By Omkar Godbole (All times ET unless indicated otherwise)

The caller TACO tease, implying "Trump Always Chickens Out" connected tariffs, apt didn't spell down good with the President, who raised the stakes successful the ongoing commercialized warfare connected Friday, starring to broad-based hazard aversion, which persists arsenic of writing.

On Friday, Trump said that connected June 4, the U.S. tariffs connected imported aluminum and alloy would spell from 25% to 50%, triggering a broad-based risk-off determination crossed planetary markets. Bitcoin has since traded successful the scope of $103,000-$106,000, with small to nary excitement successful the broader crypto market. Notably, BlackRock's spot bitcoin ETF (IBIT) registered an outflow of $430 million, ending a prolonged inflows streak.

"Tariff tensions volition apt predominate the macro communicative done June, with meaningful argumentation deadlines lone kicking successful from 8 July. In the lack of caller catalysts, BTC could stay rangebound, with the $100k and $110k levels captious to ticker fixed their presumption arsenic strikes with the highest month-end unfastened interest," Singapore-based trading steadfast QCP Capital said.

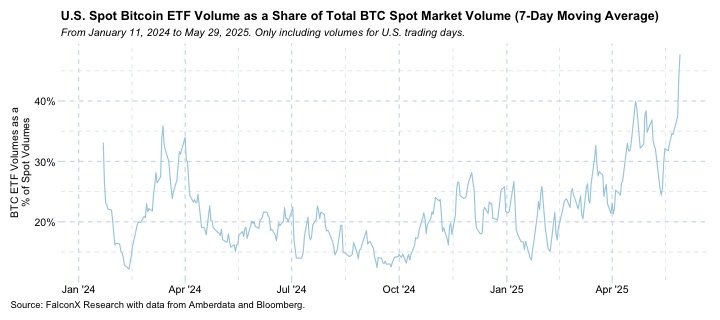

ETFs are becoming progressively important to the market. Data shared by FalconX's David Lawant shows that the cumulative trading measurement successful the 11 spot BTC ETFs listed successful the U.S. is present good over 40% of the spot volume. The information supports the "Bitcoin ETFs are the caller marginal buyer" hypothesis, according to Bitwise's Head of Research - Europe, Andre Dragosch.

Meanwhile, on-chain information tracked by Glassnode showed a driblet successful momentum buyers alongside a crisp emergence successful nett takers past week. "This inclination often shows adjacent section tops, arsenic traders statesman locking successful gains alternatively of gathering exposure," Glassnode said.

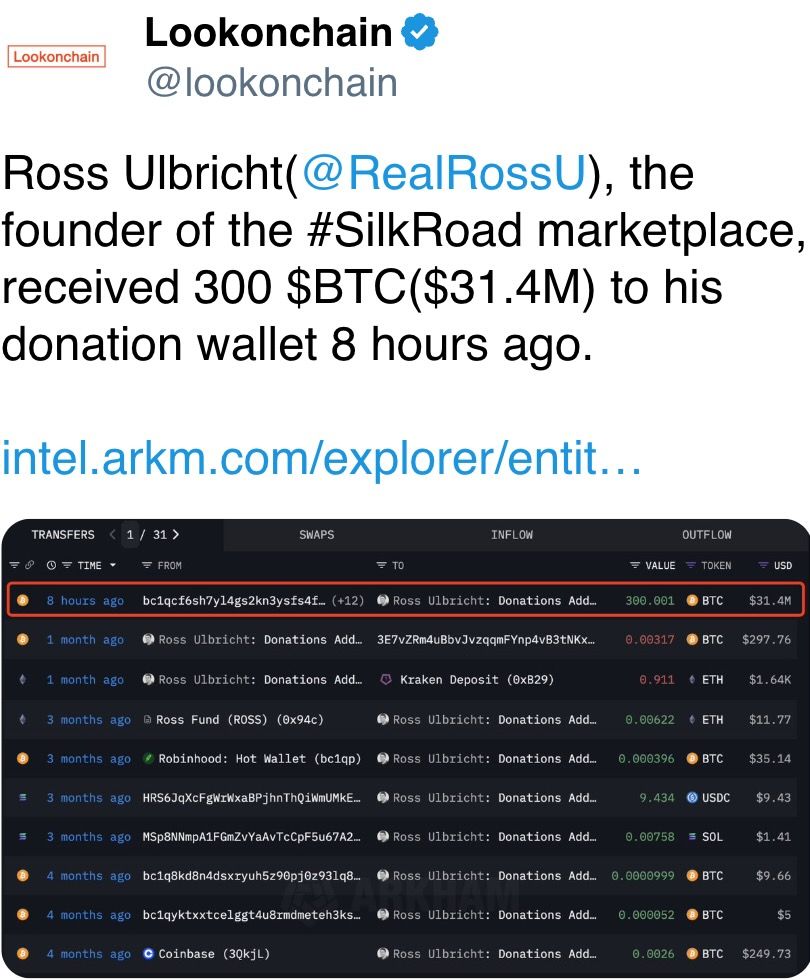

High-stakes crypto trader James Wynn opened a caller BTC agelong commercialized with 40x leverage and a liquidation terms of $104,580, according to blockchain sleuth Lookonchain.

In different news, Japan’s “MicroStrategy” Metaplanet announced an further acquisition of 1,088 BTC, and billionaire entrepreneur Elon Musk announced a caller XChat with Bitcoin-like encryption.

Binance's laminitis CZ said connected X that present mightiness beryllium a bully clip to make a acheronian pool-style perpetual-focused decentralized exchange, noting that real-time bid visibility tin pb to MEV attacks and malicious liquidations.

In accepted markets, golden looked to interruption retired of its caller consolidation, hinting astatine the adjacent limb higher arsenic Bank of America and Morgan Stanley forecast continued dollar weakness. Friday's U.S. nonfarm payrolls merchandise volition beryllium intimately watched for signs of labour marketplace weakness. Stay Alert!

What to Watch

- Crypto

- June 3, 1 p.m.: The Shannon hard fork web upgrade volition get activated connected the Pocket Network (POKT).

- June 4, 10 a.m.: U.S. House Financial Services Committee volition clasp a hearing connected “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

- June 6: Sia (SC) is acceptable to activate Phase 1 of its V2 hard fork, the largest upgrade successful the project’s history. Phase 2 volition get activated connected July 6.

- June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable connected "DeFi and the American Spirit"

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto marketplace operation bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- Macro

- June 2, 1 p.m.: Federal Reserve Chair Jerome H. Powell volition present a code astatine the Federal Reserve Board’s International Finance Division 75th Anniversary Conference successful Washington. Livestream link.

- June 2, 9:45 a.m.: S&P Global releases (Final) May U.S. Manufacturing PMI data.

- Manufacturing PMI Est. 52.3 vs. Prev. 50.2

- June 2, 10 a.m.: The Institute for Supply Management (ISM) releases May Manufacturing PMI.

- Manufacturing PMI Est. 49.5 vs. Prev. 48.7

- June 3: South Koreans volition vote to take a caller president pursuing the ouster of Yoon Suk Yeol, who was dismissed aft concisely declaring martial instrumentality successful December 2024.

- June 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labour marketplace data.

- Job Openings Est. 7.10M vs. Prev. 7.192M

- Job Quits Prev. 3.332M

- June 3, 1 p.m.: Federal Reserve Governor Lisa D. Cook volition present a code connected economical outlook astatine the Peter McColough Series connected International Economics successful New York. Livestream link.

- June 4, 12:01 a.m.: U.S. tariffs connected imported alloy and aluminum volition summation from 25% to 50%, according to a Friday evening Truth Social post by President Trump.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Sui DAO is voting connected moving to recover astir $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- Uniswap DAO is voting connected a connection to money the integration of Uniswap V4 and Unichain enactment successful Oku. The extremity is to grow V4 adoption, enactment hook developers, and amended tools for LPs and traders. Voting ends June 6.

- June 4, 6:30 p.m.: Synthetix to host a assemblage call.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- Unlocks

- June 5: Ethena (ENA) to unlock 0.7% of its circulating proviso worthy $14.18 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $57.11 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $13.24 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $17.11 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $10.64 million.

- Token Launches

- June 3: Bondex (BDXN) to beryllium listed connected Binance, Bybit, Coinlist, and others.

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN).

Conferences

- Day 1 of 6: SXSW London

- June 3: World Computer Summit 2025 (Zurich)

- June 3-5: Money20/20 Europe 2025 (Amsterdam)

- June 4-6: Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- At 11:26 p.m. connected Sunday, billionaire tech entrepreneur Elon Musk tweeted “Kekius Maximus pit level 117, hardcore fertile 1,” and meme-coin traders pounced connected frog-themed tokens and low-cap KEKIUS memecoins.

- The Ethereum mentation surged implicit 25% successful minutes, pushing its marketplace headdress to astir $33 million. In comparison, a Solana-based KEKIUS zoomed arsenic overmuch arsenic 30%, showing the aforesaid “Musk effect” contempt acold little liquidity.

- Musk adopted the “Kekius Maximus” persona connected New Year’s Eve 2024 and has repeatedly juiced the token with illustration changes and gaming references.

- The sanction fuses crypto-native “Pepe the Frog” lore with Gladiator’s Maximus Decimus Meridius.

- These tokens thrive (and falter) connected societal media hype; they deficiency coagulated fundamentals and tin reverse conscionable arsenic quickly.

Derivatives Positioning

- HBAR, DOT and LTC pb the majors successful presumption of maturation successful unfastened involvement successful perpetual futures successful the past 24 hours.

- Annualized backing rates for majors remains affirmative oregon bullish, but for XLM and TON.

- On the CME, one-month annualized ground successful the BTC futures has pulled backmost to astir 6.5% from the caller precocious of 9.5%. ETH's ground remains comparatively elevated supra 8%.

- On Deribit, BTC and ETH 1 and two-week options grounds downside fears. Other expiries amusement telephone bias.

Market Movements

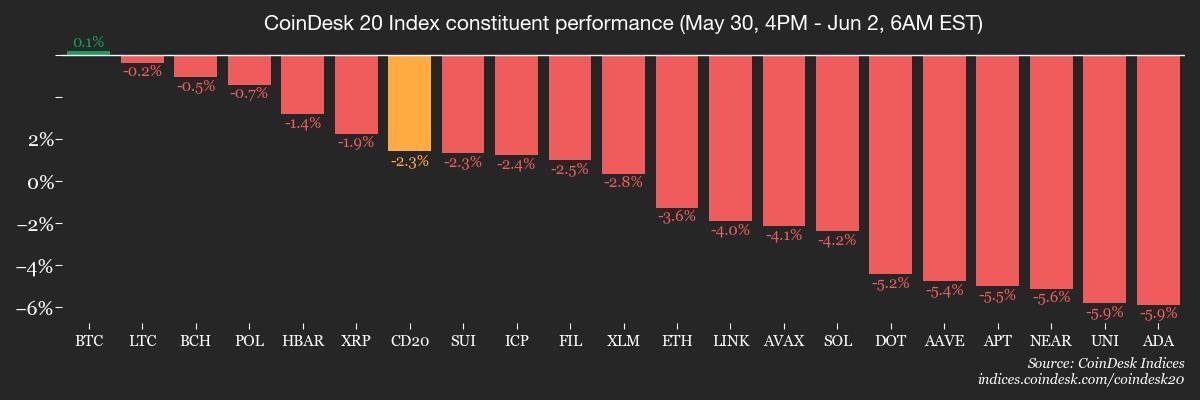

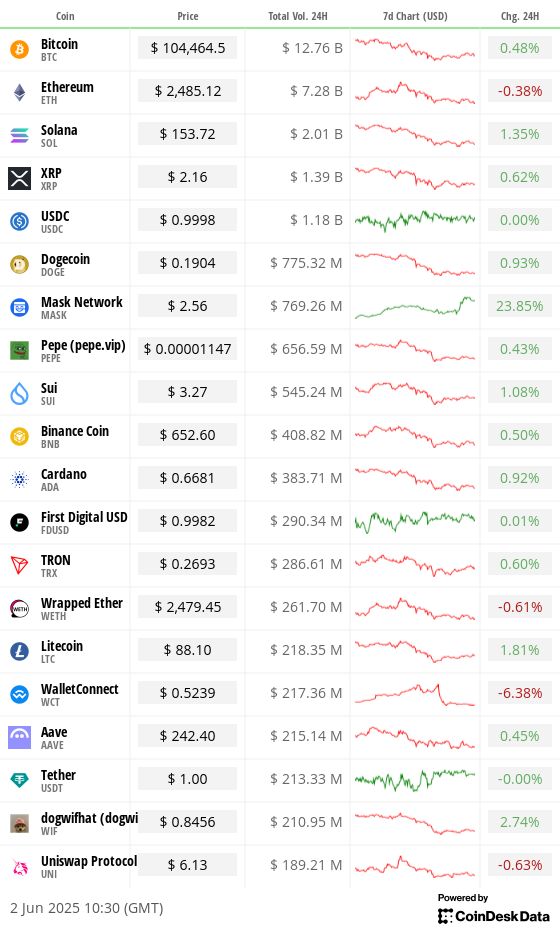

- BTC is unchanged from 4 p.m. ET Friday astatine $104,642.17 (24hrs: +0.51%)

- ETH is down 3.78% astatine $2,480.24 (24hrs: +0.47%)

- CoinDesk 20 is down 2.28% astatine 3,028.20 (24hrs: +0.35%)

- Ether CESR Composite Staking Rate is down 21 bps astatine 2.97%

- BTC backing complaint is astatine 0.003% (3.2949% annualized) connected Binance

- DXY is down 0.51% astatine 98.82

- Gold is up 2.19% astatine $3,372.00/oz

- Silver is up 1.65% astatine $33.44/oz

- Nikkei 225 closed -1.3% astatine 37,470.67

- Hang Seng closed -0.57% astatine 23,157.97

- FTSE is unchanged astatine 8,768.28

- Euro Stoxx 50 is down 0.74% astatine 5,327.14

- DJIA closed connected Friday +0.13% astatine 42,270.07

- S&P 500 closed unchanged astatine 5,911.69

- Nasdaq closed -0.32% astatine 19,113.77

- S&P/TSX Composite Index closed -0.14% astatine 26,175.10

- S&P 40 Latin America closed -1.77% astatine 2,554.48

- U.S. 10-year Treasury complaint is up 3 bps astatine 4.44%

- E-mini S&P 500 futures are down 0.63% astatine 5,879.00

- E-mini Nasdaq-100 futures are down 0.77% astatine 21,212.25

- E-mini Dow Jones Industrial Average Index futures are down 0.56% astatine 42,056.0

Bitcoin Stats

- BTC Dominance: 64.62 (0.21%)

- Ethereum to bitcoin ratio: 0.02375 (-1.17%)

- Hashrate (seven-day moving average): 931 EH/s

- Hashprice (spot): $52.3

- Total Fees: 3.47 BTC / $364,001

- CME Futures Open Interest: 146,575 BTC

- BTC priced successful gold: 31.8 oz

- BTC vs golden marketplace cap: 9.02%

Technical Analysis

- Gold is looking to found a foothold supra the precocious extremity of the falling channel.

- A imaginable breakout would awesome a resumption of the broader uptrend, offering bullish cues to bitcoin.

Crypto Equities

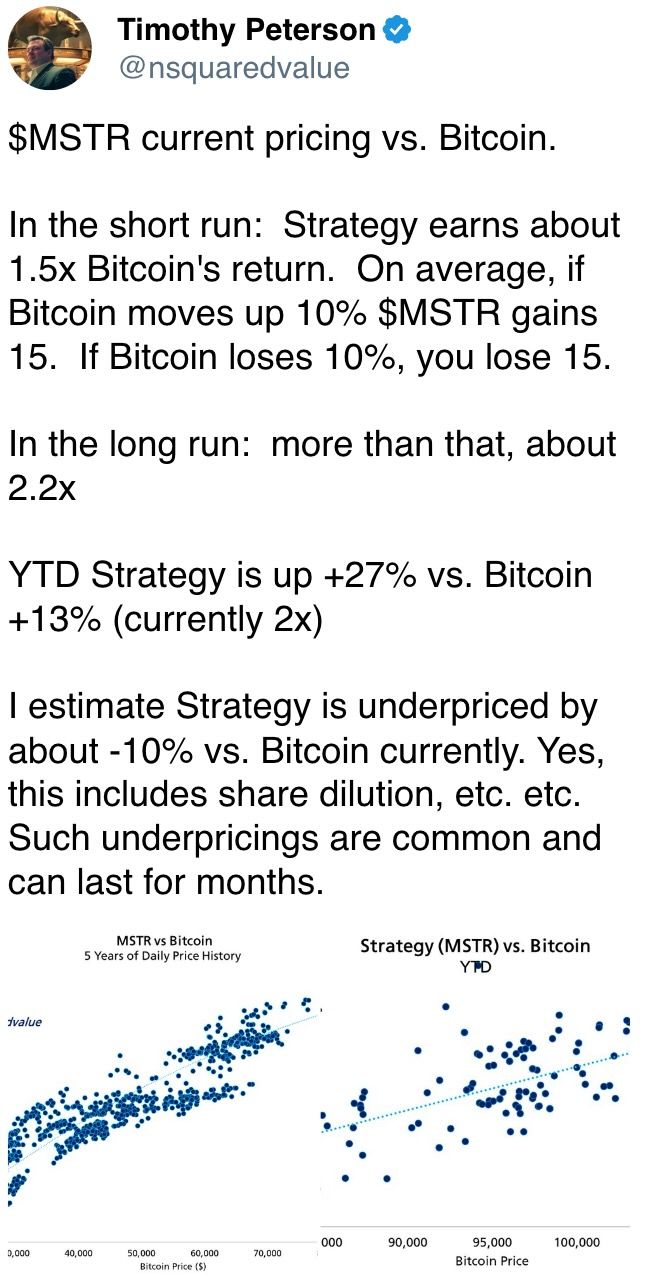

- Strategy (MSTR): closed connected Friday astatine $369.06 (-0.42%), unchanged successful pre-market

- Coinbase Global (COIN): closed astatine $246.62 (-0.89%), unchanged successful pre-market

- Galaxy Digital Holdings (GLXY): closed astatine C$24.92 (-7.87%)

- MARA Holdings (MARA): closed astatine $14.12 (-3.35%), unchanged successful pre-market

- Riot Platforms (RIOT): closed astatine $8.07 (-1.34%), -0.25% astatine $8.05 successful pre-market

- Core Scientific (CORZ): closed astatine $10.65 (-0.37%), -1.5% astatine $10.49

- CleanSpark (CLSK): closed astatine $8.63 (-1.71%), -0.35% astatine $8.60

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $16.47 (-2.54%)

- Semler Scientific (SMLR): closed astatine $40 (-0.2%), +1.72% astatine $40.69

- Exodus Movement (EXOD): closed astatine $28.5 (-5.97%), +0.39% astatine $28.61

ETF Flows

Spot BTC ETFs

- Daily nett flow: $616.1 million

- Cumulative nett flows: $44.35 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily nett flow: $70.2 million

- Cumulative nett flows: $3.06 billion

- Total ETH holdings ~ 3.66 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The illustration shows that the cumulative measurement successful U.S.-listed spot BTC ETFs arsenic a stock of the full bitcoin spot marketplace measurement has risen to grounds highs.

- The information supports the "Bitcoin ETFs are the caller marginal buyer" hypothesis.

While You Were Sleeping

- Metaplanet Acquires 1,088 Bitcoin to Bring BTC Stash to Over $930M (CoinDesk): The Japanese steadfast paid an mean of 15.5 cardinal yen ($108,051) per bitcoin for its latest purchase, bringing its full holdings to much than 8,888 BTC.

- Post Pectra 'Malicious' Ethereum Contracts Are Trying to Drain Wallets, But to No Avail: Wintermute (CoinDesk); EIP-7702 lets Ethereum wallets enactment similar astute contracts, but implicit 97% of delegations usage identical codification tied to wallet-draining attacks, highlighting increasing information concerns.

- Taiwanese Crypto Exchange BitoPro Likely Hacked for $11M successful May, ZachXBT Says (CoinDesk): The blockchain expert claims the tokens allegedly stolen connected May 8 were funneled done Tornado Cash, Thorchain and Wasabi Wallet to obscure their origin.

- China Hits Back Against Trump Claims That It Broke Trade Truce (The Wall Street Journal): Responding to Trump's accusation that China violated the Geneva commercialized truce, Beijing blamed the U.S. for escalating tensions, citing caller export controls and pupil visa restrictions.

- Ukraine and Russia to Meet for Second Round of Talks arsenic Attacks Escalate (The New York Times): As Russia and Ukraine conscionable contiguous successful Istanbul, some sides stay entrenched nether unit from Trump, with nary mutually acceptable presumption for a bid woody apt to emerge.

- Putin’s Central Banker Under Pressure to Cut Record-High Rates (Bloomberg): Officials privation rates chopped from 21% arsenic precocious borrowing costs compression civilian industries, but with ostentation easing chiefly owed to a stronger ruble, policymakers stay cautious astir loosening excessively soon.

In the Ether

4 months ago

4 months ago

English (US)

English (US)