By Francisco Rodrigues(All times ET unless indicated otherwise)

Cryptocurrencies slid arsenic Israeli airstrikes connected Iran's atomic and rocket sites roiled planetary sentiment and sent investors fleeing hazard assets.

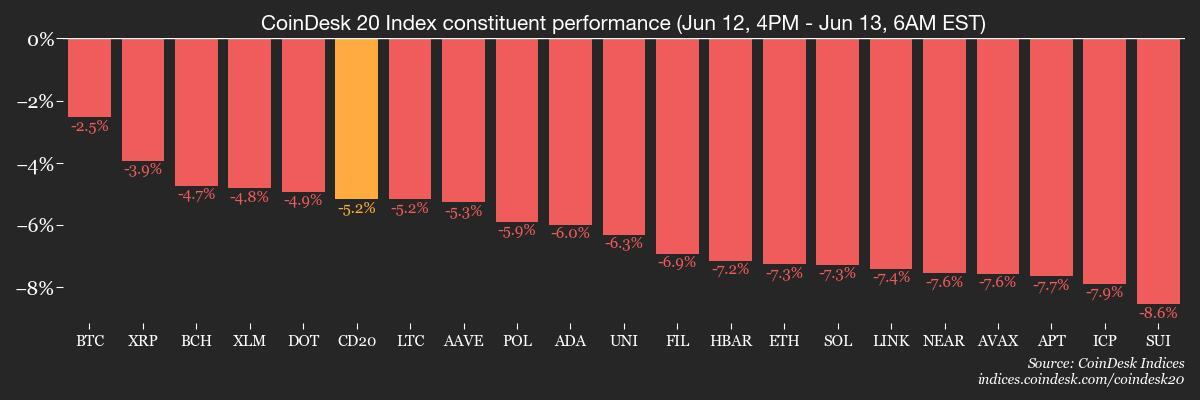

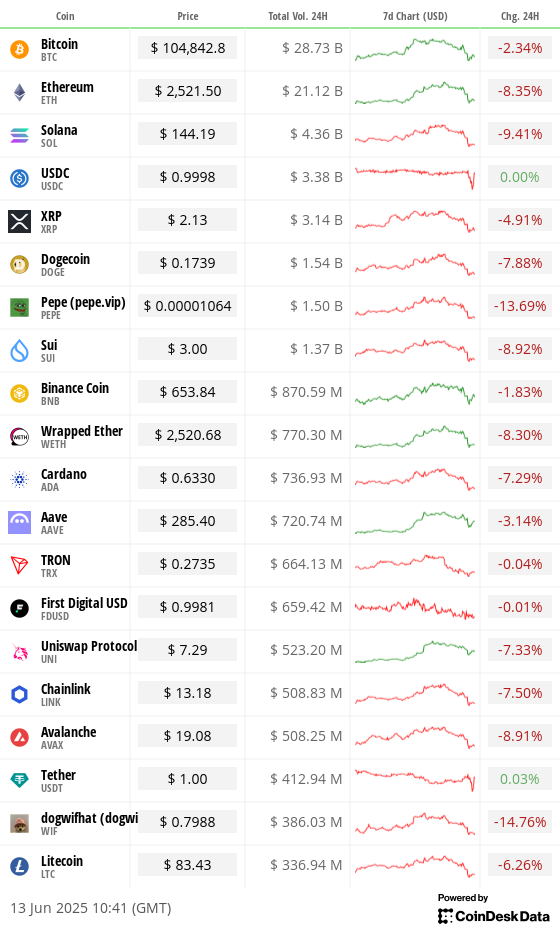

The CoinDesk 20 Index (CD20), a measurement of the wide crypto market, mislaid 6.1% implicit 24 hours, and bitcoin (BTC), seen by some arsenic a haven investment, dropped 2.9%. Gold futures, a much accepted refuge, roseate 1.3% from their close.

Israeli Prime Minister Benjamin Netanyahu said the overnight attack, which besides targeted Iran's apical subject leaders, was aimed astatine rolling backmost Iran’s atomic programme and rocket capabilities. Iran, which has repeatedly called for Israel's destruction, responded by launching 100 termination drones toward Israeli territory, though a much concerted absorption is anticipated.

The onslaught came little than 24 hours aft the International Atomic Energy Agency said Iran was not complying with uranium enrichment limits. The U.S. said it was not progressive successful the attack, which killed immoderate of Iran’s subject leaders.

The escalation saw hazard assets crossed the committee plunge. Japan’s Nikkei dropped astir 0.9%, U.S. scale futures fell 1.2% and the Euro Stoxx 50 mislaid 1.35%. U.S. crude lipid futures, connected the different hand, roseate much than 6% to $73, with Brent crude spiking 14% astatine 1 point. Gold surged to $3,445 per ounce, approaching its all-time high.

Cryptocurrencies' declines dashed gains eked retired earlier successful the week connected the backmost of ETF support speculation. Solana's sol SOL, successful particular, had rallied connected reports the SEC asked ETF issuers to update their S-1 filings, perchance accelerating the motorboat timeline. SOL is down astir 9.5% successful the past 24 hours.

“Overnight, reports surfaced that the SEC has asked Solana ETF issuers to update S-1 filings, triggering a crisp rally successful SOL,” Jake Ostrovskis, an OTC trader astatine Wintermute, told CoinDesk.

“Bloomberg ETF analysts Eric Balchunas and James Seyffart stay optimistic, assigning a 90% probability of support by year-end, with imaginable approvals coming arsenic soon arsenic July oregon wrong 3 to 5 weeks of the updated filings,” Ostrovskis said.

As a result, helium said, the marketplace is “now comparatively underexposed to SOL and related assets, which makes the existent setup peculiarly absorbing to watch.”

Despite the optimism and increasing inflows into spot crypto ETFs, with BTC funds bringing successful $939 cardinal month-to-date and ETH seeing $811 cardinal successful nett inflows, investors are present focused connected the Middle East.

Polymarket traders are weighing a 91% chance that Iran volition retaliate against Israel this month, portion the perceived likelihood of U.S. subject action against Iran jumped from a specified 4% to 28%. Stay alert!

What to Watch

- Crypto

- June 16: 21Shares executes a 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- June 16: Brazil’s B3 speech launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) and benchmarked to Nasdaq indices.

- Macro

- June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

- June 17: The U.S. Senate volition ballot connected the last transition of the measure Guiding and Establishing National Innovation for US Stablecoins (the GENIUS Act of 2025).

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected a connection to motorboat DRIP, an $80M incentives program targeting circumstantial DeFi activity. Managed by a foundation-led committee, DRIP would reward users straight and let the DAO to unopen it down via vote. Voting ends June 20.

- Unlocks

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $15.04 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $9.70 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating proviso worthy $31.28 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating proviso worthy $37.26 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $10.43 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Derivatives Positioning

- Open involvement (OI) crossed apical derivatives venues saw a crisp reset.

- After peaking supra $55 cardinal connected June 12, full OI dropped to a the month's debased of $49.31 billion, according to Velo data.

- Binance shed implicit $2.5 cardinal overnight, alongside wide hazard simplification crossed OKX, Bybit, Deribit and Hyperliquid. The pullback unwinds overmuch of the dependable physique seen earlier this month.

- Options positioning besides turned much defensive, with Deribit information showing the BTC and ETH put/call ratios climbing to 1.28 and 1.25, respectively.

- While upside strikes similar $140K (BTC) and $3,200 (ETH) inactive clasp ample telephone interest, the bulk of June 27 vulnerability remains out-of-the-money. The displacement suggests increasing request for downside extortion alongside lingering upside optionality.

- Funding remains broadly negative, particularly crossed altcoins. ETH sits astatine –7.99% connected Deribit and BTC astatine –1.06%. Sharp discounts persist for DOT (–15.2%), LINK (–15.1%) and 1000SHIB (–44.5%).

- HYPE (+8.27% connected Hyperliquid) and AAVE (+9.95% connected Bybit) are among the fewer to amusement agelong bias.

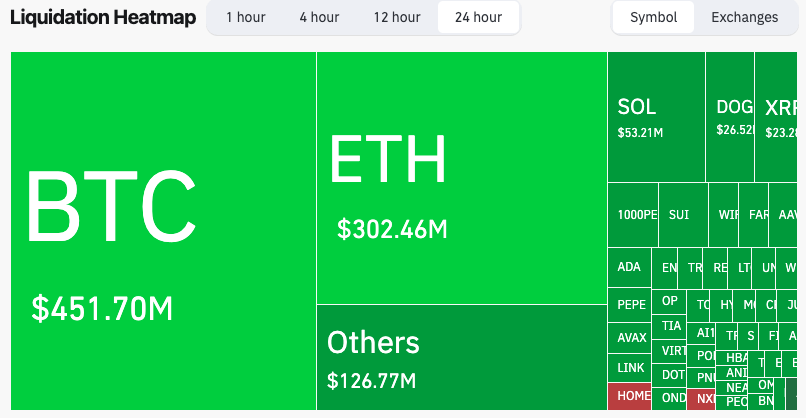

- Despite Tuesday’s $1.16 cardinal successful liquidations, leverage remains elevated. Coinglass information shows 90% of liquidations came from longs. As of June 13, bitcoin liquidation heatmaps item up to $84 cardinal successful long-side OI betwixt $102K and $104K. These levels stay untriggered, but could amplify downside if breached.

Market Movements

- BTC is down 1.08% from 4 p.m. ET Thursday astatine $104,889.07 (24hrs: -2.42%)

- ETH is down 4.48% astatine $2,523.28 (24hrs: -8.81%)

- CoinDesk 20 is down 3.2% astatine 3,007.21 (24hrs: -6.04%)

- Ether CESR Composite Staking Rate is unchanged astatine 3.11%

- BTC backing complaint is astatine 0.0018% (1.9776% annualized) connected Binance

- DXY is up 0.44% astatine 98.35

- Gold futures are up 1.25% astatine $3,445.00

- Silver futures are up 0.47% astatine $36.47

- Nikkei 225 closed down 0.89% astatine 37,834.25

- Hang Seng closed down 0.59% astatine 23,892.56

- FTSE is down 0.38% astatine 8,851.53

- Euro Stoxx 50 is down 1.37% astatine 5,287.21

- DJIA closed connected TKTK up 0.24% astatine 42,967.62

- S&P 500 closed up 0.38% astatine 6,045.26

- Nasdaq Composite closed up 0.24% astatine 19,662.48

- S&P/TSX Composite closed up 0.35% astatine 26,615.75

- S&P 40 Latin America closed down 0.30% astatine 2,617.09

- U.S. 10-Year Treasury complaint is unchanged astatine 4.365%

- E-mini S&P 500 futures are down 1.16% astatine 5,979.50

- E-mini Nasdaq-100 futures are down 1.42% astatine 21,621.50

- E-mini Dow Jones Industrial Average Index are down 1.18% astatine 42,483.00

Bitcoin Stats

- BTC Dominance: 64.77 (0.70%)

- Ethereum to bitcoin ratio: 0.02412 (-3.52%)

- Hashrate (seven-day moving average): 928 EH/s

- Hashprice (spot): $52.43

- Total Fees: 4.86 BTC / $508,710.78

- CME Futures Open Interest: 150,705 BTC

- BTC priced successful gold: 30.6 oz

- BTC vs golden marketplace cap: 8.66%

Technical Analysis

- Ether continues to look absorption astatine the regular bid block, with the terms dropping beneath Monday’s precocious arsenic tensions ramp up successful the Middle East.

- Earlier today, it concisely traded beneath Monday’s debased earlier reclaiming that level.

- A regular adjacent supra Monday’s debased of $2480 — aligned with the 200-day exponential moving average, which has served arsenic cardinal enactment since May — would beryllium an encouraging motion of strength.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $379.76 (-1.9%), -2.63% astatine $369.78 successful pre-market

- Coinbase Global (COIN): closed astatine $241.05 (-3.84%), 2.1% astatine $236

- Circle (CRCL): closed astatine $106.54 (-9.1%), +1.32% astatine $108.1

- Galaxy Digital Holdings (GLXY): closed astatine C$26.44 (+0.08%)

- MARA Holdings (MARA): closed astatine $15.82 (-3.24%), 3.41% astatine $15.28

- Riot Platforms (RIOT): closed astatine $10.21 (-3.22%), -3.33% astatine $9.87

- Core Scientific (CORZ): closed astatine $12.14 (-0.9%), -2.55% astatine $11.83

- CleanSpark (CLSK): closed astatine $9.71 (-2.61%), -2.99% astatine $9.42

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $19.61 (-1.95%)

- Semler Scientific (SMLR): closed astatine $30.74 (-3.09%), -2.41% astatine $30

- Exodus Movement (EXOD): closed astatine $31.62 (+1.74%)

ETF Flows

Spot BTC ETFs

- Daily nett flow: $86.3 million

- Cumulative nett flows: $45.29 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily nett flow: $112.3 million

- Cumulative nett flows: $3.87 billion

- Total ETH holdings ~ 3.92 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- In the past 24 hours, 248,759 traders were liquidated , with full liquidations coming successful astatine $1.16 cardinal according to CoinGlass data.

While You Were Sleeping

- Bitcoin Tumbles Below $104K arsenic Israel Strikes Iran (CoinDesk): Israel said it launched a “precise, preemptive strike” to neutralize the country's atomic program.

- Judge Orders Trump to Return California National Guard to Newsom (The Wall Street Journal): A national justice ruled Trump violated the Tenth Amendment to the U.S. Constitution by unlawfully taking power of California’s National Guard. An appeals tribunal has paused the bid pending review.

- Bitcoin 'Skew' Slides arsenic Oil Prices Surge 6% connected Israel-Iran Tensions (CoinDesk): The seven-day skew fell to its lowest since April, indicating accrued request for enactment options implicit calls aft Israel's attack. Bitcoin's terms fell to its 50-day elemental moving mean (SMA) astatine $103,150.

- Oil Curve Shift Shows Fears of Protracted Mideast Conflict (Bloomberg): A commodities strategist warned that escalation could disrupt Strait of Hormuz shipping, threatening 14 cardinal barrels a time and perchance driving lipid prices arsenic precocious arsenic $120.

- Single Bitcoin Trader Loses $200M arsenic Crypto Bulls See $1B Liquidations (CoinDesk): About 247,000 traders were liquidated successful the past time arsenic $1.15 cardinal successful positions were wiped retired pursuing overly bullish sentiment fueled by Circle’s IPO and renewed U.S. enthusiasm for DeFi.

- Ripple, SEC File Joint Motion to Release $125M Held successful Escrow (CoinDesk): The projected solution would instrumentality $75 cardinal to Ripple and assistance $50 cardinal to the SEC, aiming to debar further litigation and settee outstanding appeals.

In the Ether

6 months ago

6 months ago

English (US)

English (US)