By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace is looking to regain immoderate poise aft yesterday's tumble with on-chain indicators showing signs of capitulation successful bitcoin. Some tokens, similar MakerDAO's MKR, basal retired with a 20% summation successful 24 hours, acknowledgment to the DAO's buyback and pain process.

IP, the autochthonal token of decentralized intelligence property-focused blockchain Story Protocol, is besides successful the green, having risen astir 40%. The token's terms has doubled successful 2 weeks aft being listed connected South Korean exchanges.

Other notable outperformers see Celestia's TIA on with XDC, QNT and HYPE. Data tracked by blockchain sleuth Lookonchain shows whales person been buying the dip successful the HYPE token. XRP, meanwhile, is hanging connected to a cardinal Fibonacci level, keeping bulls' anticipation for bigger gains alive.

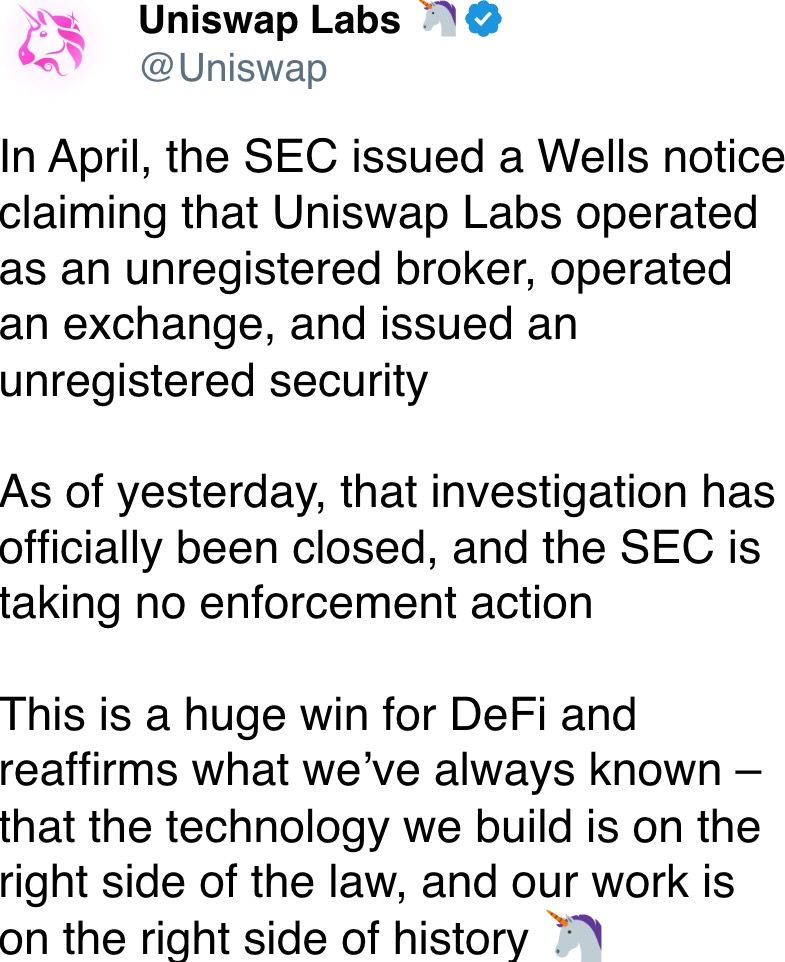

According to Matthew Hougan, main concern serviceman of Bitwise Asset Management, the crypto marketplace is digesting the extremity of the caller memecoin frenzy, which could beryllium replaced by productive sectors specified arsenic stablecoins, real-world assets and DeFi. "But until they commencement making their beingness felt, the nonaccomplishment of vigor volition make a resistance connected the market," Hougan said connected X.

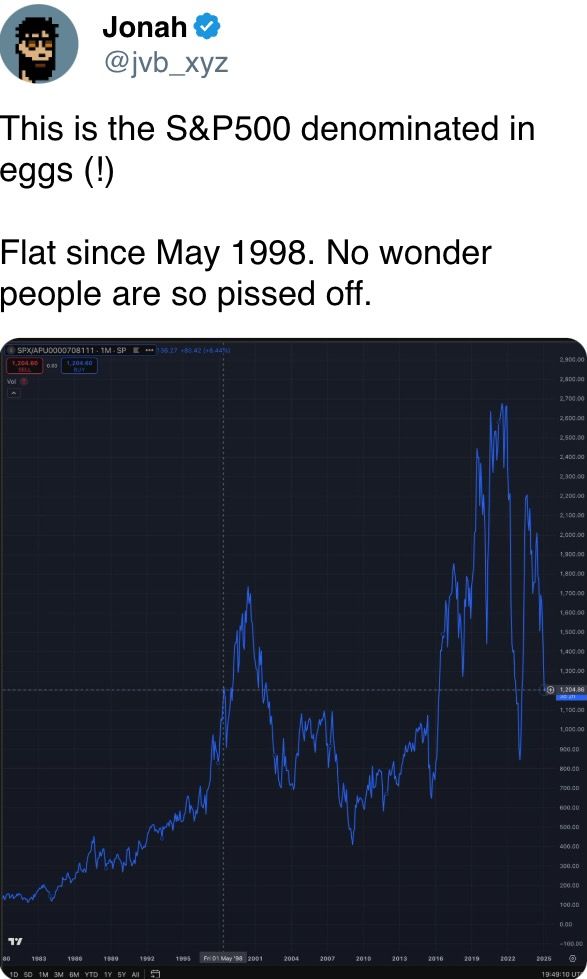

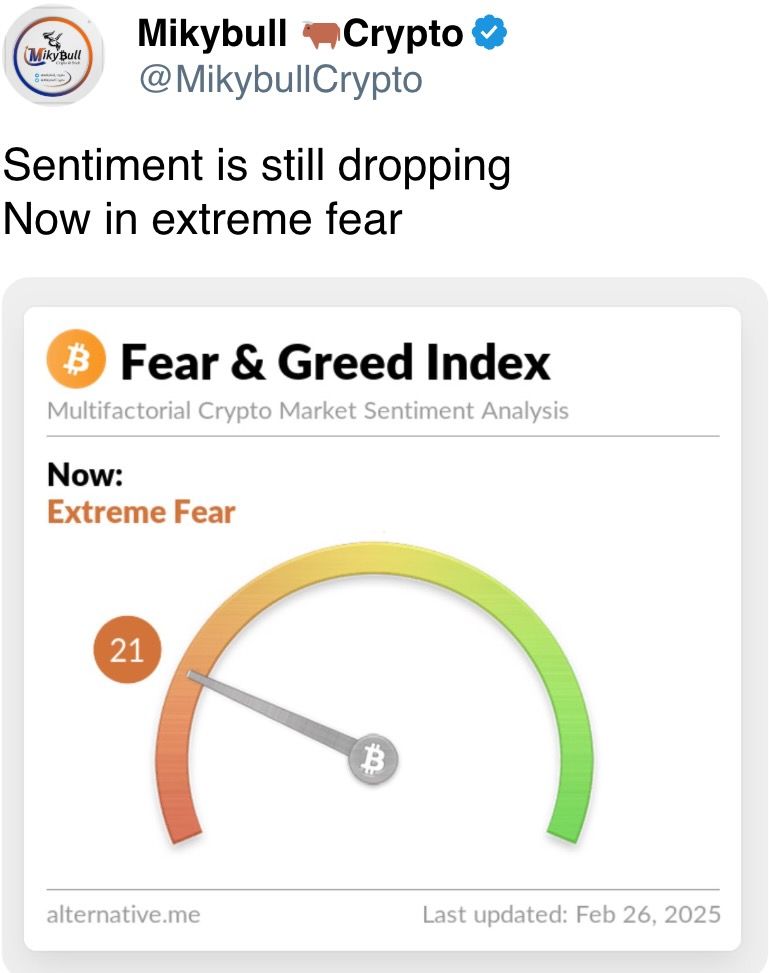

On the macroeconomic front, the optimism seen aft the Nov. 4 predetermination is being replaced by caution, arsenic evidenced by Tuesday's release of the U.S. user confidence. The gauge dropped to an eight-month low, and the one-year ostentation expectations were highest for 1.5 years, with President Donald Trump's tariffs singled retired arsenic the superior interest successful astir each household and concern survey.

The dour sentiment and a strengthening yen mightiness support the upside successful hazard assets restricted for immoderate time. Earlier this week, Belgium's cardinal bank's head, Pierre Wunsch, warned that the ECB risks sleep-walking into excessively galore complaint cuts. The Fed, for its part, is improbable to bash QE anytime soon. (Sure, the January gathering minutes discussed an extremity of quantitive tightening, but that does not mean quantitative easing.)

Speaking of cardinal events to ticker retired for, the Senate Banking Committee, led by Senator Cynthia Lummis, is acceptable to revisit crypto regulations during Wednesday's scheduled proceeding titled “Exploring Bipartisan Legislative Frameworks for Digital Assets." Stay alert!

What to Watch

Crypto:

Feb. 26, 8:30 a.m.: Cosmos (ATOM) web upgrade (to mentation v22.2.0).

Feb. 26: RedStone (RED) farming starts connected Binance Launchpool.

Feb. 27, 4:00 a.m.: Alchemy Pay (ACH) community AMA connected Discord.

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet motorboat (“Mobius”).

March 1: Spot trading connected the Arkham Exchange goes unrecorded successful 17 U.S. states.

March 5 (provisional): At epoch 222464, investigating of Ethereum’s Pectra upgrade connected the Sepolia testnet starts.

Macro

Feb. 26, 10:00 a.m.: The U.S. Census Bureau releases January’s New Residential Sales report.

New Home Sales Est. 0.68M vs. Prev. 0.698M

New Home Sales MoM Prev. 3.6%

Feb. 26-27: 2025’s archetypal G20 concern ministers and cardinal slope governors gathering (Cape Town).

Feb. 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases Q4 GDP (2nd estimate).

Core PCE Prices QoQ Est. 2.5% vs. Prev. 2.2%

PCE Prices QoQ Est. 2.3% vs. Prev. 1.5%

GDP Growth Rate QoQ Est. 2.3% vs. Prev. 3.1%

Feb. 27, 8:30 a.m.: The U.S. Department of Labor releases Unemployment Insurance Weekly claims for the week ended Feb. 22.

Initial Jobless Claims Est. 221K vs. Prev. 219K

Earnings

Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Feb. 26: NVIDIA (NVDA), post-market, $0.85

Token Events

Governances votes & calls

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the state token connected Fraxtal, implementing the Frax North Star hard fork, and introducing a process emanation program with gradually decreasing emissions and different enhancements.

DYdX DAO is voting connected distributing $1.5 cardinal successful DYDX tokens from the assemblage treasury to qualifying users successful trading play 9 arsenic portion of its incentives program.

Unlocks

Feb. 28: Optimism (OP) to unlock 2.32% of circulating proviso worthy $33.97 million.

Mar. 1: DYdX to unlock 1.14% of circulating proviso worthy $5.76 million.

Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating proviso worthy $12.81 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating proviso worthy $68.90 million.

Mar. 2: Ethena (ENA) to unlock 1.3% of circulating proviso worthy $16.47 million.

Mar. 7: Kaspa (KAS) to unlock 0.63% of circulating proviso worthy $14.85 million.

Mar. 8: Berachain (BERA) to unlock 9.28% of circulating proviso worthy $70.90 million.

Token Listings

Feb. 26: Moonwell (WELL) to beryllium listed connected Kraken.

Feb. 27: Venice token (VVV) to beryllium listed connected Kraken.

Feb. 28: Worldcoin (WLD) to beryllium listed connected Kraken.

Conferences

CoinDesk's Consensus to instrumentality spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 4 of 8: ETHDenver 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Next Block Expo (Warsaw, Poland)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

Token Talk

By Francisco Rodrigues

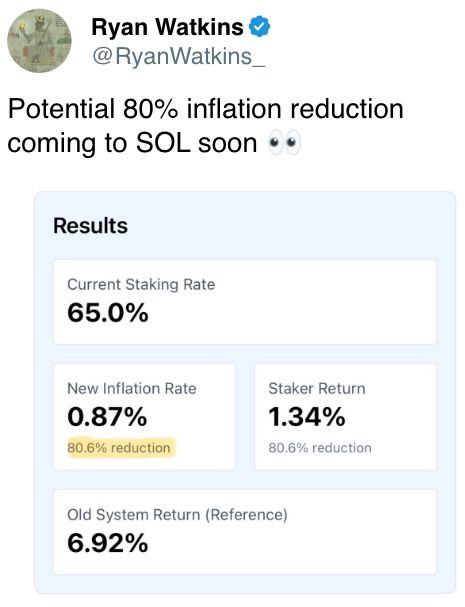

Solana, often criticized implicit its inflationary monetary policy, is presently considering implementing a governance connection to alteration it, SIMD-0228.

The connection would present a dynamic, market-driven emissions exemplary for SOL tokens and perchance trim inflation.

The connection would determination the blockchain distant from its existent fixed emissions exemplary that has seen SOL’s circulating proviso summation to astir 500 cardinal tokens.

Elsewhere Story Protocol’s token, IP, has been bucking the bearish inclination that gripped the cryptocurrency marketplace implicit the past fewer days. IP outperformed the broader CoinDesk 20 Index arsenic traders stake connected the tokenization of intelligence property.

The manufacture ecosystem is besides rallying down cryptocurrency speech Bybit aft its $1.5 cardinal hack. The speech has launched a “war against Lazarus” to crowdsource investigative efforts against the North Korean-linked group.

Derivatives Positioning

BTC's one-month CME futures ground has dropped to 4%, the lowest successful astir 2 years, according to Velo Data. That's a motion of weakening bullish sentiment. Ether's ground has dropped to conscionable implicit 5%.

Perpetual backing rates for TRX, AVAX, XLM, SHIB and OM are negative, reflecting a bias for bearish abbreviated positions.

BTC, ETH short-term puts proceed to commercialized astatine a premium to calls, reflecting fears of a continued terms drop.

Market Movements:

BTC is up 1% from 4 p.m. ET Tuesday astatine $89,19377 (24hrs: -0.11%)

ETH is down 0.36% astatine $2,487.88 (24hrs: +2.19%)

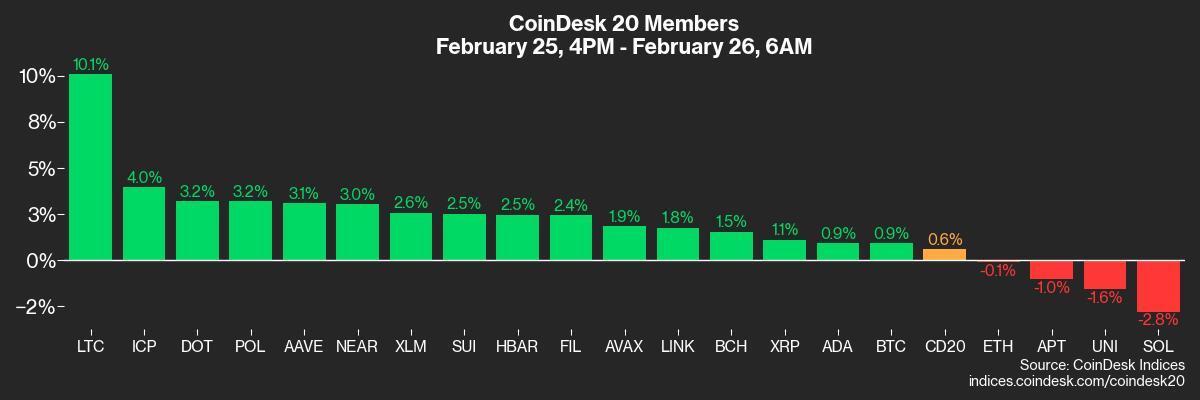

CoinDesk 20 is up 0.42% astatine 2,882.89 (24hrs: +2.34%)

Ether CESR Composite Staking Rate is up 29 bps astatine 3.28%

BTC backing complaint is astatine 0.0005% (0.6% annualized) connected OKX

DXY is up 0.17% 106.49

Gold is down 0.24% astatine $2,913.89/oz

Silver is down 0.78% astatine $31.78/oz

Nikkei 225 closed -0.25% astatine 38,142.37

Hang Seng closed +3.27% astatine 23,787.93

FTSE is up 0.54% astatine 8,715.19

Euro Stoxx 50 is up 1.14% astatine 5,510.13

DJIA closed connected Tuesday +0.37% astatine 43,621.16

S&P 500 closed -0.47% astatine 5,955.25

Nasdaq closed -1.35% astatine 19,026.39

S&P/TSX Composite Index closed +0.21% astatine 25,203.98

S&P 40 Latin America closed +0.19% astatine 2,390.95

U.S. 10-year Treasury complaint is up 2 bps astatine 4.32%

E-mini S&P 500 futures are up 0.5% astatine 5,999.75

E-mini Nasdaq-100 futures are up 0.82% astatine 21,321.50

E-mini Dow Jones Industrial Average Index futures are up 0.27% astatine 43,808.00

Bitcoin Stats:

BTC Dominance: 61.11 (0.13%)

Ethereum to bitcoin ratio: 0.02793 (-0.75%)

Hashrate (seven-day moving average): 746 EH/s

Hashprice (spot): $52.40

Total Fees: 11.39 BTC / $1.1 million

CME Futures Open Interest: 164,970 BTC

BTC priced successful gold: 30.5 oz

BTC vs golden marketplace cap: 8.66%

Technical Analysis

Bitcoin's hourly illustration shows the MACD histogram has been biased bullish since precocious Tuesday. Still, determination has been small advancement to the upside successful presumption of price.

The divergence betwixt prices and MACD, coupled with the downward sloping cardinal averages, suggests imaginable for different circular of selling earlier a meaningful bottommost is reached.

A convincing determination supra $90,000 is needed to invalidate the bearish outlook.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $250.51 (-11.41%), up 3.66% astatine $259.68 successful pre-market

Coinbase Global (COIN): closed astatine $212.49 (-6.42%), up 2.04% astatine $216.82

Galaxy Digital Holdings (GLXY): closed astatine C$20.09 (-7.84%)

MARA Holdings (MARA): closed astatine $12.41 (-10.62%), up 2.86% astatine $12.77

Riot Platforms (RIOT): closed astatine $9.32 (-6.71%), up 2.79% astatine $9.58

Core Scientific (CORZ): closed astatine $9.76 (-1.01%), up 3.28% astatine $10.08

CleanSpark (CLSK): closed astatine $8.15 (-8.43%), up 1.96% astatine $8.31

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.04 (-11.25%), up 4.46% astatine $17.80

Semler Scientific (SMLR): closed astatine $42.42 (-4.42%), up 2.5% astatine $43.48

Exodus Movement (EXOD): closed astatine $39.86 (-3.16%), down 1% astatine $39.46

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$937.7 million

Cumulative nett flows: $38.09 billion

Total BTC holdings ~ 1,157 million.

Spot ETH ETFs

Daily nett flow: -$50.1 million

Cumulative nett flows: $3.02 billion

Total ETH holdings ~ 3.750 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

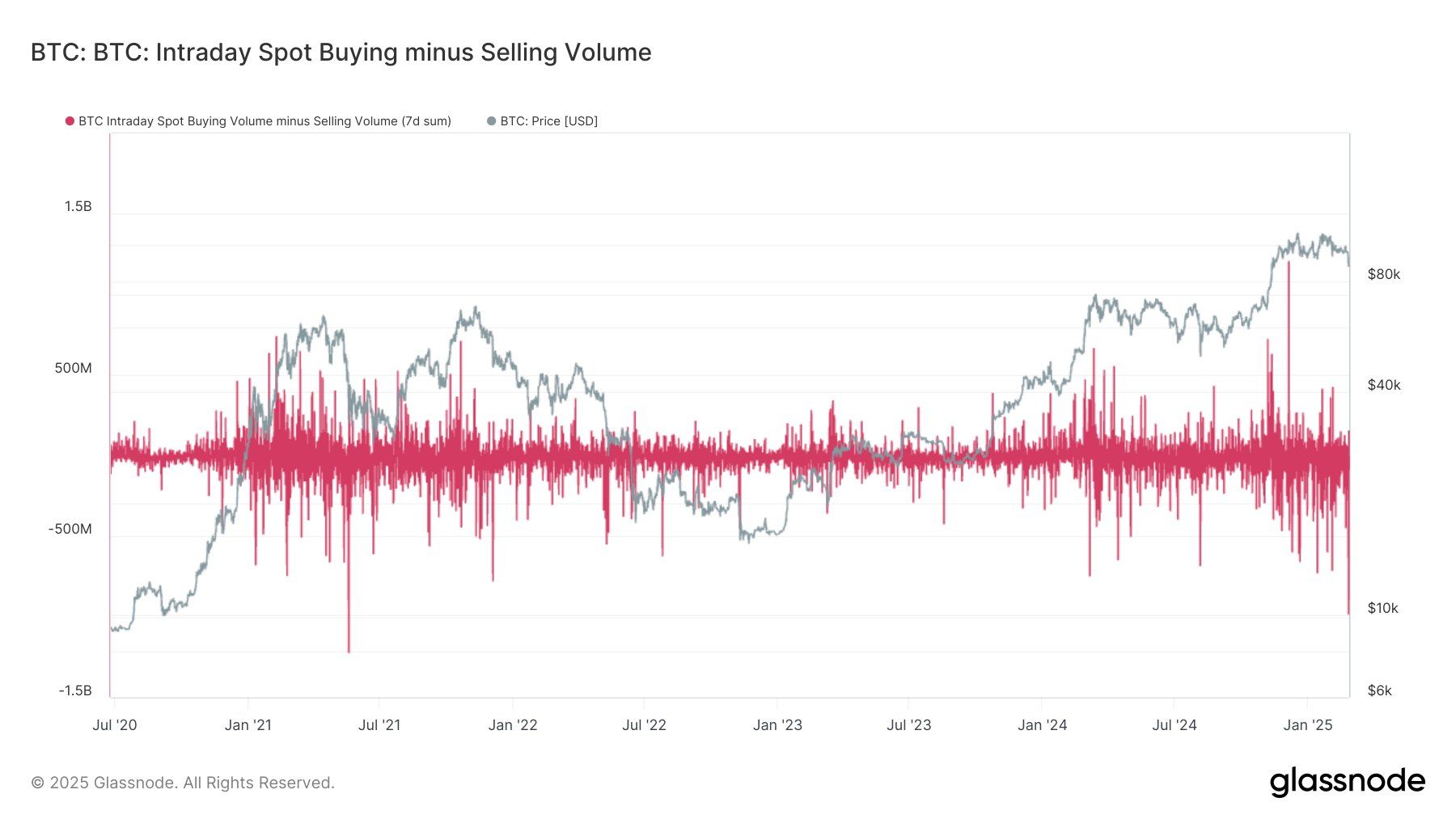

The nett selling measurement successful BTC connected Tuesday was the strongest since May 2021, according to information tracked by Glassnode and Andre Dragosch, caput of probe for Europe astatine Bitwise.

Perhaps anemic hands person capitulated, leaving the marketplace successful a overmuch healthier state.

While You Were Sleeping

XRP, BNB Edge Higher arsenic Bitcoin Bulls Eye $90K After Tuesday Bloodbath (CoinDesk): Bitcoin rebounded to astir $89,000 with large cryptocurrencies XRP and BNB besides showing signs of a cautious recovery.

Bitcoin's Tuesday Bloodbath Was the Bottom, Analyst Says (CoinDesk): On-chain signals suggest constricted further downside.

U.S. Bitcoin ETFs See Record Daily Outflow of Over $930M arsenic Carry Trades Lose Shine to the 10-Year Treasury Note (CoinDesk); Tuesday marked the steepest single-day redemption for U.S.-listed spot bitcoin ETFs since their inception.

Circle Says Stablecoin Issuers Should Be U.S. Registered (Bloomberg): Jeremy Allaire, co-founder of stablecoin issuer Circle, said issuers of dollar-pegged crypto tokens should beryllium registered successful the U.S.

Treasury Yields Rebound Slightly, Dollar Undermined by US Growth Worries (Reuters): The 10-year Treasury output climbed 3 ground points to 4.3271% aft the U.S. House passed a fund measure that paves the mode for $4.5 trillion successful taxation cuts.

Top Finance Ministers Snub G20 arsenic Global Co-Operation Comes Under Strain (Financial Times): This week's G20 gathering successful South Africa is notable for the lack of concern ministers from the U.S., China, Japan, India, Brazil and Mexico, prompting doubts astir the forum's effectiveness.

In the Ether

9 months ago

9 months ago

English (US)

English (US)