By Omkar Godbole (All times ET unless indicated otherwise)

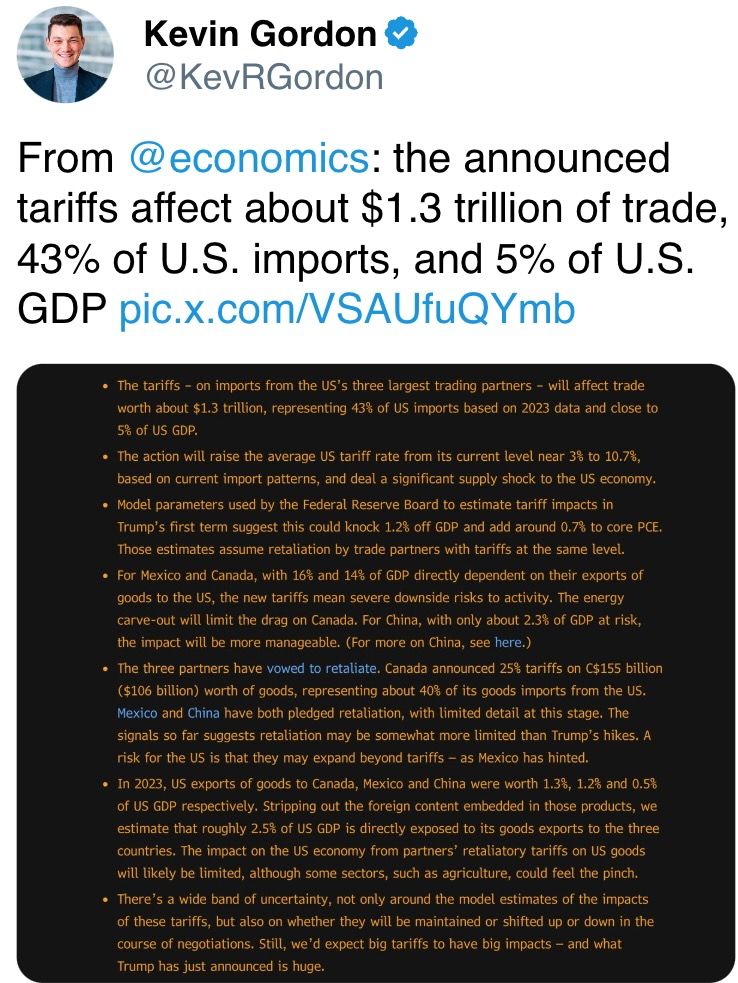

Crypto markets are a oversea of reddish alongside a increasing hazard aversion successful accepted markets, and Trump's tariffs are to blame. Late Friday, the president imposed a 25% tariff connected imports from Canada and Mexico and 10% connected China, provoking retaliatory measures that person reignited a commercialized warfare reminiscent of 2018.

The statement connected societal media and among the expert assemblage is that this tariff-induced descent successful the crypto marketplace is impermanent and that bitcoin (BTC) volition rapidly rebound. However, determination are reasons to judge otherwise.

Firstly, Trump has shattered the crypto market's content that helium is looking to pump markets and would usage tiny tariffs simply arsenic a negotiating tactic. In fact, helium has threatened to summation tariffs if trading partners retaliate. Since Canada and Mexico responded with their ain measures, the imaginable for further tariff hikes looms large.

Geo Chen, a macro trader and writer of the fashionable Substack-based newsletter, Fidenza Macro, shared his position successful an email to subscribers: "My presumption is that they volition stay successful spot for respective months with the hazard of increasing, arsenic Canada has pledged to retaliate and China has initiated a suit against the U.S. successful the World Trade Organization. These responses could escalate the situation. The champion we tin anticipation for is simply a partial rollback of tariffs erstwhile negotiations conclude."

Chen emphasized that the tariffs are driven by commercialized shortage concerns alternatively than the fentanyl crisis, arsenic Trump likes to portray, adding that markets whitethorn instrumentality days oregon weeks to grasp this, starring to persistent volatility. Besides, the latest tariffs are connected $1.3 trillion worthy of goods that the U.S. imports from the 3 nations, which is 7 times bigger successful worth than the archetypal changeable fired successful 2018.

All this makes the latest occurrence look much destabilizing than backmost then, erstwhile the S&P 500 initially dropped 9% from its highest successful March earlier rapidly rebounding. In different words, the imaginable symptom whitethorn beryllium greater this clip around, which poses a situation for risk-on assets similar BTC.

As 1 crypto trader choosing to enactment anonymous said: "Despite the speech of deals, this determination doesn't consciousness temporary." Stay alert!

What to Watch

Crypto:

Feb. 4: Pepecoin (PEPE) Halving. At artifact 400,000, the reward volition driblet to 31,250 PEPE.

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork web upgrade for its Ethereum-based L2 mainnet.

Feb. 6, 8:00 a.m.: Shentu Chain web upgrade (v2.14.0).

March 11 (TBC): Ethereum’s Pectra upgrade.

Feb. 13: Start of Kraken's "gradual" delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Macro

Feb. 3, 9:45 a.m.: S&P Global releases January’s U.S. Manufacturing PMI Final report.

Est. 50.1 vs. Prev. 49.4

Feb. 3, 10:00 a.m.: The Institute for Supply Management (ISM) releases January’s Manufacturing PMI Report connected Business.

Est. 49.5 vs. Prev. 49.3

Feb. 4, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December’s Job Openings and Labor Turnover Survey (JOLTS) report.

Job Openings Est. 7.88M vs. Prev. 8.098M

Job Quits Prev. 3.065M

Feb. 5, 9:45 a.m.: S&P Global releases January’s US Services PMI (Final) report.

Est. 52.8 vs. Prev. 56.8

Feb. 5, 10:00 a.m.: The Institute for Supply Management (ISM) releases January’s Services ISM Report connected Business.

Services PMI Est. 54.3 vs. Prev. 54.1

Services Business Activity Prev. 58.2

Services Employment Prev. 51.4

Services New Orders Prev. 54.2

Services Prices Prev. 64.4

Earnings

Feb. 5: MicroStrategy (MSTR), post-market, $0.09

Feb. 10: Canaan (CAN), pre-market

Feb. 11: HIVE Digital Technologies (HIVE), post-market

Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, C$0.01

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market

Feb. 13: CleanSpark (CLSK), $-0.05

Feb. 13: Coinbase Global (COIN), post-market, $1.61

Feb. 18: CoinShares International Ltd (STO:CS), pre-market

Feb. 18: Semler Scientific (SMLR), post-market, $0.26 (1 est.)

Feb. 20: Block (XYZ), post-market, $0.88

Feb. 26: MARA Holdings (MARA), $-0.15

Feb. 26 (TBA): Sol Strategies (CSE: HODL)

Feb. 27: Riot Platforms (RIOT), $-0.18

March 4: Cipher Mining (CIFR), $-0.09

March 6 (TBA): Bitfarms (BITF)

March 17 (TBA): Bit Digital (BTBT)

March 18 (TBA): TeraWulf (WULF)

March 27 (TBA): Bitdeer Technologies Group (BTDR)

March 28 (TBA): DeFi Technologies (NEO:DEFI)

March 31 (TBA): Galaxy Digital Holdings (TSE:GLXY)

April 11 (TBC): KULR Technology Group (KULR)

April 22: Tesla (TSLA), post-market

Token Events

Governance votes & calls

Compound DAO is discussing the instauration of Morpho-powered lending vaults connected Polygon curated by Gauntlet. Polygon Labs is acceptable to connection $1.5 cardinal successful POL, matched with $1.5 cardinal successful COMP to incentivize usage.

Arbitrum DAO is voting connected whether to transportation 1,885 ETH successful Nova transaction fees to its Treasury done the modernized interest postulation infrastructure outlined successful the ova Fee Router Proposal.

Aave DAO is nearing the extremity of a vote connected deploying Aave v3 connected Sonic, a caller layer-1 Ethereum Virtual Machine (EVM) blockchain with a precocious transaction throughput.

Feb. 4, 1 p.m.: TRON DAO and CryptoQuant to host a web review diving into performance, adoption and cardinal metrics.

Feb. 4, 12 p.m.: Stellar to host its Q4 quarterly review.

Unlocks

Feb. 5: XDC Network (XDC) to unlock 5.36% of circulating proviso worthy $75.9 million.

Feb. 9: Movement (MOVE) to unlock 2.17% of circulating proviso worthy $30.06 million.

Feb. 10: Aptos (APT) to unlock 1.97% of circulating proviso worthy $64.92 million.

Token Launches

Feb. 4: Vine (VINE), Bio Protocol (BIO), Swarms (SWARMS), and Sonic SVM (SONIC) to beryllium listed connected Kraken.

Conferences:

Feb. 3: Digital Assets Forum (London)

Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney)

March 19-20: Next Block Expo (Warsaw)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

May 1-2: Sui Basecamp (Dubai)

May 12-13: Filecoin (FIL) Developer Summit (Toronto)

May 20-22: Avalanche Summit London

May 29-30: Litecoin Summit 2025 (Las Vegas)

Token Talk

By Shaurya Malwa

Hyperliquid's HYPE is holding beardown successful the marketplace bloodbath, with a 5% leap successful the past 24 hours.

The decentralized speech generated astir $4 cardinal successful fees implicit the past 24 hours, and portion of the gross is being utilized to bargain backmost HYPE, helping enactment its terms amidst a bearish market.

Elsewhere, prices of long-forgotten Jeo Boden (BODEN), a parody token mimicking Joe Biden that was worthy $1 cardinal by marketplace capitalization astatine peak, roseate arsenic overmuch arsenic 300% successful the past 24 hours.

It registered trading volumes of implicit $8 million, the highest since July 2024, for nary instantly evident reason, which swiftly shifted prices of the once-behemoth token that present has a tiny $3.5 cardinal capitalization.

Derivatives Positioning

Major altcoins similar ETH, XRP, BNB, SOL, DOGE, ADA are seeing antagonistic perpetual backing rates, a motion of dominance of abbreviated positions.

OM and HYPE tokens basal retired with level unfastened interest-adjusted cumulative measurement delta, pointing to a neutral flow. Other tokens grounds antagonistic CVD, which connote nett selling.

BTC, ETH short-dated options amusement a bias for puts, with ETH reflecting greater downside fears comparative to BTC.

Block flows featured a ample abbreviated presumption successful the BTC $120K telephone expiring connected March 28 and a carnivore enactment dispersed successful ETH $2.8K and $2.5K strikes.

Market Movements:

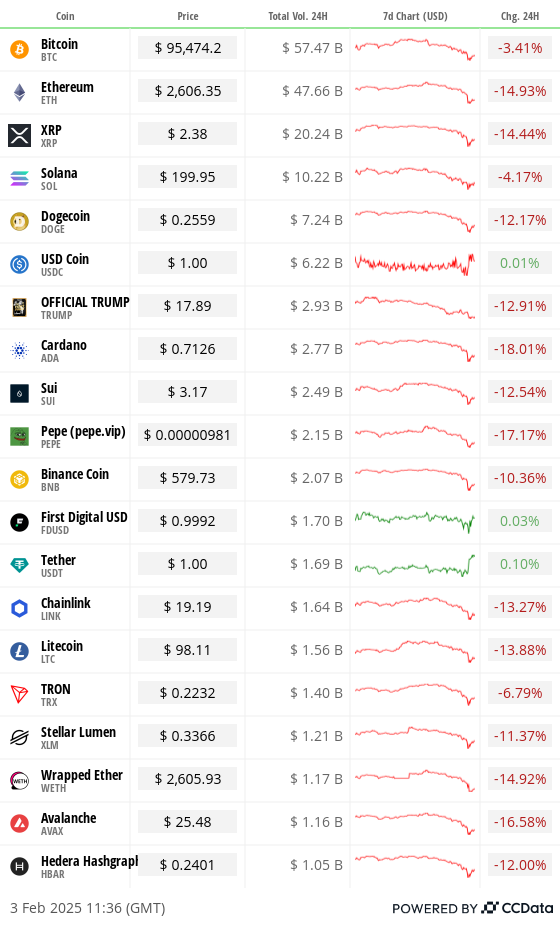

BTC is down 6.3% from 4 p.m. ET Friday astatine $95,631.55 (24hrs: -3.25%)

ETH is down 21.9% astatine $3,734.92 (24hrs: -15.28%)

CoinDesk 20 is down 15.9% astatine 3,154.76 (24hrs: -10.32%)

CESR Composite Staking Rate is up 3 bps astatine 3.03%

BTC backing complaint is astatine 0.0036% (3.97% annualized) connected Binance

DXY is up 0.95% astatine 109.41

Gold is unchanged astatine $2,801.09/oz

Silver is down 0.31% astatine $31.28/oz

Nikkei 225 closed -2.66% to 38,520.09

Hang Seng closed unchanged astatine 20,217.26

FTSE is down 1.17% astatine 8,572.04

Euro Stoxx 50 is down 0.4% astatine 5,203.52

DJIA closed connected Friday -0.75% to 44,544.66

S&P 500 closed -0.5% to 6,040.53

Nasdaq closed +0.83% astatine 19,480.91

S&P/TSX Composite Index closed -1.07% to 25,533.10

S&P 40 Latin America closed -0.73% to 2,370.49

U.S. 10-year Treasury was unchanged astatine 4.54%

E-mini S&P 500 futures are down 1.38%% astatine 5,983.50

E-mini Nasdaq-100 futures are down 1.59% astatine 21,247.00

E-mini Dow Jones Industrial Average Index futures are down 1.23% astatine 44,149

Bitcoin Stats:

BTC Dominance: 61.62 (1.35%)

Ethereum to bitcoin ratio: 0.02725 (-7.22%)

Hashrate (seven-day moving average): 833 EH/s

Hashprice (spot): $55.93

Total Fees: 4.56 BTC / $435,584

CME Futures Open Interest: 177,260 BTC

BTC priced successful gold: 33.9 oz

BTC vs golden marketplace cap: 9.65%

Technical Analysis

BTC has bounced from the double top enactment enactment astatine $91,384, trimming losses.

The bid of reddish candles, however, suggests the way of of slightest absorption is connected the little broadside for now.

A adjacent (UTC midnight) nether the enactment enactment would trigger a treble apical bearish reversal pattern, opening doors to a imaginable driblet to $75,000.

Crypto Equities

MicroStrategy (MSTR): closed connected Friday astatine $334.79 (-1.56%), down 5.37% astatine $316.81 successful pre-market.

Coinbase Global (COIN): closed astatine $291.33 (-3.31%), down 5.69% astatine $274.74 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$28.48 (-2.90%)

MARA Holdings (MARA): closed astatine $18.34 (-4.38%), down 5.34% astatine $17.36 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.88 (-0.17%), down 4.21% astatine $11.40 successful pre-market.

Core Scientific (CORZ): closed astatine $12.27 (+0.08%), down 6.68% astatine $11.45 successful pre-market.

CleanSpark (CLSK): closed astatine $10.44 (-4.83%), down 5.08% astatine $9.91 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.55 (+0.22%), down 6.34% astatine $21.12 successful pre-market.

Semler Scientific (SMLR): closed astatine $51.96 (-0.36%), down 6.08% astatine $48.80 successful pre-market.

Exodus Movement (EXOD): closed astatine $49.88 (-18.74%), up 2.25% astatine $51 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: $318.6 million

Cumulative nett flows: $40.50 billion

Total BTC holdings ~ 1.172 million.

Spot ETH ETFs

Daily nett flow: $27.8 million

Cumulative nett flows: $2.76 billion

Total ETH holdings ~ 3.634 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

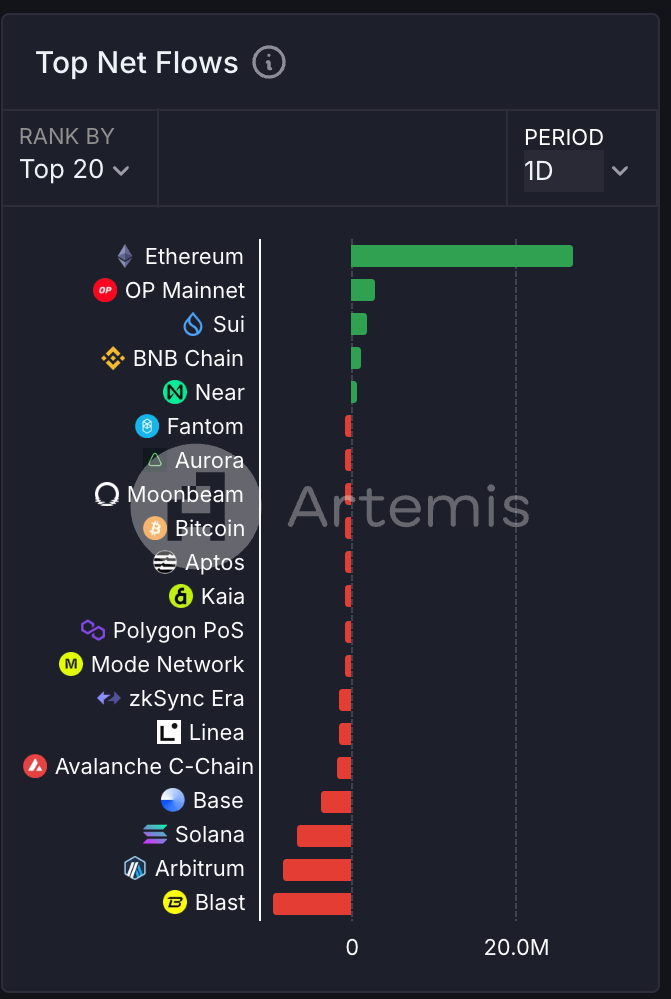

Ethereum has seen the highest magnitude of nett inflows done crypto bridges successful the past 24 hours, portion the accustomed leaders Base, Solana, Arbitrum person seen astir outflows.

That's a classical risk-off capitalist behavior, wherever the determination to the oldest and biggest astute declaration blockchain, anticipating deeper marketplace swoon.

While You Were Sleeping

XRP, Dogecoin Plunge 25% arsenic Crypto Liquidations Cross $2.2B connected Tariffs Led Dump (CoinDesk): On Sunday, large cryptocurrencies including XRP, DOGE, and ADA slumped arsenic U.S. tariffs connected Canada and Mexico announced connected Saturday fueled commercialized warfare fears and $2.2 cardinal successful futures liquidations.

Chance of Bitcoin Tanking to $75K Doubles arsenic Trump's Tariffs Ignite Trade War, Derive's Onchain Options Market Shows (CoinDesk): Derive.xyz’s on-chain options present bespeak a 22% accidental bitcoin volition driblet to $75K by March 28 — treble past week’s odds.

USDe Stable Despite Trade War Volatility (CoinDesk): Ethena’s synthetic stablecoin USDe maintained its $1 peg amid volatile crypto markets, apt aided by its yield-generating mechanism.

Dollar Soars, Stocks Fall arsenic Trump Imposes Tariffs: Markets Wrap (Bloomberg): The tariffs announced Saturday propelled the dollar to a two-year precocious arsenic planetary stocks, U.S. equity futures, and crypto prices plunged amid mounting fears of rising ostentation and economical disruption.

Beijing Prepares Its Opening Bid to Talk Trade With Trump (The Wall Street Journal): China volition reportedly contention Trump's 10% tariffs via the WTO and resume commercialized talks to revive the Phase One woody by pledging accrued U.S. purchases and investments.

Bank of England Expected to Cut Interest Rates Again arsenic U.K. Economy Stagnates (Financial Times): With stagnant maturation and easing inflation, the Bank of England is expected to chopped rates by 0.25% this week, though rising vigor costs and commercialized tensions whitethorn trigger stagflationary pressures.

In the Ether

8 months ago

8 months ago

English (US)

English (US)