By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin and astir large cryptocurrencies are weaker aft Chicago Mercantile Exchange, a proxy for organization activity, denied reports of listing futures tied to XRP and SOL. Traditional markets are besides holding their enactment for the expected Bank of Japan interest-rate summation connected Friday.

Despite BTC's continued scope play supra $100,000, retail request remains robust. Glassnode's shrimp-Crab cohort, which includes addresses holding up to 10 BTC, person absorbed 1.9 times the recently mined proviso past month, totaling implicit 25,600 BTC. Meanwhile, semipermanent holders person slowed their spending and profit-taking activities, indicating a cautious, but firm, committedness to their investments.

Still, dropping beneath $100,000 mightiness beryllium costly. According to Wintermute's OTC trader Jake Ostrovskis, that would "frame Monday's inauguration arsenic a sell-the-news lawsuit and the communicative could power beauteous quickly."

Reports suggest the fig of whale wallets holding betwixt 1 cardinal and 10 cardinal XRP has surged to an all-time precocious of 2,083, signaling accrued accumulation and assurance successful its aboriginal performance.

In the satellite of innovation, chatter astir Bitcoin Synths is gaining traction connected X. These synthetic assets let users to payment from bitcoin’s terms movements without really owning the cryptocurrency. Bitcoin Synths tin beryllium traded oregon utilized arsenic collateral successful lending protocols, avoiding the complexities associated with wrapped tokens and specialized bridges.

Ethereum layer-2 protocols are besides making headlines with grounds transaction volumes, adjacent arsenic concerns astir their capableness nearing limits persist.

On the macroeconomic front, caller information from the Labor Department shows that the "all tenant rent" index, an indicator of structure ostentation successful the Consumer Price Index (CPI), rose astatine a slower pace past quarter. The information suggest that caller worries astir ostentation whitethorn beryllium overdone and the Fed could pivot distant from its hawkish forecast, which would beryllium a affirmative motion for hazard assets. Stay alert!

What to Watch

Crypto

Jan. 23: First deadline for SEC determination connected NYSE Arca's proposal to database and commercialized shares of Grayscale Solana Trust (GSOL), a closed-end trust, arsenic an ETF.

Jan. 25: First deadline for SEC decisions connected proposals for 4 spot solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and VanEck Solana Trust, which are each sponsored by Cboe BZX Exchange.

Jan. 29: Ice Open Network (ION) mainnet launch.

Feb. 4: MicroStrategy Inc. (MSTR) reports Q4 2024 earnings.

Feb. 4: Pepecoin (PEPE) halving. At artifact 400,000, the reward volition driblet to 31,250 pepecoin.

Feb. 5, 3:00 p.m.: Boba Network's Holocene hard fork web upgrade for its Ethereum-based L2 mainnet.

Macro

Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

Initial Jobless Claims Est. 215K vs. Prev. 217K.

Jan. 23, 10:00 a.m.: The National Association of Realtors releases December 2024 U.S. Existing Home Sales report.

Existing Home Sales Est. 4.16M vs. Prev. 4.15M.

Existing Home Sales MoM Prev. 4.8%.

Jan. 23, 4:30 p.m.: The Fed releases the H.4.1 report, the cardinal slope equilibrium sheet, for the week ended Jan. 22.

Total Reserves Prev. $6.83T.

Jan. 23, 6:30 p.m.: Japan's Ministry of Internal Affairs and Communications releases December 2024's Consumer Price Index (CPI) report.

Inflation Rate MoM Prev. 0.6%.

Core Inflation Rate YoY Est. 3% vs. Prev. 2.7%.

Inflation Rate YoY Prev. 2.9%.

Jan. 23, 10:00 p.m.: The Bank of Japan (BoJ) releases Statement connected Monetary Policy.

Interest Rate Decision Est. 0.5% vs. Prev. 0.25%.

Token Events

Governance votes & calls

Morpho DAO is discussing reducing incentives by 30% crossed each networks and assets.

Yearn DAO is discussing backing and endorsing a subDAO called Bearn to absorption connected gathering and launching products connected Berachain.

Frax DAO is discussing a $5 cardinal concern successful World Liberty Financial (WLFI), the crypto task backed by the household of U.S. President Donald Trump.

Jan. 23: Livepeer (LPT) is hosting a Core Dev call.

Jan. 24: Arbitrum BoLD's activation vote deadline. BoLD allows anyone to enactment successful validation and support against malicious claims to an Arbitrum chain's state.

Jan. 24: Hedera (HBAR) is hosting a assemblage telephone astatine 11 a.m.

Unlocks

Jan. 31: Optimism (OP) to unlock 2.32% of circulating proviso worthy $52.9 million.

Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating proviso worthy $626 million.

Token Launches

Jan. 23: Sky (SKY) is being listed connected Bitget.

Jan. 23: Animecoin (ANIME) is launching, with claims starting astatine 8 a.m. The token volition beryllium listed connected aggregate exchanges including Binance, OKX and KuCoin.

Conferences:

Day 11 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Day 4 of 5: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 24-25: Adopting Bitcoin (Cape Town, South Africa)

Jan. 25-26: Catstanbul 2025 (Istanbul). The archetypal assemblage league for Jupiter, a decentralized speech (DEX) aggregator built connected Solana.

Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Jan. 30 to Feb. 4: The Satoshi Roundtable (Dubai)

Feb. 3: Digital Assets Forum (London)

Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Token Talk

By Francisco Rodrigues

Azuki, a non-fungible token (NFT) collection, is introducing its Animecoin (ANIME) contiguous connected Ethereum and Arbitrum. The token was announced connected Jan. 13.

An airdrop volition encompass Azuki NFT holders, Hyperliquid HYPE stakes, immoderate Arbitrum ecosystem participants and Kaito yappers.

It volition besides see definite anime communities and BNB token holders who, betwixt Jan. 17 and Jan. 20, subscribed to Simple Earn with their tokens connected Binance.

The debut builds connected a increasing inclination of NFT collections launching their ain tokens, a inclination that started successful 2021 erstwhile Bored Ape Yacht Club (BAYC) launched ApeCoin.

Other examples see DeGods' DUST and Pudgy Penguins' PENGU tokens, which person a $1.6 cardinal marketplace capitalization.

Other signs bespeak the NFT marketplace is heating up, with Nansen precocious pointing out that a Crypto Punk was sold for 170 ETH (around $540,000) portion an Azuki was sold for 165 ETH. The Azuki NFT had been bought a period earlier for 105 ETH.

Derivatives Positioning

The cumulative measurement delta indicator reveals that large cryptocurrencies, with the objection of TON, person experienced nett selling unit successful the perpetual futures markets implicit the past 24 hours.

Block flows connected Deribit and Paradigm featured agelong positions successful short-dated BTC puts astatine $100K, $95K and $70K. An entity bought ETH enactment astatine $2.9K.

Front-end BTC and ETH calls present traded astatine par with puts.

Market Movements:

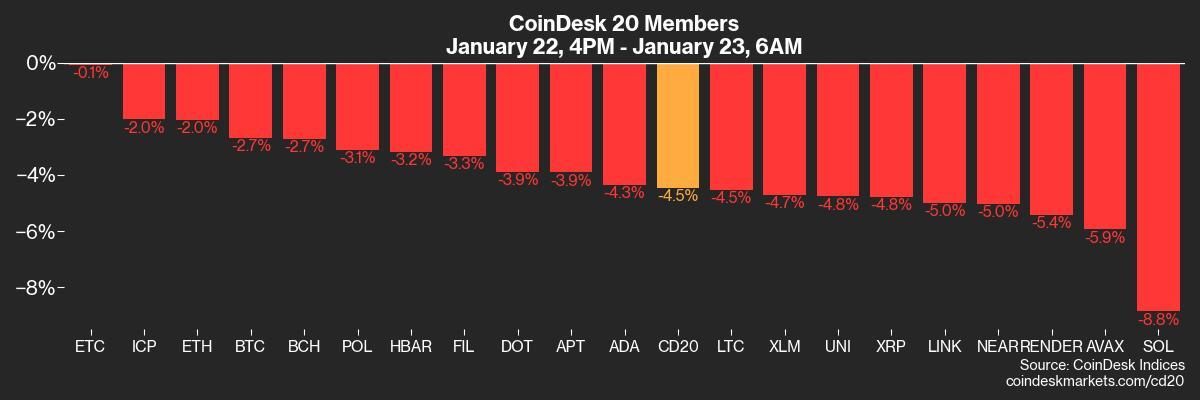

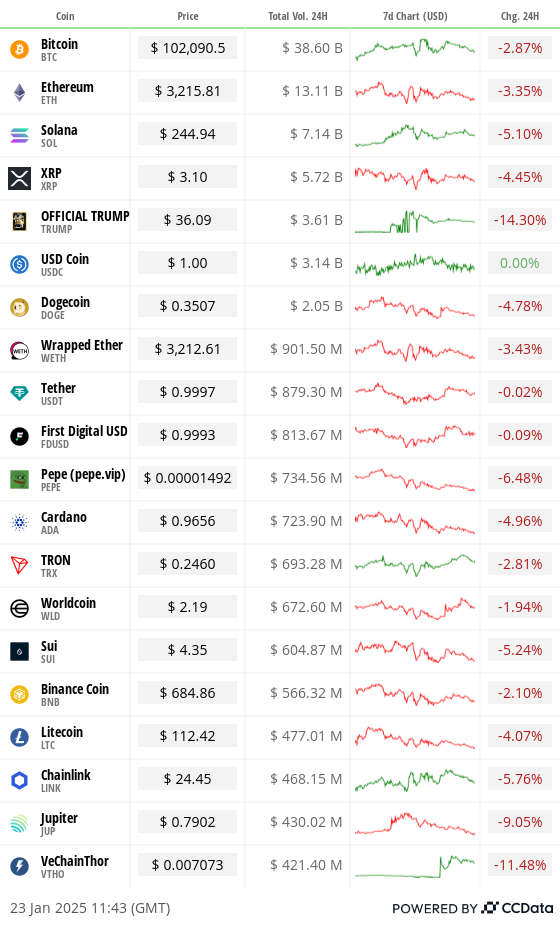

BTC is down 4.1 % from 4 p.m. ET Wednesday to $102,020 (24hrs: -2.71%)

ETH is down 3.85% astatine $3,206.18 (24hrs: -2.83%)

CoinDesk 20 is down 3.61% to 3,799.21 (24hrs: -3.58%)

CESR Composite Ether Staking Rate is down 15 bps to 3.15%

BTC backing complaint is astatine -0.0019% (-2.08% annualized) connected OKX

DXY is unchanged astatine 108.25

Gold is down 0.35% astatine $2,761.10/oz

Silver is down 0.73% to $30.57/oz

Nikkei 225 closed up 0.79% astatine 39,958.87

Hang Seng closed down 0.4% astatine 19,700.56

FTSE is unchanged astatine 8,538.7

Euro Stoxx 50 is unchangedat 5203.6

DJIA closed +0.3% to 44,156.73

S&P 500 closed +0.61% astatine 6,086.37

Nasdaq closed +1.28% astatine 20,009.34

S&P/TSX Composite Index closed +0.12% astatine 25,311.5

S&P 40 Latin America closed +1.21% astatine 2,297.32

U.S. 10-year Treasury is up 3 bps astatine 4.59%

E-mini S&P 500 futures are down 0.19% to 6,109.00

E-mini Nasdaq-100 futures are down 0.56% to 21,876.75

E-mini Dow Jones Industrial Average Index futures are unchaged astatine 44,384.00

Bitcoin Stats:

BTC Dominance: 58.59

Ethereum to bitcoin ratio: 0.031

Hashrate (seven-day moving average): 781 EH/s

Hashprice (spot): $58.9

Total Fees: 8.5 BTC/ $876,410

CME Futures Open Interest: 188,396 BTC

BTC priced successful gold: 37.1 oz

BTC vs golden marketplace cap: 10.56%

Technical Analysis

BTC's retreat from Monday's precocious is teasing a enactment of a treble apical bearish reversal pattern.

A determination beneath the horizontal enactment would corroborate the pattern, perchance bringing much chart-led sellers to the market.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $377.31 (-3.03%), down 1.89% astatine $370.19 successful pre-market.

Coinbase Global (COIN): closed astatine $295.85 (+0.56%), down 2.59% astatine $288.18 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$32.81 (+4.99%)

MARA Holdings (MARA): closed astatine $19.69 (+0.66%), down 2.54% astatine $19.19 successful pre-market.

Riot Platforms (RIOT): closed astatine $13.14 (+3.14%), down 1.75% astatine $12.91 successful pre-market.

Core Scientific (CORZ): closed astatine $15.97 (+4.58%%), down 1.63% astatine $15.71 successful pre-market.

CleanSpark (CLSK): closed astatine $11.14 (+1.64%), down 2.51% astatine $10.86 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.53 (+2.24%), up 2.58% astatine $28.27 successful pre-market.

Semler Scientific (SMLR): closed astatine $62.11 (-4.36%), up 2% astatine $64.90 successful pre-market.

Exodus Movement (EXOD): closed astatine $41.00 (+2.5%), down 2.07% astatine $40.15 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: $248.7 million

Cumulative nett flows: $39.23 billion

Total BTC holdings ~ 1.161 million.

Spot ETH ETFs

Daily nett flow: $70.7 million

Cumulative nett flows: $2.81 billion

Total ETH holdings ~ 3.648 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

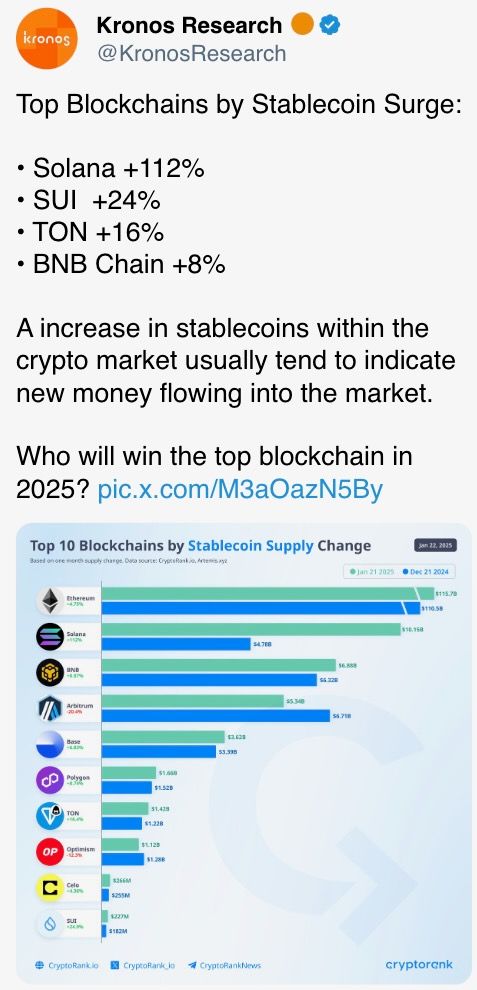

The illustration shows a spike successful the fig of progressive addresses connected Solana.

Addresses holding USDC led the maturation arsenic TRUMP token frenzy gripped the marketplace implicit the weekend.

While You Were Sleeping

Bitcoin Is Like Coiled Spring Nearing Burst of Price Volatility, Key Indicator Suggests (CoinDesk): Bitcoin’s choky 60-day terms scope suggests impending volatility, according to Glassnode and bullish options enactment signals marketplace optimism.

Trump's CFTC Pick Clears Top Ranks of Key US Crypto Regulator (CoinDesk): Newly appointed CFTC Chair Caroline Pham has overhauled the agency's leadership. The changes could reshape the CFTC’s relation successful cryptocurrency oversight.

Bitwise Registers Delaware Entity for Potential Dogecoin ETF (Decrypt): Bitwise Asset Management has registered a statutory spot successful Delaware named “Bitwise Dogecoin ETF,” a preparatory measurement toward perchance filing a Form S-1 with the U.S. Securities and Exchange Commission.

Dollar Treads Water arsenic Trump Tariff Clarity, Central Banks Awaited (Reuters): The dollar held dependable arsenic traders awaited clarity connected Trump’s tariff plans. Focus is shifting to complaint decisions from the Bank of Japan, Fed and ECB.

China Ramps Up Support for Its Stock Markets (The Wall Street Journal): Chinese regulators said state-owned insurers and communal funds would put astatine slightest 100 cardinal yuan ($13.7 billion) into the A-shares market. The cardinal slope besides pledged to enactment the banal market.

Davos Hits ‘Peak Pessimism’ connected Europe arsenic U.S. Exuberance Rises (Financial Times): U.S. executives astatine Davos expressed optimism implicit Donald Trump’s “America First” policies, portion their European counterparts voiced pessimism astir the imaginable harm to struggling EU economies from tariffs and regulatory changes.

In the Ether

10 months ago

10 months ago

English (US)

English (US)