By Francisco Rodrigues (All times ET unless indicated otherwise)

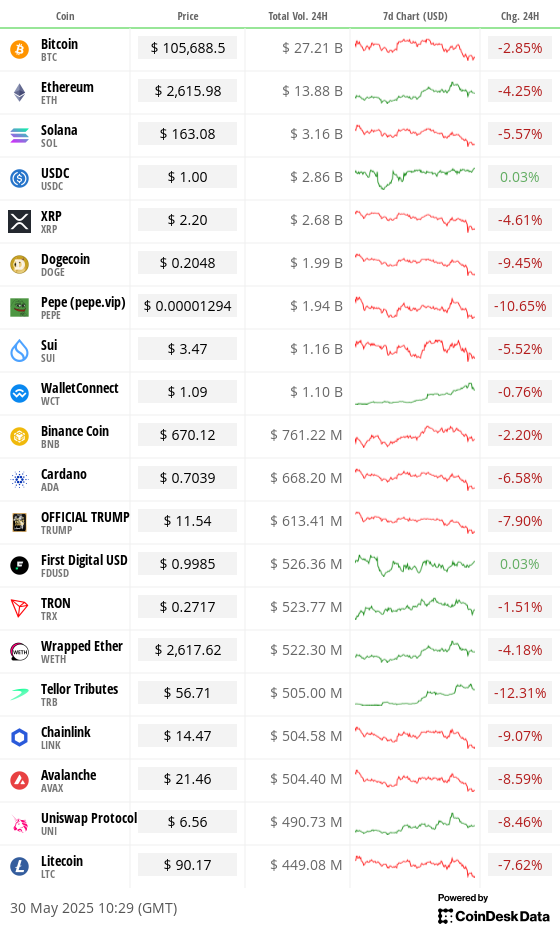

Cryptocurrency markets fell Friday arsenic renewed concerns implicit U.S. commercialized argumentation unsettled accepted markets and outweighed quality that different mightiness beryllium seen arsenic affirmative for the industry.

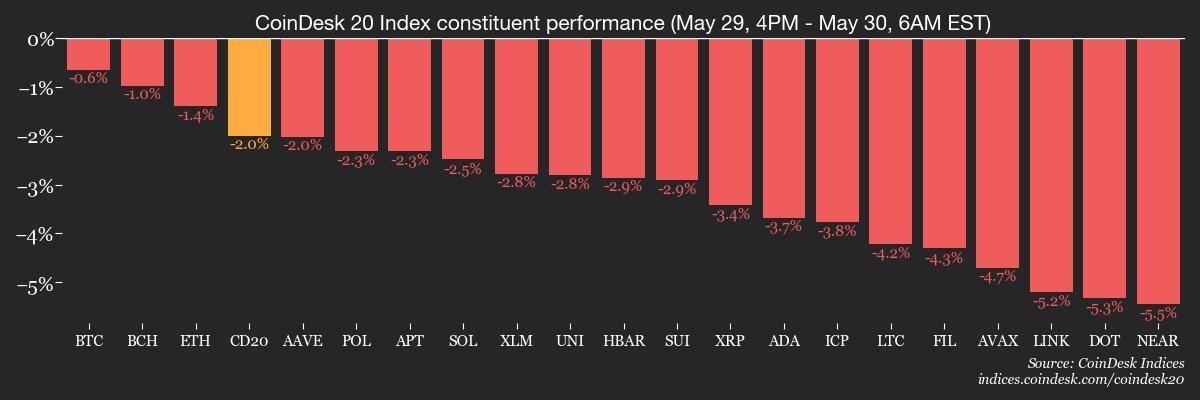

The CoinDesk 20 (CD20) Index, a measurement of the wide crypto market, fell 4.4% to 3,129 successful the past 24 hours. And portion bitcoin (BTC) slipped 2.8% to astir $105,300, it's worthy keeping successful caput the largest cryptocurrency has held supra $100,000 for much than 20 consecutive days successful a motion of persistent capitalist demand.

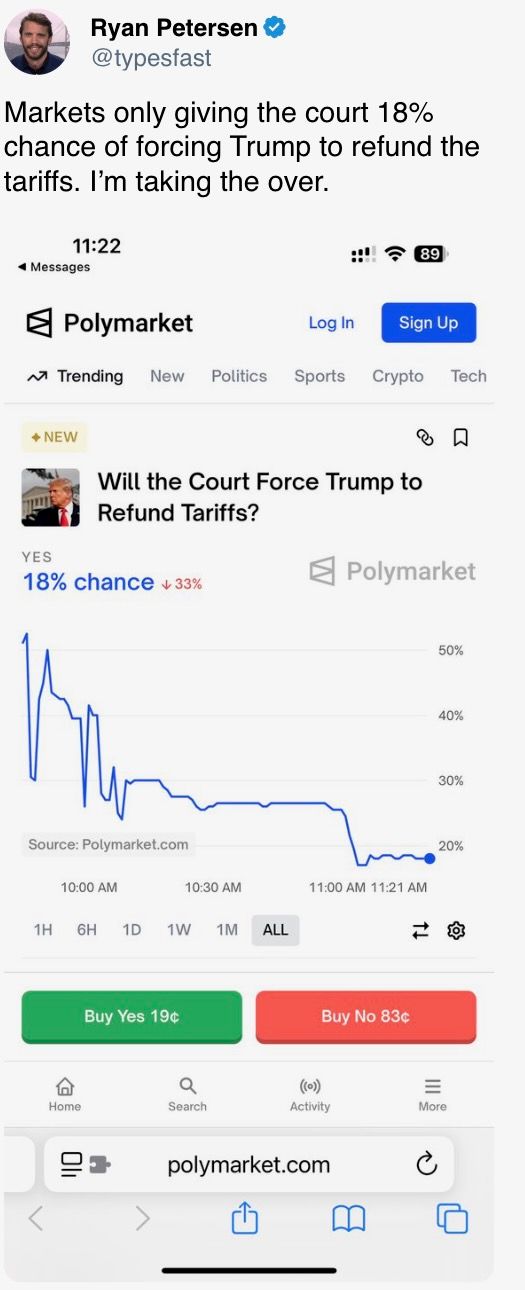

The sell-off came arsenic a U.S. appeals tribunal reinstated commercialized tariffs blocked by a little court, which had ruled them illegal. The reversal reignited concerns of an extended commercialized war. Treasury Secretary Scott Bessent, successful an interview, noted that negotiations with China were “a spot stalled,” compounding the uncertainty.

“When it comes to planetary commercialized close now, the lone certainty is uncertainty,” said Darren Nathan, caput of equity probe astatine Hargreaves Lansdown successful an emailed statement. Adding to the macroeconomic maelstrom, Trump reportedly pushed Fed Chair Jerome Powell to little involvement rates during an in-person gathering astatine the White House.

Bitcoin’s attraction has been wide during the uncertainty. BlackRock’s iShares Bitcoin Trust (IBIT) is astatine record-low volatility and drafting successful billions from investors. Spot bitcoin ETFs person seen $5.85 cardinal successful full nett flows this month, up from $2.97 cardinal successful April, according to SoSoVale data.

Adding to the momentum, Spanish banking elephantine Santander is reportedly considering offering retail clients entree to cryptocurrencies, portion Panama projected that ships pay transit fees successful its canal successful BTC.

All eyes present crook to halfway PCE ostentation data, a cardinal gauge for Fed policy. A blistery speechmaking aboriginal this greeting could dash hopes for complaint cuts, perchance weighing connected hazard assets further.

“Any motion of worsening inflationary unit is apt to measurement connected expectations for further involvement cuts by the Fed this year, which would beryllium a interest fixed the inertia gathering successful the economy,” Hargreaves Lansdown’s caput of equity probe wrote. Still, "the numbers request to beryllium taken with a ample pinch of salt, fixed that they’re yet to consciousness the afloat interaction of tariffs."

For now, bitcoin’s quality to clasp the intelligence $100,000 enactment remains a cardinal landmark amid the uncertainty. Stay alert!

What to Watch

- Crypto

- May 30: The second circular of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- June 4, 10 a.m.: U.S. House Financial Services Committee volition clasp a hearing connected “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable connected "DeFi and the American Spirit"

- Macro

- May 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP data.

- GDP Growth Rate QoQ Est. 1.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. 3.2% vs. Prev. 3.6%

- May 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases April unemployment complaint data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.2%

- May 30, 8:30 a.m.: Statistics Canada releases Q1 GDP data.

- GDP Growth Rate Annualized Est. 1.7% vs. Prev. 2.6%

- GDP Growth Rate QoQ Prev. 0.6%

- May 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases April user income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- Core PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.3%

- Personal Income MoM Est. 0.3% vs. Prev. 0.5%

- Personal Spending MoM Est. 0.2% vs. Prev. 0.7%

- May 30, 10 a.m.: The University of Michigan releases (final) May U.S. user sentiment data.

- Michigan Consumer Sentiment Est. 51 vs. Prev. 52.2

- May 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP data.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Sui DAO is voting connected moving to recover astir $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- May 30: Arkham CEO Miguel Morel to enactment successful an Ask Me Anything (AMA) session.

- June 4, 6:30 p.m.: Synthetic to host a assemblage call.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $21.68 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating proviso worthy $150.46 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating proviso worthy $10.14 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating proviso worthy $14.18 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $57.11 million.

- Token Launches

- June 1: Rewards for staking ERC-20 OM connected MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 4 of 4: Web Summit Vancouver (Vancouver, British Columbia)

- Day 2 of 2: Litecoin Summit 2025 (Las Vegas)

- Day 2 of 4: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 3: World Computer Summit 2025 (Zurich)

- June 3-5: Money20/20 Europe 2025 (Amsterdam)

- June 4-6: Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- Starting successful June, the Central African Republic volition tokenize implicit 1,700 hectares of onshore adjacent Bangui utilizing the government's authoritative CAR token connected the Solana blockchain.

- A statesmanlike decree references the nation’s mining codification and caller tokenization laws, suggesting the onshore could beryllium allocated for golden oregon diamond extraction.

- The CAR token is up 10% successful the past 24 hours and has gained 127% this week, with prices starting to ascent adjacent earlier the authoritative announcement.

- President Touadéra announced the program connected X, framing it arsenic a measurement toward transparency and easier entree to nationalist resources.

- The onshore — astir the size of 2,500 shot fields— lies westbound of Bossongo village, 45 km from the capital.

- CAR, which has a marketplace capitalization of $56.63 cardinal and implicit 18,400 holders, remains down astir 93% from its all-time high.

Derivatives Positioning

- Premium successful ether ETH futures connected the CME remains elevated comparative to BTC successful a motion of persistent bias for the Ethereum blockchain's token. Perpetual backing rates connected offshore exchanges overgarment a akin picture.

- XLM and AVAX spot antagonistic backing rates successful a motion of bias for bearish, abbreviated positions.

- The one-year put-call skew connected IBIT flipped affirmative Thursday, indicating renewed bias for enactment options, offering downside protection.

- BTC telephone skews person weakened crossed the committee connected Deribit.

- Block flows connected Paradigm featured hazard reversals and a ample abbreviated strangle, involving $100K and $170K onslaught options, some expiring successful December.

Market Movements

- BTC is down 0.47% from 4 p.m. ET Thursday astatine $105,705.74 (24hrs: -3.08%)

- ETH is down 1.01% astatine $2,618.44 (24hrs: -4.43%)

- CoinDesk 20 is down 1.85% astatine 3,133.82 (24hrs: -4.59%)

- Ether CESR Composite Staking Rate is down 2 bps astatine 3.08%

- BTC backing complaint is astatine 0.0077% (8.388% annualized) connected Binance

- DXY is up 0.31% astatine 99.58

- Gold is down 0.74% astatine $3,296.9 /oz

- Silver is down 0.55% astatine $33.13/oz

- Nikkei 225 closed -1.22% astatine 37,965.1

- Hang Seng closed -1.2% astatine 23,289.77

- FTSE is up 0.79% astatine 8,785.29

- Euro Stoxx 50 is up 0.44% astatine 5,401.87

- DJIA closed connected Thursday +0.28% astatine 42,215.73

- S&P 500 closed +0.4% astatine 5,912.17

- Nasdaq closed +0.39% astatine 19,175.87

- S&P/TSX Composite Index closed -0.28% astatine 26,210.6

- S&P 40 Latin America closed unchanged astatine 2,600,63

- U.S. 10-year Treasury complaint is down 5 bps astatine 4.42%

- E-mini S&P 500 futures are down 0.15% astatine 5,913.75

- E-mini Nasdaq-100 futures are down 0.17% astatine 21,372.75

- E-mini Dow Jones Industrial Average Index futures are down 0.1% astatine 42,235

Bitcoin Stats

- BTC Dominance: 63.99 (0.42%)

- Ethereum to bitcoin ratio: 0.02486 (-0.28%)

- Hashrate (seven-day moving average): 917 EH/s

- Hashprice (spot): $54.94

- Total Fees: 5.27 BTC / $566,744

- CME Futures Open Interest: 153,800

- BTC priced successful gold: 31.7 oz

- BTC vs golden marketplace cap: 8.97%

Technical Analysis

- The illustration shows BTC has dropped beneath a trendline that represents the crisp betterment from early-April lows adjacent $75,000.

- The breakdown coincides with the bearish crossover of the 50- and 200-hour elemental moving averages.

- The bearish displacement points to trial of supports astatine $102K and $100K.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $370.63 (1.75%), down 0.48% astatine $368.86 successful pre-market

- Coinbase Global (COIN): closed astatine $248.84 (-2.14%), down 0.42% astatine $247.8

- Galaxy Digital Holdings (GLXY): closed astatine C$27.05 (-3.39%)

- MARA Holdings (MARA): closed astatine $14.61 (-1.68%), down 0.82% astatine $14.49

- Riot Platforms (RIOT): closed astatine $8.18 (-2.39%), down 0.86% astatine $8.11

- Core Scientific (CORZ): closed astatine $10.69 (-0.83%), unchanged

- CleanSpark (CLSK): closed astatine $8.78 (-3.62%), down 1.14% astatine $8.68

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $16.9 (-2.14%)

- Semler Scientific (SMLR): closed astatine $40.08 (-3%), down 0.2% astatine $40

- Exodus Movement (EXOD): closed astatine $30.31 (16.85%), up 2.18% astatine $30.97

ETF Flows

Spot BTC ETFs

- Daily nett flow: -$346.8 million

- Cumulative nett flows: $44.97 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily nett flow: $91.9 million

- Cumulative nett flows: $2.99 billion

- Total ETH holdings ~ 3.60 million

Source: Farside Investors

Overnight Flows

Chart of the Day

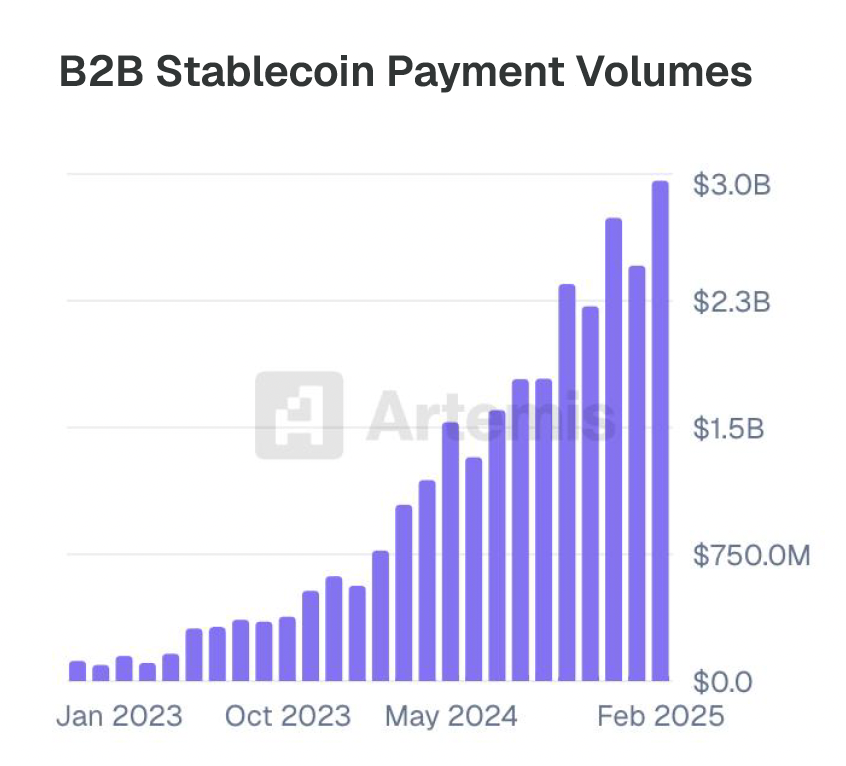

- The illustration shows stablecoin usage successful business-to-business payments has exploded from adjacent zero 2 years agone to astir $3 billion.

- The information is grounds of stablecoins' increasing adoption successful the existent economy.

While You Were Sleeping

- Crypto Staking Doesn't Violate U.S. Securities Law, SEC Says (CoinDesk): A caller SEC unit connection clarifies that definite staking-related activities won’t trigger securities violations, aligning them with mining and perchance accelerating regulatory support for staking components successful spot ether ETFs.

- Two Ways This Bitcoin Bull Market Is Sturdier Than 2020-21 and 2017 (CoinDesk): Realized volatility successful the existent bull market, which started successful aboriginal 2023, has averaged nether 50%, arsenic reduced speech leverage helps bounds the frequence and extent of terms pullbacks.

- Thailand to Block OKX, Bybit and Others, Citing Lack of License (CoinDesk): Thailand’s securities regulator filed a ailment against 5 unlicensed crypto platforms and asked the Ministry of Digital Economy and Society to artifact entree starting June 28.

- Israel Fears Being Boxed In by Trump’s Iran Talks (The Wall Street Journal): Israel fears Trump’s propulsion for a woody volition permission Iran’s uranium enrichment intact, yet acting unsocial risks losing the U.S. backing indispensable for managing Iranian retaliation aft a imaginable strike.

- Trump Aims to Exceed First Term’s Weapons Sales to Taiwan, Officials Say (Reuters): U.S. officials are pressing Taiwan’s absorption parties to enactment a peculiar defence fund raising spending to 3% of GDP arsenic Washington prepares caller arms income to antagonistic Chinese subject pressure.

- Bank of England Policymaker Plays Down Inflation Risk successful Call for Rate Cuts (Financial Times): BoE's Alan Taylor argued April's ostentation surge was driven by impermanent terms hikes, not demand, and warned Trump's commercialized warfare continues to measurement heavy connected the U.K. maturation outlook.

In the Ether

6 months ago

6 months ago

English (US)

English (US)