By Omkar Godbole (All times ET unless indicated otherwise)

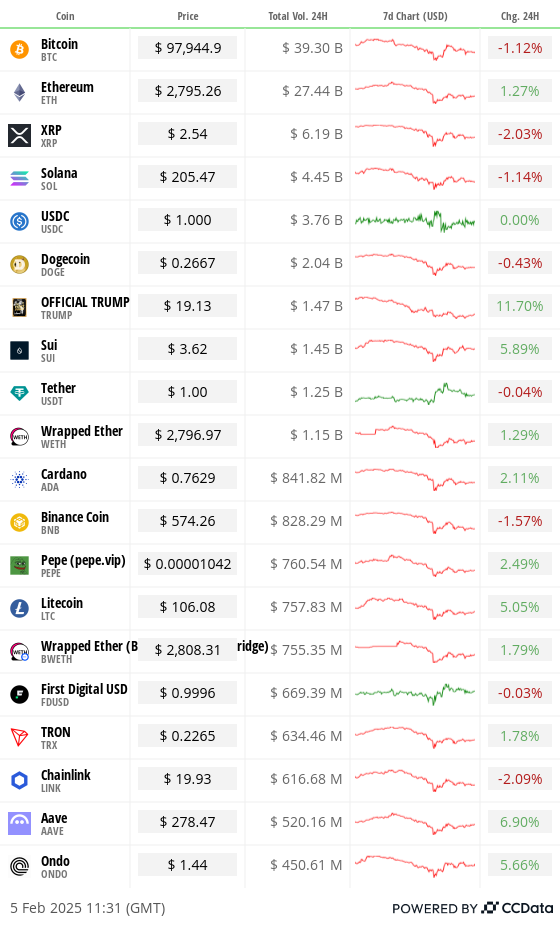

The crypto marketplace has turned somber, with large cryptocurrencies specified arsenic bitcoin (BTC), ether (ETH), solana (SOL), Binance coin (BNB) and chainlink (LINK) trading arsenic overmuch arsenic 3% lower, amid vexation implicit the dilatory advancement connected the instauration of a U.S. strategical BTC reserve and signs of dollar liquidity tightening.

Geo Chen, a macro trader and writer of the fashionable Substack-based newsletter Fidenza Macro, suggested the marketplace has been held up by hopes Trump would measurement successful and "buy everybody's bags," but that's improbable to materialize soon. Consequently, the marketplace is susceptible to hazard aversion driven by ongoing tariff discussions.

"Crypto volition not beryllium spared successful the ensuing risk-off volatility, and I expect galore coins to gully down 50% oregon much from their January highs. I person bounds orders to bargain immoderate of my favourite coins similar SOL astatine little than fractional price," Chen wrote.

Speaking of SOL, Amberdata's options artifact travel tracker revealed a sizable carnivore enactment dispersed involving a agelong presumption successful the $200 enactment and a abbreviated presumption successful the $120 put, some expiring connected Feb 28. This strategy bets connected a diminution to astatine slightest $120 by month-end, reflecting an progressively pessimistic outlook.

Sentiment remains bearish for ether, too. ETH has already fallen 15% this period and reached its lowest successful 4 years against bitcoin. Joe McCann, laminitis and CEO of Asymmetric, pointed retired that "Ethereum's cardinal positioning has weakened. Solana's ecosystem is expanding rapidly, offering higher throughput and stronger performance, making Ethereum's humanities valuation premium harder to justify."

Ethereum's layer-2 scaling solutions — Optimism, Arbitrum, and Polygon — are each down implicit 50% this year, helium noted. "This signals broader struggles, arsenic L2s were expected to thrust ETH adoption and usage, yet they're failing to make sustained momentum."

On the macro front, investors are pivoting toward golden and U.S. Treasury notes amid the menace of a imaginable commercialized war, pushing golden to a caller precocious of $2,877 per ounce, an awesome 10% summation for the year. Historically, a heightened penchant for golden has not favored bitcoin.

As if that weren't enough, rising yields connected the 10-year Japanese authorities enslaved person deed their highest levels since April 2011. Additionally, the U.S. ADP employment study owed contiguous could inject further volatility into the market. It's a clip to enactment alert!

What to Watch

Crypto:

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork web upgrade for its Ethereum-based L2 mainnet.

Feb. 6: Berachain (BERA) mainnet launch.

Feb. 6, 8:00 a.m.: Shentu Chain web upgrade (v2.14.0).

Feb. 13: Start of Kraken's gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will commencement reimbursing creditors.

Macro

Feb. 5, 9:45 a.m.: S&P Global releases January’s US Services PMI (Final) report.

Est. 52.8 vs. Prev. 56.8

Feb. 5, 10:00 a.m.: The Institute for Supply Management (ISM) releases January’s Services ISM Report connected Business.

Services PMI Est. 54.3 vs. Prev. 54.1

Services Business Activity Prev. 58.2

Services Employment Prev. 51.4

Services New Orders Prev. 54.2

Services Prices Prev. 64.4

Feb. 5, 10:00 a.m.: U.S. Senate Banking Committee proceeding connected “Investigating the Real Impacts of Debanking successful America,” featuring 4 witnesses including Nathan McCauley, co-founder and CEO of Anchorage Digital. Livestream link.

Feb. 5, 3:00 p.m.: Fed Governor Michelle W. Bowman is giving a code titled “Brief Economic Update and Bank Regulation.”

Feb. 6, 7:00 a.m.: The Bank of England (BoE) releases Monetary Policy Summary and Minutes of the Monetary Policy Committee Meeting arsenic good arsenic the February Monetary Policy Report. The property league is live-streamed 30 minutes later.

Interest Rate Decision Est. 4.5% vs. Prev. 4.75%

Feb. 6, 8:30 a.m.: The U.S. Department of Labor releases Unemployment Insurance Weekly Claims study for week ended Feb. 1.

Initial Jobless Claims Est. 213K vs. Prev. 207K

Nonfarm Productivity QoQ (Preliminary) Est.1.4% vs. Prev. 2.2%

Continuing Jobless Claims (January) Est. 1870K vs. Prev. 1858K

Jobless Claims 4-Week Average Prev. 212.5K.

Feb. 6, 2:00 p.m.: U.S. House Financial Services Committee proceeding astir “Operation Choke Point 2.0": 2 of the witnesses are Paul Grewal, Chief Legal Officer of Coinbase, and Fred Thiel, CEO of MARA Holdings. Livestream Link.

Feb. 6, 2:30 p.m.: Fed Governor Christopher J. Waller is giving a code connected Payments astatine the Atlantic Council successful Washington. Livestream link.

Earnings

Feb. 5: MicroStrategy (MSTR), post-market, $-0.09

Feb. 10: Canaan (CAN), pre-market, $-0.08

Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, break-even

Feb. 12: IREN (IREN), post-market

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market

Feb. 13: CleanSpark (CLSK), $-0.05

Feb. 13: Coinbase Global (COIN), post-market, $1.61

Token Events

Governance votes & calls

Lido DAO is discussing distributing rewards to LDO stakers based connected the protocol’s nett revenue, arsenic good arsenic the usage of a percent of its yearly gross to buyback LDO tokens.

Feb. 5, 10 a.m.: Livepeer (LPT) to hold a Treasury Talk connected “SPE updates, governance, and treasury backing for AI video projects.”

Feb. 5, 11 a.m.: USDX and Arbitrum to hold an Ask Me Anything (AMA) session.

Feb. 6: Arbitrum to hold an unfastened telephone astir utilizing AI to empower decentralized concern applications.

Unlocks

Feb. 5: XDC Network (XDC) to unlock 5.36% of circulating proviso worthy $81.58 million.

Feb. 5: Kaspa (KAS) to unlock 0.67% of circulating proviso worthy $17.29 million.

Feb. 9: Movement (MOVE) to unlock 2.17% of circulating proviso worthy $31.84 million.

Feb. 10: Aptos (APT) to unlock 1.97% of circulating proviso worthy $69.78 million.

Token Launches

Feb. 6: Berachain (BERA) to beryllium listed connected Bybit, BingX, MEXC, and KuCoin.

Conferences:

Day 1 of 2: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Francisco Rodrigues

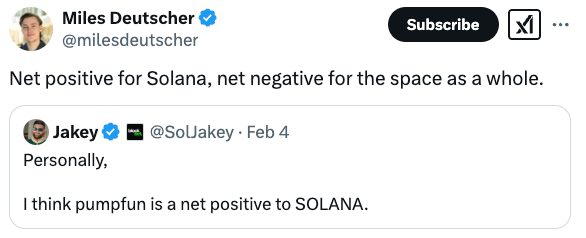

Solana memecoin juggernaut Pump.fun's monthly gross deed an all-time precocious successful January, bringing successful $121.3 cardinal portion the level is said to beryllium influencing the “destruction of the altcoin market.”

Speculative superior that would person poured into large altcoins during this cycle’s “alt season” was funneled into low-capitalization tokens launched connected the platform, according to investigation by Miles Deutscher, who pointed out retail investors got “stuck into illiquid on-chain memes” that rapidly mislaid astir of their value.

Yet high-profile altcoin debuts besides led to important downturns fixed the hazard and volatility of the sector. Lookonchain pointed to a trader who lost $2.6 cardinal retired of fearfulness of missing retired connected Venice.ai’s VVV token, portion different trader lost $21 cardinal connected Donald Trump’s memecoin.

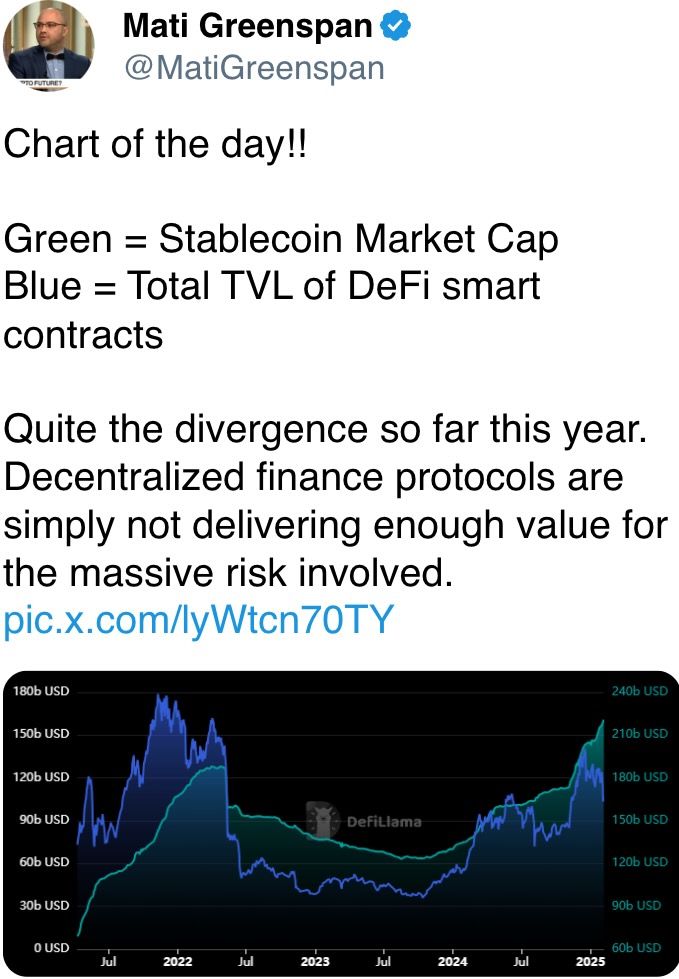

Even the biggest altcoin by marketplace capitalization, ether, saw proviso instrumentality to pre-merge levels and has been importantly underperforming bitcoin, with the ETHBTC ratio dropping beneath 0.03 for the archetypal clip since 2021 this year.

Meanwhile, Pump.fun’s occurrence remains, having precocious surpassed Circle, the issuer of the second-largest stablecoin, USDC, successful 24-hour gross according to DeFiLlama data.

Derivatives Positioning

Perpetual backing rates for XLM, TON, SHIB, BCH and ONDO stay negative, hinting astatine a bias for shorts. These tokens could spot a abbreviated compression should BTC surge, reviving risk-taking successful the crypto market.

The OI-normalized cumulative measurement delta for SHIB has flipped affirmative successful the past 24 hours, hinting astatine underlying buying pressure.

BTC, ETH futures ground connected the CME remains adjacent 10%.

Front-dated BTC and ETH proceed to amusement a bias for bearish enactment options. ETH puts proceed to beryllium pricier than BTC puts.

Market Movements:

BTC is down 0.35% from 4 p.m. ET Tuesday astatine $97,862.66 (24hrs: +1.08%)

ETH is up 2.4% astatine $2,2,783.87 (24hrs: +0.86%)

CoinDesk 20 is down 0.34% astatine 3,286.48 (24hrs: -1.41%)

CESR Composite Staking Rate is down 73 bps astatine 3.18%

BTC backing complaint is astatine 0.0011% (1.21% annualized) connected Binance

DXY is down 0.5% astatine 107.42

Gold is up 0.9% astatine $2,868.45/oz

Silver is up 0.15% astatine $32.37/oz

Nikkei 225 closed unchanged astatine 38,831.48

Hang Seng closed -0.93% astatine 20,597.09

FTSE is unchanged astatine 8,571.57

Euro Stoxx 50 is down 0.21% astatine 5,253.52

DJIA closed connected Tuesday +0.3% astatine 44,556.04

S&P 500 closed +0.72% astatine 6,037.88

Nasdaq closed +1.35% astatine 19,654.02

S&P/TSX Composite Index closed +0.15% astatine 25,279.35

S&P 40 Latin America closed +1.06% astatine 2,401.76

U.S. 10-year Treasury is down 3 bps astatine 4.48%

E-mini S&P 500 futures are down 0.52% astatine 6,031.75

E-mini Nasdaq-100 futures are down 0.88% astatine 21,479.25

E-mini Dow Jones Industrial Average Index futures are down 0.18% astatine 44,615.00

Bitcoin Stats:

BTC Dominance: 61.24 (-0.21%)

Ethereum to bitcoin ratio: 0.02833 (1.43%)

Hashrate (seven-day moving average): 817 EH/s

Hashprice (spot): $56.3

Total Fees: 5.03 BTC / $509,298

CME Futures Open Interest: 168,549

BTC priced successful gold: 33.9 oz

BTC vs golden marketplace cap: 9.64%

Technical Analysis

The U.S. 10-year Treasury output is connected the verge of violating the five-month bullish trendline.

A continued descent could enactment hazard assets.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $348.31 (+0.35%), down 0.9% astatine $345.05 successful pre-market.

Coinbase Global (COIN): closed astatine $280.39 (-1.41%), down 0.14% astatine $280 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$27.67 (-1.25%).

MARA Holdings (MARA): closed astatine $17.65 (-1.67%), down 0.45% astatine $17.57 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.29 (+2.5%), down 0.41% astatine $12.24 successful pre-market.

Core Scientific (CORZ): closed astatine $12.21 (-0.97%).

CleanSpark (CLSK): closed astatine $10.84 (+2.36%), down 0.65% astatine $10.77 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.57 (-0.53%).

Semler Scientific (SMLR): closed astatine $51.24 (+1.55%), down 2.01% successful pre-market.

Exodus Movement (EXOD): closed astatine $56.77 (-4.73%), up 5.69% successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: $340.7 million

Cumulative nett flows: $40.60 billion

Total BTC holdings ~ 1.173 million.

Spot ETH ETFs

Daily nett flow: $307.8 million

Cumulative nett flows: $3.15 billion

Total ETH holdings ~ 3.693 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The dollar scale (DXY), which tracks the U.S. currency's worth against large trading partners, seems to person peaked. The question is volition bitcoin travel suit?

Both assets surged successful the weeks starring up to and pursuing the U.S. predetermination held successful aboriginal November.

While You Were Sleeping

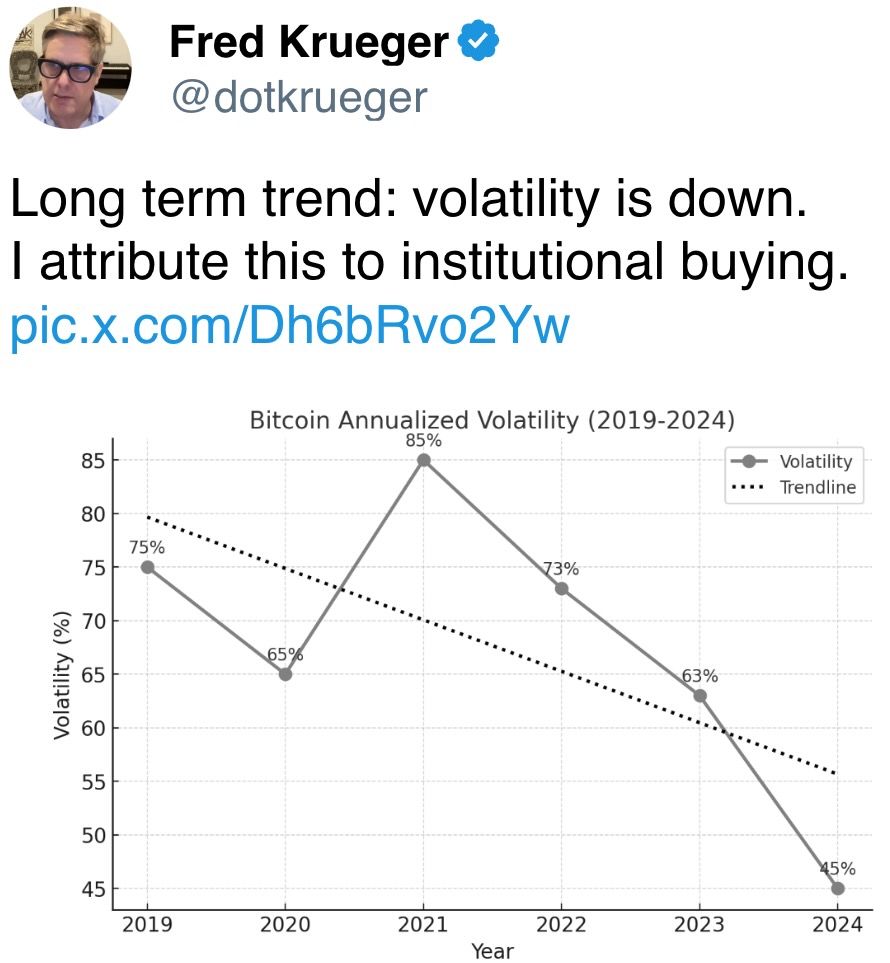

Equities-Crypto Relationship Is Likely to Weaken successful the Long Term, Citi Says (CoinDesk): Crypto's correlation with stocks is apt to decline, with organization adoption and upcoming U.S. regularisation helping to little volatility for bitcoin.

Bitcoin Risks Losing the $90K- $110K Range arsenic These 3 Development Could Put the Brakes connected the Next Bull Breakout (CoinDesk): Bitcoin’s consolidationfaces headwinds from tightening dollar liquidity, the Trump administration’s cautious attack to a BTC reserve and signals of weakening bullish momentum.

Ondo Finance Unveils Tokenization Platform to Bring Stocks, Bonds, and ETFs Onchain (CoinDesk): Ondo Finance, a person issuer of tokenized real-world assets unveiled a tokenization level that aims to bash for U.S. publically traded securities what stablecoins did for dollars.

World’s Demand for Gold Hit Another Record High Last Year; Appetite for Bullion successful 2025 Remains Firm (CNBC): As golden prices deed grounds highs, the World Gold Council reports that planetary request reached 4,974 tons successful 2024, driven by cardinal slope purchases and beardown request for golden ETFs and bullion.

EU Prepares to Hit Big Tech successful Retaliation for Donald Trump’s Tariffs (Financial Times): Officials accidental the EU could retaliate against imaginable U.S. tariffs with its 'anti-coercion instrument,' introduced during Trump’s archetypal term, though the bloc is improbable to beryllium capable to respond arsenic rapidly arsenic Canada and Mexico.

U.S. Postal Service Suspends Shipments of China Parcels (Wall Street Journal): The U.S. Postal Service said it volition not judge inbound parcels from mainland China and Hong Kong until further notice, a determination apt to interaction Chinese online merchants specified arsenic Shein and Temu.

In the Ether

10 months ago

10 months ago

English (US)

English (US)