By Omkar Godbole (All times ET unless indicated otherwise)

Both accepted and crypto markets person stabilized successful the past 48 hours, but cardinal volatility indices stay elevated, calling for caution for bulls who are expecting a dependable determination higher.

Bitcoin, the crypto marketplace leader, concisely topped $92,700, extending the betterment from lows astir $81,500 connected Tuesday. MOVE, CRO, ONDO and Render traded 10% to 17% higher arsenic of writing. Broadly speaking, AI, gaming and Layer 2 coins are the best-performing crypto sub-sectors for the past 24 hours.

The affirmative determination could beryllium attributed to rumors that President Donald Trump volition unveil a U.S. strategical bitcoin reserve during Friday’s White House crypto summit. Meanwhile, hopes that Trump's tariffs volition apt not endure person helped reconstruct the hazard sentiment connected Wall Street and Germany and China's fiscal rockets person offered enactment to Asian and European equities.

Still, we haven't seen a notable diminution successful the volatility indices. At property time, Volmex's BVIV index, which measures the implied oregon expected 30-day terms turbulence, held conscionable 5 points beneath Tuesday's precocious of 66% but good supra the February debased of 49.6%. Perhaps traders spot Friday's crypto acme arsenic the make-or-break infinitesimal for crypto, arsenic the President, having promised large for months, is present expected to present the goods arsenic soon arsenic possible.

In accepted markets, VIX, Wall Street's fearfulness gauge, held astatine 23.65 Wednesday, the highest since mid-December, according to information root TradingView. Meanwhile, the MOVE index, which measures the 30-expected volatility successful the U.S. Treasury notes, remained elevated astatine 104, the highest since November (check illustration of the day).

The elevated volatility successful bonds is peculiarly concerning arsenic it is known to origin fiscal tightening and measurement implicit hazard assets. For now, however, a weaker dollar seems to beryllium compensating for that.

Still, the sticky vol indices successful accepted markets rise an important question: Is the market's interest solely astir tariffs, oregon are determination underlying worries related to a important slowdown driven by different factors specified arsenic imaginable fiscal consolidation?

The dispersed betwixt yields connected the U.S. 10-year Treasury enactment and the three-month Treasury measure has again turned negative, inverting the output curve to suggest recession - consecutive quarterly contractions successful the GDP. "[This is] mostly not a bully sign," Noelle Acheson, writer of the Crypto is Macro Now newsletter said successful Wednesday's edition.

Early this week, the Atlanta Fed's GDPNow exemplary signaled a astir 3% contraction successful the U.S. GDP successful the archetypal quarter. The fig is due for an update today. Recession fears volition apt fortify if we don't spot an betterment today, perchance pressuring hazard assets, including cryptocurrencies.

Acheson summed up the concern best: "We are inactive navigating the tussle betwixt narratives – connected the 1 hand, risk-off sentiment driven by macro uncertainty could support BTC and different crypto assets depressed for a while. On the different hand, the “safe haven” communicative is gaining strength, arsenic affirmative quality from the White House highlights the astonishing displacement successful authoritative support." Stay alert!

What to Watch

Crypto:

March 6: Ethereum-based L2 blockchain MegaETH deploys its nationalist testnet, with idiosyncratic onboarding starting connected March 10.

March 6: Quantify Funds’ STKd 100% MSTR & 100% COIN ETF (APED) gets listed connected Nasdaq.

March 7: President Trump volition big the inaugural White House Crypto Summit, bringing unneurotic apical cryptocurrency founders, CEOs and investors.

March 11: The Bitcoin Policy Institute and U.S. Senator Cynthia Lummis co-host the invitation-only one-day lawsuit "Bitcoin for America" successful Washington.

March 12: Hemi, an L2 blockchain that operates connected some Bitcoin and Ethereum, has its mainnet launch.

March 14: Pi Network (PI) transitions from Enclosed Mainnet to Open Mainnet.

March 15: Athene Network (ATH) mainnet launch.

March 16, 6:00 p.m.: CME Group’s solana (SOL) futures commencement trading.

Macro

March 6, 8:15 a.m.: The European Central Bank (ECB) Governing Council volition denote its involvement complaint decision. Press league (livestream link) astatine 8:45 a.m. The Monetary argumentation connection is released astatine 9:00 a.m. The ECB unit macroeconomic projections are released astatine 9:45 a.m.

Deposit Facility Rate Est. 2.5% vs. Prev. 2.75%

Main Refinancing Rate Est. 2.65% vs. Prev. 2.9%

Marginal Lending Rate Prev. 3.15%

March 6, 8:30 a.m.: The U.S. Department of Labor releases employment information for the week that ended March 1.

Initial Jobless Claims Est. 235K vs. Prev. 242K.

March 7, 7:00 a.m.: Mexico's Instituto Nacional de Estadística y Geografía (INEGI) releases February user terms ostentation data.

Core Inflation Rate MoM 0.46% vs. Prev. 0.41%

Core Inflation Rate YoY Est. 3.62% vs. Prev. 3.66%

Inflation Rate MoM Est. 0.27% vs. Prev. 0.29%

Inflation Rate YoY Est. 3.77% vs. Prev. 3.59%

March 7, 8:30 a.m.: Statistics Canada releases February employment data.

Unemployment Rate Est. 6.7% vs. Prev. 6.6%

Employment Change Est. 20K vs. Prev. 76K

March 7, 8:30 a.m.: The U.S. Labor Bureau of Statistics (LBS) releases February employment data.

Nonfarm Payrolls Est. 160K vs. Prev. 143K

Unemployment Rate Est. 4% vs. Prev. 4%

March 8, 8:30 p.m.: The National Bureau of Statistics of China releases user terms ostentation information (CPI) and shaper terms ostentation information (PPI).

Inflation Rate MoM Prev. 0.7%

Inflation Rate YoY Prev. 0.5%

PPI YoY Prev. -2.3%

Earnings (Ests. based connected FactSet data)

March 6 (TBC): Bitfarms (BITF), $-0.06

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.39

Token Events

Governance votes & calls

Aave DAO is discussing the instauration of sGHO, a yield-bearing token that allows users to gain the Aave Savings Rate (ASR) by depositing GHO stablecoins.

Sandbox DAO is discussing establishing the Sandbox DAO Grants Program to administer backing to projects much efficiently.

March 6, 8:30 a.m.: GMX to clasp a Governance Community Call for the GMX DAO.

March 6, 10 a.m.: Near Protocol to big a Town Hall.

March 7, 10 a.m.: Maple to host an X Spaces wherever an “exciting announcement” volition beryllium revealed.

Unlocks

March 7: Kaspa (KAS) to unlock 0.63% of circulating proviso worthy $12.43 million.

March 9: Movement (MOVE) to unlock 2.08% of its circulating proviso worthy $24.45 million.

March 12: Aptos (APT) to unlock 1.93% of circulating proviso worthy $70.12 million.

March 15: Starknet (STRK) to unlock 2.33% of its circulating proviso worthy $12.42 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating proviso worthy $12.88 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating proviso worthy $39.46 million.

Token Listings

March 6: Roam (ROAM) to beryllium listed connected KuCoin and MEXC.

March 6: Renzo (REZ) to beryllium listed connected Coinbase.

March 6: Redstone (RED) to beryllium listed connected KuCoin, LBank, BingX, and Bybit.

March 6: Magic Eden (ME) to beryllium listed connected Binance.US

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 3 of 4: FIN/SUM 2025 (Tokyo)

March 8: Bitcoin Alive (Sydney)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25

March 19-20: Next Block Expo (Warsaw, Poland)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

Token Talk

By Shaurya Malwa

Aave, a starring Ethereum-based lending protocol, is conducting a assemblage cheque for "sGHO," a low-risk savings merchandise built astir its autochthonal GHO stablecoin and a caller "Aave Savings Rate," to grow rewards for holders.

sGHO aims to supply users with a yield-bearing ERC-20 token by depositing GHO, with the savings complaint tied to the autochthonal output from a USDC excavation connected Aave's V3.

The motorboat of sGHO, featuring nary withdrawal oregon deposit fees, is portion of Aave DAO's assertive maturation strategy to thrust GHO adoption during a depressed output market.

Alongside sGHO, Aave is pursuing different initiatives to grow GHO's idiosyncratic base, specified arsenic introducing it arsenic a state token crossed antithetic blockchains and integrating it into assorted ecosystems, portion besides approving a treasury rebalancing to trim risks and amended liquidity connected Aave v3.

Derivatives Positioning

Funding rates for astir large tokens, but ADA, XRP and TON, are positive, per information root Velo Data. The antagonistic fig for the 3 coins suggests bias for shorts and imaginable for a abbreviated compression should the spot terms clasp resilient.

BTC, ETH backing rates stay mildly positive.

Market stableness has yet to bring a notable summation successful the CME BTC and ETH's aboriginal unfastened interest. This shows institutions are apt inactive wary of imaginable downside risks.

BTC, ETH options hazard reversals present amusement a bias for puts retired to April expiry.

Market Movements:

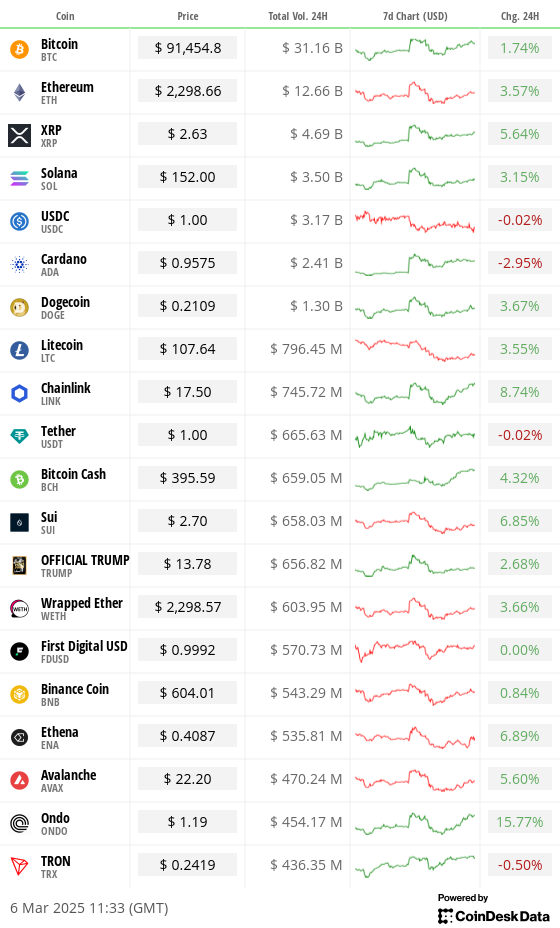

BTC is up 1.07% from 4 p.m. ET Wednesday astatine $91,402.24 (24hrs: +1.66%)

ETH is up 2.66% astatine $2,296.32 (24hrs: +3.55%)

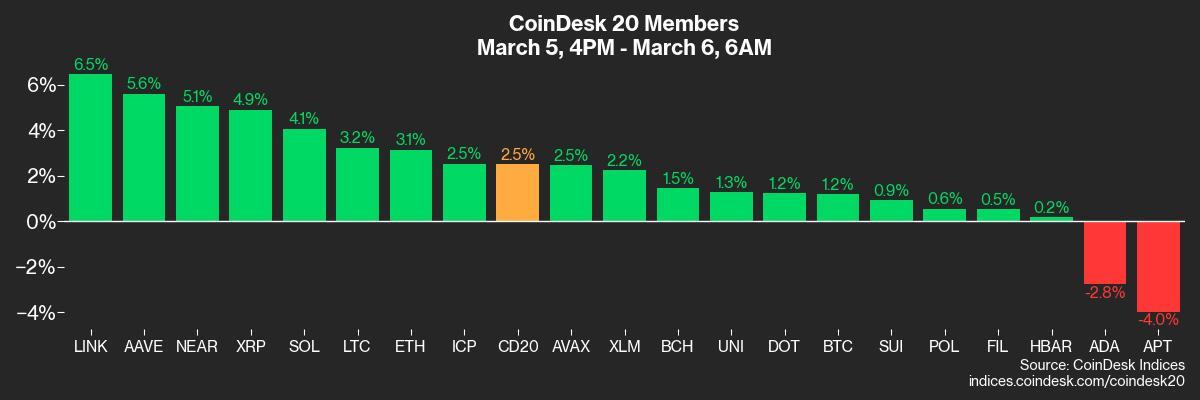

CoinDesk 20 is up 2.4% astatine 3,009.09 (24hrs: +2.99%)

Ether CESR Composite Staking Rate is down 35 bps astatine 3%

BTC backing complaint is astatine 0.0081% (8.9% annualized) connected Binance

DXY is down 0.11% astatine 104.16

Gold is down 0.21% astatine $2,909.10/oz

Silver is up 0.33% astatine $32.97/oz

Nikkei 225 closed +0.77% astatine 37,704.93

Hang Seng closed +3.29% astatine 24,369.71

FTSE is down 1.07% astatine 8,661.73

Euro Stoxx 50 is down 0.41% astatine 5,466.55

DJIA closed connected Wednesday +1.14% astatine 43,006.59

S&P 500 closed +1.12% astatine 5,842.63

Nasdaq closed +1.46% astatine 18,552.73

S&P/TSX Composite Index closed +1.22% astatine 24,870.80

S&P 40 Latin America closed +2.43% astatine 2,342.30

U.S. 10-year Treasury complaint is up 2 bps astatine 4.3%

E-mini S&P 500 futures are down 1.12% astatine 5,785.75

E-mini Nasdaq-100 futures are down 1.33% astatine 20,391.00

E-mini Dow Jones Industrial Average Index futures are down 0.95% astatine 42,658.00

Bitcoin Stats:

BTC Dominance: 61.33 (-0.41%)

Ethereum to bitcoin ratio: 0.02516 (1.74%)

Hashrate (seven-day moving average): 790 EH/s

Hashprice (spot): $50.5

Total Fees: 4.82 BTC / $430,123

CME Futures Open Interest: 144,250 BTC

BTC priced successful gold: 31.2 oz

BTC vs golden marketplace cap: 8.85%

Technical Analysis

Bitcoin is pushing against the horizontal absorption enactment from Jan. 9 and Feb. 3 lows. The adjacent absorption is the descending trendline from grounds highs.

A nonaccomplishment to surge past these cardinal levels could entice much method sellers, perchance starring to a re-test of the 200-day mean enactment astatine astir $83K.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $308.55 (+12.14%), down 0.55% astatine $306.85 successful pre-market

Coinbase Global (COIN): closed astatine $222.45 (+4.66%), down 1.38% astatine $219.38

Galaxy Digital Holdings (GLXY): closed astatine C$20.34 (+6.83%)

MARA Holdings (MARA): closed astatine $15.12 (+8.23%), down 0.4% astatine $15.06

Riot Platforms (RIOT): closed astatine $8.88 (+5.59%), down 1.58% astatine $8.74

Core Scientific (CORZ): closed astatine $9.60 (+0.1%), down 23.71% astatine $7.32

CleanSpark (CLSK): closed astatine $8.55 (+10.18%), down 1.29% astatine $8.44

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.20 (+5.78%), down 4.48% astatine $16.43

Semler Scientific (SMLR): closed astatine $38.37 (+0.03%)

Exodus Movement (EXOD): closed astatine $29.01 (-31.71%), up 6.48% astatine $30.89

ETF Flows

Spot BTC ETFs:

Daily nett flow: $22.1 million

Cumulative nett flows: $36.75 billion

Total BTC holdings ~ 1,128 million.

Spot ETH ETFs

Daily nett flow: -$63.3 million

Cumulative nett flows: $2.76 billion

Total ETH holdings ~ 3.635 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The MOVE scale has topped the January high, suggesting accrued volatility successful the U.S. Treasury notes.

Volatile bonds often origin hazard aversion.

While You Were Sleeping

ECB Expected to Cut Interest Rates arsenic Traders Pile Into Fed Easing Bets (CoinDesk): The ECB is expected to chopped its cardinal involvement complaint to 2.65% connected Thursday, adding to planetary liquidity easing and perchance boosting hazard assets, including cryptocurrencies.

Bitcoin Surges to $92K, XRP Prices Muted arsenic White House Crypto Summit Looms (CoinDesk): Major cryptocurrencies gained connected Thursday up of Friday’s White House event, with bitcoin concisely surpassing $92,000 earlier pulling back.

Trump-Backed World Liberty Financial Snaps Up $21.5M successful WBTC, ETH, MOVE: CoinDesk (CoinDesk): On-chain information shows a DeFi startup linked to the Trump household added 4,468 ETH, 110.6 WBTC and 3.42 cardinal MOVE to its treasury connected Wednesday.

The Recession Trade Is Back connected Wall Street (The Wall Street Journal): U.S. recession fears are rising among analysts and investors arsenic commercialized warfare concerns, weakening economical data, and national authorities layoffs person dented user assurance and sent equity indexes lower.

More Words Than Deeds From China connected Consumption Keep Deflation successful Play (Reuters): Despite China’s propulsion for fiscal stimulus to boost household spending and antagonistic deflation amid tariff concerns, analysts accidental bolder structural reforms and stronger payment measures are needed.

South Korea’s Mint Is Grappling With a Gold Bar Shortage arsenic Supply Constraints Bite (CNBC): Amid governmental uncertainty and a weakening won, South Korea’s mint suspended golden barroom income past month, with vending machines selling retired and banks pausing income owed to choky supply.

In the Ether

9 months ago

9 months ago

English (US)

English (US)