 8,742.63

Euro Stoxx 50 is up 1.23% to 5,471.99

DJIA closed Wednesday -0.50% astatine 44,368.56

S&P 500 closed -0.24% astatine 6,051.97

Nasdaq closed 0.03% astatine 19,649.95

S&P/TSX Composite Index closed -0.27% astatine 25,563.1

S&P 40 Latin America closed -0.93% astatine 2,421.78

U.S. 10-year Treasury complaint was down 2 bps astatine 4.61%

E-mini S&P 500 futures are unchanged astatine 6,073

E-mini Nasdaq-100 futures are up 0.17% astatine 21,842.75

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 44,480

Bitcoin Stats:

BTC Dominance: 60.91 (-0.14%)

Ethereum to bitcoin ratio: 0.02784 (-0.50)

Hashrate (seven-day moving average): 802 EH/s

Hashprice (spot): $53.2

Total Fees: 4.63 BTC / $446,657

CME Futures Open Interest: 166,680 BTC

BTC priced successful gold: 33.1 oz

BTC vs golden marketplace cap: 9.40 oz

Technical Analysis

Since the Jan. 3 crash, bitcoin has remained beneath the widely-tracked 50-day elemental moving mean (SMA).

It present appears the terms has besides dipped beneath the Ichimoku cloud, suggesting a imaginable bearish momentum shift.

This duplicate breakdown could embolden bears. Immediate enactment is seen astatine astir $90,000.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $326.82 (+2.3%), down 0.56% astatine $325 successful pre-market.

Coinbase Global (COIN): closed astatine $274.90 (+3%), up 3.24% astatine $283.8 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$26.87 (+1.24%)

MARA Holdings (MARA): closed astatine $16.24 (+1.37%), down 0.55% astatine $16.16 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.16 (+0.18%), down 0.54% astatine $11.10 successful pre-market.

Core Scientific (CORZ): closed astatine $12.09 (-1.39%), unchanged successful pre-market.

CleanSpark (CLSK): closed astatine $10.52 (+2.33%), down 0.67% astatine $10.45 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.73 (+1.75%), unchanged successful pre-market.

Semler Scientific (SMLR): closed astatine $47.69 (+1.51%), unchanged successful pre-market.

Exodus Movement (EXOD): closed astatine $48.85 (-0.63%), up 2.48% astatine $50.06 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$251 million

Cumulative nett flows: $40.21 billion

Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

Daily nett flow: -$40.9 million

Cumulative nett flows: $3.13 billion

Total ETH holdings ~ 3.788 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

Daily trading volumes successful decentralized exchanges based connected PancakeSwap person surged to the highest since aboriginal December.

The renewed enactment partially explains CAKE token's leap to a two-month precocious of $3.4.

While You Were Sleeping

Bitcoin Miner Riot Adds New Board Member to Push AI Pivot (CoinDesk): Bitcoin miner Riot Platforms added 3 caller directors arsenic it explores repurposing its mining infrastructure for AI workloads.

Bitcoin HODLer Metaplanet to Join MSCI Japan Index, Raises $26M to Buy More BTC (CoinDesk): The bitcoin purchaser volition beryllium joining the MSCI Japan Index, which tracks the show of ample and mid headdress Japanese stocks, connected Feb. 28.

Coinbase Eyes Re-Entry to India (TechCrunch): The crypto speech is reportedly moving with Indian regulators to instrumentality to the crypto marketplace it near successful 2022 astir six months aft Binance resumed operations there.

Fed’s Waller Says Scale of Stablecoins Rests connected Harmonized Rules (Bloomberg): Fed Governor Christopher Waller said stablecoins could fortify the dollar globally, but request a U.S. regulatory model that deals with their risks.

Ray Dalio to the Trump Administration: Cut Debt Now oregon Face an ‘Economic Heart Attack’ (CNBC): Citing the monolithic $36 trillion U.S. debt, Bridgewater's Ray Dalio warns of a imaginable economical situation unless the Trump medication urgently cuts the shortage to 3% of GDP from 7.5%.

In the Ether

7 months ago

7 months ago

English (US)

English (US)