By Omkar Godbole (All times ET unless indicated otherwise)

Major coins reversed aboriginal gains aft Beijing stepped up commercialized tensions by announcing retaliatory tariffs pursuing President Donald Trump's Wednesday determination to enforce further levies connected China and different nations.

Bitcoin dropped to $83,000 from $84,600, though the downside appeared limited, astir apt due to the fact that the market's worst fears person yet travel true. Markets dislike uncertainty, and the anticipation of a looming menace often creates much anxiousness and fearfulness than the existent realization of that threat.

Since Trump took bureau connected Jan. 20, markets person been wrestling with the menace of tariffs and a planetary commercialized war. That damped capitalist hazard appetite, causing the BTC terms to tumble from a grounds precocious implicit $109,000 to beneath $80,000 past month.

This week, Trump announced sweeping tariffs connected 180 nations, with higher levies connected China, the European Union and Southeast Asia. The effective U.S. tariff rate is present supra the level of astir 20% acceptable by the 1930's Smoot-Hawley Tariff Act.

This alleged tariffagedon infinitesimal marks the extremity of lingering uncertainty and could beryllium liberating for markets, chiefly due to the fact that enslaved yields person dropped crossed the precocious satellite successful the aftermath, pricing successful disinflation. That's contrary to the fashionable communicative that tariffs would pb to stagflation — precocious ostentation positive debased maturation — forcing the Fed to support involvement rates elevated.

The output connected the benchmark U.S. 10-year enslaved output has dropped beneath 4% for the archetypal clip since October and yields person fallen sharply successful the U.K., Germany and Japan. Plus, lipid has declined sharply this week connected prospects of higher proviso from OPEC countries.

All this bodes good for Fed complaint chopped bets and hazard assets, including cryptocurrencies. The aforesaid tin beryllium said for Friday's March jobs report, which, if it beats estimates, volition apt beryllium seen arsenic backward-looking, failing to relationship for this week's Trump tariffs, portion a anemic people volition lone adhd to Fed complaint cuts.

With the large macro uncertainty down us, the crypto marketplace could instrumentality to focusing connected affirmative developments, specified arsenic USDC issuer Circle's IPO filing and technological advancements.

On Thursday, Coinbase Derivatives submitted documentation to the CFTC to self-certify futures for XRP. In addition, Ethereum developers chose May 7 arsenic the day for the Pectra upgrade to spell unrecorded connected the mainnet.

Elsewhere, the SEC acknowledged Fidelity's filing for a spot exchange-traded money tied to SOL, which takes it person to approval. A batch is happening wrong the industry, truthful enactment alert!

What to Watch

Crypto:

April 5: The purported day of Satoshi Nakamoto.

April 7, 7:30 p.m.: Syscoin (SYS) activates the Nexus upgrade connected its mainnet astatine artifact 2,010,345.

April 9, 10:00 a.m.: U.S. House Financial Services Committee hearing astir however U.S. securities laws could beryllium updated to instrumentality into relationship integer assets. Livestream link.

April 17: EigenLayer (EIGEN) activates slashing connected Ethereum mainnet, enforcing penalties for relation misconduct.

April 21: Coinbase Derivatives volition list XRP futures pending support by the U.S. Commodity Futures Trading Commission (CFTC).

Macro

April 4, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases March employment data.

Nonfarm Payrolls Est. 135K vs. Prev. 151K

Unemployment Rate Est. 4.1% vs. Prev. 4.1%

April 4, 8:30 a.m.: Statistics Canada releases March employment data.

Unemployment Rate Est. 6.7% vs. Prev. 6.6%

April 4, 11:25 a.m.: Fed Chair Jerome H. Powell volition springiness a code titled “Economic Outlook.” Livestream link.

April 5, 12:01 a.m.: The Trump administration’s 10% baseline tariff on imports from each countries takes effect.

April 9, 12:01 a.m.: The Trump administration’s higher individualized tariffs connected imports from apical U.S. trade-deficit countries instrumentality effect.

April 14: Salvadoran President Nayib Bukele volition articulation President Donald Trump astatine the White House for an official moving visit.

Earnings (Estimates based connected FactSet data)

No net scheduled.

Token Events

Governance votes & calls

Sky DAO is voting connected an enforcement proposal that includes initializing ALLOCATOR-BLOOM-A, updating the Smart Burn Engine's hop parameter, approving the Spark Tokenization Grand Prix DAO solution and executing a Spark Proxy Spell to grow SparkLend's liquidity operations. Voting ends May 3.

AaveDAO is discussing an upgrade to GHO Savings to present a method plan change to sGHO, a yield-bearing mentation of GHO designed for multichain integration. It besides introduces the Aave Savings Rate (ASR) that volition find sGHO’s yield.

April 4, 9 a.m.: Core DAO to host an Ask Me Anything (AMA) session.

April 4, 2 p.m.: Sei’s probe inaugural to clasp a livestream connected real-world plus tokenization.

April 7, 9 a.m.: OriginTrail to big a “Shaping AI for Good” Zoom talk.

April 7, 4 p.m.: Livepeer to big a monthly assemblage telephone focused connected governance, funding, and the strategical absorption of its on-chain treasury.

Unlocks

April 5: Ethena (ENA) to unlock 3.25% of its circulating proviso worthy $54.22 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating proviso worthy $10.17 million.

April 9: Movement (MOVE) to unlock 2.04% of its circulating proviso worthy $19.17 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating proviso worthy $57 million.

April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating proviso worthy $24.91 million.

Token Listings

April 4: Pintu (PTU), Spartan Protocol (SPARTA), Derby Stars (DSRUN), Veloce (VEXT), BOB and KryptoniteSEILOR) to beryllium deslisted from Bybit.

April 9: IOST airdrop claims portal for a astir 1.7 cardinal IOST token airdrop to open.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 3 of 4: ETH Bucharest Conference & Hackathon (Romania)

Day 2 of 4: BitBlockBoom (Dallas)

April 6-9: Hong Kong Web3 Festival

April 8-10: Paris Blockchain Week

April 10: Bitcoin Educators Unconference (Nashville)

April 15-16: BUIDL Asia 2025 (Seoul)

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

April 24: Bitwise's Investor Day for Bitcoin Standard Corporations (New York)

Token Talk

By Shaurya Malwa

Infected, a crypto game, moves to Solana from Base web aft saying the second couldn't grip its launch.

Infected claimed it faced method issues during the start-up and Base was incapable to grip precocious transaction volumes, starring to state terms spikes and a mediocre idiosyncratic experience.

It reported that a state spike caused transaction failures during the captious archetypal 30 minutes of the game’s debut, disrupting momentum.

Although front-end issues were suspected initially, the squad concluded that Base’s scalability limitations were the basal cause, a occupation they accidental persists crossed Ethereum-based chains.

Jesse Pollak, the creator of Base, rejected the claims, asserting that Base operated smoothly and did not crash. He emphasized that Base, with a $3.05 cardinal full worth locked and 1.2 cardinal progressive addresses, had offered enactment to resoluteness front-end issues, suggesting the occupation was not inherent to the chain.

Base developer 'Saedeh' called retired Infected’s inexperience, pointing to its instauration of aggregate tokens and exaggerated marketplace headdress claims arsenic missteps.

Derivatives Positioning

BTC, ETH puts are trading astatine a premium comparative to calls retired to June expiry, representing near-term downside concerns.

The affirmative trader gamma astatine the $83K and $84K strikes means these marketplace participants could commercialized against the marketplace to hedge their books, perchance arresting terms volatility.

Perpetual backing rates for astir large tokens, excluding XRP and AVAX, stay marginally positive, implying cautiously bullish sentiment.

Market Movements

BTC is up 1.25% from 4 p.m. ET Thursday astatine $83,032.61 (24hrs: -0.28%)

ETH is up 0.61% astatine $1,795.41 (24hrs: +0.15%)

CoinDesk 20 is up 1.54% astatine 2,479.75 (24hrs: +0.62%)

Ether CESR Composite Staking Rate is up 6 bps astatine 3.08%

BTC backing complaint is astatine 0.0023% (2.4988% annualized) connected Binance

DXY is up 0.47% astatine 102.56

Gold is up 0.48% astatine $3,111.90/oz

Silver is down 1.38% astatine $31.40/oz

Nikkei 225 closed -2.75% astatine 33,780.58

Hang Seng closed -1.52% astatine 22,849.81

FTSE is down 3.4% astatine 8,186.43

Euro Stoxx 50 is down 4.26% astatine 4,895.26

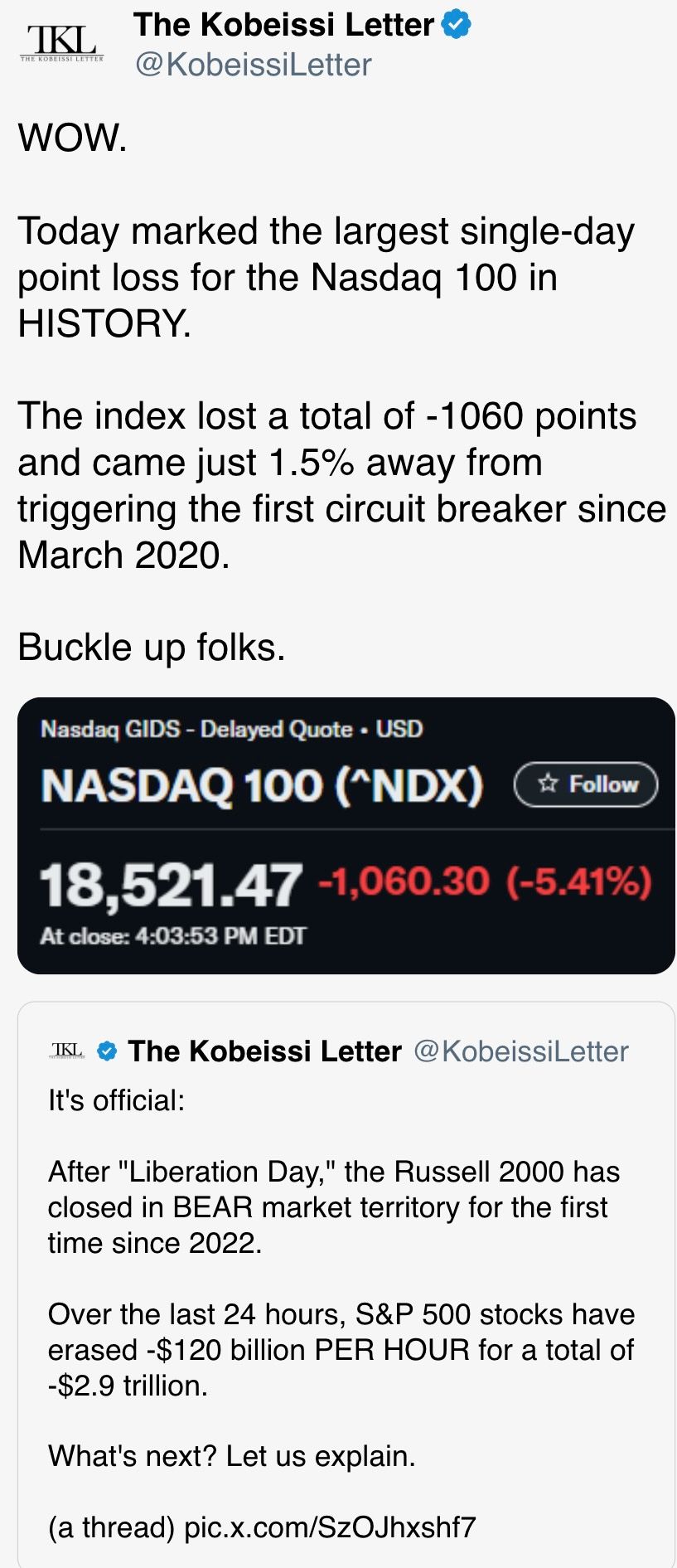

DJIA closed connected Thursday -3.98% astatine 40,545.93

S&P 500 closed -4.84% astatine 5,396.52

Nasdaq closed -5.97% astatine 16,550.61

S&P/TSX Composite Index closed -3.84% astatine 24,335.8

S&P 40 Latin America closed +0.21% astatine 2,453.38

U.S. 10-year Treasury complaint is down 13 bps astatine 3.9%

E-mini S&P 500 futures are down 2.17% astatine 5,315.00

E-mini Nasdaq-100 futures are down 2.34%% astatine 18,238.75

E-mini Dow Jones Industrial Average Index futures are down 2.26% astatine 39,854

Bitcoin Stats:

BTC Dominance: 63 (0.31%)

Ethereum to bitcoin ratio: 0.02162 (-1.05%)

Hashrate (seven-day moving average): 839 EH/s

Hashprice (spot): $46.31

Total Fees: 5.78 BTC / $478,070

CME Futures Open Interest: 135,025 BTC

BTC priced successful gold: 27.1 oz

BTC vs golden marketplace cap: 7.69%

Technical Analysis

The ratio betwixt the dollar prices of bitcoin and golden is looking to inclination lower.

Gold, however, whitethorn spot a "sell the fact" pullback successful the aftermath of Wednesday's Trump tariffs, perchance starring to a breakout successful the BTC-gold ratio.

Such a determination could beryllium taken a motion of a renewed bull tally successful BTC, arsenic the cryptocurrency tends to rally aft gold.

Crypto Equities

Strategy (MSTR): closed connected Thursday astatine $282.28 (-9.68%), down 1.11% astatine $279.14 successful pre-market

Coinbase Global (COIN): closed astatine $170.76 (-6.66%), down 3.29% astatine $165.14

Galaxy Digital Holdings (GLXY): closed astatine C$15.08 (-11.81%)

MARA Holdings (MARA): closed astatine $11.23 (-9.58%), down 3.29% astatine $10.86

Riot Platforms (RIOT): closed astatine $7.30 (-8.98%), down 3.15% astatine $7.07

Core Scientific (CORZ): closed astatine $7.15 (-15.08%), down 1.96% astatine $7.01

CleanSpark (CLSK): closed astatine $7.41 (-7.61%), down 3.51% astatine $7.15

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $12.75 (-10.46%), down 0.16% astatine $12.73

Semler Scientific (SMLR): closed astatine $34.06 (-8.02%), down 6.05% astatine $32

Exodus Movement (EXOD): closed astatine $42.63 (-9.93%), down 0.09% astatine $42.59

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$99.8 million

Cumulative nett flows: $36.23 billion

Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

Daily nett flow: -$3.6 million

Cumulative nett flows: $2.37 billion

Total ETH holdings ~ 3.39 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The planetary hunt involvement for the word "tariffs" reached a highest worth of 100 connected Thursday, indicating heightened curiosity and interest astir commercialized taxes among the wide nationalist implicit the past 90 days.

Peak involvement among the wide populace usually marks the extremity of a trend, meaning markets could soon beryllium looking past tariffs.

While You Were Sleeping

Bitcoin Falls Back to $83K arsenic China Announces 34% Tariffs connected All U.S. Goods (CoinDesk): China announced retaliatory tariffs connected each goods from the U.S.

March Jobs Report a 'Heads I Win, Tails You Lose' Moment for Bitcoin Bulls (CoinDesk): Bitcoin's terms stableness supra March lows suggests seller fatigue, with implied volatility indicating a imaginable 3.4% terms plaything successful the adjacent 24 hours.

South Korea’s President Yoon Ousted arsenic Court Upholds Impeachment (Reuters): The Constitutional Court said Yoon overstepped his powers by declaring martial law. An predetermination indispensable beryllium held wrong 60 days, with Prime Minister Han Duck-soo serving arsenic interim president.

Inflation Fears Add to Pressure connected Federal Reserve (Financial Times): Markets present spot short-term U.S. ostentation rising astatine its fastest gait since 2022.

Solana's SOL Could See Nearly 6% Price Swing arsenic Whales Dump Coins Before U.S. Jobs Data (CoinDesk): Volmex's one-day implied volatility scale indicates SOL whitethorn spot a 6% terms plaything arsenic ample investors offload holdings up of the U.S. non-farm payroll report.

China’s Response to New U.S. Tariffs Will Likely Focus More connected Stimulus, Building Trade Ties (CNBC): China is apt to respond by boosting stimulus, deepening Asian and African commercialized ties, and keeping the yuan beardown to displacement inflationary unit onto the U.S., analysts said.

In the Ether

8 months ago

8 months ago

English (US)

English (US)