By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin (BTC) traded astir its 200-day mean of $84,000 arsenic the notorious Hyperliquid whale exited its multimillion dollar abbreviated BTC position. Smaller coins similar CAKE, TKX, OKB and ATOM contributed to marketplace optimism with affirmative performances.

The SUI token struggled to widen Monday's 6% surge, which was spurred by plus managers' ETF filings with the SEC, showcasing increasing organization involvement successful the wider crypto market.

While immoderate analysts declared the extremity of the bitcoin bull run, casting uncertainty astir the sustainability of the caller bounce, information indicated otherwise, pointing to exhaustion successful the ETF-led selling pressure.

On Monday, U.S.-based spot bitcoin ETFs attracted $275 cardinal successful capitalist funds, gathering connected Friday's $41 cardinal influx. That's the archetypal back-to-back inflows since Feb. 7, according to information tracked by Farside Investors.

"This information reinforces the communicative that ETF-driven selling unit is exhausting," said Valentin Fournier, an expert astatine BRN. "If this inclination continues, we could spot inflows gradually physique momentum, further supporting bitcoin’s price."

The Fed's complaint determination connected Wednesday could present volatility into the crypto marketplace with a dovish connection perchance spurring accrued risk-taking.

"Post-FOMC, bitcoin is expected to commercialized wrong the scope of $80,000 to $86,000 with 80% confidence, portion ethereum is projected to fluctuate betwixt $1,800 and $2,100 nether the aforesaid assurance level," according to Ryan Lee, main expert astatine Bitget Research. "These ranges bespeak imaginable movements tied to macroeconomic signals, capitalist sentiment, and broader fiscal conditions."

In accepted markets, European stocks edged higher earlier a German parliamentary ballot connected historical indebtedness reforms. Gold remained steadfast supra $3,000 per ounce, with BlackRock calling the yellowish metallic a amended diversifier than Treasury notes successful the ongoing macro environment.

Meanwhile, futures tied to the Nasdaq, S&P 500 and Dow traded unchanged to antagonistic amid reports that the Trump-Putin telephone regarding the Ukraine bid woody would instrumentality spot betwixt 13:00 and 15:00 GMT. Stay alert!

What to Watch

Crypto:

March 18: Zano (ZANO) hard fork web upgrade; this activates “ETH Signature enactment for off-chain signing and plus operations.”

March 20: Pascal hard fork web upgrade goes unrecorded connected the BNB Smart Chain (BSC) mainnet.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that volition absorption connected the explanation of a security.

March 24 (before marketplace open): Bitcoin miner CleanSpark (CLSK) volition join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis web upgrade goes unrecorded connected Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes unrecorded connected Chromia (CHR) mainnet.

Macro

March 18, 8:30 a.m.: Statistics Canada releases February user terms scale (CPI) data.

Core Inflation Rate MoM Prev. 0.4%

Core Inflation Rate YoY Prev. 2.1%

Inflation Rate MoM Est. 0.6% vs. Prev. 0.1%

Inflation Rate YoY Est. 2.1% vs. Prev. 1.9%

March 18, 8:30 a.m.: The U.S. Census Bureau releases February residential operation data.

Housing Starts Est. 1.38M vs. Prev. 1.366M

March 18, 11:00 p.m.: The Bank of Japan (BoJ) releases its monetary argumentation statement.

Interest Rate Est. 0.5% vs. Prev. 0.5%

March 19, 6:00 a.m.: Eurostat releases (final) February eurozone user terms scale (CPI) data.

Core Inflation Rate YoY Est. 2.6% vs. Prev. 2.7%

Inflation Rate MoM Est. 0.5% vs. Prev. -0.3%

Inflation Rate YoY Est. 2.4% vs. Prev. 2.5%

March 19, 2:00 p.m.: The Federal Reserve announces its involvement complaint decision. The FOMC property league is live-streamed 30 minutes later.

Fed Funds Interest Rate Est. 4.5% vs. Prev. 4.5%

March 19, 3:00 p.m.: Argentina's National Institute of Statistics and Census releases GDP data.

Full Year GDP Growth (2024) Prev. -1.6%

GDP Growth Rate QoQ (Q4) Prev. 3.9%

GDP Growth Rate YoY(Q4) Est. 1.7% vs. Prev. -2.1%

March 19, 5:30 p.m.: The Central Bank of Brazil announces its involvement complaint decision.

Selic Rate Est. 14.25% vs. Prev. 13.25%

Earnings (Estimates based connected FactSet data)

March 27: KULR Technology Group (KULR), post-market

March 28: Galaxy Digital Holdings (GLXY), pre-market

Token Events

Governance votes & calls

Arbitrum DAO is voting connected registering the “Sky Custom Gateway contracts” successful the “Router contracts” to alteration users to span USDS and sUSDS done the authoritative Arbitrum Bridge UI.

Frax DAO is voting on introducing the WisdomTree Government Money Market Digital Fund (WTGXX) arsenic an on-chain reserve for Frax USD.

March 18, 8 a.m.: Binance to big an AMA session with VP of Product Jeff Li and Binance Angel Victor Balaban.

March 18, 9 a.m.: NEAR Protocol to big a governance speech session.

March 21, 11:30 a.m.: Flare to big an X Spaces session connected Flare 2.0.

Unlocks

March 21: Immutable (IMX) to unlock 1.39% of circulating proviso worthy $13.96 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating proviso worthy $242.9 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating proviso worthy $27.47 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating proviso worthy $147.65 million.

April 3: Wormhole (W) to unlock 47.7% of its circulating proviso worthy $121.48 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating proviso worthy $11.28 million.

Token Listings

March 18: Jupiter (JUP) to beryllium listed connected Arkham.

March 18: Paws (PAWS) to beryllium listed connected Bybit.

March 18: Slingshot (SLING) to beryllium listed connected KuCoin.

March 19: Hamster Kombat (HMSTR) and DuckChain (DUCK) to beryllium listed connected Kraken.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 1 of 3: Digital Asset Summit 2025 (New York)

Day 1 of 3: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

Hackers attacked BNB Chain's Four.meme motorboat platform, exploiting caller meme tokens to drain liquidity by bypassing listing restrictions and creating unauthorized trading pairs connected PancakeSwap, siphoning disconnected funds astir 04:00 GMT.

The onslaught preempted Four.meme’s curated token launches, buying tiny token amounts pre-launch, adding liquidity to PancakeSwap pairs, and rug-pulling them, targeting fashionable tokens similar MubaraKing (87.90 BNB stolen) and others specified arsenic EDDY and Cocoro.

Four.meme suspended caller token launches and promised compensation for affected users, though nary astute declaration vulnerability was found. Leaked aboriginal transactions enabled the hacker’s front-running, according to expert Chaofan Shou.

The onslaught exploited a flawed token relation allowing transfers during the bonding curve stage, a recurring travel compartment manipulation issue, perchance affecting each Four.meme tokens contempt lone a fewer being deed owed to their popularity.

Derivatives Positioning

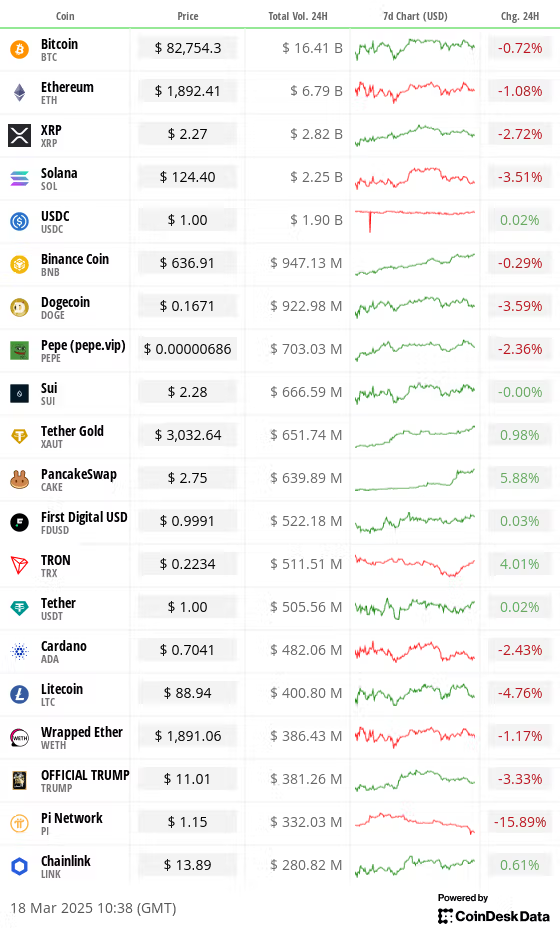

Open involvement successful ETH, LTC, XRP and SOL perpetual futures accrued successful the past 24 hours alongside a flat-to-negative cumulative measurement delta (CVD), indicating nett selling successful the market.

SOL, ADA and DOGE person besides seen antagonistic backing rates.

Both unfastened involvement and ground successful BTC and ETH CME futures stay depressed astatine caller lows, suggesting a deficiency of assurance among institutions to deploy capital.

Deribit's BTC and ETH options proceed to showcase enactment skews for expiries retired to extremity of April.

Market Movements:

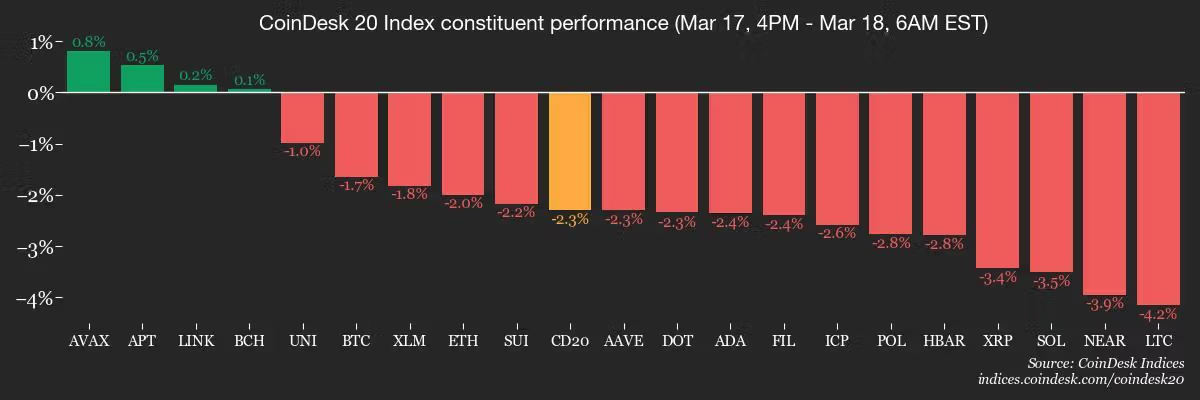

BTC is down 1.62% from 4 p.m. ET Monday astatine $82,676.40 (24hrs: -0.81%)

ETH is down 2.29% astatine $1,892.55 (24hrs: -1.1%)

CoinDesk 20 is down 2.25% astatine 2,582.56 (24hrs: -1.46%)

Ether CESR Composite Staking Rate is unchanged astatine 2.96%

BTC backing complaint is astatine 0.0036% (3.89% annualized) connected Binance

DXY is unchanged astatine 103.28

Gold is up 0.76% astatine $3,020.72/oz

Silver is up 0.82% astatine $34.07/oz

Nikkei 225 closed +1.2% astatine 37,845.42

Hang Seng closed +2.46% astatine 24,740.57

FTSE is up 0.44% astatine 8,715.59

Euro Stoxx 50 is up 0.85% astatine 5,491.99

DJIA closed connected Monday +0.85% astatine 41,841.63

S&P 500 closed +0.64% astatine 5,675.12

Nasdaq closed +0.31% astatine 17,808.66

S&P/TSX Composite Index closed +0.94% astatine 24,785.11

S&P 40 Latin America closed +1.76% astatine 2,475.69

U.S. 10-year Treasury complaint is down 1 bp astatine 4.31%

E-mini S&P 500 futures are down 0.29% astatine 5,715.75

E-mini Nasdaq-100 futures are down 0.38% astatine 19,963.00

E-mini Dow Jones Industrial Average Index futures are down 0.27% astatine 42,112.00

Bitcoin Stats:

BTC Dominance: 61.66 (-0.03%)

Ethereum to bitcoin ratio: 0.02285 (-0.31%)

Hashrate (seven-day moving average): 805 EH/s

Hashprice (spot): $47.08

Total Fees: 4.68 BTC / $386,699

CME Futures Open Interest: 151,030 BTC

BTC priced successful gold: 27 oz

BTC vs golden marketplace cap: 7.68%

Technical Analysis

The dollar index's (DXY) diminution continues with the cardinal 61.8% Fibonacci retracement enactment breached successful a affirmative motion for hazard assets.

The breakthrough has exposed the adjacent enactment astatine 102.32, representing the 78.6% Fibonacci level.

Crypto Equities

Strategy (MSTR): closed connected Monday astatine $294.27 (-1.08%), down 1.54% astatine $289.75 successful pre-market

Coinbase Global (COIN): closed astatine $188.96 (+3.19%), down 1.55% astatine $186.21

Galaxy Digital Holdings (GLXY): closed astatine C$17.35 (-3.5%)

MARA Holdings (MARA): closed astatine $12.97 (-1.59%), down 1.39% astatine $12.79

Riot Platforms (RIOT): closed astatine $7.76 (-0.77%), down 1.16% astatine $7.67

Core Scientific (CORZ): closed astatine $8.76 (-0.57%), down 0.8% astatine $8.69

CleanSpark (CLSK): closed astatine $8.12 (+1.88%), down 1.23% astatine $8.02

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $15.37 (+0.46%)

Semler Scientific (SMLR): closed astatine $36.03 (+4.89%), up 2.19% astatine $36.82

Exodus Movement (EXOD): closed astatine $32.35 (+15.33%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

Daily nett flow: $274.6 million

Cumulative nett flows: $35.67 billion

Total BTC holdings ~ 1,120 million.

Spot ETH ETFs

Daily nett flow: -$7.3 million

Cumulative nett flows: $2.53 billion

Total ETH holdings ~ 3.509 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

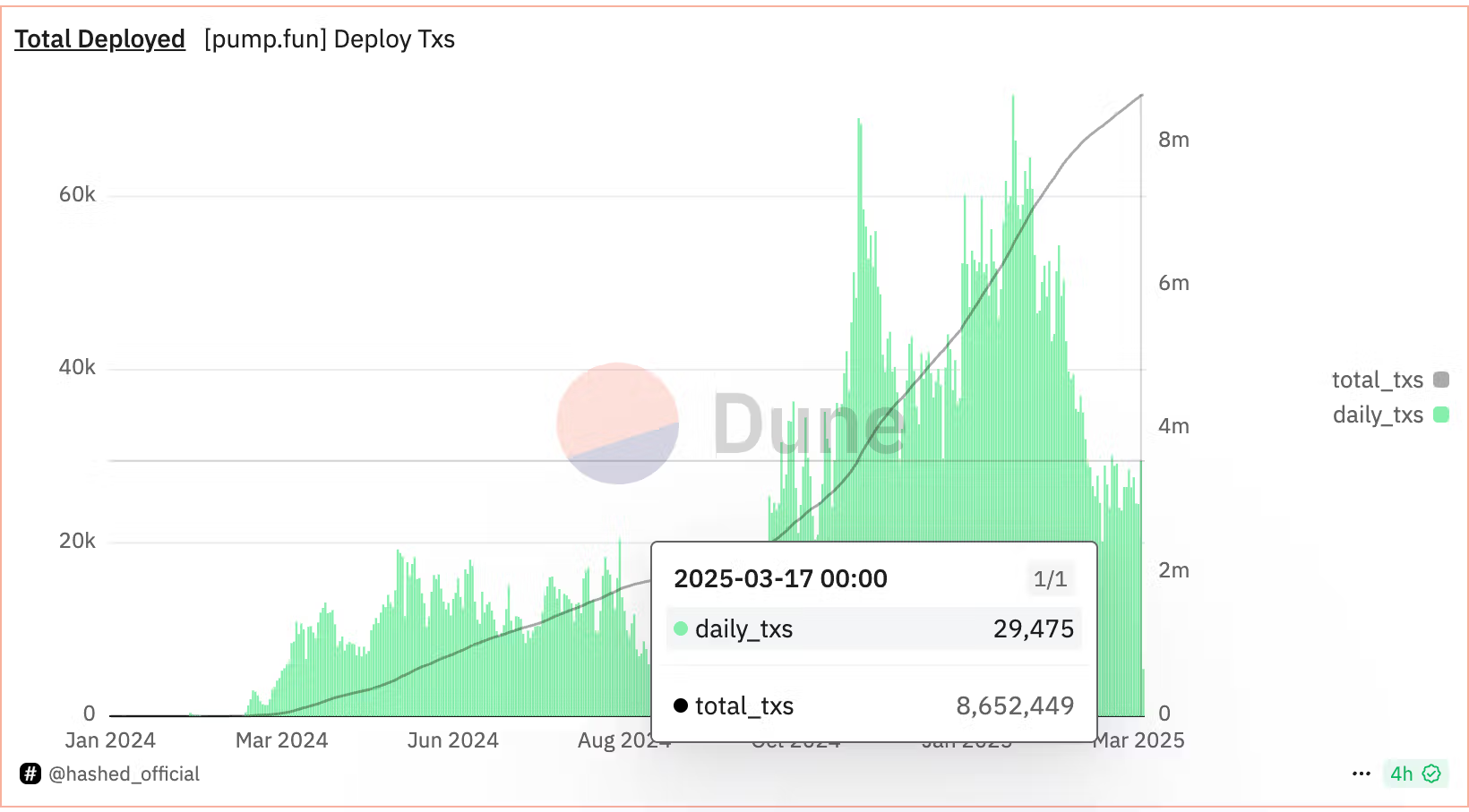

Pump.fun is simply a Solana-based marketplace wide utilized to make and administer tokens, chiefly memecoins.

Daily token deployment enactment cooled to 29,475 transactions connected Monday, down from 71,738 connected Jan. 23.

Its a motion that the broader marketplace descent has cooled speculative activities.

While You Were Sleeping

Bitcoin's Bull Market Cycle Is Over, CryptoQuant's Ki Young Ju Says (CoinDesk): Ki Young Ju forecasts 6-12 months of bearish oregon sideways terms enactment owed to declining marketplace liquidity successful a study suggesting BTC could driblet to $63,000.

Metaplanet Continues Bond Issuance for Bitcoin Buys (CoinDesk): The Japanese steadfast issued 2 cardinal yen ($13.4 million) successful zero-interest bonds utilizing immoderate of the proceeds to bargain 150 BTC for $12.5 million.

Bitcoin Storm Could Be Brewing, Crypto OnChain Options Platform Derive Says (CoinDesk): Derive warned that marketplace calm whitethorn beryllium short-lived, citing uncertainty implicit Ukraine’s ceasefire and imaginable regulatory shifts nether the Trump medication arsenic triggers for volatility.

German Bonds Fall Ahead of Historic Vote connected Fiscal Bazooka (Bloomberg): German enslaved yields roseate up of Tuesday’s parliamentary ballot connected a large spending bundle amid concerns implicit rising indebtedness issuance and ostentation risks.

Trump Team Explored Simplified Plan for Reciprocal Tariffs (The Wall Street Journal): Trump officials debated a simplified three-tier strategy for reciprocal tariffs earlier opting for an individualized approach, with the last program expected by April 2 alongside caller industry-specific duties.

Europe’s defence spending spree risks indebtedness crisis, warns Dutch politician (Financial Times): Pieter Omtzigt warned that the EU's 800 cardinal euro ($875 billion) defence program could pb to unsustainable indebtedness and perchance trigger different eurozone sovereign-debt crisis.

In the Ether

9 months ago

9 months ago

English (US)

English (US)