By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace continues to suffer ground, driven by disappointment implicit the lack of a program for the U.S. authorities to bargain bitcoin nether the recently announced strategical reserve program and amid persistent macroeconomic concerns.

BTC fell to $80,000 precocious Sunday, trading beneath the 200-day elemental moving average, and ether took retired a macro bullish trendline with a dip beneath the long-held enactment of $2,100. Other coins followed the 2 majors, posting bigger losses.

"Many investors are pulling retired of bitcoin, viewing it arsenic a risky plus people for the archetypal clip since Trump took the White House," said Zach Burks, CEO and laminitis of NFT-service supplier Mintology. "It’s nary longer playing its relation arsenic a store of value. Gold prices person spiked arsenic galore spell backmost to the archetypal ‘doomsday asset,’ which is nary astonishment arsenic tariffs and grenades continues to get thrown crossed the escaped world."

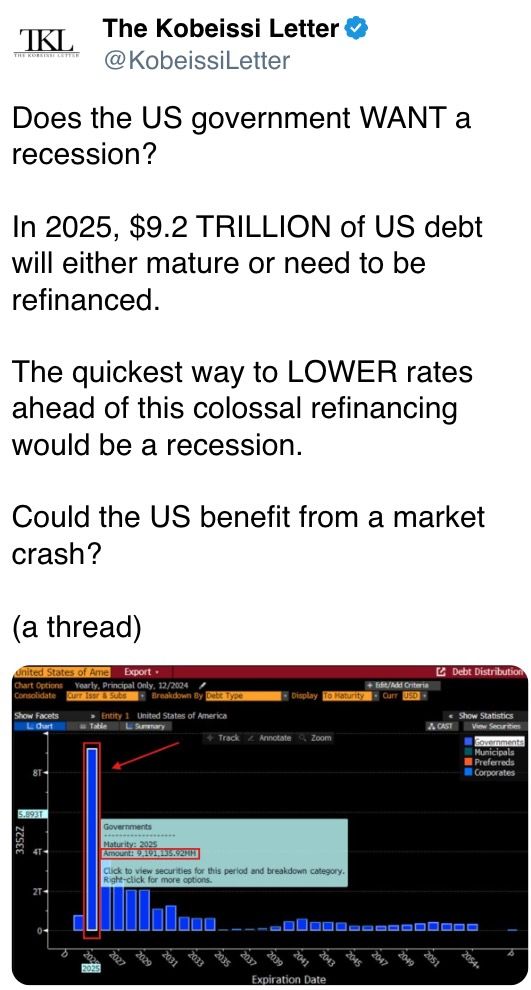

The tariffs are making it harder for the Fed to determination guardant with complaint cuts contempt the continued diminution inclination successful real-time ostentation indicators. On Friday, Fed president Jerome Powell said the cardinal slope is waiting for greater clarity connected Trump's policies earlier making the adjacent move.

Meanwhile, Japan's fastest basal wage rise successful 32 years strengthened the lawsuit for a BOJ complaint hike, pushing the nation's enslaved yields and the yen higher. Bouts of spot successful the haven currency typically breed downside volatility successful hazard assets.

Still, immoderate observers are unsure if the marketplace weakness, peculiarly seen implicit the weekend, could beryllium long-lasting. "Trading volumes implicit the play were highly low, reducing the worth of the bearish signal," Alex Kuptsikevich, the FxPro main marketplace analyst, told CoinDesk.

"We enactment that sellers propulsion the terms down successful periods of debased liquidity, but the terms bounces backmost with the accomplishment of organization buyers. It looks similar the large buyers person capable liquidity near to bargain retired the drawdown," Kuptsikevich said. Stay alert!

What to Watch

Crypto:

March 10: Movement (MOVE), an Ethereum-based L2 blockchain, has its mainnet launch.

March 11, 9:00 a.m.: Horizen (ZEN) mainnet web upgrade to mentation ZEN 5.0.6 astatine the artifact tallness of 1,730,680.

March 11, 10:00 a.m.: U.S. House Financial Services Committee hearing astir a national model for stablecoins and a U.S. CBDC. Livestream link.

March 11: The Bitcoin Policy Institute and U.S. Senator Cynthia Lummis co-host the invitation-only one-day lawsuit "Bitcoin for America" successful Washington.

March 12: Hemi (HEMI), an L2 blockchain that operates connected some Bitcoin and Ethereum, has its mainnet launch.

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy volition adjacent its V1 RAI staking programme to caller users arsenic it transitions to a afloat automated revenue-sharing protocol.

March 17.: CME Group launches solana (SOL) futures.

Macro

March 10, 7:50 p.m.: Japan’s Cabinet Office releases (final) Q4 GDP data.

GDP Growth Annualized Prev. 1.2%

GDP Growth Rate QoQ Est. 0.7% vs. Prev. 0.3%

March 11, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January concern accumulation data.

Industrial Production MoM Prev. -0.3%

Industrial Production YoY Prev. 1.6%

March 11, 10:00 a.m.: The U.S. Department of Labor releases January’s JOLTs study (job openings, hires, and separations).

Job Openings Est. 7.71M vs. Prev. 7.6M

Job Quits Prev. 3.197M

Earnings (Estimates based connected FactSet data)

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.39

Token Events

Governance votes & calls

GMX DAO is voting connected the decentralization and automation of the interest organisation process for the GMX ecosystem to guarantee “real-time, trustless, and verifiable interest allocations.”

Aavegotchi DAO is voting connected utilizing the car swapper declaration to turn $2 cardinal worthy of stablecoins into GHST.

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the state token connected Fraxtal, implementing the Frax North Star hard fork and introducing a process emanation program with gradually decreasing emissions and different enhancements.

March 10, 9 a.m.: Waves to big an Ask Me Anything (AMA) league with laminitis Sasha Ivanov.

March 13, 10 a.m.: Mantra to host a Community Connect telephone with its CEO and Co-Founder to sermon assorted large updates.

Unlocks

March 12: Aptos (APT) to unlock 1.93% of circulating proviso worthy $62.09 million.

March 15: Starknet (STRK) to unlock 2.33% of its circulating proviso worthy $10.25 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating proviso worthy $10.99 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating proviso worthy $33.46 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating proviso worthy $80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating proviso worthy $13.13 million.

Token Listings

March 11: Bybit to delist Bancor (BNT), Paxos Gold (PAXG) and Threshold.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC and PAXG.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 1 of 2: MoneyLIVE Summit (London)

Day 1 of 3: AIBC Africa (Cape Town)

March 11-12: VanEck Southern California Blockchain Conference 2025 (Los Angeles)

March 13-14: Web3 Amsterdam ‘25

March 16, 6:00 p.m.: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

Zerebro (ZEREBRO), erstwhile a celebrated AI cause token, has crashed 96% from its January highest marketplace headdress of supra $800 cardinal to conscionable $33.5 million.

AI cause tokens were among the hottest sectors successful October and November, seeing accelerated listings by exchanges and promotion by influencers connected the communicative of a confluence betwixt crypto and artificial intelligence.

Zerebro created its ain euphony medium and offered NFTs to fans, with plans of introducing a level that allows token holders to motorboat their ain AI agents. It reached implicit 120,000 followers connected X successful a abbreviated period.

Fundamentals stay strong, however, offering anticipation for those looking to put successful AI cause tokens. The task was selected arsenic 1 of the validators for IP-focused blockchain Story past week, playing a relation successful a aboriginal system that is wholly tally by AI agents and machines.

A validator is simply a captious subordinate successful a blockchain network, liable for verifying and validating transactions and blocks to guarantee the information and statement of immoderate network.

Story Protocol validators person circumstantial responsibilities tailored to the protocol’s ngo of managing and monetizing intelligence spot connected a blockchain, and the validators are paid successful instrumentality for ensuring the web keeps functioning.

Derivatives Positioning

Perpetual backing rates successful BTC, SOL, ADA, XRP and TRX person flipped negative, pointing to a bias for shorts arsenic the marketplace wilts.

Open involvement successful futures tied to BNB, HYPE, OM and DOT has accrued successful the past 24 hours, a motion of traders shorting successful a falling market.

On Deribit, traders person snapped puts astatine $85K and $80K strikes portion agelong positions successful the $75K enactment rolled retired oregon moved to June expiry.

ETH puts person been successful request arsenic well, trading astatine a premium to calls retired to June expiry.

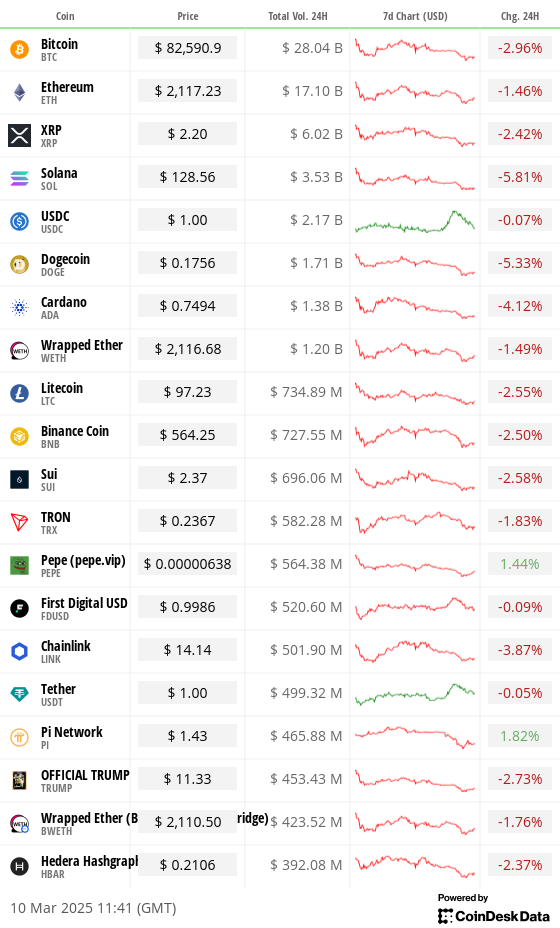

Market Movements:

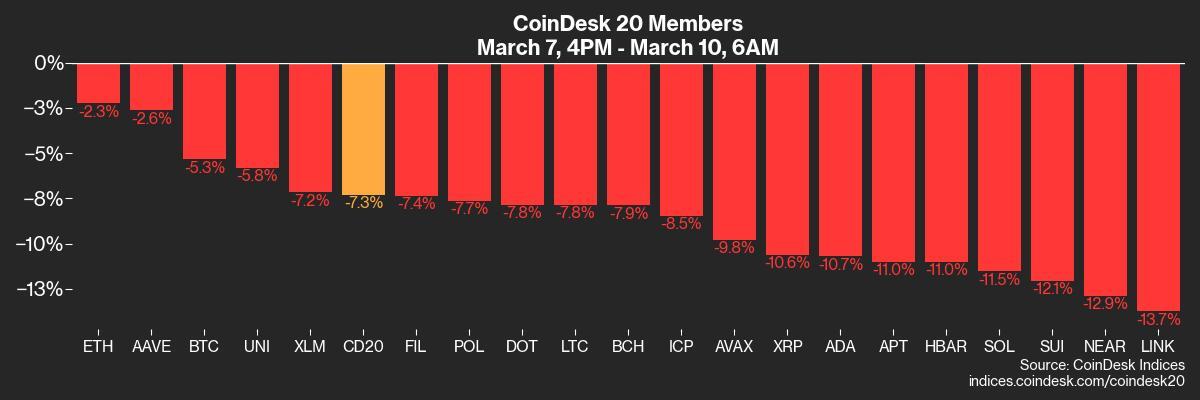

BTC is down 4.61% from 4 p.m. ET Friday astatine $82,373.88 (24hrs: -3.21%)

ETH is down 1.6% astatine $2,101.66 (24hrs: -2.04%)

CoinDesk 20 is down 6.4% astatine 2,632.12 (24hrs: -3.26%)

Ether CESR Composite Staking Rate is down 8 bps astatine 3%

BTC backing complaint is astatine 0.0015% (1.67% annualized) connected Binance

DXY is down 0.14% astatine 103.76

Gold is up 0.15% astatine $2,909.10/oz

Silver is up 1.14% astatine $32.92/oz

Nikkei 225 closed +0.38% astatine 37,028.27

Hang Seng closed -1.85% astatine 23,783.49

FTSE is down 0.59% astatine 8,629.02

Euro Stoxx 50 is down 0.96% astatine 5,415.85

DJIA closed connected Friday +0.52% astatine 42,801.72

S&P 500 closed +0.55% astatine 5,770.20

Nasdaq closed +0.7% astatine 18,196.22

S&P/TSX Composite Index closed +0.71% astatine 24,758.80

S&P 40 Latin America closed +0.73% astatine 2,361.82

U.S. 10-year Treasury complaint is down 5 bps astatine 4.25%

E-mini S&P 500 futures are down 1.16% astatine 5,709.25

E-mini Nasdaq-100 futures are down 1.34% astatine 19,958.25

E-mini Dow Jones Industrial Average Index futures are down 0.96% astatine 42,428.00

Bitcoin Stats:

BTC Dominance: 61.19 (-0.14%)

Ethereum to bitcoin ratio: 0.02562 (2.40%)

Hashrate (seven-day moving average): 813 EH/s

Hashprice (spot): $48.2

Total Fees: 4.4 BTC / $371,994

CME Futures Open Interest: 142,260 BTC

BTC priced successful gold: 28.2 oz

BTC vs golden marketplace cap: 8.01%

Technical Analysis

BTC has dived beneath a pennant pattern, hinting astatine the continuation of the broader diminution from December highs.

The breakdown has strengthened the lawsuit for a retest of the erstwhile resistance-turned-support astatine astir $73,800, the March 2024 high.

A pennant is simply a continuation pattern, representing a mid-trend triangular consolidation.

Crypto Equities

Strategy (MSTR): closed connected Friday astatine $287.18 (-5.57%), down 5.33% astatine $271.87 successful pre-market

Coinbase Global (COIN): closed astatine $217.45 (+1.53%), down 5.36% astatine $205.79

Galaxy Digital Holdings (GLXY): closed astatine C$18.84 (+0.11%)

MARA Holdings (MARA): closed astatine $16.02 (+6.16%), down 4.24% astatine $15.34

Riot Platforms (RIOT): closed astatine $8.37 (+3.21%), down 4.42% astatine $8

Core Scientific (CORZ): closed astatine $7.78 (-0.89%), down 2.7% astatine $7.57

CleanSpark (CLSK): closed astatine $8.83 (+8.34%), down 3.85% astatine $8.49

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $16.32 (+3.29%), down 6.25% astatine $15.30

Semler Scientific (SMLR): closed astatine $37.19 (+3.02%), down 3.47% astatine $35.90

Exodus Movement (EXOD): closed astatine $29.40 (+0.34%), up 6.22% successful pre-market

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$409.3 million

Cumulative nett flows: $36.21 billion

Total BTC holdings ~ 1,137 million.

Spot ETH ETFs

Daily nett flow: -$23.1 million

Cumulative nett flows: $2.72 billion

Total ETH holdings ~ 3.635 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

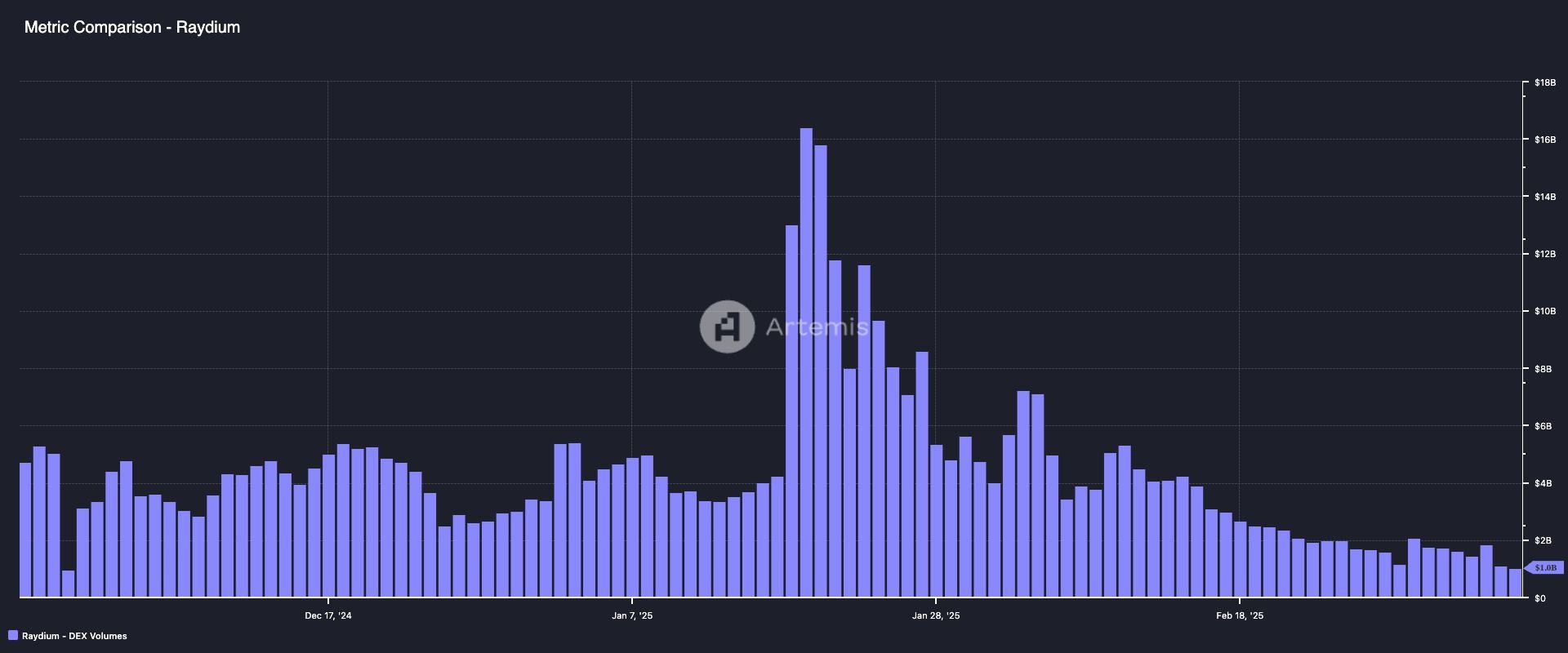

The illustration shows the regular measurement connected Solana's decentralized speech Raydium has dropped to $1 billon, the lowest since Nov. 29 and importantly beneath the Jan. 19 highest of $16.4 billion.

The crisp diminution successful enactment helps explicate the terms swoon successful Solana's SOL token.

While You Were Sleeping

Howard Lutnick Plays Down Recession Fears arsenic BTC Lingers successful $80K Range (CoinDesk): Commerce Secretary Howard Lutnick dismissed recession concerns, saying Trump’s tariff strategy volition thrust $1.3 trillion successful concern and boost U.S. growth.

Ether's 20% Plunge Shatters Bull Market Trendline Created After 2022 Terra Crash (CoinDesk): ETH's posted its worst play driblet since November 2022, breaking a bullish trendline from mid-2022 and signaling the imaginable for further losses.

Stablecoin Market Cap Tops $200B arsenic U.S. Sees Industry Helping Maintain Dollar Dominance (CoinDesk): U.S. Treasury Secretary Scott Bessent said stablecoins volition assistance support the dollar arsenic the apical reserve currency.

Oil Prices Decline As Tariff Uncertainty Keeps Investors connected Edge (Reuters): Oil prices fell arsenic uncertainty implicit U.S. tariffs, concerns astir American economical growth, rising OPEC+ production, Saudi terms cuts and deflationary pressures from China weighed connected sentiment.

Trump Declines to Rule Out Recession (The Wall Street Journal): In a Sunday interview, the U.S. president acknowledged his policies, including tariffs and fund cuts, whitethorn origin near-term instability but maintained they would fortify the system implicit time.

Japan 10-Year Yield astatine Highest Since 2008 connected Bets for BOJ Hikes (Bloomberg): Strong wage maturation and anemic request astatine a caller authorities indebtedness auction strengthened expectations for a Bank of Japan interest-rate increase, with markets pricing successful an 85% accidental by July.

In the Ether

9 months ago

9 months ago

English (US)

English (US)