By James Van Straten (All times ET unless indicated otherwise)

Bitcoin (BTC) is climbing up the plus ranks. The rally that this week took it to caller highs has lifted its marketplace capitalization to $2.2 trillion for the archetypal time.

It's already overtaken Amazon (AMZN) and Google (GOOG) to go the world's fifth-largest plus and present sits down iPhone shaper Apple (APPL), bundle developer Microsoft (MSFT) and chipmaker Nvidia (NVDA), each of which are valued astatine implicit $3 trillion. Way up is hard-to-produce, store-of-value golden astatine an estimated $22 trillion.

Bitcoin’s No. 5 ranking reflects its increasing presumption among accepted and organization investors and comes arsenic marketplace sentiment turns decisively bullish, with strong buying action crossed each capitalist cohorts —from whales to minnows — and the BTC terms holding dependable astir the $110,000 level with minimal pullbacks.

As the end-of-May options expiry approaches adjacent Friday, the options marketplace reveals important activity, with the bulk of telephone —or bullish — options positioned astatine the $110,000 onslaught terms and a max symptom level astatine $96,000. Looking into June, there's a clustering of high-strike telephone options astatine $200,000 and adjacent $300,000. That's a coagulated motion of traders betting connected continued upward momentum.

Despite bitcoin’s strength, Strategy (MSTR), the largest firm holder of bitcoin, has lagged successful stock terms show comparative to its peers. The institution precocious announced a $2.1 cardinal at-the-market offering of its caller perpetual preferred stock, STRF, intended to money further bitcoin acquisitions.

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) continues to predominate the organization market, pulling successful $877 cardinal successful inflows connected Thursday unsocial and bringing its full nett inflow to a staggering $47.6 billion, according to Farside data.

On the macroeconomic front, the largest cryptocurrency is showing wide divergence from accepted equities, rising 5% implicit the past 5 days portion the S&P 500 has slipped by much than 1%. This uncorrelated show is reinforcing bitcoin’s entreaty arsenic a macro hedge. Investors are present intimately watching for Federal Reserve Chair Jerome Powell’s code connected Sunday, which could beryllium pivotal successful shaping adjacent week’s marketplace trajectory. Stay alert!

What to Watch

- Crypto

- May 30: The second circular of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable connected "DeFi and the American Spirit"

- Macro

- May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail income data.

- Retail Sales MoM Est. 0.7% vs. Prev. -0.4%

- Retail Sales YoY Prev. 4.7%

- May 23, 10 a.m.: The U.S. Census Bureau releases April caller single-family homes data.

- New Home Sales Est. 0.692M vs. Prev. 0.724M

- New Home Sales MoM Prev. 7.4%

- May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail income data.

- Earnings (Estimates based connected FactSet data)

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected launching “The Watchdog,” a 400,000-ARB bounty programme to reward assemblage sleuths for uncovering misuse of the hundreds of millions successful grants, incentives and work budgets the DAO has deployed. Voting ends May 23.

- Lido DAO is voting connected adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock betwixt DAO decisions and execution truthful stETH holders tin escrow tokens to intermission proposals astatine 1% of TVL oregon afloat artifact and “rage-quit” astatine 10%. Voting ends May 28.

- Arbitrum DAO is voting connected a law AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them successful enactment with Ethereum’s May 7 Pectra upgrade. The connection schedules activation for June 17. Voting ends connected May 29.

- June 10: Ether.fi to host an expert telephone followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $25.64 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating proviso worthy $170.26 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating proviso worthy $12.43 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating proviso worthy $17.32 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $66.5 million.

- Token Launches

- May 23: Soon (SOON) to beryllium listed connected KuCoin, Bitget, BingX, LBank, MEXC, Phemex and others.

- June 1: Staking rewards for staking ERC-20 OM connected MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

Conferences

- Day 4 of 7: Dutch Blockchain Week (Amsterdam)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- HYPE surged 15% aft Hyperliquid Labs said it submitted 2 remark letters to the CFTC connected regulating perpetual swaps and 24/7 crypto trading.

- The squad urged U.S. regulators to clasp DeFi principles to physique safer, much businesslike fiscal markets, highlighting Hyperliquid arsenic a moving example.

- The connection marks a uncommon lawsuit of nonstop engagement betwixt a DeFi-native protocol and a large U.S. regulator, signaling increasing maturity successful the sector.

- Hyperliquid framed its high-speed, permissionless trading infrastructure arsenic a exemplary that could outperform accepted concern standards.

- With whales similar pseudonymous "James Wynn" placing billion-dollar trades connected the platform, regulatory designation whitethorn adhd legitimacy and substance further upside for HYPE.

Derivatives Positioning

- Despite bitcoin hitting $110,000, perpetual backing rates stay debased astatine 0.005%. They were astatine 0.04% successful November, indicating the marketplace isn’t overheated.

- Open involvement successful CME futures has risen 30K BTC since April,. That's inactive 40K BTC beneath November levels, reflecting comparatively restrained organization leverage.

Market Movements:

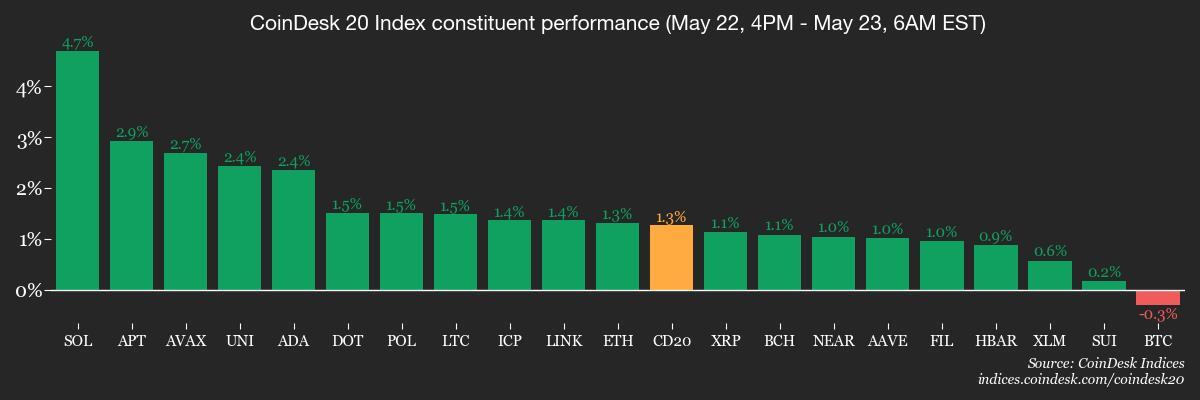

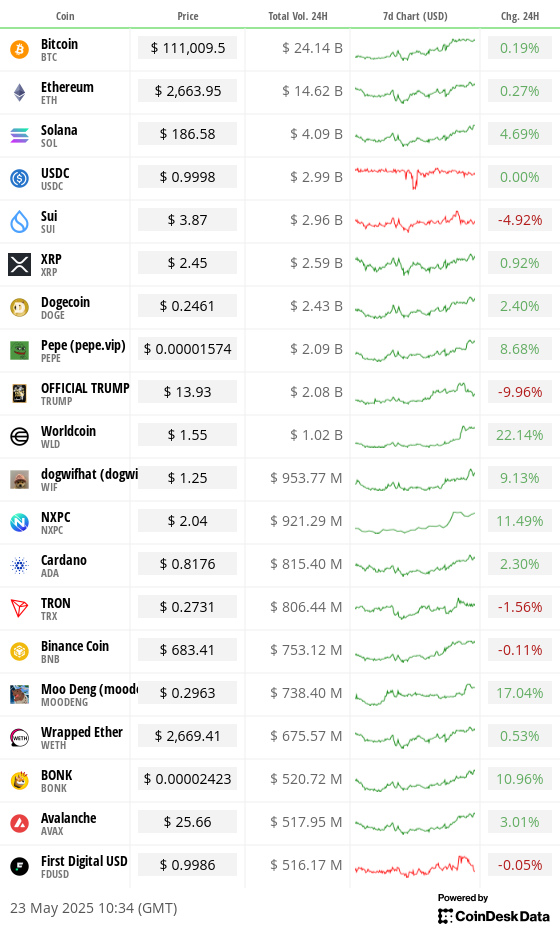

- BTC is up 0.22% from 4 p.m. ET Thursday astatine $111,330.90 (24hrs: +0.33%)

- ETH is up 1.67% astatine $2,685.47 (24hrs: +0.53%)

- CoinDesk 20 is up 3.64% astatine 3,393.60 (24hrs: +1.12%)

- Ether CESR Composite Staking Rate is unchanged astatine 3.03%

- BTC backing complaint is astatine 0.03% (10.95% annualized) connected Binance

- DXY is down 0.61% astatine 99.36

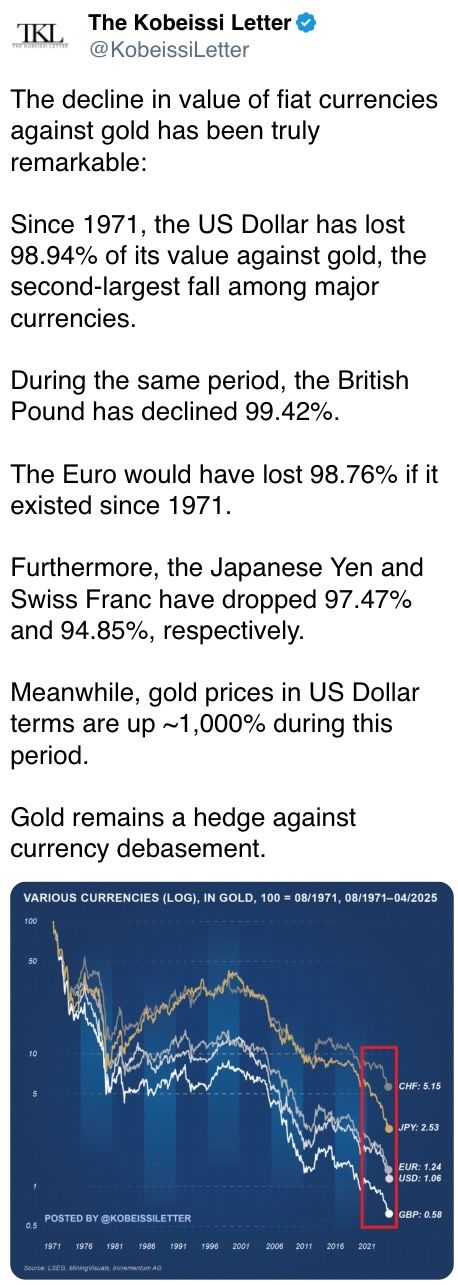

- Gold is up 1.13% astatine $3,329.50/oz

- Silver is up 0.77% astatine $33.30/oz

- Nikkei 225 closed +0.47% astatine 37,160.47

- Hang Seng closed +0.24% astatine 23,601.26

- FTSE is up 0.12% astatine 8,750.11

- Euro Stoxx 50 is down 0.16% astatine 5,415.57

- DJIA closed connected Thursday unchanged astatine 41,859.09

- S&P 500 closed unchanged astatine 5,842.01

- Nasdaq closed +0.28% astatine 18,925.74

- S&P/TSX Composite Index closed unchanged astatine 25,854.00

- S&P 40 Latin America closed +0.3% astatine 2,589.68

- U.S. 10-year Treasury complaint is down 1 bps astatine 4.53%

- E-mini S&P 500 futures are unchanged astatine 5,852.50

- E-mini Nasdaq-100 futures are unchanged astatine 21,159.75

- E-mini Dow Jones Industrial Average Index futures are down 0.11% astatine 41,877.00

Bitcoin Stats:

- BTC Dominance: 63.70 (-0.48%)

- Ethereum to bitcoin ratio: 0.02410 (1.05%)

- Hashrate (seven-day moving average): 882 EH/s

- Hashprice (spot): $58.14

- Total Fees: 7.92 BTC / $837,314

- CME Futures Open Interest: 17,579 BTC

- BTC priced successful gold: 33.6 oz

- BTC vs golden marketplace cap: 9.51%

Technical Analysis

- The comparative show of Strategy (MSTR) against BlackRock’s iShares Bitcoin Trust (IBIT) shows an ascending transmission formation.

- The terms enactment from mid-March to May is confined wrong a well-defined ascending channel, indicating a short-term bullish inclination contempt Strategy's caller pullback.

- The latest candles suggest a driblet toward the little bound of the channel, which could enactment arsenic a enactment level astir the $6.10–$6.20 range.

- That marks a imaginable determination constituent for either a rebound oregon breakdown.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $399.46 (-0.8%), up 0.1% astatine $399.86 successful pre-market

- Coinbase Global (COIN): closed astatine $271.95 (+5%), unchanged successful pre-market

- Galaxy Digital Holdings (GLXY): closed astatine C$33.84 (+9.16%)

- MARA Holdings (MARA): closed astatine $15.65 (-1.2%), up 0.32% astatine $15.70

- Riot Platforms (RIOT): closed astatine $8.94 (+1.13%), up 0.22% astatine $8.96

- Core Scientific (CORZ): closed astatine $10.83 (+0.46%), down 0.37% astatine $10.79

- CleanSpark (CLSK): closed astatine $9.87 (-2.37%), up 0.41% astatine $9.91

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18.11 (+2.03%)

- Semler Scientific (SMLR): closed astatine $44.93 (+0.09%), up 1.71% astatine $45.70

- Exodus Movement (EXOD): closed astatine $35.38 (+8%)

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $934.8 million

- Cumulative nett flows: $44.29 billion

- Total BTC holdings ~ 1.19 million

Spot ETH ETFs

- Daily nett flow: $110.5 million

- Cumulative nett flows: $2.72 billion

- Total ETH holdings ~ 3.5 million

Source: Farside Investors

Overnight Flows

Chart of the Day

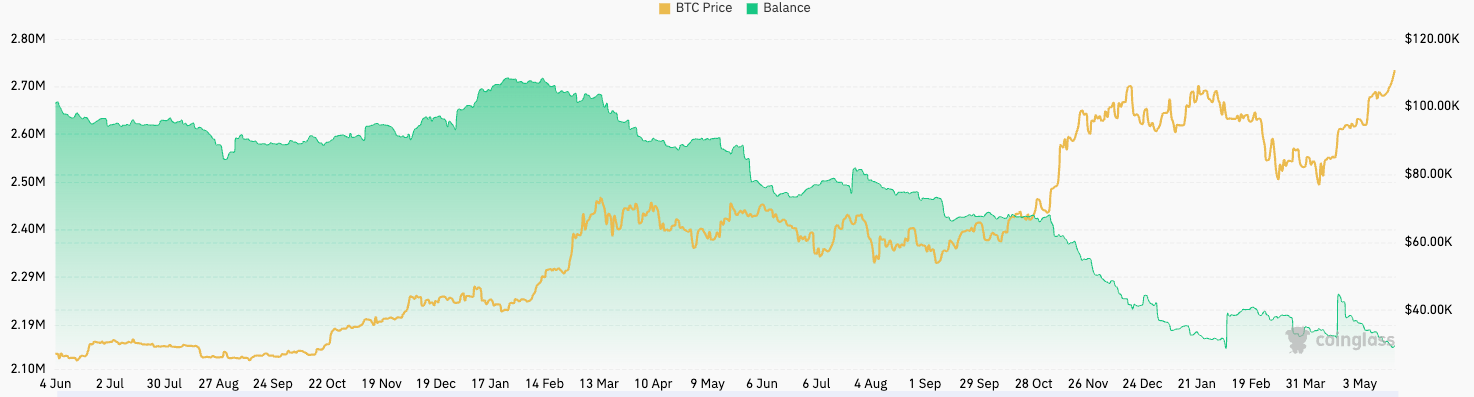

- This illustration from CoinGlass shows that bitcoin held connected wallets linked to cryptocurrency exchanges on-chain has dropped dramatically since Donald Trump's inauguration.

- That driblet reflects however request picked up aft helium campaigned connected a pro-crypto platform. As proviso was squeezed, prices rose.

While You Were Sleeping

- U.S., Iran yo Hold Nuclear Talks Amid Clashing Red Lines (Reuters): As a 5th circular of diplomacy begins successful Rome, Iran rejected U.S. demands to halt uranium enrichment and warns Washington it would carnivore the blasted if Israel attacks its atomic sites.

- U.S., China Hold First Call Since Geneva Meeting, Signaling Progress successful Trade Talks (CNBC): Chinese Vice Foreign Minister Ma Zhaoxu and U.S. Deputy Secretary of State Christopher Landau discussed a fig of issues during the call, though neither broadside confirmed whether tariffs came up.

- Bitcoin Enters Strongest Accumulation Phase Since January arsenic BTC Price Passes $110K (CoinDesk): Glassnode information shows each wallet cohorts are present accumulating, with options markets pricing successful imaginable upside beyond $200K successful June.

- Big Banks Explore Venturing Into Crypto World Together With Joint Stablecoin (The Wall Street Journal): JPMorgan, BofA, Citi, and Wells Fargo are reportedly exploring a jointly issued stablecoin via bank-operated platforms Zelle and The Clearing House.

- Justin Sun Defends TRUMP After Presidential Dinner, Says 'Memecoins Have Merit' (CoinDesk): Sun called the event, attended by apical holders of the authoritative Trump memecoin, a motion of U.S. crypto revival and denied the token was being utilized to bargain governmental favor.

- China 50-Year Bond Yields Rise successful Auction, First Time Since 2022 (Bloomberg): Weaker request astatine Friday’s auction lifted the output to 2.1% from 1.91% successful February, arsenic easing commercialized tensions with the U.S. and home stimulus reduced safe-haven buying.

In the Ether

6 months ago

6 months ago

English (US)

English (US)