By Omkar Godbole (All times ET unless indicated otherwise)

The cryptocurrency bull tally has stalled since bitcoin (BTC) deed a grounds precocious supra $110,000 past month. However, firm adoption continues astatine a brisk pace.

Shares successful Norway-based crypto speech Norwegian Block Exchange surged implicit 100% aboriginal contiguous aft the institution disclosed the acquisition of six BTC, worthy $633K astatine existent prices, with plans to boost holdings to 10 BTC by the extremity of the month.

The Nasdaq-listed Classover Holdings Inc, an acquisition exertion institution with a existent marketplace capitalization of $63 million, has entered into a securities acquisition statement with Solana Growth Ventures LLC for up to $500 cardinal successful elder secured convertible notes. According to Investing.com, up to 80% of the proceeds volition beryllium allocated to acquisition Solana's autochthonal token SOL.

Ripple's enterprise-grade stablecoin RLUSD secured regulatory approval from the Dubai Financial Services Authority, opening doors for the stablecoin to enactment the Dubai Land Department’s blockchain inaugural to tokenize existent property rubric deeds connected the XRP Ledger.

In different news, Robinhood completed a $200 cardinal all-cash acquisition of the Luxembourg-based crypto speech Bitstamp, expanding its footprints successful Europe.

Speaking of marketplace activity, U.S.-listed spot bitcoin ETFs saw a nett outflow of $268 cardinal connected Monday, marking the 3rd consecutive time of outflows. Options tied to BlackRock's spot bitcoin ETF (IBIT) continued to amusement a bias for enactment options, indicating downside fears, according to information root Market Chameleon. Ethereum spot ETFs recorded a nett inflow of $78.17 million, extending their streak to 11 consecutive days, according to Farside Investors.

In accepted markets, the anti-risk Japanese yen slid during the Asian hours aft an ex-Bank of Japan authoritative said the cardinal slope would halt tapering the magnitude of its Japanese authorities enslaved purchases successful a program for the adjacent fiscal year, erstwhile officials stitchery this month.

The dollar scale continued to stay nether unit connected increasing commercialized uncertainty and rising concerns successful the enslaved marketplace implicit the U.S. deficit. Monday's ISM manufacturing surveys delivered a antagonistic surprise, puncturing the U.S. resilience story.

According to ING, the absorption contiguous volition beryllium connected April’s JOLTS report, wherever occupation openings and layoffs volition beryllium successful the spotlight. Durable goods orders are besides expected to person taken a deed successful April. "Another circular of brushed data, peculiarly successful the labour market, tin propulsion the dollar backmost to its April lows," ING said.

Meanwhile, newsletter work LondonCryptoClub flagged Aptos Labs CEO Avery Ching's grounds astatine a U.S. House proceeding connected “The Future of Digital Assets,” led by the Agriculture Committee. Stay Alert!

What to Watch

- Crypto

- June 3, 1 p.m.: The Shannon hard fork web upgrade volition get activated connected the Pocket Network (POKT).

- June 4, 10 a.m.: U.S. House Financial Services Committee volition clasp a hearing connected “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

- June 6: Sia (SC) is acceptable to activate Phase 1 of its V2 hard fork, the largest upgrade successful the project’s history. Phase 2 volition get activated connected July 6.

- June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable connected "DeFi and the American Spirit"

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto marketplace operation bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- June 16 (market open): 21Shares executes 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- Macro

- June 3: South Koreans volition vote to take a caller president pursuing the ouster of Yoon Suk Yeol, who was dismissed aft concisely declaring martial instrumentality successful December 2024.

- June 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labour marketplace data.

- Job Openings Est. 7.10M vs. Prev. 7.192M

- Job Quits Prev. 3.332M

- June 3, 1 p.m.: Federal Reserve Governor Lisa D. Cook volition present a code connected economical outlook astatine the Peter McColough Series connected International Economics successful New York. Livestream link.

- June 4, 12:01 a.m.: U.S. import duties connected alloy and aluminum volition increase from 25% to 50%.

- June 4, 9:45 a.m.: S&P Global releases (Final) May U.S. information connected manufacturing and services activity.

- Composite PMI Est. 52.1 vs. Prev. 50.6

- Services PMI Est. 52.3 vs. Prev. 50.8

- June 4, 10 a.m.: The Institute for Supply Management (ISM) releases May U.S. services assemblage data.

- Services PMI Est. Est. 52 vs. Prev. 51.6

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Sui DAO is voting connected moving to recover astir $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- Arbitrum DAO is voting connected whether to set the 7 cardinal ARB delegated to Event Horizon, pursuing its pivot to AI-driven governance. Voting ends June 5.

- Uniswap DAO is voting connected a connection to money the integration of Uniswap V4 and Unichain enactment successful Oku. The extremity is to grow V4 adoption, enactment hook developers, and amended tools for LPs and traders. Voting ends June 6.

- June 4, 6:30 p.m.: Synthetix to host a assemblage call.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- Unlocks

- June 5: Ethena (ENA) to unlock 2.95% of its circulating proviso worthy $67.99 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $55.53 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $14.02 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $17.87 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $11.16 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 2 of 6: SXSW London

- June 3: World Computer Summit 2025 (Zurich)

- Day 1 of 3: Money20/20 Europe 2025 (Amsterdam)

- June 4-6: Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Oliver Knight

- Sky (formerly MakerDAO) rolled retired its staking diagnostic connected Wednesday, receiving $553 cardinal successful deposits.

- Those depositors are are presently receiving 16.48% APY connected their deposits though the fig was astatine 38.3% successful the hours aft launch.

- Yields are rewarded successful the USDS stablecoins and are based connected the performances of the protocol. Yield is besides tied to the Sky Savings Rate (SSR), which reflects the protocol's operational income.

- The SKY token besides experienced a play of upside, rising 16% from $0.065 to $0.074 successful the past 24 hours.

- Trading volume, however, remains reasonably muted astatine $7 cardinal -- indicating that a ample information of holders are staking and not trading, paving the mode for a deficiency of merchantability pressure.

Derivatives Positioning

- HYPE, PEPE, ETH, BNB and TON person seen the astir summation successful the perpetual futures unfastened involvement successful the past 24 hours.

- BTC's precocious Friday upswing from $103,600 to implicit $106k was marked by a diminution successful perpetual futures unfastened interest. The divergence, coupled with debased spot volumes, raises question people connected the sustainability of gains.

- Open involvement successful the CME futures has dropped to 153.6K BTC from the caller precocious of 162K BTC, with the annualized one-month ground pulling backmost to 6.5% successful a motion of intermission successful organization demand. ETH ground has besides pulled backmost to 8.7% from caller highs implicit 10%.

- On Deribit, a wide telephone oregon bullish options bias is seen lone successful the March 2021 expiry, according to hazard reversals tracked by Amberdata. ETH options are somewhat much optimistic astir terms prospects.

Market Movements

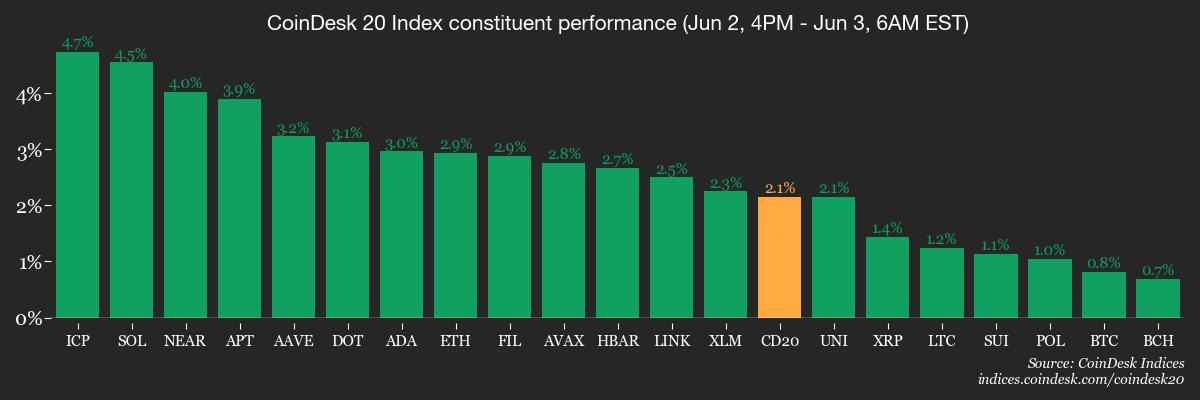

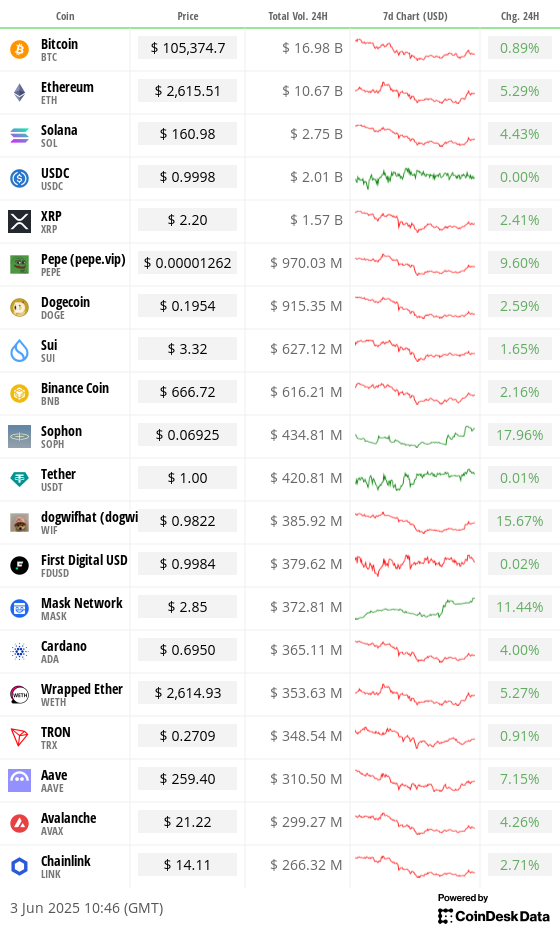

- BTC is up 0.33% from 4 p.m. ET Monday astatine $105,291.98 (24hrs: -0.78%)

- ETH is up 3.03% astatine $2,618.49 (24hrs: +5.29%)

- CoinDesk 20 is up 1.71% astatine 3,117.05 (24hrs: +2.92%)

- Ether CESR Composite Staking Rate is up 4 bps astatine 3.01%

- BTC backing complaint is astatine 0.0054% (5.9010% annualized) connected Binance

- DXY is up 0.21% astatine 98.91

- Gold is up 0.37% astatine $3,383.20/oz

- Silver is down 0.38% astatine $34.43/oz

- Nikkei 225 closed unchanged astatine 37,446.81

- Hang Seng closed +1.53% astatine 23,512.49

- FTSE is down 0.11% astatine 8,764.75

- Euro Stoxx 50 is down 0.19% astatine 5,345.17

- DJIA closed connected Monday unchanged astatine 42,305.48

- S&P 500 closed +0.41% astatine 5,935.94

- Nasdaq closed +0.67% astatine 19,242.61

- S&P/TSX Composite Index closed +0.82% astatine 26,389.00

- S&P 40 Latin America closed +0.52% astatine 2,567.88

- U.S. 10-year Treasury complaint is down 3 bps astatine 4.42%

- E-mini S&P 500 futures are down 0.39% astatine 5,924.00

- E-mini Nasdaq-100 futures are up 0.34% astatine 21,461.25

- E-mini Dow Jones Industrial Average Index futures are down 0.37% astatine 42,219.00

Bitcoin Stats

- BTC Dominance: 64.05 (-0.31%)

- Ethereum to bitcoin ratio: 0.02484 (0.89%)

- Hashrate (seven-day moving average): 922 EH/s

- Hashprice (spot): $51.3

- Total Fees: 4.77 BTC / $500,036

- CME Futures Open Interest: 145,560 BTC

- BTC priced successful gold: 31.1 oz

- BTC vs golden marketplace cap: 8.81%

Technical Analysis

- The ether-bitcoin ratio has carved retired a symmetrical triangle, identified by the 2 converging trendlines, indicating unwillingness among bulls and bears to pb the terms action.

- Such patterns typically acceptable the signifier for the adjacent limb higher.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $372.27 (+0.87%), +0.69% astatine $374.85 successful pre-market

- Coinbase Global (COIN): closed astatine $246.72 (+0.04%), +0.8% astatine $248.70

- Galaxy Digital Holdings (GLXY): closed astatine C$25.40 (+1.93%)

- MARA Holdings (MARA): closed astatine $14.36 (+1.7%), +0.63% astatine $14.45

- Riot Platforms (RIOT): closed astatine $8.48 (+5.08%), +0.59% astatine $8.53

- Core Scientific (CORZ): closed astatine $10.93 (+2.63%), -0.37% astatine $10.89

- CleanSpark (CLSK): closed astatine $8.61 (-0.23%), +0.46% astatine $8.65

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.2 (+4.43%)

- Semler Scientific (SMLR): closed astatine $35.59 (-11.03%), +0.42% astatine $35.74

- Exodus Movement (EXOD): closed astatine $26.54 (-6.88%), -0.15% astatine $26.50

ETF Flows

Spot BTC ETFs

- Daily nett flow: -$267.5 million

- Cumulative nett flows: $44.08 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily nett flow: $78.2 million

- Cumulative nett flows: $3.14 billion

- Total ETH holdings ~ 3.66 million

Source: Farside Investors

Overnight Flows

Chart of the Day

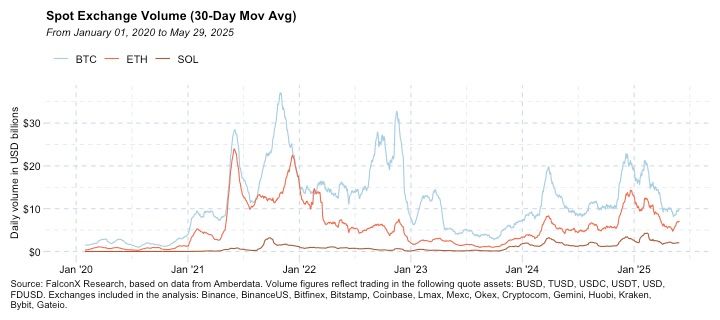

- The illustration shows the U.S. trading hours present relationship for little than 45% of the full spot marketplace enactment successful BTC, ETH and SOL.

- Meanwhile, the Asian trading hours' stock has increased.

While You Were Sleeping

- U.S. Share of Bitcoin, Ether and Solana Trading Volume Falls Below 45% arsenic Asia Catches Up (CoinDesk): Asian hours present relationship for a larger stock of BTC, ETH, and SOL trading, adjacent arsenic planetary spot volumes stay subdued contempt bitcoin’s 40% rally since aboriginal April.

- Coinbase Moves to Bring Oregon Securities Suit to Federal Jurisdiction (CoinDesk): Coinbase slams Oregon's suit arsenic a 'regulatory onshore grab,' accusing the state's lawyer wide of trying to override national crypto guidelines.

- The Blockchain Group Buys Nearly $70M Worth of Bitcoin, Boosting Total Holdings to 1,471 BTC (CoinDesk): The Blockchain Group (ALTBG), listed connected Euronext Growth Paris and known arsenic Europe’s archetypal bitcoin treasury company, bought 624 BTC for astir 60.2 cardinal euros ($68.8 million).

- U.S. Growth Forecast Cut Sharply by OECD As Trump Tariffs Sour Global Outlook (CNBC): They slashed their 2025 U.S. maturation forecast to 1.6% from 2.2%, and projected conscionable 1.5% for 2026; planetary maturation is expected to dilatory to 2.9% this twelvemonth and next.

- Russia and Ukraine Ratchet Up War While Trying to Show Trump They Want Peace (The Wall Street Journal): Russia and Ukraine met for conscionable an hr Monday successful Istanbul, agreeing lone connected a captive swap portion sidestepping meaningful steps toward peace, contempt increasing unit from Trump.

- Donald Trump Says Iran Must End All Uranium Enrichment arsenic Part of Nuclear Deal (Financial Times): Trump publically rejected his envoy’s reported connection to let low-level enrichment for civilian use, sharpening disorder implicit U.S. presumption arsenic atomic talks with Iran participate week eight.

In the Ether

6 months ago

6 months ago

English (US)

English (US)