By James Van Straten (All times ET unless indicated otherwise)

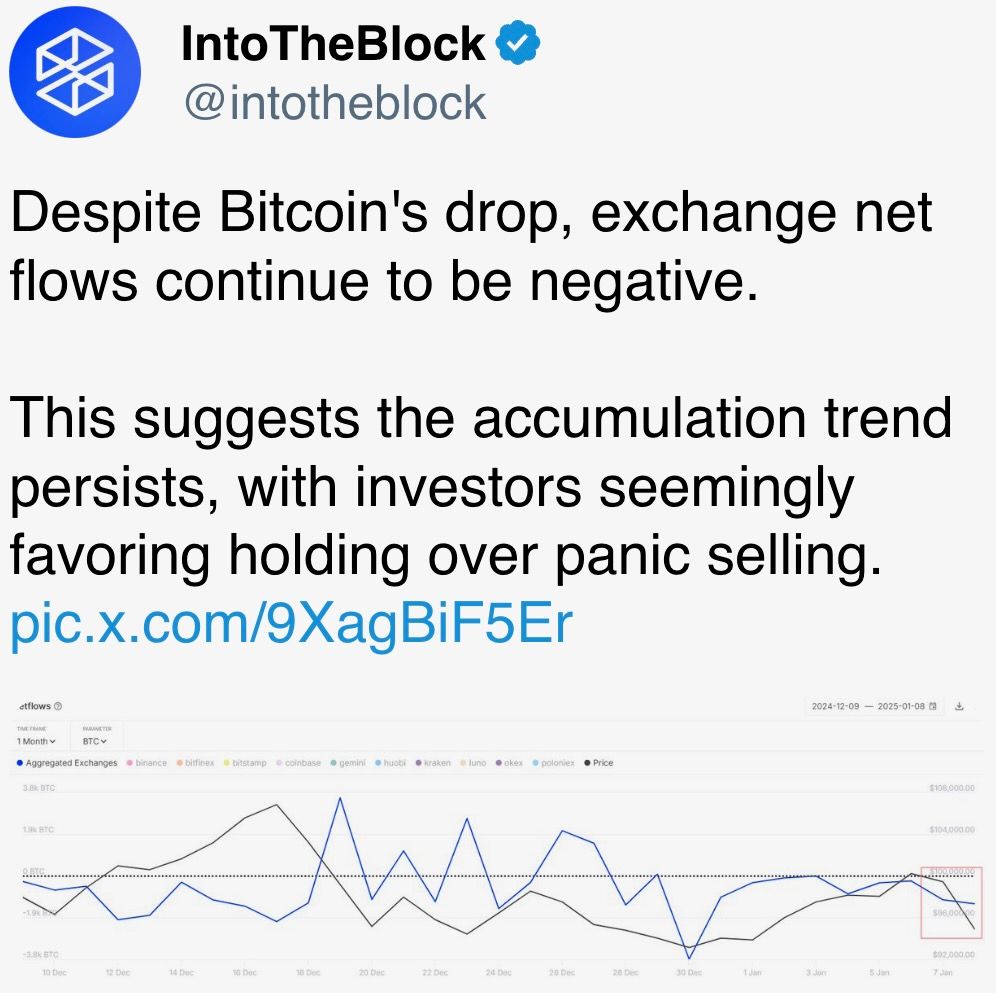

The full cryptocurrency manufacture is present nether $3.2 trillion successful marketplace capitalization, arsenic implicit $300 cardinal has been wiped retired since Jan. 6, taking distant each aboriginal gains for the year, according to the TradingView metric TOTAL. As a result, bitcoin (BTC) is present hovering supra $93,000 but has been making a succession of higher lows starting from Dec. 30.

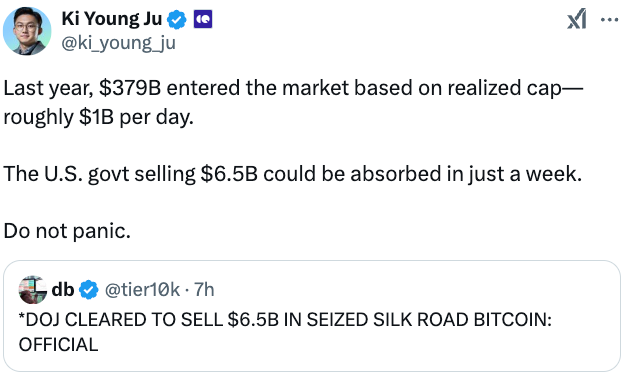

Adding to the bearish sentiment, marketplace is digesting the unconfirmed reports from DB News which suggest that the U.S. authorities has been fixed the greenish airy to liquidate arsenic overmuch arsenic 69,370 BTC ($6.5B) from the Silk Road seizure. This makes the governmental theatre betwixt the outgoing and incoming U.S. administrations adjacent much intriguing, arsenic president-elect Donald Trump, who is conscionable fewer days distant from being sworn successful connected Jan. 20, vowed not to merchantability immoderate of the bitcoin held by U.S. authorities, which, according to Glassnode data, amounts to 187,236 BTC.

The onslaught successful the crypto manufacture stems from an highly precocious DXY index, supra 109, which measures the worth of the U.S. Dollar comparative to a weighted handbasket of large overseas currencies. In addition, for a little moment, the U.S. treasury yields were rising earlier retreating somewhat yesterday. The benchmark for 10-year output was arsenic precocious arsenic 4.73%.

The ostentation concerns that paddled the selloff successful the broader marketplace is picking up alongside maturation expectations, LondonCryptoClub told CoinDesk. "The operation of rising maturation and ostentation expectations alongside rising word premia arsenic the marketplace struggles to digest immense treasury proviso to money these deficits is pushing U.S. yields higher, which is dragging planetary yields higher, excluding China."

However, turmoil is occurring crossed the pond successful the U.K., with gilt yields continuing to march higher this morning. Records were acceptable today, arsenic the 30-year U.K. jumped to astir 5.45%, the highest level since 1998. While the benchmark U.K. 10-year challenged 4.95%, the highest since 2008, the treasury was forced to intervene successful the marketplace to calm investors, according to reports from The Telegraph.

LondonCryptoClub mentioned the cardinal reasons for the turmoil, "the U.K. is nether unit aft a disastrous fund which has accrued borrowing needs with small to nary affirmative maturation impact, exacerbating the antagonistic debt/GDP dynamics and driving a larger fiscal deficit."

As a result, the not-so-Great British pound, falling yet again, is present 1.22 against the dollar, the lowest level since November 2023, and has fallen astir 4% successful the past month.

Today, Jan. 9, is declared a mourning time successful the U.S. to retrieve the decease of erstwhile President Jimmy Carter. Therefore, the banal marketplace volition beryllium closed. So, each eyes volition beryllium turning to the jobs study connected Friday. The marketplace is successful a bully quality is atrocious quality script arsenic complaint cuts for 2025 get pushed backmost with lone 1 complaint chopped expected for 2025.

A beardown jobs study could region this complaint cut, with unemployment expected to travel successful astatine 4.2%, portion nonfarm payroll is estimated astatine 154,000. A blistery jobs people could nonstop the dollar to 110, putting further unit connected risk-assets. Stay alert!

What to Watch

Crypto

Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync's latest release.

Jan. 12, 10:30 p.m.: Binance volition halt Fantom token (FTM) deposits and withdrawals and delist each FTM trading pairs. FTM tokens volition beryllium swapped for S tokens astatine a 1:1 ratio.

Jan. 15: Derive (DRV) to make and administer caller tokens successful token procreation event.

Jan. 15: Mintlayer mentation 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling autochthonal BTC cross-chain swaps.

Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is acceptable to commencement connected Binance, featuring pairs similar S/USDT, S/BTC, and S/BNB.

Macro

Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

Nonfarm payrolls Est. 154K vs. Prev. 227K.

Unemployment complaint Est. 4.2% vs Prev. 4.2%.

Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 73.8 vs. Prev. 74.0.

Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

PPI MoM Prev. 0.4%.

Core PPI MoM Prev. 0.2%.

Core PPI YoY Prev. 3.4%.

PPI YoY Prev. 3%.

Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending connected Jan. 11. Prev. 6.8%.

Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

Core Inflation Rate MoM Prev. 0.3%.

Core Inflation Rate YoY Prev. 3.3%.

Inflation Rate MoM Prev. 0.3%.

Inflation Rate YoY Prev. 2.7%.

Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

GDP MoM Prev. -0.1%

GDP YoY Prev. 1.3%.

Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending connected Jan. 11. Initial Jobless Claims Prev. 201K.

Token Events

Governance votes & calls

Gitcoin DAO started discussions connected the motorboat of Allo.Capital, an entity focused connected gathering tools for on-chain superior allocation.

Compound DAO is discussing the instauration of a New Chains Business Unit to grow into different blockchains.

Unlocks

Jan. 11: Aptos to unlock 1.13% of its APT circulating supply, worthy $98.85 million.

Jan. 12: Axie Infinity to unlock 1.45% of its circulating supply, worthy $14.08 million.

Jan. 14: Arbitrum to unlock 0.93% of its circulating supply, worthy $70.65 million.

Token Launches

Jan. 10: Lava Network (LAVA) to beryllium listed connected KuCoin and Bybit astatine 5 a.m.

Jan. 10: Bybit to delist FTM (FTM) astatine 5 a.m..

Conferences:

Day 4 of 14: Starknet, an Ethereum furniture 2, is holding its Winter Hackathon (online).

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan. 25-26: Catstanbul 2025 (Istanbul). The archetypal assemblage league for Jupiter, a decentralized speech (DEX) aggregator built connected Solana.

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Shaurya Malwa A parody token conscionable got its ain parody.

AI Agents upstart ai16z, a level mimicking task money a16z that uses AI to negociate idiosyncratic funds, saw a mockery of its token raffle among smallcap speculators successful the past day, moving to a highest of $130 cardinal marketplace capitalization arsenic of European greeting hours.

Where ai16z tried to blend AI with investment, LLM — abbreviated for “Large Language Model” laughs astatine the precise concept, suggesting that if AI tin beryllium anything, it tin surely beryllium a meme with nary existent utility.

X users were speedy to dub LLM arsenic the "McDonald's mentation of $ai16z," mixing accelerated nutrient with AI, creating a communicative wherever the lone quality was successful the marketing.

It has nary inherent inferior oregon technological backing; its worth is purely speculative and community-driven, based connected the meme's popularity and the wit it brings to the crypto conversation.

AI Agent projects virtuals (VIRTUALS), ai16z (AI16Z) and the broader class are down much than 20% since highest connected mean successful the past weeks amid disapproval of their claimed AI models, arsenic a CoinDesk analysis antecedently noted.

Derivatives Positioning

The annualized one-month ground successful BTC and ETH CME futures has retreated to 6%-7%, the lowest since the predetermination day. The positioning continues to moderate, with ETH unfastened involvement dropping to a one-month debased of $2.9 billion, according to information root Amberdata.

Annualized backing rates successful perpetual futures tied to ample headdress tokens present hover astatine astir 5%, down important from past month's excessively bullish 80% to 100%. However, the OI-normalized CVD continues to awesome nett selling unit successful the market.

In options market, front-end skews present amusement bias for BTC and ETH puts, but longer duration proceed to bespeak a bullish bias.

Notable artifact trades see a ample abbreviated commercialized successful the BTC $55K enactment expiring connected March 29. In ETH, traders shorted calls astatine strikes $4,800, $5,500 and $6,000.

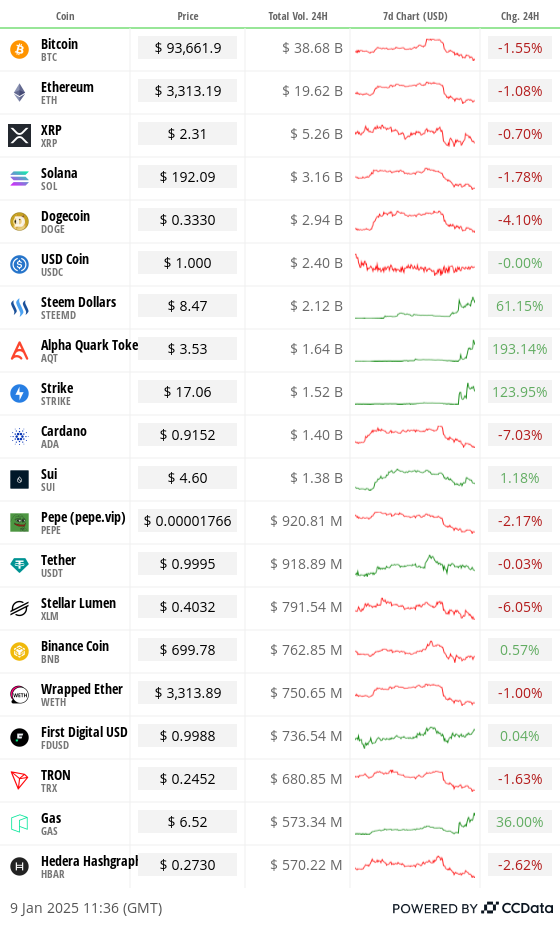

Market Movements:

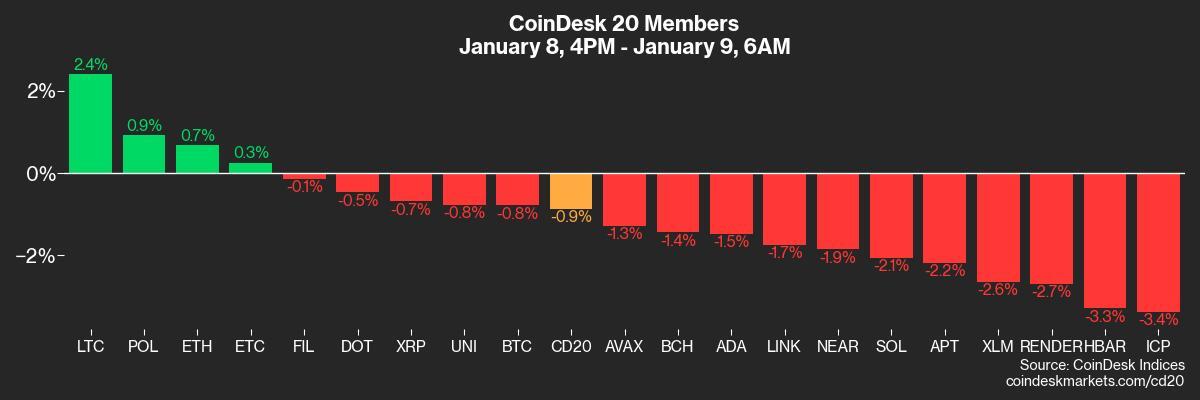

BTC is down 1.24% from 4 p.m. ET Tuesday to $93,307.05 (24hrs: -1.8%)

ETH is up 0.23% astatine $3,307.13 (24hrs: -1.15%)

CoinDesk 20 is down 1.18% to 3,954.73 (24hrs: -2.28%)

Ether staking output is up 1 bp to 3.15%

BTC backing complaint is astatine 0.0061% (6.66% annualized) connected Binance

DXY is up unchanged astatine 109.19

Gold is up 0.72% astatine $2,683.8/oz

Silver is up 1.71% to $30.86/oz

Nikkei 225 closed -0.94% astatine 39,605.09

Hang Seng closed -0.2% astatine 19,240.89

FTSE is up 0.63% astatine 8,303.24

Euro Stoxx 50 is unchanged astatine 4,997.63

DJIA closed +0.25% to 42,635.20

S&P 500 closed +0.16% astatine 5,918.25

Nasdaq closed unchanged astatine 19,478.88

S&P/TSX Composite Index closed +0.49% astatine 25,051.70

S&P 40 Latin America closed -0.87% astatine 2,204.98

U.S. 10-year Treasury is down 2 bps astatine 4.68%

E-mini S&P 500 futures are down 0.1% to 5,953.0

E-mini Nasdaq-100 futures are down 0.18% astatine 21,323.00

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 42,874.00

Bitcoin Stats:

BTC Dominance: 57.85

Ethereum to bitcoin ratio: 0.035

Hashrate (seven-day moving average): 785 EH/s

Hashprice (spot): $55.7

Total Fees: 7.57 BTC/ / $722,439

CME Futures Open Interest: 176,215 BTC

BTC priced successful gold: 34.8 oz

BTC vs golden marketplace cap: 9.90%

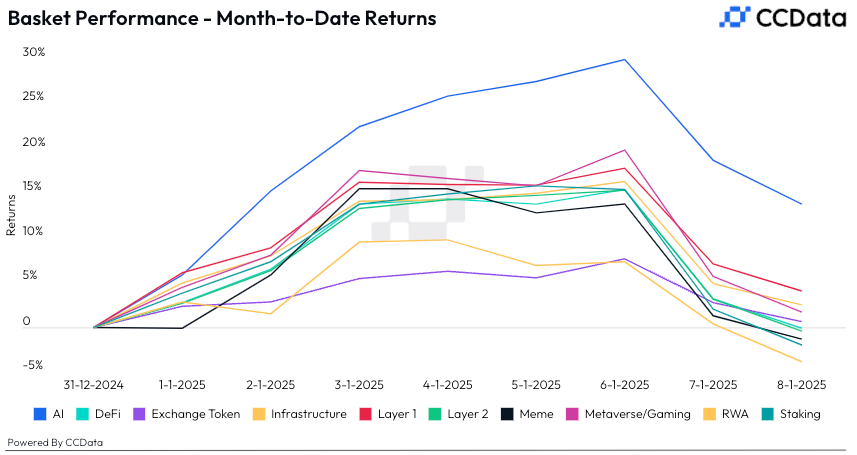

Basket Performance

Technical Analysis

The illustration shows BTC's downward momentum is weakening.

While prices proceed to chalk retired little highs, the momentum oscillator RSI is present moving successful the other direction, diverging bullishly to awesome a imaginable terms bounce ahead.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $331.7 (-2.85%%), up 0.99% astatine $335.00 successful pre-market.

Coinbase Global (COIN): closed astatine $260.01 (-1.63%), up 0.55% astatine $261.45 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$27.62 (-2.23%)

MARA Holdings (MARA): closed astatine $18.34 (-3.84%), up 0.11% astatine $18.36 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.02 (-3.14%), unchanged successful pre-market.

Core Scientific (CORZ): closed astatine $14.05 (-0.5%), up 0.36% astatine $14.10 successful pre-market.

CleanSpark (CLSK): closed astatine $10.09 (-5.79%), unchanged successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $23.15 (-4.93%), down 1.08% astatine $22.90 successful pre-market.

Semler Scientific (SMLR): closed astatine $50.19 (-9.14%), unchanged successful pre-market.

Exodus Movement (EXOD): closed astatine $37.78 (-3.89%), up 0.21% astatine $37.86 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$568.8 million

Cumulative nett flows: $36.37 billion

Total BTC holdings ~ 1.140 million.

Spot ETH ETFs

Daily nett flow: -$159.4 million

Cumulative nett flows: $2.52 billion

Total ETH holdings ~ 3.627 million.

Source: Farside Investors, arsenic of Jan. 8.

Overnight Flows

Chart of the Day

The MiCA-led diminution successful tether's (USDT) marketplace capitalization has stalled.

So, the ongoing diminution successful BTC whitethorn suffer momentum. USDT, the world's largest dollar-pegged cryptocurrency is wide utilized to money crypto purchases.

While You Were Sleeping

Bitcoin ETFs Suffer $582M Net Outflow, Second-Highest Tally Ever (CoinDesk): Bitcoin and ether ETFs saw $582M and $159M successful outflows Wednesday arsenic the Fed’s December FOMC gathering minutes noted ostentation risks from Trump’s policies and a imaginable slowdown successful complaint cuts.

XRP May Surge 40% As ‘Trump Effect’ Boosts Ripple Sentiment (CoinDesk): XRP, up 300% since November amid optimism for Trump’s crypto-friendly policies, could spot different 40% surge arsenic method investigation highlights a bullish breakout from its descending triangle pattern.

Bitfinex Relocates Derivatives Services to El Salvador (The Block): Bitfinex Derivatives is relocating to El Salvador aft obtaining its 2nd licence to run nether the nation’s crypto-friendly framework, allowing it to heighten its services and fortify its determination presence.

Bond Market Selloff Jolts Global Investors As Trump Worries Grow (Reuters): A planetary enslaved terms driblet connected Wednesday pushed yields to multi-year highs successful the U.S., U.K., and Eurozone, driven by ostentation risks, dense enslaved issuance, and concerns astir Trump’s tariff threats.

China Consumer Prices Weaken Further, Adding to Deflation Worries (Bloomberg): China’s ostentation slowed for a 4th period successful December, with CPI up conscionable 0.1% year-on-year, the National Bureau of Statistics reported, highlighting deflation risks amid planetary ostentation pressures.

Asia’s Central Banks Face a Formidable Challenge: An Ascendant U.S. Dollar (CNBC): The U.S. dollar’s post-election rally has devalued the currencies of Japan, China, South Korea, and India, raising import costs for these nations and complicating their cardinal banks’ economical strategies.

In the Ether

11 months ago

11 months ago

English (US)

English (US)