In today's Crypto for Advisors newsletter, Samantha Bohbot, spouse and main maturation serviceman from RockawayX breaks down decentralized concern and the differences Bitcoin, Ethereum, and Solana bring to this space.

Then, Kevin Tam answers questions astir organization concern successful crypto ETFs and notes immoderate planetary trends successful "Ask an Expert."

Webinar alert: On September 9 astatine 11:00am ET articulation Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices arsenic they sermon gathering a sustainable concern successful the cyclical markets of crypto. Register today. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

Event alert: CoinDesk: Policy & Regulation successful Washington D.C. connected September 10th. The docket includes elder officials from the SEC, Treasury, House, Senate, and OCC, positive backstage roundtables and unparalleled networking opportunities. Use codification COINDESK15 to prevention 15% connected your registration. http://go.coindesk.com/4oV08AA.

Sectors Beyond Bitcoin: Ethereum, Solana and On-Chain Economies

Bitcoin whitethorn predominate the crypto speech arsenic the astir established integer asset, but today’s scenery presents galore compelling opportunities to investors.

Outside of Bitcoin, blockchains powerfulness applications that delight planetary users, make meaningful revenues, and are increasing impressively.

Bringing Global Finance On-Chain

Tokenized real-world assets (RWAs) notation to the issuance and trading of accepted instruments similar stocks, bonds, commodities, and alternate assets connected blockchains. The perks of doing truthful are substantial. Settling plus trades on-chain is astir instantaneous; anyone, anyplace tin enactment (if the issuer allows it), and transactions are transparent, making them easier to way and automate.

Today, astir $300 cardinal successful tokenized assets are on-chain. Boston Consulting Group predicts the marketplace volition scope $600 cardinal by the extremity of the twelvemonth and $19 trillion by 2030. Recent RWA deployments are showcasing blockchains’ imaginable to alteration accepted markets.

In bridging accepted assets and on-chain use, blockchains enactment arsenic marketplaces, with emblematic “chicken and egg” dynamics. Namely, issuers privation to spell wherever the progressive users are, and users flock to the tract of the caller and champion products.

Ethereum was the earthy starting point. Stablecoins similar USDC and USDT archetypal launched there, giving Ethereum the deepest excavation of tokenized dollars and the bulk of today’s on-chain RWA value.

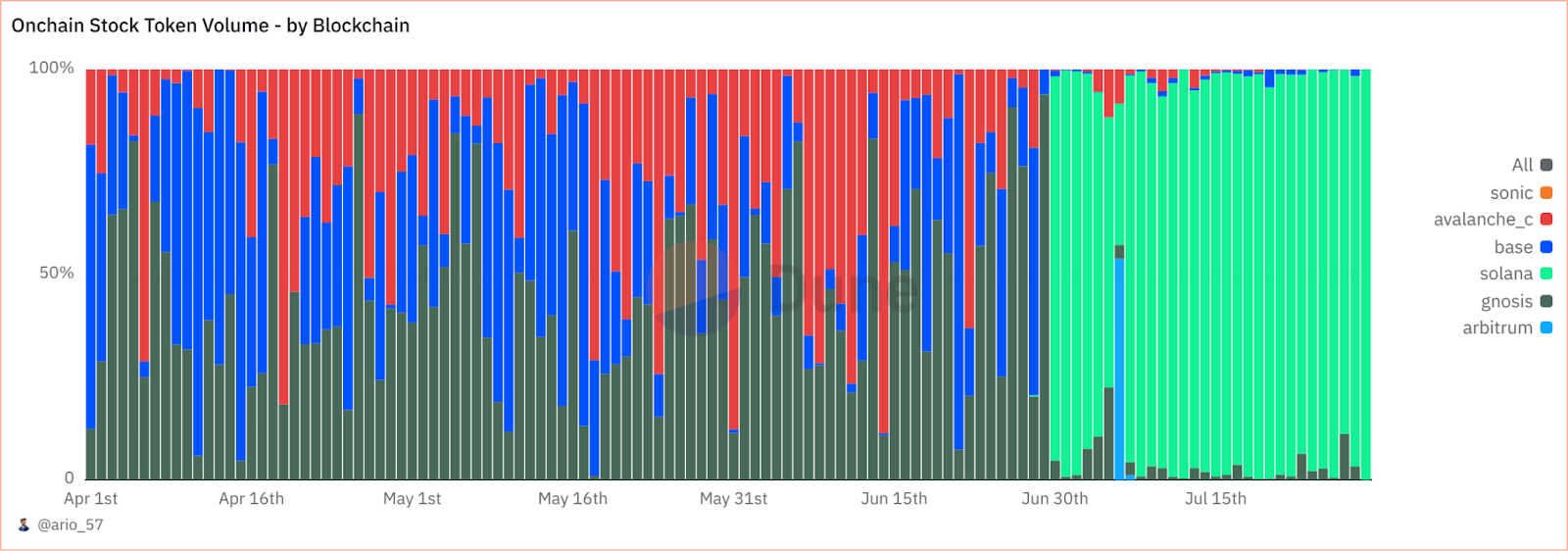

Solana is simply a apical contender for RWA activity, and caller launches showcase blockchains’ imaginable to swiftly alteration accepted markets. Kamino Finance, Solana’s starring borrowing and lending application, enables users to easy get against their holdings successful xStocks, tokenized stocks of Apple, Tesla, and different companies. Since xStocks launched crossed blockchains connected June 30, Solana has accounted for an mean of astir 93% of regular trading volume.

On-chain banal token measurement by blockchain | Source: Dune Analytics

Solana’s dominance successful planetary developer enactment and progressive users (more than treble that of the adjacent chain) gives it an borderline successful courting plus issuers, portion successfully onboarding them and unveiling caller on-chain products volition reenforce this activity.

More broadly, DeFi continues to grow, with greater diverseness successful on-chain products and institutional-grade offerings. Catering to blase portfolios, builders enactment connected products that integrate stablecoins, RWAs, and / oregon output mechanics to make entreaty to antithetic hazard preferences.

Ethereum presently leads the sector, with implicit $94 cardinal successful full worth locked (TVL) and thousands of protocols. While retaining the industry’s deepest liquidity is an advantage, there’s much to DeFi than TVL.

The Solana DeFi protocol's full worth locked (TVL) precocious surpassed astir $10 billion. In a motion that the TVL reflects existent and invaluable use, Solana’s applications collectively gain much on-chain interest gross than each different chains combined. Thanks to its velocity and debased costs, solana has established itself arsenic DeFi’s progressive trading hub and consistently leads ether successful decentralized speech (DEX) trading volumes.

Beyond bitcoin’s crypto relation arsenic “digital gold,” some the Ethereum and Solana blockchains person emerged arsenic halfway integer infrastructure, each with chiseled advantages.

Ethereum is the archetypal unfastened computer, wherever builders archetypal coded decentralized applications and foundational organization projects launched.

Solana’s DeFi momentum is building. It’s the astir utilized concatenation successful the satellite already, and a hotbed for innovative DeFi products. Like Ethereum’s autochthonal ETH token, Solana’s SOL offers wide vulnerability to the ecosystem, meaning investors don’t request to prime idiosyncratic exertion winners; instead, they tin enactment successful the wide growth.

Ethereum and Solana’s semipermanent occurrence depends connected their being location to applications that present existent worth and, ultimately, disrupt bequest fiscal systems. If they tin propulsion that off, past today’s prices whitethorn look similar charismatic introduction points.

- Samantha Bohbot, spouse and main maturation officer, RockawayX

Ask an Expert

Q. One twelvemonth into the organization investments successful the crypto ETFs trend, however are Canadian banks and pension funds approaching bitcoin?

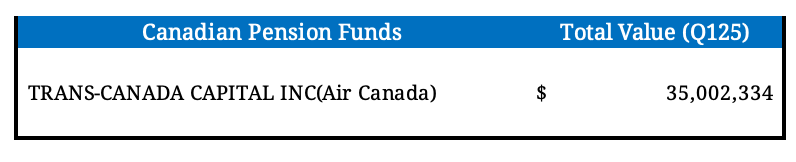

A. This quarter's 13F filings uncover that Montreal-based Trans-Canada Capital has made notable investments successful integer assets. It manages the pension assets for Air Canada, arsenic 1 of the largest firm pension plans successful the country. The pension money added $55 cardinal successful a spot bitcoin ETF.

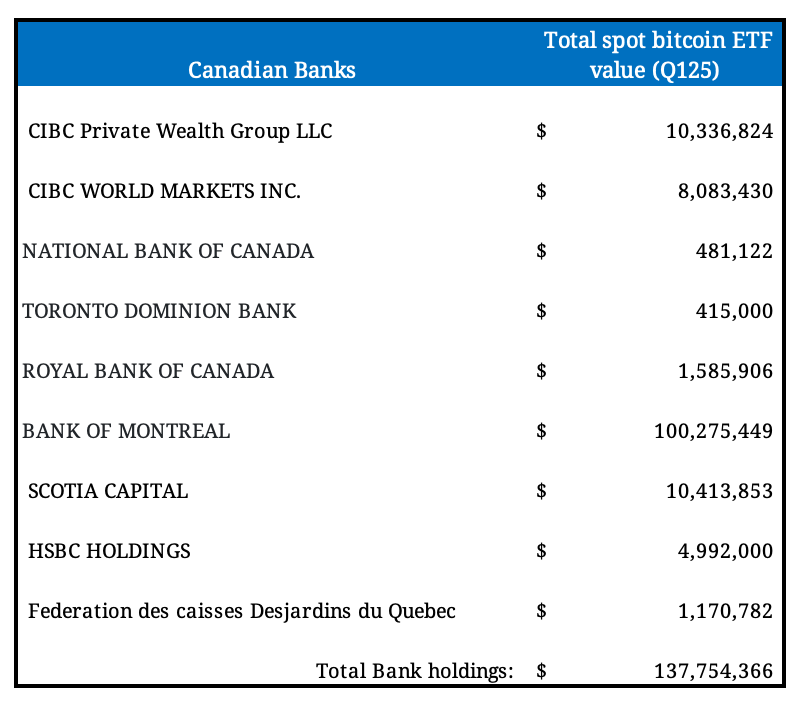

Institutional adoption of bitcoin has accelerated implicit the past year, driven by clearer regulatory guidance, the motorboat of spot ETFs and expanding designation of bitcoin arsenic a strategical asset. Schedule 1 banks successful Canada are holding much than $139 cardinal successful bitcoin exchange-traded funds, underscoring increasing organization request and semipermanent positioning.

Q. How mightiness organization accumulation impact bitcoin’s marketplace dynamics?

A. Last year, ETFs purchased astir 500,000 bitcoin, portion the web produced 164,250 caller bitcoin done its proof-of-work consensus. This means ETF request unsocial was 3 times the recently minted supply. Additionally, nationalist and backstage corporations purchased 250,000 bitcoins. As governments see including bitcoin successful their strategical reserves, different entities are exploring the summation of bitcoin to their firm treasuries.

Q. How volition the Financial Conduct Authority (FCA) greenlighting retail entree to crypto ETNs successful the U.K. accelerate the retail & organization adoption?

A. This marks an important infinitesimal for crypto products successful the retail marketplace arsenic an plus people that reflects a broader displacement successful the U.K.’s regulatory stance toward integer assets. It is simply a implicit reversal from a 2020 determination erstwhile the FCA banned crypto exchange-traded notes. ETNs volition request to beryllium traded connected an FCA-approved concern exchange. The U.K. is shifting its attack to crypto arsenic the authorities seeks to turn the system and enactment a integer assets industry, sending a beardown awesome to organization investors that the U.K. is positioning itself arsenic a competing subordinate successful the planetary crypto market.

- Kevin Tam, integer plus probe specialist

Keep Reading

- ETH reached a caller all-time high connected Sunday, Aug. 24, touching $4900.

- The U.S. Commerce Department plans to commencement releasing data and statics connected blockchain.

- Thailand selects KuCoin to supply entree to tokenized bonds.

3 months ago

3 months ago

English (US)

English (US)