By Omkar Godbole (All times ET unless indicated otherwise)

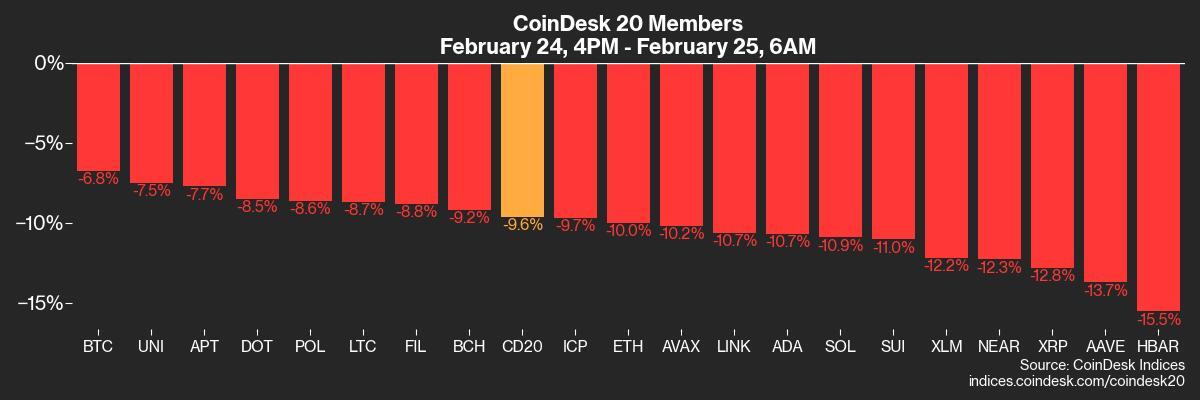

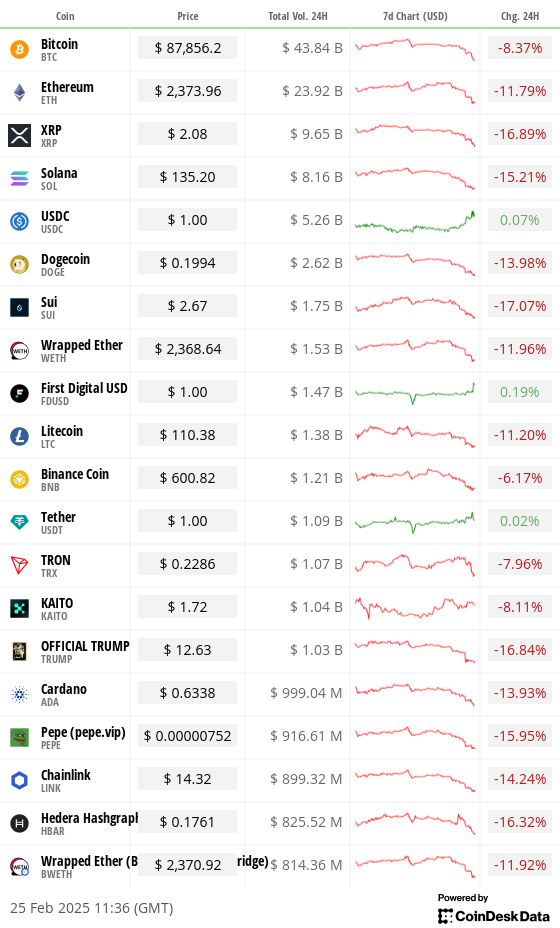

The crypto marketplace is simply a oversea of red, with bitcoin trading astatine three-month lows nether $88,000 and the CoinDesk 20 Index down much than 10% successful 24 hours. There are respective catalysts for the swoon, including risk-off sentiment successful accepted markets and power from memecoins, particularly the caller trading successful TRUMP and LIBRA.

As we discussed Monday, marketplace makers attending the Consensus Hong Kong league past week were disquieted the memecoin frenzy had sucked liquidity from the productive crypto sub-sectors, leaving the wide marketplace vulnerable.

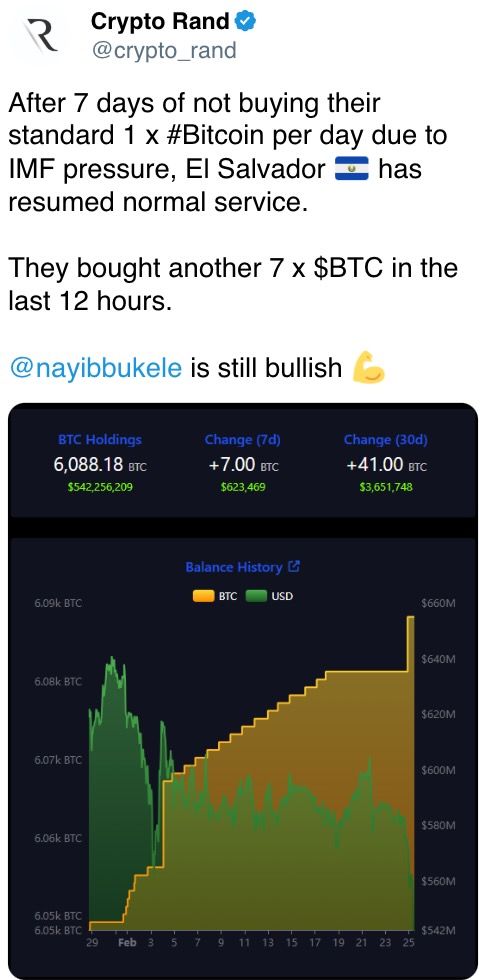

Another crushed is President Donald Trump's inaction. Although helium made important promises successful the lead-up to the elections, factual enactment has been scarce. The anticipated strategical BTC reserve remains absent, and adjacent state-level reserves are proving challenging to implement.

"The manufacture is inactive waiting for this to manifest successful a tangible mode successful the signifier of measures specified arsenic a mooted Bitcoin Strategic Reserve," Petr Kozyakov, co-founder and CEO astatine Mercuryo told CoinDesk. "In the meantime, sentiment has been deed hard by the biggest ever hack astatine the Bybit exchange, leaking 401,000 ETH, and a memecoin assemblage plagued with high-profile pump and dump schemes."

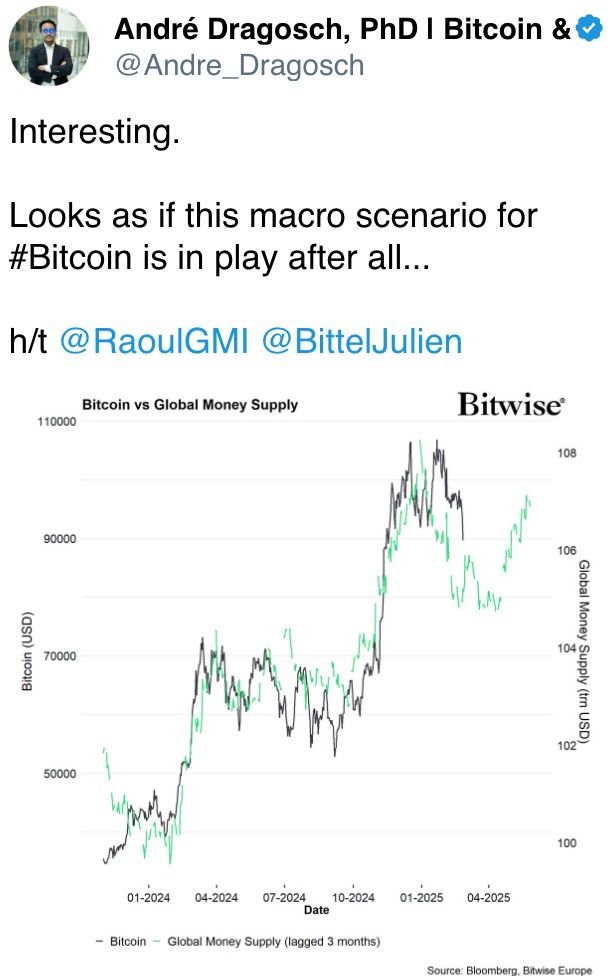

Lastly, renewed concerns astir the U.S. system are zapping request for riskier assets.

"There is besides immoderate interest astir the slowdown successful U.S. maturation since past week's U.S. Services PMI release, the lowest successful 22 months and accordant with GDP maturation tracking astatine 0.6% only," Nansen's main probe expert Aurelie Barthere said. "Our Nansen Risk Barometer besides conscionable turned Risk-off from Neutral today."

Together, they sent BTC diving retired of its two-month-long scope play betwixt $90,000 and $110,000. Technical investigation mentation suggests it could driblet to $70,000, though the maximum unfastened involvement successful BTC enactment options listed connected Deribit sits astatine the $80,000 strike, indicating that this level could supply immoderate support.

What could stabilize prices? Perhaps an announcement from Trump regarding a strategical reserve oregon a crisp reversal by the Nasdaq 100. However, that scale has fallen beneath its 50-day SMA, portion the yen, a risk-aversion signal, continues to fortify against G7 currencies, including the dollar.

The adjacent large catalysts for hazard assets are Nvidia's net connected Feb. 26 and halfway PCE ostentation connected Feb. 28. Stay alert!

What to Watch

Crypto:

Feb. 25, 9:00 a.m.: Ethereum Foundation probe squad AMA connected Reddit.

Feb. 25: Pascal hard fork web upgrade goes unrecorded connected the BNB Smart Chain (BSC) testnet.

Feb. 25, 9:00 a.m. (approximate): Reactive Network mainnet launch, arsenic good arsenic the archetypal instauration and organisation of the REACT token.

Feb. 26, 9:00 a.m. (approximate): Cosmos (ATOM) web upgrade.

Feb. 26: RedStone (RED) farming starts connected Binance Launchpool.

Feb. 27, 4:00 a.m.: Alchemy Pay (ACH) community AMA connected Discord.

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet motorboat (“Mobius”).

Macro

Feb. 25, 10:00 a.m.: The Conference Board (CB) releases February’s Consumer Confidence Index.

CB Consumer Confidence Est. 102.5 vs. Prev. 104.1

Feb. 25, 1:00 p.m.: Richmond Fed President Tom Barkin delivers a speech titled “Inflation Then and Now.”

Feb. 25, 7:30 p.m.: The Australian Bureau of Statistics releases January’s Consumer Price Index.

Monthly CPI Indicator Est. 2.6% vs. Prev. 2.5%

Feb. 26, 10:00 a.m.: The U.S. Census Bureau releases January’s New Residential Sales report.

New Home Sales Est. 0.68M vs. Prev. 0.698M

New Home Sales MoM Prev. 3.6%

Feb. 26-27: 2025’s archetypal G20 concern ministers and cardinal slope governors gathering (Cape Town).

Earnings

Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $-0.17

Feb. 25: Cipher Mining (CIFR), pre-market, $-0.09

Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Feb. 26: NVIDIA (NVDA), post-market

Token Events

Governances votes & calls

Ampleforth DAO is voting connected reducing the Flash Mint interest to 0.5% and the Flash Redeem interest to 5% to summation the system’s adaptability.

DYdX DAO is discussing the establishment of a DYDX buyback program. Its archetypal measurement would allocate 25% of the dYdX’s protocol nett gross to bargain backmost token.

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the state token connected Fraxtal, implementing the Frax North Star Hardfork, and introducing a Tail Emission Plan with gradually decreasing emissions, among different enhancements.

Unlocks

Feb. 28: Optimism (OP) to unlock 2.32% of circulating proviso worthy $30.21 million.

Mar. 1: DYdX to unlock 1.14% of circulating proviso worthy $5.36 million.

Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating proviso worthy $11.86 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating proviso worthy $61.32 million.

Mar. 7: Kaspa (KAS) to unlocked 0.63% of circulating proviso worthy $14.02 million.

Mar. 8: Berachain (BERA) to unlock 9.28% of circulating proviso worthy $61.6 million.

Mar. 12: Aptos (APT) to unlock 1.93% of circulating proviso worthy $69.89 million.

Token Listings

Feb. 25: Zoo (ZOO) to beryllium listed connected KuCoin.

Feb. 25: Ethena (ENA) to beryllium listed connected Bithumb.

Feb. 26: Moonwell (WELL) to beryllium listed connected Kraken.

Feb. 27: Venice token (VVV) to beryllium listed connected Kraken.

Feb. 28: Worldcoin (WLD) to beryllium listed connected Kraken.

Conferences:

CoinDesk's Consensus to instrumentality spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 3 of 8: ETHDenver 2025 (Denver)

Feb. 25: HederaCon 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Next Block Expo (Warsaw, Poland)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

Token Talk

By Shaurya Malwa

A token tied to a fake Sam Bankman-Fried relationship became the rug-pull of the day.

The scam started with the relationship “Comune Guardiagrele,” a tiny Italian metropolis with a verified grey checkmark indicating it’s an authoritative authorities oregon enactment account, based connected web results connected individuality verification.

Scammers astir apt hijacked oregon bought the relationship and changed the sanction to “@SBF_Doge" mimicking Sam Bankman-Fried (SBF), the disgraced crypto mogul jailed for the FTX fraud.

The relationship past launched a memecoin, apt tricking unsuspecting traders oregon bots into reasoning it was morganatic owed to the verification badge.

The memecoin’s marketplace capitalization roseate to $10 cardinal earlier its creators pulled liquidity, crashing it to a $100,000 capitalization and pocketing fees and proceeds gained from the sale.

Derivatives Positioning

The apical 25 cryptocurrencies by marketplace value, excluding stablecoins, person registered terms losses successful the past 24 hours. At the aforesaid time, astir person seen increases successful unfastened involvement successful perpetual futures and antagonistic cumulative measurement deltas, indicating an influx of bearish abbreviated positions. Perhaps determination is much symptom ahead.

On Deribit, XRP's February expiry puts commercialized astatine a 8 vol premium comparative to calls. Talk astir sentiment being notably bearish.

BTC, ETH options amusement downside concerns till mid-to-late March, with consequent expiries retaining the bullish telephone bias.

Market Movements:

BTC is down 6.23% from 4 p.m. ET Monday astatine $88,118.16 (24hrs: -7.7%)

ETH is down 9.4% astatine $2,393.03 (24hrs: -10.6%)

CoinDesk 20 is down 9.19% astatine 2,750.01 (24hrs: -11.61%)

Ether CESR Composite Staking Rate is unchanged astatine 2.99%

BTC backing complaint is astatine 0.0008% (0.84% annualized) connected Binance

DXY is unchanged astatine 106.7

Gold is down 0.28% astatine $2,937.90/oz

Silver is down 0.43% astatine $32.14/oz

Nikkei 225 closed -1.39% astatine 38,237.79

Hang Seng closed -1.32% astatine 23,034.02

FTSE is up 0.34% astatine 8,688.48

Euro Stoxx 50 is unchanged astatine 5,449.69

DJIA closed connected Monday unchanged astatine 43,461.21

S&P 500 closed -0.5% astatine 5,983.25

Nasdaq closed -1.21% astatine 19,286.93

S&P/TSX Composite Index closed unchanged astatine 25,151.26

S&P 40 Latin America closed -0.92% astatine 2,386.34

U.S. 10-year Treasury complaint is down 6 bps astatine 4.35%

E-mini S&P 500 futures are down 0.78% astatine 5,981.75

E-mini Nasdaq-100 futures are down 0.53% astatine 21,306.25

E-mini Dow Jones Industrial Average Index futures are down 0.13% astatine 43,479.00

Bitcoin Stats:

BTC Dominance: 61.81% (-0.15%)

Ethereum to bitcoin ratio: 0.02720 (-0.95%)

Hashrate (seven-day moving average): 745 EH/s

Hashprice (spot): $56.8

Total Fees: 7.5 BTC / $1.3 million

CME Futures Open Interest: 166,510 BTC

BTC priced successful gold: 29.7 oz

BTC vs golden marketplace cap: 8.42%

Technical Analysis

BTC's regular illustration shows the cryptocurrency has triggered a treble apical bearish reversal pattern.

The displacement successful inclination supports the lawsuit for a protracted weakness to the 200-day elemental moving average, presently stationed beneath $82,000.

Crypto Equities

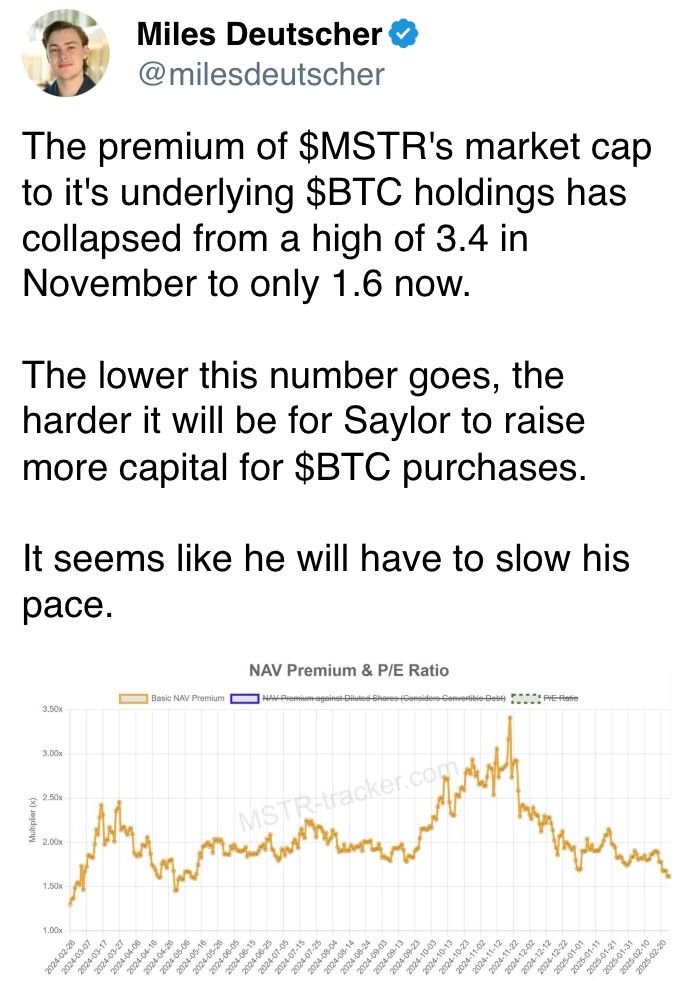

MicroStrategy (MSTR): closed connected Monday astatine $282.76 (-5.65%), down 6.35% astatine $264.81 successful pre-market

Coinbase Global (COIN): closed astatine $227.07 (-3.53%), down 5.6% astatine $214.14

Galaxy Digital Holdings (GLXY): closed astatine C$21.80 (-4.22%)

MARA Holdings (MARA): closed astatine $13.25 (-4.68%), down 5.76% astatine $13.09

Riot Platforms (RIOT): closed astatine $9.99 (-4.49%), down 5.01% astatine $9.49

Core Scientific (CORZ): closed astatine $9.86 (-8.7%), down 5.58% astatine $9.31

CleanSpark (CLSK): closed astatine $8.90 (-3.78%), down 5.39% astatine $8.42

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $19.20 (-6.43%), down 5.21% astatine $18.20

Semler Scientific (SMLR): closed astatine $44.38 (-7.04%), down 1.8% astatine $43.58

Exodus Movement (EXOD): closed astatine $41.16 (-13.91%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$516.4 million

Cumulative nett flows: $39.05 billion

Total BTC holdings ~ 1,105 million.

Spot ETH ETFs

Daily nett flow: -$78 million

Cumulative nett flows: $3.07 billion

Total ETH holdings ~ 3.331 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

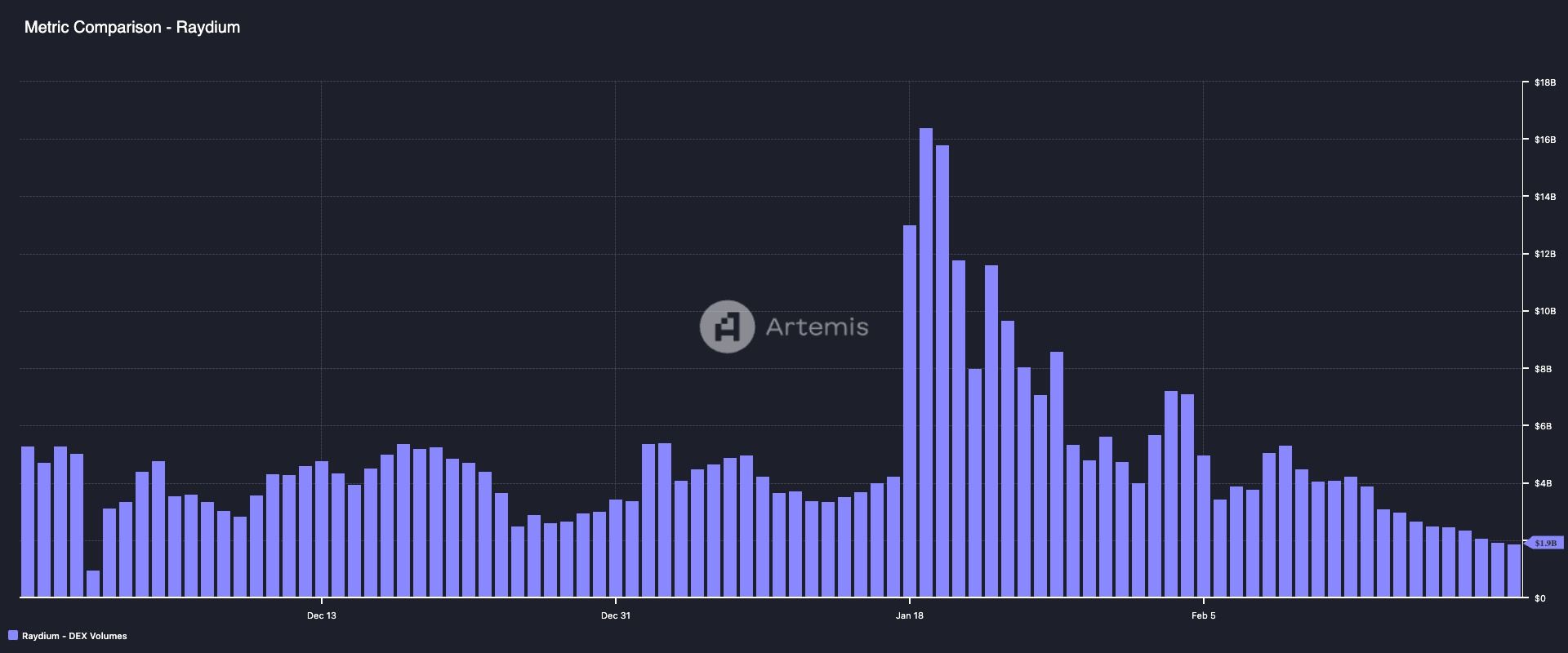

Raydium registered a cumulative trading measurement of $1.9 cardinal connected Monday, the lowest since Nov. 29, according to Artemis.

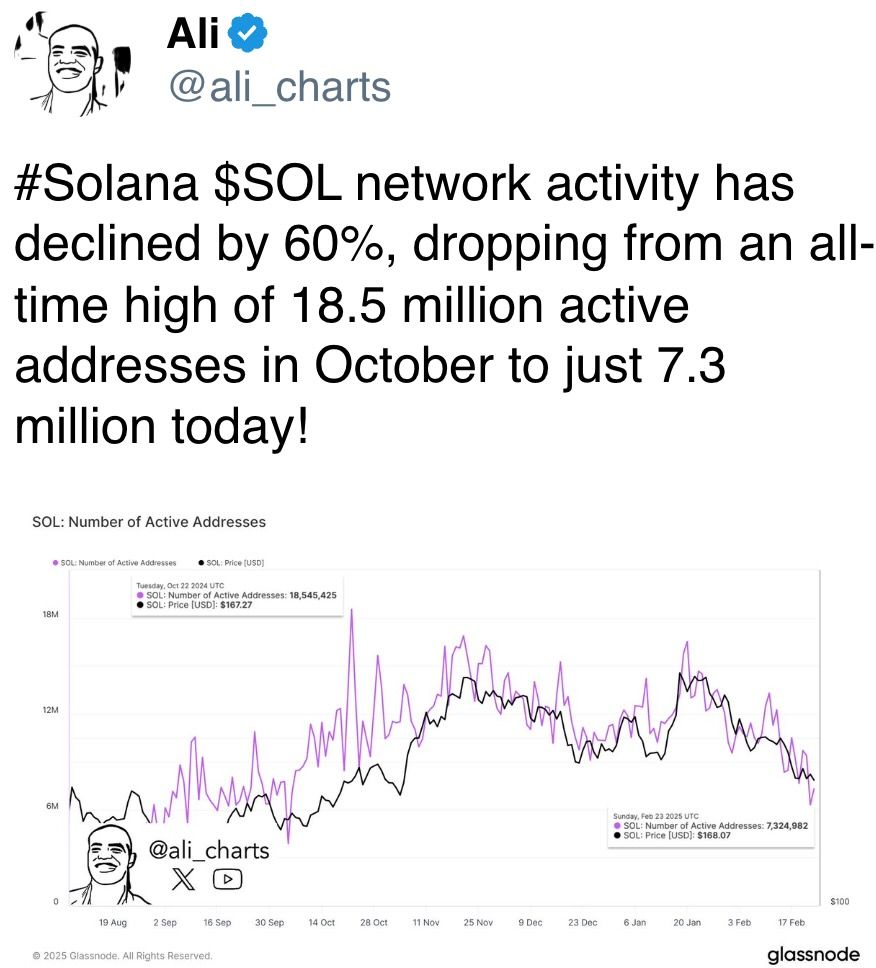

The slowdown partially explains the caller diminution the worth of the RAY token and Solana's SOL token.

While You Were Sleeping

Bitcoin Slides Below $89K to 3-Month Low arsenic Nasdaq Futures Dip, Yen Sparks Risk-Off Fears (CoinDesk): Bitcoin fell beneath $89,000 arsenic Nasdaq futures signaled further tech losses and a beardown yen raised concerns of hazard aversion akin to August 2024.

U.S. Bitcoin ETFs Post Year's 2nd-Biggest Outflows arsenic Basis Trade Drops Below 5% (CoinDesk): U.S.-listed spot BTC ETFs saw $516 cardinal successful outflows connected Monday and the bitcoin CME annualized ground fell to 4%, the lowest since the ETFs began trading successful January 2024.

USDe Issuer Ethena Labs Integrates Chaos Labs' Edge Proof of Reserves Oracles to Strengthen Risk Management (CoinDesk): Ethena Labs has enhanced USDe’s hazard absorption by adopting autarkic information oracles from Chaos Labs.

Forget MAGA, Investors Want MEGA: Make Europe Great Again (The Wall Street Journal): Once lagging down U.S. markets, Europe is staging a robust comeback, with Euro Stoxx 50 up 12% since Trump's victory, spurred by grounds inflows and mounting calls for regulatory reform.

China Learned to Embrace What the U.S. Forgot: The Virtues of Creative Destruction (Bloomberg): Amid rising U.S. tariffs and a faltering spot market, China is cutting backmost connected authorities spending, letting weaker sectors illness truthful resources tin displacement to tech and innovation.

Asian Shares Slide arsenic U.S. Curbs China Investment, Euro Gain Fades (Reuters): Asian shares fell Tuesday amid U.S. restrictions connected Chinese investments. MSCI’s Asia-Pacific scale dropped 1% and Japan’s Nikkei fell 1.3%.

In the Ether

9 months ago

9 months ago

English (US)

English (US)