In today’s Crypto for Advisors, Fabian Dori, Chief Investment Officer astatine Sygnum Bank, explores wherefore crypto is much than conscionable an plus people and looks astatine the organization adoption of decentralized finance.

Then, Abhishek Pingle, co-founder of Theo, answers questions astir however risk-adverse investors tin attack decentralized concern and what to look for successful Ask an Expert.

Crypto Is Not an Asset Class — It's an Asset Universe

Moody's precocious warned that nationalist blockchains airs a hazard to organization investors. At the aforesaid time, U.S. bitcoin ETFs are drafting billions successful inflows. We’re seeing the commencement of a long-awaited displacement successful organization adoption. But crypto's existent imaginable lies acold beyond passive bitcoin exposure. It's not conscionable an plus people — it's an plus universe, spanning yield-generating strategies, directional plays, and hedge fund-style alpha. Most institutions are lone scratching the aboveground of what's possible.

Institutional investors whitethorn heighten their risk-return illustration by moving beyond a monolithic presumption of crypto and recognizing 3 chiseled segments: yield-generating strategies, directional investments, and alternate strategies.

Like accepted fixed income, yield-generating strategies connection constricted marketplace hazard with debased volatility. Typical strategies scope from tokenized wealth marketplace funds that gain accepted yields to approaches engaging with the decentralized crypto concern ecosystem, which present charismatic returns without accepted duration oregon recognition risk.

These crypto output strategies whitethorn boast charismatic Sharpe ratios, rivalling high-yield bonds' hazard premia but with antithetic mechanics. For example, returns tin beryllium earned from protocol participation, lending and borrowing activities, backing complaint arbitrage strategies, and liquidity provisioning. Unlike bonds that look main erosion successful rising complaint environments, galore crypto output strategies relation mostly independently of cardinal slope argumentation and supply genuine portfolio diversification precisely erstwhile it's astir needed. However, determination is nary specified happening arsenic a escaped lunch. Crypto output strategies entail risks, chiefly centered astir the maturity and information of the protocols and platforms a strategy engages with.

The way to organization adoption typically follows 3 chiseled approaches aligned with antithetic capitalist profiles:

- Risk-averse institutions statesman with yield-generating strategies that bounds nonstop marketplace vulnerability portion capturing charismatic returns. These introduction points alteration accepted investors to payment from the unsocial yields disposable successful the crypto ecosystem without incurring the volatility associated with directional exposure.

- Mainstream institutions often follow a bitcoin-first attack earlier gradually diversifying into different assets. Starting with bitcoin provides a acquainted communicative and established regulatory clarity earlier expanding into much analyzable strategies and assets.

- Sophisticated players similar household offices and specialized plus managers research the full crypto ecosystem from the outset and physique broad strategies that leverage the afloat scope of opportunities crossed the hazard spectrum.

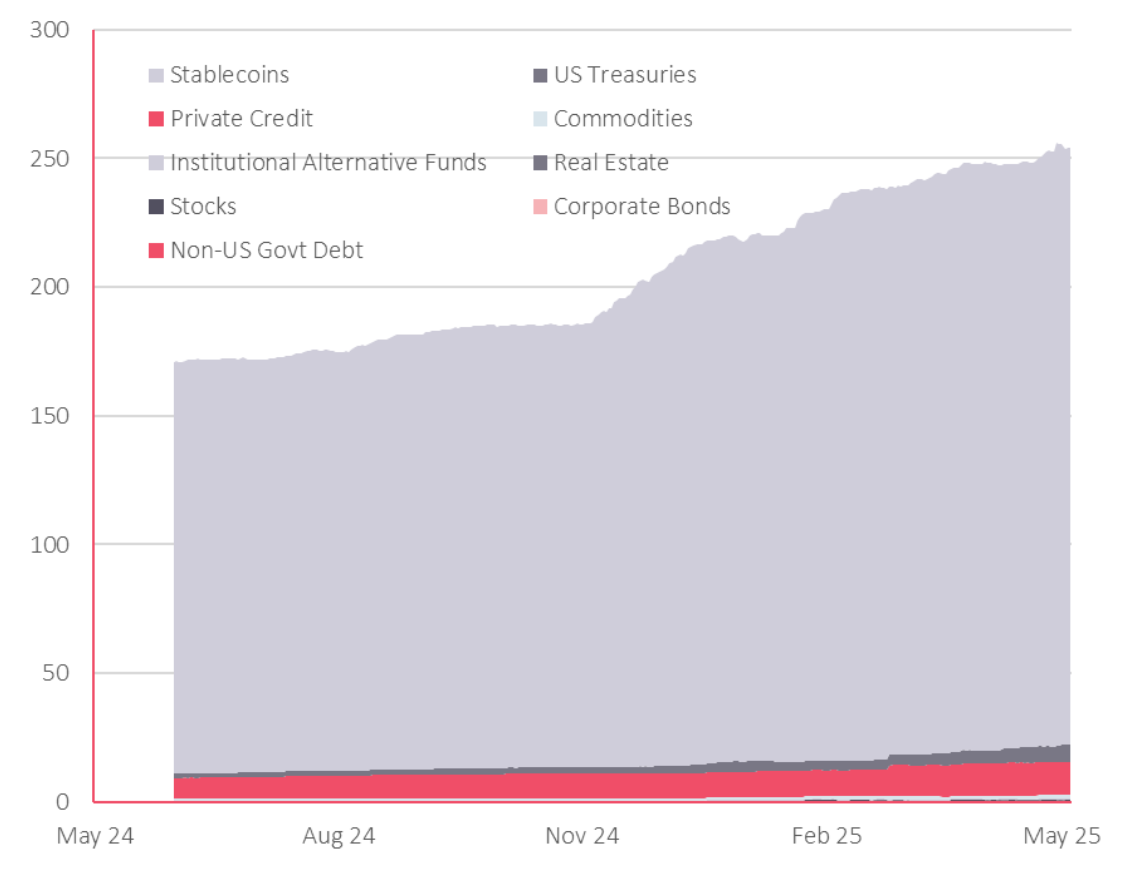

Contrary to aboriginal manufacture predictions, tokenization is progressing from liquid assets similar stablecoins and wealth marketplace funds upward, driven by liquidity and familiarity, not promises of democratizing illiquid assets. More analyzable assets are pursuing suit, revealing a pragmatic adoption curve.

Moody's caution astir protocol hazard exceeding accepted counterparty hazard deserves scrutiny. This communicative whitethorn deter institutions from crypto's output layer, yet it highlights lone 1 broadside of the coin. While blockchain-based assets present method risks, these risks are often transparent and auditable, dissimilar the perchance opaque hazard profiles of counterparties successful accepted finance.

Smart contracts, for example, connection caller levels of transparency. Their codification tin beryllium audited, stress-tested, and verified independently. This means hazard appraisal tin beryllium conducted with less assumptions and greater precision than fiscal institutions with off-balance-sheet exposures. Major decentralized concern platforms present acquisition aggregate autarkic audits and support important security reserves. They have, astatine slightest partially, mitigated risks successful the nationalist blockchain situation that Moody's warned against.

While tokenization doesn't destruct the inherent counterparty hazard associated with the underlying assets, blockchain exertion provides a much businesslike and resilient infrastructure for accessing them.

Ultimately, organization investors should use accepted concern principles to these caller plus classes portion acknowledging the immense array of opportunities wrong integer assets. The question isn't whether to allocate to crypto but alternatively which circumstantial segments of the crypto plus beingness align with peculiar portfolio objectives and hazard tolerances. Institutional investors are well-positioned to make tailored allocation strategies that leverage the unsocial characteristics of antithetic segments of the crypto ecosystem.

- Fabian Dori, main concern officer, Sygnum Bank

Ask an Expert

Q: What yield-generating strategies are institutions utilizing on-chain today?

A: The astir promising strategies are delta-neutral, meaning they are neutral to terms movements. This includes arbitrage betwixt centralized and decentralized exchanges, capturing backing rates, and short-term lending crossed fragmented liquidity pools. These make nett yields of 7–15% without wider marketplace exposure.

Q: What structural features of DeFi alteration much businesslike superior deployment compared to accepted finance?

A: We similar to deliberation of decentralized concern (DeFi) arsenic “on-chain markets”. On-chain markets unlock superior ratio by removing intermediaries, enabling programmable strategies, and offering real-time entree to on-chain data. Unlike accepted finance, wherever superior often sits idle owed to batch processing, counterparty delays, oregon opaque systems, on-chain markets supply a satellite wherever liquidity tin beryllium routed dynamically crossed protocols based connected quantifiable hazard and instrumentality metrics. Features similar composability and permissionless entree alteration assets to beryllium deployed, rebalanced, oregon withdrawn successful real-time, often with automated safeguards. This architecture supports strategies that are some agile and transparent, peculiarly important for institutions that optimize crossed fragmented liquidity pools oregon negociate volatility exposure.

Q: How should a risk-averse instauration attack output on-chain?

A: Many institutions exploring DeFi instrumentality a cautious archetypal measurement by evaluating stablecoin-based, non-directional strategies, arsenic explained above, that purpose to connection accordant yields with constricted marketplace exposure. These approaches are often framed astir superior preservation and transparency, with infrastructure that supports on-chain hazard monitoring, customizable guardrails, and unafraid custody. For firms seeking output diversification without the duration hazard of accepted fixed income, these strategies are gaining traction arsenic a blimpish introduction constituent into on-chain markets.

- Abhishek Pingle, co-founder, Theo

Keep Reading

- Bitcoin reached a caller all-time high of $111,878 past week.

- Texas Strategic Bitcoin Reserve Bill passed the legislature and advances to the governor's table for signature.

- U.S. Whitehouse Crypto Czar David Sacks said regulation is coming successful the crypto abstraction successful August.

6 months ago

6 months ago

English (US)

English (US)