By Omkar Godbole (All times ET unless indicated otherwise)

Just a time ago, I highlighted that the bias for protective puts successful the S&P 500 options marketplace are coating a cautious representation for hazard assets. Fast guardant to today, the tide has turned and hazard assets, including BTC, are connected the defensive.

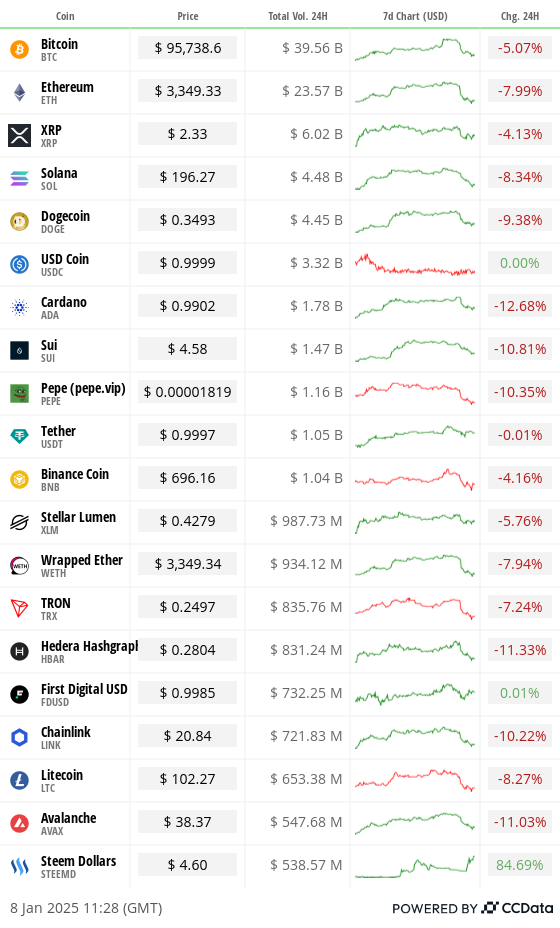

The alteration successful sentiment is much noticeable successful the altcoin sector, wherever ETH, ADA and DeFi coins person taken a bigger deed than BTC's 5% nonaccomplishment successful 24 hours. Expectations for the "alt season" were riding precocious pursuing altcoin person ether's awesome comparative to bitcoin since Dec. 20.

That excitement is fading accelerated and present is wherever it gets interesting: The ETH/BTC guardant word structure, calculated arsenic the ratio betwixt prices for ether futures and bitcoin futures implicit antithetic maturities, has slipped into backwardation, according to information tracked by crypto fiscal level BloFin.

It means that immoderate of the sharpest minds successful the derivatives marketplace are anticipating that ETH and different altcoins volition underperform successful the coming months. So overmuch for the much-anticipated altcoin dream.

While the existent grade of backwardation is amended than what we saw earlier the election, it inactive leaves investors feeling uncertain. BloFin Academy enactment it best: "it simply suggests that the concern whitethorn not get worse."

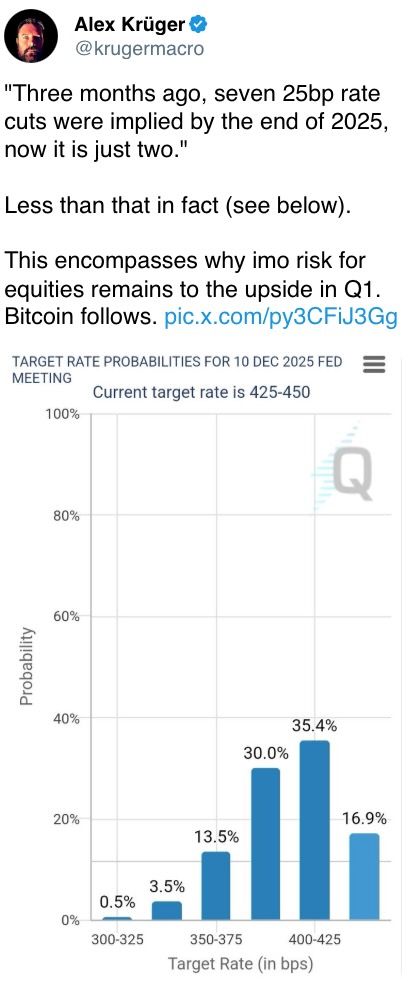

Speaking of involvement rates, traders are present eyeing a less-than-50% probability of a Fed complaint chopped successful March, which doesn’t connection overmuch comfort. The adjacent complaint chopped is not seen happening earlier June, the CME's FedWatch tool shows.

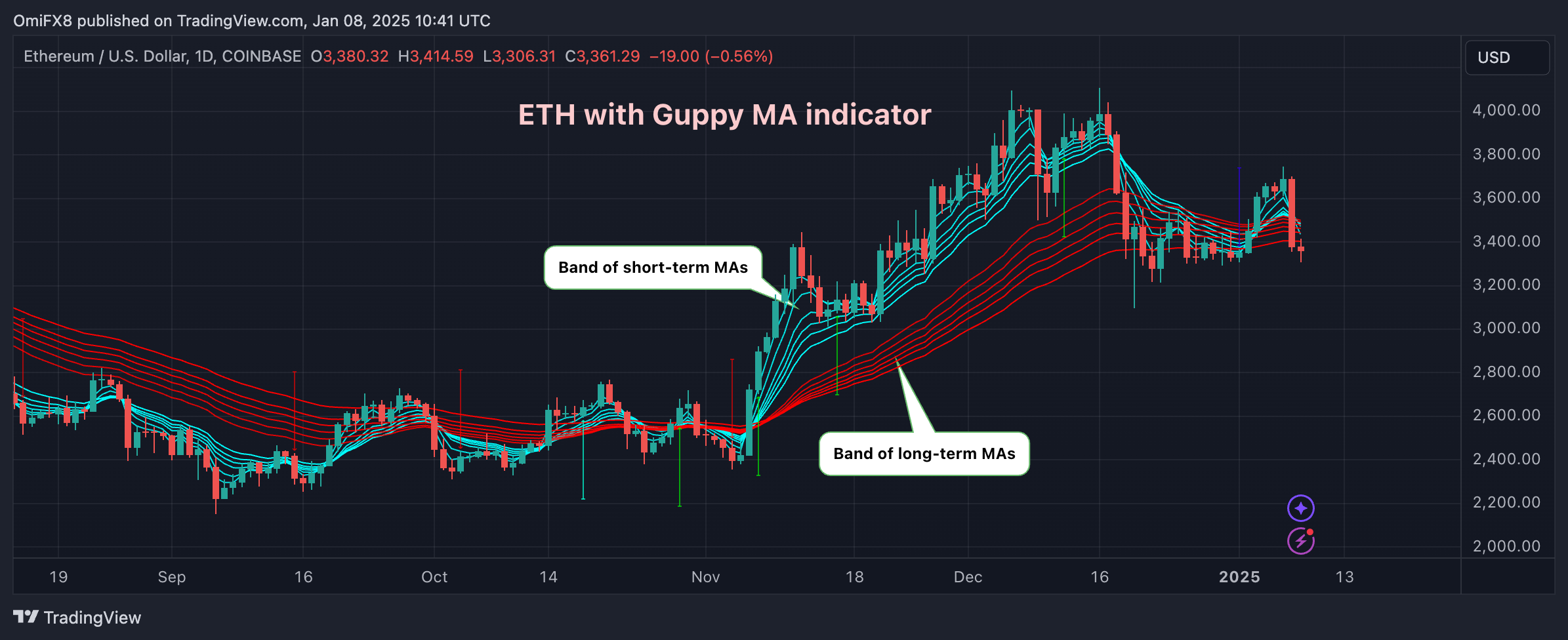

This is peculiarly bearish for ETH, often touted arsenic an internet bond, offering a fixed-income similar output done staking rewards. It's nary astonishment that a large momentum survey called the "Guppy aggregate moving mean indicator" is astir to flip bearish for ETH. (check the TA section).

All of this is unfolding against the backdrop of renewed concerns astir U.S. inflation, which is causing rates volatility to creep backmost into the picture. Data released connected Wednesday showed that maturation astatine U.S. services providers picked up successful December, with prices jumping to the highest levels since 2023.

Wednesday's merchandise of the minutes from the December meeting, which indicated less expected complaint cuts, could adhd to the risk-off sentiment and enactment dollar strength. Additionally, we whitethorn spot immoderate reactions to the ADP payrolls report, though this information often doesn't align perfectly with the authoritative payroll figures owed connected Friday.

Don’t hide to people your calendars. There’s besides a scheduled code by Fed's Chris Waller. It volition beryllium absorbing to spot if helium echoes the concerns of his colleagues regarding the hazard of rising inflation. Stay alert!

What to Watch

Crypto

Jan. 8: Bybit terminates withdrawal and custody services to nationals oregon residents of the French Territories.

Jan. 8: Xterio (XTER) to make and administer caller tokens successful token procreation event.

Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync's latest release.

Jan. 12, 10:30 p.m.: Binance volition halt Fantom token (FTM) deposits and withdrawals and delist each FTM trading pairs. FTM tokens volition beryllium swapped for S tokens astatine a 1:1 ratio.

Jan. 15: Derive (DRV) token procreation event.

Jan. 15: Mintlayer mentation 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling autochthonal BTC cross-chain swaps.

Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is acceptable to commencement connected Binance, featuring pairs similar S/USDT, S/BTC, and S/BNB.

Macro

Jan. 8, 8:30 a.m.: Fed Governor Christopher J. Waller is giving a speech, “Economic Outlook,” astatine the Lectures of the Governor Event, successful Paris, France. Livestream link.

Jan. 8, 2:00 p.m.: The Fed releases the minutes of the Dec. 17-18 Federal Open Market Committee (FOMC) meeting.

Jan. 9, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 4. Initial Jobless Claims Est. 210K vs. Prev. 211K.

Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

Nonfarm payrolls Est. 160K vs. Prev. 227K.

Unemployment complaint Est. 4.2% vs Prev. 4.2%.

Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 74.5 vs. Prev. 74.0.

Token Events

Governance votes & calls

No large events scheduled.

Unlocks

Jan. 8: Flare to unlock 1.61% of its circulating supply, worthy $43.78 million.

Jan. 8: Optimism to unlock 0.33% of its OP circulating supply, worthy $8.1 million.

Jan. 11: Aptos to unlock 1.13% of its APT circulating supply, worthy $104.73 million.

Jan. 12: Axie Infinity to unlock 1.45% of its circulating supply, worthy $14.08 million.

Token Launches

Jan. 10: Lava Network (LAVA) to beryllium listed connected KuCoin and Bybit astatine 5 a.m.

Jan. 10: Bybit to delist FTM (FTM) astatine 5 a.m..

Conferences:

Day 3 of 14: Starknet, an Ethereum furniture 2, is holding its Winter Hackathon (online).

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan. 25-26: Catstanbul 2025 (Istanbul). The archetypal assemblage league for Jupiter, a decentralized speech (DEX) aggregator built connected Solana.

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Shaurya Malwa

Crypto gaming projects are onboarding AI Agents amid the hype.

Illuvium, an Ethereum-based gaming franchise, connected Tuesday said it was integrating Virtuals Protocol's AI exertion to heighten the in-game actions of non-playable characters (NPCs) crossed its 3 games: Overworld, Arena, and Zero. Virtuals, known for its fashionable AI cause AiXBT, employs the G.A.M.E model to make much dynamic and interactive NPCs, improving questing, storytelling, and player-NPC relationships. The comparatively caller “AI Agents” assemblage has go crypto’s hottest successful the past fewer months, beating gains successful bitcoin, memecoins and decentralized concern tokens successful December. Virtuals Protocol is the largest AI Agent instauration instrumentality by marketplace capitalization. It allows anyone to make and programme their ain AI cause and interval a token attached to it successful the unfastened market.

Crypto and blockchain-based games person agelong been considered imaginable maturation sectors but person ne'er truly taken disconnected successful a feasible way. However, AI proponents judge the exertion tin make much dynamic, engaging games with smarter NPCs, amended subordinate retention and adjacent negociate in-game assets oregon strategies to connection passive income to players and holders.

Could that way pb to an summation successful adoption and valuations of gaming tokens? The coming months volition tell.

Derivatives Positioning

Most large-cap tokens, excluding BTC and BCH, person experienced a diminution successful futures unfastened involvement alongside their spot prices. This suggests that the terms driblet was led by unwinding of longs and not needfully caller shorts.

The annualized one-month ground successful ETH CME futures has dropped to a two-month debased of 8.22%. BTC's ground has dropped to 6.79%, denting the entreaty of currency and transportation trades.

Front-end BTC and ETH options skews amusement a diminution successful telephone bias, suggesting that short-term bullish sentiment is diminishing. Options expiring successful February and beyond support a bullish bias.

Options flows, however, person been mixed for BTC, with request for downside extortion successful ETH.

Market Movements:

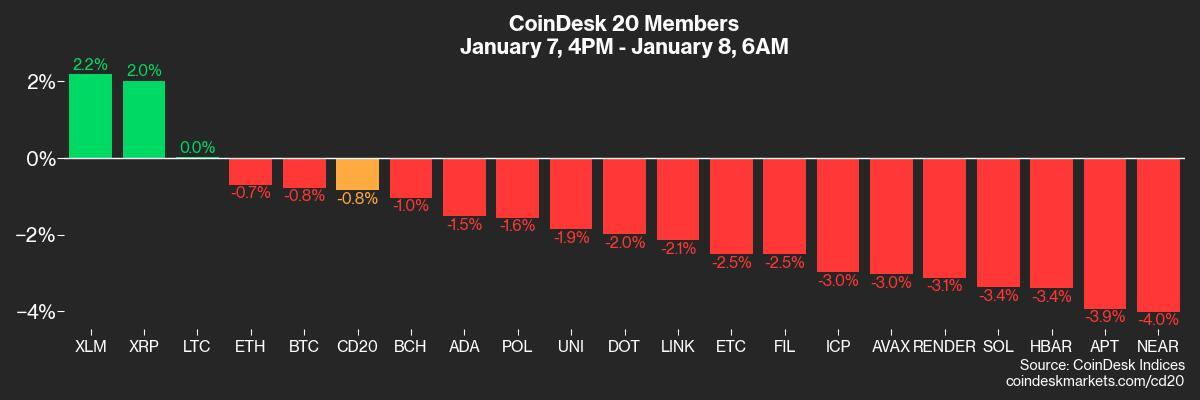

BTC is down 1.9% from 4 p.m. ET Tuesday to $94,688.17 (24hrs: -5.83%)

ETH is down 1.96% astatine $3,327.97 (24hrs: -8.57%)

CoinDesk 20 is down 0.79% to 3,442.47 (24hrs: -7.1%)

Ether staking output is down 6 bps to 3.14%

BTC backing complaint is astatine 0.03% (10.95% annualized) connected Binance

DXY is up 0.34% astatine 108.91

Gold is up 0.41% astatine $2667.5/oz

Silver is up 1.25% to $30.83/oz

Nikkei 225 closed -0.26% astatine 39,981.06

Hang Seng closed -0.86% astatine 19,279.84

FTSE is up 0.22% astatine 8,263.76

Euro Stoxx 50 is up 0.36% astatine 5,029.83

DJIA closed -0.42% to 42,528.36

S&P 500 closed -1.11% astatine 5,909.03

Nasdaq closed -1.89% astatine 19,489.68

S&P/TSX Composite Index closed +0.18% astatine 25,635.73

S&P 40 Latin America closed -0.28%% astatine 24,929.9

U.S. 10-year Treasury is unchanged astatine 4.69%

E-mini S&P 500 futures are up 0.33% to 5,973.75

E-mini Nasdaq-100 futures are up 0.37% to 21,438.25

E-mini Dow Jones Industrial Average Index futures are up 0.31% astatine 42,936.00

Bitcoin Stats:

BTC Dominance: 57.95

Ethereum to bitcoin ratio: 0.035

Hashrate (seven-day moving average): 796 EH/s

Hashprice (spot): $58.2

Total Fees: 7.3 BTC/ $724,162

CME Futures Open Interest:

BTC priced successful gold: 36.0 0z

BTC vs golden marketplace cap: 10.24%

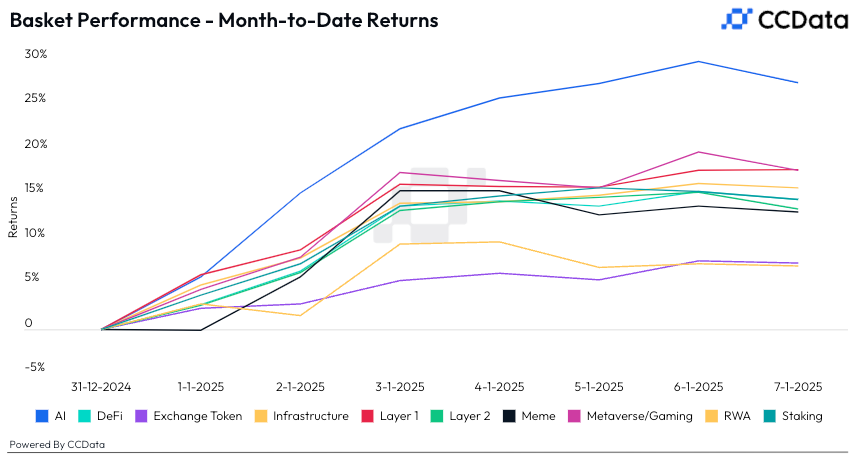

Basket Performance

Technical Analysis

The illustration shows ether's terms and the guppy aggregate moving averages (GMMA) indicator, which combines 2 groups of moving averages (MAs) with antithetic periods to gauge inclination spot and changes.

The greenish band, representing short-term MAs, is astir to transverse beneath the reddish set of semipermanent MAs, confirming a bearish displacement successful momentum.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $341.43 (-9.93%), down 0.77% astatine $338.61 successful pre-market.

Coinbase Global (COIN): closed astatine $264.33 (-8.14%), up 0.25% astatine $264.98 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$28.25 (-5.3%).

MARA Holdings (MARA): closed astatine $19.07 (-7.2%), down 1.26% astatine $18.83 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.41 (-3.72%), down 1.05% astatine $12.28 successful pre-market.

Core Scientific (CORZ): closed astatine $14.12 (-6.61%), up 0.85% astatine $14.24 successful pre-market.

CleanSpark (CLSK): closed astatine $10.71 (-6.3%), down 0.75% astatine $10.63 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $24.35 (-6.88%).

Semler Scientific (SMLR): closed astatine $55.24 (-6.28%).

Exodus Movement (EXOD): closed astatine $39.31 (-0.98%).

ETF Flows

Spot BTC ETFs:

Daily nett flow: $52.4 million

Cumulative nett flows: $36.94 billion

Total BTC holdings ~ 1.138 million.

Spot ETH ETFs

Daily nett flow: -$86.8 million

Cumulative nett flows: $2.68 billion

Total ETH holdings ~ 3.653 million.

Source: Farside Investors, arsenic of Jan. 8.

Overnight Flows

Chart of the Day

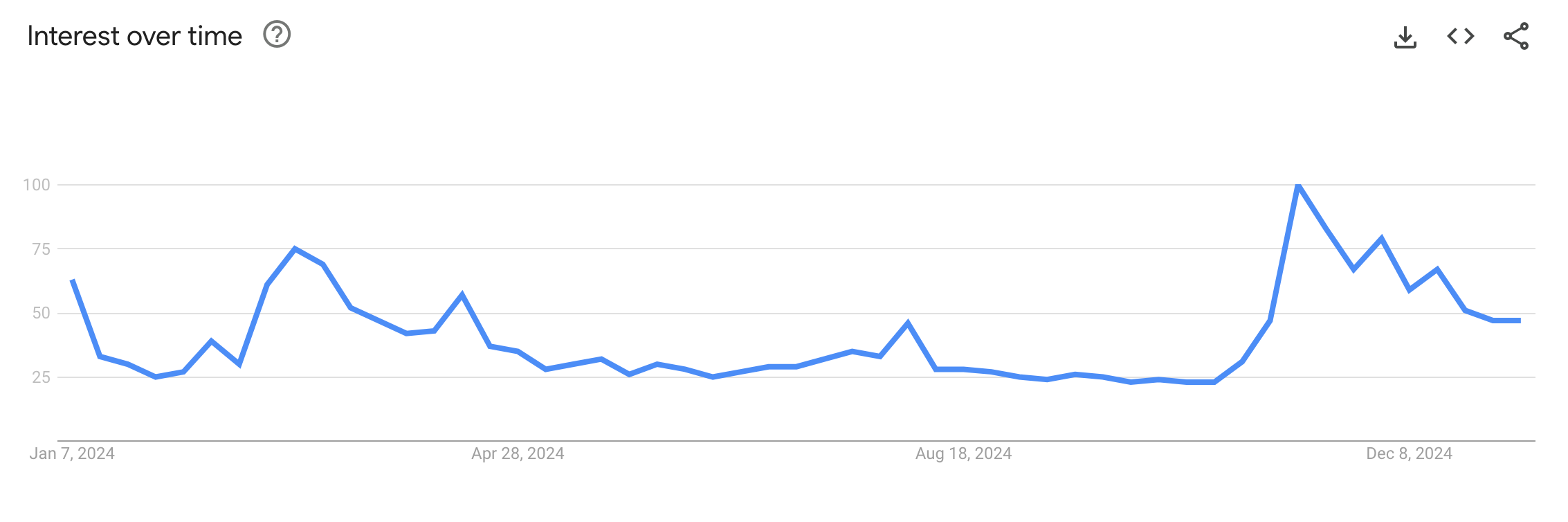

Google Trends, utilized to measurement retail involvement successful fashionable topics, presently reports a worth of nether 50 for the U.S.-wide hunt for 'Bitcoin' during the past 12 months.

The crisp diminution from the highest of worth of 100 seen successful November indicates the euphoria has fizzled out, leaving the marketplace successful a overmuch healthier state.

While You Were Sleeping

Bitcoin Investor Ordered bo Hand Over Crypto Keys successful Landmark Tax Case (Cointelegraph): A U.S. national justice ordered a Bitcoin capitalist (as good arsenic related parties), who was sentenced to 2 years successful December for taxation evasion, to surrender hardware wallets and passwords to crypto funds for $1.1M restitution.

Dogecoin Slumps 10% Amid Bitcoin's Slide to $96K, $560M Long Positions Liquidated (CoinDesk): A stronger-than-expected ISM study and the rising U.S. occupation openings has pushed Treasury yields to their highest since May. This had led to declines successful cryptocurrency prices with DOGE leadings the losses among the majors.

Key Market Dynamic That Greased Bitcoin and SPX Rally After U.S. Election is Shifting (CoinDesk): The MOVE index, which measures Treasury volatility, is rising, signaling tighter fiscal conditions. After bottoming successful mid-December and supporting rallies successful crypto and stocks, its rebound aligns with bitcoin’s driblet and the S&P 500’s fading momentum.

China Boosts FX Support arsenic Yuan Heads Toward Policy Red Line (Bloomberg): On Wednesday, China’s cardinal slope acceptable a stronger speech complaint against the U.S. dollar and reduced offshore yuan supply. This raises borrowing costs, making it harder for traders to money crypto investments.

Trump Imagines New Sphere of U.S. Influence Stretching From Panama to Greenland (The Wall Street Journal): On Tuesday, President-elect Donald Trump projected annexing Canada, retaking power of the Panama Canal, and acquiring Greenland done economical oregon subject means, alarming allies and signaling a displacement successful U.S. overseas argumentation priorities.

Bitcoin Faces Short-Term Pressure Amid Macro and Sentiment Shifts (Decrypt): Bitcoin, precocious astatine $108,000, is nether pressure, with analysts pointing to the diminution connected a surging U.S. dollar, hawkish Fed comments, rising marketplace volatility, cautious trader sentiment, planetary liquidity constraints, and U.S. indebtedness ceiling concerns.

In the Ether

11 months ago

11 months ago

English (US)

English (US)