By Omkar Godbole (All times ET unless indicated otherwise)

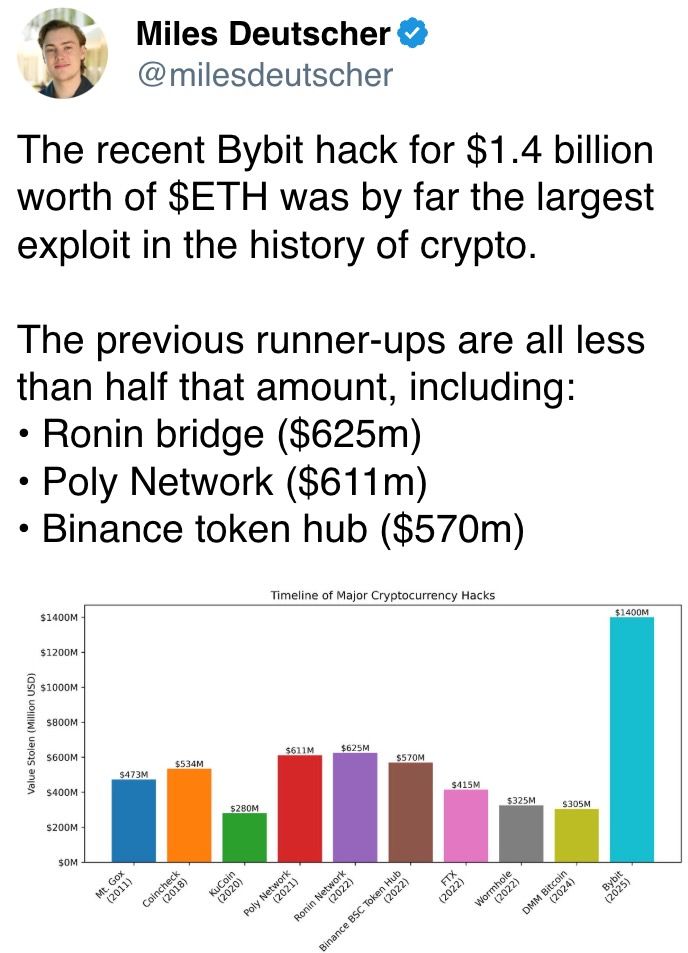

Bitcoin and ether, the 2 largest integer assets by marketplace value, stay mostly wrong their caller trading ranges 2 days aft the $1.5 cardinal hack of Bybit, 1 of the apical cryptocurrency exchanges.

Perpetual backing rates for some are positive, indicating a bias for agelong positions that payment from terms rises. Bitcoin options trading connected Deribit amusement a bullish bias for telephone options crossed each clip frames, portion those tied to ether amusement a downside bias into March. The bias for ether puts, however, has been contiguous since good earlier the hack.

Meanwhile, Volmex Finance's 30-day bitcoin implied volatility scale has dropped to an annualized 48.45%, the lowest since July, according to charting level TradingView. Ether's implied volatility has reversed the insignificant play spike from 67% to 70%.

The calm is simply a motion of marketplace maturity, according to QCP Capital. "The terms enactment underscores the increasing maturity of the crypto scenery since the FTX illness successful 2022, peculiarly successful the crypto recognition market," the trading steadfast said. "Every facet of crypto — from custodial and information solutions to firm governance and transparency — has strengthened with each past crisis."

Overall, the crypto assemblage is reassured by Bybit’s quality to manage implicit $6 cardinal successful withdrawals pursuing the hack. Plus, the speech has filled the gap successful its ETH reserves.

According to Mena Theodorou, a co-founder of crypto speech Coinstash, each eyes volition beryllium connected Solana's SOL arsenic Franklin Templeton, 1 of the world’s largest plus absorption firms, has submitted a spot SOL ETF connection to the SEC. In addition, 11.2 cardinal SOL (2.3% of full supply) from the FTX property are scheduled to beryllium unlocked connected March 1, which could breed marketplace volatility. That has already boosted measurement successful SOL enactment options connected Deribit.

President Donald Trump's decision to audit golden reserves astatine Fort Knox successful Kentucky has piqued involvement successful the crypto community. "While regular golden audits are rare, the timing is notable arsenic Trump continues to propulsion a pro-crypto narrative. If the golden proviso turns retired to beryllium little than expected, it could reenforce Bitcoin’s lawsuit arsenic integer golden — and perchance adjacent arsenic a superior reserve asset," Theodorou said successful an email.

In accepted markets, the yen continues to summation crushed against the U.S. dollar and growth-sensitive commodity currencies specified arsenic the Australian dollar, calling for caution connected the portion of the hazard plus bulls. Stay alert

What to Watch

Crypto:

Feb. 24, 11:00 a.m.: Bugis web upgrade goes unrecorded connected Enjin Relaychain mainnet.

Feb. 24: At epoch 115968, investigating of Ethereum’s Pecta upgrade connected the Holesky testnet starts.

Feb. 25, 9:00 a.m.: Ethereum Foundation probe squad AMA connected Reddit.

Feb. 25: Pascal hard fork web upgrade goes unrecorded connected the BNB Smart Chain (BSC) testnet.

Feb. 25: Reactive Network mainnet launch, arsenic good arsenic the archetypal instauration and organisation of the REACT token.

Macro

Feb. 24, 8:00 p.m.: Bank of Korea’s (BOK) Monetary Policy Committee announces its involvement complaint decision.

Base Rate Est. 2.75% vs. Prev. 3%

Feb. 25, 10:00 a.m.: The Conference Board (CB) releases February’s “Consumer Confidence Index” report.

CB Consumer Confidence Est. 102.1 vs. Prev. 104.1

Feb. 25, 1:00 p.m.: Richmond Fed President Tom Barkin delivers a speech titled “Inflation Then and Now.”

Feb. 25, 7:30 p.m.: The Australian Bureau of Statistics releases January’s "Monthly Consumer Price Index Indicator" report.

Monthly CPI Indicator Est. 2.5% vs. Prev. 2.5%

Earnings

Feb. 24: Riot Platforms (RIOT), post-market, $-0.18

Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $-0.17

Feb. 25: Cipher Mining (CIFR), pre-market, $-0.09

Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Feb. 26: NVIDIA (NVDA), post-market

Token Events

Governances votes & calls

Sky DAO is voting connected key changes to the protocol including reducing the Smart Burn Engine’s protocol-owned liquidity to $15 million, and adjusting immoderate parameters to alteration contiguous buybacks and nonstop each surplus to burning.

Ampleforth DAO is voting connected reducing the Flash Mint interest to 0.5% and the Flash Redeem interest to 5% to summation the system’s adaptability.

DYdX DAO is discussing the establishment of a DYDX buyback program. Its archetypal measurement would allocate 25% of the dYdX’s protocol nett gross to bargain backmost the token.

Unlocks

Feb. 28: Optimism (OP) to unlock 2.32% of circulating proviso worthy $35.43 million.

Mar. 1: DYdX to unlocked 1.14% of circulating proviso worthy $6.24 million.

Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating proviso worthy $13.7 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating proviso worthy $81.07 million.

Mar. 7: Kaspa (KAS) to unlock 0.63% of circulating proviso worthy $15.55 million.

Mar. 12: Aptos (APT) to unlock 1.93% of circulating proviso worthy $69.89 million.

Token Listings

Feb. 25: Zoo (ZOO) to beryllium listed connected KuCoin.

Feb. 26: Moonwell (WELL) to beryllium listed connected Kraken.

Feb. 27: Venice (VVV) to beryllium listed connected Kraken.

Feb. 28: Worldcoin (WLD) to beryllium listed connected Kraken.

Conferences:

CoinDesk's Consensus to instrumentality spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 2 of 8: ETHDenver 2025 (Denver)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Francisco Rodrigues

The perpetrators of the adjacent $1.5 cardinal hack of large crypto speech Bybit person seemingly turned to fashionable Solana-based token launchpad Pump.fun to effort to launder the stolen funds.

Pump.fun linked a token called “QinShinhuang (500000)” to the hacker(s) aft a 60 SOL transportation and removed the token from its beforehand extremity to forestall this benignant of activity.

Pump.fun could meantime soon launch its ain automated marketplace shaper (AMM) successful a stroke to fashionable Solana-based decentralized speech Raydium, which benefited from being the level graduating Pump.fun tokens traded on.

Derivatives Positioning

SOL enactment options expiring this Friday connected Deribit commercialized astatine a premium of 7 vol points to calls, reflecting beardown downside fears.

Ether options proceed to amusement concerns of downside hazard until the extremity of March, with consequent expiries reflecting a bullish positioning. BTC options are biased bullish crossed clip frames.

BTC artifact flows connected Deribit featured calendar spreads and a bull telephone spread. ETH flows included agelong positions successful calls astatine strikes of $2,850 and $2,900 and a abbreviated strangle successful the April expiry.

Funding rates successful perpetual futures linked to the OM token stay negative, a motion of traders taking protective bearish bets arsenic the spot terms continues to deed grounds highs.

Market Movements:

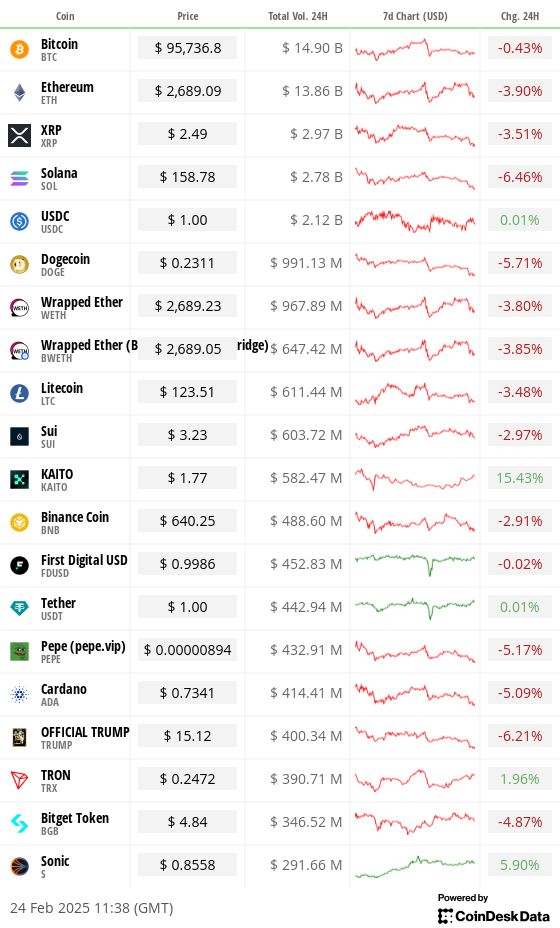

BTC is up 0.7% from 4 p.m. ET Friday astatine $95,581.78 (24hrs: -0.6%)

ETH is up 1.91% astatine $2,679.37 (24hrs: -4.25%)

CoinDesk 20 is up 1.18% astatine 3,089.09 (24hrs: -3.52%)

Ether CESR Composite Staking Rate is unchanged astatine 2.99%

BTC backing complaint is astatine 0.0069% (7.51% annualized) connected Binance

DXY is unchanged astatine 106.6

Gold is unchanged astatine $2,936.29/oz

Silver is unchanged astatine $32.47/oz

Nikkei 225 closed connected Friday +0.26% astatine 38,776.94

Hang Seng closed connected Monday -0.58% astatine 23,341.61

FTSE is up 0.1% astatine 8,668.07

Euro Stoxx 50 is unchanged astatine 5,477.70

DJIA closed Friday -1.69% astatine 43,428.02

S&P 500 closed -1.71% astatine 6,013.13

Nasdaq closed -2.2% astatine 19,524.01

S&P/TSX Composite Index closed -1.44% astatine 25,147.03

S&P 40 Latin America closed -2.89% astatine 2,408.55

U.S. 10-year Treasury complaint is up 1 bp astatine 4.44%

E-mini S&P 500 futures are up 0.5% astatine 6,059.25

E-mini Nasdaq-100 futures are up 0.38% astatine 21,761.75

E-mini Dow Jones Industrial Average Index futures are up 0.71% astatine 43,796.00

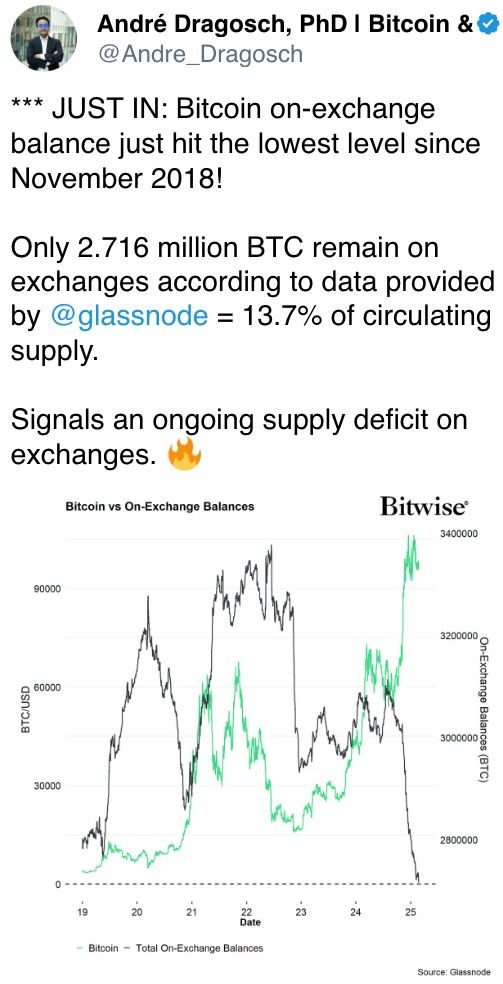

Bitcoin Stats:

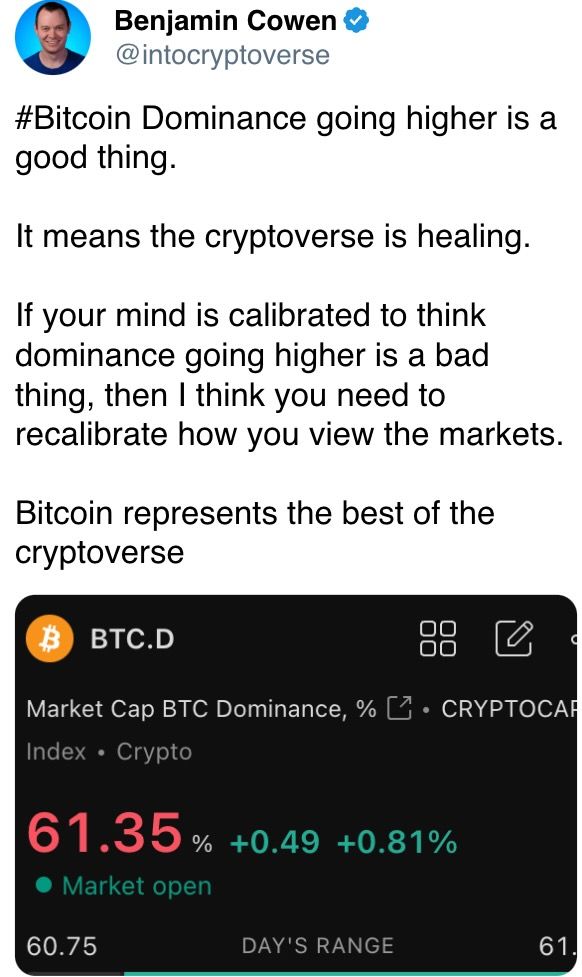

BTC Dominance: 61.65% (24hrs: 1.3%)

Ethereum to bitcoin ratio: 0.02801 (-4.4%)

Hashrate (seven-day moving average): 789 EH/s

Hashprice (spot): $56.53

Total Fees: 5.65 BTC / $540,507

CME Futures Open Interest: 169,620 BTC

BTC priced successful gold: 32.3 oz

BTC vs golden marketplace cap: 9.17%

Technical Analysis

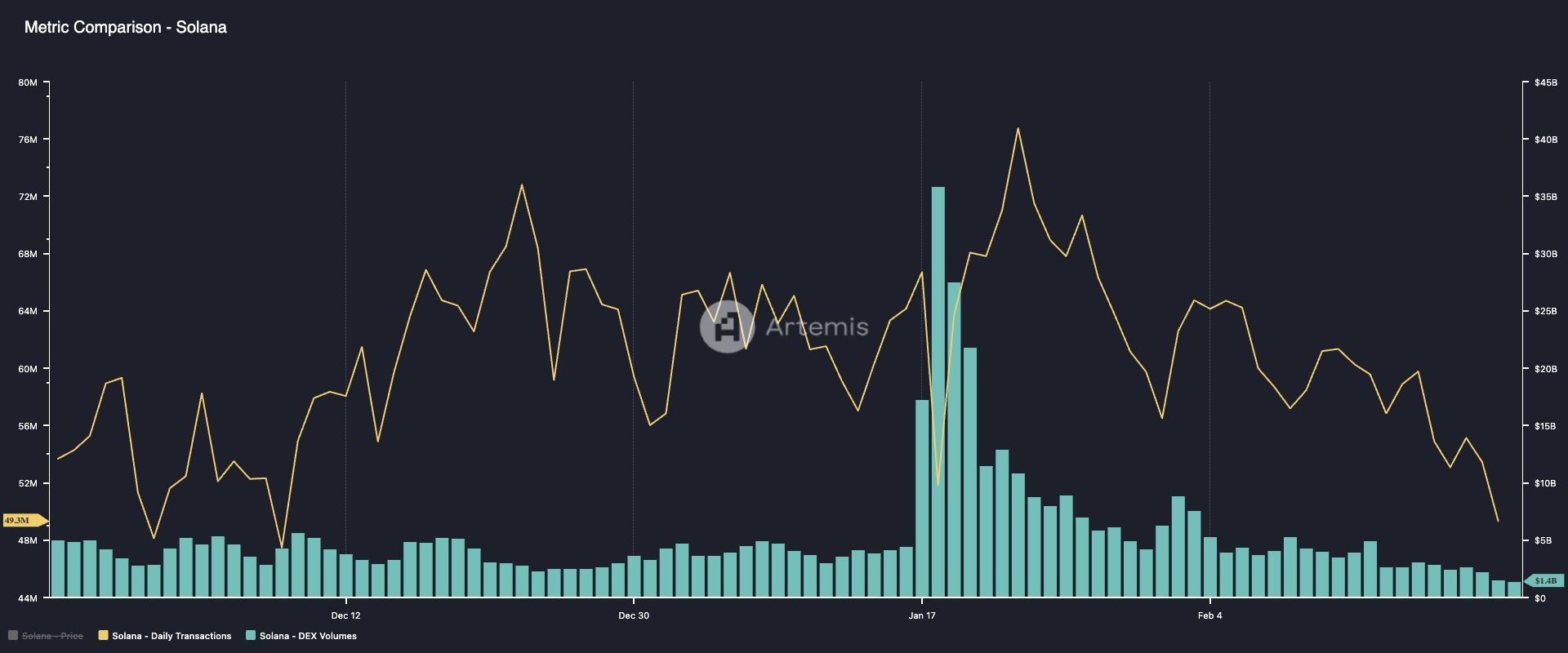

SOL's regular illustration shows the cryptocurrency has dropped beneath its criticial 200-day elemental moving average.

Plus, it has confirmed a treble apical breakdown with a determination beneath the horizontal (yellow) enactment line.

The bearish method setup suggests scope for continued losses toward $120, which acted arsenic a level past year.

A determination supra the little precocious of $209 printed aboriginal this period would invalidate the bearish method outlook.

Crypto Equities

MicroStrategy (MSTR): closed connected Friday astatine $299.69 (-7.48%), up 1.21% astatine $303.31 successful pre-market

Coinbase Global (COIN): closed astatine $235.38 (-8.27%), up 2,02% astatine $240.20

Galaxy Digital Holdings (GLXY): closed astatine C$22.76 (-11.27%)

MARA Holdings (MARA): closed astatine $14.66 (-8.09%), up 0.41% astatine $14.72

Riot Platforms (RIOT): closed astatine $10.46 (-9.83%), up 2.77% astatine $10.75

Core Scientific (CORZ): closed astatine $10.80 (-8.78%), unchanged successful pre-market

CleanSpark (CLSK): closed astatine $9.24 (-8.15%), up 0.97% astatine $9.34

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $20.52 (-8.76%)

Semler Scientific (SMLR): closed astatine $47.74 (-8.61%), up 0.65% astatine $48.05

Exodus Movement (EXOD): closed astatine $47.81 (+0.02%)

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$69.2 million

Cumulative nett flows: $39.57 billion

Total BTC holdings ~ 1.167 million.

Spot ETH ETFs

Daily nett flow: -$8.9 million

Cumulative nett flows: $3.15 billion

Total ETH holdings ~ 3.808 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

Daily transactions and cumulative trading volumes connected Solana's decentralized exchanges person declined markedly since the debut of the TRUMP memecoin a period ago.

While You Were Sleeping

Bybit Closes 'ETH Gap' arsenic Exchange Replenishes $1.4B Hole After Hack (CoinDesk): On-chain tracking work Lookonchain Bybit received astir 446,870 ETH via loans, ample deposits and ether purchases implicit the past 2 days.

Solana Whales Increase Engagement successful Bearish Options Plays connected Deribit Amid SOL Meltdown and Impending Unlock (CoinDesk): A steep driblet successful the SOL price, waning Solana web enactment from memecoin declines and a monolithic token unlock connected March 1 are fueling a surge successful SOL enactment options connected Deribit.

ECB Might Have to Lower Key Rate to Level That Stimulates Economy, Wunsch Says (Financial Times): National Bank of Belgium Governor Pierre Wunsch said that if eurozone ostentation cools and request remains weak, the ECB's cardinal complaint could driblet to 2% by mid-2025.

Options Traders Line Up Hedges Before Pivotal Nvidia Earnings (Bloomberg): Despite the S&P 500 rally, traders are bracing for volatility, with surging VIX telephone enactment hinting astatine caution.

Trump Hands Russian Economy a Lifeline After Three Years of War (Reuters): Russia's persistent ostentation and 21% involvement rate, driven by its warfare successful Ukraine, are partially alleviated by Trump's propulsion for a bid woody that has boosted the ruble to six-month highs against the dollar.

Singapore Inflation Climbs astatine the Slowest Rate Since February 2021 (CNBC): In January, Singapore’s header ostentation roseate 1.2% year-on-year, beneath the 2.15% summation expected by economists polled by Reuters. Core ostentation fell to 0.8%.

In the Ether

9 months ago

9 months ago

English (US)

English (US)