Crypto exchange-traded products (ETPs) suffered their largest play sell-off connected record, with investors pulling astir $2.9 cardinal from these funds, according to a study by CoinShares published connected Monday.

The monolithic outflows people a important displacement successful sentiment aft a prolonged play of dependable concern into integer plus products.

This latest question of withdrawals extended a three-week streak of outflows, present totaling $3.8 billion. CoinShares probe expert James Butterfill pointed to respective factors apt driving the sell-off, including mounting capitalist concerns pursuing the caller $1.5 cardinal hack connected crypto speech Bybit and the Federal Reserve’s progressively hawkish stance connected monetary policy.

Before this downturn, crypto concern products had enjoyed 19 consecutive weeks of inflows, suggesting that immoderate investors were locking successful profits amid increasing marketplace uncertainty.

Bitcoin (BTC), the largest cryptocurrency by marketplace capitalization, bore the brunt of the outflows, losing $2.6 cardinal implicit the past week. Meanwhile, funds that stake against bitcoin, known arsenic abbreviated Bitcoin ETPs, saw lone a humble inflow of $2.3 million, indicating that bearish sentiment has yet to afloat instrumentality hold.

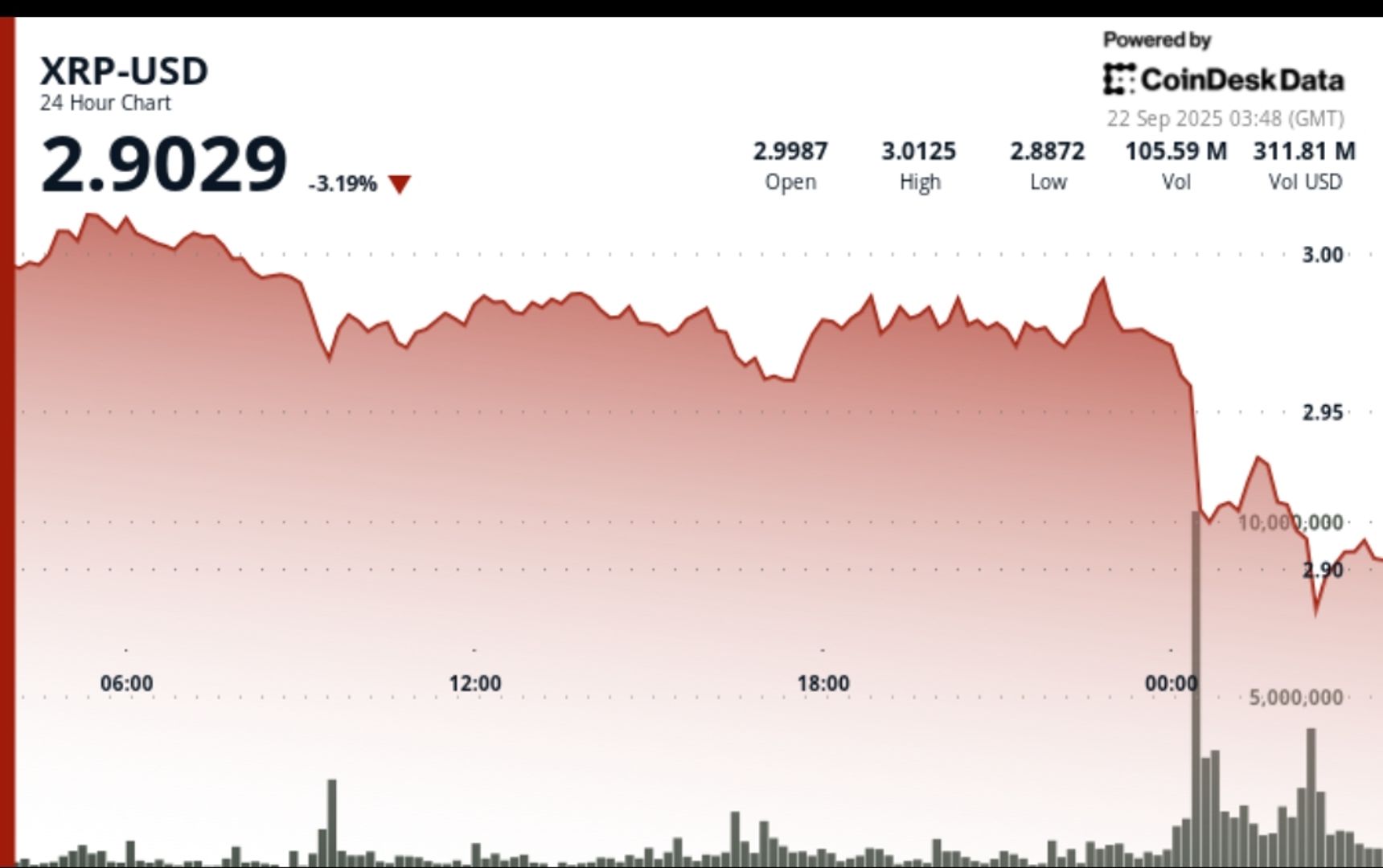

While astir assets struggled, a fewer bucked the trend—Sui (SUI) emerged arsenic the apical performer with $15.5 cardinal successful inflows, followed by XRP (XRP), which besides attracted caller investment.

Spot Bitcoin ETFs faced 1 of their toughest weeks yet, with investors pulling important superior from these funds. BlackRock’s iShares Bitcoin Trust (IBIT), the largest of its kind, recorded a staggering $1.3 cardinal successful outflows, according to CoinShares, the highest play withdrawal since its launch.

Similarly, CME Bitcoin futures unfastened involvement dropped sharply implicit the past 2 weeks, falling from 170,000 BTC to 140,000 BTC, signaling a imaginable displacement successful organization positioning. At the aforesaid time, the three-month futures annualized rolling ground is yielding 7%, lone somewhat higher than the 4% output offered by short-term U.S. Treasuries, making the commercialized little charismatic for investors.

"This tells maine the hedge funds are starting to unwind their ground commercialized position, which is simply a nett neutral position," said James Van Straten, expert astatine CoinDesk. "With a narrowing dispersed betwixt futures yields and risk-free returns, traders whitethorn beryllium reallocating superior distant from bitcoin derivatives successful favour of safer, much liquid assets."

Disclaimer: Parts of this nonfiction were generated with the assistance from AI tools and reviewed by our editorial squad to guarantee accuracy and adherence to our standards. For much information, spot CoinDesk’s afloat AI Policy.

6 months ago

6 months ago

English (US)

English (US)