Recent information breaches person rocked the crypto space, highlighting the information that information volition proceed to request to beryllium a cardinal absorption for providers.

In today’s issue, Marcin Kaźmierczak from Redstone Oracles breaks down wherefore 2025 volition beryllium a captious twelvemonth for DeFi and on-chain finance.

Then, Kevin Tam looks astatine the organization adoption of bitcoin arsenic seen from the caller 13-F filings and highlights cardinal positions successful Ask and Expert.

You’re speechmaking Crypto for Advisors, CoinDesk’s play newsletter that unpacks integer assets for fiscal advisors. Subscribe here to get it each Thursday.

DeFi Renaissance - Why 2025 Will Be The Year of Decentralized And On-Chain Finance?

The recent hack of ByBit for astir 401.000 ETH, valued astatine astir $1.5 cardinal astatine that time, exposed that information volition play a tremendous relation successful further crypto adoption. Can institutions grow on-chain aft specified an incident? Undoubtedly. It’s a substance of gradual adoption alongside ensuring top-notch information procedures.

Growing Adoption of Yield-Bearing Assets: Staking, Liquid Staking, Restaking and Liquid Restaking

In accepted finance, yield-generating assets are typically seen arsenic stronger semipermanent investments than non-productive ones since they supply investors with ongoing currency travel and income. This position helps explicate wherefore immoderate investors similar ether implicit bitcoin. Ether is seen arsenic much “productive” due to the fact that it powers a web supporting a wide scope of decentralized applications, benefiting from web effects. Beyond that, ether tin beryllium staked to gain accordant yield, aligning good with accepted valuation methods that prioritize ongoing dividends. The rising involvement successful staking, particularly successful the discourse of yield-generating assets, is evident successful the maturation of liquid staking, which enables frictionless and capital-efficient staking. This inclination accelerated further successful 2024 with the emergence of liquid restaking — for instance, ether.fi, a starring liquid restaking platform, saw explosive maturation past year, with implicit $8 cardinal worthy of ether staked done its rails.

Source: DeFi Llama, Total Value Locked successful Ether.Fi

The full magnitude of staked ether is expected to turn and play a important relation successful DeFi. Around one-third of each ETH — oregon $90 cardinal — is staked, with further inflows anticipated from accepted fiscal institutions exploring staking. As staking becomes much accessible done FinTech applications, immoderate investors whitethorn modulation from custodial to non-custodial solutions arsenic they summation a deeper knowing of blockchain technology.

Stablecoin Growth

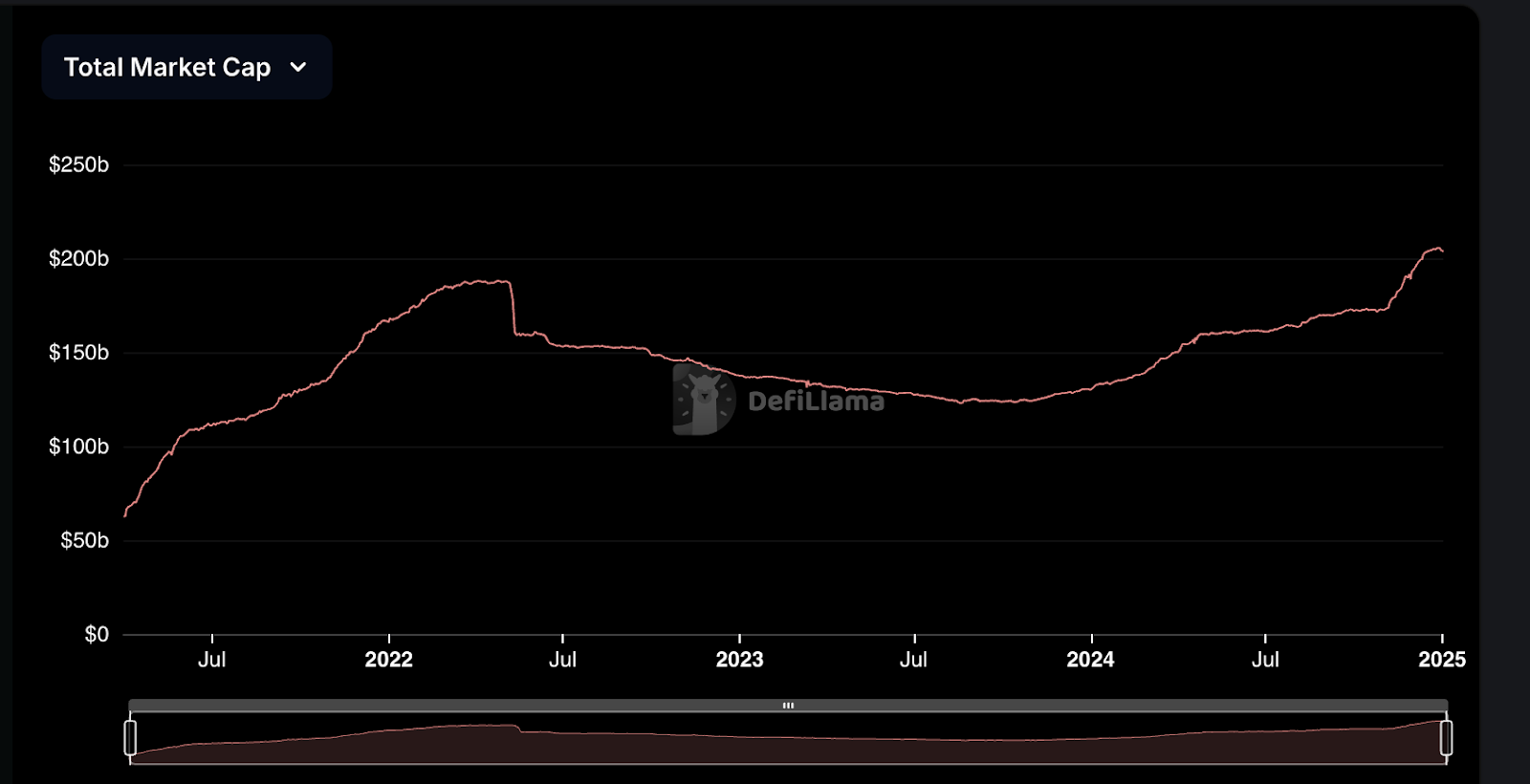

Global request for U.S. dollar vulnerability is immense, and stablecoins are the astir businesslike mode to conscionable it. Stablecoins similar USDC grow entree to dollar-denominated wealthiness preservation and streamline worth exchange. In 2024, task superior investments person flowed into stablecoin projects, and we expect further improvement successful this space. Regulatory frameworks similar the EU’s MiCA person provided much explicit guidelines, further legitimizing stablecoins and apt driving higher adoption adjacent year. Additionally, stablecoins are being integrated into accepted fiscal systems. For example, Visa has begun utilizing USDC connected networks similar Solana to facilitate faster and much businesslike payments. Additionally, PayPal entered the marketplace with PUSD, and Stripe made 1 of crypto’s astir important acquisitions by purchasing Bridge to grow its stablecoin operations. In 2024, the full stablecoin marketplace capitalization reached an all-time high, exceeding $200 cardinal dollars, and continuing to acceptable caller records successful 2025.

Source: DeFi Llama, Total Stablecoins Market Cap

Enhanced Interoperability and User-Friendly Non-Custodial Solutions

A cardinal situation successful DeFi is moving funds crossed networks to entree antithetic investments. By 2025, important advancement is anticipated toward eliminating the necessity of bridging funds by introducing a "one-click solution." This improvement should simplify the process for caller DeFi users, apt attracting much participants to the space. Additionally, wallet providers are expected to amended the information of on-chain concern and streamline the onboarding process by eliminating cumbersome crypto-native setups. This shift, driven by innovations similar the Account Abstraction movement, aims to marque crypto much accessible and user-friendly for accessing on-chain finance. Currently, the irreversible quality of transactions and the prevalence of blase scams deter galore caller users. However, improved information features should promote much individuals to prosecute with decentralized finance.

Bitcoin Reaching $100K

While simply holding bitcoin connected its autochthonal web isn’t inherently linked to on-chain finance, we’re witnessing a increasing integration of bitcoin with decentralized fiscal ecosystems. For example, astir 0.5% of bitcoin’s full proviso done staking protocol Babylon is present locked to unafraid Proof-of-Stake (POS) chains. The accrued acceptance of bitcoin by ample banks and immoderate governments is anticipated to make trickle-down effects, changing the public’s cognition of integer currencies distant from being seen purely arsenic a speculative plus oregon illicit activities toward being a morganatic fiscal instrument, bringing caller users on-chain.

-Marcin Kaźmierczak, COO, Redstone Oracles

Ask an Expert

Q: Can banks clasp crypto with SEC’s SAB 122?

A: SEC’s Staff Accounting Bulletin 122 whitethorn promote banks to integrate integer assets into the regulated fiscal system. By opening competition, banks tin vie with centralized exchanges. Banks tin connection services similar bitcoin-backed lending, staking and custodial services, which dainty integer assets much similar accepted assets.

This is simply a affirmative determination into a much flexible regulatory attack and balancing capitalist protections with the operational realities of fiscal institutions.

From organization concern to mainstream recognition, this is different large displacement successful however the satellite views and interacts with integer assets.

Q: Which Institutions (e.g. sovereign wealthiness funds, pensions, companies, etc.) are buying bitcoin?

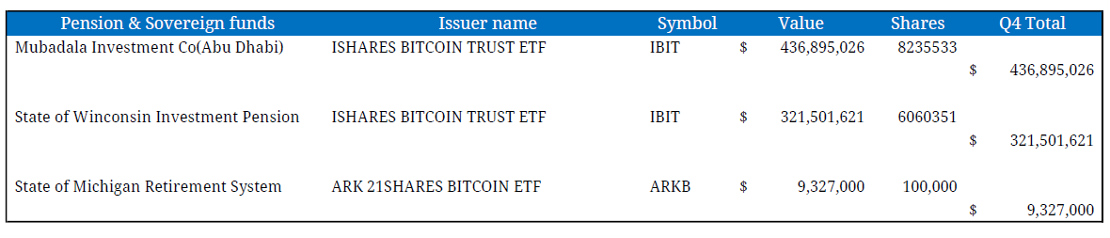

A: The accumulation by sovereign wealthiness funds, and pension funds is conscionable getting started.

Mubadala Investment Company PJSC (the wealthiness money owned by the authorities of Abu Dhabi) holds $436 cardinal successful 1 bitcoin ETF with wide assets nether absorption of $302 billion. Abu Dhabi’s sovereign wealthiness money (AIDA) manages a combined $1.7 trillion, indicating that their bitcoin concern is simply a comparatively tiny information of the wide portfolio.

Additionally, this past fall, Mubadala offered to acquire Canadian plus absorption steadfast CI Financial Corp. for $4.6 billion.

In the U.S., the State of Wisconsin Investment Board’s latest study shows its bitcoin ETF holdings person much than doubled from past 4th to implicit $321 million.

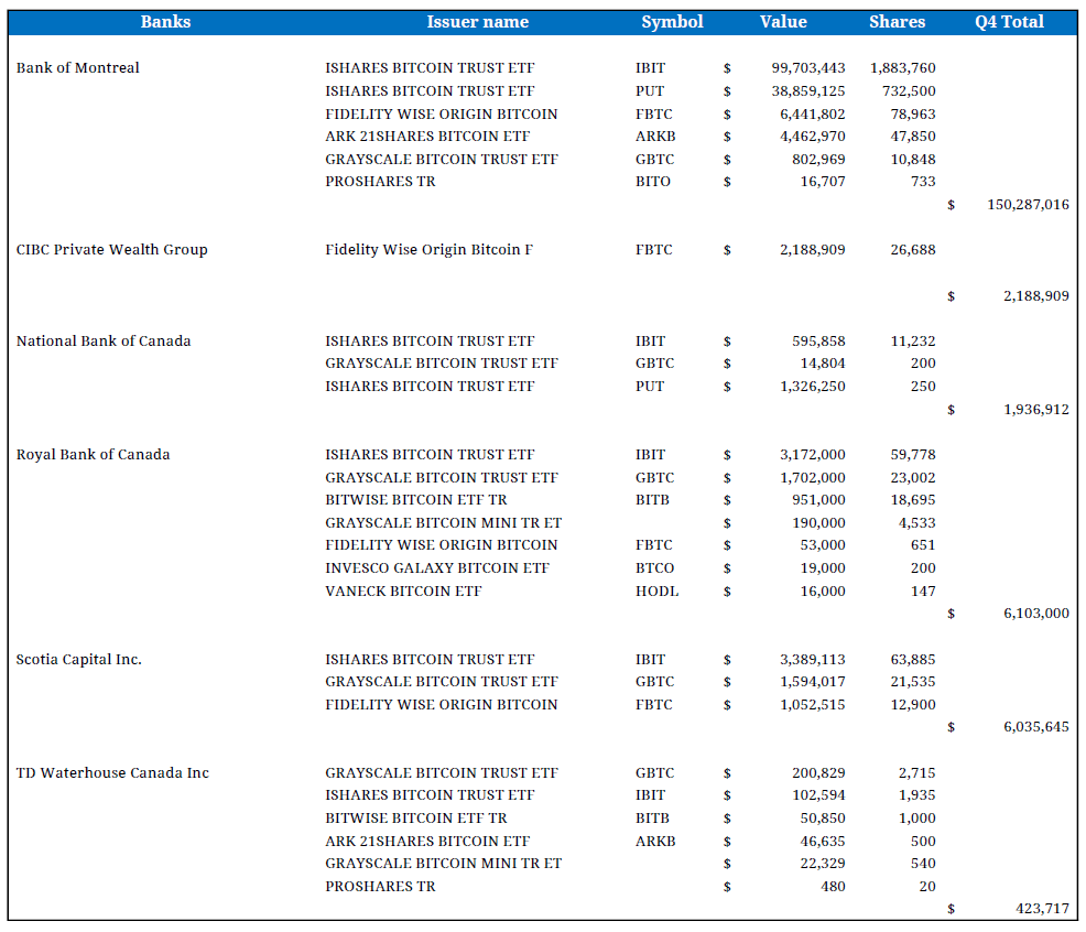

Q: Banking connected bitcoin – Which Canadian slope is starring the charge?

A: Recent Q4 2024 SEC filings uncover that Canadian Schedule 1 banks, organization wealth managers, pension funds and sovereign wealthiness funds person disclosed important bitcoin holdings (see charts).

Notably, Bank of Montreal present tops Canadian banks with $139 cardinal successful spot bitcoin ETF investments. And BMO’s bitcoin holdings went from zero to implicit $100 cardinal successful a azygous year.

Currently, successful North America, determination are astir 1,623 ample entities holding implicit $25.8 cardinal successful bitcoin ETPs.

-Kevin Tam, integer plus probe specialist

Keep Reading

Citadel announced plans to connection crypto trading and liquidity.

Curious astir the Bybit hack? Stephen Sargeant created a LinkedIn post summarizing immoderate of the betterment efforts that are underway with the enactment of the crypto community.

Coinbase announced past week that the SEC would beryllium dropping its suit against the exchange.

7 months ago

7 months ago

English (US)

English (US)