By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace is treading h2o and the biggest cryptocurrency, bitcoin, is taking a bull breather. Its upward momentum is getting stifled by Trump's renewed tariff threats, which are besides sending golden prices soaring to grounds highs and propping up request for the U.S. dollar.

But determination is enactment successful immoderate corners of the market. The VIRTUAL token popped aft its caller listing connected Upbit, and Hyperliquid's HYPE token has seen a 3% gain. Litecoin is besides making waves, with its perpetual futures unfastened involvement connected centralized exchanges climbing to 5.19 cardinal LTC, the astir since Dec. 9, according to Coinglass. The surge hints astatine caller superior flowing into the market, apt fueled by hopes of a spot ETF listing successful the U.S.

Speaking of stablecoins, USDC is stealing the spotlight arsenic the prima performer this month, boasting a singular marketplace headdress maturation of 21% to $53.12 billion. That's its champion period since May 2021, according to TradingView data. In contrast, USDT, the heavyweight champion of dollar-pegged stablecoins, eked retired conscionable a 1% increase. USDC adjacent outperformed bitcoin, which grew a respectable 10%.

According to IntoTheBlock, USDC's outperformance is apt owed to its compliance with Europe’s MiCA regulations, portion rivals similar USDT face pugnacious headwinds. But don’t number USDT retired conscionable yet; its marketplace is starting to bounce back, and the simultaneous maturation of USDC is offering a bullish impulse for the crypto market.

As we support an oculus connected the macro landscape, the pivotal U.S. halfway PCE — the Fed’s go-to measurement for ostentation — is acceptable to beryllium released. Expectations are for a blistery header figure, with halfway reading, which excludes nutrient and energy, showing affirmative improvements that mightiness assistance BTC interruption retired of its dull terms enactment adjacent $104,000.

However, ING is cautioning that the dollar mightiness enactment beardown into the weekend.

“If we don't person immoderate quality connected Canada and Mexico by the extremity of today, there's a hazard that the dollar could fortify further arsenic the marketplace starts to terms successful a higher accidental of tariffs being announced tomorrow,” it wrote. So, enactment alert!

What to Watch

Crypto:

Jan. 31: Crypto.com is suspending purchases of cryptocurrencies USDT, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO, and XSGD successful the EU to comply with MiCA regulations. Withdrawals volition beryllium supported done Q1.

Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork web upgrade (v1.0.14)

Feb. 4: Pepecoin (PEPE) halving. At artifact 400,000, the reward volition driblet to 31,250 PEPE.

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork web upgrade for its Ethereum-based layer-2 mainnet.

Feb. 5 (after marketplace close): MicroStrategy (MSTR) Q4 FY 2024 earnings.

Feb. 6, 8:00 a.m.: Shentu Chain web upgrade (v2.14.0).

Feb. 11 (after marketplace close): Exodus Movement (EXOD) Q4 2024 earnings.

Feb. 12 (before marketplace open): Hut 8 (HUT) Q4 2024 earnings.

Feb. 13: CleanSpark (CLSK) Q1 FY 2025 earnings.

Feb. 13 (after marketplace close): Coinbase Global (COIN) Q4 2024 earnings.

Feb. 15: Qtum (QTUM) hard fork web upgrade astatine artifact 4,590,000.

Feb. 18 (after marketplace close): Semler Scientific (SMLR) Q4 2024 earnings.

Feb. 20 (after marketplace close): Block (XYZ) Q4 2024 earnings.

Feb. 26: MARA Holdings (MARA) Q4 2024 earnings.

Feb. 27: Riot Platforms (RIOT) Q4 2024 earnings.

March 4: Cipher Mining (CIFR) releases Q4 2024 earnings.

Macro

Jan. 31, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases December’s Personal Income and Outlays report.

Core PCE Price Index MoM Est. 0.2% vs. Prev. 0.1%.

Core PCE Price Index YoY Est. 2.8% vs. Prev. 2.8%.

PCE Price Index MoM Est. 0.3% vs. Prev. 0.1%.

PCE Price Index YoY Est. 2.6% vs. Prev. 2.4%.

Feb. 2, 8:45 p.m.: China’s Caixin releases January's Manufacturing PMI report.

Manufacturing PMI Est. 50.5 vs. Prev. 50.5.

Token Events

Governance votes & calls

Compound DAO is voting connected an upgrade of its governance contracts from GovernorBravo to OpenZeppelin’s modern Governor implementation.

Balancer DAO is voting whether to initiate a token swap betwixt Balancer DAO and CoW DAO involving 200,000 BAL tokens and astir 631,000 COW tokens.

Unlocks

Jan. 31: Optimism (OP) to unlock 2.32% of circulating proviso worthy $46.39 million.

Feb. 1: Sui (SUI) to unlock astir 2.13% of its circulating proviso worthy $261.91 million.

Feb. 2: Ethena (ENA) to unlock astir 1.34% of its circulating proviso worthy $29.53 million.

Token Listings

Jan. 31: Movement (MOVE), Virtuals Protocol (VIRTUAL) and Sundog (SUNDOG) to beryllium listed connected Indodax.

Conferences:

Day 3 of 3: Crypto Peaks 2025 (Palisades, California)

Day 2 of 2: Ethereum Zurich 2025

Day 2 of 2: Plan B Forum (San Salvador, El Salvador)

Day 2 of 3: Crypto Gathering 2025 (Miami Beach, Florida)

Day 2 of 3: CryptoXR 2025 (Auxerre, France)

Day 2 of 4: Oasis Onchain 2025 (Nassau, Bahamas)

Day 2 of 6: The Satoshi Roundtable (Dubai)

Feb. 3: Digital Assets Forum (London)

Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: CoinDesk's Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23-March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Derivatives Positioning

TRX, TRUMP and OM registered the biggest summation successful perpetual futures unfastened interest. Traders, however, look to beryllium shorting TRUMP, arsenic evident from the antagonistic cumulative measurement delta.

BTC, ETH unfastened involvement and CVD are small changed. The BTC CME ground is hovering astir 10%.

Flows successful Deribit's options marketplace person been muted, but BTC and ETH calls proceed to commercialized pricier than puts.

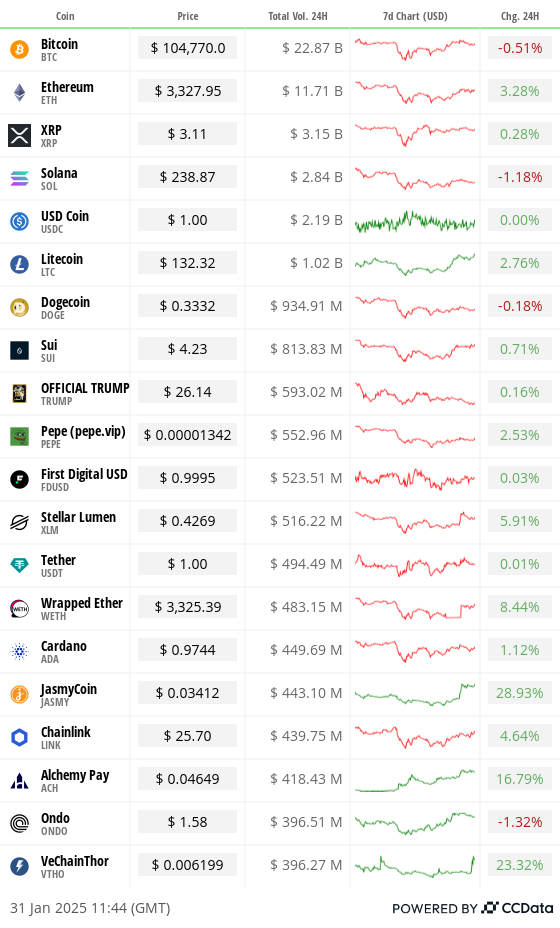

Market Movements:

BTC is down 0.29% from 4 p.m. ET Thursday to $104,810.50 (24hrs: -0.47%)

ETH is up 2.39% to $3,324 (24hrs: +3.32%)

CoinDesk 20 is down 0.3% to 3,838.81 (24hrs: +0.28%)

CESR Composite Staking Rate is up 4 bps to 3.07%

BTC backing complaint is astatine 0.0012% (1.2961% annualized) connected OKX

DXY is up 0.47% astatine 108.30

Gold is unchanged astatine $2,794.77/oz

Silver is up 0.19% astatine $31.60/oz

Nikkei 225 closed +0.15% to 39,572.49

Hang Seng closed +0.14% to 20,225.11

FTSE is up 0.3% astatine 8,673.13

Euro Stoxx 50 is up 0.39% astatine 5,302.75

DJIA closed connected Thursday +0.38% to 44,882.13

S&P 500 closed +0.53% to 6,071.17

Nasdaq closed +0.25% to 19,681.75

S&P/TSX Composite Index closed +1.31% to 25,808.25

S&P 40 Latin America closed +2.21% to 2,388.03

U.S. 10-year Treasury is up 2 bps astatine 4.536%

E-mini S&P 500 futures are up 0.43% astatine 6,125.75

E-mini Nasdaq-100 futures are up 0.79% astatine 21,795.50

E-mini Dow Jones Industrial Average Index futures are up 0.32% astatine 45,200.00

Bitcoin Stats:

BTC Dominance: 59.21 (-0.11%)

Ethereum to bitcoin ratio: 0.03127 (0.84%)

Hashrate (seven-day moving average): 781 EH/s

Hashprice (spot): $61.7

Total Fees: 4.97 BTC/ $522,698

CME Futures Open Interest: 176,270 BTC

BTC priced successful gold: 37.3 oz

BTC vs golden marketplace cap: 10.60%

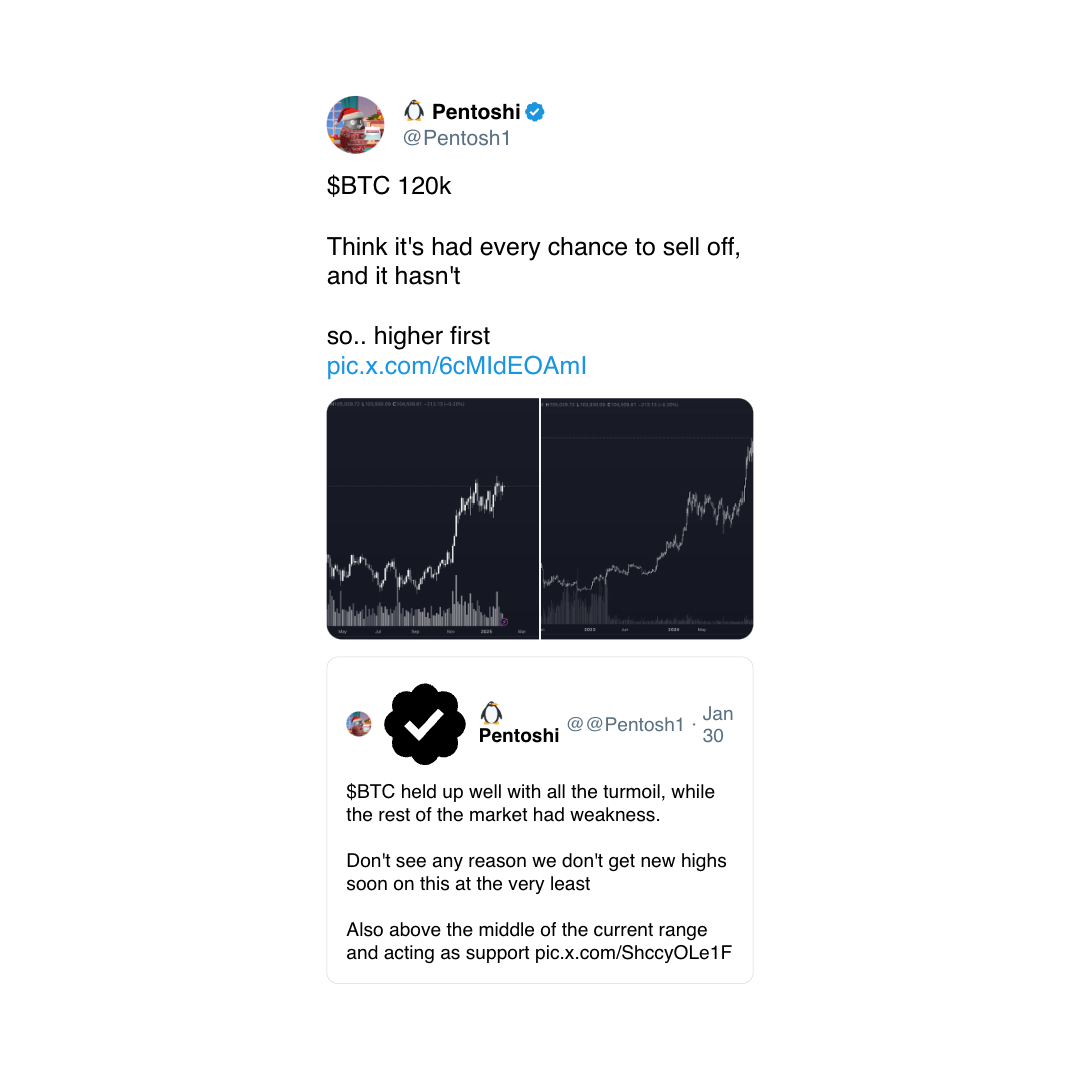

Technical Analysis

The illustration shows $60 has emerged arsenic a beardown absorption for BlackRock's IBIT exchange-trade money since December, with bulls consistently failing to found a foothold supra that level.

Such patterns correspond bullish exhaustion and often pave the mode for insignificant terms pullbacks that shingle retired anemic hands, mounting the signifier for the adjacent limb higher.

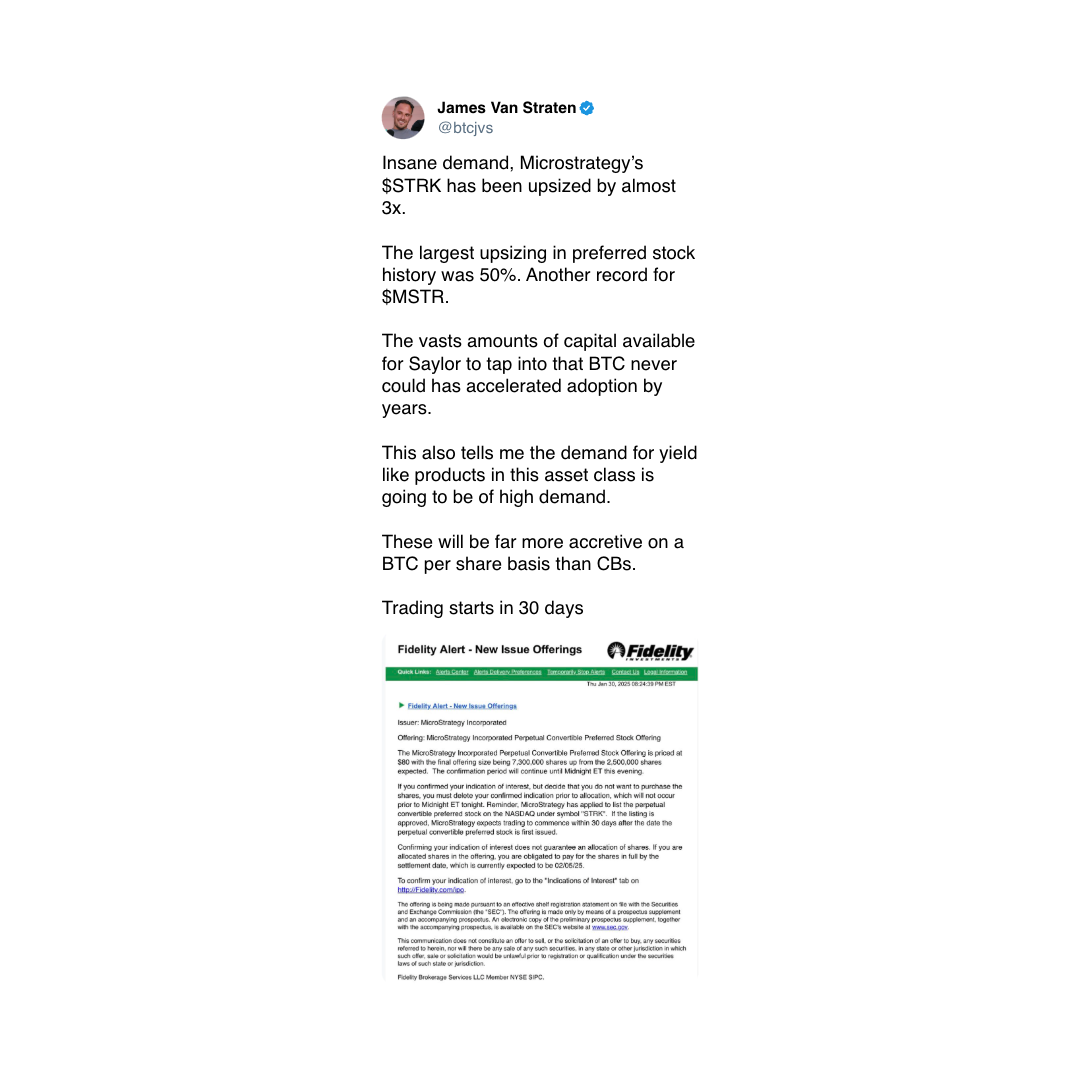

Crypto Equities

MicroStrategy (MSTR): closed connected Thursday astatine $340.09 (-0.34%), up 0.2% astatine $340.77 successful pre-market.

Coinbase Global (COIN): closed astatine $301.30 (+3.54%), down 0.17% astatine $300.80 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$29.33 (+0.83%).

MARA Holdings (MARA): closed astatine $19.18 (+4.13%), up 0.36% astatine $19.25 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.90 (+6.06%), up 0.76% astatine $11.99 successful pre-market.

Core Scientific (CORZ): closed astatine $12.26 (+6.98%), up 3.18% astatine $12.65 successful pre-market.

CleanSpark (CLSK): closed astatine $10.97 (+6.92%), up 0.55% astatine $11.03 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.50 (+6.33%), up 3.47% astatine $23.28 successful pre-market.

Semler Scientific (SMLR): closed astatine $52.15 (+0.13%).

Exodus Movement (EXOD): closed astatine $61.38 (-31.27%), down 2.23%% astatine $60.01 successful pre-market.

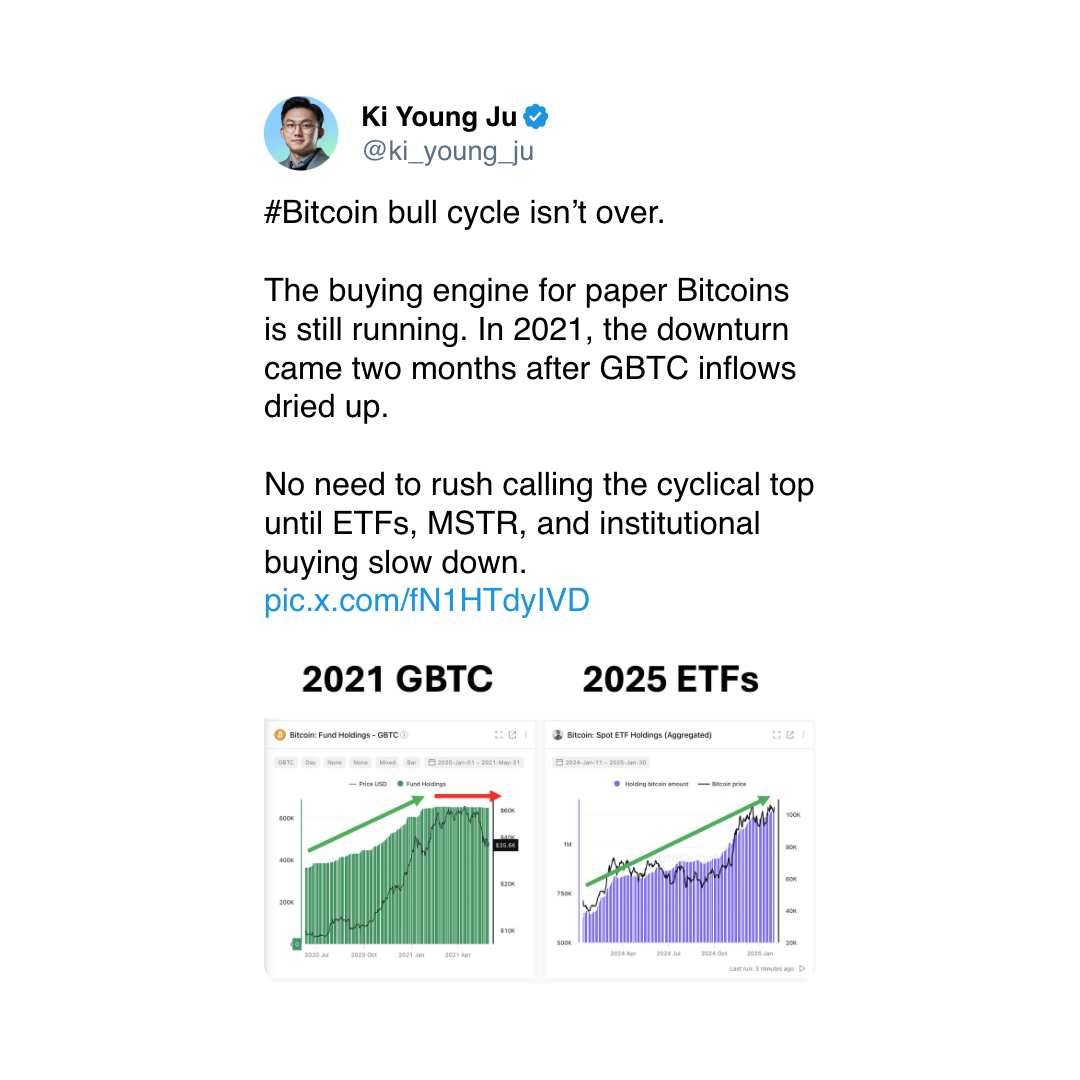

ETF Flows

ETF Flows

Spot BTC ETFs:

Daily nett flow: $588.2 million

Cumulative nett flows: $40.18 billion

Total BTC holdings ~ 1.18 million.

Spot ETH ETFs

Daily nett flow: $67.77 million

Cumulative nett flows: $2.73 billion

Total ETH holdings ~ 3.65 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The MOVE index, which represents an options-based measurement of however volatile the U.S. Treasury marketplace is apt to go successful the adjacent 4 weeks, has turned lower.

Declining Treasury marketplace volatility often bodes good for risky assets.

While You Were Sleeping

Bitcoin Steady, Gold Tokens Shine arsenic XAU Hits Record High; Inflation successful Tokyo Rises (CoinDesk): President Trump’s tariff threats are a headwind for bitcoin, but derivatives information bespeak skepticism toward a large downturn, with traders remaining bullish and increasing involvement successful state-level BTC reserves.

Grayscale Files SEC Proposal to Convert XRP Trust Into ETF (CoinDesk): On Thursday, NYSE Arca filed a Form 19b-4 with the SEC to database shares of Grayscale’s XRP Trust arsenic an ETF.

VIRTUAL Surges 28% arsenic Upbit Listing Exposes the Token to Altcoin Savvy South Koreans (CoinDesk): The terms of VIRTUAL, the autochthonal token of Virtuals Protocol, a decentralized level connected the Base blockchain for creating AI agents, surged aft Upbit said it would database the token.

Trump Is Getting the Lower Interest Rates He Demanded From Everyone but the Fed (Reuters): Despite Trump’s calls for complaint cuts, the Fed remains hawkish, portion the Bank of Canada, Bank of England and European Central Bank are easing monetary policy.

Trump Says 25% Tariffs connected Mexico and Canada May Not Include Oil (CNBC): Trump confirmed connected Thursday that 25% tariffs connected Mexican and Canadian imports volition commencement Feb. 1 but near lipid uncertain.

Japan’s Economy Faces Fallout From Trump’s China Tariff Threats (Bloomberg): Japan’s main economist, Tomoko Hayashi, said a U.S.-China commercialized warfare could wounded her country's economy, though she believes firms are amended prepared present than during Trump’s archetypal term.

In the Ether

8 months ago

8 months ago

English (US)

English (US)