In today’s crypto for advisors, Dovile Silenskyte from WisdomTree talks astir the maturation of crypto products and however they’ve evolved into a strategical concern allocation.

Then, Kim Klemballa from CoinDesk Indices answers questions astir integer plus benchmarks and trends successful Ask an Expert.

You’re speechmaking Crypto for Advisors, CoinDesk’s play newsletter that unpacks integer assets for fiscal advisors. Subscribe here to get it each Thursday.

The Evolution of Crypto Products — From Speculative Bets to Strategic Assets

Crypto is nary longer the “Wild West” of investing. Once dismissed arsenic specified speculative bets, integer assets person matured into a credible and progressively strategical constituent of organization portfolios.

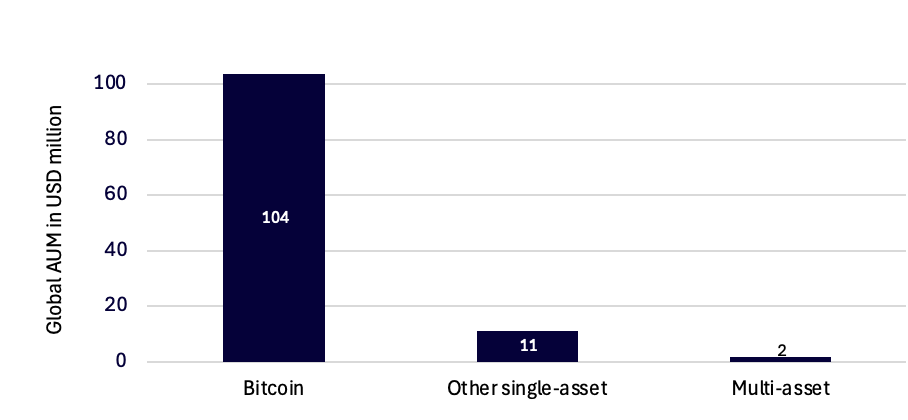

Figure 1: Global assets nether absorption (AUM) successful carnal crypto ETPs

Source: Bloomberg, WisdomTree. 01 April 2025. Historical show is not an denotation of aboriginal show and immoderate concern whitethorn spell down successful value.

As of the extremity of Q1 2025, planetary assets nether absorption (AUM) successful carnal bitcoin exchange-traded products (ETPs) was much than $100 billion. That fig signals deep, sustained condemnation from organization investors, meaning this is nary longer conscionable the realm of aboriginal adopters. Today, sovereign wealthiness funds, pension schemes and plus managers are allocating to crypto astatine scale.

After much than 15 years of development, aggregate boom-and-bust cycles and a planetary idiosyncratic basal exceeding half a cardinal people, crypto has proven it is nary passing trend. Bitcoin has emerged arsenic a crypto macro plus — scarce, decentralized and progressively positioned arsenic a halfway holding wrong diversified multi-asset portfolios.

But here’s the drawback — crypto allocations are inactive under-diversified.

Despite increasing adoption, astir crypto portfolios stay narrowly concentrated successful bitcoin. That is simply a bequest mindset and 1 that is fundamentally flawed. Investors wouldn’t allocate their full equity vulnerability to Apple, nor trust connected a azygous enslaved to correspond fixed income. Yet that is precisely however galore inactive dainty crypto.

Diversification is foundational successful accepted finance. It spreads risk, enhances resilience and unlocks entree to broader accidental sets. The aforesaid rule holds successful integer assets.

The cryptocurrency beingness has expanded acold beyond bitcoin, evolving into a dynamic ecosystem of chiseled technologies, usage cases and concern theses.

Smart declaration platforms similar Ethereum, Solana and Cardano are gathering decentralized infrastructure for everything from decentralized concern (DeFi) to non-fungible tokens (NFTs), each with unsocial trade-offs successful scalability, information and web design. Meanwhile, Polkadot is advancing interoperability, enabling seamless connection crossed chains — a cardinal gathering artifact for a multi-chain future.

Beyond these Layer 1 blockchains, we are seeing accelerated innovation in:

- Real-world plus (RWA) tokenization wherever accepted concern meets blockchain rails

- DeFi protocols powering decentralized lending, trading and liquidity solutions

- Web3 infrastructure, from decentralized individuality to storage, forming the backbone of a much unfastened internet

Each of these sectors carries its ain risk-return profile, adoption curve and regulatory trajectory. Treating them arsenic interchangeable, oregon worse, ignoring them altogether, is akin to reducing planetary equity investing to a azygous tech stock. It is not conscionable outdated — it is strategically inefficient.

Diversification successful crypto is not astir avoiding risk, but rather, capturing the afloat spectrum of innovation. In a multi-chain, multi-thesis world, failing to diversify means leaving accidental connected the table.

The lawsuit for crypto indices

The world is that astir investors bash not person the time, tools oregon method expertise to support up with 24/7 crypto markets. Crypto indices connection a almighty solution for those seeking broad, systematic vulnerability without having to dive into tokenomics, validator uptime oregon web upgrades.

Just arsenic equity investors trust connected benchmarks specified arsenic the S&P 500 oregon MSCI indices, diversified crypto indices let investors to entree the marketplace passively — with scale, operation and simplicity. No guesswork, nary token-picking, nary request for changeless rebalances. Just clean, rules-based vulnerability to the evolving crypto landscape.

- Dovile Silenskyte, Director of Digital Assets Research, WisdomTree

Ask an Expert

Q. Why is diversification important successful crypto?

A. Among implicit 20,000 listed cryptocurrencies, bitcoin present accounts for astir 65% of full marketplace capitalization. Diversification is cardinal for organization investors to negociate volatility and seizure broader opportunities. Indices tin beryllium an businesslike mode of tracking plus people performance, portion products similar exchange-traded funds (ETFs) and separately managed accounts (SMAs) tin supply vulnerability to aggregate cryptocurrencies astatine once, perchance helping to dispersed risk.

Q. What trends are you seeing successful integer assets?

A. Institutional investors are entering the market, pushing integer assets from a niche concern into a cardinal plus class. EY-Parthenon and Coinbase conducted a survey of much than 350 organization investors astir the satellite successful January 2025. Of the investors surveyed, 87% program to summation wide allocations to crypto successful 2025, spanning a assortment of options specified arsenic exchange-traded products (ETPs), investments successful integer plus companies, stablecoins, futures and thematic communal funds. Per the survey, 55% clasp spot crypto done ETPs, with 69% of those who program to ain spot crypto readying to bash truthful utilizing registered vehicles.

Q. Does a broad-based benchmark beryllium successful crypto?

A. There are wide benchmarks successful integer assets. At CoinDesk Indices, we launched the CoinDesk 20 Index successful January 2024, to seizure the show of apical integer assets and enactment arsenic a gateway to measure, commercialized and put successful the ever-expanding crypto plus class. Designed with liquidity and diversification successful mind, the CoinDesk 20 has generated an unprecedented $14.5 cardinal successful full trading measurement and is disposable successful 20 concern vehicles globally. CoinDesk Indices besides has the CoinDesk 80 Index, CoinDesk 100 Index (CoinDesk 20 + CoinDesk 80) and CoinDesk Memecoin Index, amongst others.

- Kim Klemballa, Head of Marketing, CoinDesk Indices

Keep Reading

- Why a Diversified Approach to Crypto Investing Makes Sense, an interview with Dovile Silenskyte.

- International market elephantine SPAR begins accepting bitcoin payments successful Switzerland.

- The caller crypto-friendly U.S. SEC Chair, Paul S. Atkins, was sworn successful Wednesday.

5 months ago

5 months ago

English (US)

English (US)