By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace has stabilized somewhat pursuing comments from Commerce Minister Howard Lutnick, who said President Donald Trump could denote connected Wednesday a pathway for tariff alleviation connected Canadian and Mexican imports covered by NAFTA.

That has helped BTC bounce to astir $90K, with the full crypto marketplace headdress rising to the $2.9 trillion mark. The betterment could widen further arsenic the caller commercialized warfare fears and marketplace volatility person reignited bets connected Federal Reserve (Fed) complaint cuts.

According to CME's FedWatch tool, the marketplace is present pricing successful astatine slightest 3 complaint cuts for this year, portion the 10-year Treasury output has retreated to 4.15%, down from 4.80% astatine the clip of Trump's inauguration. Meanwhile, Germany's determination to wantonness its fiscal constraints has led to soaring enslaved yields, prompting a sell-off successful the dollar scale that could promote risk-taking successful the market.

As a result, determination is simply a accidental that bitcoin whitethorn revisit its play precocious of $95,000, peculiarly arsenic method charts indicate signs of seller exhaustion.

However, worsening maturation concerns could bounds these gains. Just 2 days ago, the Atlanta Fed's GDP forecast turned antagonistic astatine -2.8%, raising fears of stagflation, arsenic noted by Singapore-based QCP Capital. The steadfast stressed the value of monitoring firm output spreads—both high-yield and investment-grade bonds—in narration to U.S. Treasury yields for signs of marketplace stress. "While this isn't signaling panic close now, it's a inclination worthy monitoring closely," QCP said successful a Telegram broadcast.

An important information is however overmuch of the diminution successful the 10-year output and the weakness successful the dollar tin beryllium attributed to traders adjusting their expectations astir U.S. economical exceptionalism, which was mostly based connected Biden era's fiscal splurge. Given the emergence of ETFs and Trump's pro-crypto stance, bitcoin has go much of a U.S. play, and a displacement successful the U.S. exceptionalism communicative could pb to BTC volatility.

JPMorgan, however, foresees strengthening of the U.S. exceptionalism communicative nether Trump's Presidency.

All of this means that Wednesday's U.S. ISM non-manufacturing (services) PMI and Friday's nonfarm payrolls could importantly power the crypto markets.

There are besides rumors that President Trump volition unveil the crypto reserve strategy astatine the White House Crypto Summit this Friday. With Trump having made sizeable promises, the markets volition beryllium watching intimately to spot if helium delivers; otherwise, determination could beryllium further turmoil ahead. Stay alert!

What to Watch

Crypto:

March 5, 11:00 a.m.: Circle hosts a unrecorded webinar titled “State of the USDC Economy 2025” featuring Circle Chief Strategy Officer and Head of Global Policy Dante Disparte and 3 different executives from Bridge, Nubank and Cumberland.

March 6: Ethereum-based L2 blockchain MegaETH deploys its nationalist testnet, with idiosyncratic onboarding starting connected March 10.

March 7: President Trump volition big the inaugural White House Crypto Summit, bringing unneurotic apical cryptocurrency founders, CEOs and investors.

March 11: The Bitcoin Policy Institute and U.S. Senator Cynthia Lummis co-host the invitation-only one-day lawsuit "Bitcoin for America" successful Washington.

March 12: Hemi, an L2 blockchain that operates connected some Bitcoin and Ethereum, has its mainnet launch.

Macro

March 5, 8:00 a.m.: S&P Global releases February Brazil economical enactment data.

Services PMI Prev. 47.6

Composite PMI Prev. 48.2

March 5, 8:15 a.m.: Automatic Data Processing (ADP) releases February U.S. non-farm backstage assemblage employment data.

ADP Employment Change Est. 140K vs. Prev. 183K

March 5, 9:30 a.m.: S&P Global releases February Canada economical enactment data.

Services PMI Prev. 49

Composite PMI Prev. 49.5

March 5, 9:45 a.m.: S&P Global releases February U.S. economical enactment data.

Services PMI Est. 49.7 vs. Prev. 52.9

Composite PMI Est. vs. 50.4 vs. Prev. 52.7

March 5, 10:00 a.m.: Institute for Supply Management (ISM) releases February U.S. economical enactment data.

Services PMI Est. 52.6 vs. Prev. 52.8

Earnings (Ests. based connected FactSet data)

March 6 (TBC): Bitfarms (BITF), $-0.06

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.39

Token Events

Governance votes & calls

Paraswap DAO is discussing the instrumentality of 44.67 wrapped ether (wETH) to hacked cryptocurrency speech Bybit that were collected by the DAO since the information breach.

Morpho DAO is voting connected adjusting MORPHO token rewards connected assorted networks by granting the Morpho Association the quality to change rewards wrong predefined limits.

Aave DAO is discussing the instauration of sGHO, a yield-bearing token that allows users to gain the Aave Savings Rate (ASR) by depositing GHO stablecoins.

March 5, 8 a.m.: Aptos and MEXC to hold an Ask Me Anything (AMA) session.

March 5, 9 a.m.: Next to hold a Product Lounge: Markets Edition AMA session.

March 5, 11 a.m.: Circle to big a telephone connected The State of the USDC Economy.

March 5, 12 p.m.: Wormhole to clasp an Ecosystem Call.

March 6, 8:30 a.m.: GMX to clasp a Governance Community Call for the GMX DAO.

Unlocks

March 7: Kaspa (KAS) to unlock 0.63% of circulating proviso worthy $12.68 million.

March 9: Movement (MOVE) to unlock 2.08% of its circulating proviso worthy $20.85 million.

March 12: Aptos (APT) to unlock 1.93% of circulating proviso worthy $67.41 million.

March 15: Starknet (STRK) to unlock 2.33% of its circulating proviso worthy $11.88 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating proviso worthy $12.76 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating proviso worthy $37.03 million.

Token Listings

March 5: Just (JST) to beryllium listed connected HashKey

March 6: Roam (ROAM) to beryllium listed connected KuCoin and MEXC.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 2 of 4: FIN/SUM 2025 (Tokyo)

March 8: Bitcoin Alive (Sydney)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25

March 19-20: Next Block Expo (Warsaw, Poland)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

Token Talk

By Shaurya Malwa

Berachain's 'first' memecoin HENLO goes live, racking up a $26 cardinal marketplace headdress soon aft issuance.

HENLO is simply a community-driven memecoin connected Berachain, created by The Honey Jar collective, focusing connected wit and engagement with nary explicit utility.

It raised $3 cardinal successful a February 2025 effect round, backed by Framework Ventures and different VCs.

It offers staking, DEX trading, and output farming connected Berachain’s mainnet, with Henlo 'points' to reward aboriginal adopters.

Aims to heighten inferior with staking and governance, grow partnerships, refine tokenomics (with a 100 cardinal full supply), and turn its assemblage done events and airdrops.

Derivatives Positioning

Positioning successful BTC and ETH CME futures remains airy contempt signs of marketplace stability, leaving the ground adjacent 6%.

BTC, ETH perpetual backing rates are marginally positive, indicating continued caution among traders.

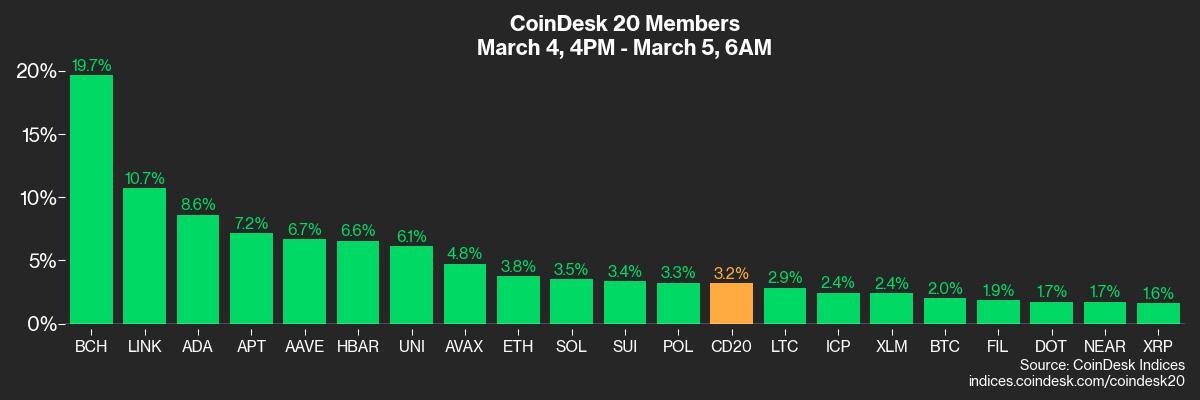

BCH leads the majors successful presumption of terms and unfastened involvement gains, but the level 24-hour cumulative measurement delta questions the sustainability of the terms surge.

BTC hazard reversals amusement a bias for puts successful mid-March and end-of-the-month expiries. The pricing flips decisively bullish successful favour of calls lone aft the April expiry. ETH options amusement a akin story.

Market Movements:

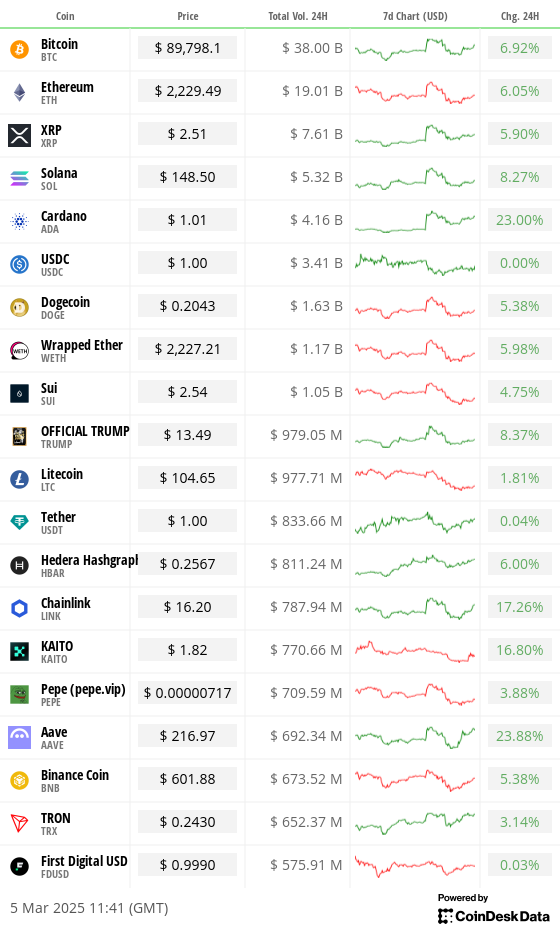

BTC is up 2.85% from 4 p.m. ET Tuesday astatine $90,063.44 (24hrs: +6.98%)

ETH is up 2.82% astatine $2,240.32 (24hrs: +6.11%)

CoinDesk 20 is down 4.37% astatine 2,938.93 (24hrs: +7.8%)

Ether CESR Composite Staking Rate is up 29 bps astatine 3.36%

BTC backing complaint is astatine -0.0007% (-0.25% annualized) connected Binance

DXY is down 0.69% astatine 105.01

Gold is up 0.57% astatine $2926.20/oz

Silver is up 2.58% astatine $32.94/oz

Nikkei 225 closed +0.23% astatine 37,418.24

Hang Seng closed +2.84% astatine 23,594.21

FTSE is up 0.6% astatine 8,811.13

Euro Stoxx 50 is up 2.45% astatine 5,519.47

DJIA closed connected Tuesday -1.55% astatine 42,520.99

S&P 500 closed -1.22% astatine 5,778.15

Nasdaq closed -0.35% astatine 18,285.16

S&P/TSX Composite Index closed -1.72% astatine 24,572.00

S&P 40 Latin America closed unchanged astatine 2,286.69

U.S. 10-year Treasury complaint is unchanged astatine 4.25%

E-mini S&P 500 futures are up 0.66% astatine 5,828.00

E-mini Nasdaq-100 futures are up 0.81% astatine 20,564.00

E-mini Dow Jones Industrial Average Index futures are up 0.58% astatine 42,840.00

Bitcoin Stats:

BTC Dominance: 61.29 (0.03%)

Ethereum to bitcoin ratio: 0.02500 (0.48%)

Hashrate (seven-day moving average): 808 EH/s

Hashprice (spot): $49.6

Total Fees: 5.24 BTC / $444,853

CME Futures Open Interest: 139,245 BTC

BTC priced successful gold: 30.7 oz

BTC vs golden marketplace cap: 8.72%

Technical Analysis

The dollar index, which tracks the greenback's worth against large currencies, has dropped to the lowest since November, establishing a due downtrend connected the regular chart.

With the German-U.S.- enslaved output dispersed widening successful the EUR-positive manner, further losses successful the DXY tin beryllium expected.

Weakness successful the DXY mostly bodes good for riskier assets.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $275.15 (+9.66%), up 3.83% astatine $285.80 successful pre-market

Coinbase Global (COIN): closed astatine $212.55 (+3.3%), up 2.34% astatine $217.53

Galaxy Digital Holdings (GLXY): closed astatine C$19.04 (-8.29%)

MARA Holdings (MARA): closed astatine $13.97 (+1.31%), up 4.58% astatine $14.61

Riot Platforms (RIOT): closed astatine $8.41(-5.08%), up 4.28% astatine $8.77

Core Scientific (CORZ): closed astatine $9.59 (-5.42%), up 5.74% astatine $10.14

CleanSpark (CLSK): closed astatine $7.76 (-0.39%), up 4.64% astatine $8.12

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $16.26 (-1.45%), up 5.1% astatine $17.09

Semler Scientific (SMLR): closed astatine $38.36 (-1.36%), up 4.14% astatine $39.95

Exodus Movement (EXOD): closed +3.69% astatine $42.48

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$143.5 million

Cumulative nett flows: $36.73 billion

Total BTC holdings ~ 1,139 million.

Spot ETH ETFs

Daily nett flow: $14.6 million

Cumulative nett flows: $2.82 billion

Total ETH holdings ~ 3.649 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

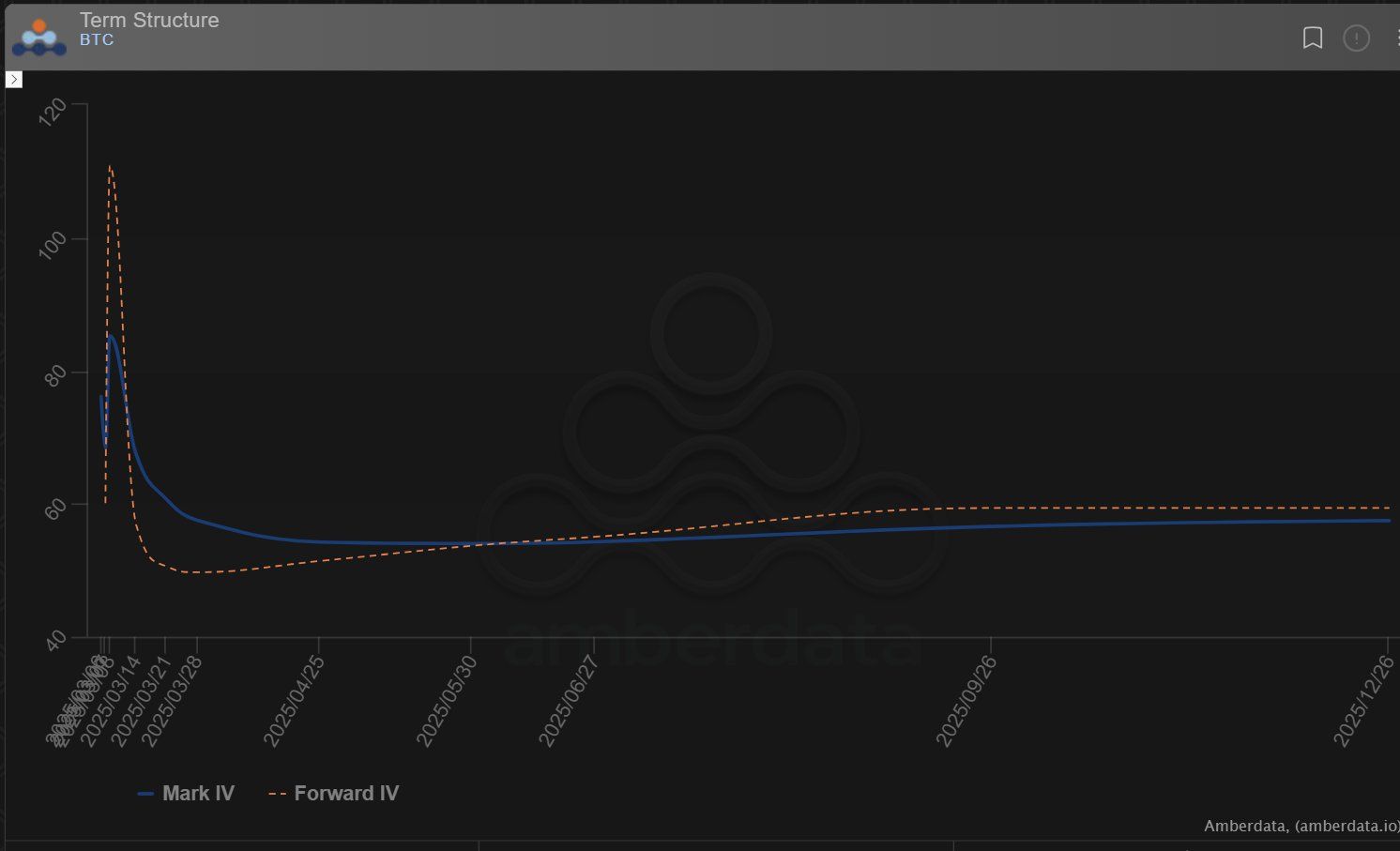

The illustration shows bitcoin's options-based implied volatility word structure, a graphical practice of implied oregon expected volatilities astatine antithetic expirations.

Both guardant IV and people IV amusement a large bump higher connected March 8, a motion that traders expect Trump's comments astatine Friday's White House Crypto acme to pb to volatile marketplace conditions.

While You Were Sleeping

Metaplanet Buys 497 BTC successful Another Bargain-Hunting Bitcoin Acquisition (CoinDesk): Japan’s Metaplanet announced Wednesday that its latest bitcoin purchase, acquired astatine $88,448 per BTC, brings its full holdings to 2,888 BTC.

BlackRock's Bitcoin ETF Registers Highest Trading Volume successful 3 Months (CoinDesk): As BlackRock's spot Bitcoin ETF (IBIT) terms declined past week, trading measurement deed its highest level since mid-November, according to TradingView data.

AAVE Jumps 21% arsenic Aave DAO Reveals its ‘Most Important’ Proposal (CoinDesk): On Tuesday, Aave DAO projected a program to boost AAVE token worth and reward users, including accrued staking benefits, a buyback program, and protections against marketplace downturns.

Key Moments From Donald Trump’s Address to Congress (Financial Times): In a Tuesday nighttime code to Congress, Trump pledged to bring Greenland into the U.S., called for ending the Russia-Ukraine war, and praised Elon Musk’s propulsion to chopped authorities waste.

China Targets ‘Around 5%’ Growth successful 2025 and Lays Out Stimulus Measures As Trade Worries Mount (CNBC): At its yearly legislative meeting, China acceptable a 2025 fund shortage people of 4% of GDP and lowered its user ostentation people to astir 2%.

Dollar Falls connected Fears Over U.S. Outlook (The Wall Street Journal): The dollar slid to a 16-week low, with the DXY scale astatine 105.252, arsenic concerns implicit U.S. economical weakness, commercialized argumentation turmoil, and ostentation weighed connected capitalist confidence, Pepperstone’s Michael Brown said.

In the Ether

9 months ago

9 months ago

English (US)

English (US)