By Omkar Godbole (All times ET unless indicated otherwise)

Risk assets are trading down arsenic the dollar scale and Treasury yields payment from Friday's blowout nonfarm payrolls study and the Palisades Fires posing a risk to the security assemblage and immoderate P&C companies.

BTC is down 2%, changing hands successful the cardinal enactment portion of $90,000 and $93,000, with alternate cryptocurrencies posting bigger losses arsenic usual. ETH has dropped to the lowest since Dec. 21 and the risk-off has clouded XRP's bullish method outlook (see TA section). Whales apt accumulated XRP implicit South Korea-based Upbit implicit the weekend. AI coins is the worst performing sub-sector of the past 24 hours. In accepted markets, futures tied to the S&P 500 constituent to antagonistic unfastened alongside continued downside volatility successful the British lb and emerging marketplace currencies.

The risk-off sentiment, however, didn't halt Michael Saylor from indicating a imaginable for different bitcoin acquisition arsenic helium shared an update connected MicroStrategy's bitcoin acquisition tracker. If it would enactment a dent into the antagonistic marketplace sentiment, is different story. "The firm's acquisition past Monday amounted to astir $100 million, which had constricted marketplace impact, but underscores the firm's ongoing demand," Valentin Fournier, expert astatine BRN said.

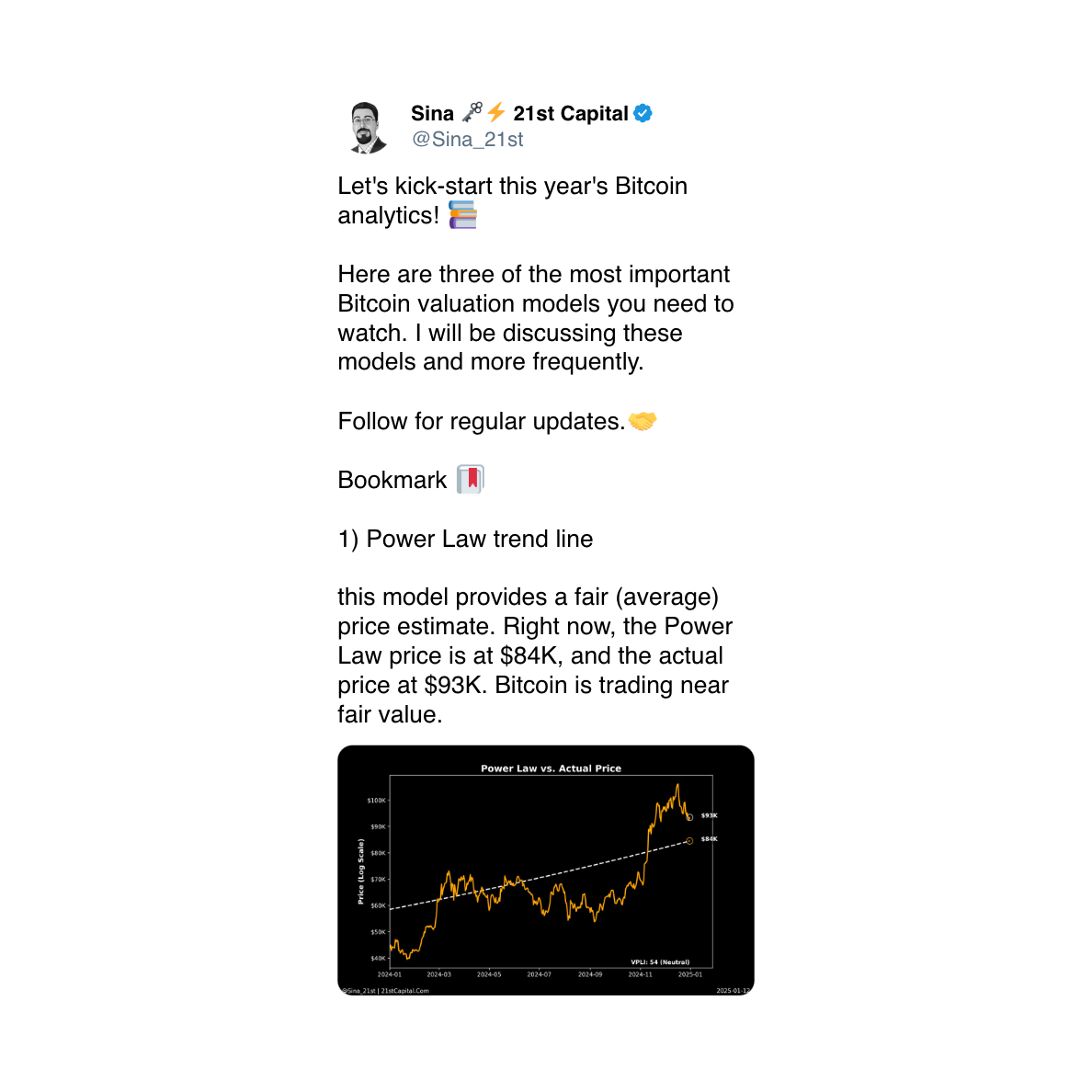

Other things being equal, the hazard of BTC losing the enactment portion appears precocious arsenic immoderate concern banks judge the Fed rate-cutting rhythm is over, with Bank of America suggesting a imaginable for a complaint hike. Per immoderate observers, the statement is that prices volition deflate to $70K, followed by a renewed rally.

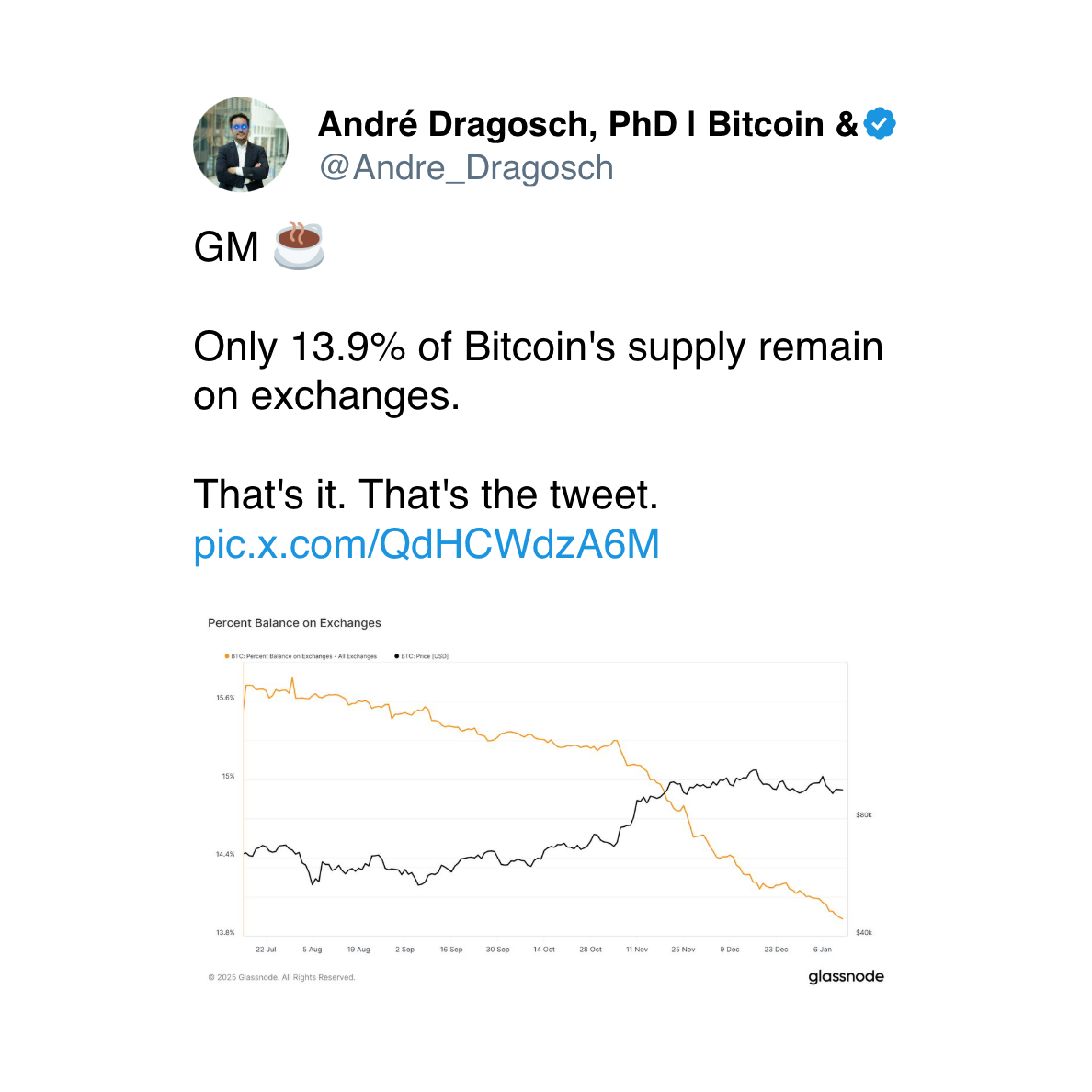

Meanwhile, the 30-day moving mean of the Coinbase-Binance BTC terms differential, which has a knack of marking large terms tops, has slipped to the lowest since astatine slightest 2019, a motion of weaker stateside demand.

Over the adjacent term, the crypto marketplace is apt to absorption connected President-elect Donald Trump's inauguration connected Jan. 20 and the ongoing FTX assertion distributions, according to Coinbase Institutional.

What to Watch

Crypto

Jan. 13: Solayer (LAYER) "Season 1" airdrop snapshot for staking participants, liquidity providers, and spouse ecosystem users.

Jan. 15: Derive (DRV) to make and administer caller tokens successful token procreation event.

Jan. 15: Mintlayer mentation 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling autochthonal BTC cross-chain swaps.

Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is acceptable to commencement connected Binance, featuring pairs similar S/USDT, S/BTC, and S/BNB.

Jan. 17: Primary listing of SOLV, the autochthonal token of Solv Protocol.

Macro

Jan. 13, 2:00 p.m.: The U.S. Department of the Treasury releases December 2024's Monthly Treasury Statement report. Monthly fund shortage Est. $62B vs. Prev. $367B.

Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

PPI MoM Est. 0.3% vs. Prev. 0.4%.

Core PPI MoM Est. 0.3% vs. Prev. 0.2%.

Core PPI YoY Est. 3.7% vs. Prev. 3.4%.

PPI YoY Est. 3.4% vs. Prev. 3%.

Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending connected Jan. 11. Prev. 6.8%.

Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%.

Core Inflation Rate YoY Est. 3.3% vs. Prev. 3.3%.

Inflation Rate MoM Est. 0.3% vs. Prev. 0.3%.

Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%.

Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

GDP MoM Est. 0.2% vs. Prev. -0.1%.

GDP YoY Prev. 1.3%.

Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending connected Jan. 11. Initial Jobless Claims Est. 214K vs. Prev. 201K.

Jan. 17, 5:00 a.m.: Eurostat releases December 2024's Eurozone ostentation data.

Inflation Rate MoM Final Est. 0.4% vs Prev. -0.3%.

Core Inflation Rate YoY Final Est. 2.7% vs. Prev. 2.7%.

Inflation Rate YoY Final Est. 2.4% vs. Prev. 2.2%.

Token Events

Governance votes & calls

Aave assemblage suggest adjusting get complaint for its GHO stablecoin from 10.50% to 9.00%.

Aavegotchi DAO has an progressive ballot connected modifying ETH merchantability ladder parameters owed to "significant underperformance" by ETH.

Jan. 14: Mantra community call with its co-founder

Unlocks

No large unlocks scheduled today.

Jan. 14: Arbitrum (ARB) to unlock 0.93% of its circulating supply, worthy $70.65 million.

Jan. 15: Connex (CONX) to unlock 376% of its circulating supply, worthy $84.5 million.

Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worthy $2.19 billion.

Token Launches

No large token launches scheduled today.

Jan. 15: Derive (DRV) volition launch, with 5% of proviso going to sENA stakers. Jan. 16: Solayer (LAYER) to big token merchantability followed by 5 months of points farming.

Jan. 17: Solv Protocol (SOLV) to beryllium listed connected Binance.

Conferences:

Day 8 of 14: Starknet, an Ethereum furniture 2, is holding its Winter Hackathon (online).

Day 1 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan. 25-26: Catstanbul 2025 (Istanbul). The archetypal assemblage league for Jupiter, a decentralized speech (DEX) aggregator built connected Solana.

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Oliver Knight

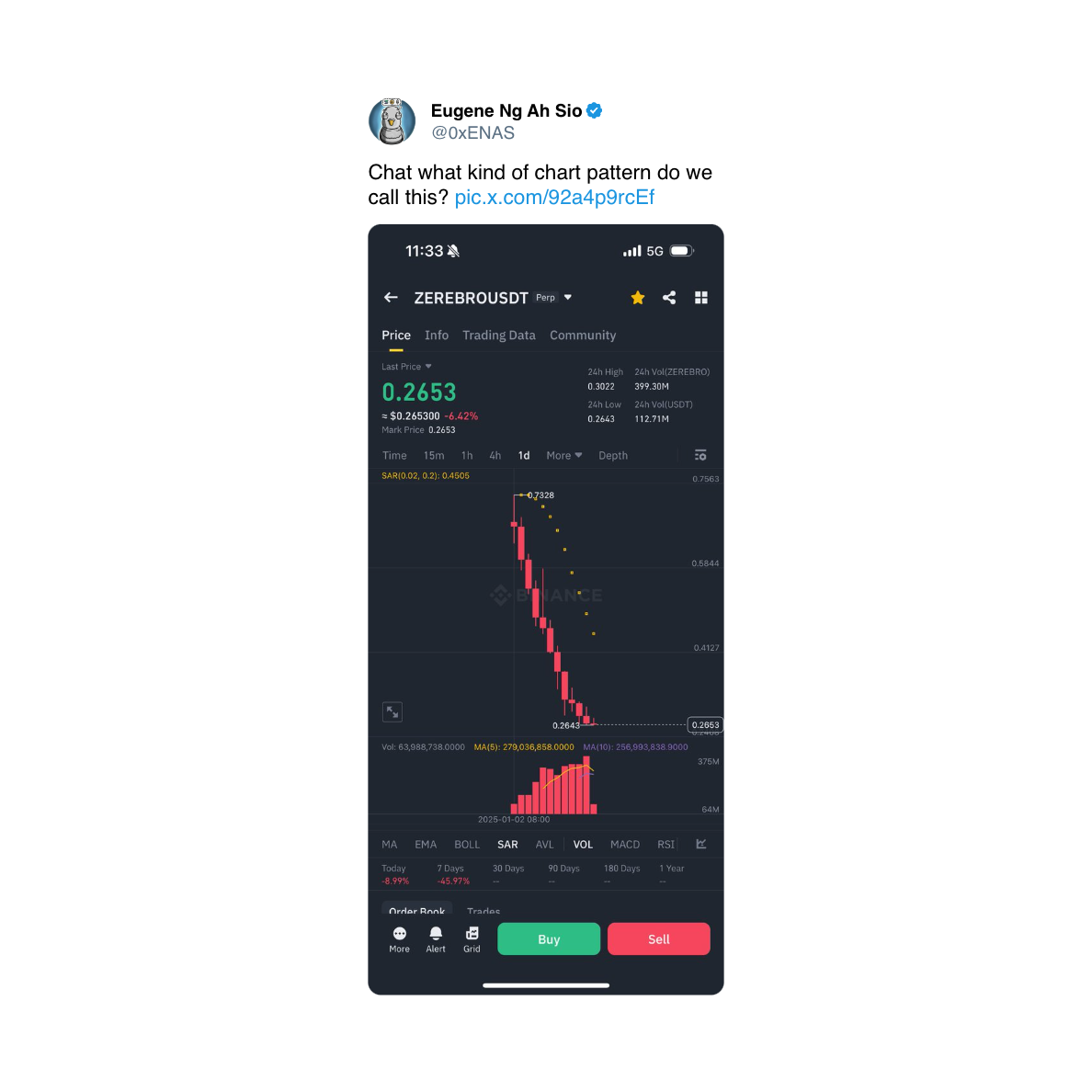

AI cause tokens person suffered a heavy correction, with ai16z present trading astatine $1.02, down much than 60% from its grounds precocious acceptable connected Jan. 2. Virtual Protocol's autochthonal token (VIRTUAL) has slumped a further 16% implicit the past 24-hours to compound its caller downtrend, it is present trading astatine $2.40 aft surging to $5.04 connected Jan. 2.

NFT task Azuki has announced the motorboat of ANIME, a Japanese cartoon-themed token that volition administer 50.5% of the token's proviso to the Azuki community. Azuki employees and advisors volition person 15.62% of proviso bound by a vesting schedule.

Ethena's ENA token has dropped by 11.4% implicit the past 24-hours arsenic backing rates for ETH, which Ethena's concern exemplary relies on, is opening to autumn into neutral territory. Ethena inactive offers a output of 11% connected its stablecoin though it's unclear however agelong that complaint is sustainable if backing rates proceed to fall.

Ether whales person begun offloading ETH astatine a nonaccomplishment with 1 trader selling 10,070 ETH for $33 cardinal astatine a $1 cardinal loss, the wallet inactive holds $45 million, on-chain information reported by Lookonchain shows.

Derivatives Positioning

Perpetual backing rates for TRX, AVAX, SUI and TON person flipped negative, indicating a bearish displacement successful positioning.

Front-end hazard reversals amusement a beardown bias for BTC and ETH protective enactment options successful enactment with the risk-off sentiment successful markets. Screen traders person bought puts astatine $92K, $90K and $87K successful BTC.

There is notable antagonistic trader gamma successful the scope of $90K and $93K, which means these entities mightiness commercialized successful the market's absorption to hedge book, bolstering the move. A akin dynamic exists betwixt $3.2K and $3,450. successful the ETH market.

BTC and ETH DVOLs, measuring 30-day expected terms swings, stay successful the acquainted ranges for the month.

Market Movements:

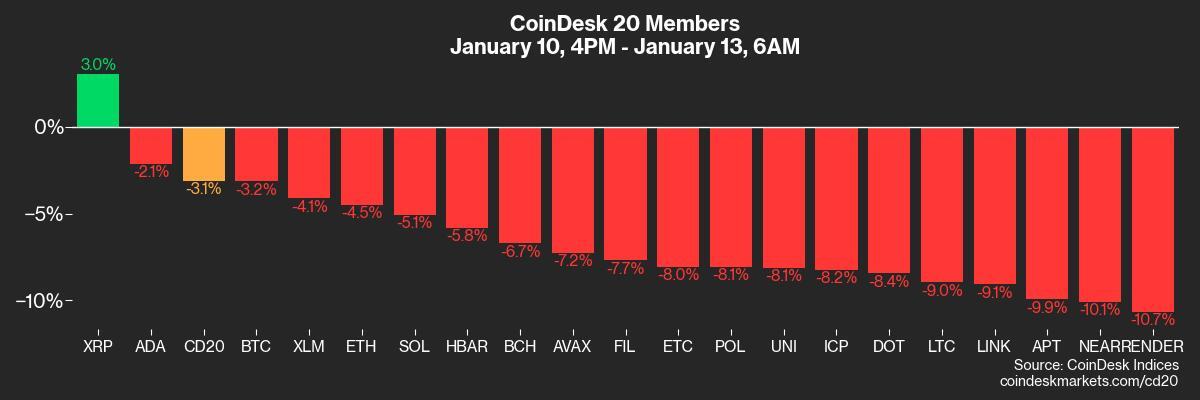

BTC is down 3.12% from 4 p.m. ET Friday to $91,392.04 (24hrs: -2.67%)

ETH is down 4.78% astatine $3,109.45 (24hrs: -4.05%)

CoinDesk 20 is down 2.15% to 3,310.23 (24hrs: -3.08%)

Ether staking output is down 16 bps to 2.97%

BTC backing complaint is astatine -0.0149% (-16.27% annualized) connected Binance

DXY is up 0.35% astatine 110.04

Gold is down 0.13% astatine $2,705.00/oz

Silver is down 0.84% to $30.83/oz

Nikkei 225 closed -1.05% astatine 39,190.40

Hang Seng closed -1% astatine 18,874.14

FTSE is down 0.25% astatine 82,27.71

Euro Stoxx 50 is up 0.92% astatine 4,931.47

DJIA closed connected Friday -1.63% to 41,938.45

S&P 500 closed -1.54% astatine 5,827.04

Nasdaq closed -1.63% astatine 19,161.63

S&P/TSX Composite Index closed -1.22% astatine 24,767.70

S&P 40 Latin America closed -1.31% astatine 2,181.96

U.S. 10-year Treasury is up 2 bps astatine 4.79%

E-mini S&P 500 futures are down 0.78% to 5,820.50

E-mini Nasdaq-100 futures are down 1.18% to 20,767.25

E-mini Dow Jones Industrial Average Index futures are down 0.48% astatine 42,022.00

Bitcoin Stats:

BTC Dominance: 58.39

Ethereum to bitcoin ratio: 0.033

Hashrate (seven-day moving average): 775 EH/s

Hashprice (spot): $54.6

Total Fees: 4.89 BTC/ $462,582

CME Futures Open Interest: 175,380 BTC

BTC priced successful gold: 34.5 oz

BTC vs golden marketplace cap: 9.82%

Technical Analysis

XRP broke retired of a descending triangle signifier Friday, signaling a resumption of the broader uptrend from aboriginal November lows.

However, BTC's macro-led risk-off enactment has pushed XRP backmost to the breakout point.

Watch retired for a imaginable determination backmost wrong the triangle, arsenic failed breakouts are almighty bearish reversal signals.

Crypto Equities

MicroStrategy (MSTR): closed connected Friday astatine $327.91 (-1.14%), down 4.95% astatine $311.67 successful pre-market.

Coinbase Global (COIN): closed astatine $258.78 (-0.47%), down 4.42% astatine $247.34 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$27.07 (+0.82%)

MARA Holdings (MARA): closed astatine $17.86 (-2.62%), down 4.59% astatine $17.04 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.00 (-0.17%), down 5.25% astatine $11.37 successful pre-market.

Core Scientific (CORZ): closed unchanged astatine $14.04, down 3.49% astatine $13.55 successful pre-market.

CleanSpark (CLSK): closed unchanged astatine $10.09, down 5.05% astatine $9.58 successful pre-market

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $23.11 (-0.17%), down 4.41% astatine $22.09 successful pre-market.

Semler Scientific (SMLR): closed astatine $51.36 (+2.33%), down 7.03% astatine $47.75 successful pre-market.

Exodus Movement (EXOD): closed unchanged astatine $37.77, down 9.98% astatine $34.00 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: $-149.4 million

Cumulative nett flows: $36.22 billion

Total BTC holdings ~ 1.137 million.

Spot ETH ETFs

Daily nett flow: $-68.5 million

Cumulative nett flows: $2.45 billion

Total ETH holdings ~ 3.582 million.

Source: Farside Investors, arsenic of Jan. 10.

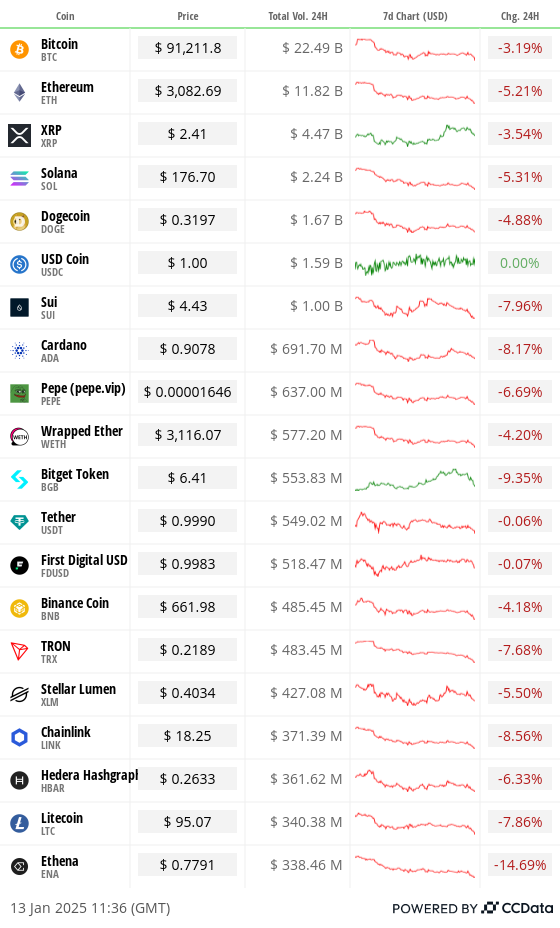

Overnight Flows

Chart of the Day

The fig of Bitcoin Runes minted regular has slipped to a grounds lows, averaging little than 10% of past year's figures.

Runes was a large deed among traders pursuing the Bitcoin blockchain's reward halving successful April past year.

Runes is akin to Ordinals, allows radical to “etch” and mint tokens on-chain.

While You Were Sleeping

Bitcoin Under Pressure arsenic Goldman Trims Fed Rate Cut Expectations, BofA Sees Potential Hike After Blowout Jobs Report (CoinDesk): Bitcoin fell beneath $93K during Monday’s European trading hours arsenic beardown U.S. jobs information spurred concern banks to revise Fed complaint chopped expectations, with immoderate informing of imaginable hikes.

Singapore Blocks Polymarket, Following Taiwan and France (CoinDesk): Over the weekend, Singapore blocked entree to Polymarket, labeling it an unlicensed gambling site. This follows akin actions successful Taiwan and France, arsenic planetary scrutiny of the level grows.

AI Agent Tokens Reel From a Steep Market Correction (The Block): AI cause tokens plunged implicit the past week, with AI16Z going from $2.26 to $1.10 and GOAT falling from $0.5 to $0.33, portion bitcoin held dependable astir the $95,000 level.

Global Bond Tantrum Is a Wrenching and Worrisome Start to New Year (Bloomberg): U.S. Treasury yields are nearing 5%, driven by beardown economical growth, persistent inflation, and rising authorities debt, raising planetary borrowing costs and reducing request for riskier investments similar stocks.

Dollar Hits 2-Year High After Robust US Data Pares Back Bets connected Rate Cuts (Financial Times): On Monday, the U.S. dollar scale deed a two-year precocious pursuing Friday's beardown U.S. jobs report. Oil prices rose, with Brent reaching $81 and WTI hitting $77.90, connected caller Russian sanctions.

ECB Seeking Middle Ground With Rate Cuts, Lane Tells Newspaper (Reuters): The European Central Bank (ECB) plans cautious monetary easing, striving to curb ostentation without triggering recession, arsenic wage maturation moderates and ostentation approaches its 2% people by mid-2025.

In the Ether

11 months ago

11 months ago

English (US)

English (US)