In today’s Crypto for Advisors, Bryan Courchesne from DAIM provides accusation connected taxation readying for crypto trades. Although we are fractional a twelvemonth distant from taxation season, determination are galore considerations to way successful bid to beryllium tax-ready.

Then, Saim Akif from Akif CPA breaks down the differences successful taxation attraction betwixt crypto and equities/bonds successful Ask an Expert.

Crypto Taxes Are Complicated, Don’t Let Them Derail Your Portfolio

As advisors focused connected crypto, we’re acquainted with the unsocial taxation situations this plus people presents. For example, crypto is not taxable to wash-sale rules, which allows for much businesslike tax-loss harvesting. It besides enables nonstop plus swaps, specified arsenic converting bitcoin (BTC) to ether (ETH) oregon ETH to Solana (SOL), without archetypal selling into cash. These are conscionable a mates of features that acceptable crypto isolated from accepted investments.

However, possibly the astir important happening for investors to see is the sheer fig of platforms they whitethorn usage and however challenging it tin beryllium to way everything astatine taxation time.

Tracking your crypto taxes isn’t conscionable a year-end chore; it’s a year-round challenge, particularly if you’re progressive connected aggregate centralized exchanges (CEXs) oregon decentralized platforms (DEXs). Every trade, swap, airdrop, staking reward, oregon bridging lawsuit tin beryllium a taxable event.

Centralized Exchange Trading

When utilizing CEXs similar Coinbase, Binance, oregon Kraken, you whitethorn person year-end taxation summaries, but those are often incomplete oregon inconsistent crossed platforms. One large situation is tracking your outgo ground crossed exchanges.

For example, if you bargain Amazon banal successful a Fidelity relationship and transportation it to Schwab, your outgo ground transfers seamlessly and updates with each caller trade. At taxation time, Schwab tin make an close 1099 showing your gains and losses.

But successful crypto, if you transportation assets from Kraken to Coinbase, your outgo ground doesn’t automatically transportation with them. If you’re moving assets crossed aggregate platforms, you’ll request to manually way each transaction, oregon you’ll look a large headache erstwhile filing taxes.

Decentralized Exchange Trading

Things get adjacent much analyzable erstwhile utilizing DEXs. Apps similar Coinbase Wallet (not to beryllium confused with the Coinbase exchange) oregon Phantom link you to decentralized trading platforms similar Uniswap oregon Jupiter. These DEXs don’t contented taxation forms oregon way your outgo basis, truthful it’s wholly up to you to log and reconcile each transaction.

Miss a azygous token swap oregon hide to grounds the just marketplace worth of a liquidity excavation withdrawal, and your taxation study could beryllium inaccurate. That could trigger IRS scrutiny oregon pb to missed deductions. While immoderate apps tin cipher gains and losses from a azygous wallet address, they often conflict erstwhile assets are transferred betwixt addresses, making them little utile for progressive users.

And here’s the kicker: if you’re actively trading connected DEXs, chances are you’re not adjacent making money. But adjacent losses indispensable beryllium reported correctly to suffice for a deduction. If not, you hazard losing the write-off or, worse, facing an audit.

Unless you’re a full-time crypto trader, the clip and effort required to way each transaction isn’t conscionable stressful, it tin outgo you existent money.

What steps tin I instrumentality to marque definite I'm taxation ready?

There are, however, respective ways to hole decently for crypto taxes:

- Use crypto taxation bundle from the beginning. Even then, you’ll privation to double-check that the reported enactment makes consciousness and set arsenic needed.

- Hire a crypto taxation specializer oregon enactment with a crypto-focused advisor who understands the landscape.

- Download each transaction logs and spot if your CPA oregon advisor tin assistance physique a outgo ground and find your realized gains and losses.

As adoption increases, taxation reporting volition undoubtedly germinate — successful the meantime keeping way of your commercialized enactment is important to beryllium acceptable for taxation season.

Ask an Expert

Q. Why are advisors watching crypto closely?

A.Institutional crypto inflows person surged to $35 billion. While crypto is much volatile than accepted assets, large cryptocurrencies similar bitcoin, person historically outperformed different accepted plus classes since 2012.

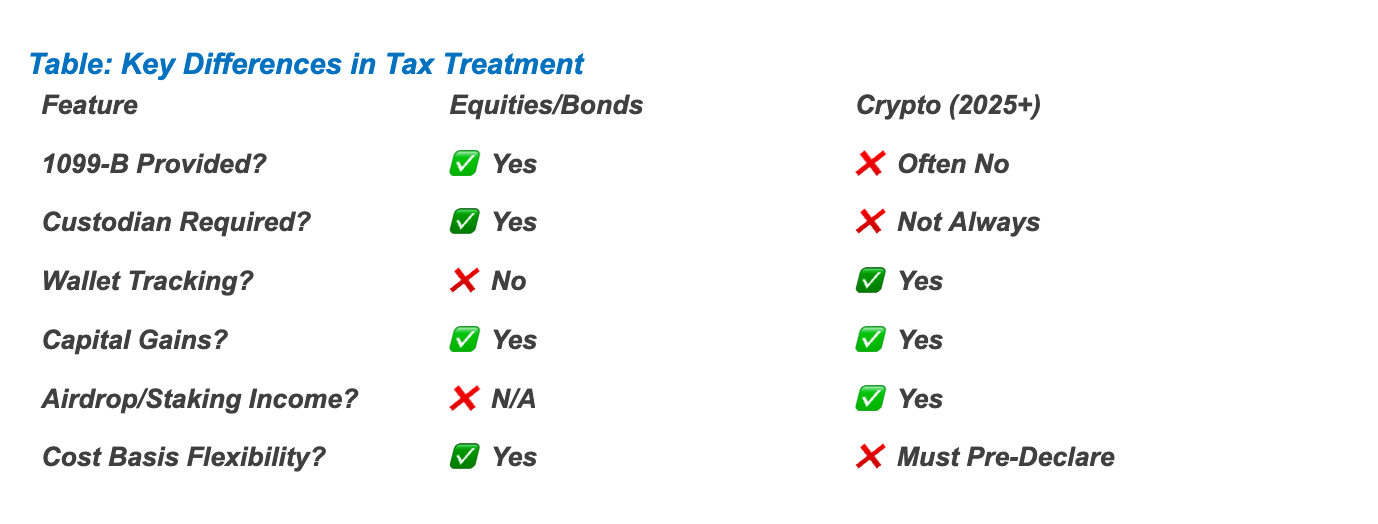

Q. How is crypto being treated otherwise from equities/bonds from a taxation side?

A. Crypto differs fundamentally from equities and bonds. Advisors indispensable way each wallet separately for outgo ground (starting Jan 2025). Unlike accepted 1099s, clients often get small to nary reporting enactment from exchanges, particularly for self-custodied assets.

Q. Do you person immoderate peculiar insights for CPAs and taxation advisors?

A. Compliance isn’t optional anymore. Starting with 2025 returns:

- Wallet-level outgo ground reporting is mandatory.

- IRS Form 1099-DA volition statesman showing up successful 2026.

- Exchanges often don’t enactment reporting for self-custodied assets.

Smart taxation professionals are combining taxation reporting, audit defence, and DeFi accounting into premium advisory services.

- Saim Akif, founder, Akif CPA

Keep Reading

- Spanish banking elephantine BBVA tells affluent clients to put 3 to 7% of their portfolio successful bitcoin.

- The U.S. Senate passed the Genius Act, paving the mode for stablecoin adoption.

- Thailand to exempt superior gains connected crypto investments for 5-years.

- CoinDesk Overnight Rates (CDOR) become available to enactment stablecoin wealth markets based connected Aave.

6 months ago

6 months ago

English (US)

English (US)