By James Van Straten (All times ET unless indicated otherwise)

With conscionable implicit a week to spell until the extremity of March, the archetypal 4th has been disappointing, peculiarly successful presumption of terms enactment alternatively than communicative for the crypto industry.

Bitcoin (BTC) has dropped 10%, its worst first-quarter show since 2020, and ether (ETH) has posted its weakest archetypal 4th since inception. So far, bitcoin has been comparatively dependable successful March.

Markets stay successful the second stages of President Donald Trump’s archetypal 100 days successful office, a play historically marked by uncertainty and volatility. This is expected to persist astatine slightest done the extremity of April.

As quarter-end approaches, antagonistic liquidity and presumption absorption could pb to accrued volatility and whipsaw terms action, according to the London Crypto Club, founders of a trading newsletter.

Despite short-term weakness, the brace support a bullish outlook heading into the 2nd quarter. A somewhat much dovish code from the Federal Reserve astatine its March gathering — adjacent without existent complaint cuts — combined with a weakening U.S. dollar, accrued fiscal spending successful the European Union and a U.S. system that is slowing but not collapsing, are each factors they accidental volition enactment a beardown 3 months.

Bitcoin began to merchantability disconnected connected Thursday pursuing Trump's lack of a factual update connected a bitcoin strategical reserve oregon a tax-free crypto superior gains policy.

“Market participants were hoping for a tax-free superior gains model oregon a bitcoin nationalist reserve accumulation plan," noted Blockhead Research Network (BRN). "Instead, Trump reiterated his wide enactment for the crypto industry, highlighting the relation of stablecoins successful maintaining the U.S. dollar’s dominance successful planetary trade. While supportive successful the agelong term, the deficiency of contiguous argumentation commitments is simply a short-term bearish signal.”

BRN sees integer assets struggling to prolong breakouts, with accumulation continuing astatine little levels, peculiarly for altcoins.

“Despite near-term weakness, we urge staying heavy invested, arsenic the marketplace could respond swiftly to the adjacent affirmative development. Support levels are not acold from existent prices,” BRN told CoinDesk successful an email. Stay alert!

What to Watch

Crypto:

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that volition absorption connected the explanation of a security.

March 24 (before marketplace open): Bitcoin miner CleanSpark (CLSK) volition join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis web upgrade goes unrecorded connected Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes unrecorded connected the Chromia (CHR) mainnet.

March 26, 3:37 a.m.: Ethereum’s Hoodi testnet volition activate the Pascal hard fork web upgrade astatine epoch 2048.

Macro

March 23, 8:30 p.m.: S&P Global releases (Flash) Japan March shaper terms scale (PPI) data.

Composite PPI Prev. 52

Manufacturing PPI Prev. 49

Services PPI Prev. 53.7

March 24, 9:45 a.m.: S&P Global releases (Flash) U.S. March shaper terms scale (PPI) data.

Composite PPI Prev. 51.6

Manufacturing PPI Prev. 52.7

Services PPI Prev. 51

Earnings (Estimates based connected FactSet data)

March 27: KULR Technology Group (KULR), post-market, $-0.02

March 28: Galaxy Digital Holdings (GLXY), pre-market, C$0.38

Token Events

Governance votes & calls

Aave DAO is discussing the activation of Aave Umbrella, a strategy meant to regenerate Aave Safety Module. It would alteration users to involvement their Aave aTokens to screen imaginable atrocious indebtedness and gain rewards for it.

Sky DAO is voting connected an executive connection that would see a fig of cardinal initiatives, including implementing aggregate complaint changes, updating the Smart Burn Engine's "hop" parameter, allocating 55,000 USDS for a bug bounty payout, transferring 3 cardinal USDS for Integration Boost backing and triggering a Spark proxy spell, among different things.

Compound DAO is discussing the implementation of COMP Staker, a staking mechanics aimed astatine enhancing governance and information from COMP holders. It would let token holders to involvement and delegate their votes to gain a stock of protocol revenue.

March 21, 11:30 a.m.: Flare to big an X Spaces session connected Flare 2.0.

March 25, 1 a.m.: Crypto.com to hold an Ask Me Anything (AMA) session with its co-founder and CEO Kris Marszalek.

Unlocks

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating proviso worthy $307.8 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating proviso worthy $26.81 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating proviso worthy $147.01 million.

April 3: Wormhole (W) to unlock 47.64% of its circulating proviso worthy $114.79 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating proviso worthy $11.81 million.

Token Listings

March 21: PancakeSwap (CAKE) to beryllium listed connected HashKey.

March 21: Orca (ORCA) to beryllium listed connected Upbit.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

Token Talk

By Shaurya Malwa

Issuance level Pump.Fun introduced its Pumpswap work connected Thursday, allowing tokens made connected the level to beryllium traded connected the caller work alternatively of decentralized speech (DEX) Raydium, wherever they were antecedently listed.

Pump introduced a caller interest structure, replacing the 6 SOL migration interest with a 0.25% trading fee.

It besides has plans for a gross sharing exemplary that incentivizes creators to absorption connected semipermanent token maturation by earning gross connected each trade, shifting distant from the erstwhile dump-on-buyers dynamic.

Pump.fun metrics amusement a diminution successful token launches and graduations, with 29,000 coins launched connected March 8 but lone 264 graduating and occurrence rates — oregon the tokens listed connected a DEX — dipping beneath 1%.

Derivatives Positioning

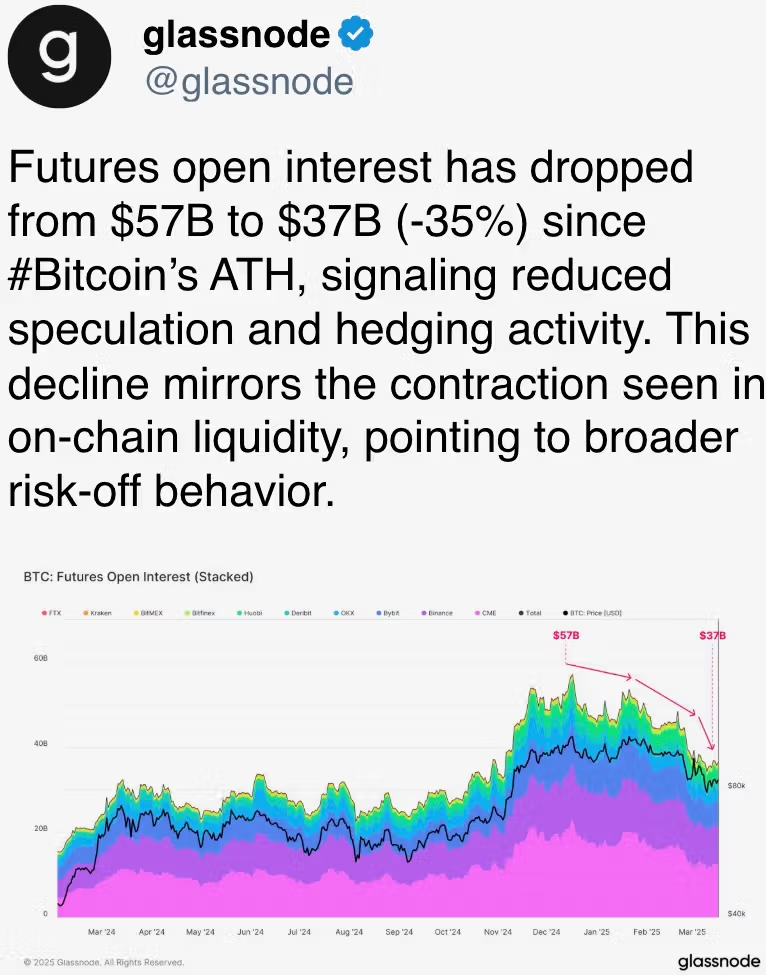

Bitcoin futures unfastened involvement has declined to 628,000 BTC from the play precocious of astir 650,000 BTC alongside marginally affirmative perpetual backing rates. The operation indicates that BTC's 24-hour terms driblet is mostly characterized by unwinding of longs alternatively than caller shorts.

Open involvement successful ETH futures, meanwhile, remains elevated astatine grounds highs supra 10 cardinal ETH successful a motion traders are continuing to abbreviated a falling market.

XRM, BNB, TRX are standouts successful the altcoin market, boasting a affirmative cumulative measurement delta indicator for the past 24 hours. It's a motion of nett buying successful these markets.

BTC's abbreviated and near-dated options person flipped bearish, indicating renewed request for puts retired to the May extremity expiry. Ether puts are pricier than BTC.

Market Movements:

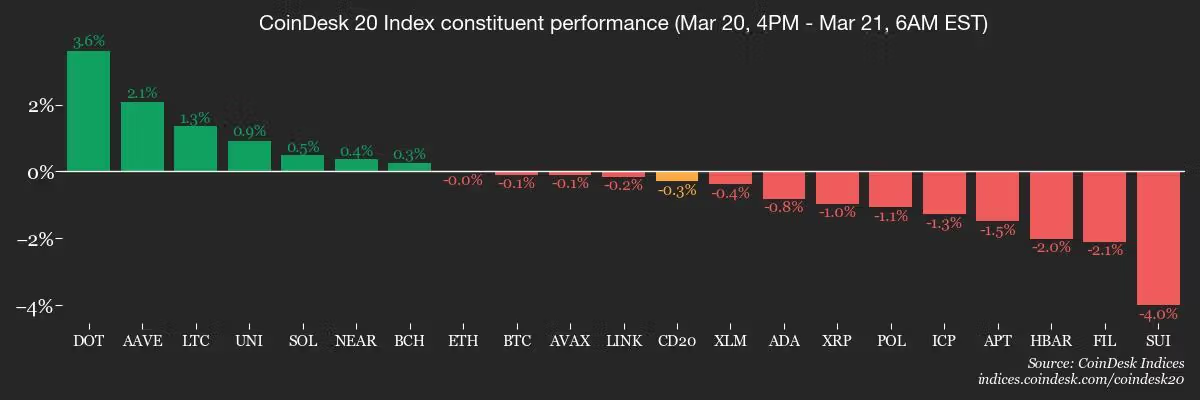

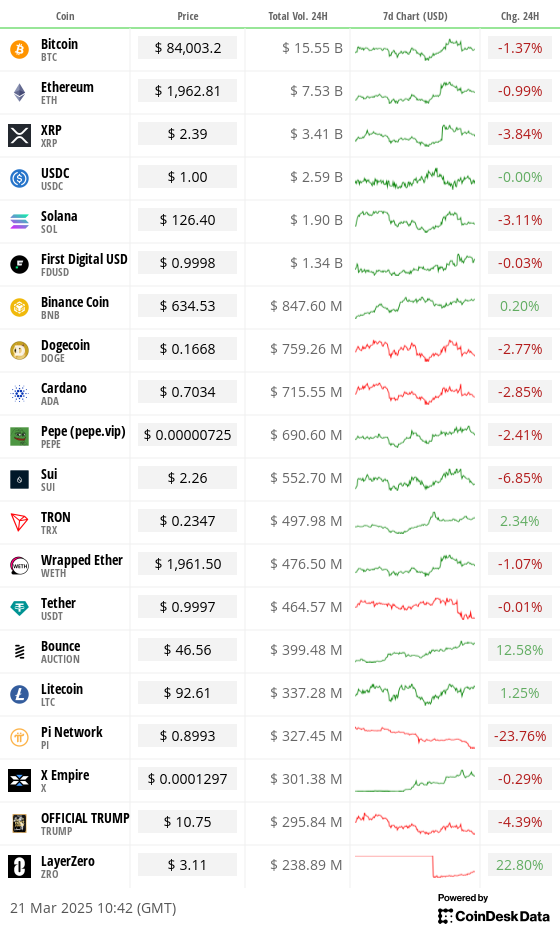

BTC is down 0.73% from 4 p.m. ET Thursday astatine $83,935.26 (24hrs: -1.43%)

ETH is down 1.19% astatine $1,960.00 (24hrs: -1.18%)

CoinDesk 20 is down 1.29% astatine 2,648.64 (24hrs: -2.08%)

Ether CESR Composite Staking Rate is up 5 bps astatine 3.06%

BTC backing complaint is astatine 0.0108% (3.95% annualized) connected Binance

DXY is up 0.16% astatine 104.02

Gold is down 0.12% astatine $3,033.22/oz

Silver is down 1.08% astatine $33.11/oz

Nikkei 225 closed connected Thursday -0.25% astatine 37,677.06

Hang Seng closed connected Thursday -2.19% astatine 23,689.72

FTSE is down 0.49% astatine 8,659.67

Euro Stoxx 50 is down 0.76% astatine 5,410.04

DJIA closed connected Thursday unchanged astatine 41,953.32

S&P 500 closed -0.22% astatine 5,662.89

Nasdaq closed -0.33% astatine 17,691.63

S&P/TSX Composite Index closed unchanged astatine 25,060.24

S&P 40 Latin America closed -0.96% astatine 2,471.90

U.S. 10-year Treasury complaint is down 2 bps astatine 4.23%

E-mini S&P 500 futures are down 0.21% astatine 5,700.50

E-mini Nasdaq-100 futures are down 0.25% astatine 19,828.75

E-mini Dow Jones Industrial Average Index futures are down 0.19 astatine 42,204.00

Bitcoin Stats:

BTC Dominance: 61.52 (0.16%)

Ethereum to bitcoin ratio: 0.02348 (-0.38%)

Hashrate (seven-day moving average): 808 EH/s

Hashprice (spot): $48.01

Total Fees: 5.47 BTC / $465,938

CME Futures Open Interest: 150,645 BTC

BTC priced successful gold: 27.4 oz

BTC vs golden marketplace cap: 7.79%

Technical Analysis

The XRP/ETH regular illustration shows the MACD histogram, a momentum indicator, has precocious produced a little high, diverging bearishly from the continued emergence successful the ratio.

The divergence suggests XRP whitethorn underperform ether successful the coming days.

Crypto Equities

Strategy (MSTR): closed connected Thursday astatine $302.07 (-0.71%), down 0.83% astatine $299.55 successful pre-market

Coinbase Global (COIN): closed astatine $190.38 (+0.33%), down 0.76% astatine $188.93

Galaxy Digital Holdings (GLXY): closed astatine C$18.15 (+2.54%)

MARA Holdings (MARA): closed astatine $12.50 (-0.24%), down 0.56% astatine $12.43

Riot Platforms (RIOT): closed astatine $7.76 (-0.26%), down 0.13% astatine $7.75

Core Scientific (CORZ): closed astatine $8.59 (-1.04%), down 0.93% astatine $8.51

CleanSpark (CLSK): closed astatine $7.75 (-3.25%), down 0.77% astatine $7.69

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.98 (-1.45%)

Semler Scientific (SMLR): closed astatine $38.82 (-3.05%)

Exodus Movement (EXOD): closed astatine $48.51 (+19.04%), down 0.74% astatine $48.15

ETF Flows

Spot BTC ETFs:

Daily nett flow: $165.7 million

Cumulative nett flows: $36.05 billion

Total BTC holdings ~ 1,120 million.

Spot ETH ETFs

Daily nett flow: -$12.5 million

Cumulative nett flows: $2.45 billion

Total ETH holdings ~ 3.452 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

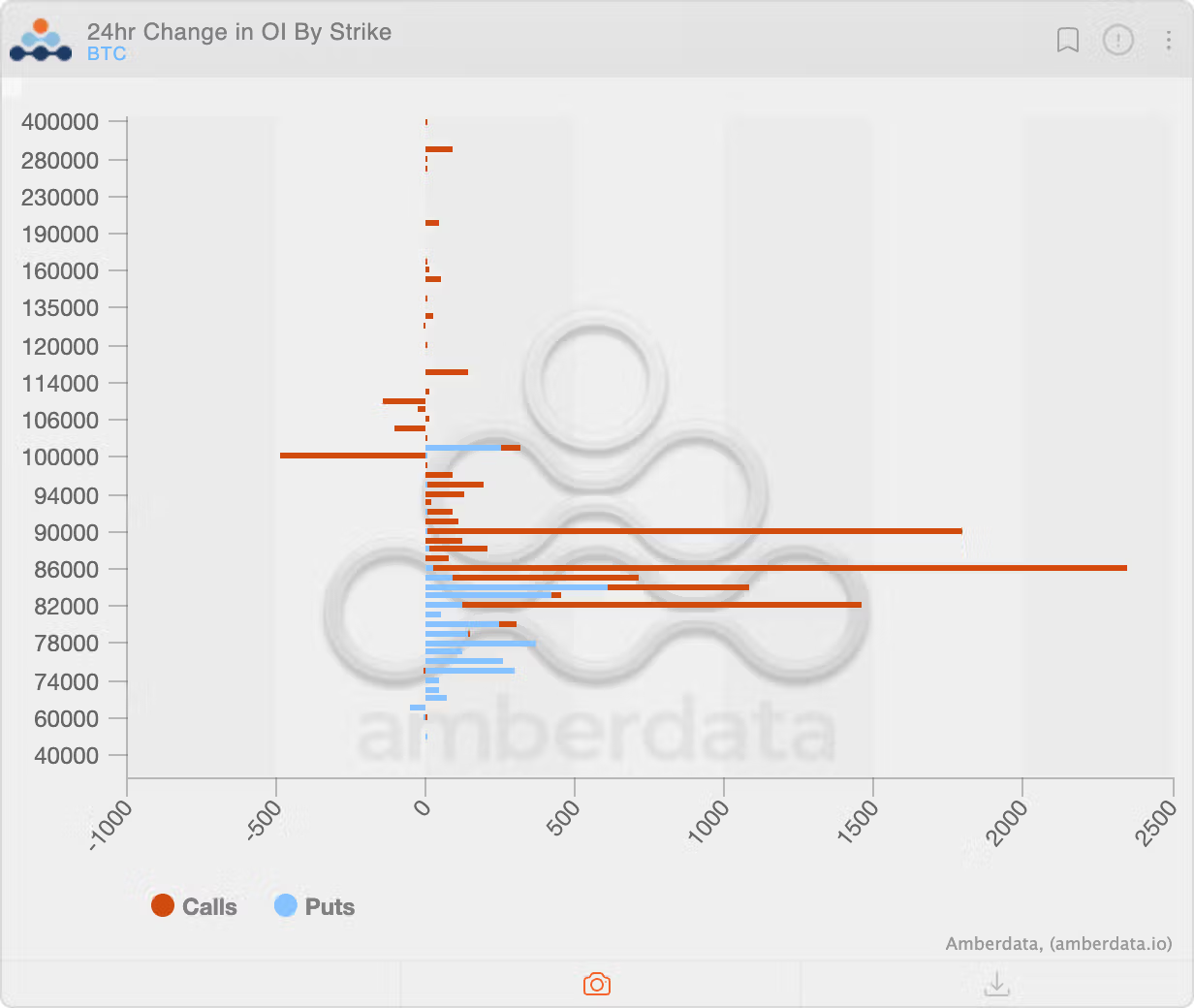

The fig of progressive oregon unfastened positions successful the $100,000 onslaught telephone has decreased portion unfastened involvement successful little onslaught calls betwixt $85,000 and $90,000 has accrued alongside renewed involvement successful protective puts astatine little levels.

The information shows a cautious marketplace sentiment.

While You Were Sleeping

North Korea-Linked Lazarus Group Holds More Bitcoin Than Elon Musk's Tesla (CoinDesk): The radical down the $1.4 cardinal Bybit ether theft held 13,441 bitcoin, 16% much than Tesla, according to Arkham Intelligence.

Polymarket Is 90% Accurate successful Predicting World Events: Research (CoinDesk): Polymarket predictions scope up to 94% accuracy erstwhile utmost probabilities are excluded, though users often inflate likelihood owed to bias, herd behavior, debased liquidity and risk-seeking tendencies.

Australia Proposes New Crypto Regulation Structure, Plans to Integrate Digital Assets Into the Economy (CoinDesk): The authorities intends to enactment tokenization, real-world plus integration and cardinal slope integer currencies to assistance modernize its fiscal system, according to a Treasury achromatic paper.

Dollar Slump Magnifies Stock Market Pain for Foreign Investors (Financial Times): The S&P 500’s 4% driblet this twelvemonth has translated into implicit 8% losses for eurozone investors arsenic the U.S. currency weakens connected concerns implicit U.S. economical growth.

Japan’s Households Slash Cash astatine Record Pace arsenic Inflation Bites (Bloomberg): Cash holdings fell to 105.3 trillion yen ($707 billion) successful the last 4th of 2024, marking a 3.4% year-over-year diminution — the steepest driblet since 1998.

Oil Set for Second Straight Weekly Gain connected Iran Sanctions, Planned OPEC+ Cuts (Reuters): Brent and WTI futures are acceptable for their largest play emergence since January, driven by caller U.S. sanctions connected Iranian lipid and plans by 7 exporters to curb proviso done mid-2026.

In the Ether

9 months ago

9 months ago

English (US)

English (US)