By Omkar Godbole (All times ET unless indicated otherwise)

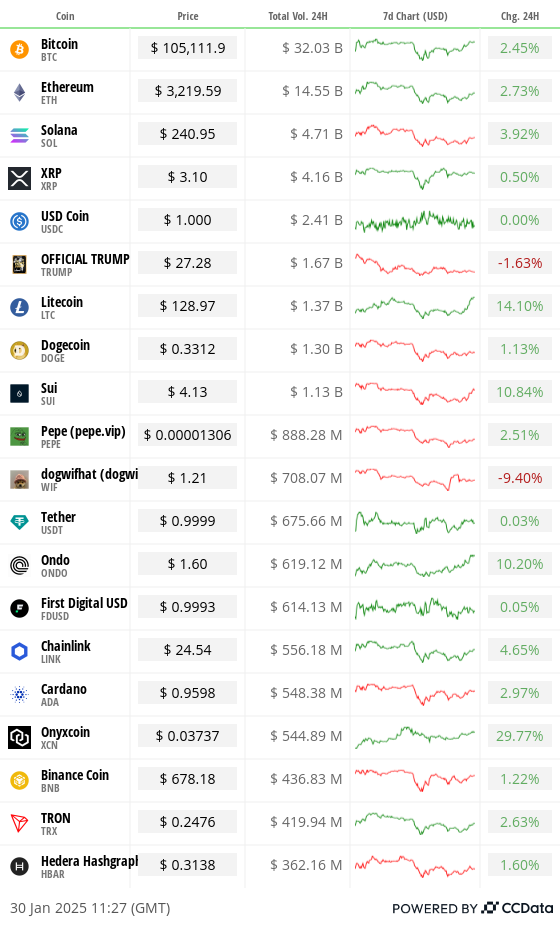

The crypto marketplace is trading positively with the Fed hazard lawsuit retired of the way, focusing connected positives specified arsenic the crypto-friendly president successful the White House, the renewed upswing successful Tether's market, and the bullish Chinese New Year effect.

Among cryptocurrencies with $5 billion-plus marketplace valuations, the standout performer is litecoin (LTC), the metallic to bitcoin's gold, which has jumped much than 11% since the aboriginal Asian hours compared with gains of 1% to 3% for the rest. It is the third-best performing of the apical 100 coins successful the past 24 hours, acknowledgment to the SEC acknowledging Canary Capital’s Litecoin ETF proposal. That has opened for nationalist feedback, a determination that hints astatine imaginable support successful the coming months.

"This is the archetypal altcoin ETF filing to get acknowledged," Bloomberg Senior ETF expert Eric Balchunas said on X, noting that the connection is the 1 to marque the astir advancement successful regulatory requirements.

A imaginable listing could beryllium arsenic affirmative for LTC arsenic it has been for BTC and ETH. Note that contempt the terms surge to $130, LTC is inactive good abbreviated of the $410 grounds precocious deed successful 2021. Its terms illustration shows a constructive outlook (check retired the Technical Analysis conception below).

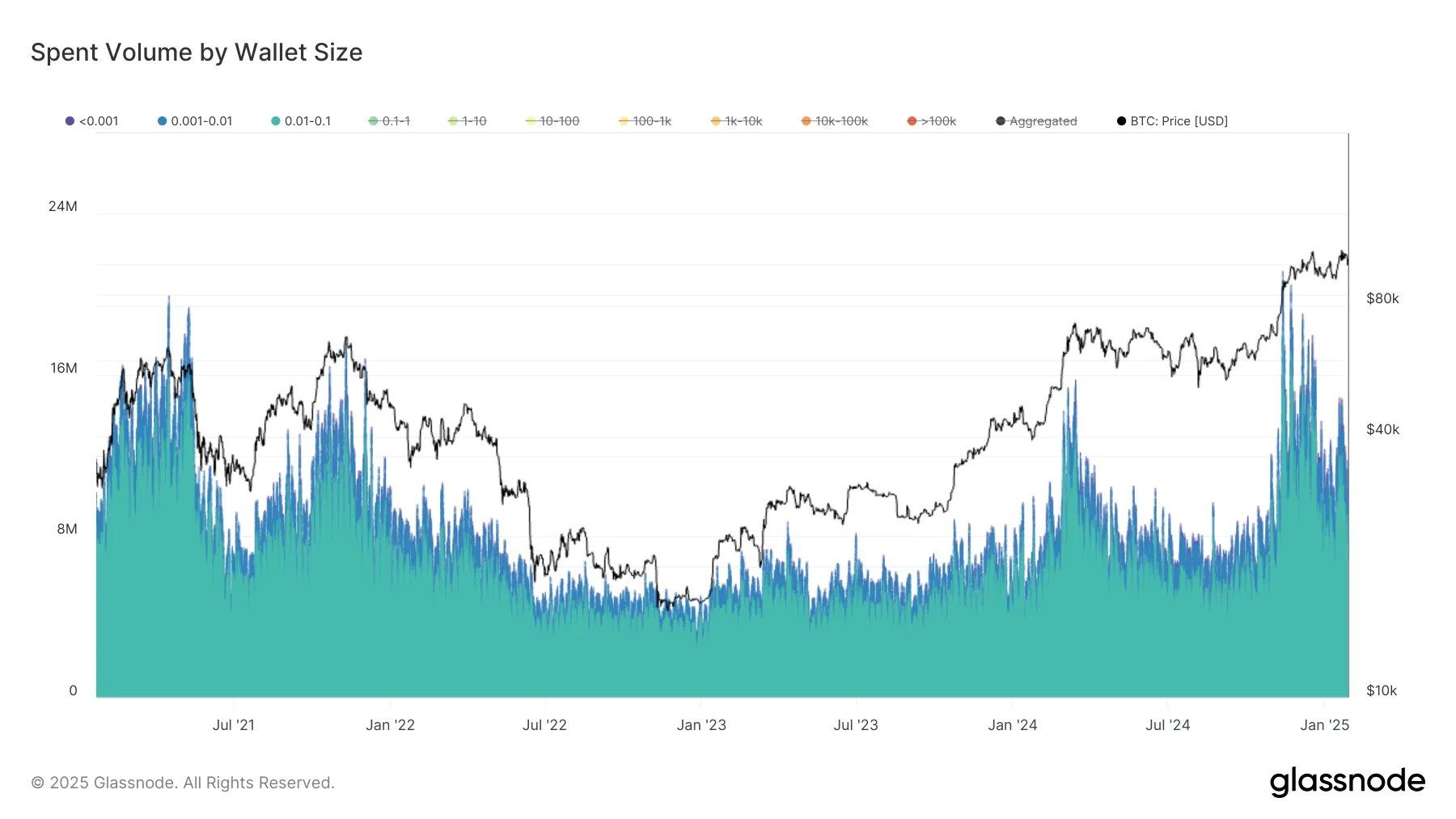

In different cardinal developments, on-chain enactment tracked by Glassnode shows a little level of retail information successful BTC close than successful November. That's encouraging for bulls looking for cues connected whether the latest determination supra $100,000 is sustainable. Meanwhile, Lombard Finance is becoming much ascendant successful the bitcoin staking space, capturing a elephantine stock of the full BTC staked this week.

The fig of Ethereum's progressive addresses precocious topped a March 2024 high, signaling a renewed uptick successful the on-chain activity, according to IntoTheBlock data. Ether's terms has crossed supra $3,200 but is yet to wide the bearish trendline connecting the Dec. 16 and Jan. 6 highs.

In accepted markets, the output connected the benchmark U.S. 10-year Treasury enactment has dropped to 4.50%, revisiting Monday's debased successful a bullish determination for hazard assets. Those bullish connected BTC whitethorn beryllium hoping for U.S. halfway PCE ostentation to travel successful softer-than-expected aboriginal today, driving the enslaved output adjacent lower.

That said, we volition besides get fourth-quarter GDP alongside the play jobless claims report. Meanwhile, European state prices person surged to a 15-month precocious and could inject immoderate volatility into hazard assets. Stay alert!

What to Watch

Crypto:

Jan. 31: Crypto.com is suspending purchases of cryptocurrencies USDT, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO, and XSGD successful the EU to comply with MiCA regulations. Withdrawals volition beryllium supported done Q1.

Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork web upgrade (v1.0.14)

Feb. 4: Pepecoin (PEPE) halving. At artifact 400,000, the reward volition driblet to 31,250 PEPE.

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork web upgrade for its Ethereum-based layer-2 mainnet.

Feb. 5 (after marketplace close): MicroStrategy (MSTR) Q4 FY 2024 earnings.

Feb. 6, 8:00 a.m.: Shentu Chain web upgrade (v2.14.0).

Feb. 11 (after marketplace close): Exodus Movement (EXOD) Q4 2024 earnings.

Feb. 12 (before marketplace open): Hut 8 (HUT) Q4 2024 earnings.

Feb. 13 (after marketplace close): Coinbase Global (COIN) Q4 2024 earnings.

Feb. 15: Qtum (QTUM) hard fork web upgrade astatine artifact 4,590,000.

Feb. 18 (after marketplace close): Semler Scientific (SMLR) Q4 2024 earnings.

Feb. 20 (after marketplace close): Block (XYZ) Q4 2024 earnings.

Feb. 26: MARA Holdings (MARA) Q4 2024 earnings.

Feb. 27: Riot Platforms (RIOT) Q4 2024 earnings.

Macro

Jan. 30: At a gathering of the Czech National Bank board, Governor Aleš Michl is presenting his plan for the cardinal slope to follow bitcoin arsenic a reserve asset.

Jan. 30, 8:15 a.m.: The ECB announces its interest-rate decision. This is followed by a property league astatine 8:45 a.m. Livestream link.

Deposit Facility Rate Est. 2.75% vs. Prev. 3%.

Main Refinancing Rate Est. 2.9% vs. Prev. 3.15%.

Marginal Lending Rate Prev. 3.4%.

Jan. 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases Q4 Advance GDP report.

GDP Growth Rate QoQ Est. 2.8% vs. Prev. 3.1%.

GDP Price Index QoQ Est. 2.5% vs. Prev. 1.9%.

Initial Jobless Claims for Week Ended Jan. 25 Est. 220K vs. Prev. 223K.

Continuing Jobless Claims Est. 18900K vs. Prev. 1899K.

Core PCE Prices QoQ Est. 2.5% vs. Prev. 2.2%.

PCE Prices QoQ Prev. 1.5%.

Real Consumer Spending QoQ Prev. 3.7%.

Jan. 30, 4:30 p.m.: The Federal Reserve releases H.4.1 study connected Factors Affecting Reserve Balances for the week ended Jan. 29.

Balance Sheet Prev. $6.83T.

Jan. 30, 6:30 p.m.: Japan’s Ministry of Internal Affairs and Communications releases December unemployment report.

Unemployment Rate Est. 2.5% vs. Prev. 2.5%.

Jan. 30, 6:50 p.m.: Japan’s Ministry of Economy, Trade and Industry releases December concern accumulation (preliminary) report.

Industrial Production MoM Est. 0.3% vs. Prev. -2.2%.

Industrial Production YoY Prev. -2.8%.

Retail Sales MoM Prev. 1.8%.

Retail Sales YoY Est. 3.2% vs. Prev. 2.8%.

Jan. 31, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases December 2024’s Personal Income and Outlays report.

Core PCE Price Index MoM Est. 0.2% vs. Prev. 0.1%.

Core PCE Price Index YoY Est. 2.8% vs. Prev. 2.8%.

PCE Price Index MoM Est. 0.3% vs. Prev. 0.1%.

PCE Price Index YoY Est. 2.6% vs. Prev. 2.4%.

Token Events

Governance votes & calls

Rarible DAO is voting whether to assistance the Rari Foundation a mandate to collaborate with Rarible connected implementing multichain protocol interest postulation and designing a superior protocol interest operation for NFT mints.

CoW DAO is voting connected granting its Core Treasury Team an allocation of 80 cardinal COW tokens to enactment liquidity provisioning, treasury growth, and merchandise improvement for CoW DAO from 2025 to 2028.

Synapse DAO is voting connected upgrading SYN token to CX from the Cortex Protocol and holders of some bask the aforesaid value.

Unlocks

Jan. 31: Optimism (OP) to unlock 2.32% of circulating proviso worthy $46.39 million.

Feb. 1: Sui (SUI) to unlock astir 2.13% of its circulating proviso worthy $261.91 million.

Feb. 2: Ethena (ENA) to unlock astir 1.34% of its circulating proviso worthy $29.53 million.

Token Listings

Jan. 30: Pepe (PEPE) to beryllium listed connected Bitflyer.

Conferences:

Day 2 of 3: Crypto Peaks 2025 (Palisades, California)

Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

Day 1 of 2: Ethereum Zurich 2025

Day 1 of 2: Plan B Forum (San Salvador, El Salvador)

Day 1 of 3: Crypto Gathering 2025 (Miami Beach, Florida)

Day 1 of 3: CryptoXR 2025 (Auxerre, France)

Day 1 of 4: Oasis Onchain 2025 (Nassau, Bahamas)

Day 1 of 6: The Satoshi Roundtable (Dubai)

Feb. 3: Digital Assets Forum (London)

Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: CoinDesk's Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23-March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

The JELLY token soared to a $200 cardinal marketplace capitalization successful latest illustration of Web2 startup founders launching their ain tokens.

The token was launched by Sam Lessin, a co-founder of Venmo, to bootstrap and summation traction for a caller video chat app called Jelly.

JELLY is integrated into Jelly eSports, which includes features similar Solana Boxes, a loot container crippled wherever players tin triumph luxury items by spinning with SOL oregon JELLY tokens.

Fees from utilizing JELLY are dynamically allocated to burning, staking, liquidity proviso incentives, gamification and squad support.

Derivatives Positioning

Litecoin's perpetual futures unfastened involvement has surged astir 20% successful 24 hours with affirmative nett cumulative measurement delta (CVD) signaling nett buying.

TRX, SUI and BTC besides boast of a affirmative nett CVD.

BTC and ETH CME futures premiums tick higher successful a motion of traders chasing bullish exposure.

On Deribit, BTC and ETH calls proceed to commercialized pricier than puts. Block flows person been mixed, featuring calendar spreads and abbreviated vol strategies similar abbreviated straddles.

Market Movements:

BTC is up 0.86% from 4 p.m. ET Wednesday to $105,190.06 (24hrs: +2.46%)

ETH is up 2.63% astatine $3,134.98 (24hrs: +2.62%)

CoinDesk 20 is up 1.74% to 3,826.50 (24hrs: +2.41%)

CESR Composite Staking Rate is down 3 bps to 3.03%

BTC backing complaint is astatine 0.0092% (10.12% annualized) connected Binance

DXY is unchanged astatine 107.98

Gold is up 0.91% astatine $2,778.26/oz

Silver is up 1.11% astatine $31.05/oz

Nikkei 225 closed +0.25% to 39,513.97

Hang Seng closed +0.14% to 20,225.11

FTSE is up 0.34% astatine 8,587.03

Euro Stoxx 50 is up 0.73% astatine 5,269.01

DJIA closed connected Wednesday -0.31% to 44,713.52

S&P 500 closed -0.47% to 6,039.31

Nasdaq closed -0.51% to 19,632.32

S&P/TSX Composite Index closed +0.21% to 25,473.30

S&P 40 Latin America closed unchanged astatine 2,336.48

U.S. 10-year Treasury is down 3 bps astatine 4.51%

E-mini S&P 500 futures are up 0.33% astatine 6,087.50

E-mini Nasdaq-100 futures are up 0.49% astatine 21,627.75

E-mini Dow Jones Industrial Average Index futures are up 0.38% astatine 45,062.00

Bitcoin Stats:

BTC Dominance: 59.53 (-0.51%)

Ethereum to bitcoin ratio: 0.03054 (1.73%)

Hashrate (seven-day moving average): 774 EH/s

Hashprice (spot): $62.2

Total Fees: 4.82 BTC/ $494,506

CME Futures Open Interest: 170,105 BTC

BTC priced successful gold: 38.0 oz

BTC vs golden marketplace cap: 10.80%

Technical Analysis

LTC has breached retired of a multimonth basing pattern, indicating a renewed bullish displacement successful momentum.

Resistance is seen astatine $150 followed by $300, with enactment astatine $86, the December plaything low.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $341.25 (+1.58%), up 0.87% astatine $343.86 successful pre-market.

Coinbase Global (COIN): closed astatine $291.00 (+3.26%), up 0.69% astatine $293 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$29.09 (+4.38%).

MARA Holdings (MARA): closed astatine $18.42 (+0.88%), up 0.87% astatine $18.58 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.22 (+2.47%), up 1.52% astatine $11.39 successful pre-market.

Core Scientific (CORZ): closed astatine $11.88 (+1.33%), up 3.66% astatine $11.88 successful pre-market.

CleanSpark (CLSK): closed astatine $10.26 (+2.09%), up 1.07% astatine $10.37 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $11.22 (+1.58%).

Semler Scientific (SMLR): closed astatine $52.08 (-0.42%), down 0.15% astatine $52 successful pre-market.

Exodus Movement (EXOD): closed astatine $89.30 (+11.4%), up 5.88% astatine $94.55 successful pre-market.

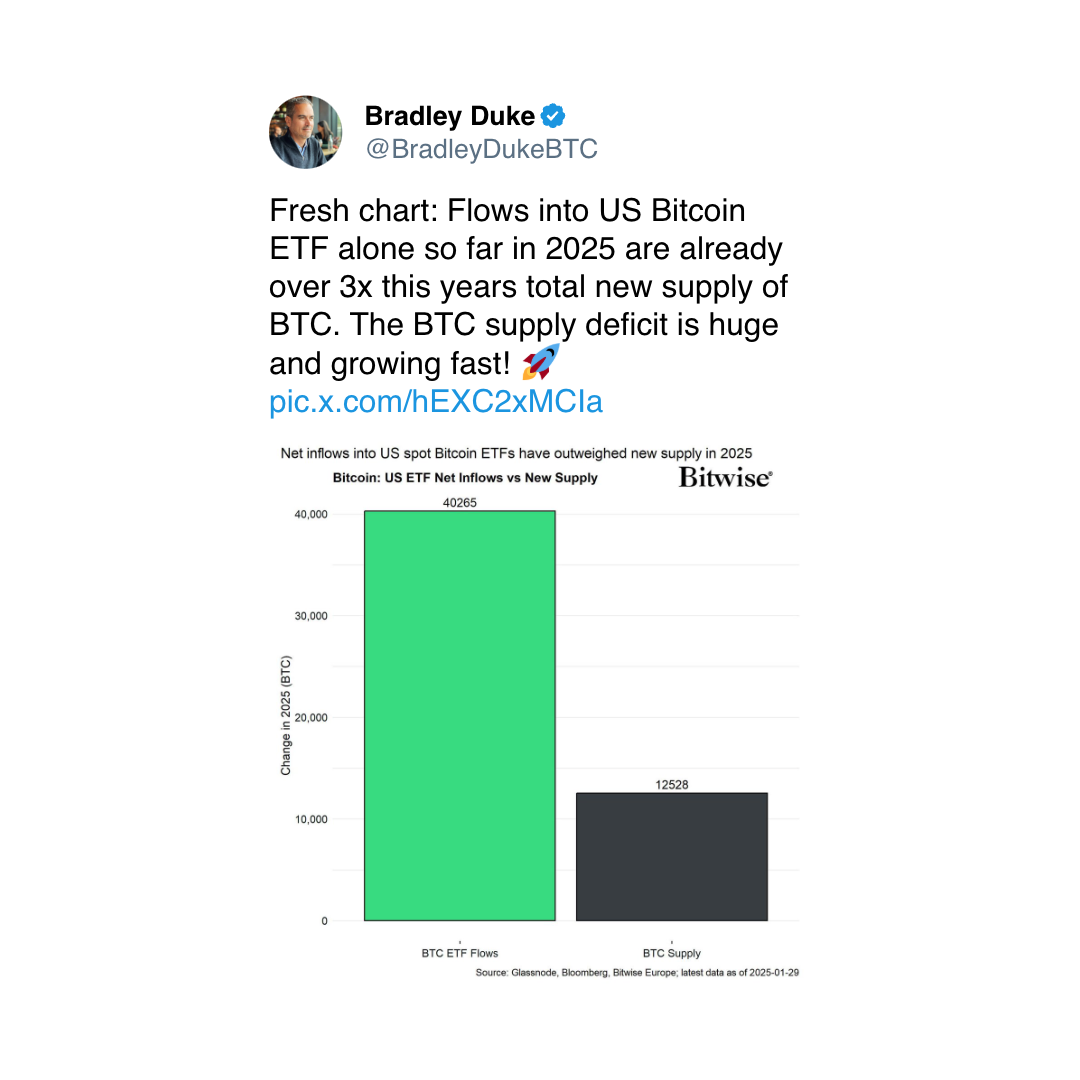

ETF Flows

ETF Flows

Spot BTC ETFs:

Daily nett flow: $92 million

Cumulative nett flows: $39.6 billion

Total BTC holdings ~ 1.17 million.

Spot ETH ETFs

Daily nett flow: -$4.82 million

Cumulative nett flows: $2.66 billion

Total ETH holdings ~ 3.6 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The illustration shows BTC spent by wallets owned by tiny and retail investors and whales.

Small addresses are presently spending $10.7 cardinal successful BTC each hour, a 48% diminution from the highest of $20.6 cardinal successful November.

While You Were Sleeping

Crypto Consortium T3 Helps Spanish Authorities Freeze $26.4M Linked to Crime Syndicate (CoinDesk): The T3 Financial Crime Unit, comprising investigators from Tron, Tether and TRM Labs, helped dismantle a European transgression syndicate laundering wealth done cryptocurrency.

Pudgy Penguins’ Layer 2 Network, Abstract, Struggles to Attract Liquidity (CoinDesk): Abstract has struggled to pull liquidity since starting up connected Jan. 27 with dense transaction volume.

Polymarket Still Skeptical of U.S Bitcoin Reserve Despite David Sacks' Assurance (CoinDesk): The Polymarket prediction marketplace assigns conscionable a 16% accidental that President Trump volition found a U.S. bitcoin reserve.

Bitcoin Extends Advance After Fed Meeting, Powell Commentary (Bloomberg): Bitcoin climbed past $105,000 aboriginal Thursday aft comments immoderate traders saw arsenic pro-crypto by Fed Chair Jerome Powell astatine Wednesday’s property conference.

Trump Lashes Out astatine a Favorite Nemesis: The Federal Reserve (The Wall Street Journal): Shortly aft the Fed’s FOMC property league ended, President Trump posted connected Truth Social criticizing Powell for his handling of U.S. inflation.

France’s Shrinking Economy Betrays Urgent Need to Overcome Budget Wrangles (CNBC): France’s system contracted 0.1% successful Q4, heightening urgency for Prime Minister François Bayrou to navigate governmental deadlock and walk a 2025 budget.

In the Ether

10 months ago

10 months ago

English (US)

English (US)