By Omkar Godbole (All times ET unless indicated otherwise)

If you travel fiscal markets, you've astir apt travel crossed the presumption "risk-on" and "risk-off." Now we look to beryllium entering a caller epoch of "tariffs on/tariffs off."

In a risk-on environment, growth-sensitive assets similar stocks and cryptocurrencies thin to emergence owed to expectations of economical enlargement oregon accommodative monetary policy. Conversely, risk-off situations reflects a deficiency of capitalist confidence, starring to sell-offs and a penchant for safer assets.

But this week, President Trump's tariffs announcement person single-handedly guided markets. Early Monday, bitcoin (BTC) plummeted to astir $91,000 arsenic Canada and Mexico retaliated against Trump's tariffs. That was "tariffs on" trading.

Later, it rebounded supra $100,000 aft Trump paused the Mexico tariffs for the 30 days and announced the instauration a sovereign wealthiness fund, which generated hopes of imaginable investments successful BTC. That was "tariffs off."

The bullish momentum ran retired of steam aboriginal Tuesday arsenic China retaliated against Trump's import tax, reviving "tariffs on" trading. BTC fell implicit 3% to $98,000, dragging altcoins lower. Nasdaq futures dropped implicit 0.5% and the dollar drew haven bids.

Bitcoin and the broader crypto marketplace volition apt rebound should Trump denote an 11th-hour woody with China, conscionable arsenic helium did with Mexico and Canada connected Monday. Foreign-exchange marketplace enactment suggests that's likely. The AUD/CAD is down conscionable 0.3% for the day, a motion traders don't expect a prolonged tariff warfare betwixt the U.S. and China. (The Australian dollar is wide seen arsenic a proxy for China).

"A transverse similar AUD/CAD should commercialized sharply little successful this concern fixed Canada has dodged tariffs and China has not, but it is lone 0.5% little connected the day. That signals markets are pricing successful a bully accidental that the US and China volition besides onslaught a woody and hold tariffs," ING said successful a enactment to clients.

That said, you tin ne'er beryllium definite of Trump. So, expect heightened volatility and enactment alert!

What to Watch

Crypto:

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork web upgrade for its Ethereum-based L2 mainnet.

Feb. 6, 8:00 a.m.: Shentu Chain web upgrade (v2.14.0).

Feb. 13: Start of Kraken's "gradual" delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Macro

Feb. 4, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December’s Job Openings and Labor Turnover Survey (JOLTS) report.

Job Openings Est. 7.88M vs. Prev. 8.098M

Job Quits Prev. 3.065M

Feb. 4, 2:30 p.m.: White House AI and Crypto Czar David Sacks, on with 4 legislature leaders, clasp a property league connected integer assets cooperation. Livestream link.

Feb. 4, 7:30 p.m.: Fed Vice Chair Philip N. Jefferson is giving a code titled "U.S. Economic Outlook and Monetary Policy."

Feb. 5, 9:45 a.m.: S&P Global releases January’s US Services PMI (Final) report.

Est. 52.8 vs. Prev. 56.8

Feb. 5, 10:00 a.m.: The Institute for Supply Management (ISM) releases January’s Services ISM Report connected Business.

Services PMI Est. 54.3 vs. Prev. 54.1

Services Business Activity Prev. 58.2

Services Employment Prev. 51.4

Services New Orders Prev. 54.2

Services Prices Prev. 64.4

Feb. 5, 10:00 a.m.: U.S. Senate Banking Committee proceeding connected “Investigating the Real Impacts of Debanking successful America,” featuring 4 witnesses including Nathan McCauley, co-founder and CEO of Anchorage Digital. Livestream link.

Feb. 5, 3:00 p.m.: Fed Governor Michelle W. Bowman is giving a code titled “Brief Economic Update and Bank Regulation.”

Earnings

Feb. 5: MicroStrategy (MSTR), post-market, $-0.09

Feb. 10: Canaan (CAN), pre-market, $-0.08

Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, break-even

Feb. 12: IREN (IREN), post-market

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market, $0.25

Token Events

Governance votes & calls

Compound DAO is discussing the instauration of Morpho-powered lending vaults connected Polygon curated by Gauntlet. Polygon Labs is acceptable to connection $1.5 cardinal successful POL, matched with $1.5 cardinal successful COMP to incentivize usage.

Arbitrum DAO is voting connected whether to transportation 1,885 ETH successful Nova transaction fees to its Treasury done the modernized interest postulation infrastructure outlined successful the ova Fee Router Proposal.

Aave DAO is nearing the extremity of a vote connected deploying Aave v3 connected Sonic, a caller layer-1 Ethereum Virtual Machine (EVM) blockchain with a precocious transaction throughput.

Lido DAO is discussing distributing rewards to LDO stakers based connected the protocol’s nett revenue, arsenic good arsenic the usage of a percent of its yearly gross to buyback LDO tokens.

Feb. 4, 1 p.m.: TRON DAO and CryptoQuant to host a web review diving into performance, adoption and cardinal metrics.

Feb. 4, 12 p.m.: Stellar to host its Q4 quarterly review.

Unlocks

Feb. 5: XDC Network (XDC) to unlock 5.36% of circulating proviso worthy $81.58 million.

Feb. 5: Kaspa (KAS) to unlock 0.67% of circulating proviso worthy $17.29 million.

Feb. 9: Movement (MOVE) to unlock 2.17% of circulating proviso worthy $31.60 million.

Feb. 10: Aptos (APT) to unlock 1.97% of circulating proviso worthy $68.20 million.

Token Launches

Feb. 4: Vine (VINE), Bio Protocol (BIO), Swarms (SWARMS), and Sonic SVM (SONIC) to beryllium listed connected Kraken.

Conferences:

Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

Entities down President Donald Trump's memecoin TRUMP amassed astir $100 cardinal successful trading fees wrong 2 weeks of its Jan. 17 introduction.

The fees were generated connected Meteora, a DeFi speech wherever the archetypal TRUMP coins were traded. Here, fees are charged for liquidity provision, which benefits the coin's creators by allowing them to gain from trading activities indefinitely, according to Reuters.

A marketwide driblet connected Monday sent the token spiraling further down, bringing losses from the highest to a staggering 75%.

The president continues to endorse the token connected his societal media platform, Truth Social, wherever helium posted "I LOVE $TRUMP!!" alongside a nexus to acquisition the token implicit the weekend.

Derivatives Positioning

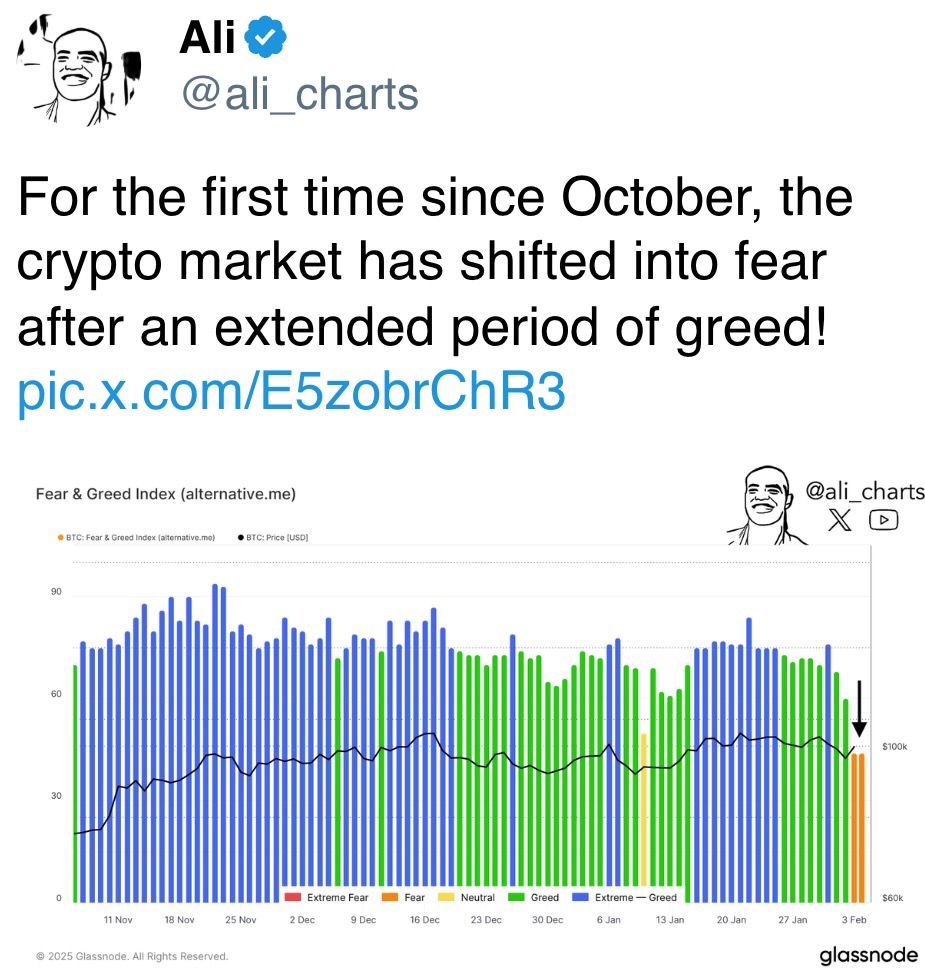

Perpetual backing rates for SOL, DOGE, ADA, LINK and AVAX stay negative, indicating a bias for abbreviated positions. These coins whitethorn spot outsized gains connected the backmost of a short-squeeze should the marketplace situation flip backmost to "tariffs off" during the American hours.

Deribit's ETH volatility scale has retreated to 70% from supra 100%. BTC's volatility has faded from Monday's spike to 61%.

The perpetual futures unfastened interest-adjusted cumulative measurement delta for astir large-cap tokens, excluding TRX, is antagonistic for the past 24 hours. That raises a question connected the sustainability of the terms recovery.

Deribit's BTC, ETH options expiring this period proceed to grounds downside fears. The broader bias for bullish calls remains intact.

Block flows featured a carnivore telephone dispersed successful SOL, a calendar dispersed successful BTC and agelong positions successful the ETH $3K and $3.2K calls.

Market Movements:

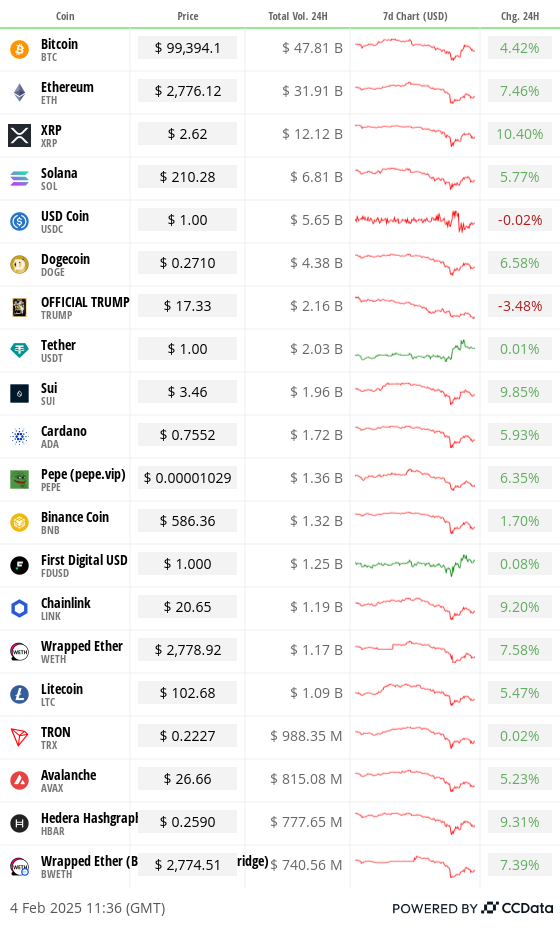

BTC is down 1.85% from 4 p.m. ET Monday astatine $99,347.23 (24hrs: +4.4%)

ETH is up 2.3% astatine $2,777.08 (24hrs: +7.45%)

CoinDesk 20 is down 2.21% astatine 3,154.76 (24hrs: +5.33%)

CESR Composite Staking Rate is up 88 bps astatine 3.91%

BTC backing complaint is astatine 0.0035% (3.76% annualized) connected Binance

DXY is down 0.39% astatine 108.57

Gold is down 0.16% astatine $2,814.16/oz

Silver is up 0.18% astatine $31.65/oz

Nikkei 225 closed +0.72% astatine 38,798.37

Hang Seng closed +2.83% astatine 20,789.96

FTSE is down 0.12% astatine 8,572.97

Euro Stoxx 50 is up 0.13% astatine 5,224.71

DJIA closed connected Monday -0.28% astatine 44,421.91

S&P 500 closed -0.76% astatine 5,994.57

Nasdaq closed -1.2% astatine 19,391.96

S&P/TSX Composite Index closed -1.14% astatine 25,241.76

S&P 40 Latin America closed +0.25% astatine 2,376.48

U.S. 10-year Treasury is up 2 bps astatine 4.58%

E-mini S&P 500 futures are down 0.16% astatine 6012.75

E-mini Nasdaq-100 futures are unchanged astatine 21,398.50

E-mini Dow Jones Industrial Average Index futures are down 0.21% astatine 44,472.00

Bitcoin Stats:

BTC Dominance: 61.70 (1.06%)

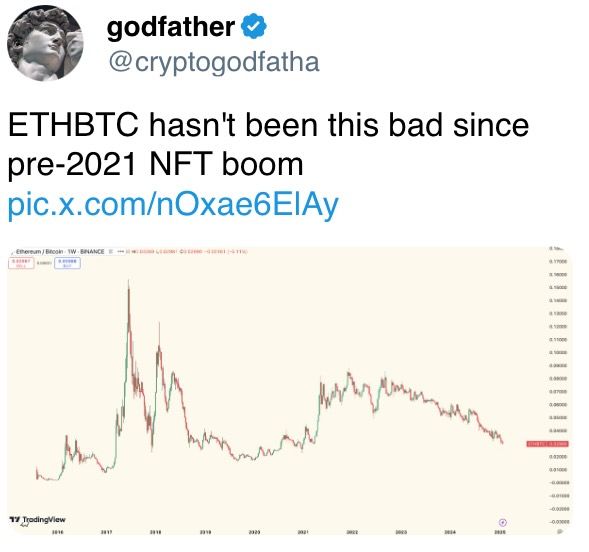

Ethereum to bitcoin ratio: 0.02750 (-3.27%)

Hashrate (seven-day moving average): 833 EH/s

Hashprice (spot): $57.5

Total Fees: 6.1 BTC / $592,574

CME Futures Open Interest: 164,925 BTC

BTC priced successful gold: 35.0 oz

BTC vs golden marketplace cap: 9.94%

Technical Analysis

Bitcoin's regular illustration shows a classical "stair step" bull run, characterized by terms rises followed by consolidations, representing accumulation periods.

The latest consolidation betwixt $90,000 and $110,000 is the 3rd specified signifier since 2023. A breakout would mean continuation of the uptrend.

Note, however, that gains seen aft the 2nd consolidation betwixt $50,000 and $70,000 were importantly little than those seen aft the archetypal breakout successful precocious 2023.

Crypto Equities

MicroStrategy (MSTR): closed connected Monday astatine $347.09 (+3.67%), down 1.35% astatine $342.40 successful pre-market.

Coinbase Global (COIN): closed astatine $284.41 (-2.38%), down 0.47% astatine $283.08 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$28.02 (-1.62%)

MARA Holdings (MARA): closed astatine $17.95 (-2.13%), down 1.23% astatine $17.73 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.99 (+0.93%), down 0.58%% astatine $11.92 successful pre-market.

Core Scientific (CORZ): closed astatine $12.33 (+0.49%), down 1.05% astatine $12.20 successful pre-market.

CleanSpark (CLSK): closed astatine $10.59 (+1.44%), down 0.85% astatine $10.50 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.69 (+0.62%).

Semler Scientific (SMLR): closed astatine $50.46 (-2.89%).

Exodus Movement (EXOD): closed astatine $59.59 (+19.47%), unchanged successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$234.4 million

Cumulative nett flows: $40.26 billion

Total BTC holdings ~ 1.177 million.

Spot ETH ETFs

Daily nett flow: $83.6 million

Cumulative nett flows: $2.84 billion

Total ETH holdings ~ 3.648 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

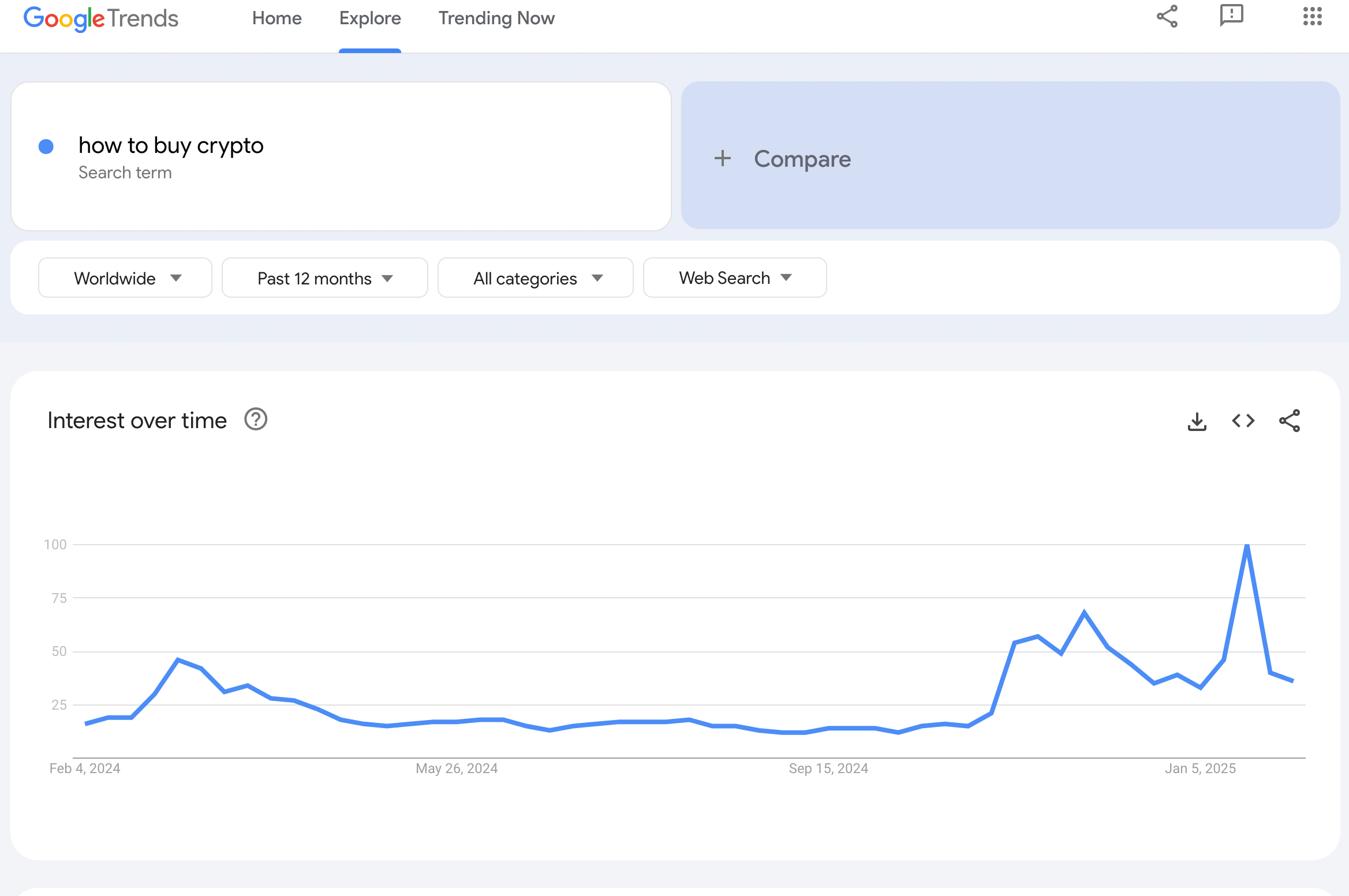

Google trends for the worldwide hunt query "how to bargain crypto" shows retail capitalist involvement successful integer assets has cooled since hitting a highest of 100 past month.

While You Were Sleeping

Ethereum Raises Gas Limits for First Time Since 2021, Boosting ETH Appeal (CoinDesk): Ethereum’s state bounds roseate to astir 32 cardinal units, which should assistance summation the network’s throughput and perchance little transaction costs during periods of precocious demand.

Lending Protocol Aave Processes $200M successful Liquidation Without Adding to Bad-Debt Burden (CoinDesk): Aave processed $210 cardinal successful liquidations connected Monday, the astir since August, without adding caller debt. Strong hazard controls reduced existing liabilities by 2.7% amid marketplace volatility.

TRON, Movement Labs Deny ‘Token Swap’ Deal for World Liberty Financial Inclusion (CoinDesk): Representatives from TRON and Movement Labs rejected allegations of token swap deals for treasury inclusion with World Liberty Financial (WLFI).

Yuan Extends Loss With China Proxies arsenic US Trade War Reignites (Bloomberg): China's retaliatory tariffs connected U.S. coal, LNG, lipid and cultivation instrumentality spooked Asia-Pacific markets, pressuring offshore Chinese yuan. Talks betwixt the U.S. and China could assistance deescalate the commercialized war.

Stocks Erase Gains After China Retaliates Against U.S. (Financial Times): Shortly aft Trump's 10% tariff connected each Chinese goods took effect connected Tuesday, Beijing deed backmost by imposing import tariffs connected assorted U.S. goods, causing planetary stocks to springiness backmost immoderate of Monday's gains.

Euro Stays Weaker Amid Tariff Risks (The Wall Street Journal): Danske Bank's Stefan Mellin says Trump's threats of tariffs connected EU imports are apt to support the euro nether unit implicit the adjacent respective weeks adjacent though these mightiness conscionable beryllium "primarily a negotiating tool."

In the Ether

10 months ago

10 months ago

English (US)

English (US)