By Francisco Rodrigues (All times ET unless indicated otherwise)

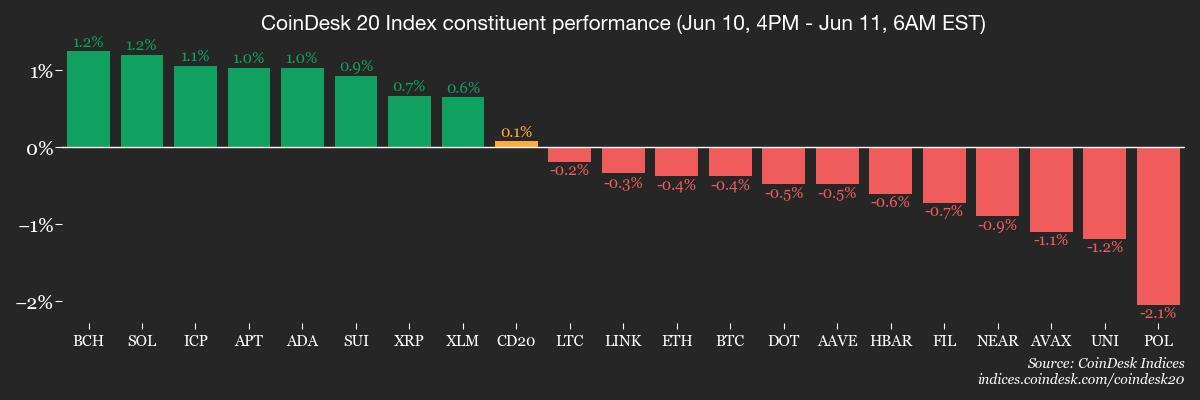

Bitcoin (BTC) concisely roseate past $110,000 aft headlines retired of London pointed to advancement successful U.S.-China commercialized negotiations. It's present dropped backmost to stay small changed implicit 24 hours portion the CoinDesk 20 (CD20) scale roseate 2%, suggesting a rotation into altcoins.

One origin keeping bitcoin astatine bay and the penchant for altcoins mightiness beryllium that the statement retired of London remains tentative, inactive needing sign-off from some Presidents Donald Trump and Xi Jinping.

In accepted markets, the absorption was besides mixed. Asian equities rose, with the Hang Seng scale adding 0.8%, European banal indexes gained little than 0.2% and U.S. scale futures pointed down.

“There’ve been respective twists and turns already, and markets are getting reasonably utilized to this uncertainty by now,” Deutsche Bank strategist Jim Reid said.

Meantime, investors are preparing for a caller batch of ostentation data. The U.S. Consumer Price Index (CPI) study owed aboriginal contiguous is expected to amusement a 0.3% summation successful halfway ostentation for May, with yearly halfway ostentation rising to 2.9%. Producer terms data, which volition travel tomorrow, is besides forecast to climb.

Among altcoins, ether (ETH) is showing quieter but perchance much meaningful strength. Options markets suggest traders are positioning for upside, with front-end volatility spiking and telephone options gaining favor, according to analysts astatine hedge money QCP Capital.

Add to that the $450 cardinal successful ether ETF inflows logged truthful acold this month, and there's a proposition of increasing capitalist appetite. The displacement is underpinned by the Ethereum blockchain’s expanding relation arsenic infrastructure for tokenized real-world assets.

“Looking ahead, macro tailwinds are aligning for ETH," the QCP Capital analysts wrote. "With the GENIUS Act advancing successful the U.S. Senate, Circle’s IPO discussions resurfacing, and stablecoins gaining regulatory traction, Ethereum’s autochthonal relation successful tokenization and colony rails whitethorn beryllium primed for outsized structural upside.”

Nevertheless, the CPI study is apt to predominate the conversation. A hotter-than-expected speechmaking could reenforce concerns that ostentation whitethorn stay sticky into the coming months, reducing the accidental of a Fed interest-rate chopped and perchance prompting a renewed tally for hedges similar gold.

If the information comes successful cooler, it could unfastened the doorway for hazard assets, including crypto, to widen their gains. Stay alert!

What to Watch

- Crypto

- June 11, 7 a.m.: Stratis (STRAX) activates mainnet hard fork astatine artifact 2,587,200 to alteration the Masternode Staking protocol.

- June 12, 10 a.m.: Coinbase's State of Crypto Summit 2025 (New York). Livestream link.

- June 16: 21Shares executes a 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- June 16: Brazil’s B3 speech launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) and benchmarked to Nasdaq indices.

- Macro

- June 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases May user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 2.9% vs. Prev. 2.8%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.2%

- Inflation Rate YoY Est. 2.5% vs. Prev. 2.3%

- June 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases May shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.4%

- Core PPI YoY Est. 3.1% vs. Prev. 3.1%

- PPI MoM Est. 0.2% vs. Prev. -0.5%

- PPI YoY Est. 2.6% vs. Prev. 2.4%

- June 12, 3 p.m.: Argentina’s National Institute of Statistics and Census releases May ostentation data.

- Inflation Rate MoM Prev. 2.8%

- Inflation Rate YoY Prev. 47.3%

- June 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases May user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market

Token Events

- Governance votes & calls

- ApeCoin DAO is weighing scrapping the decentralized autonomous organization and launching ApeCo to “supercharge the APE ecosystem.”

- Optimism DAO is voting to o.k. eligibility criteria for the Milestones and Metrics (M&M) Council successful Seasons 8 and 9, introducing a exemplary where members are selected “based connected competencies alternatively than elections.” Voting ends June 11.

- June 11, 7 a.m.: Cronos Labs ead Mirko to enactment successful a assemblage Ask Me Anything (AMA) session.

- Unlocks

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $57.11 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $12.82 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $17.97 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $11.31 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating proviso worthy $36.91 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating proviso worthy $43.30 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $11.20 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- Day 2 of 3: Ripple's Apex 2025 (Singapore)

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Oliver Knight

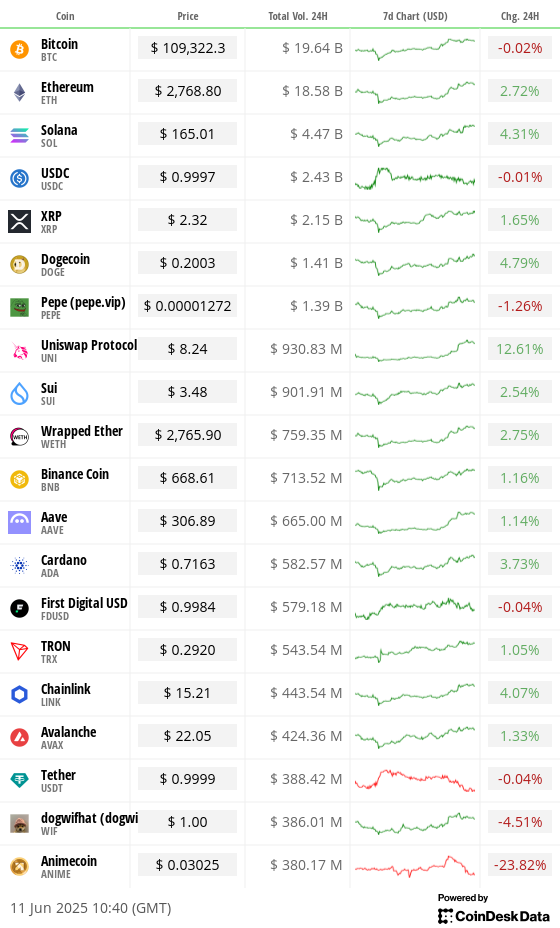

- ETF expert Eric Balchunas predicted an "altcoin ETF summer" with the support of a SOL, LTC and XRP exchange-traded funds.

- The prediction comes arsenic the altcoin marketplace rebounded this week with ether (ETH) starring the pack.

- CoinMarketCap's altcoin play index has risen to 31 from 17 successful the past 12 days. The maximum speechmaking is 100.

- ETH trading besides dominated derivatives markets: Coinglass information shows that much than $111 cardinal worthy of ETH contracts changed hands implicit the past 24 hours, portion BTC's declaration trading measurement conscionable topping $87.5 billion.

- Ether besides experienced $131 cardinal worthy of liquidations, much than treble bitcoin's total.

- ETH is presently trading astatine $2,760, up 2.5% successful the past 24 hours portion bitcoin is small changed.

Derivatives Positioning

- BTC options unfastened involvement (OI) deed $36.0B connected Deribit, different June high. The $140K onslaught remains the astir active, with $1.8B notional, and the 27 June expiry continues to clasp the bulk of positioning astatine $13.9B.

- Calls marque up 63% of OI, with the put/call ratio astatine 0.58 according to Deribit.

- ETH options OI roseate to $6.6B, with the $3K onslaught holding $521M notional. The 27 June expiry leads with $2.4B, and calls relationship for 70% of unfastened interest. The put/call ratio sits astatine 0.43 based connected Deribit data, a much bullish skew than BTC.

- Futures OI crossed Binance, Bybit, OKX, Deribit and Hyperliquid climbed to $57.5B, marking the highest level since precocious January, according to Velo data. Binance leads with $24.3B. Funding complaint APR remains broadly positive, with BTC astatine 9.8% connected Binance and ETH astatine 10.95% connected mean crossed large exchanges.

- Actual 24-hour liquidations totaled $310.7M, led by $125.7M successful ETH (split $48.1M long, $77.6M short) and $55.4M successful BTC (evenly divided betwixt $27.5M longs and $27.9M shorts), according to Coinglass. ETH saw the bulk of trader wipeouts.

Market Movements

- BTC is down 0.62% from 4 p.m. ET Tuesday astatine $109,259.01 (24hrs: -0.03%)

- ETH is down 0.65% astatine $2,755.53 (24hrs: +2.57%)

- CoinDesk 20 is down 0.32% astatine 3,262.46 (24hrs: +1.88%)

- Ether CESR Composite Staking Rate is down 4 bps astatine 3.05%

- BTC backing complaint is astatine 0.0077% (8.4063% annualized) connected Binance

- DXY is down 0.06% astatine 99.03

- Gold futures are up 0.37% astatine $3,355.80

- Silver futures are down 0.58% astatine $36.43

- Nikkei 225 closed up 0.55% astatine 38,421.19

- Hang Seng closed up 0.84% astatine 24,366.94

- FTSE is small changed astatine 8,857.58

- Euro Stoxx 50 is small changed astatine 5,419.20

- DJIA closed connected Tuesday up 0.25% astatine 42,866.87

- S&P 500 closed up 0.55% astatine 6,038.81

- Nasdaq Composite closed up 0.63% astatine 19,714.99

- S&P/TSX Composite closed up 0.19% astatine 26,426.31

- S&P 40 Latin America closed up 0.52% astatine 2,588.16

- U.S. 10-Year Treasury complaint is up 2 bls astatine 4.5%

- E-mini S&P 500 futures are down 0.19% astatine 6,033.75

- E-mini Nasdaq-100 futures are down 0.17% astatine 21,925.25

- E-mini Dow Jones Industrial Average Index are down 0.19% astatine 42,829.00

Bitcoin Stats

- BTC Dominance: 64.03 (-0.07%)

- Ethereum to bitcoin ratio: 0.02531 (-0.90%)

- Hashrate (seven-day moving average): 900 EH/s

- Hashprice (spot): $54.6

- Total Fees: 5.34 BTC / $585,384

- CME Futures Open Interest: 151,010 BTC

- BTC priced successful gold: 32.6 oz

- BTC vs golden marketplace cap: 9.24%

Technical Analysis

- Ethereum remains the strongest performer among the BTC, ETH and SOL trio, closing supra scope highs aft breaking done the $2,800 level yesterday.

- The terms is inactive trading successful the regular orderblock of supply, which has capped the terms since May.

- A steadfast pullback could spot terms revisit the regular just worth spread astir $2,650 — an country that bulls volition apt oculus for a imaginable higher low, particularly with the U.S. CPI information connected platform aboriginal today.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $391.18 (-0.24%), -0.81% astatine $388 successful pre-market

- Coinbase Global (COIN): closed astatine $254.94 (-0.66%), unchanged successful pre-market

- Circle (CRCL): closed astatine $105.91 (-8.1%), +2.17% astatine $108.01

- Galaxy Digital Holdings (GLXY): closed astatine C$27.35 (-4.3%)

- MARA Holdings (MARA): closed astatine $16.49 (+1.35%), 0.3% astatine $16.44

- Riot Platforms (RIOT): closed astatine $10.45 (+3.26%), -0.1% astatine $10.44

- Core Scientific (CORZ): closed astatine $12.77 (+0.47%), -1.8% astatine $12.54

- CleanSpark (CLSK): closed astatine $10.13 (+0.1%), -0.3% astatine $10.10

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $20.28 (+0.6%)

- Semler Scientific (SMLR): closed astatine $31.5 (-7.33%)

- Exodus Movement (EXOD): closed astatine $33.75 (+16.34%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs

- Daily nett flow: $431.2 million

- Cumulative nett flows: $45.04 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily nett flow: $125 million

- Cumulative nett flows: $3.52 billion

- Total ETH holdings ~ 3.79 million

Source: Farside Investors

Overnight Flows

Chart of the Day

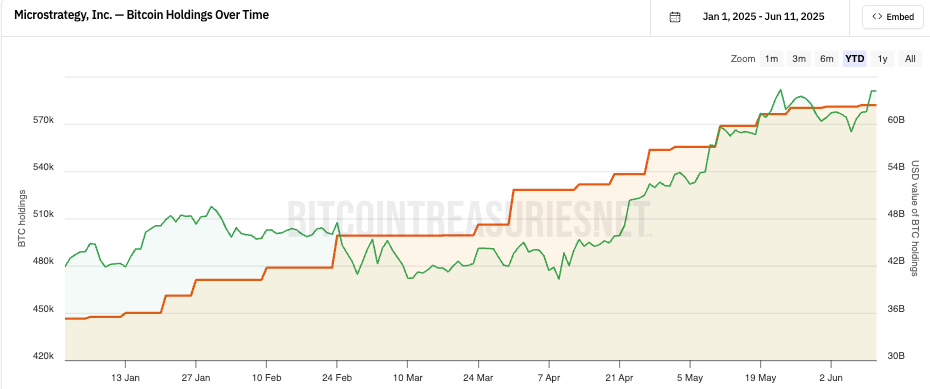

- Strategy (MSTR) added 1,045 BTC to its holdings earlier this week, expanding its treasury holdings to 582,000 BTC.

While You Were Sleeping

- U.S. and China Agree to Resume Trade Truce After Tensions Escalated (The New York Times): A model to beryllium presented Wednesday to Trump and Xi restores China’s exports of uncommon world minerals and magnets to the U.S., resolving a cardinal quality successful caller commercialized talks.

- US Marines Arrive successful LA; California Governor Warns ‘Democracy Under Assault’ (Reuters): Marines are positioned adjacent Los Angeles awaiting imaginable deployment amid Trump’s migration crackdown. The politician imposed a multi-day downtown curfew from 8 p.m. to 6 a.m. aft concern looting.

- Peter Thiel-Backed Crypto Group Bullish Files for Wall Street IPO (Financial Times): Bullish confidentially filed for a U.S. IPO to pat Trump-era crypto tailwinds, with Jefferies named arsenic the pb underwriter.

- XRP Ledger's Ethereum-Compatible Sidechain to Go Live successful Q2 (CoinDesk): Peersyst Technologies says the XRPL EVM sidechain testnet, launched earlier this year, is increasing rapidly. Once the sidechain launches connected mainnet, it could alteration users to gain output via DeFi applications.

- Appeals Court Keeps Trump’s Sweeping Tariffs successful Place for Now (The Wall Street Journal): The U.S. Court of Appeals paused a national commercialized court's ruling striking down Trump’s tariffs and scheduled afloat arguments for July 31.

- Dollar Divorce? Asia’s Shift Away From the U.S. Dollar Is Picking Up Pace (CNBC): Sanctions risk, commercialized argumentation unpredictability and a weakening dollar are accelerating de-dollarization arsenic the Association of Southeast Asian Nations pledges to grow section currency usage successful determination commercialized and investment.

In the Ether

3 months ago

3 months ago

English (US)

English (US)