In today’s issue, Leo Mindyuk from MLTech provides a crypto outlook for 2025 and highlights cardinal factors that could thrust the adoption of these assets.

Then, Miguel Kudry from L1 Advisors shares his insights connected the taxable successful Ask and Expert.

You’re speechmaking Crypto for Advisors, CoinDesk’s play newsletter that unpacks integer assets for fiscal advisors. Subscribe here to get it each Thursday.

2025 Outlook for Crypto Adoption: Building Bridges to the Mainstream

The crypto manufacture is entering 2025 with a renewed consciousness of purpose. Over the past year, the assemblage has witnessed cardinal developments that awesome crypto’s expanding integration into accepted concern (TradFi) and broader adoption of crypto assets, particularly bitcoin. However, the roadworthy up volition trial the resilience of this increasing ecosystem. As we measure the outlook for 2025, respective factors look arsenic captious to shaping the adoption trajectory: regulatory clarity, organization participation, and technological innovation.

1. Regulatory Clarity: Turning Uncertainty Into Institutional Guidelines

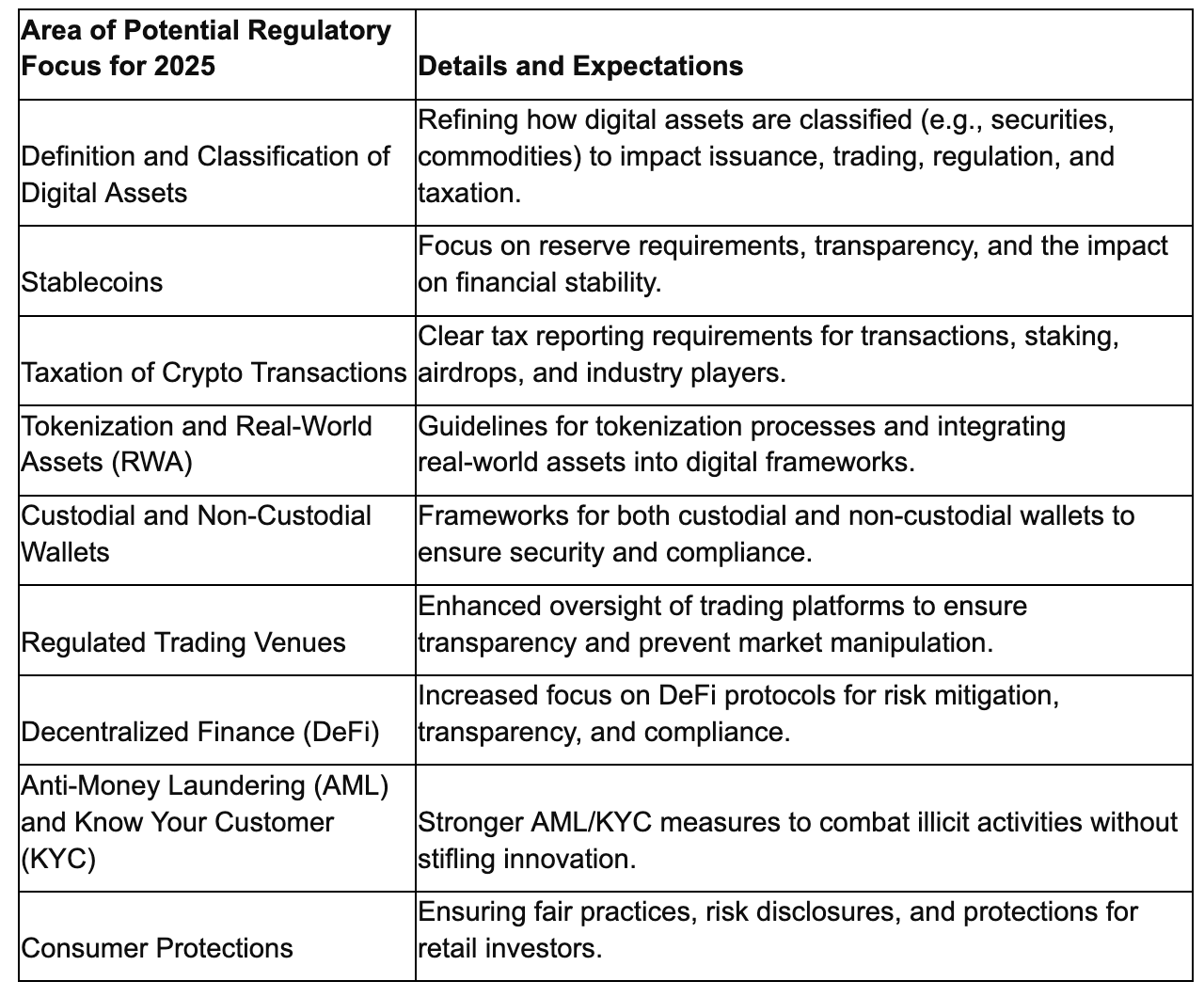

As I've concisely discussed connected my CoinDesk podcast astir predetermination nighttime results and the terms enactment astir it, regulatory clarity is emerging arsenic a pivotal origin for crypto adoption. The marketplace has already started pricing successful the anticipation that recently elected officials volition bring long-awaited operation to the integer plus ecosystem. We volition spot immoderate of those expectations starting to play retired this year. Key areas wherever we are apt to spot much clarity include:

a) Definition and classification of integer assets: The U.S. is expected to refine however integer assets are classified - whether arsenic securities, commodities, oregon immoderate combination. This clarity volition straight interaction however tokens are issued, traded, regulated, and taxed.

b) Stablecoins: These are apt to beryllium a large absorption for regulators owed to their transformative real-world usage cases and imaginable interaction connected fiscal stability.

c) Taxation of crypto transactions: Recent changes person already been made, and we volition apt spot clearer taxation reporting requirements for integer assets, assorted associated activities, and assorted manufacture players.

Additional topics specified arsenic tokenization—including real-world assets—custodial and non-custodial wallets, regulated trading venues, decentralized concern (DeFi), anti-money laundering (AML) and cognize your lawsuit (KYC) compliance, and user protections volition besides beryllium actively discussed and perchance acted upon.

2. Institutional Participation: ETFs arsenic a Catalyst

In 2024, crypto ETFs experienced explosive growth, with billions successful nett inflows and notable launches. With caller products, crypto ETFs present correspond a rapidly expanding fiscal marketplace segment, attracting important capitalist involvement and outperforming accepted funds. We volition apt spot a assortment of adjacent products.

For 2025, increasing inflows and precocious volumes successful BTC and ETH ETFs volition apt proceed to validate crypto arsenic an plus people and streamline entree for retail and organization investors. This volition unfastened the way for different single-asset ETFs, multi-asset ETFs, and assorted adjacent ETFs (e.g., leveraged, inverse, market-timing, volatility). If regulatory clarity progresses accelerated enough, we whitethorn spot the U.S.'s archetypal crypto yield-generating ETFs (e.g., staking). These products could bring further capitalist involvement to the plus people and summation inflows into passive and progressive concern products.

3. Technological Innovation: The Convergence of Blockchain Scalability and AI

Technological advancements successful 2025 volition beryllium driven by Layer-2 blockchain scalability and AI integration. Rollups, zero-knowledge proofs, and interoperability volition heighten transaction ratio and idiosyncratic acquisition for decentralized applications (dApps) and DeFi. Simultaneously, AI agents operating connected decentralized networks volition lick and optimize a assortment of tasks and interact with users and each other. This synergy simplifies Web3 interactions and ensures secure, transparent execution of AI decisions connected blockchain. Together, these innovations volition little barriers to entry, pull developers and users, and accelerate mainstream adoption, making 2025 a pivotal twelvemonth for blockchain and AI convergence.

Summary

The outlook for crypto adoption successful 2025 is overwhelmingly positive, but not without challenges. Regulatory clarity, organization participation, and technological innovation volition beryllium the pillars of growth. The question isn’t whether crypto volition summation mainstream acceptance—it’s however accelerated and successful what form. As we attack this adjacent phase, those who accommodate to the evolving scenery volition pb the complaint successful shaping the future.

Ask an Expert

Q. What were the astir impactful developments successful the crypto marketplace implicit the past year, and however person they shaped crypto adoption?

The astir important improvement successful crypto past twelvemonth was the governmental shift, with President-elect Donald Trump making crypto a cardinal portion of his platform. Markets are lone opening to terms successful the interaction of the Executive and Legislative branches, on with fiscal regulators, that not lone refrained from warring the crypto manufacture but besides encouraged crypto innovation wrong the United States. Beyond bitcoin adoption and the imaginable constitution of a nationalist strategical bitcoin reserve, the broader implications for fiscal markets are inactive unclear to galore marketplace participants. Some of the world’s largest fiscal institutions that were antecedently connected the sidelines are present actively processing their crypto strategy successful effect to the caller pro-crypto administration.

Q. How is the evolving regulatory scenery apt to interaction crypto markets and organization engagement successful 2025?

The SEC’s regulation-by-enforcement attack has had a far-reaching interaction connected the crypto markets. A displacement to a neutral - oregon adjacent affirmative - stance means fiscal professionals and institutions volition request to actively research however to amended service their customers who are already engaged with crypto, peculiarly fixed its decisive relation successful the election. Additionally, they volition request to accommodate their offerings to stay competitory successful a satellite wherever fiscal markets and assets progressively run connected crypto rails. Financial advisors, successful particular, present person much opportunities to service their clients by incorporating crypto allocations and existing crypto portfolios into broad fiscal readying and strategy.

Q. Given the macroeconomic climate, however should fiscal professionals deliberation astir integrating crypto into broader concern strategies successful 2025?

The twelvemonth 2025 volition people a pivotal displacement for crypto, transitioning from simply being an plus people to becoming the infrastructure that underpins a increasing information of each plus classes. Put differently, with the adoption of crypto rails, fiscal professionals volition beryllium amended equipped to respond to the macroeconomic climate, further accelerating the flywheel of plus tokenization, portfolio allocations, and broader adoption.

- Miguel Kudry, CEO, L1 Advisors

Keep Reading

J.P. Morgan’s retail level E-Trade is considering adding crypto trading.

The SEC suit against Coinbase has been paused and is moving to the 2nd circuit.

Czech National Bank opens up discussions astir bitcoin arsenic they see reserve diversification options.

11 months ago

11 months ago

English (US)

English (US)