By James Van Straten (All times ET unless indicated otherwise) Bitcoin (BTC) continues to ascent the partition of worry, pushing supra $97,000 contempt hotter-than-expected U.S. consumer and producer price ostentation reports successful the past mates of days. That's a surprise. With prices rising and the likelihood of a Fed complaint chopped receding, you'd expect risky investments similar cryptocurrencies to pause, astatine the precise least.

The buoyant behaviour is perchance underpinned by signs that ostentation is inactive seen arsenic easing successful coming months.

"Bitcoin could apt get immoderate alleviation successful the short-term judging by the high-frequency U.S. ostentation indicator by truflation which suggests a important diminution successful header ostentation implicit the coming months," said Andre Dragosch, the caput of European probe astatine Bitwise. The Truflation U.S. Inflation Index presently shows 2.06%, indicating a imaginable decline.

Dragosch besides noted the Federal Reserve's cautious stance, suggesting the cardinal slope is precise alert of what happened successful the 1970s, erstwhile 3 waves of ostentation deed peaks of 6.2%, 12% and 15%.

"The Fed is acrophobic of the 1970s ostentation scenario, which is wherefore it alternatively takes a much cautious attack astatine the infinitesimal and is acrophobic of cutting rates excessively aggressively," helium said.

All that means the bitcoin bull marketplace is far from over if humanities trends clasp out. Take a look astatine the 200-week moving mean (a play of astir 4 years!). That's presently astir $44,200, beneath the erstwhile marketplace highest of $69,000 from November 2021. In the past, the mean has risen toward the anterior record, a determination that implies further terms maturation is connected the cards.

Also see that short-term holders person accumulated 1.5 cardinal bitcoin since September, showing continued request from investors who thin to support their BTC for little than 155 days.

On the nationalist institution front, Coinbase followed Robinhood with beardown net and Gamestop is pondering a bitcoin investment, different imaginable catalyst for the market. Stay Alert!

What to Watch

Crypto:

Feb. 14: Dynamic TAO (DTAO) web upgrade goes unrecorded connected the Bittensor (TAO) mainnet.

Feb. 14, 2:30 a.m.: Qtum (QTUM) hard fork web upgrade.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, starts reimbursing creditors.

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging level Telegram’s Mini App ecosystem.

Feb. 24: Ethereum developers commencement investigating the codification for the Pectra web upgrade on the Holesky testnet.

Macro

Feb. 14, 8:30 a.m.: The U.S. Census Bureau releases January's Retail Sales data.

Retail Sales MoM Est. -0.1% vs. Prev. 0.4%

Retail Sales YoY Prev. 3.9%

Feb. 18, 10:20 a.m.: San Francisco Fed President and CEO Mary C. Daly delivers a code astatine the Conference for Community Bankers successful Phoenix. Livestream link.

Feb. 19, 2:00 p.m.: The Fed releases minutes of the Jan. 28-29 FOMC Meeting.

Earnings

Feb. 18: CoinShares International (CS), pre-market

Feb. 18: Semler Scientific (SMLR), post-market

Feb. 20: Block (XYZ), post-market, $0.88

Feb. 26: MARA Holdings (MARA), $-0.13

Token Events

Governance votes and calls

Aave DAO is discussing utilizing GHO arsenic a state token crossed assorted networks. The model proposes utilizing the canonical web span to mint GHO straight arsenic a state token.

Umma DAO is voting connected reducing UMA token emissions to optimize its economics. The connection is to trim emissions by 14% and measure the interaction of the move.

Aavegotchi DAO is discussing migrating the protocol to Base implicit a request to articulation a concatenation with “strong ecosystem support.”

Arbitrum DAO is discussing upgrading to ArbOS 40 “Callisto,” which includes enactment for Ethereum’s upcoming Pectra upgrade.

Unlocks

Feb. 14: Starknet (STRK) to unlock 2.48% of circulating proviso worthy $15.19 million.

Feb. 15: Sei (SEI) to unlock 1.25% of circulating proviso worthy $13.46 million.

Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating proviso worthy $46.2 million.

Feb. 16: Avalanche (AVAX) to unlock 0.4% of circulating proviso worthy $43.55 million.

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating proviso worthy $78.8 million.

Feb. 28: Optimism (OP) to unlock 2.32% of circulating proviso worthy $36.67 million.

Token Launches

Feb. 14: Pudgy Penguins (PENGU) to beryllium listed connected Coinbase, according to a station shared by the Pudgy Penguins account.

Conferences:

CoinDesk's Consensus to instrumentality spot in Hong Kong connected Feb. 18-20 and in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 2 of 2: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Francisco Rodrigues

Binance laminitis and erstwhile CEO Changpeng Zhao’s canine has been the speech of the town. After revealing helium had the favored and being bombarded with requests for information, he yet gave in, knowing memecoins would beryllium launched.

Zhao shared a representation of himself with the Belgian malinois named Broccoli successful a lengthy station that inspired a slew memecoins. These tokens, trading nether the ticker BROCCOLI, debuted some BNB Chain and Solana.

Some saw important terms rises close aft their instauration to scope cardinal dollar-plus marketplace caps arsenic traders rushed in. As the hype faded, truthful did the prices. Fortunes were made and sold implicit Broccoli.

One trader, for example, spent little than $1,000 to create a token inspired by the canine and started selling the tokens conscionable 2 minutes later. The trader managed to marque $6.5 cardinal connected the launch, arsenic CoinDesk's Danny Nelson reported.

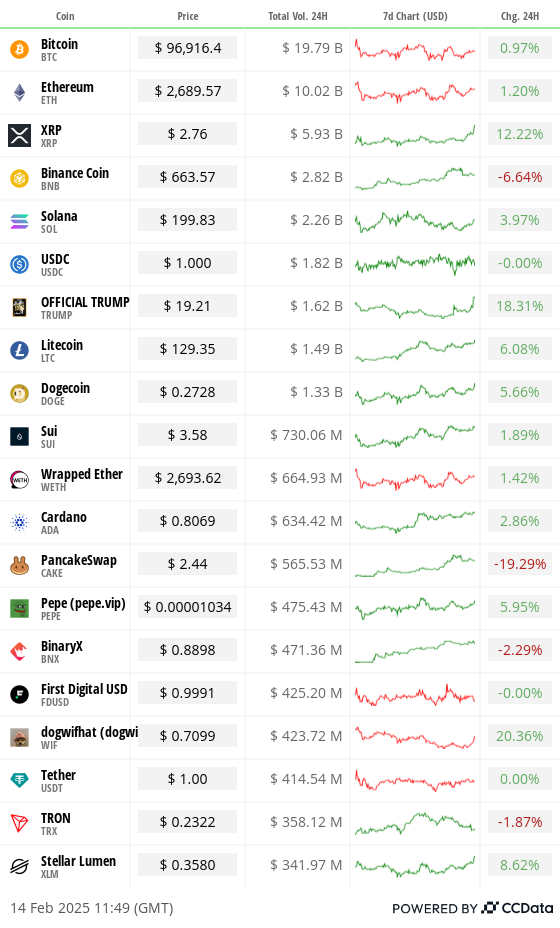

The volatility affected the terms of BNB itself, which is present 6.6% little successful the past 24 hours portion bitcoin and ether are some up slightly. PancakeSwap’s CAKE token, which was up much than 70% connected the week, is down 18%in the aforesaid period.

Elsewhere, the Trump-backed DeFi protocol WLFI has kept accumulating tokens, purchasing astir $5 cardinal worthy of wrapped bitcoin (WBTC) and $1.4 cardinal of Movement (MOVE).

Derivatives Positioning

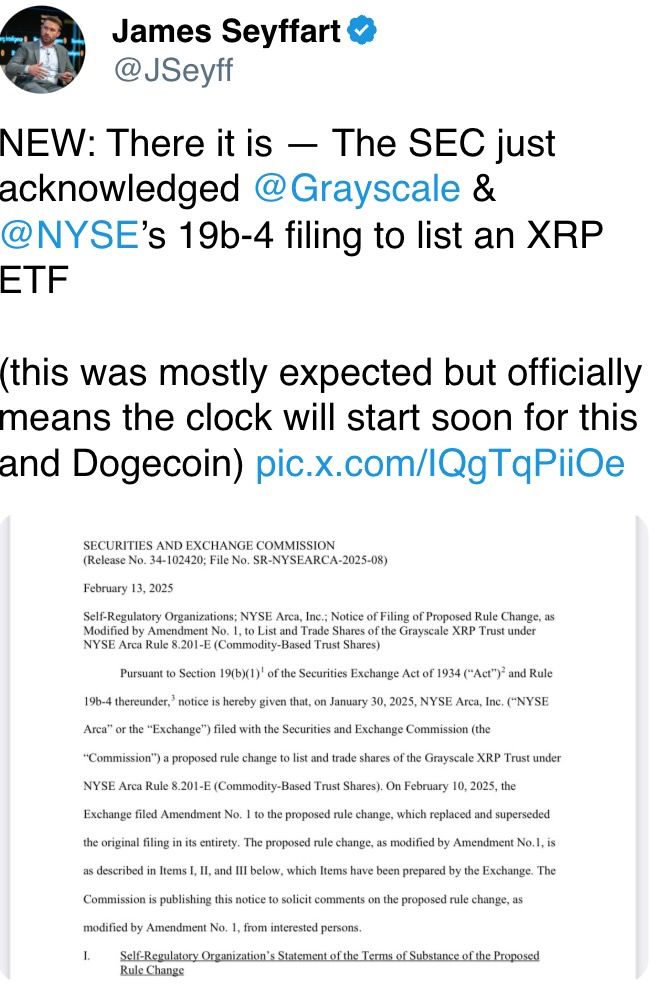

XRP's perpetual backing rates stay somewhat negative, indicating a bias for shorts contempt a 10% terms surge. Should prices proceed to rise, these shorts whitethorn propulsion successful the towel, squaring disconnected their bets and adding to an upward determination successful prices.

LTC, XLM and DOGE person seen nett buying unit successful perpetual futures, according to the unfastened interest-adjusted cumulative measurement delta tracked by Velo Data.

BTC CME futures ground remains beneath ETH basis.

Block flows connected Deribit featured outright longs successful out-of-the-money calls and a bull telephone spread. In ETH, a telephone enactment astatine the $3,300 onslaught was filed successful the March expiry, according to Amberdata.

Market Movements:

BTC is up 0.57% from 4 p.m. ET Thursday to $97,093.36 (24hrs: +0.96%)

ETH is up 1.39% astatine $2706.09 (24hrs: +1.13%)

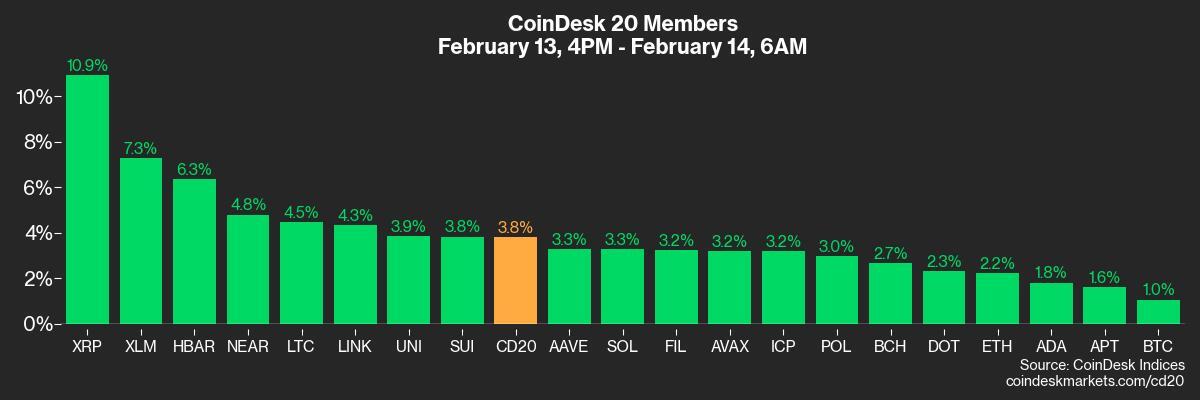

CoinDesk 20 is up 3.70% to 3,324.03 (24hrs: +3.85%)

Ether CESR Composite Staking Rate is up 1 bps to 3.06%

BTC backing complaint is astatine 0.0035% (3.8632% annualized) connected Binance

DXY is down 0.32% astatine 106.97

Gold is up 1.17% astatine $2,960/oz

Silver is up 4.32% to $34.06/oz

Nikkei 225 closed -0.79% astatine 39,149.43

Hang Seng closed +3.69% astatine 22,620.33

FTSE is down 0.26% astatine 8,741.88

Euro Stoxx 50 is unchanged astatine 5,501.78

DJIA closed Thursday +0.77% astatine 44,711.43

S&P 500 closed +1.04% astatine 6,115.07

Nasdaq closed +1.5% astatine 19,945.64

S&P/TSX Composite Index closed +0.53% astatine 25,698.5

S&P 40 Latin America closed +0.69% astatine 2,438.53

U.S. 10-year Treasury complaint was down 7 bps astatine 4.53%

E-mini S&P 500 futures are down 0.1% to 6,129.25

E-mini Nasdaq-100 futures are unchanged astatine 22,107

E-mini Dow Jones Industrial Average Index futures are down to 44,686

Bitcoin Stats:

BTC Dominance: 60.58 (-0.63%)

Ethereum to bitcoin ratio: 0.02783 (0.47%)

Hashrate (seven-day moving average): 818 EH/s

Hashprice (spot): $54.1

Total Fees: 5.67 BTC / $546,770

CME Futures Open Interest: 167,750

BTC priced successful gold: 33.0 oz

BTC vs golden marketplace cap: 9.37%

Technical Analysis

XRP has bounced disconnected the Ichimoku unreality support, keeping the broader bullish outlook intact.

Prices look to beryllium headed toward the descending trendline resistance, which, if topped, volition apt output a determination to grounds highs.

A imaginable determination beneath the unreality would awesome a bearish inclination change.

Crypto Equities

MicroStrategy (MSTR): closed connected Thursday astatine $324.92 (-0.58%), up 0.6% astatine $327.03 successful pre-market.

Coinbase Global (COIN): closed astatine $298.11 (8.44%), down 1% astatine $295.12.

Galaxy Digital Holdings (GLXY): closed astatine C$28.37 (+5.58%)

MARA Holdings (MARA): closed astatine $16.91 (+4.13%), up 0.65% astatine $17.02

Riot Platforms (RIOT): closed astatine $12.23 (+9.59%), up 0.1% astatine $12.24.

Core Scientific (CORZ): closed astatine $12.54 (+3.72%), down 0.32% astatine $12.50.

CleanSpark (CLSK): closed astatine $10.67 (+1.43%), up 0.66% astatine $10.74.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $23.28 (+2.42%), down 1.12% astatine $23.02.

Semler Scientific (SMLR): closed astatine $49.45 (+3.69%), up 1.86% astatine $50.37.

Exodus Movement (EXOD): closed astatine $50.00 (+2.35%), down 3.34% astatine $48.33.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$156.8 million

Cumulative nett flows: $40.05 billion

Total BTC holdings ~ 1.171 million.

Spot ETH ETFs

Daily nett flow: $12.8 million

Cumulative nett flows: $3.14 billion

Total ETH holdings ~ 3.777 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The illustration shows yields connected the U.S. 10-year and two-year Treasury notes.

The 10-year output has declined by 27 ground points successful 4 weeks portion the two-year output has dropped 10 ground points.

The alleged bull flattening of the Treasury output curve is simply a affirmative motion for hazard assets, per immoderate observers.

While You Were Sleeping

Bitcoin Bull Market Is Far From Over, Suggests Historical BTC Trend Tied to 200-Week Average (CoinDesk): Historical trends suggest the bitcoin terms has country to turn contempt renewed U.S. ostentation pressures. While the semipermanent mean remains beneath erstwhile highs, capitalist bets awesome optimism for further gains.

China’s Gaorong Ventures Invests $30 Million successful Crypto Unicorn (Bloomberg): HashKey Group, the relation of 1 of Hong Kong’s regulated crypto exchanges, received $30 cardinal from a Chinese task superior steadfast astatine a reported post-money valuation of astir $1.5 billion.

Japanese Energy Firm Remixpoint Boosts Crypto Holdings More Than 8,000% successful 9 Months (CoinDesk): Remixpoint (3825) disclosed it had accumulated implicit 125 BTC for its treasury and spent implicit 9 cardinal yen ($59 million) connected crypto.

Vance Wields Threat of Sanctions, Military Action to Push Putin Into Ukraine Deal (The Wall Street Journal): U.S. Vice President Vance warned that subject powerfulness could beryllium utilized if Russia refuses to hold to a bid woody that guarantees Ukraine's independency from Moscow.

India, US Agree to Resolve Trade and Tariff Rows After Trump-Modi Talks (Reuters): India promised to summation its oil, state and military-equipment purchases from the U.S. arsenic it prepares for commercialized talks that could easiness tariff tensions.

Taiwan Pledges to Boost US Investment After Donald Trump’s Tariff Threat (Financial Times): Taiwan's President Lai Ching-te outlined measures to code the U.S. commercialized imbalance and pledged to guarantee Taiwan remains indispensable successful the planetary semiconductor proviso chain.

In the Ether

7 months ago

7 months ago

English (US)

English (US)