By James Van Straten (All times ET unless indicated otherwise)

The caller marketplace turmoil mightiness person fixed golden the bragging rights of being the "store of value" portion "digital gold" struggles, astatine slightest for now.

Gold futures for April transportation person surpassed $3,000 an ounce for the archetypal clip ever, marking a historical milestone for the precious metal. Spot golden is consolidating conscionable beneath $3,000 an ounce, up 15% year-to-date, portion its integer counterpart, bitcoin (BTC), is struggling—down 12% this twelvemonth and hovering astir $80,000.

This divergence underscores gold’s relation arsenic the eventual safe-haven plus successful the existent economical environment. Since mid-February, U.S. spot bitcoin ETFs person experienced lone 3 days of inflows, causing full nett inflows to diminution from $40 cardinal to astir $35 billion, according to Eric Balchunas, a elder Bloomberg ETF analyst. Meanwhile, the S&P 500 has entered correction territory, falling implicit 10% and struggling to reclaim its 200-day moving average amid escalating geopolitical tensions. Further tariffs imposed by erstwhile President Trump and stalled ceasefire negotiations betwixt President Putin and Ukraine person exacerbated planetary uncertainty.

Andre Dragosch, Head of Research astatine Bitwise successful Europe, attributes gold’s grounds highs and the U.S. equity sell-off to rising short- and medium-term ostentation expectations, coupled with declining user confidence. “The caller rally successful golden to caller all-time highs apt reflects some expanding ostentation expectations and a broader formation to safety,” Dragosch explains. “In fact, some short- and medium-term ostentation expectations successful the University of Michigan user survey person risen to multi-decade highs. U.S. consumers are increasing progressively acrophobic astir inflation, apt owed to the Trump administration’s caller tariff policies.” He further notes, “Meanwhile, U.S. equities person been selling disconnected owed to mounting economical uncertainty driven by these commercialized policies, arsenic good arsenic rising recession risks amid a slowdown successful the labour market. Both factors person importantly buoyed the terms of gold.”

What to Watch

Crypto:

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy volition adjacent its V1 RAI staking programme to caller users arsenic it transitions to a afloat automated revenue-sharing protocol.

March 17: CME Group launches solana (SOL) futures.

March 17: Ethereum (ETH) testnet Hoodi goes live. The Pectra upgrade volition beryllium applied to this testnet connected March 26 and to the mainnet “30+ days aft Hoodi forks successfully, pending infra and lawsuit testing.”

March 18: Zano (ZANO) hard fork web upgrade; this activates “ETH Signature enactment for off-chain signing and plus operations.”

March 20: Pascal hard fork web upgrade goes unrecorded connected the BNB Smart Chain (BSC) mainnet.

March 21, 1:00 p.m.: The U.S. SEC’s Crypto Task Force hosts a roundtable, which is open to the public, that volition absorption connected the explanation of a security.

Macro

March 14, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January shaper terms ostentation data.

PPI MoM Prev. 1.48%

PPI YoY Prev. 9.42%

March 14, 10:00 a.m.: The University of Michigan’s March (U.S.) Consumer Sentiment (preliminary) scale Est. 63.1 vs. Prev. 64.7.

March 14, 3:00 p.m.: Argentina's National Institute of Statistics and Census releases February ostentation data.

Inflation Rate MoM Est. 2.4% vs. Prev. 2.2%

Inflation Rate YoY Est. 66.8 vs. Prev. 84.5%

March 16, 10:00 p.m.: The National Bureau of Statistics of China releases February employment data.

Unemployment Rate Prev. 5.1%

Earnings (Estimates based connected FactSet data)

March 14: Bit Digital (BTBT), pre-market, $-0.05

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governance votes & calls

ApeCoin DAO is discussing the establishment of an APE base successful Lhasa, Tibet Autonomous Region, China. It’s besides discussing the creation of ApeSites, which aims to supply the BAYC assemblage an “easy-to-use instrumentality to make personalized websites.”

Aave DAO is discussing the launch of Horizon, a licensed lawsuit of the Aave Protocol to let institutions to “access permissionless stablecoin liquidity portion gathering issuer requirements.”

Balancer DAO is discussing the deployment of Balancer V3 connected OP Mainnet.

March 14: CoW DAO’s ballot connected the incorporation of a 4-entity ineligible operation for the enactment ends.

March 14, 10 a.m.: Representatives from Lombard, Etherfi, Coinbase and Curve to enactment successful an X Spaces session

Unlocks

March 14: Starknet (STRK) to unlock 2.33% of its circulating proviso worthy $11.15 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating proviso worthy $10.06 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating proviso worthy $32.29 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating proviso worthy $79.80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating proviso worthy $12.91 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating proviso worthy $102.6 million.

March 23: Mantra (OM) to unlock 0.51% of its circulating proviso worthy $31.2 million.

Token Listings

March 18: Paws (PAWS) to beryllium listed connected Bybit.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 2 of 2: Web3 Amsterdam ‘25

March 16: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Oliver Knight

In an different muted time for altcoins, HyperLiquid's autochthonal token is starring the pack, having risen by 9.5% successful the past 24 hours. The boost comes arsenic the decentralized speech topped $1 trillion successful cumulative measurement this month, with $4.8 cardinal worthy of derivatives successful the past time alone.

The aforesaid cannot beryllium said for different DeFi tokens similar AAVE, LIDO and PYTH, which person each been betwixt 19% and 21% down implicit the past 7 days aft failing to retrieve from a market-wide plunge implicit the weekend.

One trader profited a chill $108k aft buying Base memecoin doginme connected Thursday lone for Coinbase to database the token connected Friday, spurring a 150% rally.

Derivatives Positioning

Earlier this morning, the terms of Bitcoin bounced to $82,895 from levels beneath $80,000, hitting a clump of abbreviated liquidations leverage worthy $52.1mn, according to CoinGlass. The adjacent important liquidations leverage level is $79,760, holding liquidations worthy $41.9mn.

Among the assets with implicit $100mn successful unfastened interest, Chainlink saw the highest 1D percent gain, rising 35.8% to $409.5mn. PNUT, Near Protocol, Stellar and Trump implicit the apical five, with their unfastened involvement rising 19.7%, 15.8%, 14.8% and 11.8% connected the day. Layer-1 Network Sei (SEI) saw the highest diminution successful unfastened interest, falling 17.2% to $101mn.

In the bitcoin options marketplace connected Deribit, telephone options astatine a $100,000 onslaught terms clasp the highest unfastened interest, with a notional worth of $1.5 billion, followed by $1.35 cardinal successful unfastened involvement astatine the $120,000 strike. However, the Put-to-Call ratio, presently astatine 0.52, signals important put-side interest, with the largest enactment contracts holding $800 cardinal and $700 cardinal successful unfastened involvement astatine onslaught prices of $80,000 and $75,000, respectively.

Market Movements:

BTC is up 2.93% from 4 p.m. ET Thursday astatine $82,739.17 (24hrs: -0.57%)

ETH is up 2.38% astatine $1,890.23 (24hrs: -0.55%)

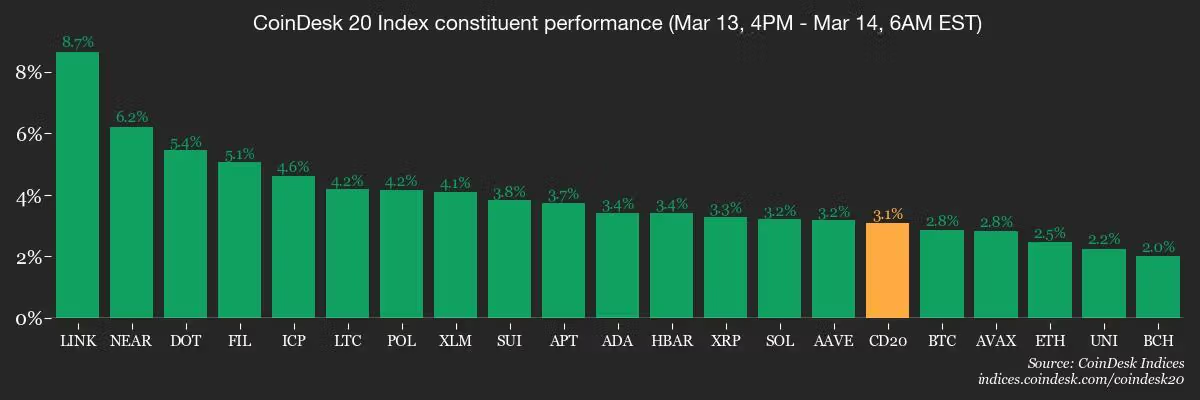

CoinDesk 20 is up 3.36% astatine 2,592.81 (24hrs: -0.14%)

Ether CESR Composite Staking Rate is down 17 bps astatine 2.99%

BTC backing complaint is astatine 0.0025% (2.79% annualized) connected Binance

DXY is unchanged astatine 103.88

Gold is up 0.71% astatine $3,000.95/oz

Silver is up 0.83% astatine $33.97/oz

Nikkei 225 closed +0.72% astatine 37,053.10

Hang Seng closed +2.12% astatine 23,959.98

FTSE is up 0.49% astatine 8,584.53

Euro Stoxx 50 is up 0.69% astatine 5,365.00

DJIA closed connected Thursday -1.3% astatine 40,813.57

S&P 500 closed -1.39% astatine 5,521.52

Nasdaq closed -1.96% astatine 17,303.01

S&P/TSX Composite Index closed -0.9% astatine 24,203.23

S&P 40 Latin America closed +0.73% astatine 2,343.21

U.S. 10-year Treasury complaint is up 2bps astatine 4.3%

E-mini S&P 500 futures are up 0.67% astatine 5,564.75

E-mini Nasdaq-100 futures are up 0.9% astatine 19,421.50

E-mini Dow Jones Industrial Average Index futures are up 0.42% astatine 41,036.00

Bitcoin Stats:

BTC Dominance: 61.82 (0.26%)

Ethereum to bitcoin ratio: 0.02288 (-0.48%)

Hashrate (seven-day moving average): 825 EH/s

Hashprice (spot): $47.3

Total Fees: 5.55 BTC / $456,716

CME Futures Open Interest: 144,785 BTC

BTC priced successful gold: 27.7 oz

BTC vs golden marketplace cap: 7.86%

Technical Analysis

Bitcoin has rebounded disconnected its play 50-day EMA, a historically important enactment level during past uptrends. In erstwhile cycles, this touchpoint often led to a consolidation signifier lasting 6 to 9 weeks earlier resuming momentum.

For bulls, maintaining a play adjacent supra the 50-day EMA is crucial, arsenic sustained terms enactment beneath this level could awesome deeper weakness. Additionally, reclaiming the yearly open—aligned with erstwhile scope lows—would fortify bullish conviction.

Without this reclaim, immoderate short-term bounces whitethorn hazard turning into bearish retests, reinforcing the breakdown successful marketplace operation connected the play timeframe.

Crypto Equities

Strategy (MSTR): closed connected Thursday astatine $263.26 (+0.27%), up 3.34% astatine $272.04 successful pre-market

Coinbase Global (COIN): closed astatine $177.49 (-7.43%), up 2.89% astatine $182.62

Galaxy Digital Holdings (GLXY): closed astatine C$16.62 (-5.03%)

MARA Holdings (MARA): closed astatine $12.16 (-7.25%), up 3.37% astatine $12.57

Riot Platforms (RIOT): closed astatine $7.31 (-6.88%), up 2.74% astatine $7.51

Core Scientific (CORZ): closed astatine $8.66 (-3.24%), down 2.89% astatine $8.91

CleanSpark (CLSK): closed astatine $7.69 (-5.06%), up 3.25% astatine $7.94

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.57 (-4.71%)

Semler Scientific (SMLR): closed astatine $32.62 (-2.92%)

Exodus Movement (EXOD): closed astatine $26.08 (-4.92%), down 3.6% astatine $25.14

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$135.2 million

Cumulative nett flows: $35.35 billion

Total BTC holdings ~ 1,115 million.

Spot ETH ETFs

Daily nett flow: -$73.6 million

Cumulative nett flows: $2.58 billion

Total ETH holdings ~ 3.545 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

With Gold reaching a caller all-time precocious of $3,000, the Gold/BTC ratio has reached 0.037, the highest level since the U.S. elections connected Nov. 5th.

While You Were Sleeping

Russia Leans connected Cryptocurrencies for Oil Trade, Sources Say (Reuters): Some Russian lipid firms reportedly usage cryptocurrencies to bypass sanctions and streamline converting yuan and rupees from China and India into rubles.

BofA Says US Stocks Rout Is Correction, Not Start of Bear Market (Bloomberg): Strategist Michael Hartnett suggests buying the S&P 500 if it nears 5,300, provided capitalist currency reserves emergence supra 4%, enslaved hazard premiums widen, and banal sell-offs accelerate.

Trump-backed World Liberty Financial (WLFI) Completes $590M Token Sale (CoinDesk); Despite aboriginal reports of sluggish sales, the Trump-associated crypto task raised $590 cardinal successful a token merchantability restricted to accredited investors, with Justin Sun’s concern helping to boost demand.

AI's Lead Over Crypto for VC Dollars Increased successful Q1'25, But Does This Race Really Matter? (CoinDesk): AI backing this 4th nears $20 billion, led by Databricks’ $15.3 cardinal raise, portion the largest crypto woody truthful acold is Binance securing $2 cardinal successful funding.

A New Hope for Europe’s Ailing Economies: the Military (The Wall Street Journal): The European Commission’s €800 cardinal defence inaugural could substance technological advancements, stimulate occupation creation, and fortify concern capacity, peculiarly successful sectors similar robotics, outer networks, and autonomous systems.

UK Economy Unexpectedly Contracted 0.1% successful January (Financial Times): The British lb fell 0.2% against the dollar aft anemic GDP data. Chancellor Rachel Reeves is expected to denote imaginable spending cuts successful the March 26 Spring Statement.

In the Ether

6 months ago

6 months ago

English (US)

English (US)