By Omkar Godbole (All times ET unless indicated otherwise)

The marketplace is astir to beryllium deed with the archetypal large U.S. economical lawsuit of 2025: December CPI data. With hawkish Fed fears successful the aerial and bitcoin strengthening its correlation with tech stocks, Wednesday's study becomes adjacent much important for the integer assets market. The stalled liquidity inflows done stablecoins person besides raised question marks connected the sustainability of terms betterment from nether $90K, and traders are preparing for imaginable downside volatility by adding short-dated puts.

Here’s what experts are saying astir the upcoming event:

QCP Capital

"In crypto, cautious sentiment is evident successful BTC options flows, with puts rolled beneath the cardinal $90k support. Front-end vols and flies stay elevated, portion the VIX stays precocious astatine 18.68 – suggesting volatility to persist done January."

Geoffrey Chen, writer of the Fidenza Macro blog

"The rising markets successful November and the lifting of predetermination uncertainty pushed concern assurance higher, resulting successful stronger data. The frontloading of goods imports and the raising of prices to get up of tariffs whitethorn person besides contributed to higher PMIs. On apical of that, lipid has woken up and rallied implicit 10% from its December levels, reinforcing the stagflation regime. None of this bodes good for CPI time [Jan. 15] and the FOMC aboriginal this month. These hazard events whitethorn astonishment towards hawkish and stagflationary outcomes, putting much unit connected hazard assets.”

Markus Thielen, laminitis of 10x Research

"Bitcoin continues to commercialized wrong a narrowing wedge, with respective captious catalysts connected the horizon. Expectations for a higher CPI fig person risen, creating a script wherever a softer-than-expected ostentation speechmaking could trigger a bitcoin rally."

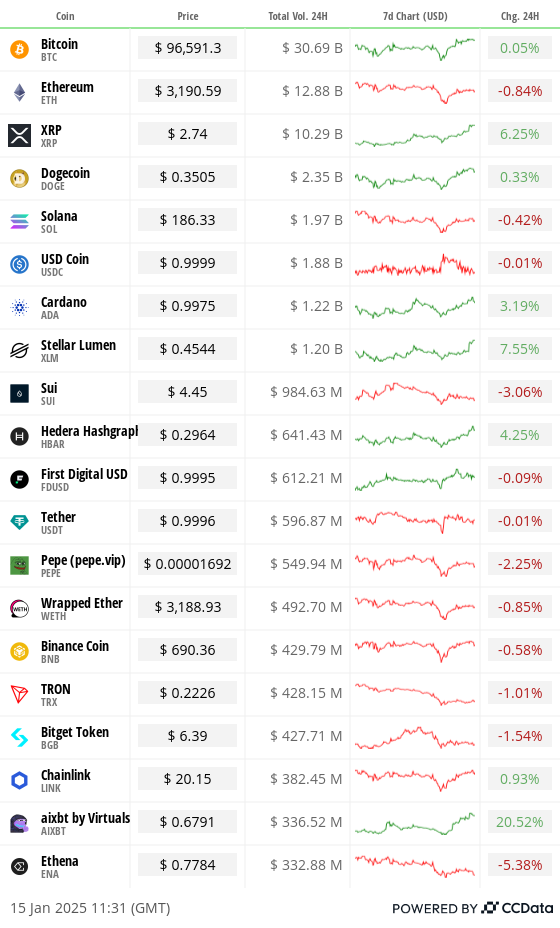

Focus connected XRP and AI

XRP surged to $2.90 aboriginal today, matching the December precocious with method investigation suggesting a continued tally higher. Meanwhile, according to Wintermute, dip buyers person been progressive successful AI coins, namely FAI, GRASS, VIRTUAL, Ai16z and TAO.

These coins, therefore, could chalk retired bigger gains successful lawsuit the CPI spurs renewed risk-taking successful fiscal markets.

What to Watch

Crypto

Jan. 15: Degen liquidity mining airdrop; the past snapshot was taken astatine the extremity of Jan. 14 (UTC).

Jan. 15: Mintlayer mentation 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling autochthonal BTC cross-chain swaps.

Jan. 17: Oral arguments astatine the U.S. Court of Appeals for the District of Columbia Circuit successful KalshiEX LLC v. CFTC, wherever the CFTC is appealing the territory court's Sep. 12, 2024 ruling favoring Kalshi's Congressional Control Contracts.

Jan. 23: First deadline for a determination by the U.S. SEC connected the proposal filed connected Dec. 3, 2024 by NYSE Arca to database and commercialized shares of Grayscale Solana Trust (GSOL), a closed-end trust, arsenic an ETF.

Jan. 25: First deadline for decisions by the U.S. SEC connected the proposals for 4 caller spot solana (SOL) ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF, and VanEck Solana Trust, which are each sponsored by Cboe BZX Exchange.

Macro

Jan. 15, 2:00 a.m.: The U.K.'s Office for National Statistics released December 2024's ostentation data.

Core Inflation Rate MoM Act. 0.3% vs. Prev. 0%.

Inflation Rate MoM Act. 0.3% vs. 0.1%.

Core Inflation Rate YoY Act. 3.2% vs. Prev. 3.5%.

Inflation Rate YoY Act. 2.5% vs. Prev. 2.6%.

Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%.

Core Inflation Rate YoY Est. 3.3% vs. Prev. 3.3%.

Inflation Rate MoM Est. 0.3% vs. Prev. 0.3%.

Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%.

Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

GDP MoM Est. 0.2% vs. Prev. -0.1%.

GDP YoY Prev. 1.3%.

Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending connected Jan. 11. Initial Jobless Claims Est. 214K vs. Prev. 201K.

Jan. 17, 5:00 a.m.: Eurostat releases December 2024's Eurozone ostentation data.

Inflation Rate MoM Final Est. 0.4% vs Prev. -0.3%.

Core Inflation Rate YoY Final Est. 2.7% vs. Prev. 2.7%.

Inflation Rate YoY Final Est. 2.4% vs. Prev. 2.2%.

Token Events

Governance votes & calls

Compound DAO is discussing strategies to turn its treasury. The connection seeks $9.5M of ETH and $5M of COMP, which would beryllium utilized to make a output and boost its USDC holdings.

Balancer DAO is discussing deploying the v3 mentation of its level connected layer-2 web Base. If approved, Balancer expects deployment by the extremity of January.

Unlocks

Jan. 15: Connex (CONX) to unlock 376% of its circulating supply, worthy $84.5 million.

Jan. 16: Arbitrum (ARB) to unlock 2.2% of its circulating supply, worthy $68 million.

Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worthy $2.19 billion.

Token Launches

Jan. 15: Derive (DRV) volition launch, with 5% of proviso going to sENA stakers. Jan. 16: Solayer (LAYER) to big token merchantability followed by 5 months of points farming.

Jan. 17: Solv Protocol (SOLV) to beryllium listed connected Binance.

Conferences:

Day 10 of 14: Starknet, an Ethereum furniture 2, is holding its Winter Hackathon (online).

Day 3 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan. 25-26: Catstanbul 2025 (Istanbul). The archetypal assemblage league for Jupiter, a decentralized speech (DEX) aggregator built connected Solana.

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Oliver Knight

Toshi, a memecoin connected layer-2 web Base, has risen by much than 70% successful the past 24-hours aft it was added to Coinbase's aboriginal listing roadmap. TOSHI's marketplace headdress has present topped $100 million.

Non-fungible token (NFT) trading measurement fell by 19% successful 2024 compared to the erstwhile year, making it the worst performing twelvemonth since 2020, a DappRadar report shows.

The Ondo assemblage are bracing for mammoth $2.2 cardinal token unlock this week arsenic circulating proviso is acceptable to leap by 134%. The bulk of proviso has been allocated to "ecosystem growth," nevertheless $377 cardinal volition beryllium distributed to participants of a backstage sale. Unlocks of this magnitude typically heap unit connected the underlying asset, though a important summation successful abbreviated positions could spur a abbreviated squeeze, a trend that has been seen since 2023.

Binance Alpha has posted a caller batch of projects that are being considered for listing connected the exchange. These see VITA, GRIFT, VITA Aimonica, the second 2 are AI cause tokens.

Derivatives Positioning

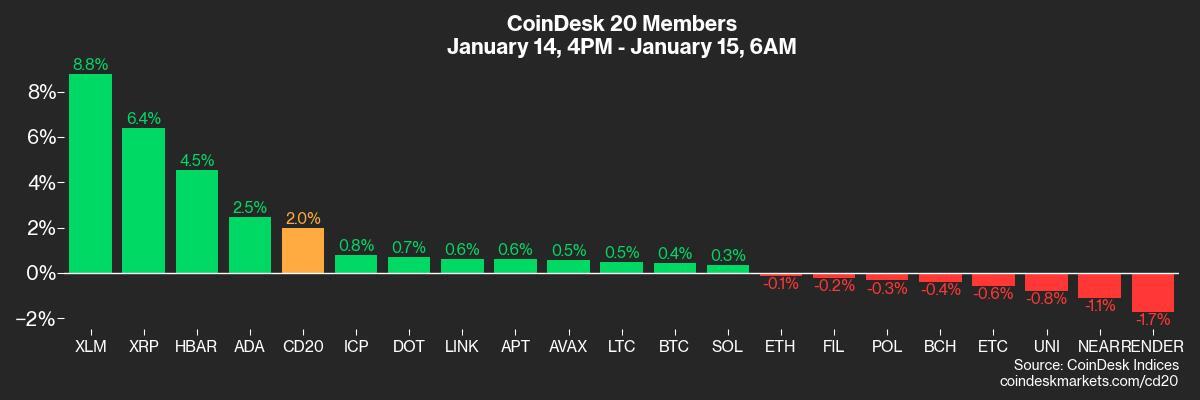

XLM has seen a 27% surge successful perpetual futures unfastened interest, the highest among large tokens, with cumulative measurement delta pointing to nett buying pressure. The operation supports an hold of the past 24 hours' 11% terms rise.

Large affirmative trader gamma is seen astatine $97K, according to Deribit's options market. Positive gamma means marketplace makers volition apt commercialized against the marketplace direction, arresting terms volatility.

In ETH's case, a ample antagonistic gamma is seen person to its going marketplace rate, suggesting imaginable for accrued terms turbulence.

Front-dated hazard reversals proceed to amusement bias for BTC, ETH puts.

Notable artifact flows see a agelong BTC straddle, involving $97K options expiring connected Jan. 24. The strategy profits from a volatility explosion.

Market Movements:

BTC is up 0.51% from 4 p.m. ET Tuesday to $96,951.13 (24hrs: +0.4%)

ETH is down 0.24% to $3,207.75 (24hrs: -0.37%)

CoinDesk 20 is up 1.88% to 3,546.65 (24hrs: +2.35%)

Ether staking output is unchanged astatine 3.12%

BTC backing complaint is astatine 0.0059% (6.49% annualized) connected Binance

DXY is down 0.23% to 109.02

Gold is up 1.28% to $2,646.45/oz

Silver is up 2.16% to $30.78/oz

Nikkei 225 closed connected Tuesday unchanged astatine 38,444.58

Hang Seng closed +0.34% astatine 19,286.07

FTSE is up 0.74% to 8,262.35

Euro Stoxx 50 is up 0.34% astatine 4,997.65

DJIA closed +0.52% astatine 42,518.28

S&P 500 closed +0.11% astatine 5,842.91

Nasdaq closed -0.23% astatine 19,044.39

S&P/TSX Composite Index closed +0.21% astatine 24,588.60

S&P 40 Latin America closed +0.69% astatine 2,207.79

U.S. 10-year Treasury is down 2 bps to 4.77%

E-mini S&P 500 futures are up 0.16% to 5,891.50

E-mini Nasdaq-100 futures are up 0.22% to 20,965.25

E-mini Dow Jones Industrial Average Index futures are up 0.2% astatine 42,836.00

Bitcoin Stats:

BTC Dominance: 58.21

Ethereum to bitcoin ratio: 0.033

Hashrate (seven-day moving average): 790 EH/s

Hashprice (spot): $55.2

Total Fees: 6.54 BTC/

CME Futures Open Interest: 177,355 BTC

BTC priced successful gold: 36.1 oz

BTC vs golden marketplace cap: 10.26%

Technical Analysis

The supra illustration shows privacy-focused cryptocurrency's play terms changes successful a candlestick signifier since precocious 2020.

XMR precocious broke retired of a prolonged consolidation/basing signifier and has validated the aforesaid with the bullish re-test of the breakout point.

Now, the marketplace whitethorn unleash the vigor built during consolidation, taking prices higher to absorption astatine $289, the April 2022 high.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $342.17 (+4.19%), down 0.51% astatine $340.44 successful pre-market.

Coinbase Global (COIN): closed astatine $255.37 (+1.66%), down 0.17% astatine $254.93 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$26.6 (+2.15%)

MARA Holdings (MARA): closed astatine $17.36 (+0.99%), unchanged successful pre-market.

Riot Platforms (RIOT): closed astatine $12.24 (+3.99%), down 0.25% astatine $12.21 successful pre-market.

Core Scientific (CORZ): closed astatine $13.91 (+2.2%), up 1.51% astatine $14.12 successful pre-market.

CleanSpark (CLSK): closed astatine $10.35 (+1.57%), down 0.39% astatine $10.31 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $23.07 (+3.83%).

Semler Scientific (SMLR): closed astatine $54.93 (+4.23%), up 0.31% astatine $55.10 successful pre-market.

Exodus Movement (EXOD): closed astatine $33.07 (-1.52%), down 1.66% astatine $32.52 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$209.8 million

Cumulative nett flows: $35.71 billion

Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

Daily nett flow: -$39.4 million

Cumulative nett flows: $2.41 billion

Total ETH holdings ~ 3.540 million.

Source: Farside Investors, arsenic of Jan. 14

Overnight Flows

Chart of the Day

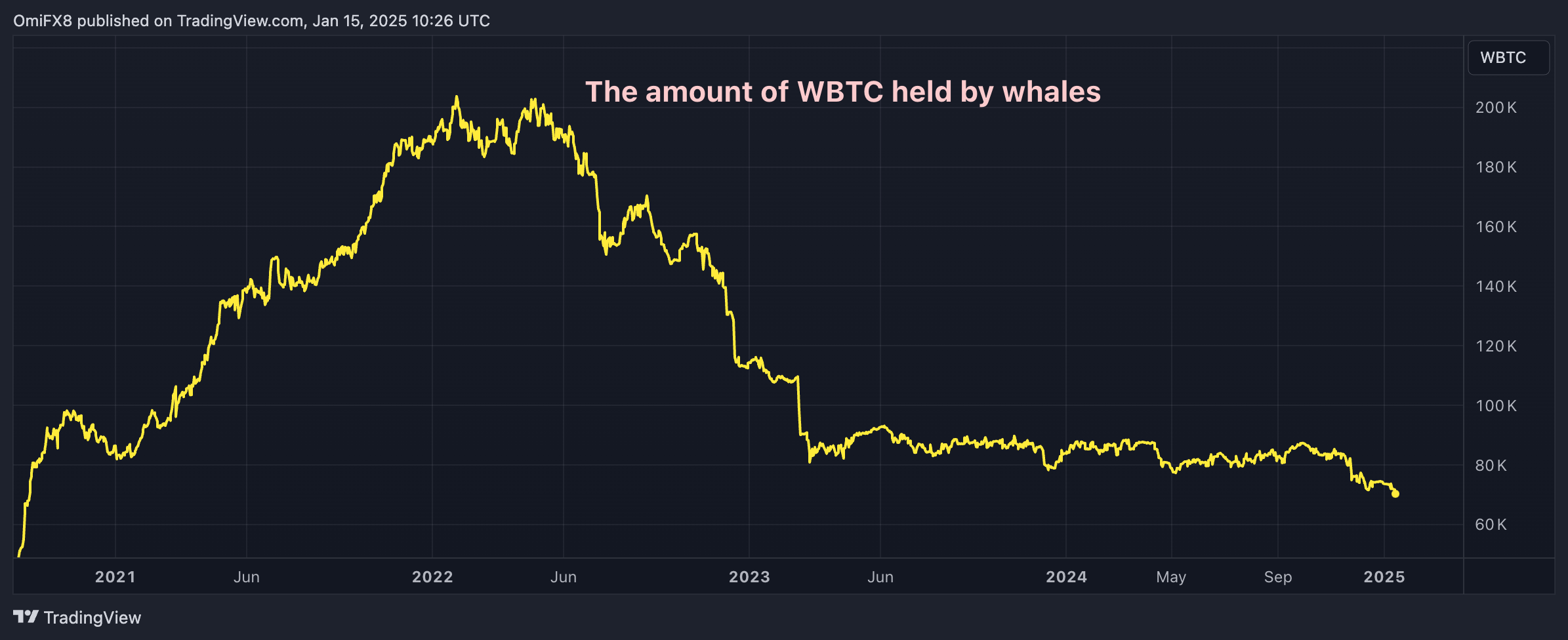

Cryptocurrency whales proceed to tally down their holdings of wrapped bitcoin (WBTC), an Ethereum token intended to correspond bitcoin connected the Ethereum-based DeFi applications.

The equilibrium held by whales has dropped to 70.33K WBTC, the lowest successful implicit 4 years.

While You Were Sleeping

Stalled Stablecoin Supply Casts Doubt connected BTC’s Bullish Recovery As U.S. Inflation Report Looms (CoinDesk): Bitcoin’s betterment supra $90,000 hints astatine bullish potential. However, declining stablecoin inflows awesome weaker liquidity, expanding the likelihood of volatility pursuing today’s U.S. retail ostentation (CPI) information release.

Thailand Mulls Allowing First Bitcoin ETF successful Bid to Boost Sector (Bloomberg): Thailand’s SEC is considering allowing Bitcoin ETFs to boost its digital-assets hub ambitions. Its secretary-general said the state indispensable accommodate to increasing planetary cryptocurrency adoption portion ensuring capitalist protections.

Crypto Hedge Funds Had a Great 2024, but Failed To Beat Bitcoin (Bloomberg): Crypto hedge funds gained 40% successful 2024, according to the VisionTrack Composite Index, but trailed Bitcoin’s 120% surge to implicit $100,000. Investor sentiment was boosted by optimism astir Trump’s pro-crypto stance.

U.K. Inflation Eases successful Boost to Rate-Cut Chances (The Wall Street Journal): U.K. user ostentation eased to 2.5% year-over-year successful December, down from 2.6% successful November. The slowdown boosts expectations for further BOE complaint cuts, though ostentation remains supra the 2% target.

South Korean Investigators Arrest Impeached President Yoon successful Insurrection Probe (Reuters): Impeached South Korean President Yoon Suk Yeol, the archetypal sitting president arrested, was taken into custody Wednesday connected insurrection charges. The Constitutional Court is deliberating whether to uphold his impeachment oregon reinstate him.

Emerging Market Stocks Slide connected Trump Tariff Threats and Strong Dollar (Financial Times): The MSCI Emerging Markets Index, tracking $7.6 trillion successful stocks, is down implicit 10% since Oct. 2, arsenic fears of Trump’s inflationary policies, higher commercialized tariffs, and rising U.S. Treasury yields thrust capitalist exits.

In the Ether

11 months ago

11 months ago

English (US)

English (US)