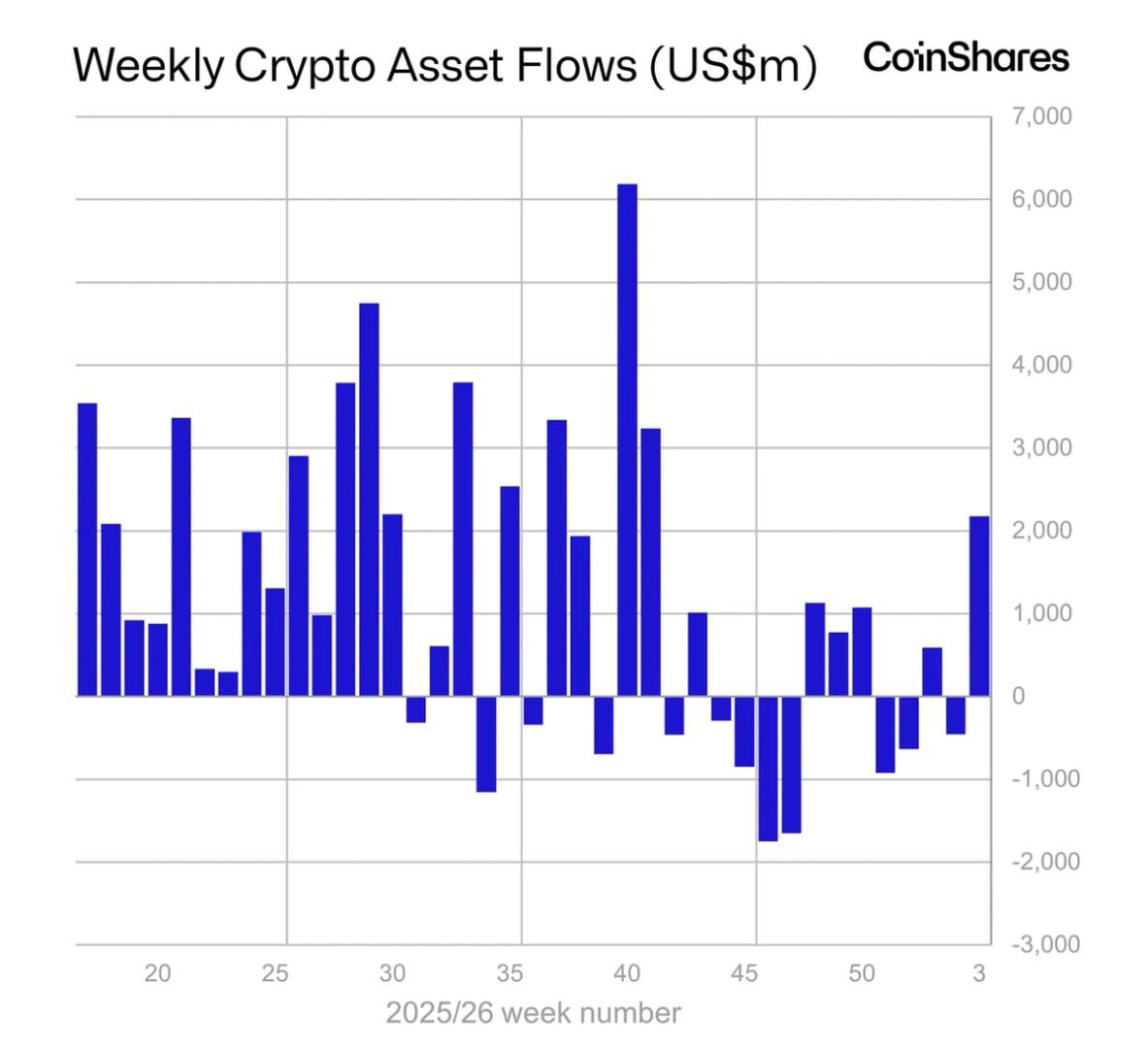

Crypto concern products continued gathering steam past week, with money inflows outpacing each different week successful 2026 truthful acold and marking the largest gains since October.

Crypto exchange-traded products (ETPs) drew $2.17 cardinal of inflows past week, European crypto plus manager CoinShares reported connected Monday.

The bulk of inflows came earlier successful the week, but Friday saw sentiment displacement arsenic $378 cardinal successful outflows amid Greenland geopolitical escalation and caller tariff worries, CoinShares’ caput of research, James Butterfill, said.

“Sentiment was besides weighed down by suggestions that Kevin Hassett, a starring contender for the adjacent US Fed Chair and a well-known argumentation dove, is apt to stay successful his existent role,” the expert added.

Bitcoin leads gains with $1.6 cardinal of inflows

Most of past week’s crypto money gains were concentrated successful bitcoin (BTC), which attracted $1.55 cardinal of inflows, oregon much than 71% of the full play haul.

Ether (ETH) funds drew $496 cardinal successful inflows, exceeding the total inflows into each crypto products combined the erstwhile week.

Weekly crypto ETP flows by plus arsenic of Friday (in millions of US dollars). Source: CoinShares

Weekly crypto ETP flows by plus arsenic of Friday (in millions of US dollars). Source: CoinSharesXRP (XRP) and Solana (SOL) funds followed, pulling successful astir $70 cardinal and $46 million, respectively. Smaller altcoins specified arsenic Sui (SUI) and Hedera (HBAR) recorded inflows of $5.7 cardinal and $2.6 million.

CoinShares’ Butterfill added that Ether and Solana inflows held up contempt CLARITY Act proposals successful the US Senate Banking Committee that could bounds stablecoin output offerings.

Related: Bitcoin ETFs station biggest inflows of 2026 truthful acold arsenic BTC rallies supra $97K

Multi-asset and abbreviated Bitcoin concern products were the lone 2 categories to grounds monthly outflows by Friday, totaling $32 cardinal and $8.6 million.

All large issuers saw notable gains past week, with BlackRock’s iShares exchange-traded funds (ETFs) starring the battalion with $1.3 cardinal of inflows. Grayscale Investments and Fidelity Investments followed with $257 cardinal and $229 million, respectively.

Weekly crypto ETP flows by issuer arsenic of Friday (in millions of US dollars). Source: CoinShares

Weekly crypto ETP flows by issuer arsenic of Friday (in millions of US dollars). Source: CoinSharesGeographically, the US led inflows with $2 billion, portion Sweden and Brazil saw insignificant outflows of $4.3 cardinal and $1 million, respectively.

With the latest inflows, full assets nether absorption successful crypto funds climbed supra $193 cardinal for the archetypal clip since aboriginal November.

Cointelegraph is committed to independent, transparent journalism. This quality nonfiction is produced successful accordance with Cointelegraph’s Editorial Policy and aims to supply close and timely information. Readers are encouraged to verify accusation independently. Read our Editorial Policy https://cointelegraph.com/editorial-policy

2 hours ago

2 hours ago

English (US)

English (US)