By Francisco Rodrigues (All times ET unless indicated otherwise)

Cryptocurrency prices are rising aft the U.S. Securities and Exchange Commission’s erstwhile crypto enforcement portion transitioned into the Cyber and Emerging Technologies Unit and amid dovish comments from Atlanta Fed President Raphael Bostic.

Renaming the Crypto Assets and Cyber Unit is important due to the fact that it shows the bureau is moving distant from its crypto absorption that often led to accusations of regularisation by enforcement and ineligible battles with large manufacture participants.

“In the adjacent to mean term, clearer regulations volition apt boost organization participation, starring to improvements successful marketplace infrastructure,” BackPack laminitis and CEO Armani Ferrante told CoinDesk. Bitcoin is present supra $98,000 aft adding 1.2% successful 24 hours, portion the broader CoinDesk 20 Index roseate 1.35%.

Yet, volatility is inactive relatively low. "These environments whitethorn consciousness dilatory and frustrating, but they seldom persist for agelong — volatility tends to mean revert,” Wintermute OTC trader Jake O told CoinDesk.

With tensions betwixt the U.S. and its European allies growing, investors are hoping Germany's predetermination connected Sunday volition pb to a unchangeable conjugation authorities that volition propulsion retired economical reforms to stimulate maturation and boost defence spending. Germany is Europe’s largest system and a affirmative effect could pb to a much risk-on approach.

Open involvement has already moved up up of the election. Still, the crypto marketplace lacks affirmative catalysts successful the adjacent term, JPMorgan analysts led by Nikolaos Panigirtzoglou wrote successful a report.

In fact, the marketplace is nearing backwardation — wherever spot prices emergence supra futures prices — successful a “negative development” that’s “indicative of request weakness” by organization investors utilizing regulated CME futures contracts to summation vulnerability to the market. Stay alert!

What to Watch

Crypto:

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging level Telegram’s Mini App ecosystem.

Feb. 24: At epoch 115968, investigating of Ethereum’s Pecta upgrade connected the Holesky testnet starts.

Feb. 25, 9:00 a.m.: Ethereum Foundation probe squad AMA connected Reddit.

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet motorboat (“Mobius”).

Macro

Feb. 21, 9:45 a.m.: S&P Global releases February’s (Flash) U.S. Purchasing Managers' Index (Flash) reports.

Composite PMI Prev. 52.7

Manufacturing PMI Est. 51.5 vs. Prev. 51.2

Services PMI Est. 53 vs. Prev. 52.9

Feb. 24, 5:00 a.m.: Eurostat releases eurozone's (final) user ostentation information for January.

Core Inflation Rate YoY Est. 2.7% vs. Prev. 2.7%

Inflation Rate YoY Est. 2.5% vs. Prev. 2.4%

Earnings

Feb. 24: Riot Platforms (RIOT), post-market, $-0.18

Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $-0.17

Feb. 25: Cipher Mining (CIFR), pre-market, $-0.09

Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Token Events

Governance votes & calls

Sky DAO is discussing withdrawing a portion of the Smart Burn Engine’s LP tokens to halt malicious actors from acquiring them.

DYdX DAO is discussing expanding the bounds connected the maximum notional worth of liquidations that tin hap wrong a fixed artifact connected the dYdX protocol to enhance the velocity and efficiency of hazard simplification during liquidations.

Unlocks

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating proviso worthy $78.6 million.

Feb. 28: Optimism (OP) to unlock 1.92% of circulating proviso worthy $34.23 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating proviso worthy $81.07 million.

Token Launches

Conferences:

CoinDesk's Consensus to instrumentality spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Feb. 23-March 2: ETHDenver 2025 (Denver)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Oliver Knight

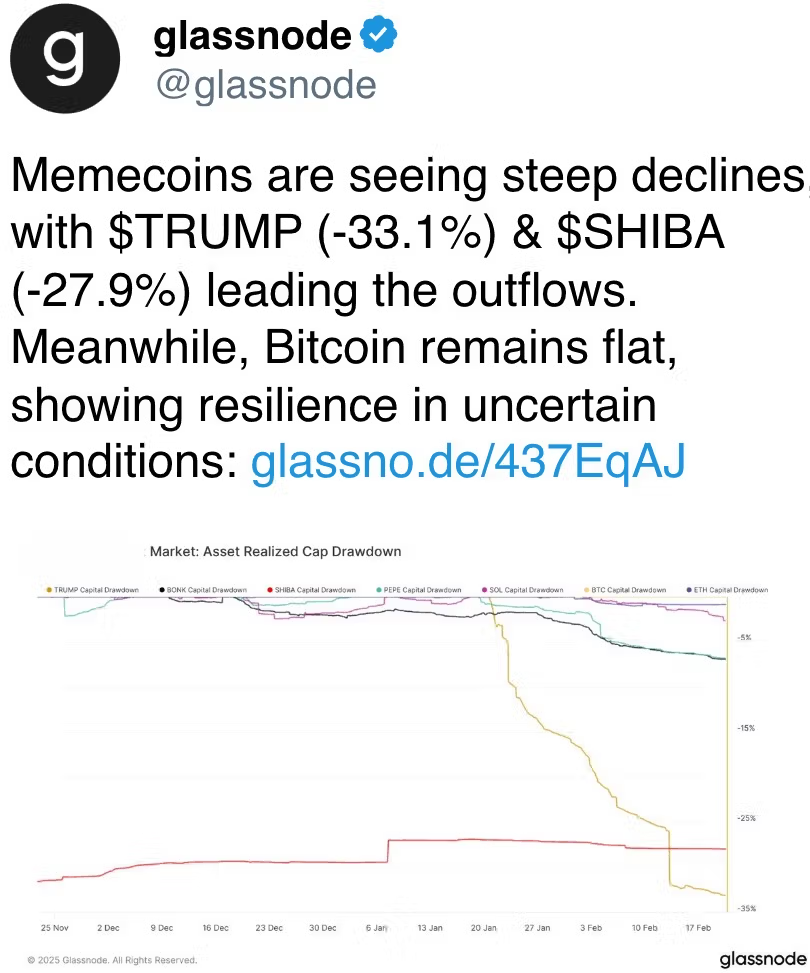

With a botched motorboat from Argentine president Javier Milei and a token projected by self-professed Nazi Kanye West, present known arsenic Ye, this week successful memecoin onshore has been 1 to forget.

Castle Island Ventures spouse Nic Carter said the craze is "unquestionably over," a presumption that mightiness beryllium cemented by a study revealing that West is readying to present YZY token — and volition ain 70% of the supply.

The remainder of the crypto marketplace remains comparatively unperturbed by the imaginable demise of the sector: ETH and LTC are up by 3% this week whilst TRX has risen by 7.7% arsenic liquidity appears to beryllium rotating from speculative tokens backmost to much utilitarian projects.

NEAR leads the battalion connected Friday, surging by 11% aft announcing the "first genuinely autonomous" AI agents. The agents volition beryllium capable to autonomously own, commercialized and negociate assets on-chain.

Derivatives Positioning

BTC unfastened involvement connected centralized exchanges roseate astir 5% to $37.3 cardinal successful the past 24 hours. This, coupled with the reversal successful backing from affirmative to negative, suggests a imaginable abbreviated compression scenario. Short liquidations person dominated the futures markets implicit that period, nearing a full of $110 cardinal compared with $6.11 cardinal successful longs.

Among the assets with implicit $100 cardinal successful unfastened interest, Maker DAO, Virtuals Protcol and Artificial Super Intelligence saw the highest one-day increase, rising by 39.2%, 35.5% and 28.00%, respectively.

Among the options instruments, the telephone enactment connected BTC with a onslaught terms of $99,000 and expiring Feb. 22 has traded with the astir measurement connected Deribit. The adjacent astir fashionable options instrumentality is the telephone connected BTC with a onslaught terms of $108,000, expiring connected Feb. 28. The enactment hints astatine the optimistic short-term sentiment successful the marketplace implicit the past mates of days.

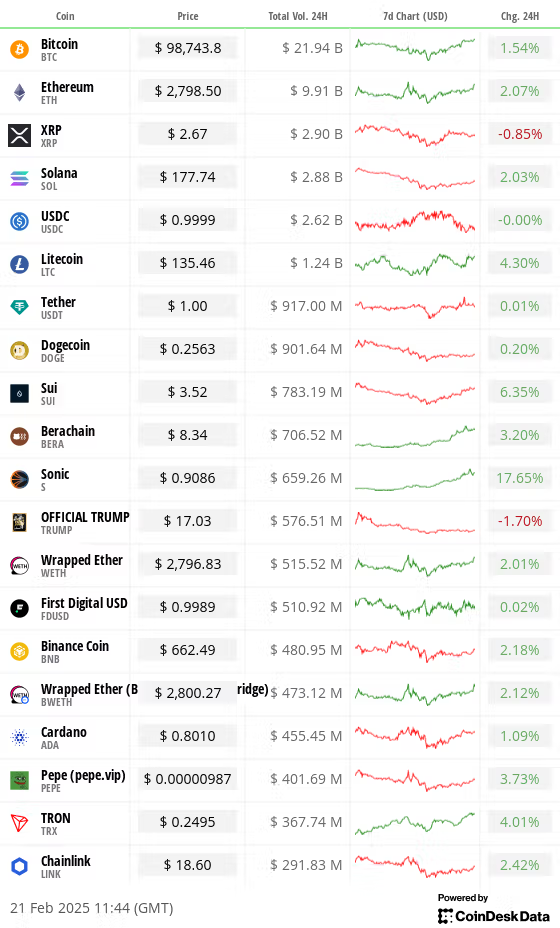

Market Movements:

BTC is up 0.28% from 4 p.m. ET Thursday to $98,632.42 (24hrs: +1.35%)

ETH is up 2.09% astatine $2,800.02 (24hrs: +2.15%)

CoinDesk 20 is up 0.92% to 3,298.29 (24hrs: +1.49%)

Ether CESR Composite Staking Rate is unchanged astatine 2.99%

BTC backing complaint is astatine 0.0010% (1.0961% annualized) connected Binance

DXY is up 0.29% astatine 106.68

Gold is down 0.31% astatine $2,929.76/oz

Silver is down 0.12% to $32.91/oz

Nikkei 225 closed +0.26% astatine 38,776.94

Hang Seng closed +3.99% astatine 23.477.92

FTSE is up 0.20% astatine 8,680.19

Euro Stoxx 50 is up 0.18% astatine 5,471.08

DJIA closed Thursday down -1.01% astatine 44,176.65

S&P 500 closed -0.43% astatine 6,117.52

Nasdaq closed -0.47% astatine 19,962.36

S&P/TSX Composite Index closed -0.44% astatine 25,514.08

S&P 40 Latin America closed +0.76% astatine 2,480.21

U.S. 10-year Treasury complaint was down 2 bps astatine 4.49%

E-mini S&P 500 futures are unchanged astatine 6,138.25

E-mini Nasdaq-100 futures are up 0.13% astatine 22,170.75

E-mini Dow Jones Industrial Average Index futures are up 0.10% to 44,309

Bitcoin Stats:

BTC Dominance: 61.02 (-0.35%)

Ethereum to bitcoin ratio: 0.02842 (2.01%)

Hashrate (seven-day moving average): 807 EH/s

Hashprice (spot): $54.92

Total Fees: 5.34 BTC / $526,892

CME Futures Open Interest: 178,500 BTC

BTC priced successful gold: 33.4 oz

BTC vs golden marketplace cap: 9.49%

Technical Analysis

TAO has emerged arsenic 1 of the strongest-performing assets implicit the past week, fueled by the motorboat of the dynamicTAO upgrade. This momentum has propelled the terms supra each cardinal exponential moving averages connected the regular clip frame, signaling renewed strength.

Adding to the bullish sentiment, the terms enactment has formed an inverse caput and shoulders pattern.

TAO’s caller listing connected Coinbase provided an other catalyst, driving its terms up astir 20% to a precocious of $495 since the archetypal announcement.

Crypto Equities

MicroStrategy (MSTR): closed connected Thursday astatine $323.92 (+1.65%), up 0.37% astatine $324.85 successful pre-market

Coinbase Global (COIN): closed astatine $256.59 (-0.80%), up 0.86% astatine $258.80

Galaxy Digital Holdings (GLXY): closed astatine C$25.65 (+1.30%)

MARA Holdings (MARA): closed astatine $15.95 (+1.08%), up 0.38% astatine $16.01

Riot Platforms (RIOT): closed astatine $11.60 (+0.35%), up 0.52% astatine $11.66

Core Scientific (CORZ): closed astatine $11.84 (-1.50%), up 0.51% astatine $11.90

CleanSpark (CLSK): closed astatine $10.06 (+1.72%), up 0.80% astatine $10.14

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.49 (-1.27%), down 0.31% astatine $22.42

Semler Scientific (SMLR): closed astatine $52.24 (+0.04%), unchanged

Exodus Movement (EXOD): closed astatine $47.80 (-1.26%), down 2.72% astatine $46.50

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$364.8 million

Cumulative nett flows: $39.63 billion

Total BTC holdings ~ 1.169 million.

Spot ETH ETFs

Daily nett flow: -$13.1 million

Cumulative nett flows: $3.16 billion

Total ETH holdings ~ 3.807 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

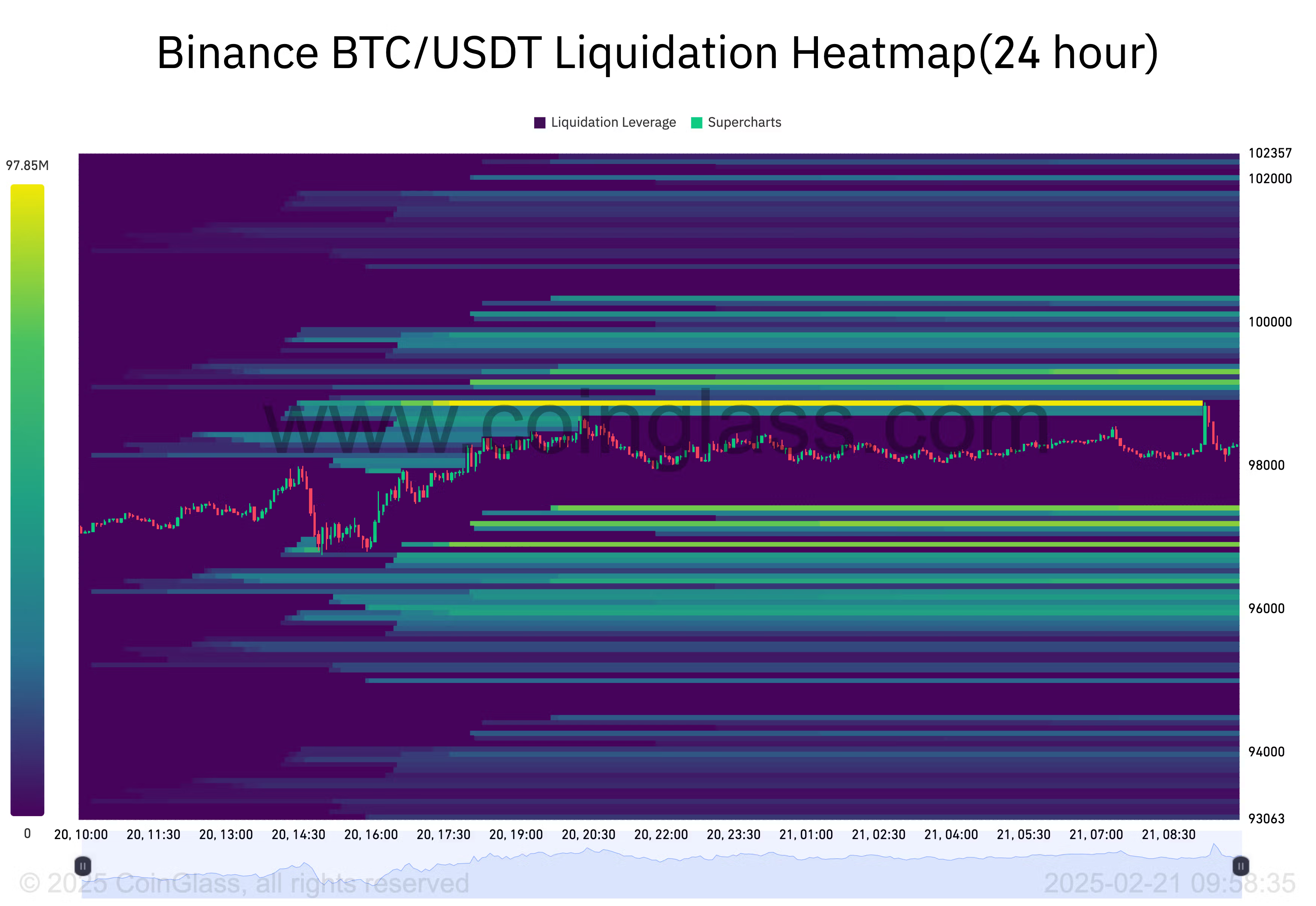

Bitcoin's terms enactment has triggered abbreviated liquidations totaling $97.9 cardinal astatine the $98,890 level, according to CoinGlass. The adjacent cardinal absorption levels, based connected the liquidation vigor map, are $99,185 and $99,332, wherever liquidations worthy $65.2 cardinal and $67.9 million, respectively, are clustered.

On the downside, important agelong liquidations are positioned astatine $97,415 and $97,194, amounting to $69.3 cardinal and $70.7 million, respectively. These cardinal levels item imaginable areas of volatility arsenic bitcoin navigates its existent terms range.

While You Were Sleeping

Crypto Market Faces Weak Demand, Needs Trump Initiatives to Kick In, JPMorgan Says (CoinDesk): JPMorgan said CME futures information reveals anemic organization involvement successful crypto, with immoderate pro-crypto initiatives from the Trump medication improbable to look until the 2nd fractional of the year.

South African Firm to Amass Bitcoin Hoard successful First for Continent (Bloomberg): Altvest Capital adopted bitcoin to beryllium a treasury reserve asset. It bought 1 BTC and is considering a $10 cardinal stock merchantability to grow its integer holdings.

Block Shares Fall connected Profit, Revenue Miss (CNBC): At its Q4 2024 net call, Block (XYZ) executives commented connected Proto, their bitcoin mining initiative. CFO Amrita Ahuja said the task should thrust maturation successful the 2nd half.

Japan Yields Fall arsenic Ueda Warns BOJ Can Step In to Smooth Market (Bloomberg): Bank of Japan Governor Kazuo Ueda vowed to bargain authorities bonds if semipermanent yields spike. Earlier, 10-year yields deed 1.455% — the astir since 2009.

U.K. Retail Sales Rise for First Time successful Five Months (The Wall Street Journal): In January, retail spending successful the U.K. roseate 1.7% from December, led by a 5.6% leap successful nutrient store income arsenic much radical ate astatine home.

New Microsoft Chip Shortens Timeline to Make Bitcoin Quantum-Resistant: River (Cointelegraph): Bitcoin-focused fiscal services steadfast River said Microsoft’s Majorana — though not yet a menace — could scope a 1-million-qubit standard by 2027–2029, perchance enabling attacks connected the blockchain.

In the Ether

9 months ago

9 months ago

English (US)

English (US)