Nations astir the satellite are astatine differing stages of evaluating oregon establishing centralized slope integer currencies (CBDCs).

In today's Crypto for Advisors newsletter, we look to the East, arsenic Dr Sangmin Seo, chairman, Kaia DLT Foundation, compares and contrasts South Korea’s closed and controlled CBDC strategy to Japan’s unfastened framework.

Then, Patrick Murphy from Eightcap answers questions astir however these changes volition interaction investors successful Ask an Expert.

What Are the Approaches of South Korea and Japan Towards Stablecoins

After the transition of the GENIUS Act successful the U.S., stablecoin projects, implementations and regulations are present a large taxable of treatment astir the world. South Korea and Japan are some having high-level and precocious discussions presently astir however those stablecoins should operate. And however the backstage assemblage and governments should interact successful regulating stablecoins.

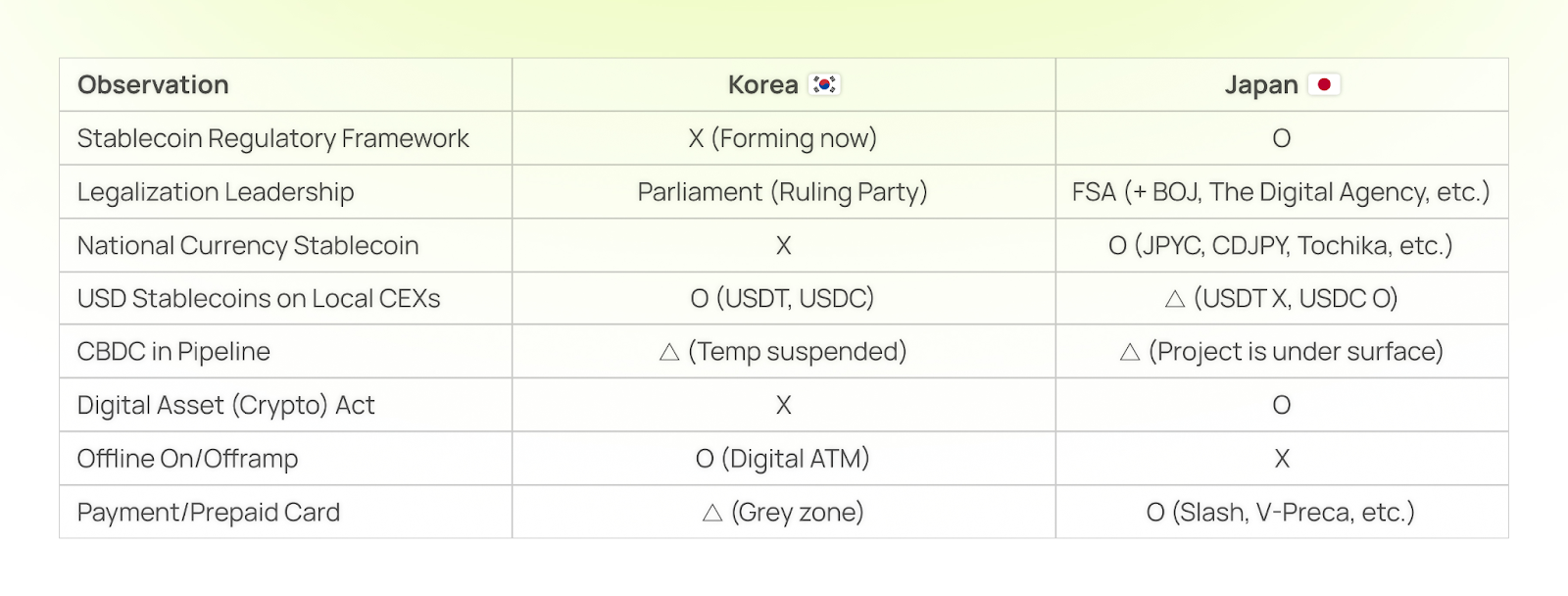

Central Banks successful Korea and Japan disagree successful their approaches towards stablecoins and CBDCs:

- A CBDC, or a cardinal bank-controlled integer currency, is a blockchain-powered integer currency controlled by a cardinal slope pegged to a real-world currency denomination.

- A stablecoin is typically issued by backstage enterprises. They are usually designed to person a worth identical to real-world currencies.

Japan: CBDCs tin larn from stablecoins

The Bank of Japan maintains a steadfast stance that CBDCs should lone beryllium utilized for interbank settlements. Private banks' issued stablecoins tin beryllium utilized for business-to-business (B2B) and business-to-consumer (B2C) transactions. The Bank of Japan and the Financial Services Agency person devised a stablecoin regulatory model with a affirmative stance connected the usage of privately regulated stablecoins.

While the Bank of Japan acknowledges the “the imaginable of stablecoins arsenic an businesslike means of payment,” it besides envisions co-existence with CBDCs and views the integer Yen arsenic a complementary, alternatively than competitive, signifier of cash, with accepted finance.

The Governor of the Bank of Japan, Kazuo Ueda, precocious said, “Stablecoins summation tiny planetary remittances, starring to hazard diversification. With much high-frequency micropayments, it volition beryllium absorbing to research however CBDCs tin play a complementary role.” Suggesting that backstage stablecoins could supply learnings for a CBDC plan successful presumption of its outgo efficiency.

South Korea: Ambivalence but leaning towards backstage stablecoins

This contrasts with the Bank of Korea's existent ambivalent stance arsenic to whether oregon not backstage stablecoins should beryllium controlled by cardinal banks, considering that they volition perchance origin instability successful home currency worth oregon superior flight. It is important to recognize that Korea has precise choky superior controls connected the currency system.

However, South Korea’s National Assembly has led the pro-stablecoin discussions by proposing 3 antithetic Digital Asset bills to legalize KRW stablecoins. These bills came aft President Jae Myung Lee pledged to make home stablecoins during the caller predetermination run that concluded successfully successful June. It is noteworthy that Korea’s CBDC task was halted connected 29 June 2025, pursuing these stablecoin discussions.

Image: Kaia

As a result, galore competing consortia from Web3, fintech, and the banks are each scrambling for a presumption to beryllium portion of immoderate aboriginal stablecoin designs. Kakao and Naver, the largest IT enterprises successful South Korea, person begun their stablecoin probe task forces, filed trademarks, oregon formed an confederation radical seeking imaginable partners.

Circle, the USDC issuer, signed an MOU with Hana Bank, 1 of Korea’s main banks, to laic the groundwork for a aboriginal stablecoin concern alliance. Private South Korean banks person already begun positioning themselves arsenic stablecoin businesses; the CBDC task was frozen successful June.

Nevertheless, South Korea has maintained a “one slope for 1 centralized crypto exchange" regulation, blocking caller marketplace entrants. Therefore, galore successful the manufacture are keenly awaiting to spot which of the 3 bills is adopted.

Why Japan and South Korea’s approaches substance for non-USD stablecoins

Rather than benefiting the South Korean economy, the Bank of Korea and others reason that a Korean-won (KRW) backed stablecoin volition not forestall superior flights from South Korea, arsenic those stablecoins volition not beryllium wide utilized successful planetary integer plus transactions similar USD stablecoins.

Despite these statements, the backstage assemblage could good person a salient relation successful the instauration of a South Korean stablecoin, particularly arsenic South Korea has the second-biggest retail crypto market.

The enactment betwixt the backstage assemblage and governments successful regulating stablecoins, arsenic good arsenic however South Korea and Japan code these issues, peculiarly successful balancing the wide adoption of stablecoins with adherence to Web3 principles, has implications beyond their borders.

- Dr Sangmin Seo, chairman, Kaia DLT Foundation

Ask an Expert

Q: What is driving the displacement successful Asia to integrate blockchain exertion into accepted fiscal systems?

A: Asia's clasp of blockchain is simply a strategical pivot, moving beyond the speculative aspects of cryptocurrency to its imaginable arsenic a foundational technology. Policy leaders crossed the portion spot that regulatory clarity is indispensable for sustainable innovation; examples specified arsenic Hong Kong's licensing authorities for Virtual Asset Service Providers (VASPs) and Singapore's regulated DeFi and cross‑border outgo pilots amusement this successful action. This proactive attack creates the regulatory clarity and robust infrastructure indispensable to facilitate unafraid on-chain transactions and much businesslike cross-border payments, yet modernizing fiscal systems.

Q: South Korea's caller regulatory model is simply a important development. What are the cardinal features, and what bash they awesome for organization adoption?

A: South Korea's caller framework, formalized successful the Digital Asset Basic Act (DABA), represents a large measurement toward organization acceptance. Its cardinal features, including broad guidelines for stablecoins and the instauration of crypto exchange-traded funds (ETFs), are designed to make a much unafraid and defined situation for integer assets. Furthermore, the motorboat of a state-supported blockchain web underscores a strategical absorption connected gathering institutional-grade infrastructure. These developments collectively awesome that South Korea views integer assets not conscionable arsenic a retail product, but arsenic a morganatic portion of the fiscal ecosystem, paving the mode for greater organization participation.

Q: What are the cardinal takeaways for fiscal advisors from Asia's evolving blockchain landscape, and what should they beryllium monitoring?

A: The developments successful Asia, peculiarly successful countries similar South Korea, supply a wide roadmap for the aboriginal of planetary finance. Advisors should admit that this inclination signals a determination toward organization acceptance and the imaginable for new, regulated fiscal products. It is important to show developments successful tokenized securities, which could fundamentally alteration however assets are issued, traded, and settled. Additionally, keeping an oculus connected caller stablecoin regulations and integer Know Your Customer (KYC) frameworks is essential, arsenic these trends could precise good beryllium a preview of the adjacent improvement of superior markets globally.

- Patrick Murphy, main commercialized officer, Eighcap

Keep Reading

- A caller working paper from the Central Bank of Malaysia (CBM) has identified XRP and bitcoin arsenic imaginable “alternatives to the existent monetary and outgo instruments”.

- The United Arab Emirates prepares for the rollout of the Digital Dirham CBDC.

- The European Central Bank aims to decorativeness its digital euro investigating signifier by October 2025

1 month ago

1 month ago

English (US)

English (US)