By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin (BTC) and different large cryptocurrencies proceed to connection small directional clarity to traders, with inflows into spot ETFs slowing during the seasonally bearish period.

According to 10x Research, June tends to beryllium a mixed-to-negative period for the largest tokens. Bitcoin has averaged a 1.9% instrumentality successful June implicit the past 10 years, evenly divided betwixt 5 affirmative and 5 antagonistic occurrences. Ethereum's ether (ETH) averaged an 11.7% decline, with lone 2 retired of the past 7 Junes successful the green. XRP has fared adjacent worse, though SOL has been stronger.

The apathy is reflected successful the U.S.-listed spot bitcoin ETFs, which recorded nett inflows successful lone 2 of the past 5 trading days. Inflows connected Wednesday were conscionable $87 million, a crisp diminution from Tuesday's $387 million, SoSoValue information show. Ether ETFs recorded a nett inflow of $57 million, the slightest since May 21.

"The weakening gait of organization flows confirms a nonaccomplishment of momentum — and makes america much cautious connected the short-term outlook," Valentin Fournier, pb probe expert astatine BRN, said successful an email.

Other analysts, however, stay optimistic, citing the accelerated gait of organization adoption.

"Despite the seasonal summertime lull, the structural backdrop remains intact," QCP Capital said. "With some BTC and ETH emanation rates present trailing planetary wealth proviso growth, a semipermanent affirmative terms drift appears progressively probable. Fresh treasury buyers are absorbing supply."

The steadfast besides noted the comparative spot successful ether arsenic the ETH-BTC ratio trades adjacent to the caller scope highs.

The crypto quality travel implicit the past 24 hours has been positive. Circle, the issuer of the regulated USDC stablecoin, priced its archetypal nationalist offering astatine $31 per share, supra the expected scope of $24 to $26. The institution sold astir 34 cardinal shares successful the offering for a valuation of $1.1 billion.

The California Assembly approved the AB-1052 bill, classifying long-inactive crypto assets arsenic “unclaimed property” and allowing the authorities to clasp them successful custody.

Blockchain quality steadfast Arkham said that a whale code supposedly linked to Consensys purchased $320 cardinal successful ETH from Galaxy Digital and transferred it to a caller address.

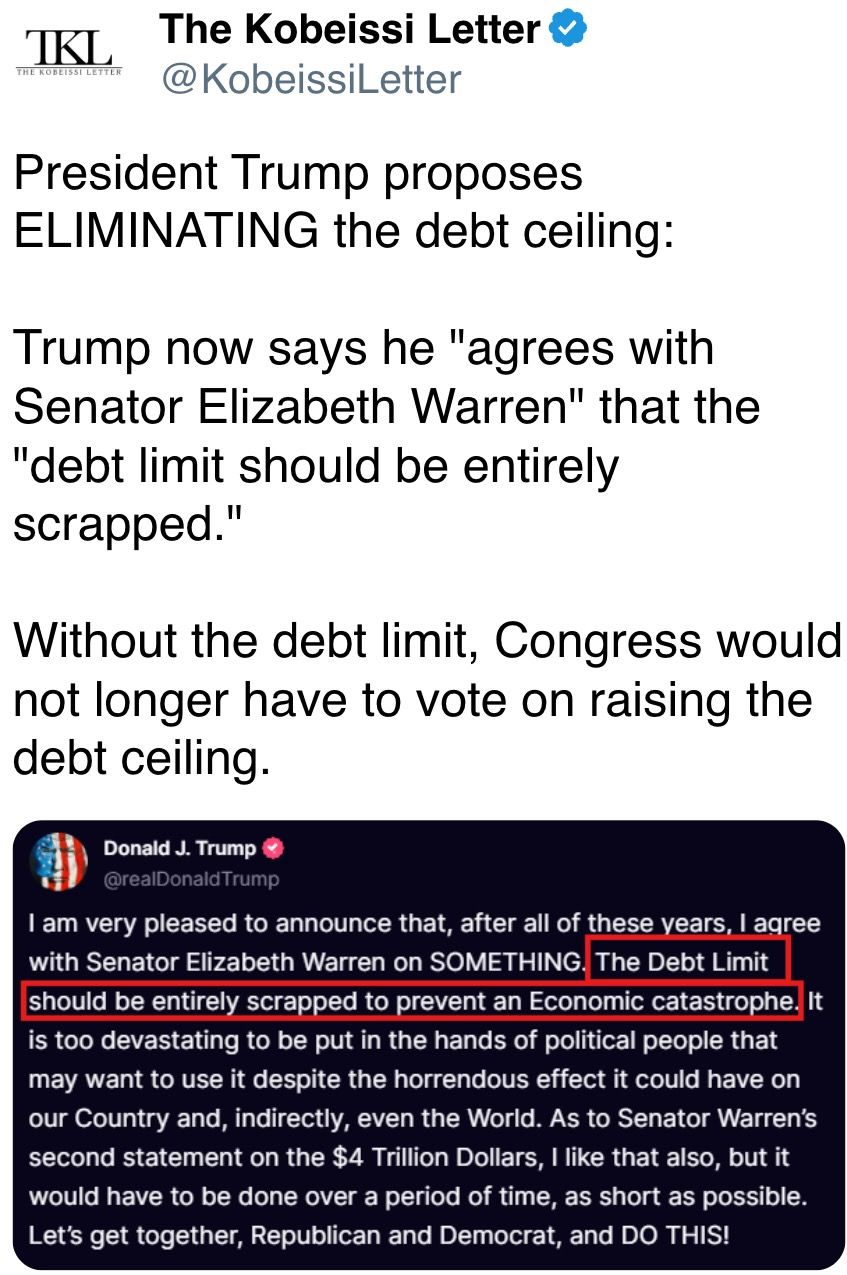

Economic developments, however, person been dismal. Three brushed U.S. economical reports, including the Fed's Beige book, sent the Treasury yields tumbling, reviving hopes for the Fed complaint cut. Stay alert!

What to Watch

- Crypto

- June 5, 9:30 a.m.: Shares of Circle (CRCL), issuer of stablecoin USDC, begin trading connected the NYSE. The IPO priced that banal astatine $31 apiece, valuing the institution astatine $6.9 billion.

- June 6: Sia (SC) is acceptable to activate Phase 1 of its V2 hard fork, the largest upgrade successful the project’s history. Phase 2 volition get activated connected July 6.

- June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable connected "DeFi and the American Spirit"

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto marketplace operation bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- June 11, 7 a.m.: Stratis (STRAX) activates mainnet hard fork astatine artifact 2,587,200 to alteration the Masternode Staking protocol.

- June 16 (market open): 21Shares executes a 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- Macro

- June 5, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 31.

- Initial Jobless Claims Est. 235K vs. Prev. 240K

- Continuing Jobless Claims Est. 1910K vs. Prev. 1919K

- June 5: German Chancellor Friedrich Merz meets President Donald Trump successful the Oval Office to sermon tariffs, defense, Ukraine.

- June 6, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April shaper terms ostentation data.

- PPI MoM Prev. -0.62%

- PPI YoY Prev. 8.37%

- June 6, 8:30 a.m.: Statistics Canada releases May employment information .

- Unemployment Rate Est. 7% vs. Prev. 6.9%

- Employment Change Est. -15K vs. Prev. 7.4K

- June 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases May employment data.

- Non Farm Payrolls Est. 130K vs. Prev. 177K

- Unemployment Rate Est. 4.2% vs. Prev. 4.2%

- Government Payrolls Prev. 10K

- Manufacturing Payrolls Est. -1K vs. Prev. -1K

- June 5, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 31.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected whether to adjust the 7 cardinal ARB delegated to Event Horizon pursuing its pivot to AI-driven governance. Voting ends June 5.

- Uniswap DAO is voting connected a connection to fund the integration of Uniswap V4 and Unichain enactment successful Oku. The extremity is to grow V4 adoption, enactment hook developers and amended tools for liquidity providers and traders. Voting ends June 6.

- June 5, 9 a.m.: PancakeSwap to big an Ask Me Anything (AMA) league connected security.

- June 5, 10 a.m.: TON to big a builders call, decentralized concern edition.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- June 11, 7 a.m.: Cronos Labs pb Mirko Zhao to enactment successful a assemblage Ask Me Anything (AMA) session.

- Unlocks

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $54.40 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $13.36 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $17.08 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $10.71 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating proviso worthy $32.91 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating proviso worthy $42.47 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $11.02 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- Day 4 of 6: SXSW London

- Day 3 of 3: Money20/20 Europe 2025 (Amsterdam)

- Day 2 of 3 Non Fungible Conference (Lisbon)

- Day 1 of 2: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- DEGO nosedived astir 60% to $1.26 connected June 4–5 aft the BNB Chain-based Dego protocol said it would bargain World Liberty Financial’s stablecoin, USD1, arsenic a treasury reserve and effect a DEGO/USD1 excavation connected BNB Chain.

- Chain sleuths recovered 93% of USD1’s circulating proviso parked successful conscionable 3 wallets.

- Traders are acrophobic the pair’s depth, and truthful DEGO’s caller terms floor, could beryllium yanked astatine immoderate moment, sparking “exit-liquidity” accusations.

- Dego Finance said successful a Thursday tweet that “fundamentals, tokenomics, semipermanent vision" were unchanged and pinned the terms illness connected “short-term marketplace psychology."

- The squad claimed it is auditing on-chain flows and liaising with exchanges/market makers to dampen volatility.

- Skeptics warned of “ghost liquidity” and impulse the squad to tribunal much reputable stablecoins specified arsenic USDT, FDUSD and USDC earlier deploying treasury funds.

- Dego volition people a post-mortem and treasury-transparency dashboard “within days,” big an AMA with halfway devs, and outline further safeguards (e.g., time-locked treasury moves, multi-sig sign-offs) to rebuild confidence.

Derivatives Positioning

- Growth successful CME-listed BTC and ETH futures unfastened involvement has stagnated this month, leaving the annualized one-month ground betwixt 5% and 10%.

- The figures amusement that institutions person scaled backmost demand.

- Binance's 1000SHIB perpetual futures and BCH perpetual futures amusement antagonistic backing rates successful a motion of bearish bias. Other large tokens, including BTC and ETH, proceed to commercialized with mildly bullish oregon affirmative backing rates.

- On Deribit, the BTC telephone bias has weakened crossed aggregate clip frames. Still, higher onslaught BTC calls proceed to predominate the 24-hour measurement rankings.

- Institutional flows connected OTC web Paradigm featured outright enactment buying successful June and July expiries and calendar spreads.

Market Movements

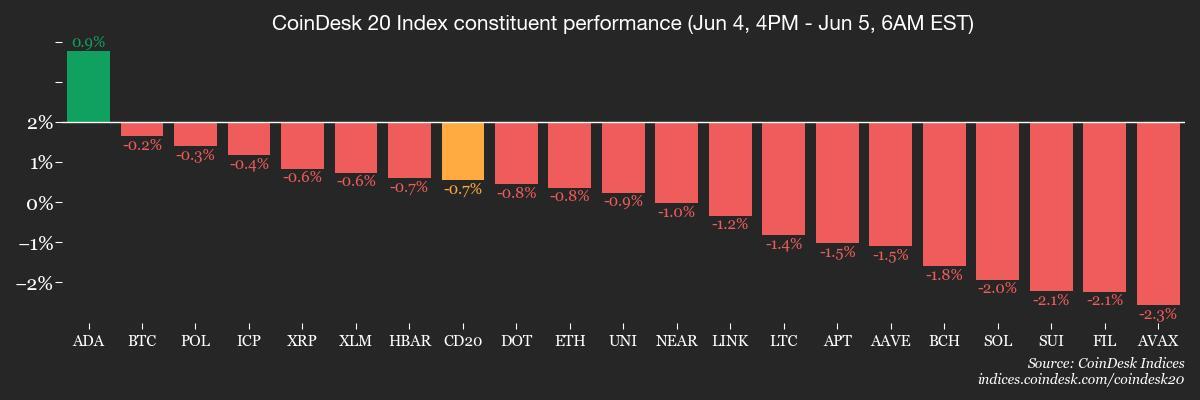

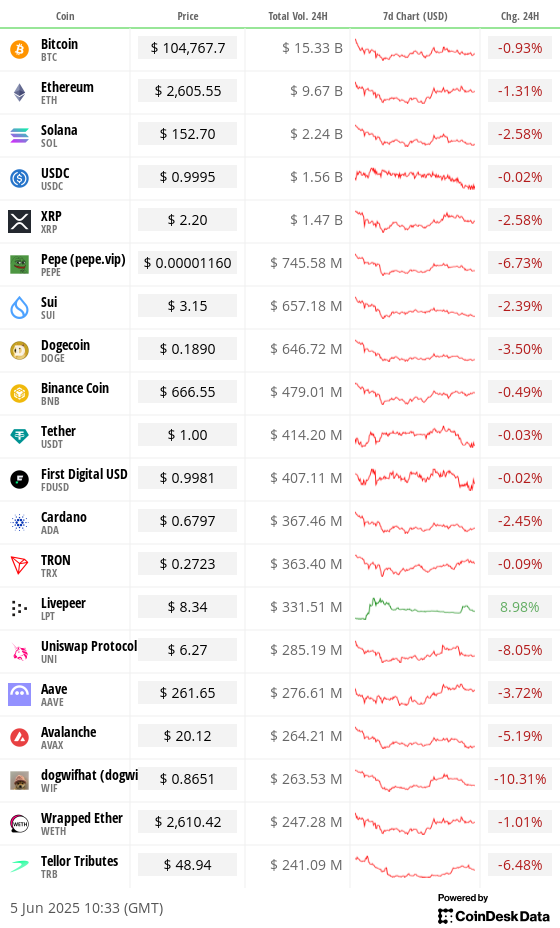

- BTC is up 0.25% from 4 p.m. ET Wednesday astatine $104,909.52 (24hrs: -0.79%)

- ETH is unchanged astatine $2,607.45 (24hrs: -1.02%)

- CoinDesk 20 is unchanged astatine 3,086.55 (24hrs: +0.81%)

- Ether CESR Composite Staking Rate is down 2 bps astatine 3.05%

- BTC backing complaint is astatine 0.0041% (4.4435% annualized) connected Binance

- DXY is unchanged astatine 99.82

- Gold futures are up 1.15% astatine $3,412.40/oz

- Silver futures are up 3.61% astatine $35.76/oz

- Nikkei 225 closed -0.51% astatine 37,554.49

- Hang Seng closed +1.07% astatine 23,906.97

- FTSE is up 0.19% astatine 8,817.89

- Euro Stoxx 50 is up 0.44% astatine 5,429.08

- DJIA closed connected Wednesday -0.22% astatine 42,427.74

- S&P 500 closed unchanged astatine 5,970.81

- Nasdaq Composite closed +0.32% astatine 19,460.49

- S&P/TSX Composite Index closed -0.37% astatine 26,329.00

- S&P 40 Latin America closed -0.71% astatine 2,560.51

- U.S. 10-year Treasury complaint is down 2 bps astatine 4.35%

- E-mini S&P 500 futures are up 0.07% astatine 5,985.25

- E-mini Nasdaq-100 futures are up 0.08% astatine 21,784.5

- E-mini Dow Jones Industrial Average Index futures are up 0.12% astatine 42,550.00

Bitcoin Stats

- BTC Dominance: 64.16 (0.00%)

- Ethereum to bitcoin ratio: 0.02487 (-0.12%)

- Hashrate (seven-day moving average): 900 EH/s

- Hashprice (spot): $52.7

- Total Fees: 4.7 BTC / $496,562

- CME Futures Open Interest: 145,655 BTC

- BTC priced successful gold: 30.9 oz

- BTC vs golden marketplace cap: 8.76%

Technical Analysis

- The output connected the U.S. 10-year Treasury enactment has dived retired of an ascending trendline from aboriginal April lows.

- The breakdown suggests much losses ahead, which could easiness fiscal conditions, powering BTC higher.

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $378.10 (-2.41%), +0.28% astatine $379.15 successful pre-market

- Coinbase Global (COIN): closed astatine $256 (-1.12%), +0.48% astatine $257.23

- Galaxy Digital Holdings (GLXY): closed astatine C$27.49 (+4.76%)

- MARA Holdings (MARA): closed astatine $15.67 (+2.22%), -0.26% astatine $15.63

- Riot Platforms (RIOT): closed astatine $9.5 (+5.2%), unchanged successful pre-market

- Core Scientific (CORZ): closed astatine $12.56 (+6.44%), +0.64% astatine $12.64

- CleanSpark (CLSK): closed astatine $9.53 (+3.47%), -0.21% astatine $9.51

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $19.19 (+7.09%)

- Semler Scientific (SMLR): closed astatine $35.76 (+0.51%)

- Exodus Movement (EXOD): closed astatine $26.93 (-9.78%), +7.43% astatine $28.93

ETF Flows

Spot BTC ETFs

- Daily nett flow: $87 million

- Cumulative nett flows: $44.55 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily nett flow: $57 million

- Cumulative nett flows: $3.30 billion

- Total ETH holdings ~ 3.73 million

Source: Farside Investors

Overnight Flows

Chart of the Day

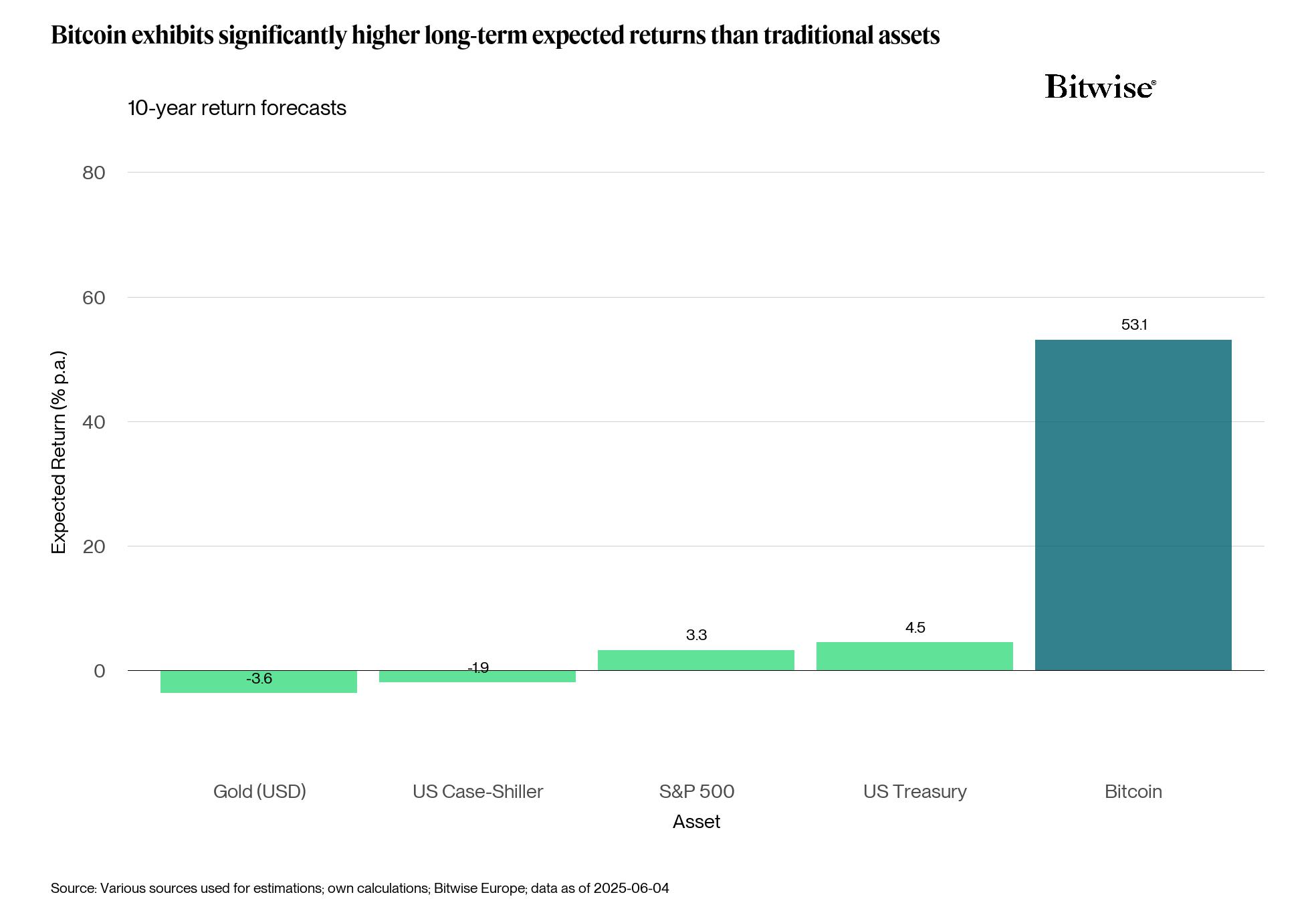

- Bitcoin is expected to make respective times much wealthiness for holders than immoderate different asset, including gold, implicit the adjacent 10 years, according to Bitwise.

- Prices are reflexive, meaning expectations of higher valuations tin really gully buyers, starring to a self-fulfilling cycle.

While You Were Sleeping

- Big Investors Shift Away From U.S. Markets (Financial Times): Concerned by indebtedness risks and volatile commercialized policy, large investors are trimming U.S. vulnerability and shifting toward Europe, wherever governmental stableness and infrastructure plans are drafting caller capital.

- Bitcoin's 50-Day Average Hits Record High, but There's a Catch (CoinDesk): ETF-driven buying has cooled and nett taking is rising, narrowing the spread betwixt spot and inclination levels and expanding the hazard of a pullback toward $100,000.

- Hong Kong Set to Allow Crypto Derivatives Trading (CoinDesk): Hong Kong’s Securities and Futures Commission is reportedly readying to unfastened crypto derivatives trading to nonrecreational investors, tapping a marketplace that saw $21 trillion successful Q1 measurement — acold outpacing spot activity.

- Coinbase Unlocks DeFi Opportunities for XRP and Dogecoin Holders connected Base (CoinDesk): Coinbase debuted wrapped versions of XRP and DOGE — cbXRP and cbDOGE — connected its Base blockchain.

- As Drones Transform Warfare, NATO May Be Vulnerable (The New York Times): Ukraine’s drone blitz heavy wrong Russia has prompted NATO to measure its ain vulnerabilities, with Cornell’s James Patton Rogers calling it a glimpse into however aboriginal wars whitethorn unfold.

- Germany’s Leader Has a Message for Trump: We Need You, but You Also Need Us (The Wall Street Journal): Chancellor Friedrich Merz meets Trump to revive commercialized talks, backmost stronger Russia sanctions and item Berlin’s expanding defence outlays up of cardinal NATO and G7 summits.

In the Ether

4 months ago

4 months ago

English (US)

English (US)