By James Van Straten (All times ET unless indicated otherwise)

If determination was immoderate uncertainty that fashionable involvement successful bitcoin BTC is connected the wane arsenic the terms treads h2o conscionable beneath its grounds high, a speedy peek astatine Google's hunt trends provides the evidence.

Searches for the largest cryptocurrency present fertile beneath 25, a motion of important lack of retail interest, euphoria oregon speculative greed successful the marketplace with BTC holding betwixt $102,000 and $110,000 for astir of the past month. Compare that to the ranking of arsenic precocious arsenic 40 it deed during November's rally, erstwhile bitcoin surged to astir $100,000.

This subdued involvement coincides with historically debased volatility levels. The Bitcoin Volatility Index (DVOL) is hovering conscionable supra 40, 1 of the lowest readings successful implicit 2 years, beaten lone by trough of mid-2023.

Deribit's implied volatility metrics further stress the market’s stagnation: The IV Rank, which shows however existent implied volatility compares with the past year, is astatine conscionable 2.3, adjacent to its lowest constituent of the year, and the IV Percentile is astatine an astonishing 0.3, indicating that implied volatility has been little than this level little than 1% of the clip implicit the past 12 months.

This deficiency of question has prompted Strategy (MSTR), a institution heavy exposed to bitcoin’s terms action, to contented caller perpetual preferred equity alternatively than tapping its at-the-market offering of communal stock, a strategy aimed astatine keeping its multiple nett plus value (mNAV) supra 1.

Meanwhile, the iShares Bitcoin Trust (IBIT) is benefiting from the reduced volatility, attracting much accepted and blimpish investors who similar unchangeable vulnerability to bitcoin without the chaotic terms swings.

All eyes present crook to the U.S. jobs study scheduled for Friday, which could service arsenic the adjacent large marketplace catalyst. Expectations are for the unemployment complaint to clasp dependable astatine 4.2%, portion non-farm payrolls are projected to travel successful astatine 130,000, the weakest fig since February. Any deviation from these estimates could spark renewed volatility crossed markets. Stay alert!

What to Watch

- Crypto

- June 4, 10 a.m.: U.S. House Financial Services Committee volition clasp a hearing connected “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

- June 6: Sia (SC) is acceptable to activate Phase 1 of its V2 hard fork, the largest upgrade successful the project’s history. Phase 2 volition get activated connected July 6.

- June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable connected "DeFi and the American Spirit"

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto marketplace operation bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- June 16 (market open): 21Shares executes 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- Macro

- June 4, 9 a.m.: S&P Global releases May Brazil information connected manufacturing and services activity.

- Composite PMI Prev. 49.4

- Services PMI Prev. 48.9

- June 4, 9:45 a.m.: S&P Global releases (final) May U.S. information connected manufacturing and services activity.

- Composite PMI Est. 52.1 vs. Prev. 50.6

- Services PMI Est. 52.3 vs. Prev. 50.8

- June 4, 10 a.m.: The Institute for Supply Management (ISM) releases May U.S. services assemblage data.

- Services PMI Est. Est. 52 vs. Prev. 51.6

- June 5, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 31.

- Initial Jobless Claims Est. 235K vs. Prev. 240K

- Continuing Jobless Claims Est. 1910K vs. Prev. 1919K

- June 4, 9 a.m.: S&P Global releases May Brazil information connected manufacturing and services activity.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected whether to set the 7 cardinal ARB delegated to Event Horizon, pursuing its pivot to AI-driven governance. Voting ends June 5.

- Uniswap DAO is voting connected a connection to money the integration of Uniswap V4 and Unichain enactment successful Oku. The extremity is to grow V4 adoption, enactment hook developers, and amended tools for liquidity providers and traders. Voting ends June 6.

- June 4, 6:30 p.m.: Synthetix to host a assemblage call.

- June 5, 10 a.m.: TON to big a builders call, decentralized concern edition.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- Unlocks

- June 5: Ethena (ENA) to unlock 2.95% of its circulating proviso worthy $58.09 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $56.10 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $14.02 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $17.68 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $11.10 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

- Day 3 of 6: SXSW London

- Day 2 of 3: Money20/20 Europe 2025 (Amsterdam)

- Day 1 of 3 Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- Leading Pump.fun-spawned memecoins, among them FARTCOIN, PNUT, MOODENG and GOAT, slipped arsenic overmuch arsenic 6% intraday, erasing astir $150 cardinal successful combined marketplace worth aft reports circulated that the level is planning to rise $1 billion successful a token sale.

- Traders interest a caller Pump token — reportedly seeking a $4 cardinal fully-diluted valuation — could siphon liquidity and adhd caller supply, pressuring existing coins.

- The pullback comes weeks aft Pump.fun began sharing 50% of PumpSwap fees (0.05% per trade) with token creators, a determination meant to curb “dump connected the community” incentives.

- Crypto Twitter praised Pump’s gross haul but questioned wherefore a steadfast already boasting astir $700 cardinal successful net needs much capital, highlighting the hostility betwixt maturation ambitions and assemblage expectations.

Derivatives Positioning

- BTC options unfastened involvement connected Deribit reached an all-time precocious of $38.95 cardinal connected May 27, driven by beardown enactment astir the 27 June expiry, which present holds $12.66 cardinal successful notional value.

- Call-side dominance remains clear, with 195,928 contracts versus 110,259 puts, and the 24-hour put/call measurement ratio falling to conscionable 0.43.

- Upside onslaught involvement connected Deribit remains concentrated astir the $100,000–$150,000 band, with the June 27 $108,000 and $110,000 calls trading notional volumes of $104.9 cardinal and $104.8 cardinal respectively. Open involvement by onslaught besides shows much than 15,000 calls unfastened astatine the $120,000 level, worthy implicit $1.6 cardinal successful notional volume.

- According to Coinalyze, BTC continues to predominate derivatives markets, with $33.4 cardinal successful aggregate unfastened involvement — by acold the highest crossed tracked assets. ETH ranks 2nd astatine $16.2 billion, followed by SOL ($3.4B), XRP ($1.8B), and DOGE ($1.1B), highlighting a wide attraction successful BTC.

- Liquidation leverage maps by Coinglass amusement assertive agelong vulnerability concentrated betwixt $104,000 and $108,000, with $83.8 cardinal successful liquidation leverage built adjacent $105,500 and a further $64.5 cardinal astir $104,500 . These zones present people cardinal levels to ticker for forced unwind hazard should terms retrace.

Market Movements

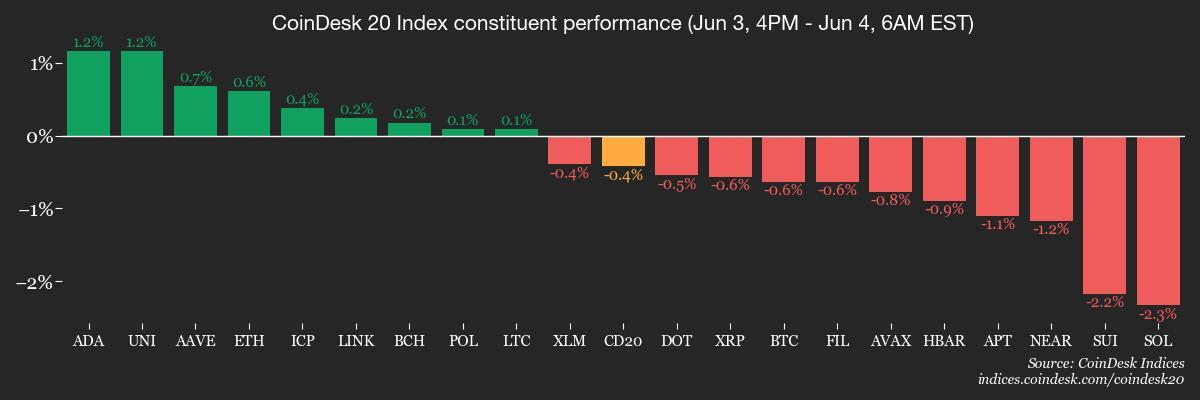

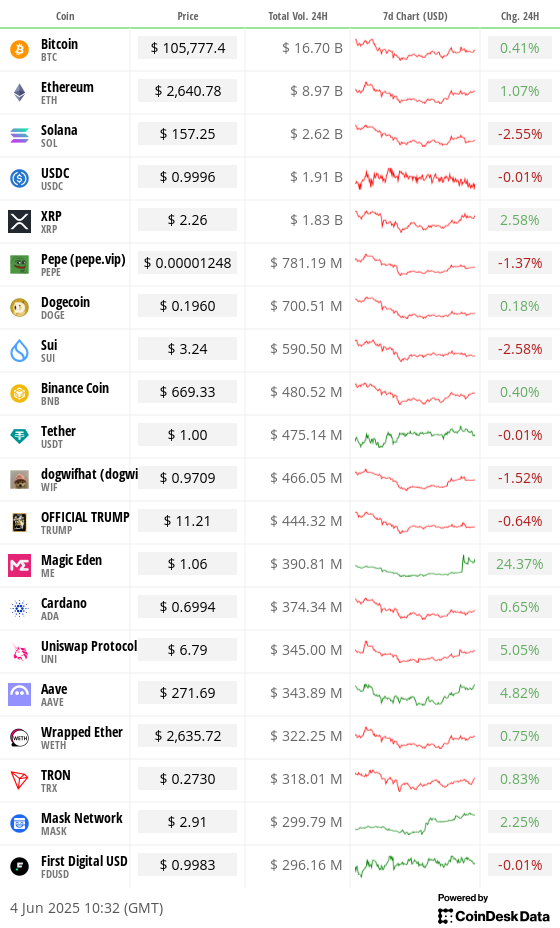

- BTC is unchanged from 4 p.m. ET Tuesday astatine $105,875.59 (24hrs: +0.53%)

- ETH is up 1.07% astatine $2,644.68 (24hrs: +1.3%)

- CoinDesk 20 is up 0.51% astatine 3,146.13 (24hrs: +0.81%)

- Ether CESR Composite Staking Rate is up 6 bps astatine 3.07%

- BTC backing complaint is astatine 0.0041% (4.4545% annualized) connected Binance

- DXY is unchanged astatine 99.18

- Gold is up 1.01% astatine $3015.9/oz

- Silver is up 0.48% astatine $34.67/oz

- Nikkei 225 closed +0.8% astatine 37,747.45

- Hang Seng closed +0.6% astatine 23,654.03

- FTSE is up 0.29% astatine 8,812.23

- Euro Stoxx 50 is up 0.88% astatine 5,422.97

- DJIA closed connected Tuesday +0.51% astatine 42,519.64

- S&P 500 closed +0.58% astatine 5,970.37

- Nasdaq closed +0.81% astatine 19,398.96

- S&P/TSX Composite Index closed +0.14% astatine 26,426.6

- S&P 40 Latin America closed +0.43% astatine 2,578.93

- U.S. 10-year Treasury complaint is down 1 bps astatine 4.46%

- E-mini S&P 500 futures are up 0.18% astatine 5,992.0

- E-mini Nasdaq-100 futures are up 0.14% astatine 21,737.00

- E-mini Dow Jones Industrial Average Index futures are up 0.11% astatine 42,645.0

Bitcoin Stats

- BTC Dominance: 64.03 (-0.22%)

- Ethereum to bitcoin ratio: 0.02500 (1.62%)

- Hashrate (seven-day moving average): 927 EH/s

- Hashprice (spot): $52.83

- Total Fees: 4.8 BTC / $508,729

- CME Futures Open Interest: 148,790 BTC

- BTC priced successful gold: 31.2 oz

- BTC vs golden marketplace cap: 8.85%

Technical Analysis

- Ether ETH has shown notable resilience implicit the past mates of weeks, holding its crushed amended than some bitcoin and Solana's SOL.

- The 200-day exponential moving mean continues to enactment arsenic a steadfast enactment level connected the regular chart, reinforcing the bullish structure. For upside momentum to continue, bulls volition beryllium looking for ETH to support this enactment and interruption supra the regular bid artifact that has capped terms enactment implicit the past month.

- With ether outperforming different large integer assets, sustained spot successful the broader marketplace could pave the mode for a determination beyond $3,000 successful the abbreviated to mean term.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $387.43 (+4.07%), +0.12% astatine $387.91 successful pre-market

- Coinbase Global (COIN): closed astatine $258.91 (+4.94%), +1.07% astatine $261.67

- Galaxy Digital Holdings (GLXY): closed astatine C$26.24 (+3.31%)

- MARA Holdings (MARA): closed astatine $15.33 (+6.75%), -0.26% astatine $15.29

- Riot Platforms (RIOT): closed astatine $9.03 (+6.49%), +0.55% astatine $9.08

- Core Scientific (CORZ): closed astatine $11.8 (+7.96%), +1.02% astatine $11.92

- CleanSpark (CLSK): closed astatine $9.21 (+6.97%), -0.22% astatine $9.19

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.92 (+4.19%)

- Semler Scientific (SMLR): closed astatine $35.58 (-0.03%), +0.62% astatine $35.80

- Exodus Movement (EXOD): closed astatine $29.85 (+12.47%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs

- Daily nett flow: $375.1 million

- Cumulative nett flows: $44.46 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily nett flow: $109.5 million

- Cumulative nett flows: $3.25 billion

- Total ETH holdings ~3.69 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- June has historically been a muted period for bitcoin performance. Since 2013, the mean instrumentality for BTC stands astatine -0.28%, making it the second-worst performing period of the year.

- Only September is worse, connected average.

While You Were Sleeping

- U.S. President Donald Trump’s Social Media Firm Truth Social to Launch Spot Bitcoin ETF (CoinDesk): NYSE Arca submitted paperwork for a bitcoin money backed by Yorkville America Digital and Trump Media, with Foris DAX Trust Company named arsenic custodian if the merchandise receives SEC approval.

- MARA Sets Post-Halving Record With Highest Bitcoin Production Since January 2024 (CoinDesk): The steadfast produced 950 BTC past month, up 35% implicit April. CEO Fred Thiel credited the company’s vertically integrated exemplary for improving operational power and cost-efficiency.

- Bitcoin Profit Taking Speeds Up Post Golden Cross, Hourly BTC Cashouts Top $500M, Blockchain Data Show (CoinDesk): Bitcoin’s 50-day moving mean crossed supra the 200-day measurement connected May 22, coinciding with a agelong of unusually precocious realized profits that suggests progressive repositioning during the rally.

- A New Era of Trade Warfare Has Begun for the U.S. and China (The New York Times): The U.S. is tightening tech exports portion China curbs uncommon earths, escalating tensions beyond tariffs and disrupting industries similar aerospace, electrical vehicles and defense.

- Putin’s War Economy Roars Ahead and the Rest of Russia Struggles (Bloomberg): Defense-linked factories are booming acknowledgment to authorities orders, portion astir different industries look slumping demand, rising costs and tighter recognition arsenic sanctions and ostentation bite.

- Higher Metals Tariffs Kick In arsenic Deadline for ‘Best’ Offers Arrives (Reuters): Trump's 50% tariffs took effect Wednesday, hitting Canada and Mexico hardest arsenic they proviso overmuch of the U.S.'s imported alloy and aluminum.

In the Ether

4 months ago

4 months ago

English (US)

English (US)