By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace consolidated connected Wednesday's tariff pause-spurred terms bounce with memecoins, AI and DeFi tokens lasting retired arsenic the best-performing crypto sub-sectors. Coins including HYPE, HBAR and SHIB led the recovery.

Bullish method patterns and a crisp overnight pullback successful Treasury marketplace volatility, arsenic represented by the MOVE index, suggested further gains are successful the offing. The China-sensitive Australian dollar extended Wednesday's gain, offering affirmative cues to hazard assets. U.S. equity futures, however, did not bespeak that optimism, trading much than 1% lower.

Another enactment of caution showed successful derivatives data. LTC, TON, BCH, BNB and PEPE were the lone coins with 24-hour maturation successful unfastened interest, validating terms recovery. Open involvement successful different majors cryptocurrencies, including BTC and ETH, fell, a motion the betterment was chiefly led by the unwinding of bearish bets and not caller bullish positioning.

President Donald Trump's determination to rise tariffs connected China to 125% and trim others to 10% for 90 days inactive leaves the U.S. with an mean import taxation complaint of 24% versus 27% earlier Thursday. That's still, anti-growth, pro-inflation and anti-risk assets, according to Bloomberg.

In broader crypto marketplace news, the SEC published the 19b-4 filing by Cboe BZX Exchange to database the Fidelity Solana Fund successful the Federal Register. That's said to bring the regulator 1 measurement person to listing the SOL ETF successful the U.S.

The minutes of the Federal Reserve's March gathering showed statement among policymakers implicit the hazard of the system entering stagflation, characterized by higher ostentation and slower growth, with immoderate members saying "difficult tradeoffs" could prevarication up of the cardinal bank.

The absorption contiguous volition beryllium connected the U.S. user terms scale information for March, which is forecast to person accrued by conscionable 0.1% month-on-month, the slowest gait successful 8 months, according to FXStreet. A brushed people whitethorn beryllium dismissed arsenic backward-looking, considering the commercialized warfare escalated much recently. On the different hand, a hotter-than-expected speechmaking whitethorn assistance Treasury yields and the dollar. Stay alert!

What to Watch

Crypto

April 10, 10:30 a.m.: Status conference for erstwhile Terraform Labs CEO Do Kwon astatine the U.S. District Court for the Southern District of New York.

April 11, 1 p.m.: U.S. SEC Crypto Task Force Roundtable connected "Tailoring Regulation for Crypto Trading" successful Washington.

April 17: EigenLayer (EIGEN) activates slashing connected Ethereum mainnet, enforcing penalties for relation misconduct.

Macro

April 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March user terms ostentation data.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Rate YoY Est. 3% vs. Prev. 3.1%

Inflation Rate MoM Est. 0.1% vs. Prev. 0.2%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.8%

April 10, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended April 5.

Initial Jobless Claims Est. 223K vs. Prev. 219K

April 10, 10:00 a.m.: U.S. Senate Banking Committee hearing connected the information of Michelle Bowman arsenic Federal Reserve Vice Chair for Supervision. Livestream link.

April 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March shaper terms ostentation data.

Core PPI MoM Est. 0.3% vs. Prev. -0.1%

Core PPI YoY Est. 3.6% vs. Prev. 3.4%

PPI MoM Est. 0.2% vs. Prev. 0%

PPI YoY Est. 3.3% vs. Prev. 3.2%

April 14: Salvadoran President Nayib Bukele volition articulation U.S. President Donald Trump astatine the White House for an official moving visit.

Earnings (Estimates based connected FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events

Governance votes & calls

Spartan Council is voting connected raising the liquidation ratio for SNX solo stakers, with an archetypal summation to 250% connected April 11, past to 500% connected April 18 and “high capable to deprecate solo SNX staking” connected April 21. Voting ends April 19.

Lido DAO is discussing onboarding recognition delegation protocol Twyne into the Lido Alliance. Twyne aims to grow stETH’s usage cases and is requesting strategical endorsement, promotional enactment and method guidance from Lido.

April 10, 10 a.m.: Hedera to host a assemblage call discussing the HBR Foundation joining ERC3643, the non-profit’s standards, and the Header Asset Tokenization Studio.

April 11, 3 p.m.: Zcash to big a municipality hallway connected lockbox organisation & governance.

April 14, 10 a.m.: Stacks to host a livestream with caller announcements from the project.

Unlocks

April 10: Internet Computer (ICP) to unlock 0.57% of its circulating proviso worthy $13.54 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating proviso worthy $51.69 million.

April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating proviso worthy $21.73 million.

April 15: Starknet (STRK) to unlock 4.37% of its circulating proviso worthy $16.71 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating proviso worthy $26.27 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating proviso worthy $324.35 million.

Token Launches

April 10: Stacks (STX) to beryllium listed connected Bitfinex.

April 10: Streamr (DATA) to beryllium listed connected Binance.US.

April 10: Babylon (BABY) to beryllium listed connected Binance, Bitget, Bybit, Bitrue, KuCoin, OKX, and others.

April 10: Ren (REN), KonPay (KON) and Symbol (XYM) to be delisted from Bybit.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 3 of 3: Paris Blockchain Week

Day 2 of 2: FIBE Fintech Festival Berlin 2025

Day 2 of 2: Mexico Finance & Fintech Summit 2025 (Mexico City)

Day 2 of 2: Middle East Resilient Banking and Payments Symposium 2025 (Abu Dhabi)

April 10: Bitcoin Educators Unconference (Nashville)

April 10: FinXtex Malaysia 2025 (Kuala Lumpur)

April 10: Institutional Crypto Conference (New York)

April 10: SheFi Sumit 2025 (Seoul)

Day 1 of 2: BITE-CON 2025 Conference (Miami)

Day 1 of 2: 2025 Fintech and Financial Institutions Research Conference (Philadelphia)

April 11-12: Strategy's OPNEXT Conference (Tysons, Va.)

April 12: Ethereum Argentina (Córdoba)

April 12-13: DeSci London 2025

Token Talk

By Shaurya Malwa

DeFi-focused upstart Berachain has recorded nett outflows of $320 million successful the past week, the astir among each networks, followed by Arbitrum with conscionable $30 cardinal successful exits.

Berachain's regular progressive users dropped from a precocious of 630,000 connected March 3, according to TokenTerminal, to conscionable implicit 300,000 arsenic of April 8.

The network's BERA token is down 40% successful a week, shrinking its marketplace headdress to $465 cardinal and afloat diluted worth to $2.1 billion. It got a 12% assistance connected Thursday aft Trump's 90-day tariff pause, but it’s inactive a acold outcry from bully news.

Total worth locked is down 23% to $2.7 cardinal from a highest of $3.5 cardinal connected March 26, DefiLlama information shows. Still, the blockchain enjoys a cult pursuing and is hyped among retail traders making it 1 to ticker erstwhile marketplace conditions improve.

Meanwhile, Ethereum layer-2 Base, backed by Coinbase, has emerged arsenic the apical web with implicit $186 cardinal successful nett inflows successful the past 10 days.

Derivatives Positioning

BTC, ETH annualized futures ground held dependable supra 5% during the caller rout, signaling resilient marketplace sentiment.

Put skews for the 2 largest cryptocurrencies connected Deribit person weakened, but proceed to amusement downside fears retired to the June extremity expiry.

Flows featured purchases of $100K BTC calls expiring successful December, reflecting a bullish semipermanent outlook.

Market Movements:

BTC is down 1.74% from 4 p.m. ET Wednesday astatine $81,748.51 (24hrs: +6.2%)

ETH is down 4.65%% astatine $1,595.49 (24hrs: +7.78%)

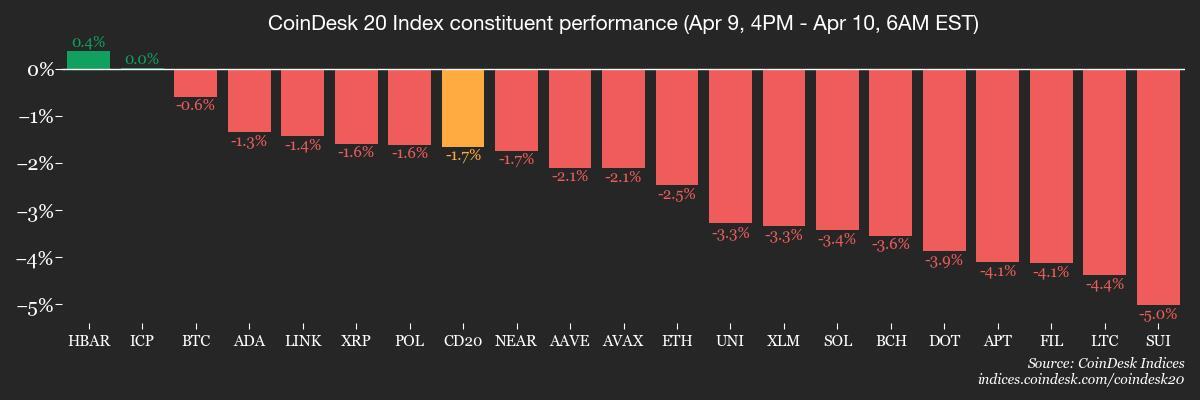

CoinDesk 20 is down 1.72% astatine 2,372.30 (24hrs: +7.55%)

Ether CESR Composite Staking Rate is unchanged astatine 3.69%

BTC backing complaint is astatine 0.0043% (4.7085% annualized) connected Binance

DXY is down 0.85% astatine 102.03

Gold is up 2.23% astatine $3,124.6/oz

Silver is up 1.68% astatine $30.83/oz

Nikkei 225 closed +9.13% astatine 34,609.00

Hang Seng closed +2.06% astatine 20,681.78

FTSE is up 3.97% astatine 7,984.64

Euro Stoxx 50 is up 5.33% astatine 4,868.37

DJIA closed connected Wednesday +7.87% astatine 40,608.45

S&P 500 closed +9.52% astatine 5,456.90

Nasdaq closed +12.16% astatine 17,124.97

S&P/TSX Composite Index closed +5.42% astatine 23,727.00

S&P 40 Latin America closed +7.02% astatine 2,330.16

U.S. 10-year Treasury complaint is down 7 bps astatine 4.29%

E-mini S&P 500 futures are down 2.13% astatine 5,374.00

E-mini Nasdaq-100 futures are down 2.44% astatine 18,818.50

E-mini Dow Jones Industrial Average Index futures are down 1.58% astatine 40,189.00

Bitcoin Stats:

BTC Dominance: 63.47 (0.34%)

Ethereum to bitcoin ratio: 0.01953 (-3.36%)

Hashrate (seven-day moving average): 899 EH/s

Hashprice (spot): $41.08

Total Fees: 5.6 BTC / $438,630

CME Futures Open Interest: 134,545

BTC priced successful gold: 26.2 oz

BTC vs golden marketplace cap: 7.47%

Technical Analysis

The per tube prices for West Texas Intermediate crude lipid person dropped beneath the long-held enactment astatine $67, suggesting much losses ahead.

Sliding crude could assistance compensate for the inflationary interaction of Trump’s tariffs, helping cardinal banks, including the Fed, to chopped involvement rates and enactment hazard assets successful lawsuit of a large marketplace instability.

Crypto Equities

Strategy (MSTR): closed connected Wednesday astatine $2296.86 (+24.76%), down 3.64% astatine $286.06 successful pre-market

Coinbase Global (COIN): closed astatine $177.09 (+16.91%), down 2.31% astatine $173

Galaxy Digital Holdings (GLXY): closed astatine C$15.19 (+14.9%)

MARA Holdings (MARA): closed astatine $12.31 (+17.02%), down 2.44% astatine $12.01

Riot Platforms (RIOT): closed astatine $7.38(+12.84%), down 1.56% astatine $7.26

Core Scientific (CORZ): closed astatine $7.51 (+15.36%), down 3.6% astatine $7.24

CleanSpark (CLSK): closed astatine $7.63 (+13.2%), down 2.75% astatine $7.42

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $13.06 (+13.66%)

Semler Scientific (SMLR): closed astatine $35.16 (+9.98%)

Exodus Movement (EXOD): closed astatine $43.14 (+7.47%), up 8.92% astatine $46.99

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$127.2 million

Cumulative nett flows: $35.61 billion

Total BTC holdings ~ 1.11 million

Spot ETH ETFs

Daily nett flow: -$11.2 million

Cumulative nett flows: $2.36 billion

Total ETH holdings ~ 3.37 million

Source: Farside Investors

Overnight Flows

Chart of the Day

The illustration shows the breakdown of BTC options artifact trades connected Deribit. Block trades are ample trades executed connected over-the-counter tech platforms and past listed connected Deribit.

Selling telephone options has been the astir fashionable play, a motion marketplace participants are betting connected a driblet successful volatility and dilatory terms ascent.

While You Were Sleeping

China State Media Hints astatine Rate Cuts to Counter Trump’s Tariffs (Bloomberg): Front-page commentary successful the state-run Securities Daily urged complaint cuts and little slope reserve requirements to combat deflation and offset Trump’s tariffs.

Russia, United States to Hold Talks connected Diplomatic Missions (Reuters): Talks successful Istanbul purpose to resoluteness embassy issues, including restrictions connected diplomat movements and frozen assets specified arsenic consulates, commercialized missions, and historical estates.

Crypto Investors Flee Spot Bitcoin, Ether ETFs connected Tariff-Driven Uncertainty (CoinDesk): U.S.-listed spot BTC and ETH ETFs saw outflows Wednesday adjacent arsenic cryptocurrency prices surged.

Bitcoin Eyes $87K After Double Bottom Breakout; Dogecoin, XRP Bulls Look to Establish Control (CoinDesk): Bitcoin rebounded from 2 caller lows adjacent $74,600 and broke supra $80,800, a determination analysts accidental could propulsion it toward $87,000.

Binance Gains Market Share arsenic Bitcoin Volume Declined 77% From Yearly Peak: CryptoQuant (CoinDesk): A measurement driblet of specified magnitude suggests traders and investors are losing involvement oregon confidence.

NFT Marketplace Magic Eden Buys Trading App Slingshot (CoinDesk): Slingshot allows trading tokens from a azygous USDC balance, removing the request for wallet setup, state fees oregon moving assets crossed blockchains, expanding Magic Eden beyond Solana to each chains.

In the Ether

8 months ago

8 months ago

English (US)

English (US)