By Omkar Godbole (All times ET unless indicated otherwise)

If you were looking guardant to a quiescent Christmas distant from your computer, expecting bitcoin to emergence steadily done the year-end, hide it. Looks similar the Fed has dashed those plans.

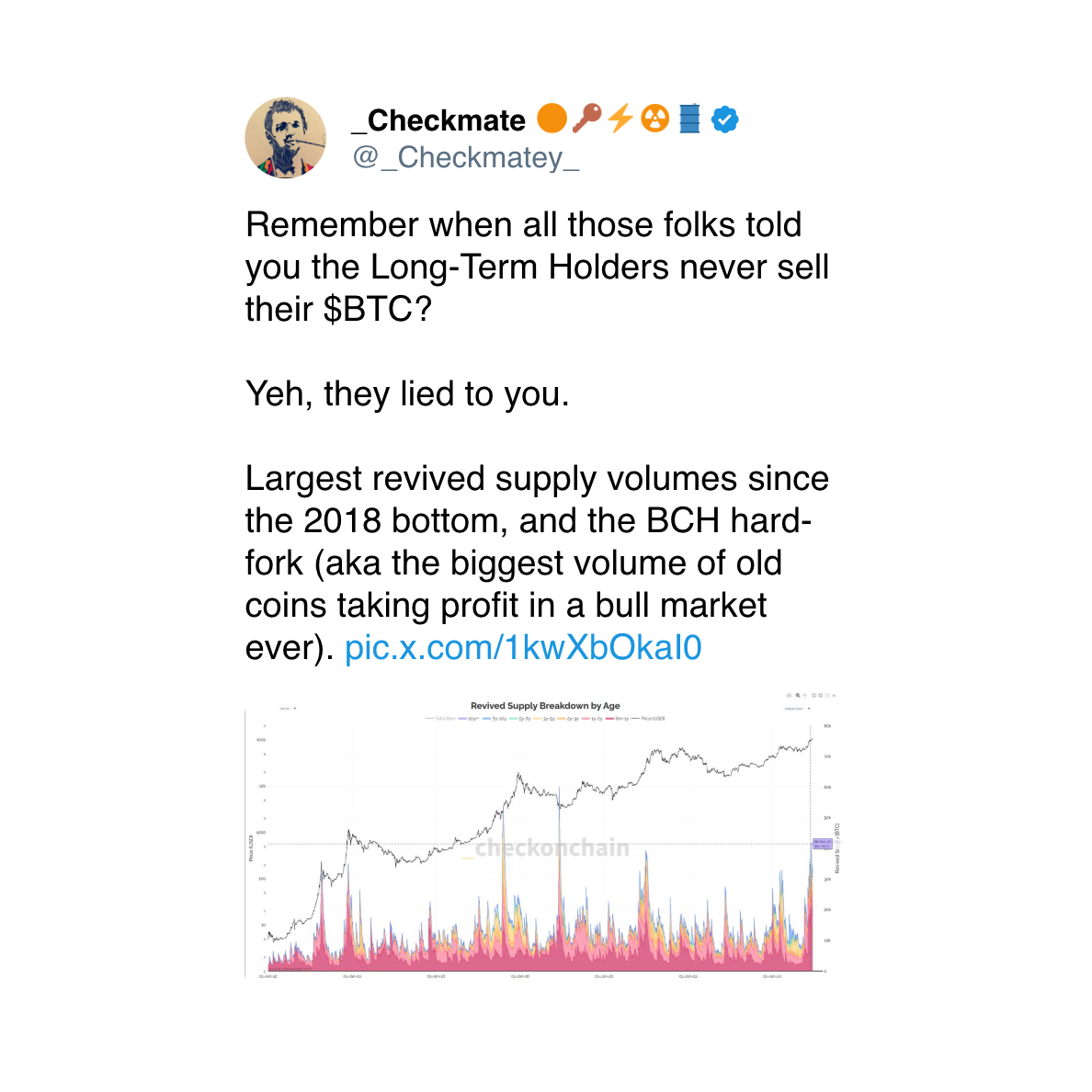

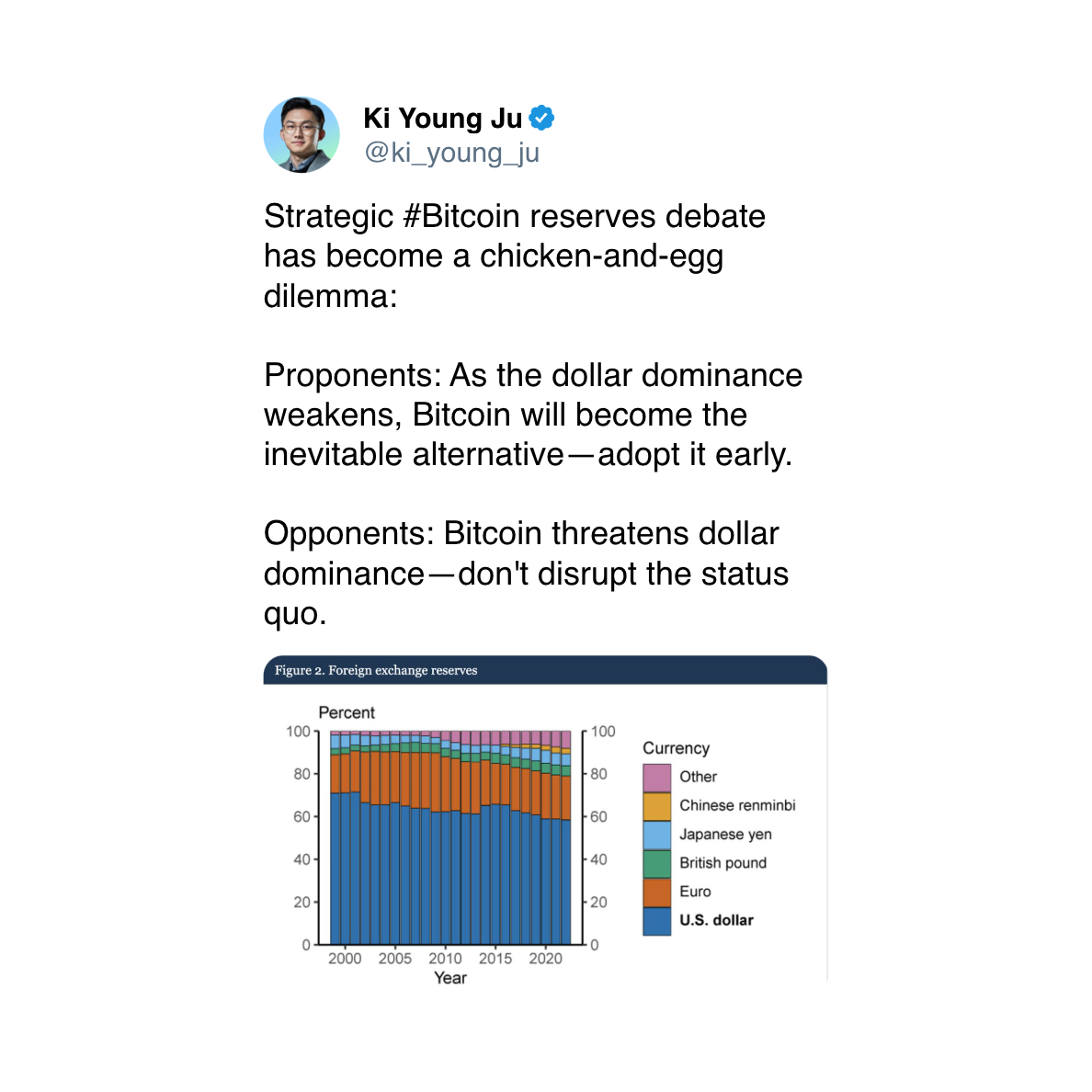

First of all, Chair Jerome Powell's comments distancing the cardinal slope from President-elect Donald Trump's imaginable instauration of a strategical bitcoin reserve mean traders hoping for 1 volition request immoderate coagulated reassurance. Many are apt to beryllium connected the sidelines until the caller medication makes bully connected its promises. That volition weaken the market's bid broadside until Trump takes bureau connected Jan. 20.

The 2nd interest revolves astir complaint projections. Fed officials are anticipating conscionable 2 complaint cuts successful 2025, saying they spot the benchmark borrowing outgo dropping to 3.9% successful 12 months' clip from the existent 4.25%-4.5% range. That is simply a 50 basis-point upward revision from an earlier forecast of 3.40%.

The marketplace could rapidly question a chopped to beneath 4% should incoming information constituent to sticky ostentation and/or labour marketplace strength. This concern has led to concerns that long-end rates, including the 10-year yield, mightiness beryllium excessively low, according to ING.

Interestingly, the 10-year output has conscionable breached retired of a 14-month downward inclination that characterized bitcoin's bull tally to implicit $100,000 from $30,000. A further emergence successful yields could bolster the already beardown portion triggering a broader diminution successful hazard assets, including BTC. Bitcoin dipped beneath $100,000 overnight and dragged the broader marketplace down on with it.

This output breakout poses peculiar concerns for ether, often viewed arsenic an "internet bond" with an annualized staking output of astir 3%, weakening the lawsuit for a sustained bounce successful the ETH-BTC ratio. The continued diminution successful risk-sensitive assets similar the Australian and New Zealand dollars and emerging-market currencies, partially reflecting worries astir the Chinese economy, besides signals caution.

Still, pullbacks of 20% oregon much are emblematic successful crypto bull markets, and the wide outlook remains positive.

"Looking ahead, heightened volatility is connected the skyline arsenic markets set to the expectations surrounding Donald Trump’s presidency. Although short-term turbulence whitethorn occur, the semipermanent outlook for Bitcoin and Ether remains bullish," said Valentin Fournier, an expert astatine BRN.

In this uncertain climate, traders mightiness question refuge successful high-yielding crypto assets similar Ethena's USDe, which offers returns of astir 12%. Pseudonymous expert OxJeff suggests these pullbacks could contiguous a aureate accidental to put successful tokens linked to AI-powered systems successful the blockchain space. Candidates to ticker see AI16Z, ZEREBRO, VIRTUAL, MODE, and DOLOS. Stay alert!

What to Watch

Crypto:

Dec. 19, 12:00 p.m.: Coinbase is delisting BiT Global’s wrapped Bitcoin (wBTC) token, pursuing a determination it announced connected Nov. 19 and Wednesday's tribunal ruling.

Dec. 23: MicroStrategy (MSTR) banal volition beryllium added to the Nasdaq-100 Index earlier the marketplace opens, making it portion of funds similar the Invesco QQQ Trust ETF that way the index.

Dec. 25, 10:00 p.m.: Binance plans to delist the WazirX (WRX) token. Two different tokens being delisted astatine the aforesaid clip are Kaon (AKRO) and Bluzelle (BLZ).

Dec. 30: The European Union's Markets successful Crypto-Assets (MiCA) Regulation becomes fully effective. The stablecoin provisions came into effect connected June 30.

Dec. 31: Crypto speech Gemini is shutting its operations successful Canada. In an email sent retired connected Sept. 30, it said each lawsuit accounts successful Canada would beryllium closed astatine the extremity of the year.

Jan 3: Bitcoin Genesis Day. The 16th day of the mining of Bitcoin's archetypal block, oregon Genesis Block, by the blockchain's pseudonymous inventor Satoshi Nakamoto. This came astir 2 months aft helium published the Bitcoin achromatic paper successful an online cryptography mailing list.

Macro

Dec. 19, 7:00 a.m.: The Monetary Policy Committee (MPC) of the Bank of England (BoE) announces its interest-rate decision. Bank Rate Est. 4.75% vs Prev. 4.75%.

Dec. 19, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases third-quarter GDP (final).

GDP Growth Rate QoQ Final Est. 2.8% vs Prev. 3.0%.

GDP Price Index QoQ Final Est. 1.9% vs Prev. 2.5%.

Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November's Personal Income and Outlays report.

PCE Price Index YoY Est. 2.5% vs Prev. 2.3%.

Core PCE Price Index YoY Est. 2.9% vs Prev. 2.8%.

Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.

Token Events

Governance votes & calls

Lido floats Aragon Vote 182, including projected limits, treasury swaps (Lido Stonks) limit, and reward code change. The ballot is live.

Airdrops

Tron memecoin SUNDOG to airdrop TRX holders connected Trust Wallet, based connected holdings.

Conferences:

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Shaurya Malwa Memecoins and AI tokens pb Binance users' trading activity.

AI tokens are predicted to beryllium the stars of 2025, with astir 24% of respondents successful a survey of 27,000 Binance users saying they'll pb marketplace maturation adjacent year. Memecoins are not acold behind, with 19% saying they expect them to emergence adjacent year. The tokens are fun, fashionable and presently the astir held crypto assets, with 16% of Binance users owning them. That's adjacent much than bitcoin, astatine 14%.

The survey recovered that 45% of participants were caller to the scene, joining lone successful 2024 and saying they were "still learning" their mode crossed the market. Over 40% person been astir for 1 to 5 years. Most aren't betting the workplace connected crypto, with 44% of respondents having little than 10% of their wealth exposed to it. Trading, however, is common, with astir a 3rd trading daily.

It is not each amusive and games, though. Many respondents said they expect to spot much maturity and real-world relevance successful the crypto manufacture successful the coming year. A notable 19% of the illustration said they expect accrued crypto regulations implicit the adjacent 12 months, and 16% expect greater information from accepted fiscal institutions and organization investors. In addition, 17% foresee wider implementation of blockchain exertion successful real-world applications.

Derivatives Positioning

The panic from the overnight sell-off has faded, and BTC and ETH calls expiring connected Dec. 27 and beyond are backmost to trading astatine a premium comparative to puts. However, the wide bias is inactive considerably weaker than it was earlier this month.

BTC flows person been mixed, with ample bull telephone spread, involving $105K and $100K strikes alongside a agelong straddle astatine $100K onslaught options expiring connected Jan. 31 and notable buying successful $102K and $100K puts. (Source: Amberdata)

A ample enactment dispersed involving strikes $3.7K and $3.4K has been lifted

Perpetual futures unfastened involvement has dropped successful astir large coins, including ETH, successful the past 24 hours, a motion the diminution has been led by the unwinding of bullish bets alternatively than caller longs. BTC's unfastened involvement has accrued 3% successful 24 hours, with cumulative measurement delta indicating dominance of sellers.

Market Movements:

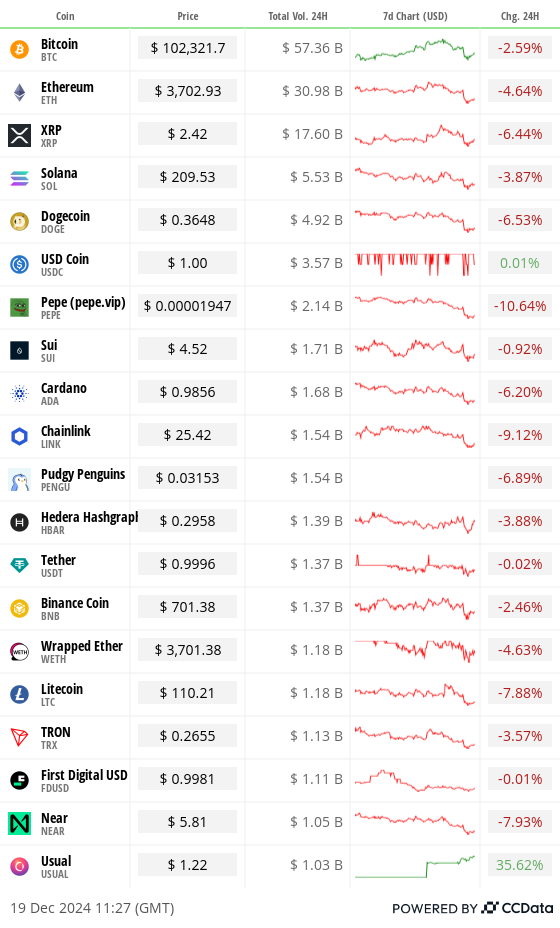

BTC is up 1.5% from 4 p.m. ET Wednesday to $102,532.08 (24hrs: -2.59%%)

ETH is up 0.49% astatine $3,711.07 (24hrs: -4.64%)

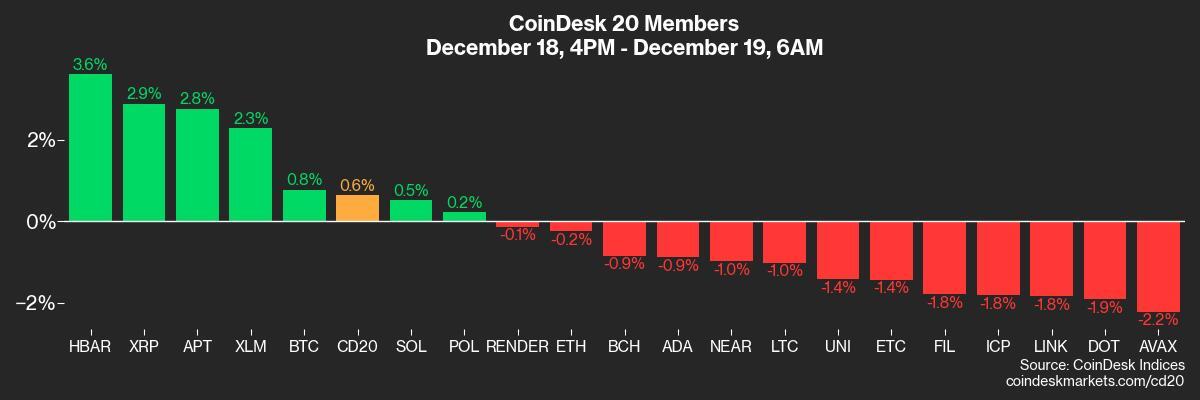

CoinDesk 20 is up 1% to 3,683.74 (24hrs: -4.39%)

Ether staking output is down 6 bps to 3.12%

BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

DXY is down 0.11% astatine 107.91

Gold is unchanged astatine $2,638.3/oz

Silver is down 1.12% to $30.07/oz

Nikkei 225 closed -0.69% astatine 38,813.58

Hang Seng closed -0.56% astatine 19,752.51

FTSE is down 1.37% astatine 8,086.92

Euro Stoxx 50 is down 1.69% astatine 4,873.36

DJIA closed connected Wednesday -2.58% to 42,326.87

S&P 500 closed -2.95% astatine 5,872.16

Nasdaq closed -3.56% astatine 19,392.69

S&P/TSX Composite Index closed -2.24% astatine 24,557.00

S&P 40 Latin America closed -4.44% astatine 2,179.31

U.S. 10-year Treasury was is up 0.02% astatine 4.54%

E-mini S&P 500 futures are up 0.43% to 5,897.5

E-mini Nasdaq-100 futures are up 1.66% to 21,570.75

E-mini Dow Jones Industrial Average Index futures are down 0.39% astatine 42,486.00

Bitcoin Stats:

BTC Dominance: 58.33% (24hrs: +0.14%)

Ethereum to bitcoin ratio: 0.036 (24hrs: -0.14%)

Hashrate (seven-day moving average): 784 EH/s

Hashprice (spot): $60.55

Total Fees: $1.4M

CME Futures Open Interest: 212,620 BTC

BTC priced successful gold: 38.7 oz

BTC vs golden marketplace cap: 11.02%

Bitcoin sitting successful over-the-counter table balances: 409,600 BTC

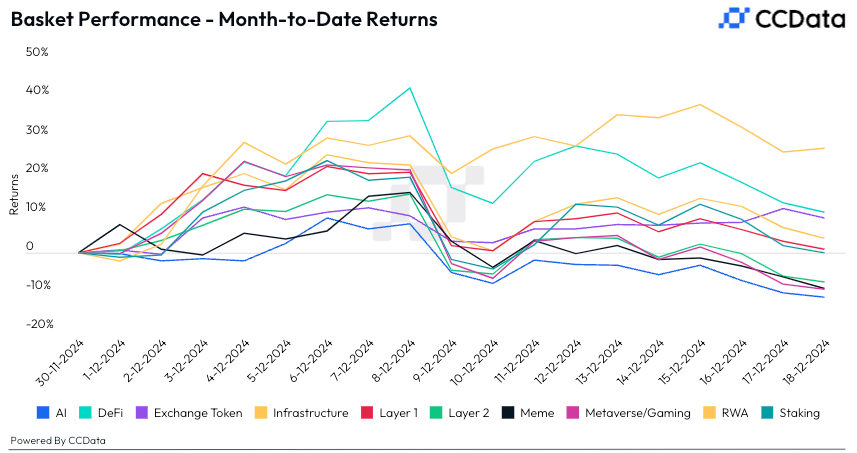

Basket Performance

Technical Analysis

BTC's regular illustration shows the broader outlook remains constructive contempt Wednesday's drop, arsenic 50-, 100- and 200-day elemental moving averages stay stacked 1 supra the other, trending north.

The confluence of the 50-day SMA and Dec. 5's plaything debased betwixt $90,000 and $91,500 is the cardinal country to ticker retired successful lawsuit the pullback deepens.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $349.64 (-9.52%), up 4.95% astatine $366.95 successful pre-market.

Coinbase Global (COIN): closed astatine $279.86 (-10.2%), up 3.42% astatine $289.44 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$26.31 (-8.23%)

MARA Holdings (MARA): closed astatine $21.61 (-12.15%), up 3.66% astatine $22.40 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.95 (-14.46%), up 3.93% astatine $12.42 successful pre-market.

Core Scientific (CORZ): closed astatine $14.45 (-9.86%), up 1.87% astatine $14.72 successful pre-market.

CleanSpark (CLSK): closed astatine $11.32 (-8.41%), up 4.95% astatine $11.88 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.89 (-10.85%), up 6.14% astatine $27.48 successful pre-market.

Semler Scientific (SMLR): closed astatine $65.02 (-12.99%), up 7.64% astatine $69.99 successful pre-market.

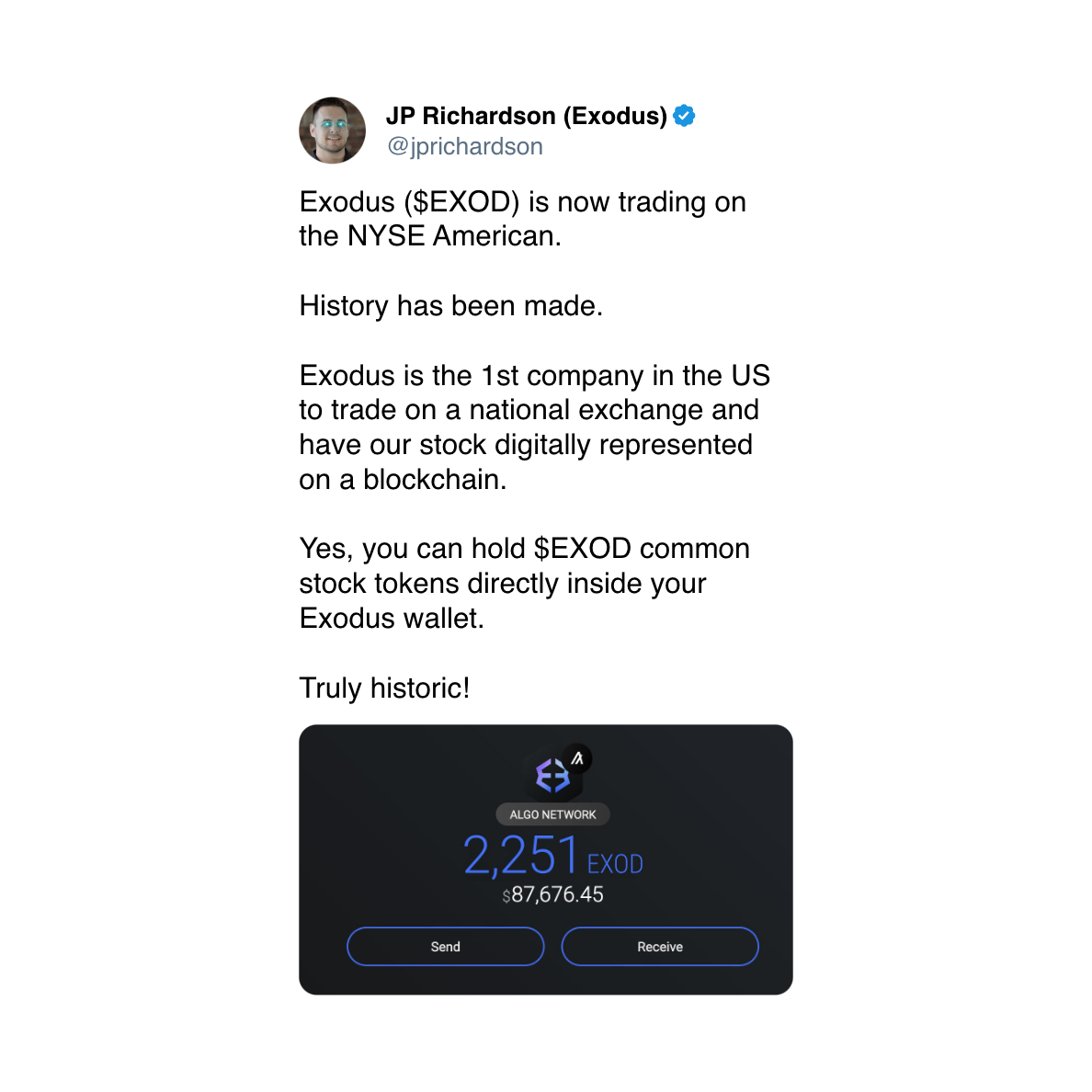

Exodus Movement (EXOD): closed astatine $53.10 (+36.3%), unchanged successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett inflow: $275.3 million

Cumulative nett inflows: $36.98 billion

Total BTC holdings ~ 1.141 million.

Spot ETH ETFs

Daily nett inflow: $2.5 million

Cumulative nett inflows: $2.46 billion

Total ETH holdings ~ 3.563 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The output connected the U.S. 10-year Treasury enactment looks to person breached retired supra a 14-month channel.

More gains mightiness measurement implicit hazard assets.

While You Were Sleeping

Hawkish Fed Has Bitcoin Market Feeling Most Fearful successful 3 Months (CoinDesk): Demand for bitcoin play enactment options surged Wednesday, with traders pricing successful greater downside extortion costs aft the Fed signaled caution, driving puts to their highest comparative worth since September.

Bitcoin's Nosedive to Under $100K Shaves $700M Crypto Longs, XRP Drops 5% (CoinDesk): Bitcoin’s clang beneath $100,000 pursuing yesterday’s FOMC property league triggered implicit $700 cardinal successful liquidations crossed crypto futures, with XRP and DOGE derivatives deed peculiarly hard.

How IMF’s $1.4B Deal With El Salvador, If Approved, Could Jeopardize Bitcoin’s Role arsenic Legal Tender (CryptoGlobe): The IMF’s staff-level indebtedness statement with El Salvador, if approved, would sharply trim bitcoin's relation successful the system by ending mandatory concern acceptance, requiring taxes to beryllium paid successful dollars and curbing authorities involvement.

Trump Says He Opposes Stopgap Government Funding Bill (Bloomberg): President-elect Trump opposed a projected national backing measure connected Wednesday, demanding indebtedness ceiling provisions and threatening Republicans who disagree. His stance heightens the hazard of a authorities shutdown arsenic the backing deadline approaches.

The Next Big Fed Debate: Has the Era of Very Low Rates Ended? (The Wall Street Journal): Fed Chair Jerome Powell signaled Wednesday that aboriginal complaint cuts whitethorn dilatory amid uncertainty implicit the neutral rate, present estimated higher post-pandemic, with immoderate Fed officials seeing it adjacent existent involvement levels.

Bank of Japan Holds Rates astatine 0.25%, Yen Weakens to One-Month Low (CNBC): The BOJ’s divided 8-1 determination to clasp rates astatine 0.25% aligns with a canvass wherever 13 of 24 economists expected nary alteration successful December but anticipated a complaint hike successful January.

In the Ether

1 year ago

1 year ago

English (US)

English (US)