By Omkar Godbole (All times ET unless indicated otherwise)

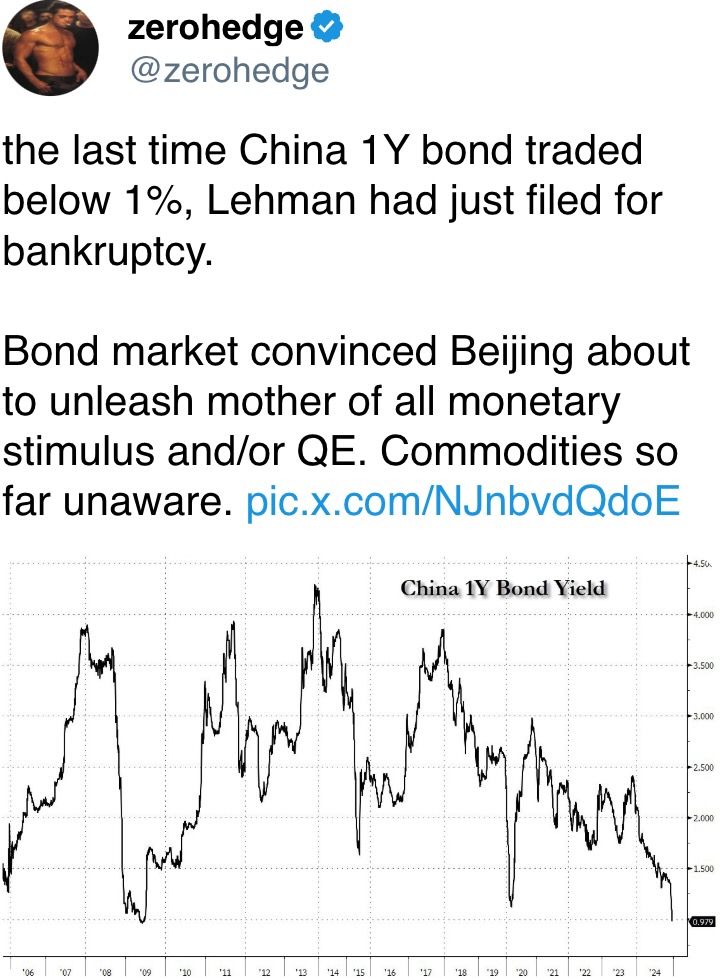

Keeping an oculus connected the Far East has been our mantra lately, and the latest quality from the Chinese enslaved marketplace shows why. Just today, China's one-year authorities enslaved output dropped below 1% for the archetypal clip since the Great Financial Crisis, adding to the year-to-date downturn. The benchmark 10-year output slipped to 1.7%.

How does that play retired for hazard assets similar bitcoin, which slumped overnight? Well, determination are 2 cardinal reasons to consciousness optimistic. For a start, the continued diminution successful yields suggests Beijing volition person to rotation retired much assertive stimulus measures than we saw earlier this year.

Jeroen Blokland, the laminitis and manager of the Blokland Smart Multi-Asset Fund, enactment it succinctly: “This indicates that China's economical troubles are acold from over, and the authorities volition bash what aging economies often do: ramp up authorities spending, let for larger deficits and higher indebtedness levels, and thrust involvement rates down toward zero.”

And there's much to consider. This concern successful China besides raises questions astir Fed Chairman Jerome Powell's caller alarm implicit involvement rates, which sent bitcoin tumbling to $95,000 from $105,000.

China, the world's factory, is facing worsening deflation having already experienced the longest agelong of falling prices since the precocious 1990s. That could headdress PPI and CPI readings worldwide, including successful the U.S., a large trading partner.

BNP Paribas noted this improvement earlier this year, with analysts saying that China has already contributed to lowering halfway ostentation successful the eurozone and the U.S. by astir 0.1 percent constituent and halfway goods ostentation by astir 0.5 percent point.

What this means is that Powell's concerns astir stubborn ostentation whitethorn beryllium unfounded and begs the question whether helium volition truly instrumentality to conscionable 2 complaint cuts for 2025 arsenic helium implied connected Wednesday? Many experts deliberation determination mightiness beryllium more.

“Fed concerns connected ostentation are misguided. Interest rates are inactive excessively precocious successful the U.S., and liquidity is astir to increase, driving Bitcoin higher,” said Dan Tapiero, CEO and CIO of 10T Holdings, on X, alluding to China's declining enslaved yields.

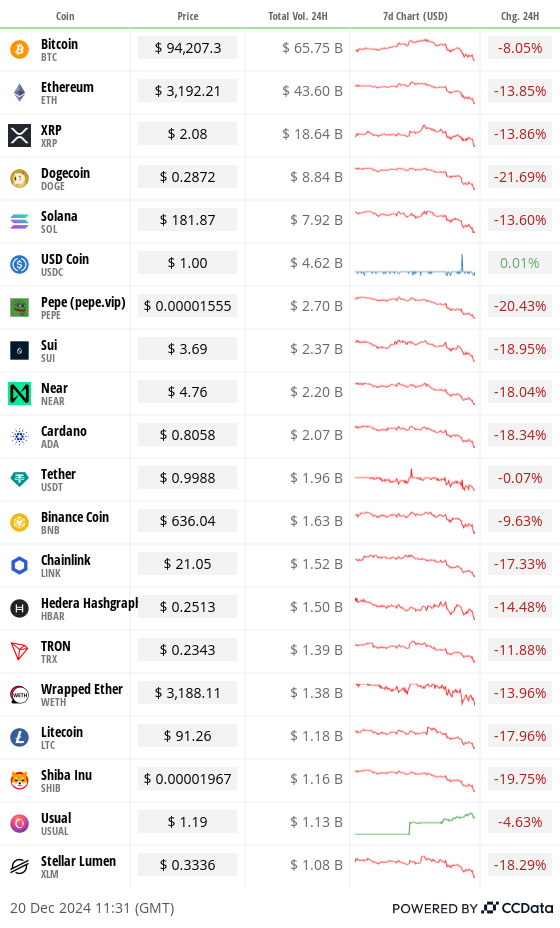

For now, markets aren't considering this bullish angle. BTC has dropped beneath $95,000 and ETH has slipped to $3,200. All the 100 biggest coins are flashing red. Futures tied to the S&P 500 are down 0.5%, indicating a antagonistic unfastened and continuation of the post-Fed risk-off.

Sentiment whitethorn worsen if the halfway PCE, the Fed's preferred ostentation gauge, comes successful hotter than expected aboriginal today. That mightiness spot markets terms retired different complaint cut, leaving conscionable 1 connected the array for 2025. Stay alert!

What to Watch

Crypto:

Dec. 23: MicroStrategy (MSTR) banal volition beryllium added to the Nasdaq-100 Index earlier the marketplace opens, making it portion of funds similar the Invesco QQQ Trust ETF that way the index.

Dec. 25, 10:00 p.m.: Binance plans to delist the WazirX (WRX) token. Two different tokens being delisted astatine the aforesaid clip are Kaon (AKRO) and Bluzelle (BLZ).

Dec. 30: The European Union's Markets successful Crypto-Assets (MiCA) Regulation becomes fully effective. The stablecoin provisions came into effect connected June 30.

Dec. 31: Crypto speech Gemini is shutting its operations successful Canada. In an email sent retired connected Sept. 30, it said each lawsuit accounts successful the state would beryllium closed astatine the extremity of the year.

Jan 3: Bitcoin Genesis Day. The 16th day of the mining of Bitcoin's archetypal block, oregon Genesis Block, by the blockchain's pseudonymous inventor Satoshi Nakamoto. This came astir 2 months aft helium published the Bitcoin achromatic paper successful an online cryptography mailing list.

Macro

Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November's Personal Income and Outlays report.

PCE Price Index YoY Est. 2.5% vs Prev. 2.3%.

Core PCE Price Index YoY Est. 2.9% vs Prev. 2.8%.

Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.

Token Events

Token Launches

Binance Alpha announced the 4th batch of tokens, including BANANA, KOGE, BOB, MGP, PSTAKE, GNON, Shoggoth, LUCE and ODOS. Binance Alpha is the pre-selected excavation for Binance listings.

Conferences:

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Shaurya Malwa Fartcoin (FART) conscionable touched $1 billion. The scatologically named AI cause token jumped implicit $1.1 cardinal successful marketplace headdress aboriginal Friday adjacent arsenic the broader marketplace saw a second-straight time of losses, becoming 1 of the fewer tokens successful the green.

FART's emergence is arsenic overmuch astir quality science arsenic economics. In a marketplace wherever cardinal investments are faltering, it has go a awesome of the absurd, a light-hearted rebellion against the grim fiscal forecasts.

Its level allows users to perchance taxable related-theme memes oregon jokes to gain tokens. It features a unsocial transactional strategy wherever each commercialized produces a integer flatuence sound.

People are investing not for the committedness of inferior oregon groundbreaking exertion but for the joyousness of the moment, the shared giggle implicit a coin whose sanction unsocial is capable to interruption the hostility of the day.

It isn't each astir the jokes, though. The token is portion of the rising AI cause crypto sector, 1 that claims to usage AI-powered entities to execute tasks connected blockchain networks autonomously nether a memecoin branding.

Derivatives Positioning

The BTC one-month ground has pulled backmost to 10% connected the CME portion the three-month ground has dropped to astir 12% connected offshore exchanges. ETH futures show akin behavior.

Most large tokens are showing antagonistic perpetual cumulative measurement deltas for the past 24 hours, a motion of nett selling pressure. DOGE has seen the astir aggravated selling.

Front-end BTC and ETH amusement a beardown enactment bias, but calls expiring connected Jan. 31 and beyond proceed to commercialized astatine a premium.

Block trades successful options leaned somewhat bearish, with ample transactions involving a standalone agelong presumption successful the $75K enactment expiring connected Jan. 31.

Someone sold a ample magnitude of ETH $3K put.

Market Movements:

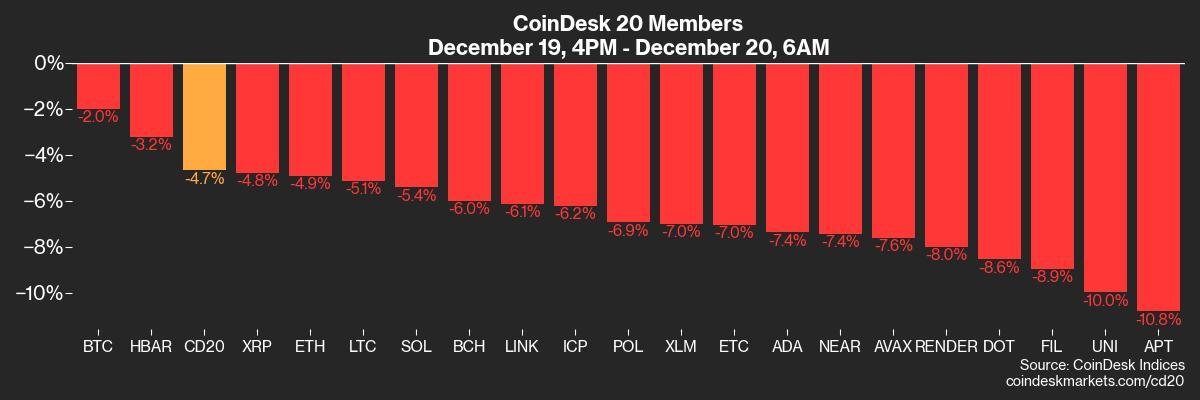

BTC is down 2.55% from 4 p.m. ET Thursday to $94,947.95 (24hrs: -7.92%)

ETH is down 5.41% astatine $3,232.19 (24hrs: -14.06%)

CoinDesk 20 is down 5.14% to 3,196.80 (24hrs: -13.12%)

Ether staking output is up 7 bps to 3.19%

BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

DXY is down 0.25% astatine 108.14

Gold is up 1.11% astatine $2,621.1/oz

Silver is up 0.65% to $29.28/oz

Nikkei 225 closed -0.29% astatine 38,701.90

Hang Seng closed -0.16% astatine 19,720.70

FTSE is down 1.05% astatine 8,020.42

Euro Stoxx 50 is down 1.36% astatine 4,812.53

DJIA closed connected Thursday unchanged astatine 42,342.24

S&P 500 closed unchanged astatine 5,867.08

Nasdaq closed -0.1% astatine 19,372.77

S&P/TSX Composite Index closed -0.58% astatine 24,413.90

S&P 40 Latin America closed +0.40% astatine 2,187.98

U.S. 10-year Treasury is down 0.03% astatine 4.54%

E-mini S&P 500 futures are down 0.79% to 5,822.25

E-mini Nasdaq-100 futures are unchanged astatine 21,112.25

E-mini Dow Jones Industrial Average Index futures are down 0.53% astatine 42,134.00

Bitcoin Stats:

BTC Dominance: 59.21 (24hrs: +0.58%)

Ethereum to bitcoin ratio: 0.034 (24hrs: -1.37%)

Hashrate (seven-day moving average): 785 EH/s

Hashprice (spot): $62.5

Total Fees: $2.3 million

CME Futures Open Interest: 211,885 BTC

BTC priced successful gold: 36.3 oz

BTC vs golden marketplace cap: 10.34%

Bitcoin sitting successful over-the-counter table balances: 409,300 BTC

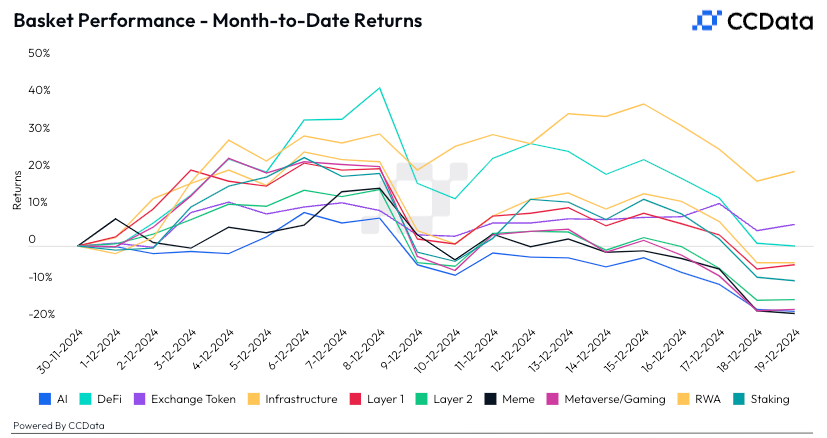

Basket Performance

Technical Analysis

BTC is accelerated approaching the little extremity of the caller expanding transmission pattern.

A UTC adjacent beneath the enactment enactment could entice much chart-driven sellers to the market, perchance starring to a deeper driblet to $80,000, a level wide watched aft the U.S. election.

Crypto Equities

MicroStrategy (MSTR): closed connected Thursday astatine $326.46 (-6.63%), down 5.35% astatine $309.00 successful pre-market.

Coinbase Global (COIN): closed astatine $273.92 (-2.12%), down 5.65% astatine $258.43 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$24.75 (-5.93%)

MARA Holdings (MARA): closed astatine $20.37 (-5.74%), down 4.52% astatine $19.41 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.19 (-6.36%), down 4.2% astatine $10.72 successful pre-market.

Core Scientific (CORZ): closed astatine $14.48 (+0.21%), down 4.42% astatine $13.84 successful pre-market.

CleanSpark (CLSK): closed astatine $10.91 (-3.62%), down 3.94% astatine $10.48 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $24.45 (-5.56%), down 2.66% astatine $23.80 successful pre-market.

Semler Scientific (SMLR): closed astatine $61.34 (-5.66%), down 4.22% astatine $58.75 successful pre-market.

Exodus Movement (EXOD): closed astatine $50.95 (-4.05%), unchanged successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$671.9 million

Cumulative nett flows: $36.310 billion

Total BTC holdings ~ 1.142 million.

Spot ETH ETFs

Daily nett flow: -$60.5 million

Cumulative nett flows: $2.406 billion

Total ETH holdings ~ 3.565 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

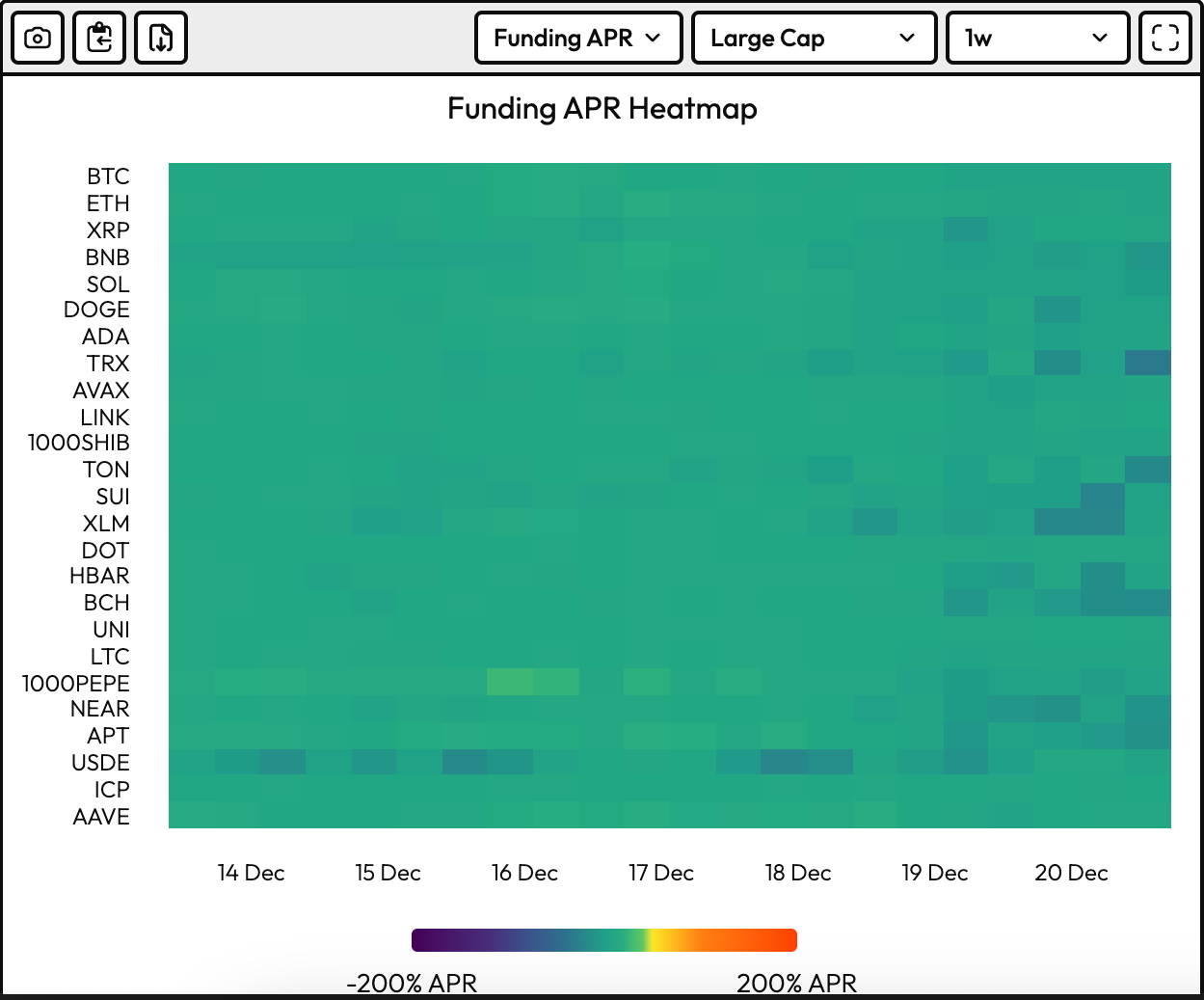

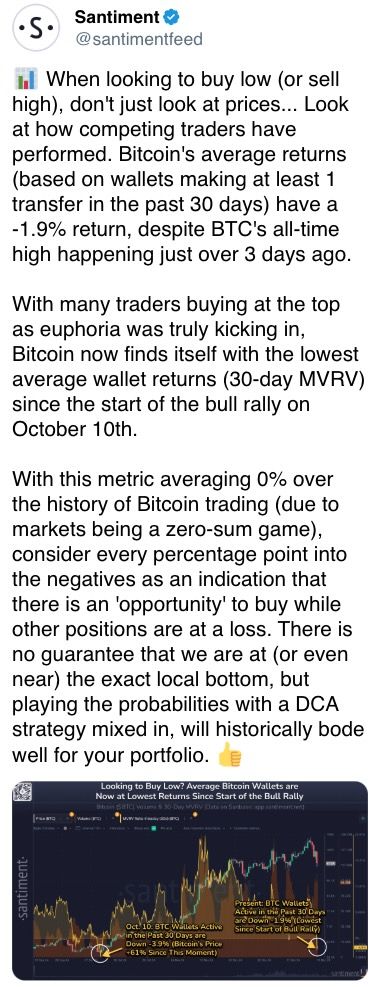

The illustration shows annualized perpetual backing rates for large cryptocurrencies person been reset to healthier levels beneath 10%.

The marketplace swoon has cleared retired over-leveraged bets.

While You Were Sleeping

Dogecoin's 11% Drop Leads Losses successful Crypto Majors arsenic Bitcoin Sours Festive Mood (CoinDesk): Bitcoin fell aboriginal Friday, extending its three-day post-FOMC slump arsenic hawkish Fed signals and overbought conditions triggered a sell-off. DOGE led declines among the 10 biggest cryptocurrencies.

Dozens of House Republicans Defy Trump successful Test of His Grip connected GOP (The New York Times): President-elect Donald Trump’s power implicit his enactment failed a trial connected Thursday arsenic 38 blimpish House Republicans ignored his threats and rejected a measure to widen national spending into 2025 and suspend the indebtedness bounds until 2027.

As Bitcoin's Post-Fed Price Dip Extends, This Key Contrary Indicator Offers Fresh Hope: Godbole (CoinDesk): Bitcoin’s driblet beneath $96,000 triggered a cardinal contrary indicator—the 50-hour SMA crossing beneath the 200-hour SMA—suggesting imaginable for a renewed rally supra $100,000, though risks of further declines remain.

Hedge Funds Cash In connected Trump-Fuelled Crypto Boom (Financial Times): Crypto hedge funds surged successful November with 46 percent monthly and 76 percent year-to-date gains, arsenic Trump’s predetermination triumph fueled bitcoin’s emergence past $100,000, making Brevan Howard and Galaxy Digital standout performers.

EM Central Banks Ramp Up Currency Defense arsenic Dollar Surges Ahead (Bloomberg): Emerging-market cardinal banks are deploying assertive measures, similar Brazil’s $14 cardinal involution and South Korea’s eased FX rules, to antagonistic a surging dollar that’s raising import costs and escalating indebtedness risks.

Japan Consumer Prices Rise Faster arsenic Rate Hike Timing Under Scrutiny (The Wall Street Journal): Japan’s ostentation roseate to 2.9 percent successful November, driven by vigor and nutrient prices and fueling complaint hike expectations, though subdued work ostentation and cautious BOJ messaging could hold enactment until March.

In the Ether

9 months ago

9 months ago

English (US)

English (US)