By Francisco Rodrigues (All times ET unless indicated otherwise)

The U.S. ostentation study owed aboriginal contiguous mightiness displacement bitcoin (BTC) retired of the doldrums that person mired it this week.

In caller years, the January fig has tended to amusement important terms hikes. Last year, for example, the month's information enactment an extremity to a bid of little readings, repeating a signifier besides seen successful 2023. That's due to the fact that businesses often measure their costs and rise prices astatine the commencement of the year, arsenic the Wall Street Journal points out.

A higher-than-expected ostentation study could suggest “monetary argumentation has much enactment to do” Dallas Fed President Lorie Logan said successful a code past week. The Federal Reserve has already indicated it isn’t rushing to set involvement rates aft 100 ground points of reductions past year.

Also playing into the information are the Trump administration’s tariffs, with the Federal Reserve Bank of Boston pointing to a imaginable emergence arsenic precocious arsenic 0.8% to halfway PCE, the ostentation measurement the Fed focuses on. Still, successful 2018 and 2019 tariffs had negligible effects.

On the different hand, a brushed ostentation study could beryllium beneficial for risks assets including bitcoin. A lower-than-expected fig volition astir apt rise interest-rate chopped expectations, perchance weakening the U.S. dollar scale and lowering Treasury yields, CoinDesk’s Omkar Godbole has reported.

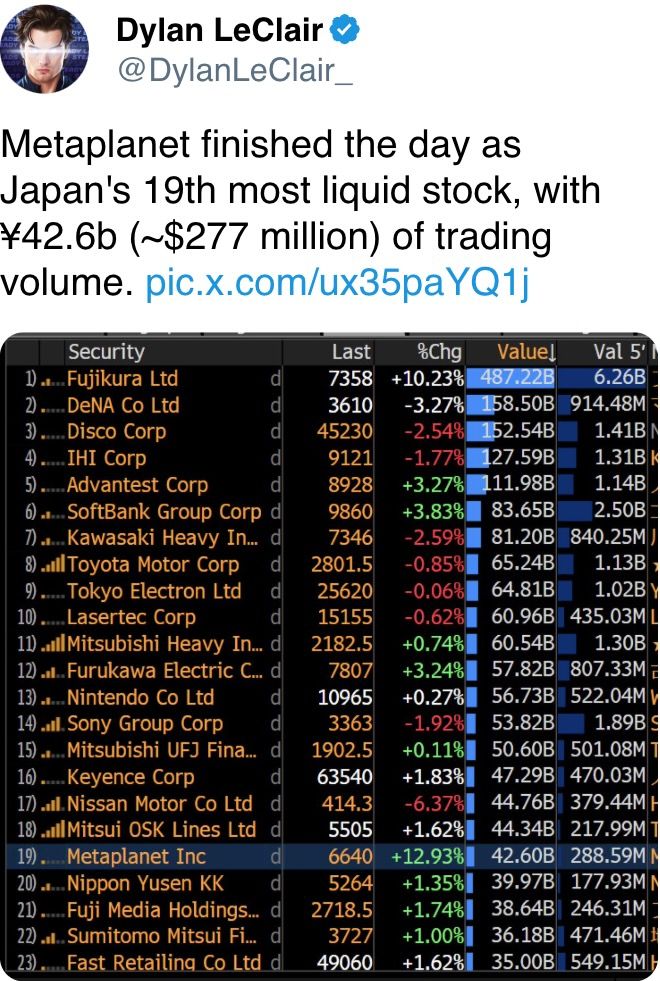

Meanwhile, request for the largest cryptocurrency holds strong. Just this week, Japanese mobile-game workplace Gumi revealed plans to accumulate astir $6.6 million worthy of BTC, portion KULR Technology Group increased its crypto holdings to 610.3 bitcoin.

Similarly, Goldman Sachs' 13F filing shows the banking elephantine importantly accrued its vulnerability to spot bitcoin and ether ETFs successful the 4th quarter. And don't hide Strategy’s near-weekly bitcoin purchases.

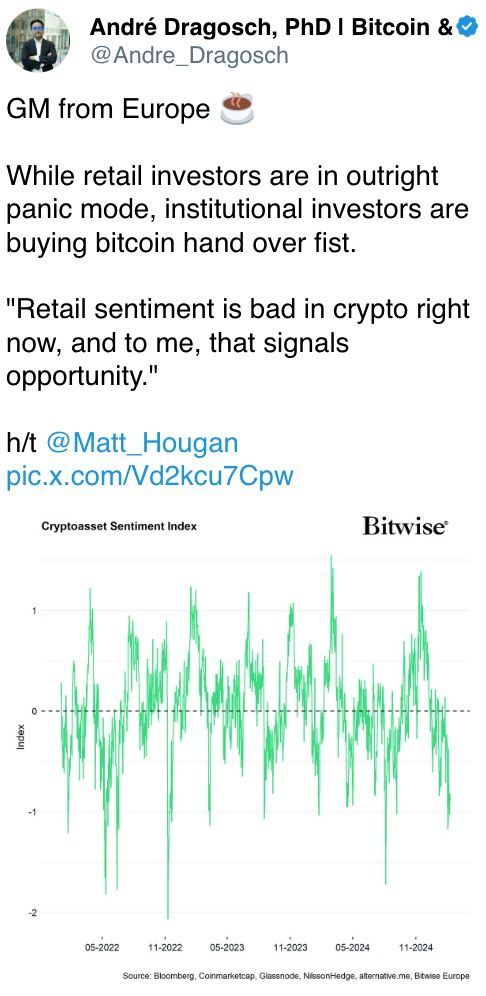

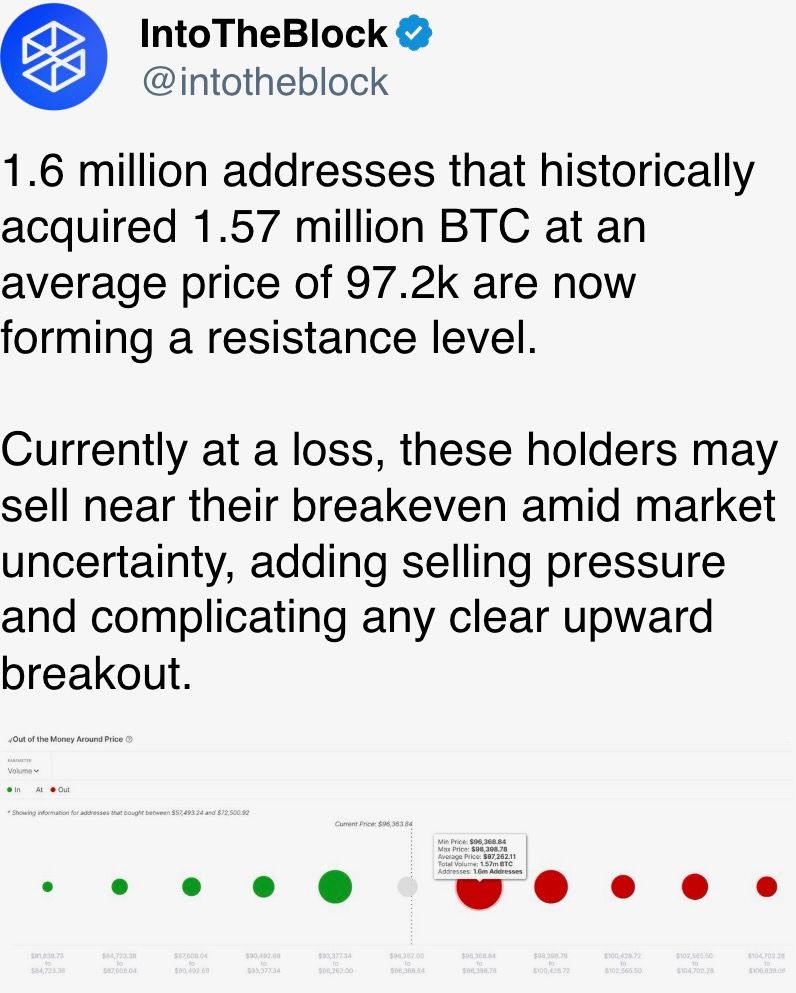

Bitcoin’s Coinbase premium, which measures the quality betwixt BTC’s terms connected the U.S. speech and Binance, recently turned negative, suggesting U.S. traders are cautious astir the upcoming ostentation report.

The caution comes amid increasing headwinds for the crypto market, which whitethorn person reached the apical of its cycle. Research steadfast BCA Research has precocious shared a enactment with clients suggesting the grounds ETF inflows and the memecoin craze are informing signals.

Warning signals are contiguous elsewhere, with a caller JPMorgan study pointing retired that crypto ecosystem maturation slowed past month, portion full trading volumes dropped 24%. Activity is nevertheless up of wherever it was earlier the U.S. elections. Stay alert!

What to Watch

Crypto:

Feb. 13: Start of Kraken's gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 13: Story (IP) mainnet launch.

Feb. 14: Dynamic TAO (DTAO) web upgrade goes unrecorded connected the Bittensor (TAO) mainnet.

Feb. 14, 2:30 a.m.: Qtum (QTUM) hard fork web upgrade.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, starts reimbursing creditors.

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging level Telegram’s Mini App ecosystem.

Macro

Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Consumer Price Index (CPI) report.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Rate YoY Est. 3.1% vs Prev. 3.2%

Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

Inflation Rate YoY Est. 2.9% vs. Prev. 2.9%

Feb. 12, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual study to the U.S. House Committee connected Financial Services. Livestream link.

Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’’s Producer Price Index (PPI) report.

Core PPI MoM Est. 0.3% vs. Prev. 0%

Core PPI YoY Est. 3.3% vs. Prev. 3.5%

PPI MoM Est. 0.3% vs. Prev. 0.2%

PPI YoY Prev. 3.3%

Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims study for the week ended Feb. 8.

Initial Jobless Claims Est. 216K vs. Prev. 219K

Earnings

Feb. 12: Hut 8 (HUT), pre-market, $0.05

Feb. 12: IREN (IREN), post-market, $-0.01

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

Feb. 13: Coinbase Global (COIN), post-market, $1.89

Feb. 14: Remixpoint (TYO: 3825)

Feb. 18: CoinShares International (STO: CS), pre-market

Feb. 18: Semler Scientific (SMLR), post-market

Token Events

Governance votes & calls

Morpho DAO is discussing a 25% reduction successful MORPHO rewards connected some Ethereum and Base aft different simplification took effect connected Jan. 30.

DYdX DAO is voting connected the dYdX Treasury subDAO taking control implicit the stDYDX wrong the protocol’s Community Treasury and immoderate tokens accrued done car compounding staking rewards.

Curve DAO is voting connected increasing 3pool’s amplification coefficient to 8,000 implicit 30 days and rise admin fees to 100%. To optimize liquidity, arsenic portion of an experiment, 3pool volition person higher fees portion Strategic Reserves volition connection little fees.

Feb. 12 2 p.m. : Render (RENDER) to host an AI Scout Discord AMA session.

Unlocks

Feb. 12: Aethir (ATH) to unlock 10.21% of circulating proviso worthy $23.80 million.

Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating proviso worthy $80.2 million.

Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating proviso worthy $42.93 million.

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating proviso worthy $78.8 million.

Token Launches

Feb. 12: Avalon (AVL) to beryllium listed connected Bybit.

Feb. 12: Game7 (G7) to beryllium listed connected Bybit, Gate.io, HashKey, MEXC, XT, and KuCoin.

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to nary longer beryllium supported astatine Deribit.

Conferences:

CoinDesk's Consensus to instrumentality spot in Hong Kong connected Feb. 18-20 and in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Feb. 12-13: Frankfurt Digital Finance (FDF) 2025

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

The Central African Republic's CAR token is down 95% from Monday's highest prices, with a marketplace capitalization present astir $40 million.

CAR was issued precocious Sunday and promoted by the republic's President Faustin-Archange Touadéra arsenic an plus that could assistance money nationalist facilities successful the impoverished nation.

Touadéra claimed proceeds from CAR token are being utilized to rebuild and furnish a precocious school, whose details are not yet public.

Market Movements:

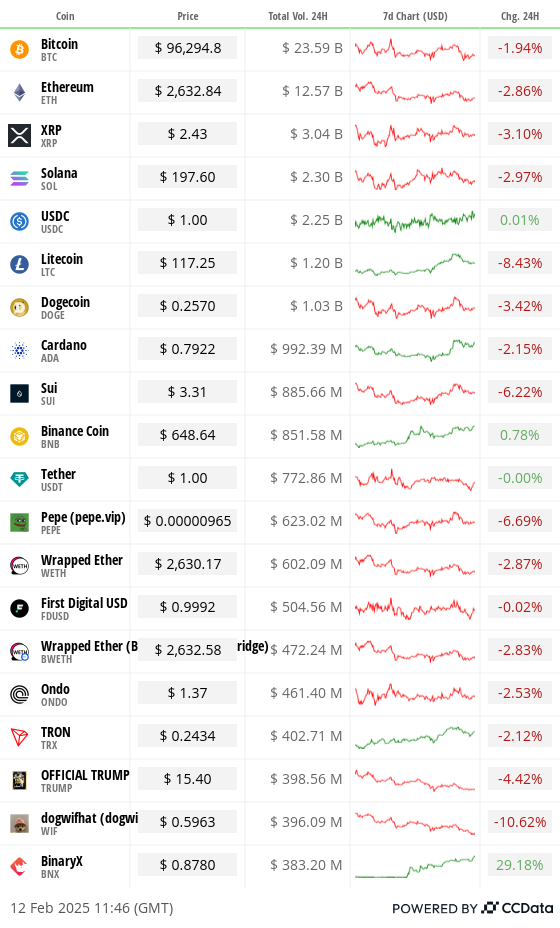

BTC is down 0.4% from 4 p.m. ET Tuesday to $96,029.62 (24hrs: -1.97%)

ETH is down 0.17% astatine $2,619.27 (24hrs: -2.87%)

CoinDesk 20 is up 0.66% to 3,178.54 (24hrs: -2.74%)

Ether CESR Composite Staking Rate is up 5 bps to 3.1%

BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

DXY is unchanged astatine 107.99

Gold is down 0.15% astatine $2908.1/oz

Silver is down 0.22% to $32.16/oz

Nikkei 225 closed up 0.42% astatine 38,963.7

Hang Seng closed +2.64% astatine 21,857.92

FTSE is unchanged astatine 8,781.91

Euro Stoxx 50 is up 0.1% to 5,396.36

DJIA closed Tuesday +0.28% astatine 44,593.65

S&P 500 closed unchanged astatine 6,068.5

Nasdaq closed -0.36% astatine 19,643.86

S&P/TSX Composite Index closed -0.11% astatine 25,631.8

S&P 40 Latin America closed +0.65% astatine 2,444.58

U.S. 10-year Treasury complaint was up 1 bps astatine 4.54%

E-mini S&P 500 futures are down 0.16% to 6,082.5

E-mini Nasdaq-100 futures are unchanged astatine 21,777

E-mini Dow Jones Industrial Average Index futures are down 0.21% astatine 44,616

Bitcoin Stats:

BTC Dominance: 61.32% (+0.06%)

Ethereum to bitcoin ratio: 0.02728 (+0.33%)

Hashrate (seven-day moving average): 800 EH/s

Hashprice (spot): $53.56

Total Fees: 5.25 BTC / $505,060

CME Futures Open Interest: 167,470 BTC

BTC priced successful gold: 33.1 oz

BTC vs golden marketplace cap: 9.4%

Technical Analysis

Dogecoin reaches a captious constituent enactment and absorption astatine 25 cents, with prices coiling astir that level since Feb.3.

Traders whitethorn ticker DOGE’s Moving Average Convergence Divergence (MACD) indicator, which tracks the comparative changes successful prices crossed circumstantial clip periods.

The indicator is trending upward with nett buying volumes since Feb. 3, indicative of a rally if the MACD enactment crosses supra zero.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $319.46 (-4.53%), up 0.82% astatine $322.30 successful pre-market.

Coinbase Global (COIN): closed astatine $266.90 (-4.75%), up 0.88% astatine $269.25 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$26.54 (-2.57%)

MARA Holdings (MARA): closed astatine $16.02 (-4.42%), up 1% astatine $16.18 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.14 (-4.21%), up 0.81% astatine $11.23 successful pre-market.

Core Scientific (CORZ): closed astatine $12.26 (-4.37%), up 0.24% astatine $12.29 successful pre-market.

CleanSpark (CLSK): closed astatine $10.28 (-8.05%), up 0.39% astatine $10.32 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.34 (-4.94%), up 0.12% astatine $22.46 successful pre-market.

Semler Scientific (SMLR): closed astatine $46.98 (-5.3%), unchanged successful pre-market.

Exodus Movement (EXOD): closed astatine $49.16 (-3.95%), unchanged successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$56.7 million

Cumulative nett flows: $40.46 billion

Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

Daily nett flow: $12.6 million

Cumulative nett flows: $3.17 billion

Total ETH holdings ~ 3.785 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

Ethereum has dropped down to 17th successful presumption of play revenues crossed each blockchains and applications, with a comparatively tiny $7 cardinal pocketed by web validators.

While You Were Sleeping

Bitcoin May See Gains from Soft U.S. CPI, Major Risk-On Surge successful BTC Appears Unlikely (CoinDesk): Bitcoin and different hazard assets whitethorn get a boost if today's CPI study shows brushed inflation, but Trump's tariffs are apt to curb further complaint cuts and enactment the brakes connected a sustained rally.

Trump to Tap Former CFTC Commissioner, a16z Policy Head Brian Quintenz for CFTC Head (CoinDesk): Brian Quintenz, a erstwhile commissioner of the Commodity Futures Trading Commission (CFTC) and a crypto advocate, has reportedly been chosen by President Trump to beryllium the agency's chairman.

Crypto Custody Firm BitGo Said to Weigh IPO arsenic Soon arsenic This Year (Bloomberg): Crypto custodian BitGo is considering an IPO for the 2nd fractional of 2025, joining firms specified arsenic Gemini and Kraken, which are besides expected to spell nationalist this year.

Why Today’s Inflation Report Is Especially Important (The Wall Street Journal): January's U.S. ostentation information — with the CPI released today, PPI tomorrow, and PCE connected Feb. 28 — is important for predicting the Fed's monetary argumentation due to the fact that businesses typically rise prices astatine the commencement of the year.

Stocks Steady; Sanguine Powell Knocks Bonds and Gold (Reuters): Fed Chari Powell's Senate grounds connected Tuesday, downplaying rate-cut urgency unless ostentation falls oregon occupation marketplace weakens, boosted Treasury yields and the dollar, portion sending lipid and golden prices lower.

China’s Tech Stocks Enter Bull Market After DeepSeek Breakthrough (Financial Times): Chinese tech stocks person surged 20% successful 1 period aft DeepSeek's AI breakthrough revived capitalist assurance successful net companies, helping the Hang Seng Tech scale to outpace the Nasdaq 100.

In the Ether

7 months ago

7 months ago

English (US)

English (US)