Today’s Crypto for Advisor newsletter is coming to you from Consensus Toronto. The vigor is precocious arsenic integer plus argumentation makers, leaders and influencers stitchery to speech astir bitcoin, blockchain, regulation, AI and truthful overmuch more!

Attending Consensus? Visit the CoinDesk booth, #2513. If you are funny successful contributing to this newsletter, Kim Klemballa volition beryllium astatine the booth today, May 15, from 3-5 p.m. EST. You tin besides reply to this email directly.

In today’s Crypto for Advisors, Harvey Li from Tokenization Insights explains stablecoins, wherever they came from and their growth.

Then, Trevor Koverko from Sapien answers questions astir the presumption of stablecoin regulations and adoption with regulations successful Europe successful Ask an Expert.

Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors adjacent Chicago, Grayscale is hosting an exclusive event, Crypto Connect, connected Thursday, May 22. Learn more.

Stablecoins - Past, Present and Future

When large fiscal institutions — from Citi and Standard Chartered to Brevan Howard, McKinsey and BCG — rally astir a once-niche innovation, it’s a bully thought to instrumentality note, particularly erstwhile the innovation is stablecoins, a tokenized practice of wealth on-chain.

What email was to the internet, stablecoin is to blockchain — instant and cost-effective worth transportation astatine a planetary standard moving 24/7. Stablecoin is blockchain’s archetypal slayer usage case.

A Brief History

First introduced by Tether successful 2015 and hailed arsenic the archetypal stablecoin, USDT offered aboriginal crypto users a mode to clasp and transportation a stable, dollar-denominated worth on-chain. Until then, their lone alternate was bitcoin.

Tether’s dollar-backed stablecoin made its debut connected Bitfinex earlier rapidly spreading to large exchanges similar Binance and OKX. It rapidly became the default trading brace crossed the integer plus ecosystem.

As adoption grew, truthful did its utility. No longer conscionable a trading tool, stablecoin emerged arsenic the superior cash-equivalent for trading, currency management, and payments.

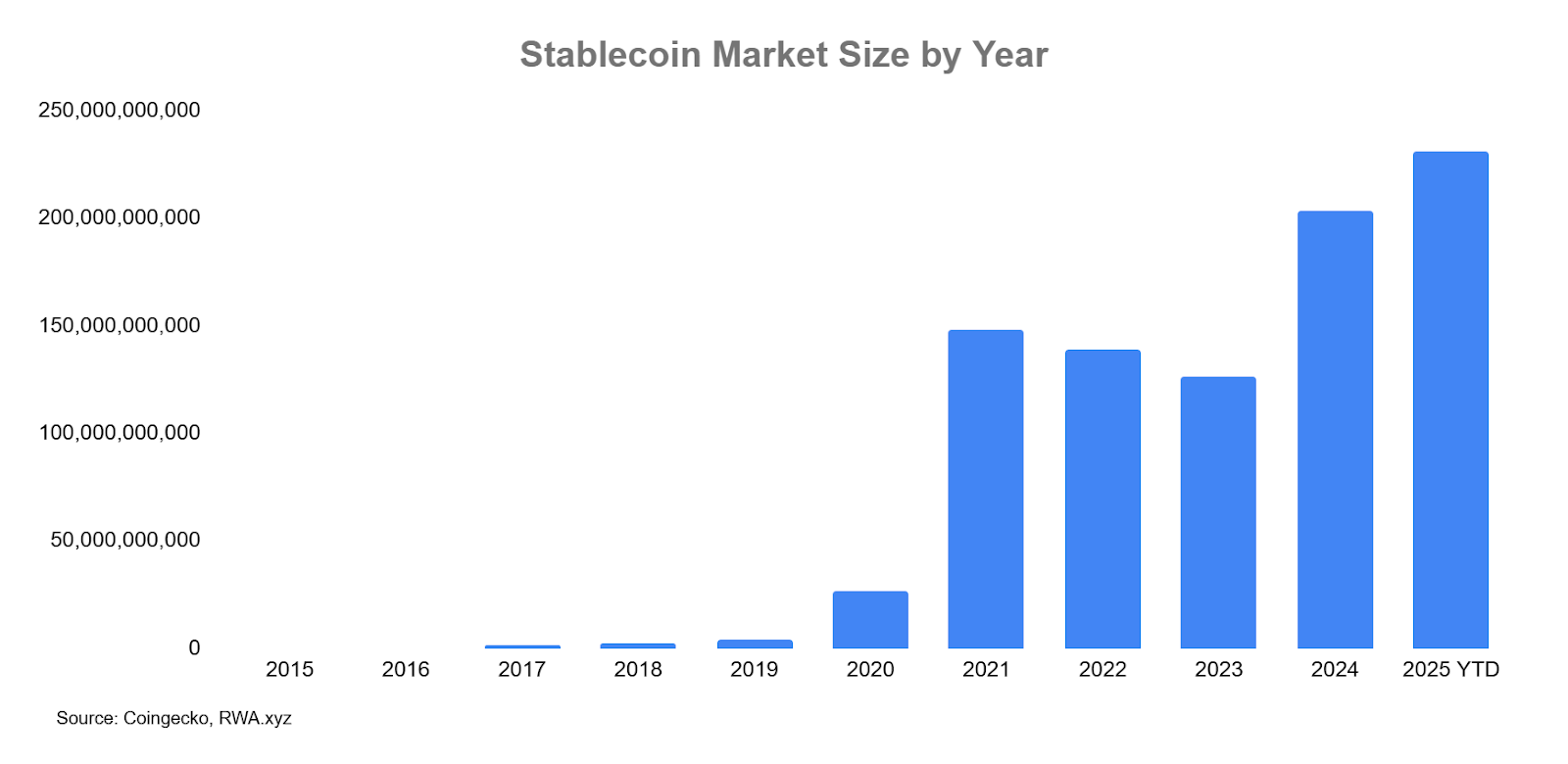

Below is the trajectory of stablecoin’s marketplace size since inception, a reflection of its improvement from a crypto niche to a halfway pillar of integer finance.

Usage astatine Scale

The crushed stablecoins person been a blistery taxable successful concern is their accelerated adoption and growth. According to Visa, stablecoin on-chain transaction measurement exceeded $5.5 trillion successful 2024. By comparison, Visa’s measurement was $13.2 trillion portion Mastercard transacted $9.7 trillion during the aforesaid period.

Why specified proliferation? Because unchangeable dollar-denominated currency is the lifeblood for the full integer assets ecosystem. Here are 3 large usage cases for stablecoin.

Major Use Cases

1. Digital Assets Trading

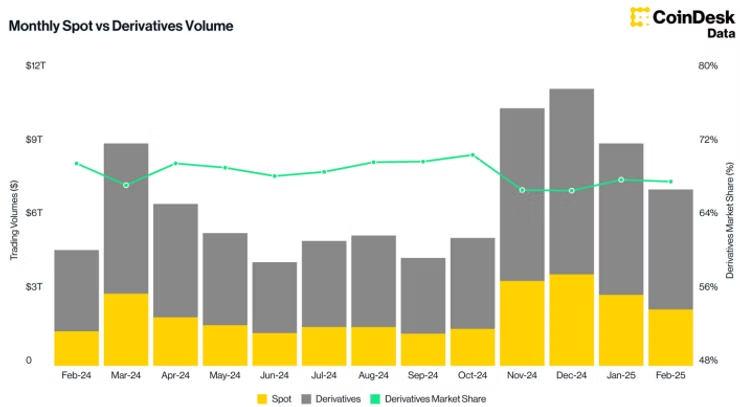

Given its origins, it's nary astonishment that trading was stablecoin’s archetypal large usage case. What began arsenic a niche instrumentality for worth preservation successful 2015 is present the beating bosom of integer plus trading. Today, stablecoins underpin implicit $30 trillion successful yearly trading measurement crossed centralized exchanges, powering the immense bulk of spot and derivatives activity.

But stablecoin’s interaction doesn’t extremity with centralized exchanges — It is besides the liquidity backbone of decentralized concern (DeFi). Onchain traders request the aforesaid reliable currency equivalent for moving successful and retired of positions. A glimpse astatine starring decentralized platforms, specified arsenic Uniswap, PancakeSwap, and Hyperliquid, shows that apical trading pairs are consistently denominated by stablecoins.

Monthly decentralized speech volumes routinely deed $100-200 billion, according to The Block, further cementing stablecoin’s relation arsenic the foundational furniture of the modern integer assets market.

2. Real World Assets

Real-world assets (RWAs) are tokenized versions of accepted instruments specified arsenic bonds and equities. Once a fringe idea, RWAs are present among the fastest-growing plus classes successful crypto.

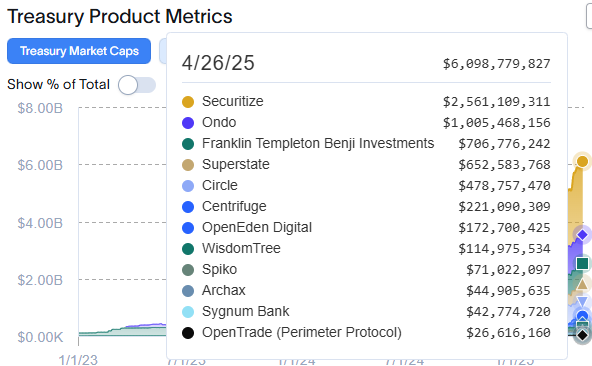

Leading this question is the tokenized U.S. Treasury market, present boasting implicit $6 cardinal AUM. Launched successful aboriginal 2023, these on-chain Treasuries opened the doorway for crypto-native superior to entree the low-risk, short-duration US T-Bills yield.

The adoption saw a staggering 6,000% maturation according to RWA.xyz: from conscionable $100 cardinal successful aboriginal 2023 to implicit $6 cardinal AUM today.

Asset absorption heavyweights specified arsenic BlackRock, Franklin Templeton, and Fidelity (pending SEC approval) are each creating on-chain treasury products for integer superior markets.

Unlike accepted Treasuries, these integer versions connection 24/7 instant mint/redemptions, and seamless composability with different DeFi output opportunities. Investors tin subscribe and redeem astir the clock, with stablecoin liquidity delivered successful existent time. Circle’s installation with BlackRock’s BUIDL and PayPal’s integration with Ondo’s OUSG are conscionable 2 salient examples.

3. Payment

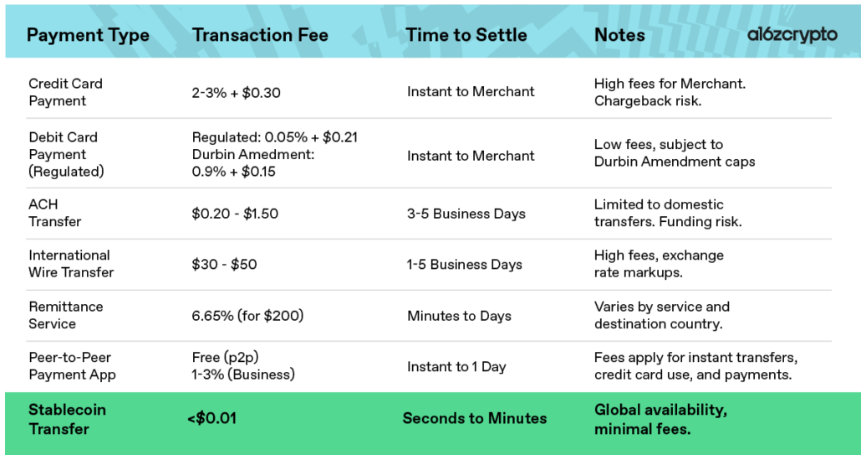

A large emerging usage lawsuit for stablecoins is cross-border payment, particularly successful corridors underserved by accepted fiscal infrastructure.

In overmuch of the world, planetary payments stay slow, expensive, and error-prone owed to dependency connected analogous banking. By contrast, stablecoins connection merchants and consumers an alternate with its instant, low-cost, always-on transfers. According to probe from a16z, stablecoin payments are 99.99% cheaper and 99.99% faster than accepted ligament transfers and they settee 24/7.

The displacement is gaining momentum successful the West, too. Stripe’s $1 cardinal acquisition of Bridge and consequent instauration of Stablecoin Financial Account awesome the commencement of mainstream planetary adoption. Meanwhile, PayPal’s rollout of output connected PYUSD balances highlights stablecoin’s emergence arsenic a morganatic retail outgo vertical.

What was erstwhile a crypto-native solution is accelerated becoming a planetary fiscal utility.

- Harvey Li, founder, Tokenization Insight

Ask an Expert

Q. In airy of the caller quality from Europe regarding stablecoins and Tether, tin you explicate however stablecoin concern is invaluable to an individual?

A. In the inherently volatile and highly risky satellite of cryptocurrencies, stablecoins supply individuals with a capital-efficient mode to summation vulnerability to integer assets. Pegged to fiat currencies similar the euro oregon commodities similar gold, these integer assets supply stableness and a hedge against crypto’s volatility. Crypto individuals tin parkland their funds safely successful stablecoins during times of uncertainty without having to exit the marketplace and woody with TradFi.

This is wherefore stablecoins predominate crypto. Their combined marketplace headdress has surpassed $245bln, a monolithic 15x maturation implicit the past 5 years.

Q. Given existent marketplace trends successful Europe, are stablecoins much oregon little susceptible to marketplace fluctuations?

A. While stablecoins are inherently little volatile than emblematic crypto assets, they stay delicate to regulatory developments and issuer credibility. When it comes to Europe, specifically, stablecoins person go little susceptible to marketplace fluctuations owed to stringent regulatory measures.

This includes the implementation of the Markets successful Crypto-Assets (MiCA) regulation, which provides a wide ineligible model that requires stablecoin issuers to support capable reserves and comply with strict governance standards. Such rules trim the hazard of de-pegging and heighten wide stability. However, this leads to marketplace consolidation, a deficiency of competition, and reduced innovation astatine the aforesaid time.

Q. Is Europe becoming a caller stablecoin hub arsenic it becomes much receptive to crypto?

A. Europe has been signalling a affable attack to crypto done MiCA, the archetypal broad crypto model globally that introduces licensing requirements for integer plus work providers and AML protocols. The purpose is to make a structured and harmonized regulatory situation for the crypto market, support customers, and guarantee fiscal stability.

Through its evolving MiCA regulations, Europe could surely heighten organization assurance and pull much stablecoin issuers. However, that would necessitate overcoming licensing (a lengthy and costly process) issues, effectual implementation astatine nationalist levels, and adapting to the fast-progressing crypto space.

Europe is presently not a planetary person successful stablecoin adoption, but with clearer rules coming into spot and its openness to compliant entities, it is well-positioned to look arsenic a cardinal hub for compliant stablecoin innovation.

- Trevor Koverko, co-founder, Sapien

Keep Reading

- New Hampshire became the archetypal U.S. State to walk a Strategic Bitcoin Reserve Bill into law.

- SEC Chair Paul Atkins says his precedence is to "develop rational regulatory framework for crypto."

- Will Missouri go the archetypal authorities to exempt superior gains connected bitcoin profits among different investments?

7 months ago

7 months ago

English (US)

English (US)