By Omkar Godbole (All times ET unless indicated otherwise)

The flip-flopping quality of the crypto marketplace is connected afloat show arsenic the sentiment connected societal media has changed from "it's truthful over" to "we are truthful back" successful conscionable 24 hours, acknowledgment to President Donald Trump naming BTC, ETH, XRP, SOL and ADA arsenic candidates for the long-promised strategical crypto reserve.

The announcement has lifted valuations crossed the board, with marketplace person bitcoin reinstating $89,000 and $91,000 arsenic cardinal enactment levels, and the options marketplace shows renewed involvement successful the $100K bets.

Still, immoderate analysts are calling for caution. "Crypto is backmost connected way with a affirmative momentum and enthusiasm from investors. However, it's important to enactment that nary factual actions person been taken yet, and a continued deficiency of contiguous catalysts could pb to different dilatory correcting market," Valentin Fournier, expert at BRN, said successful an email.

That's sensible due to the fact that pugnacious questions whitethorn beryllium asked erstwhile the archetypal excitement astir the announcement subsides. For instance, Trump inactive needs legislature support for this handbasket of reserves. While BTC makes consciousness arsenic a reserve asset, having reportedly recovered a spot successful capitalist portfolios arsenic integer gold, including XRP, ETH, SOL, and ADA raises concerns, arsenic immoderate of these tokens hardly person links to economical activity.

It begs the question: Why would a authorities facing indebtedness issues put successful assets with minimal ties to the system and are improbable to make a important multiplier effect and assistance amended debt-to-GDP ratios?

Plus, allegations of insider trading related to Trump's Sunday announcement mightiness dent sentiment. On Sunday, an unidentified trader deployed astir $6 cardinal successful a 50x leveraged agelong bet connected BTC and ETH and booked retired with a nett of $6.8 million. "A U.S. crypto reserve could beryllium a large boon to the plus class, but investors whitethorn consciousness much assured if important measures are taken to resoluteness the fearfulness of insider meddling," Mena Theodorou, co-founder astatine crypto speech Coinstash, said, referring to the alleged insider trading.

For now, it's risk-on, and a akin affirmative enactment connected Wall Street could spot coagulated gains successful XRP/BTC, SOL/BTC and ADA/BTC crosses. Solana's co-founder Anatoly Yakovenko, besides known arsenic Toly, has reportedly expressed enactment for the SIMD-0228 proposal, which seeks to betterment Solana’s staking mechanics to reduce inflation.

We tin expect much details astir the projected reserve astatine Friday's crypto acme astatine the White House. In the meantime, 2 different cardinal events to ticker are Wednesday's U.S. ISM non-manufacturing (services) PMI and Friday's payrolls report.

Note that the U.S. 10-year output has declined for 7 consecutive weeks, mostly pricing a slowdown successful the economy. The absorption mightiness displacement backmost to that if the 2 impending information sets people beneath estimates, perchance weighing implicit hazard assets.

What to Watch

Crypto:

March 5, 2:29 a.m.: Ethereum testnet Sepolia receives the Pectra hard fork web upgrade astatine epoch 222464.

March 5, 11:00 a.m.: Circle hosts a unrecorded webinar titled “State of the USDC Economy 2025” featuring Circle Chief Strategy Officer and Head of Global Policy Dante Disparte and 3 different executives from Bridge, Nubank and Cumberland.

March 7: President Trump volition big the inaugural White House Crypto Summit, which volition bring unneurotic apical cryptocurrency founders, CEOs and investors.

March 11: The Bitcoin Policy Institute and U.S. Senator Cynthia Lummis co-host the invitation-only one-day lawsuit "Bitcoin for America" successful Washington.

Macro

March 3, 8:00 a.m.: S&P Global releases February Brazil manufacturing data.

Manufacturing PMI Prev. 50.7

March 3, 9:30 a.m.: S&P Global releases February Canada manufacturing data.

Manufacturing PMI Est. 51.9 vs. Prev. 51.6

March 3, 9:45 a.m.: S&P Global releases (final) February U.S. Manufacturing data.

Manufacturing PMI Est. 51.6 vs. Prev. 51.2

March 3, 10:00 a.m.: S&P Global releases February Mexico manufacturing data.

Manufacturing PMI Prev. 49.1

March 3, 10:00 a.m.: The Institute for Supply Management releases February U.S. manufacturing data.

Manufacturing PMI Est. 50.8 vs. Prev. 50.9

March 3, 8:00 p.m.: Chinese People's Political Consultative Conference (CPPCC) Third Annual Session starts.

March 4, 12:01 a.m.: The U.S. imposes different 10% tariff connected each goods from China and a 25% tariff connected astir goods from Canada and Mexico (10% tariff for Canadian energy).

March 4, 5:00 a.m.: Eurostat releases January eurozone employment data.

Unemployment Rate Est. 6.3% vs. Prev. 6.3%

March 4, 8:00 p.m.: China’s 14th National People’s Congress (NPC) Third Annual Session starts.

March 4, 8:30 p.m.: Bank of Japan Governor Kazuo Ueda code astatine the IMF lawsuit "Asia and the IMF: Resilience done Cooperation" successful Tokyo.

March 4, 8:45 p.m.: Caixin Media releases February China economical enactment data.

Services PMI Est. 50.8 vs. Prev. 51

Composite PMI Prev. 51.1

Earnings

March 6 (TBC): Bitfarms (BITF), $-0.04

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.03

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governance votes & calls

Paraswap DAO is discussing the instrumentality of 44.67 wrapped ether (wETH) to hacked cryptocurrency speech Bybit that were collected by the DAO since the information breach.

Ampleforth DAO is discussing authorizing the Ampleforth Foundation to get 800,000 FORTH tokens from the treasury implicit 12 months to provide liquidity connected large centralized exchanges.

March 3, 4 p.m.: Livepeer (LPT) to big a Treasury Talk session.

March 3, 12 p.m.: Solana Name Service (SNS) to big a Townhall Meeting.

Unlocks

March 2: Ethena (ENA) to unlock 1.3% of circulating proviso worthy $15.91 million.

March 7: Kaspa (KAS) to unlocked 0.63% of circulating proviso worthy $12.35 million.

March 8: Berachain (BERA) to unlock 9.28% of circulating proviso worthy $73.80 million.

March 9: Movement (MOVE) to unlock 2.08% of its circulating proviso worthy $21.4 million.

March 12: Aptos (APT) to unlock 1.93% of circulating proviso worthy $66.16 million.

Token Listings

March 6: Roam ($ROAM) to beryllium listed connected KuCoin and MEXC.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 2 of 2: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Next Block Expo (Warsaw, Poland)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

Token Talk

By Shaurya Malwa

Football icon Ronaldinho launched $STAR10, his latest BNB Chain memecoin earlier connected Monday, hitting a $270 cardinal marketplace headdress wrong hours.

Touted arsenic his “official” token, it’s his 4th known crypto task since 2018, pursuing Ronaldinho Soccer Coin (RSC), $RON, and a Solana-based token—all of which soared concisely earlier crashing, earning him “rug pull” accusations.

RSC aimed for VR shot projects but flopped; $RON and the Solana token faded amid hype and nary delivery.

Critics connected X slam $STAR10 arsenic different currency grab, citing his pattern: leveraging 21 cardinal X and 76 cardinal Instagram followers for pumps, past abandoning projects. Past tokens lacked follow-through, with prices tanking aft archetypal spikes—RSC deed near-zero, $RON stalled, and the Solana token raised manipulation flags.

Community sentiment is wary—some spot a speedy flip, others a repetition rug. Four tokens successful 7 years, each hyped and forgotten specified days aft launch. Investors tread carefully.

Derivatives Positioning

BTC and ETH's futures unfastened involvement remained level Sunday arsenic prices surged, a motion the rally was spot-driven.

OM, HYPE and BCH tokens inactive spot antagonistic backing rates, a motion of the dominance of leveraged abbreviated bets.

TRX, BTC, XMR, ADA and BCH are tokens with affirmative cumulative measurement deltas, implying nett buying successful the perpetual futures markets.

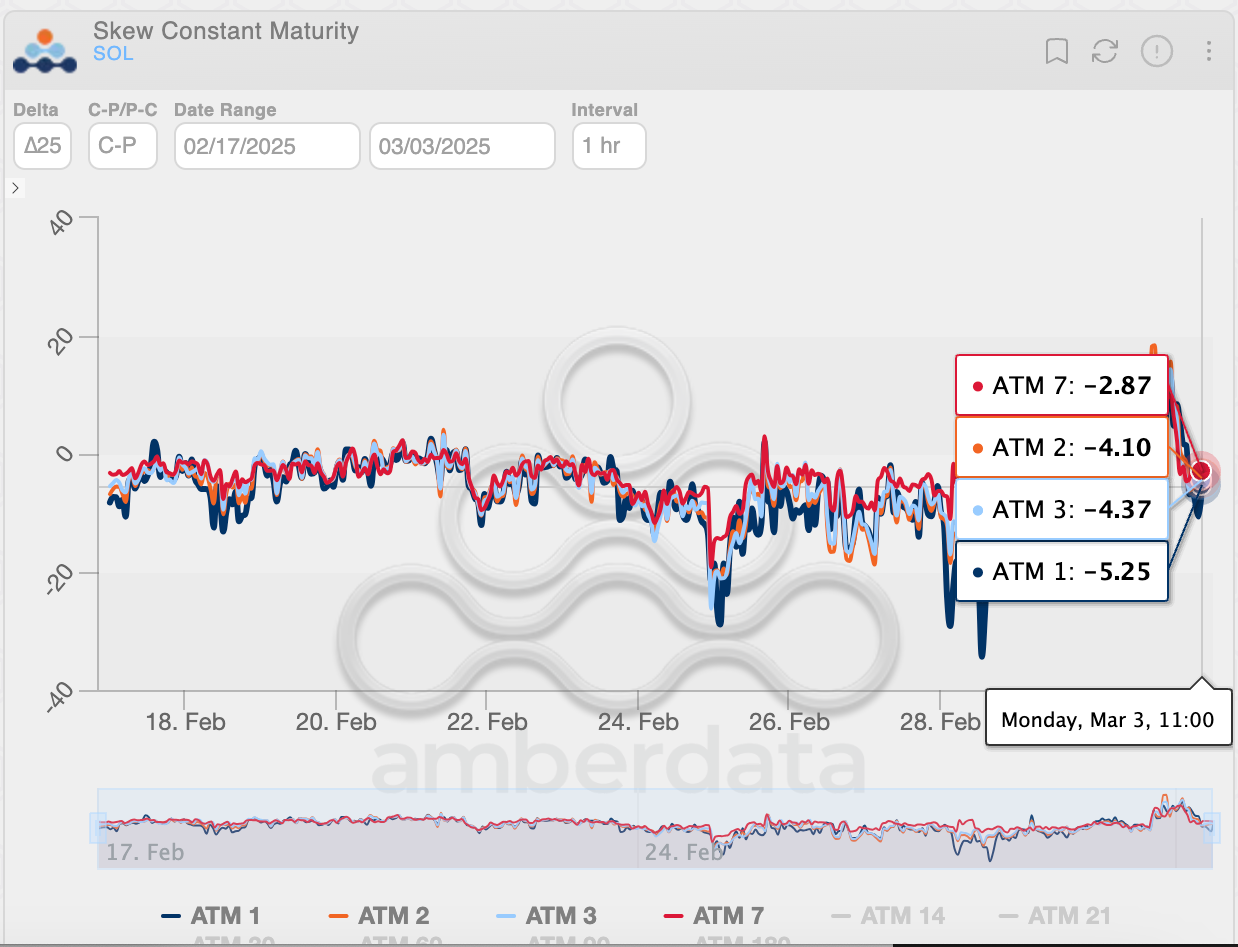

On Deribit, short-term skews person bounced to zero from negative, indicating a diminution successful bias for protective puts.

Block flows featured request for BTC $90K and $100K calls, calendar spreads astatine $85K onslaught puts. An entity sold the $92K onslaught enactment successful April expiry portion purchasing the $102 telephone successful the aforesaid expiry, according to Amberdata. Ether flows featured abbreviated positions successful puts to money longs successful calls.

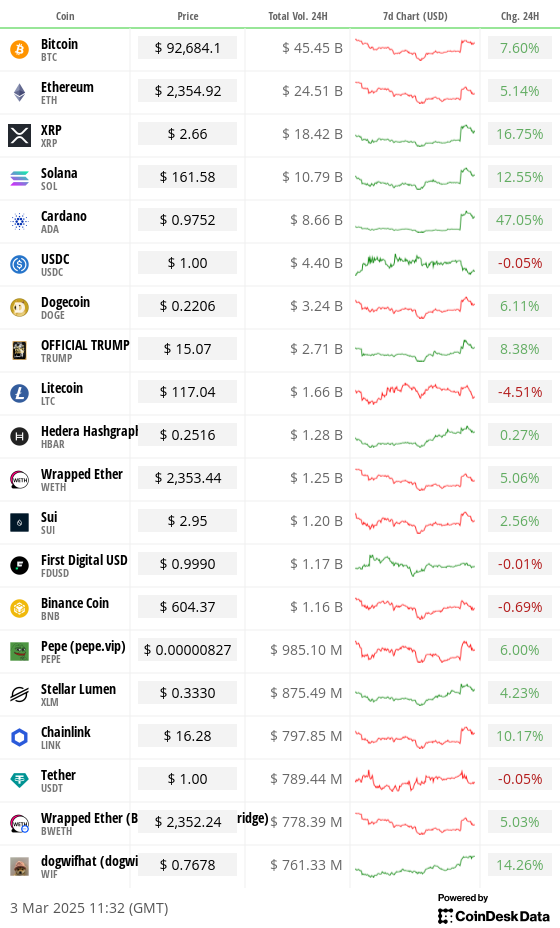

Market Movements:

BTC is up 9.86% from 4 p.m. ET Friday astatine $92,589.90 (24hrs: +7.61%)

ETH is up 6% astatine $2,359.35 (24hrs: +5.27%)

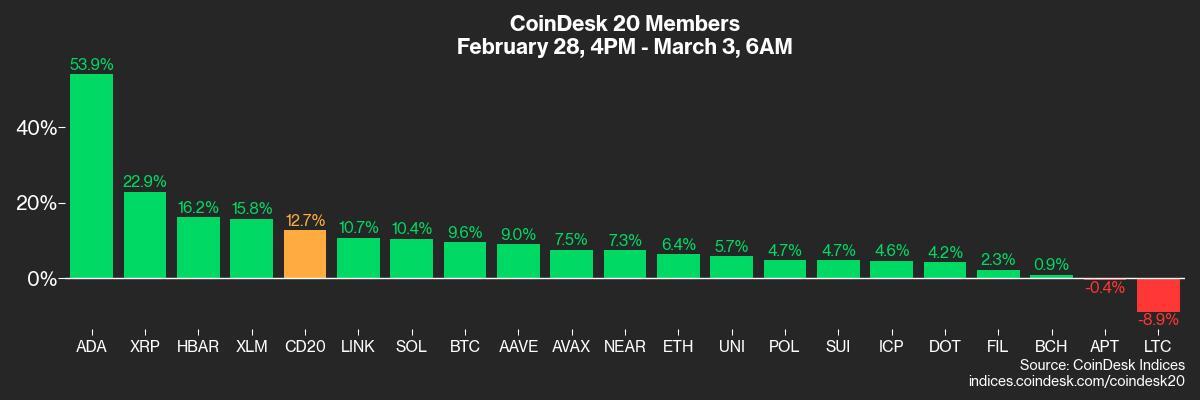

CoinDesk 20 is up 12.7% astatine 3,072.74 (24hrs: +10.14%)

Ether CESR Composite Staking Rate is down 18 bps astatine 3.14%

BTC backing complaint is astatine 0.0068% (7.45% annualized) connected Binance

DXY is down 0.52% 107.06

Gold is up 0.44% astatine $2,871.94/oz

Silver is up 1.05% astatine $31.49/oz

Nikkei 225 closed +1.7% astatine 37,785.47

Hang Seng closed +0.28% astatine 23,006.27

FTSE is up 0.53% astatine 8,856.47

Euro Stoxx 50 is up 0.75% astatine 5,504.53

DJIA closed connected Friday +1.39% astatine 43,840.91

S&P 500 closed +1.59% astatine 5,954.50

Nasdaq closed +1.63% astatine 18,847.28

S&P/TSX Composite Index closed +1.06% astatine 25,393.45

S&P 40 Latin America closed -2.07% astatine 2,298.92

U.S. 10-year Treasury complaint is up 4 bps astatine 4.26%

E-mini S&P 500 futures are up 0.31% astatine 5,982.00

E-mini Nasdaq-100 futures are up 0.4% astatine 21,002.75

E-mini Dow Jones Industrial Average Index futures are up 0.22% astatine 43,984.00

Bitcoin Stats:

BTC Dominance: 61.37 (1.58%)

Ethereum to bitcoin ratio: 0.02548 (-4.64%)

Hashrate (seven-day moving average): 792 EH/s

Hashprice (spot): $49.9

Total Fees: 5.54 BTC / $490,522

CME Futures Open Interest: 430,806 BTC

BTC priced successful gold: 32.4 oz

BTC vs golden marketplace cap: 9.20%

Technical Analysis

The cardano-bitcoin (ADA/BTC) ratio has formed a ample inverse head-and-shoulders pattern.

A interruption supra the trendline would corroborate oregon trigger the pattern, signaling a bullish displacement successful sentiment.

Crypto Equities

MicroStrategy (MSTR): closed connected Friday astatine $255.43 (+6.41%), up 12.85% astatine $288.24 successful pre-market

Coinbase Global (COIN): closed astatine $215.62 (+3.48%), up 10.06% astatine $237.31

Galaxy Digital Holdings (GLXY): closed astatine C$21.53 (+6.16%)

MARA Holdings (MARA): closed astatine $13.92 (+6.02%), up 9.63% astatine $15.26

Riot Platforms (RIOT): closed astatine $9.28 (+7.16%), up 10.56% astatine $10.26

Core Scientific (CORZ): closed astatine $11.16 (+4.2%), up 5.11% astatine $11.73

CleanSpark (CLSK): closed astatine $7.99 (+6.39%), up 10.76% astatine $8.85

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.82 (+5.51%), up 10.04% astatine $19.61

Semler Scientific (SMLR): closed astatine $42.92 (+5.64%), up 7.69% astatine $42.92

Exodus Movement (EXOD): closed unchanged astatine $42.20

ETF Flows

Spot BTC ETFs:

Daily nett flow: $94.3 million

Cumulative nett flows: $36.95 billion

Total BTC holdings ~ 1,133 million.

Spot ETH ETFs

Daily nett flow: -$41.9 million

Cumulative nett flows: $2.82 billion

Total ETH holdings ~ 3.652 million.

Source: Farside Investors

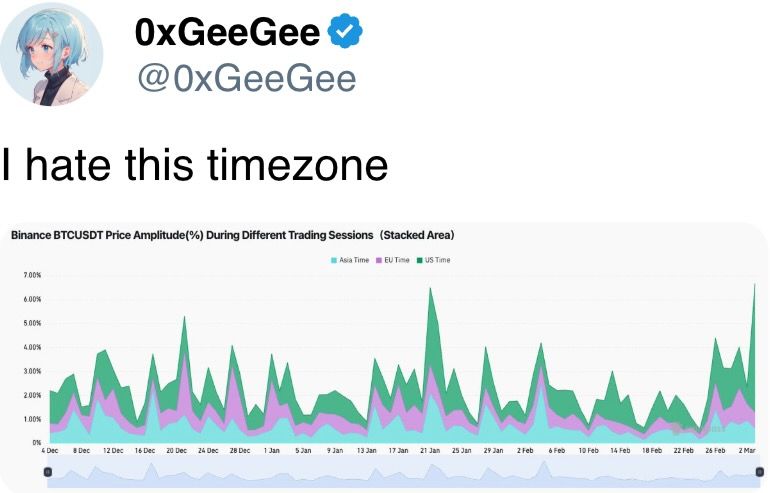

Overnight Flows

Chart of the Day

SOL's short-term skews stay negative, showing a bias for protective puts, reflecting persistent fears of downside risks.

While You Were Sleeping

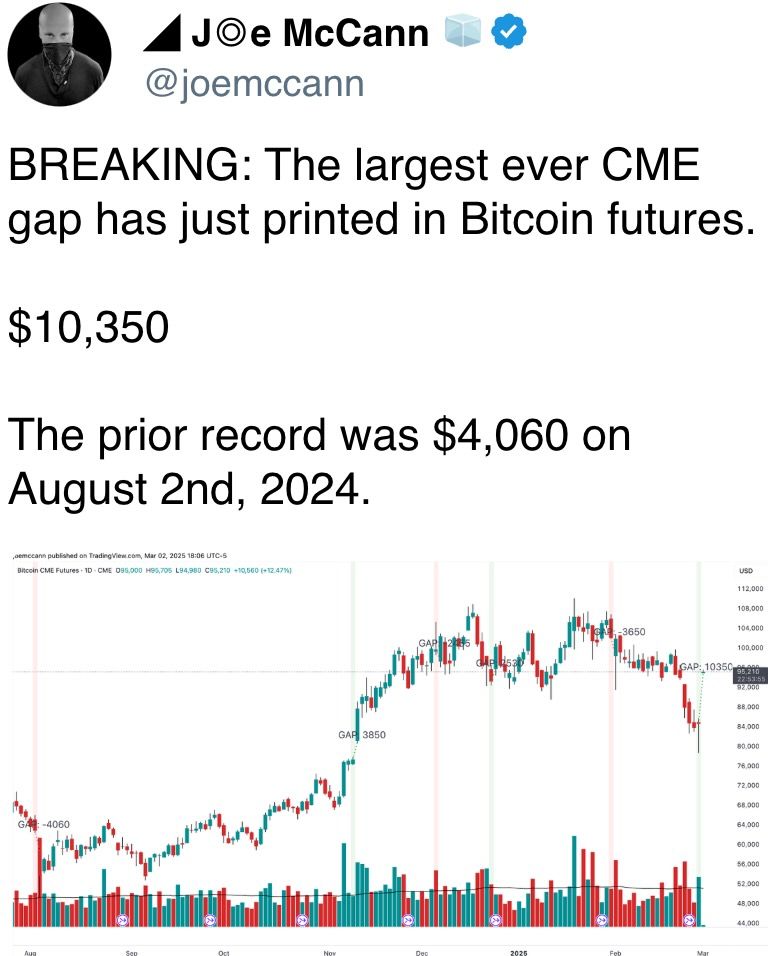

CME Bitcoin March Futures Gap Jumps By Over $9K (CoinDesk): Bitcoin’s spot terms surge past $94,000 connected Sunday created a $9,280 spread successful March CME futures, which opened astatine $95,000 connected Monday, up from Friday’s $85,720 high.

Bitcoin Rally to $93K Sees Bears Lose $550M successful Big Sunday Liquidations (CoinDesk): Nearly $600M successful bearish crypto bets were liquidated Sunday arsenic Trump’s crypto reserve announcement fueled volatility, with unfastened involvement successful XRP, ADA, and SOL futures jumping 40%.

Bitcoin $100K Plays Back successful Vogue After 10% BTC Price Surge from 'Trump Put' (CoinDesk): President Trump's telephone for a strategical crypto reserve has renewed involvement successful $100K BTC calls connected Deribit, though immoderate pass the program could look important hurdles.

ECB Rate Cuts Enter Final Stretch With Divisions Widening (Bloomberg): The ECB nears the extremity of its rate-cutting cycle, but policymakers are divided betwixt caution implicit ostentation and calls for faster cuts amid commercialized uncertainty.

Starmer Announces ‘Coalition of the Willing’ to Guarantee Ukraine Peace (BBC News): U.K. Prime Minister Keir Starmer outlined a four-point program for Ukraine: subject aid, economical unit connected Russia, Ukraine’s relation successful bid talks, and a European-led effort to warrant semipermanent security.

US Hints That Tariffs connected Mexico and Canada Could Be Lower Than 25% (Financial Times): Trump’s Tuesday tariffs connected Mexico and Canada stay successful flux, arsenic Commerce Secretary Howard Lutnick said Sunday that ongoing negotiations and fentanyl concerns could power the last rates.

Chinese Buyers Are Ordering Nvidia’s Newest AI Chips, Defying U.S. Curbs (The Wall Street Journal): Chinese resellers are bypassing U.S. export curbs connected Nvidia chips by utilizing foreign-registered companies to bargain servers from authorized Nvidia customers successful Malaysia, Vietnam, and Taiwan.

In the Ether

9 months ago

9 months ago

English (US)

English (US)